Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsCost MGT

Cost MGT

Uploaded by

jacoba.paula.dllCost management reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Ideology of Modernism - György Lukács PDFDocument18 pagesThe Ideology of Modernism - György Lukács PDFEmilija Nikolić100% (3)

- Taranatha - History-of-Buddhism-in-India PDFDocument518 pagesTaranatha - History-of-Buddhism-in-India PDFRakjeff86% (7)

- Filipino: Ikalawang Markahan - Modyul 13Document23 pagesFilipino: Ikalawang Markahan - Modyul 13Libert Moore Omambat Betita100% (2)

- Job Order Costing 4Document10 pagesJob Order Costing 4Eross Jacob SalduaNo ratings yet

- II Cost Terms Concepts Classification BehaviorDocument18 pagesII Cost Terms Concepts Classification Behaviortnjm5vxg6kNo ratings yet

- Cosman2 ReviewerDocument6 pagesCosman2 ReviewerAggi Rayne Sali BucoyNo ratings yet

- AccountancyDocument67 pagesAccountancyDhananjay SinghNo ratings yet

- Definition of Cost and CostingDocument6 pagesDefinition of Cost and CostingNahidul Islam IUNo ratings yet

- PERSYS ReviewerDocument6 pagesPERSYS ReviewerNJ PantigNo ratings yet

- Includes Theory Questions FromDocument70 pagesIncludes Theory Questions FromNbut ddgfNo ratings yet

- Strategy CostDocument4 pagesStrategy Costseungwan sonNo ratings yet

- Theory Problems Of: Cost AccountingDocument83 pagesTheory Problems Of: Cost AccountingDipak Mahalik100% (2)

- Lesson 2 - Cost Accounting Cycle Part 1Document39 pagesLesson 2 - Cost Accounting Cycle Part 1Mama MiyaNo ratings yet

- Amad NotesDocument96 pagesAmad NotesDalili Kamilia100% (1)

- CA 01 - Introduction To Cost AccountingDocument3 pagesCA 01 - Introduction To Cost AccountingJoshua UmaliNo ratings yet

- Week 8 - Overcoming Myopia & Balance ScorecardDocument6 pagesWeek 8 - Overcoming Myopia & Balance ScorecardMERINANo ratings yet

- Module 1 - Introduction To Cost AccountingDocument4 pagesModule 1 - Introduction To Cost AccountingArrianne CuetoNo ratings yet

- Cost & Management Accounting Dec 2020Document10 pagesCost & Management Accounting Dec 2020Shivam mishraNo ratings yet

- Cost Accounting Terms Final 10Document11 pagesCost Accounting Terms Final 10Mehdi MemesNo ratings yet

- Module 5 MARGINAL COSTING STRATEGIC COST MANAGEMENTDocument27 pagesModule 5 MARGINAL COSTING STRATEGIC COST MANAGEMENTParikshit MishraNo ratings yet

- Introduction To Cost AccountingDocument2 pagesIntroduction To Cost AccountingMary Jullianne Caile SalcedoNo ratings yet

- 01 CostconDocument6 pages01 CostconNicah RoseNo ratings yet

- Account 203Document1 pageAccount 203RAVI KISHANNo ratings yet

- Cost Concepts and SheetDocument43 pagesCost Concepts and SheetYash BhushanNo ratings yet

- Summary Theory - Costing PDFDocument66 pagesSummary Theory - Costing PDFartizutshiNo ratings yet

- ENTR 20083 - Module 1Document6 pagesENTR 20083 - Module 1Mar Jonathan FloresNo ratings yet

- Strat CostDocument5 pagesStrat CostJanella KeizyNo ratings yet

- Cost AccountingDocument117 pagesCost AccountingSIKANDARR GAMING YTNo ratings yet

- Slide Management AccountingDocument152 pagesSlide Management AccountingChitta Lee100% (1)

- Fin Man Finals CoverageDocument5 pagesFin Man Finals Coverageaculify321No ratings yet

