Professional Documents

Culture Documents

Balance of Payments

Balance of Payments

Uploaded by

Vidhi ShahCopyright:

Available Formats

You might also like

- Business: Level 1/2 Paper 2: Investigating Large BusinessesDocument16 pagesBusiness: Level 1/2 Paper 2: Investigating Large BusinessesEHANo ratings yet

- Convergys Data (GE)Document15 pagesConvergys Data (GE)Anwesha Dev ChaudharyNo ratings yet

- Balance of Payment Position of Sri Lanka.Document32 pagesBalance of Payment Position of Sri Lanka.Dhawal KhandelwalNo ratings yet

- Current AccoCurrent AccountDocument25 pagesCurrent AccoCurrent AccountRajesh NairNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsrohitlohiyaNo ratings yet

- Balance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsDocument120 pagesBalance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsMahesh KumbharNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of PaymentsJutt TheMagicianNo ratings yet

- Balance of Payments ProjectDocument21 pagesBalance of Payments Projectmanoj100% (2)

- Causes of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTDocument36 pagesCauses of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTAlisha Singh67% (3)

- Composition of The Balance of Payments SheetDocument13 pagesComposition of The Balance of Payments SheetAndy SdsdsadNo ratings yet

- Balance of Payment (BINAY SINGH) 11Document12 pagesBalance of Payment (BINAY SINGH) 11barhpatnaNo ratings yet

- Balance of Payments Accounting Concepts of Foreign TradeDocument6 pagesBalance of Payments Accounting Concepts of Foreign TradePravin BadeNo ratings yet

- Balance of Payments WikiDocument24 pagesBalance of Payments WikiSOURAV MONDALNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentssneha_gehaniNo ratings yet

- A Balance of PaymentsDocument27 pagesA Balance of PaymentsThaneesh KumarNo ratings yet

- Balance of Trade and Balance of Payment NewDocument27 pagesBalance of Trade and Balance of Payment NewApril OcampoNo ratings yet

- Govt R.C College of Commerce & Management International BusinessDocument17 pagesGovt R.C College of Commerce & Management International BusinessManasa PuttaswamyNo ratings yet

- Balance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsDocument14 pagesBalance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsdeanNo ratings yet

- Balance of PaymentsDocument6 pagesBalance of PaymentsarjunreddygrNo ratings yet

- Balance of PaymentsDocument19 pagesBalance of PaymentsANIL_SHAR_MANo ratings yet

- Balance of PaymentDocument35 pagesBalance of PaymentRupesh MoreNo ratings yet

- Int FinanceDocument59 pagesInt FinanceKshitij KaushikNo ratings yet

- Balance of Payments - Document TranscriptDocument10 pagesBalance of Payments - Document TranscriptMir Wajahat AliNo ratings yet

- BOP (Balance of Payment) : IMF DefinitionDocument33 pagesBOP (Balance of Payment) : IMF DefinitionHapp'z Sid'zNo ratings yet

- Balance of Payment (BOP) - Concept & DefinitionDocument3 pagesBalance of Payment (BOP) - Concept & DefinitionAnand VermaNo ratings yet

- Balance of PaymentDocument6 pagesBalance of Paymentbhagat103No ratings yet

- Balance of PaymentDocument5 pagesBalance of PaymentAbraham Kyagz KyagulanyiNo ratings yet

- Chapter 4Document10 pagesChapter 4Askar GaradNo ratings yet

- Balance of Payments (BOP) Definition - InvestopediaDocument2 pagesBalance of Payments (BOP) Definition - InvestopediaShachi SangharajkaNo ratings yet

- Balance of PaymentsDocument7 pagesBalance of Paymentsmahantesh123No ratings yet

- What Is The Balance of Payments?Document4 pagesWhat Is The Balance of Payments?Iram AzharNo ratings yet

- Epathshala BOPDocument9 pagesEpathshala BOPSiddhant AthawaleNo ratings yet

- Finals Speto ReviewerDocument2 pagesFinals Speto ReviewerMhars Dela CruzNo ratings yet

- Introduction of Balance of PaymentsDocument27 pagesIntroduction of Balance of PaymentsPallavi RanjanNo ratings yet

- Balance of PaymentDocument16 pagesBalance of PaymentpatelrutulNo ratings yet

- Balance of Payment Interpretation and ExerciseDocument5 pagesBalance of Payment Interpretation and ExerciseFadele1981No ratings yet

- PiyushDocument14 pagesPiyushVarsha KumariNo ratings yet

- Balance of Payments (Bop)Document29 pagesBalance of Payments (Bop)Chintakunta PreethiNo ratings yet

- BOP AssignmentDocument20 pagesBOP AssignmentSajid Karbari0% (1)

- Composition of Balance of PaymentsDocument8 pagesComposition of Balance of PaymentsYashonidhi ShuklaNo ratings yet

- Introducing: Balance of Payment Comparing South Africa and IndonesiaDocument15 pagesIntroducing: Balance of Payment Comparing South Africa and IndonesiaEpik AbillyNo ratings yet

- A Report On "Balance of Payments": Concept QuestionsDocument25 pagesA Report On "Balance of Payments": Concept QuestionsSaraswatiSinghNo ratings yet

- A Report On "Balance of Payments": Concept QuestionsDocument28 pagesA Report On "Balance of Payments": Concept QuestionsSaif ShakilNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentsনীল রহমানNo ratings yet

- Eco NotesDocument13 pagesEco Notesjaydeep.signkraftNo ratings yet

- Chapter V The Balance of PaymentDocument25 pagesChapter V The Balance of PaymentAshantiliduNo ratings yet

- International Finance Balance of PaymentsDocument25 pagesInternational Finance Balance of PaymentsЈованаNo ratings yet

- Balance of PaymentsDocument28 pagesBalance of Paymentsmanojpatel5150% (2)

- The Balance of Payments BOP - FinalDocument45 pagesThe Balance of Payments BOP - FinalWaleed ElsebaieNo ratings yet

- Chapter 3 - Balance of PaymentDocument19 pagesChapter 3 - Balance of PaymentAisyah AnuarNo ratings yet

- Macroeconomics Notes Unit 4Document19 pagesMacroeconomics Notes Unit 4Eshaan GuruNo ratings yet

- Consortium BankDocument5 pagesConsortium BankAbdul QuddusNo ratings yet

- BOP SatyaDocument4 pagesBOP SatyaAshwin KumarNo ratings yet

- Ifm Assign BopDocument11 pagesIfm Assign BopRuhan MasaniNo ratings yet

- DIB 02 - 202 International Trade and Finance - 01Document14 pagesDIB 02 - 202 International Trade and Finance - 01farhadcse30No ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- The Fundamantal BalanceDocument2 pagesThe Fundamantal BalancekifayatullahsheNo ratings yet

- Balance of Payments Credit Debit Current AccountDocument3 pagesBalance of Payments Credit Debit Current AccountVijay ManeNo ratings yet

- Creative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceFrom EverandCreative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceRating: 3.5 out of 5 stars3.5/5 (5)

- Chapter 6 - The Revenue CycleDocument23 pagesChapter 6 - The Revenue CycleTấn TấnNo ratings yet

- Microsoft Word - Vision 2030 Jamaica - Final Draft Manufacturing Sector PlaDocument54 pagesMicrosoft Word - Vision 2030 Jamaica - Final Draft Manufacturing Sector PlaSrihari KollapuriNo ratings yet

- Auditing-Review Questions Chapter 13Document2 pagesAuditing-Review Questions Chapter 13meiwin manihingNo ratings yet

- Practice Exercise - Adjusting Entries WorksheetDocument9 pagesPractice Exercise - Adjusting Entries WorksheetRhea Rocha AlfonsoNo ratings yet

- Cross Cultural DiferencesDocument112 pagesCross Cultural DiferencesKatarina TešićNo ratings yet

- Stocks vs. Gold - Updated Historical Chart - Longtermtrends PDFDocument3 pagesStocks vs. Gold - Updated Historical Chart - Longtermtrends PDFJagjyot SinghNo ratings yet

- 2 - FPA (DTC Format Agreement)Document4 pages2 - FPA (DTC Format Agreement)Thomas DyeNo ratings yet

- Ksutt 7Document3 pagesKsutt 7Kelle SuttonNo ratings yet

- Sapphiro Joining Gift Vouchers TermsDocument5 pagesSapphiro Joining Gift Vouchers TermsPragun SaraffNo ratings yet

- Metro Bank PDFDocument65 pagesMetro Bank PDFRhea May BaluteNo ratings yet

- Dell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Document71 pagesDell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Henry WijayaNo ratings yet

- BSG PowerPoint Presentation - V3.0Document85 pagesBSG PowerPoint Presentation - V3.0Henry PamaNo ratings yet

- Book Value Per Share PresentationDocument22 pagesBook Value Per Share PresentationharoonameerNo ratings yet

- Agent Study MaterialDocument51 pagesAgent Study MaterialPrakash ReddyNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Nature, Scope and Objectives of PartnershipDocument4 pagesNature, Scope and Objectives of PartnershipKathleenNo ratings yet

- Case 1Document2 pagesCase 1GA ZinNo ratings yet

- EODBDocument10 pagesEODBJyotishree PandeyNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRommel VinluanNo ratings yet

- Value Guide Dec 08 - SSKIDocument57 pagesValue Guide Dec 08 - SSKIIndrajeet PaNo ratings yet

- Ch7 Ident - Market Segments&Targets FINALDocument19 pagesCh7 Ident - Market Segments&Targets FINALdianaflorezhNo ratings yet

- Customergrievance Redressal PolicyDocument3 pagesCustomergrievance Redressal PolicySatyam PatilNo ratings yet

- Internship Report - Kamrul Islam TuhinDocument43 pagesInternship Report - Kamrul Islam TuhinJehan MahmudNo ratings yet

- Bidding Documents - Solarization of Schools Merged Areas - FinalDocument235 pagesBidding Documents - Solarization of Schools Merged Areas - FinalFaridoon AhmedNo ratings yet

- CIB OnlineDocument22 pagesCIB OnlineRejaul KarimNo ratings yet

- The Implementation of ISO9000 in Vietnam: Case Studies From The Footwear IndustryDocument10 pagesThe Implementation of ISO9000 in Vietnam: Case Studies From The Footwear Industrysps fetrNo ratings yet

- VNT - Step 4 - Group 212032 - 68Document9 pagesVNT - Step 4 - Group 212032 - 68lina osorioNo ratings yet

- Gcoc Vs ScocDocument6 pagesGcoc Vs Scocdanish_1985No ratings yet

Balance of Payments

Balance of Payments

Uploaded by

Vidhi ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance of Payments

Balance of Payments

Uploaded by

Vidhi ShahCopyright:

Available Formats

431

Name: Vidhi Shah Roll No: 431 Topic: Causes of BOP disequilibrium. Class: T.Y.B.Com Dic: C Academic Year 2011-12