- MA M4 U1 FinalDocument19 pagesMA M4 U1 FinalmohitNo ratings yet

- Standard Costing Cost and Management Accounting Cap Ii IcanDocument11 pagesStandard Costing Cost and Management Accounting Cap Ii IcanArjan AdhikariNo ratings yet

- Chapter 1 Answer Cost Accounting PDFDocument5 pagesChapter 1 Answer Cost Accounting PDFCris VillarNo ratings yet

- Learning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGDocument6 pagesLearning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGRegina PhalangeNo ratings yet

- Cost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsDocument8 pagesCost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsXyne FernandezNo ratings yet

- Cost AccountingDocument25 pagesCost Accountingoh my ghod samuelNo ratings yet

- Standard Costing and Variance Analysis NotesDocument8 pagesStandard Costing and Variance Analysis NotesPratyush Pratim SahariaNo ratings yet

- 7 - Standard CostingDocument16 pages7 - Standard CostingRakeysh RakyeshNo ratings yet

- Prelim Week4Document11 pagesPrelim Week4John Paul MoralesNo ratings yet

- Cost Accounting ReviewerDocument2 pagesCost Accounting Reviewerwhin Limbo100% (2)

- NEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Document20 pagesNEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Heleniya RenukaNo ratings yet

- Cost Accounting NOTESDocument16 pagesCost Accounting NOTESAthNo ratings yet

- Guerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleDocument6 pagesGuerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleJenny Brozas JuarezNo ratings yet

- Topic 1-Intro & Cost ClassificationDocument8 pagesTopic 1-Intro & Cost ClassificationMuhammad Alif100% (2)

- Cost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V SemDocument188 pagesCost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V Sempdd801852No ratings yet

- Cost AccountingDocument19 pagesCost AccountingDurga Prasad NallaNo ratings yet

- N6 Cost and Management AccountingDocument31 pagesN6 Cost and Management AccountingSanele N ThabetheNo ratings yet

- Variable Costing-A Tool For ManagementDocument13 pagesVariable Costing-A Tool For Managementsaha.anik317No ratings yet

- F5 Synergy KitDocument58 pagesF5 Synergy KitPEARL ANGEL100% (1)

- Module 1 - Overview of Cost AccountingDocument7 pagesModule 1 - Overview of Cost AccountingMae JessaNo ratings yet

- Class Presentation Cost Accounting-1Document310 pagesClass Presentation Cost Accounting-1KANIKA GOSWAMINo ratings yet

- Notes - Cost Acc Chapter 1 de Leon 2022Document3 pagesNotes - Cost Acc Chapter 1 de Leon 2022Sofia BasisterNo ratings yet

- Slide Management AccountingDocument152 pagesSlide Management AccountingChitta LeeNo ratings yet

- Cost Accounting and Control Reviewer NotesDocument29 pagesCost Accounting and Control Reviewer Notesabb.reviewersNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingMeenakshi SeerviNo ratings yet

- SCM, IntroductionDocument20 pagesSCM, IntroductionAnant GopalNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- CA Inter Costing Theory Notes by CA Namit Arora SirDocument78 pagesCA Inter Costing Theory Notes by CA Namit Arora SirINTER SMARTIANSNo ratings yet

- Activity-Based Management: Questions For Writing and DiscussionDocument36 pagesActivity-Based Management: Questions For Writing and DiscussionrpdeniNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- Block 4 MCO 5 Unit 3Document19 pagesBlock 4 MCO 5 Unit 3Tushar SharmaNo ratings yet

- Cost ManagementDocument3 pagesCost ManagementJandyeeNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- EXCESSIVE FINES Pp. Vs Dacuycuy & Agbanlog vs. Pp.Document3 pagesEXCESSIVE FINES Pp. Vs Dacuycuy & Agbanlog vs. Pp.Cel DelabahanNo ratings yet

- United NationsDocument275 pagesUnited Nationsedo-peiraias.blogspot.comNo ratings yet

- Cybernetic GovernanceDocument3 pagesCybernetic Governancesuhajanan16No ratings yet

- How To Write A Cover Letter For A Resident AssistantDocument8 pagesHow To Write A Cover Letter For A Resident Assistantsnnscprmd100% (1)

- Đề kiểm tra giữa HKII - 11Anh 211Document6 pagesĐề kiểm tra giữa HKII - 11Anh 211Ngô ThảoNo ratings yet

- Final Micro Plan Quality Evaluation, Desk Review and FieldValidation FormsDocument4 pagesFinal Micro Plan Quality Evaluation, Desk Review and FieldValidation Formsmoss4u100% (1)

- Ledger - Upstox 2019Document5 pagesLedger - Upstox 2019Hemant BilliardsNo ratings yet

- Rick Gates - Prosecuton Sentencing Memo PDFDocument989 pagesRick Gates - Prosecuton Sentencing Memo PDFWashington Examiner100% (2)

- Ec6 JharkhandDocument103 pagesEc6 JharkhandSunilNo ratings yet

- VEE Manju - Mam (Complete) MergedDocument204 pagesVEE Manju - Mam (Complete) MergedHiten AhujaNo ratings yet

- Newbold Stat7 Ism 07Document28 pagesNewbold Stat7 Ism 07tawamagconNo ratings yet

- Use Security Equipment: Facilitator/Learner GuideDocument82 pagesUse Security Equipment: Facilitator/Learner GuideAbongile PhinyanaNo ratings yet

- Informal Le!er e Mail Template Client Business Email Normal EmailDocument1 pageInformal Le!er e Mail Template Client Business Email Normal EmailJean-Pierre MwananshikuNo ratings yet

- Hagerstown Community College Nursing 229 Clinical Prep CardDocument3 pagesHagerstown Community College Nursing 229 Clinical Prep CardBenNo ratings yet

- The Swahili Alphabet and Digraphs For StudyDocument3 pagesThe Swahili Alphabet and Digraphs For Studyquestnvr73100% (1)

- Business Studies - ArticlesDocument122 pagesBusiness Studies - Articlesapi-3697361No ratings yet

- 2nd Q QRA-FORM-3BDocument79 pages2nd Q QRA-FORM-3BApril Catadman QuitonNo ratings yet

- Luciana Oviedo Castillo.Document15 pagesLuciana Oviedo Castillo.ander oviedoNo ratings yet

- Registration Number: SecunderabadDocument2 pagesRegistration Number: SecunderabadManishVishwakarmaNo ratings yet

- Ndejje University: Kampala Campus Faculty of Social SciencesDocument6 pagesNdejje University: Kampala Campus Faculty of Social SciencesGgayi JosephNo ratings yet

- 0025 A (4) C Lawis ST Dela Paz Antipolo June 2, 2022: Business Plan Scallion (Spring Onion) SaladsDocument7 pages0025 A (4) C Lawis ST Dela Paz Antipolo June 2, 2022: Business Plan Scallion (Spring Onion) SaladsCarol Maina100% (1)

- PDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full ChapterDocument53 pagesPDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full Chapterbarbara.white983100% (1)

- Bacani vs. Nacoco - Case DigestDocument4 pagesBacani vs. Nacoco - Case Digestclaire HipolNo ratings yet

- Form F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessDocument2 pagesForm F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessBhava SharmaNo ratings yet

- III. Akta Perwakilan Kuasa 1956 (Akta 358)Document14 pagesIII. Akta Perwakilan Kuasa 1956 (Akta 358)ainfazira100% (1)

- Pseudo Code ExamplesDocument4 pagesPseudo Code ExamplesViji RamNo ratings yet

- Andhra Pradesh Grama - Ward SachivalayamDocument1 pageAndhra Pradesh Grama - Ward Sachivalayamబొమ్మిరెడ్డి రాంబాబుNo ratings yet

Cost MGT

Cost MGT

Uploaded by

jacoba.paula.dll0 ratings0% found this document useful (0 votes)

1 views2 pagesCost management reviewer

Original Title

Cost Mgt

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCost management reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views2 pagesCost MGT

Cost MGT

Uploaded by

jacoba.paula.dllCost management reviewer

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

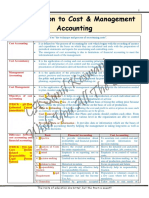

Cost Mgt.- involves process in creating a 1.