Vivek College of Commerce

Page 1

431

Balance of payments (BOP) accounts are an accounting record of all monetary transactions between a country and the rest of the world.[1] These transactions include payments for the country's exports and imports of goods, services, financial capital, and financial transfers. The BOP accounts summarize international transactions for a specific period, usually a year, and are prepared in a single currency, typically the domestic currency for the country concerned. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as negative or deficit items. When all components of the BOP accounts are included they must sum to zero with no overall surplus or deficit. For example, if a country is importing more than it exports, its trade balance will be in deficit, but the shortfall will have to be counter-balanced in other ways such as by funds earned from its foreign investments, by running down central bank reserves or by receiving loans from other countries. While the overall BOP accounts will always balance when all types of payments are included, imbalances are possible on individual elements of the BOP, such as the current account, the capital account excluding the central bank's reserve account, or the sum of the two. Imbalances in the latter sum can result in surplus countries accumulating wealth, while deficit nations become increasingly indebted. The term "balance of payments" often refers to this sum: a country's balance of payments is said to be in surplus (equivalently, the balance of payments is positive) by a certain amount if sources of funds (such as export goods sold and bonds sold) exceed uses of funds (such as paying for imported goods and paying for foreign bonds purchased) by that amount. There is said to be a balance of payments deficit (the balance of payments is said to be negative) if the former are less than the latter. Under a fixed exchange rate system, the central bank accommodates those flows by buying up any net inflow of funds into the country or by providing foreign currency funds to the foreign exchange market to match any international outflow of funds, thus preventing the funds flows from affecting the exchange rate between the country's currency and other currencies. Then the net change per year in the central bank's foreign exchange reserves is sometimes called the balance of payments surplus or deficit. Alternatives to a fixed exchange rate system include a managed float where some changes of exchange rates are allowed, or at the other extreme a purely floating exchange rate (also known as a purely flexible exchange rate). With a pure float the central bank does not intervene at all to protect or devalue its currency, allowing the rate to be set by the market, and the central bank's foreign exchange reserves do not change. Historically there have been different approaches to the question of how or even whether to eliminate current account or trade imbalances. With record

Vivek College of Commerce Page 2

431

trade imbalances held up as one of the contributing factors to the financial crisis of 20072010, plans to address global imbalances have been high on the agenda of policy makers since 2009

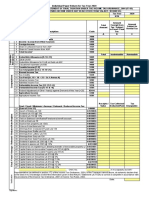

Basic analysis The two principal parts of the BOP accounts are the current account and the capital account. The current account shows the net amount a country is earning if it is in surplus, or spending if it is in deficit. It is the sum of the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors) and cash transfers. It is called the current account as it covers transactions in the "here and now" - those that don't give rise to future claims. The capital account records the net change in ownership of foreign assets. It includes the reserve account (the foreign exchange market operations of a nation's central bank), along with loans and investments between the country and the rest of world (but not the future regular repayments/dividends that the loans and investments yield; those are earnings and will be recorded in the current account). The term "capital account" is also used in the narrower sense that excludes central bank foreign exchange market operations: Sometimes the reserve account is classified as "below the line" and so not reported as part of the capital account. Expressed with the broader meaning for the capital account, the BOP identity assumes that any current account surplus will be balanced by a capital account deficit of equal size - or alternatively a current account deficit will be balanced by a corresponding capital account surplus: The balancing item, which may be positive or negative, is simply an amount that accounts for any statistical errors and assures that the current and capital accounts sum to zero. By the principles of double entry accounting, an entry in the current account gives rise to an entry in the capital account, and in aggregate the two accounts automatically balance. A balance isn't always reflected in reported figures for the current and capital accounts, which might, for example, report a surplus for both accounts, but when this happens it always means something has been missedmost commonly, the operations of the country's central bankand what has been missed is recorded in the statistical discrepancy term (the balancing item).[3]

Vivek College of Commerce

Page 3

431

An actual balance sheet will typically have numerous sub headings under the principal divisions. For example, entries under Current account might include:

Trade buying and selling of goods and services Exports a credit entry Imports a debit entry Trade balance the sum of Exports and Imports Factor income repayments and dividends from loans and investments Factor earnings a credit entry Factor payments a debit entry Factor income balance the sum of earnings and payments.

Especially in older balance sheets, a common division was between visible and invisible entries. Visible trade recorded imports and exports of physical goods (entries for trade in physical goods excluding services is now often called the merchandise balance). Invisible trade would record international buying and selling of services, and sometimes would be grouped with transfer and factor income as invisible earnings.[1] The term "balance of payments surplus" (or deficit a deficit is simply a negative surplus) refers to the sum of the surpluses in the current account and the narrowly defined capital account (excluding changes in central bank reserves). Denoting the balance of payments surplus as BOP surplus, the relevant identity is

Variations in the use of term "balance of payments" Economics writer J. Orlin Grabbe warns the term balance of payments can be a source of misunderstanding due to divergent expectations about what the term denotes. Grabbe says the term is sometimes misused by people who aren't aware of the accepted meaning, not only in general conversation but in financial publications and the economic literature. A common source of confusion arises from whether or not the reserve account entry, part of the capital account, is included in the BOP accounts. The reserve account records the activity of the nation's central bank. If it is excluded, the BOP can be in surplus (which implies the central bank is building up foreign exchange reserves) or in deficit (which implies the central bank is running down its reserves or borrowing from abroad).

Vivek College of Commerce

Page 4

431

The term "balance of payments" is sometimes misused by non-economists to mean just relatively narrow parts of the BOP such as the trade deficit, [3] which means excluding parts of the current account and the entire capital account. Another cause of confusion is the different naming conventions in use.[4] Before 1973 there was no standard way to break down the BOP sheet, with the separation into invisible and visible payments sometimes being the principal divisions. The IMF has their own standards for BOP accounting which is equivalent to the standard definition but uses different nomenclature, in particular with respect to the meaning given to the term capital account.

The IMF definition The International Monetary Fund (IMF) use a particular set of definitions for the BOP accounts, which is also used by the Organization for Economic Cooperation and Development (OECD), and the United Nations System of National Accounts (SNA).[ The main difference in the IMF's terminology is that it uses the term "financial account" to capture transactions that would under alternative definitions be recorded in the capital account. The IMF uses the term capital account to designate a subset of transactions that, according to other usage, form a small part of the overall capital account. The IMF separates these transactions out to form an additional top level division of the BOP accounts. Expressed with the IMF definition, the BOP identity can be written:

Vivek College of Commerce

Page 5

431

Causes of BOP imbalances There are conflicting views as to the primary cause of BOP imbalances, with much attention on the US which currently has by far the biggest deficit. The conventional view is that current account factors are the primary cause [12] these include the exchange rate, the government's fiscal deficit, business competitiveness, and private behavior such as the willingness of consumers to go into debt to finance extra consumption.[13] An alternative view, argued at length in a 2005 paper by Ben Bernanke, is that the primary driver is the capital account, where a global savings glut caused by savers in surplus countries, runs ahead of the available investment opportunities, and is pushed into the US resulting in excess consumption and asset price inflation.[14]

Reserve asset Main article: Reserve currency

The US dollar has been the leading reserve asset since the end of the gold standard. In the context of BOP and international monetary systems, the reserve asset is the currency or other store of value that is primarily used by nations for their foreign reserves.[15] BOP imbalances tend to manifest as hoards of the reserve asset being amassed by surplus countries, with deficit countries building debts denominated in the reserve asset or at least depleting their supply. Under a gold standard, the reserve asset for all members of the standard is gold. In the Bretton Woods system, either gold or the U.S. dollar could serve as the reserve asset, though its smooth operation depended on countries apart from the US choosing to keep most of their holdings in dollars. Following the ending of Bretton Woods, there has been no de jure reserve asset, but the US dollar has remained by far the principal de facto reserve. Global reserves rose sharply in the first decade of the 21st century, partly as a result of the 1997 Asian Financial Crisis, where several nations ran out of foreign currency needed for essential imports and thus had to accept deals on unfavorable terms. The International Monetary Fund (IMF) estimates that between 2000 to mid-2009, official reserves rose from $1,900bn to $6,800bn.[16] Global reserves had peaked at about $7,500bn in mid 2008, and then declined by about $430bn as countries without their own reserve currency used them to shield themselves from the worst effects of the financial crisis. From Feb 2009 global reserves began increasing again to reach close to

Vivek College of Commerce Page 6

431

$9,200bn by the end of 2010. As of 2009 approximately 65% of the world's $6,800bn total is held in U.S. dollars and approximately 25% in Euros. The UK pound, Japanese yen, IMFSpecial Drawing Rights (SDRs), and precious metals [19] also play a role. In 2009 Zhou Xiaochuan, governor of the People's Bank of China, proposed a gradual move towards increased use of SDRs, and also for the national currencies backing SDRs to be expanded to include the currencies of all major economies. Dr Zhou's proposal has been described as one of the most significant ideas expressed in 2009. While the current central role of the dollar does give the US some advantages such as lower cost of borrowings, it also contributes to the pressure causing the U.S. to run a current account deficit, due to the Triffin dilemma. In a November 2009 article published in Foreign Affairs magazine, economist C. Fred Bergsten argued that Dr Zhou's suggestion or a similar change to the international monetary system would be in the United States' best interests as well as the rest of the worlds. Since 2009 there has been a notable increase in the number of new bilateral agreements which enable international trades to be transacted using a currency that isn't a traditional reserve asset, such as the renminbi, as the Settlement currency.

Balance of payments crisis Main article: Currency crisis A BOP crisis, also called a currency crisis, occurs when a nation is unable to pay for essential imports and/or service its debt repayments. Typically, this is accompanied by a rapid decline in the value of the affected nation's currency. Crises are generally preceded by large capital inflows, which are associated at first with rapid economic growth. However a point is reached where overseas investors become concerned about the level of debt their inbound capital is generating, and decide to pull out their funds. The resulting outbound capital flows are associated with a rapid drop in the value of the affected nation's currency. This causes issues for firms of the affected nation who have received the inbound investments and loans, as the revenue of those firms is typically mostly derived domestically but their debts are often denominated in a reserve currency. Once the nation's government has exhausted its foreign reserves trying to support the value of the domestic currency, its policy options are very limited. It can raise its interest rates to try to prevent further declines in the value of its currency, but while this can help those with debts in denominated in foreign currencies, it generally further depresses the local economy.