Planning- setting of goals, identifying

dynamic & competitive environment. alternatives

2. Controlling- involves evaluation of

PURPOSE: to give emphasis to long term

manager’s performance & the

measures NOT JUST TO SURVIVE, but to SCORE

operation itself.

A GOAL.

3. Decision-Making- it involves

Strategy- set of policies, procedures & determination of predictive info.

approaches that produces long-term success.

SCM- involves development of cost

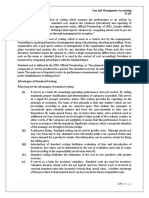

One of the advantage of using variable costing

management to facilitate long term success.

is it meets the management control objectives

FUNCTIONS OF COST MANAGEMENT by showing separately the costs traceable and

controllable.

1. Strategic Mgt.- competitive advantage

= continued success & involves A basic tenet of direct costing is that Period cost

identifying & implementation of goals. should be currently expensed. What is the

2. Planning & Decision Making- involves rationale behind this procedure?

budgeting, profit planning, and cash

Period costs will occur whether or not

flow mgt.

production occurs and so it is improper to

3. Mgt. & Operational Control- who

allocate these costs to production and defer a

manages who?

current cost of doing business.

The inventory under absorption costing carries

with it portion of the prior period's fixed

overhead.

When sales exceeded production, the net

4. Reportorial & Compliance to legal income reported under variable costing is

requirements- responsibility, require higher than under absorption costing.

compliance to regulatory services. (SEC

& BIR) Last year, Mandonar Company had an income

of 800,000 using absorption costing. Beginning

Cost Management Accountants- concerned and ending inventories were 3,000 and 7,000

with providing info. to people inside the org. units respectively. If the fixed

who has direct control on the operations of manufacturing cost per unit is 55. What was the

business. income using variable costing? 580,000

Analytical reports- frequent update, business Variable costing is also known as direct costing

opportunity, & specific problems.

Under conventional costing, the unit product

TYPES OF MANAGEMENT ACCOUNTANT cost is: 17

1. Scorekeeping- data accumulation

2. Attention directing- interpretation and

report of information

3. Problem Solving

MEANS/PROCESS TO ATTAIN THE MGT. GOAL

Absorption Costing- treats direct manufacturing

costs and manufacturing overhead cost, both

variable and fixed, as inventoriable costs.

Net income using variable costing is not

affected by the level of changes in inventory

because all fixed costs are deducted on the

period they occur.

The reconciliation of net income using

absorption costing can be determined by adding

the decrease in inventory units multiplied by

FMOH/unit.

COST ASSOCIATED WITH DECISION MAKING

1. Relevant Cost- expected future which

either between decision alternatives

2. Differential Cost- cost that will be

increased/decreased as a result of

decision

3. Avoidable Cost- can be eliminated as a

result of choosing one alternative.

GENERAL RULE: ALL COST ARE

AVOIDABLE, EXCEPT:

1. Sunk Cost/Historical

2. Other Unavoidable Cost

4. Opportunity Cost- benefit

forgone/highest income sacrificed when

an option is chosen over another.

5. Out of pocket Cost- costs required for

immediate/near future cash outlay.