Vivek College of Commerce

Page 7

431

DISEQUILIBRIUM IN BALANCE OF PAYMENT

Disequilibrium in balance of payment the balance of payment of a country is said to be in equilibrium when the demand for foreign exchange is exactly equivalent to the supply of it. The balance of payment is in disequilibrium when there is either a surplus or deficit in the balance of payments. When there is deficit in the balance of payments, the demand for foreign exchange exceeds the demand for it. A number of factors may cause disequilibrium in the balance of payments. These causes may be broadly categorized into: 1. Economic factors; 2. Political factors; 3. Sociological factors. 1. Economic factors i. Development Disequilibrium large scale development expenditures usually increase the purchasing power, aggregate demand and prices, resulting in substantially large imports. The development disequilibrium is common in developing countries, because the above factors, and large scale capital goods imports needed for carrying out the various development programmers, give rise to a deficit in the balance of payments. ii. Capital Disequilibrium Cyclical fluctuations in general business activity are one of the prominent reasons for the balance of payments disequilibrium. As Lawrance W. Towle points out, depression always brings about a drastic shrinkage in world trade, while prosperity stimulates it. A country enjoying a boom all by itself ordinarily experiences more rapid growth in its imports than its exports, while the opposite is true of other countries. But production in the other countries will be activated as a result of the increase exports to the boom country. iii. Secular disequilibrium sometimes, the balance of payments disequilibrium persists for a long time because of certain secular trends in the economy. For instance in a developed country, the disposal income is generally very high and, therefore, the

Vivek College of Commerce Page 8

431

aggregate demand, too, is very high. At the same time, production costs are very high because of the higher wages. This naturally results in higher prices. These two factors-high domestic prices may result in the imports being much higher than the exports. This could be one of the reasons for the persistent balance of payments deficits of the USA. 2. Political Factors Certain political factors may also produce a balance of payment disequilibrium. For, instance a country plagued with political instability may experience large capital outflows, inadequacy of domestic investment and production, etc. These factors may sometimes, cause disequilibrium in the balance of payments. Further factors like wars, changes in world trade routes, etc. may also produce balance of payments difficulties. 3. Social Factors Certain social factors may also produce a balance of payments. For instance, changes in tastes, preferences, fashion, etc. may affect imports and exports and thereby affect the balance of payments. Trade cycle: Cyclical fluctuations, their phases and amplitudes, differences in different countries, generally produce cyclical disequilibrium. Huge development & investment programmes: Due to huge development and investment programs , Import goes on increasing for want of capital for rapid industrialization, while exports may not be boosted up to that extent as these are the primary producing countries. Thus, there will be structural changes in the balance of payments and structural equilibrium will result. Changing Export demand: A vast increase in the domestic production of foodstuffs, raw materials, substitute goods, etc. in advanced countries has decreased their need for import from the underdeveloped countries. Hence, export demand has considerably changed resulting in structural disequilibrium. Similarly, developed countries will loose their market share in underdeveloped countries, owing to the tendency of underdeveloped nations to self reliance.

Population growth: High population growth in poor countries has adverse impact on their balance of payments. Increase in the population increases the n needs of these countries for imports and decreases the capacity of export.

Vivek College of Commerce Page 9

431

Huge external borrowing: A country will have adverse balance of payments when it borrows heavily from another country, while the lending country will have a favorable balance and a deficit balance of payments. Inflation: Rapid economic development, increase in the income & price will adversely affect BOP position of a developing country. With increase in income, import requirements will get increased. Also consumption of the domestic production will be fast. This leads to increase in Import and decrease in export. Also huge investment in heavy industries in the developing countries may have an inflationary impact, as the output of these industries will not be forthcoming immediately, whereas money income will have been already increased.

Demonstration effect: When people of underdeveloped nations come into contact with those of advance countries through economic, political or social relations there will be a demonstration effect on the consumption pattern. It will increase need for import whereas their export quantum remains same.

Reciprocal demands: Need of reciprocal demand for products of different countries differs leading terms of trade of a country may be set differently with differently with different countries under multi trade transactions. This may lead to disequilibrium.

4. Natural Factors Natural calamities such as the failure of rains or the coming floods may easily cause disequilibrium in the balance of payments by adversely affecting agriculture and industrial production in the country. The exports may decline while the imports may go up causing a discrepancy in the country's balance of payments.

Vivek College of Commerce

Page 10

431

5. Cyclical Fluctuations Business fluctuations introduced by the operations of the trade cycles may also cause disequilibrium in the country's balance of payments. For example, if there occurs a business recession in foreign countries, it may easily cause a falling the exports and exchange earning of the country concerned, resulting in a disequilibrium in the balance of payments.

Globalization

Due to globalization there has been more liberal and open atmosphere for international movement of goods, services and capital. Competition has beer increased due to the globalization of international economic relations. The emerging new global economic order has brought in certain problems for some countries which have resulted in the balance of payments disequilibrium

Methods of Correcting Disequilibrium in Balance of Payments: We have stated earlier that a country must obtain equilibrium in her balance of payments with other countries in the long run. When the balance of payments is favorable, it can be looked at with satisfaction from her point of view because the surplus will be invested abroad in securities. But if a country has deficit balance in perpetuity, it must be rectified by taking necessary steps. The days of the gold standard are gone when the balance was corrected automatically under gold standard. An active or passive balance accompanied by an inflow or outflow of gold was normally supposed to result in an expansion or contraction of the domestic money supply, and this expansion or contraction was expected to bring about a rise or fall in the level of domestic costs and prices tending in the former case to stimulate imports and discourage exports or in the latter, to discourage imports and stimulate exports. Gold flow, changes in the quantity of money, and changes in relative price levels, thus appeared as the principal factor in the mechanism of adjustment. But, now days when every country is on inconvertible standard, steps are to be

Vivek College of Commerce Page 11

431

taken to correct the adverse balance of payments. The main methods adopted to cover a deficit in balance of payments of a country are as follows: (i) Rectifying the Balance of Trade: One of the major items which can adversely affect the balance of payments of a country is the excess of imports over exports. In case of a deficit in the balance of payments, a country must try to stimulate exports or discourage imports or do both. The exports can be encouraged by bringing down the level of costs in the country, of by granting bounties or by giving concessions to industrialists and exporters. Imports can be restricted either by adopting quota system or by imposing duties or by reducing people's disposable income or by higher taxation or by reduced government expenditure or by total prohibitions, etc. (ii) Deflation: Deflation is another important weapon which is used to correct the unfavorable balance of payments. The currency authority may try to lower the prices by reducing the quantity of money in circulation. If the country succeeds in bringing down the prices, it then becomes a good market to buy from and a bad market to sell in. Exports are encouraged, and imports fall and thus the deficit gap is greatly reduced. This method when adopted is full of dangers. If by contracting supply of money, the prices are lowered, the rigid costs may not be brought down. Labor may oppose tire reduction in the wages. This can lead to depression and unemployment in the country which may prove very dangerous. (iii) Devaluation: Devaluation is a remedy which is applied only in times of extreme crisis to correct the adverse balance of payments. Devaluation means the lowering of the exchange rate. This method like devaluation is adopted to cheapen exports and make imports dearer. Devaluation, thus, raises exports and lowers imports. England devalued the value of pound from 4.03 dollars to 2.80 dollars, i.e. by 30% in September, 1949 to correct disequilibrium in her balance of payments. Pakistan first devalued its currency in 1955. The advantage with this method is that there is no need to reduce the money wages and the object is achieved. The disadvantage is that it shakes the people's confidence in home currency. (iv) Exchange Control: Exchange control is a very effective and useful method for correcting adverse balance of payments. Under this system, the government enforces a complete monopoly of buying and selling of foreign exchange in the foreign exchange market. The exporters are required to surrender their foreign exchange at fixed rates to the central bank. The central bank then rations out this foreign exchange among the licensed importers of essential commodities only. When imports are restricted to the available foreign exchange, the problem of adverse balance of payments is then greatly solved.

Vivek College of Commerce

Page 12

431

(v) International Monetary Fund: Deficit in the balance of payments can also be covered by obtaining assistance from International Monetary Fund. The IMF, which began its operation in March, 1941, helps member countries in maintaining equilibrium in the balance of payments. The International Monetary Fund has proved very helpful in promoting exchange stability and facilitating the settlement of international transactions.

INDIA balance of payments Key statistical concept The Reserve Bank of India (RBI) is responsible for compiling the balance of payments for India . The RBI obtains data on the balance of payments External primarily as a by-product of the administration of the exchange control. In accordance with the Foreign Exchange Management Act (FEMA) of 1999, all foreign exchange transactions must be channeled through the banking system, and the banks that undertake foreign exchange transactions must submit various periodical returns and supporting documents prescribed under the FEMA. In respect of the transactions that are not routed through banking channels, information is obtained directly from the relevant government agencies, other concerned agencies, and other departments within the RBI. The information is also supplemented by data collected through various surveys conducted by the RBI.Data are prepared on a quarterly basis and are published in the Reserve Bank of India Bulletin. The data are compiled in cores of rupees (one core is equal to 10million) and are broadly in conformity with the recommendations of the BPM5. The data are also expressed in millions of U.S. The data are compiled in cores of rupees (one core is equal to 10 million) and are broadly in conformity with the recommendations of theBPM5. The data are also expressed in millions of U.S. dollars

Vivek College of Commerce

Page 13

431

Key statistical concept Current Account Goods The RBI compiles data on merchandise transactions mainly as a by-product of the administration of exchange control. Data on exports are based on export transactions and the collection of export proceeds as reported by the banks. In the case of imports, exchange control records cover only those imports for which payments have been effected through banking channels in India. Information on payments for imports not passing through the banking channels is obtained from other sources, primarily government records and borrowing entities in respect of their commercial borrowing. Since 1992-93, the value of gold and silver brought to India by returning travelers has been added to the imports data with a contra-entry under current transfers, other sectors. Exports are recorded on an f.o.b. basis, whereas imports are recorded c.i.f. The IMF adjusts imports, for publication, to an f.o.b. basis by assuming freight and insurance to be 10 percent of the c.i.f.value.

Service Under the exchange control rules, authorized dealers (i.e., banks authorized to dealing foreign exchange) are required to report details in respect of transactions, other than exports, when the individual remittances exceed a stipulated amount. For receipts below this amount, the banks report only aggregate amounts without indicating the purpose of the incoming remittance. The balance of payments classification of these receipts is made on the basis of the Survey of Unclassified Receipts conducted by the RBI. This sample survey is conducted on a biweekly basis.