AVOIDABLE- /- variable X- fixed (or if the prob.

says)

ALL VARIABLE COST ARE RELEVANT

You might also like

- The Ideology of Modernism - György Lukács PDFDocument18 pagesThe Ideology of Modernism - György Lukács PDFEmilija Nikolić100% (3)

- Taranatha - History-of-Buddhism-in-India PDFDocument518 pagesTaranatha - History-of-Buddhism-in-India PDFRakjeff86% (7)

- Filipino: Ikalawang Markahan - Modyul 13Document23 pagesFilipino: Ikalawang Markahan - Modyul 13Libert Moore Omambat Betita100% (2)

- Job Order Costing 4Document10 pagesJob Order Costing 4Eross Jacob SalduaNo ratings yet

- II Cost Terms Concepts Classification BehaviorDocument18 pagesII Cost Terms Concepts Classification Behaviortnjm5vxg6kNo ratings yet

- Cosman2 ReviewerDocument6 pagesCosman2 ReviewerAggi Rayne Sali BucoyNo ratings yet

- AccountancyDocument67 pagesAccountancyDhananjay SinghNo ratings yet

- Definition of Cost and CostingDocument6 pagesDefinition of Cost and CostingNahidul Islam IUNo ratings yet

- PERSYS ReviewerDocument6 pagesPERSYS ReviewerNJ PantigNo ratings yet

- Includes Theory Questions FromDocument70 pagesIncludes Theory Questions FromNbut ddgfNo ratings yet

- Strategy CostDocument4 pagesStrategy Costseungwan sonNo ratings yet

- Theory Problems Of: Cost AccountingDocument83 pagesTheory Problems Of: Cost AccountingDipak Mahalik100% (2)

- Lesson 2 - Cost Accounting Cycle Part 1Document39 pagesLesson 2 - Cost Accounting Cycle Part 1Mama MiyaNo ratings yet

- Amad NotesDocument96 pagesAmad NotesDalili Kamilia100% (1)

- CA 01 - Introduction To Cost AccountingDocument3 pagesCA 01 - Introduction To Cost AccountingJoshua UmaliNo ratings yet

- Week 8 - Overcoming Myopia & Balance ScorecardDocument6 pagesWeek 8 - Overcoming Myopia & Balance ScorecardMERINANo ratings yet

- Module 1 - Introduction To Cost AccountingDocument4 pagesModule 1 - Introduction To Cost AccountingArrianne CuetoNo ratings yet

- Cost & Management Accounting Dec 2020Document10 pagesCost & Management Accounting Dec 2020Shivam mishraNo ratings yet

- Cost Accounting Terms Final 10Document11 pagesCost Accounting Terms Final 10Mehdi MemesNo ratings yet

- Module 5 MARGINAL COSTING STRATEGIC COST MANAGEMENTDocument27 pagesModule 5 MARGINAL COSTING STRATEGIC COST MANAGEMENTParikshit MishraNo ratings yet

- Introduction To Cost AccountingDocument2 pagesIntroduction To Cost AccountingMary Jullianne Caile SalcedoNo ratings yet

- 01 CostconDocument6 pages01 CostconNicah RoseNo ratings yet

- Account 203Document1 pageAccount 203RAVI KISHANNo ratings yet

- Cost Concepts and SheetDocument43 pagesCost Concepts and SheetYash BhushanNo ratings yet

- Summary Theory - Costing PDFDocument66 pagesSummary Theory - Costing PDFartizutshiNo ratings yet

- ENTR 20083 - Module 1Document6 pagesENTR 20083 - Module 1Mar Jonathan FloresNo ratings yet

- Strat CostDocument5 pagesStrat CostJanella KeizyNo ratings yet

- Cost AccountingDocument117 pagesCost AccountingSIKANDARR GAMING YTNo ratings yet

- Slide Management AccountingDocument152 pagesSlide Management AccountingChitta Lee100% (1)

- Fin Man Finals CoverageDocument5 pagesFin Man Finals Coverageaculify321No ratings yet

- MA M4 U1 FinalDocument19 pagesMA M4 U1 FinalmohitNo ratings yet

- Standard Costing Cost and Management Accounting Cap Ii IcanDocument11 pagesStandard Costing Cost and Management Accounting Cap Ii IcanArjan AdhikariNo ratings yet

- Chapter 1 Answer Cost Accounting PDFDocument5 pagesChapter 1 Answer Cost Accounting PDFCris VillarNo ratings yet

- Learning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGDocument6 pagesLearning Activity 1-1 - INTRODUCTION TO COST ACCOUNTING, SCOPE, AND OBJECTIVES OF COST ACCOUNTINGRegina PhalangeNo ratings yet

- Cost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsDocument8 pagesCost Accounting & Control (Acecost) Chapter 1: Cost Accounting FundamentalsXyne FernandezNo ratings yet

- Cost AccountingDocument25 pagesCost Accountingoh my ghod samuelNo ratings yet

- Standard Costing and Variance Analysis NotesDocument8 pagesStandard Costing and Variance Analysis NotesPratyush Pratim SahariaNo ratings yet

- 7 - Standard CostingDocument16 pages7 - Standard CostingRakeysh RakyeshNo ratings yet

- Prelim Week4Document11 pagesPrelim Week4John Paul MoralesNo ratings yet

- Cost Accounting ReviewerDocument2 pagesCost Accounting Reviewerwhin Limbo100% (2)

- NEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Document20 pagesNEW Netflix Inspired Powerpoint Design Template (By GEMO EDITS)Heleniya RenukaNo ratings yet

- Cost Accounting NOTESDocument16 pagesCost Accounting NOTESAthNo ratings yet

- Guerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleDocument6 pagesGuerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleJenny Brozas JuarezNo ratings yet

- Topic 1-Intro & Cost ClassificationDocument8 pagesTopic 1-Intro & Cost ClassificationMuhammad Alif100% (2)

- Cost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V SemDocument188 pagesCost Accounting: Study Material St. Joseph's Degree & PG College Hyderabad. Bba V Sempdd801852No ratings yet

- Cost AccountingDocument19 pagesCost AccountingDurga Prasad NallaNo ratings yet

- N6 Cost and Management AccountingDocument31 pagesN6 Cost and Management AccountingSanele N ThabetheNo ratings yet

- Variable Costing-A Tool For ManagementDocument13 pagesVariable Costing-A Tool For Managementsaha.anik317No ratings yet

- F5 Synergy KitDocument58 pagesF5 Synergy KitPEARL ANGEL100% (1)

- Module 1 - Overview of Cost AccountingDocument7 pagesModule 1 - Overview of Cost AccountingMae JessaNo ratings yet

- Class Presentation Cost Accounting-1Document310 pagesClass Presentation Cost Accounting-1KANIKA GOSWAMINo ratings yet

- Notes - Cost Acc Chapter 1 de Leon 2022Document3 pagesNotes - Cost Acc Chapter 1 de Leon 2022Sofia BasisterNo ratings yet

- Slide Management AccountingDocument152 pagesSlide Management AccountingChitta LeeNo ratings yet

- Cost Accounting and Control Reviewer NotesDocument29 pagesCost Accounting and Control Reviewer Notesabb.reviewersNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingMeenakshi SeerviNo ratings yet

- SCM, IntroductionDocument20 pagesSCM, IntroductionAnant GopalNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- CA Inter Costing Theory Notes by CA Namit Arora SirDocument78 pagesCA Inter Costing Theory Notes by CA Namit Arora SirINTER SMARTIANSNo ratings yet

- Activity-Based Management: Questions For Writing and DiscussionDocument36 pagesActivity-Based Management: Questions For Writing and DiscussionrpdeniNo ratings yet

- Cost Ii CH 4Document31 pagesCost Ii CH 4TESFAY GEBRECHERKOSNo ratings yet

- Block 4 MCO 5 Unit 3Document19 pagesBlock 4 MCO 5 Unit 3Tushar SharmaNo ratings yet

- Cost ManagementDocument3 pagesCost ManagementJandyeeNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- EXCESSIVE FINES Pp. Vs Dacuycuy & Agbanlog vs. Pp.Document3 pagesEXCESSIVE FINES Pp. Vs Dacuycuy & Agbanlog vs. Pp.Cel DelabahanNo ratings yet

- United NationsDocument275 pagesUnited Nationsedo-peiraias.blogspot.comNo ratings yet