Vivek College of Commerce

Page 14

431

SUMMARY

Some trade deficits are partially self correcting But recession and depreciation are not enough if the root causes lie on the supply-side of the economy Ultimately BOP adjustment requires: Period of below trend growth Improvement in investment in traded goods industries Control of price and cost inflation relative to that of our competitors Open trade to drive better export performance Protectionism is not the answer

Vivek College of Commerce

Page 15

431

Bibliography: www.economicshelp.org www.wiki.answers.com www.books.google.co.in www.umanitoba.ca/faculties/arts/economics

Vivek College of Commerce

Page 16

You might also like

- Business: Level 1/2 Paper 2: Investigating Large BusinessesDocument16 pagesBusiness: Level 1/2 Paper 2: Investigating Large BusinessesEHANo ratings yet

- Convergys Data (GE)Document15 pagesConvergys Data (GE)Anwesha Dev ChaudharyNo ratings yet

- Balance of Payment Position of Sri Lanka.Document32 pagesBalance of Payment Position of Sri Lanka.Dhawal KhandelwalNo ratings yet

- Current AccoCurrent AccountDocument25 pagesCurrent AccoCurrent AccountRajesh NairNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsrohitlohiyaNo ratings yet

- Balance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsDocument120 pagesBalance of Payments: Balance of Payments (BOP) Accounts Are An Accounting Record of All Monetary TransactionsMahesh KumbharNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of PaymentsJutt TheMagicianNo ratings yet

- Balance of Payments ProjectDocument21 pagesBalance of Payments Projectmanoj100% (2)

- Causes of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTDocument36 pagesCauses of Disequilibrium in Balance of PaymentCAUSES OF DISEQUILIBRIUM IN BALANCE OF PAYMENTAlisha Singh67% (3)

- Composition of The Balance of Payments SheetDocument13 pagesComposition of The Balance of Payments SheetAndy SdsdsadNo ratings yet

- Balance of Payment (BINAY SINGH) 11Document12 pagesBalance of Payment (BINAY SINGH) 11barhpatnaNo ratings yet

- Balance of Payments Accounting Concepts of Foreign TradeDocument6 pagesBalance of Payments Accounting Concepts of Foreign TradePravin BadeNo ratings yet

- Balance of Payments WikiDocument24 pagesBalance of Payments WikiSOURAV MONDALNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentssneha_gehaniNo ratings yet

- A Balance of PaymentsDocument27 pagesA Balance of PaymentsThaneesh KumarNo ratings yet

- Balance of Trade and Balance of Payment NewDocument27 pagesBalance of Trade and Balance of Payment NewApril OcampoNo ratings yet

- Govt R.C College of Commerce & Management International BusinessDocument17 pagesGovt R.C College of Commerce & Management International BusinessManasa PuttaswamyNo ratings yet

- Balance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsDocument14 pagesBalance of Payments: Exports Imports Goods Services Financial Capital Financial Transfers Loans InvestmentsdeanNo ratings yet

- Balance of PaymentsDocument6 pagesBalance of PaymentsarjunreddygrNo ratings yet

- Balance of PaymentsDocument19 pagesBalance of PaymentsANIL_SHAR_MANo ratings yet

- Balance of PaymentDocument35 pagesBalance of PaymentRupesh MoreNo ratings yet

- Int FinanceDocument59 pagesInt FinanceKshitij KaushikNo ratings yet

- Balance of Payments - Document TranscriptDocument10 pagesBalance of Payments - Document TranscriptMir Wajahat AliNo ratings yet

- BOP (Balance of Payment) : IMF DefinitionDocument33 pagesBOP (Balance of Payment) : IMF DefinitionHapp'z Sid'zNo ratings yet

- Balance of Payment (BOP) - Concept & DefinitionDocument3 pagesBalance of Payment (BOP) - Concept & DefinitionAnand VermaNo ratings yet

- Balance of PaymentDocument6 pagesBalance of Paymentbhagat103No ratings yet

- Balance of PaymentDocument5 pagesBalance of PaymentAbraham Kyagz KyagulanyiNo ratings yet

- Chapter 4Document10 pagesChapter 4Askar GaradNo ratings yet

- Balance of Payments (BOP) Definition - InvestopediaDocument2 pagesBalance of Payments (BOP) Definition - InvestopediaShachi SangharajkaNo ratings yet

- Balance of PaymentsDocument7 pagesBalance of Paymentsmahantesh123No ratings yet

- What Is The Balance of Payments?Document4 pagesWhat Is The Balance of Payments?Iram AzharNo ratings yet

- Epathshala BOPDocument9 pagesEpathshala BOPSiddhant AthawaleNo ratings yet

- Finals Speto ReviewerDocument2 pagesFinals Speto ReviewerMhars Dela CruzNo ratings yet

- Introduction of Balance of PaymentsDocument27 pagesIntroduction of Balance of PaymentsPallavi RanjanNo ratings yet

- Balance of PaymentDocument16 pagesBalance of PaymentpatelrutulNo ratings yet

- Balance of Payment Interpretation and ExerciseDocument5 pagesBalance of Payment Interpretation and ExerciseFadele1981No ratings yet

- PiyushDocument14 pagesPiyushVarsha KumariNo ratings yet

- Balance of Payments (Bop)Document29 pagesBalance of Payments (Bop)Chintakunta PreethiNo ratings yet

- BOP AssignmentDocument20 pagesBOP AssignmentSajid Karbari0% (1)

- Composition of Balance of PaymentsDocument8 pagesComposition of Balance of PaymentsYashonidhi ShuklaNo ratings yet

- Introducing: Balance of Payment Comparing South Africa and IndonesiaDocument15 pagesIntroducing: Balance of Payment Comparing South Africa and IndonesiaEpik AbillyNo ratings yet

- A Report On "Balance of Payments": Concept QuestionsDocument25 pagesA Report On "Balance of Payments": Concept QuestionsSaraswatiSinghNo ratings yet

- A Report On "Balance of Payments": Concept QuestionsDocument28 pagesA Report On "Balance of Payments": Concept QuestionsSaif ShakilNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentsনীল রহমানNo ratings yet

- Eco NotesDocument13 pagesEco Notesjaydeep.signkraftNo ratings yet

- Chapter V The Balance of PaymentDocument25 pagesChapter V The Balance of PaymentAshantiliduNo ratings yet

- International Finance Balance of PaymentsDocument25 pagesInternational Finance Balance of PaymentsЈованаNo ratings yet

- Balance of PaymentsDocument28 pagesBalance of Paymentsmanojpatel5150% (2)

- The Balance of Payments BOP - FinalDocument45 pagesThe Balance of Payments BOP - FinalWaleed ElsebaieNo ratings yet

- Chapter 3 - Balance of PaymentDocument19 pagesChapter 3 - Balance of PaymentAisyah AnuarNo ratings yet

- Macroeconomics Notes Unit 4Document19 pagesMacroeconomics Notes Unit 4Eshaan GuruNo ratings yet

- Consortium BankDocument5 pagesConsortium BankAbdul QuddusNo ratings yet

- BOP SatyaDocument4 pagesBOP SatyaAshwin KumarNo ratings yet

- Ifm Assign BopDocument11 pagesIfm Assign BopRuhan MasaniNo ratings yet

- DIB 02 - 202 International Trade and Finance - 01Document14 pagesDIB 02 - 202 International Trade and Finance - 01farhadcse30No ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- The Fundamantal BalanceDocument2 pagesThe Fundamantal BalancekifayatullahsheNo ratings yet

- Balance of Payments Credit Debit Current AccountDocument3 pagesBalance of Payments Credit Debit Current AccountVijay ManeNo ratings yet

- Creative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceFrom EverandCreative Cash Flow Reporting: Uncovering Sustainable Financial PerformanceRating: 3.5 out of 5 stars3.5/5 (5)

- Chapter 6 - The Revenue CycleDocument23 pagesChapter 6 - The Revenue CycleTấn TấnNo ratings yet

- Microsoft Word - Vision 2030 Jamaica - Final Draft Manufacturing Sector PlaDocument54 pagesMicrosoft Word - Vision 2030 Jamaica - Final Draft Manufacturing Sector PlaSrihari KollapuriNo ratings yet

- Auditing-Review Questions Chapter 13Document2 pagesAuditing-Review Questions Chapter 13meiwin manihingNo ratings yet

- Practice Exercise - Adjusting Entries WorksheetDocument9 pagesPractice Exercise - Adjusting Entries WorksheetRhea Rocha AlfonsoNo ratings yet

- Cross Cultural DiferencesDocument112 pagesCross Cultural DiferencesKatarina TešićNo ratings yet

- Stocks vs. Gold - Updated Historical Chart - Longtermtrends PDFDocument3 pagesStocks vs. Gold - Updated Historical Chart - Longtermtrends PDFJagjyot SinghNo ratings yet

- 2 - FPA (DTC Format Agreement)Document4 pages2 - FPA (DTC Format Agreement)Thomas DyeNo ratings yet

- Ksutt 7Document3 pagesKsutt 7Kelle SuttonNo ratings yet

- Sapphiro Joining Gift Vouchers TermsDocument5 pagesSapphiro Joining Gift Vouchers TermsPragun SaraffNo ratings yet

- Metro Bank PDFDocument65 pagesMetro Bank PDFRhea May BaluteNo ratings yet

- Dell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Document71 pagesDell, Inc. Historical Closing Stock Prices Stock (6!23!88 Until 10-29-13)Henry WijayaNo ratings yet

- BSG PowerPoint Presentation - V3.0Document85 pagesBSG PowerPoint Presentation - V3.0Henry PamaNo ratings yet

- Book Value Per Share PresentationDocument22 pagesBook Value Per Share PresentationharoonameerNo ratings yet

- Agent Study MaterialDocument51 pagesAgent Study MaterialPrakash ReddyNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- Nature, Scope and Objectives of PartnershipDocument4 pagesNature, Scope and Objectives of PartnershipKathleenNo ratings yet

- Case 1Document2 pagesCase 1GA ZinNo ratings yet

- EODBDocument10 pagesEODBJyotishree PandeyNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRommel VinluanNo ratings yet

- Value Guide Dec 08 - SSKIDocument57 pagesValue Guide Dec 08 - SSKIIndrajeet PaNo ratings yet

- Ch7 Ident - Market Segments&Targets FINALDocument19 pagesCh7 Ident - Market Segments&Targets FINALdianaflorezhNo ratings yet

- Customergrievance Redressal PolicyDocument3 pagesCustomergrievance Redressal PolicySatyam PatilNo ratings yet

- Internship Report - Kamrul Islam TuhinDocument43 pagesInternship Report - Kamrul Islam TuhinJehan MahmudNo ratings yet

- Bidding Documents - Solarization of Schools Merged Areas - FinalDocument235 pagesBidding Documents - Solarization of Schools Merged Areas - FinalFaridoon AhmedNo ratings yet

- CIB OnlineDocument22 pagesCIB OnlineRejaul KarimNo ratings yet

- The Implementation of ISO9000 in Vietnam: Case Studies From The Footwear IndustryDocument10 pagesThe Implementation of ISO9000 in Vietnam: Case Studies From The Footwear Industrysps fetrNo ratings yet

- VNT - Step 4 - Group 212032 - 68Document9 pagesVNT - Step 4 - Group 212032 - 68lina osorioNo ratings yet

- Gcoc Vs ScocDocument6 pagesGcoc Vs Scocdanish_1985No ratings yet