- Cybernetic GovernanceDocument3 pagesCybernetic Governancesuhajanan16No ratings yet

- How To Write A Cover Letter For A Resident AssistantDocument8 pagesHow To Write A Cover Letter For A Resident Assistantsnnscprmd100% (1)

- Đề kiểm tra giữa HKII - 11Anh 211Document6 pagesĐề kiểm tra giữa HKII - 11Anh 211Ngô ThảoNo ratings yet

- Final Micro Plan Quality Evaluation, Desk Review and FieldValidation FormsDocument4 pagesFinal Micro Plan Quality Evaluation, Desk Review and FieldValidation Formsmoss4u100% (1)

- Ledger - Upstox 2019Document5 pagesLedger - Upstox 2019Hemant BilliardsNo ratings yet

- Rick Gates - Prosecuton Sentencing Memo PDFDocument989 pagesRick Gates - Prosecuton Sentencing Memo PDFWashington Examiner100% (2)

- Ec6 JharkhandDocument103 pagesEc6 JharkhandSunilNo ratings yet

- VEE Manju - Mam (Complete) MergedDocument204 pagesVEE Manju - Mam (Complete) MergedHiten AhujaNo ratings yet

- Newbold Stat7 Ism 07Document28 pagesNewbold Stat7 Ism 07tawamagconNo ratings yet

- Use Security Equipment: Facilitator/Learner GuideDocument82 pagesUse Security Equipment: Facilitator/Learner GuideAbongile PhinyanaNo ratings yet

- Informal Le!er e Mail Template Client Business Email Normal EmailDocument1 pageInformal Le!er e Mail Template Client Business Email Normal EmailJean-Pierre MwananshikuNo ratings yet

- Hagerstown Community College Nursing 229 Clinical Prep CardDocument3 pagesHagerstown Community College Nursing 229 Clinical Prep CardBenNo ratings yet

- The Swahili Alphabet and Digraphs For StudyDocument3 pagesThe Swahili Alphabet and Digraphs For Studyquestnvr73100% (1)

- Business Studies - ArticlesDocument122 pagesBusiness Studies - Articlesapi-3697361No ratings yet

- 2nd Q QRA-FORM-3BDocument79 pages2nd Q QRA-FORM-3BApril Catadman QuitonNo ratings yet

- Luciana Oviedo Castillo.Document15 pagesLuciana Oviedo Castillo.ander oviedoNo ratings yet

- Registration Number: SecunderabadDocument2 pagesRegistration Number: SecunderabadManishVishwakarmaNo ratings yet

- Ndejje University: Kampala Campus Faculty of Social SciencesDocument6 pagesNdejje University: Kampala Campus Faculty of Social SciencesGgayi JosephNo ratings yet

- 0025 A (4) C Lawis ST Dela Paz Antipolo June 2, 2022: Business Plan Scallion (Spring Onion) SaladsDocument7 pages0025 A (4) C Lawis ST Dela Paz Antipolo June 2, 2022: Business Plan Scallion (Spring Onion) SaladsCarol Maina100% (1)

- PDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full ChapterDocument53 pagesPDF Sustainable Banking The Greening of Finance First Edition Edition Jan Jaap Bouma Ebook Full Chapterbarbara.white983100% (1)

- Bacani vs. Nacoco - Case DigestDocument4 pagesBacani vs. Nacoco - Case Digestclaire HipolNo ratings yet

- Form F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessDocument2 pagesForm F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessBhava SharmaNo ratings yet

- III. Akta Perwakilan Kuasa 1956 (Akta 358)Document14 pagesIII. Akta Perwakilan Kuasa 1956 (Akta 358)ainfazira100% (1)

- Pseudo Code ExamplesDocument4 pagesPseudo Code ExamplesViji RamNo ratings yet

- Andhra Pradesh Grama - Ward SachivalayamDocument1 pageAndhra Pradesh Grama - Ward Sachivalayamబొమ్మిరెడ్డి రాంబాబుNo ratings yet