Professional Documents

Culture Documents

NCPL Tan

NCPL Tan

Uploaded by

CA Alpesh TatedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NCPL Tan

NCPL Tan

Uploaded by

CA Alpesh TatedCopyright:

Available Formats

May 17, 2024

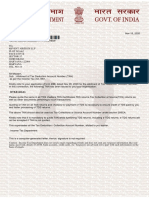

Ref.No.:830008600038061171/TAN/CR/NOR

TO,

NATURAL CEMECO PRIVATE LIMITED

KHASRA NO 4709/1929

NEAR JHOTA FARM HOUSE

60 FT ROAD GUDLI

RIICO INDUSTRIAL AREA

UDAIPUR-313024

RAJASTHAN

TEL. NO.:91-8875012519

Sir/Madam,

Sub : Request for changes or correction in Tax Deduction Account Number(TAN) data.

Kindly refer to your application dated May 10, 2024 for 'Request for changes or correction in TAN data'.

Your request has been processed as per change/correction form submitted by you.

Your updated details are as follows :

TAN JDHN04529A

Category / sub category of deductor OTHER COMPANY

Name As mentioned above

Designation of person responsible for Tax DIRECTOR

Deduction

Address As mentioned above

E-Mail Ids: ALPESH@CEMECO.IN

Phone: As mentioned above

Nationality INDIAN

TAN / TANS surrendered(if any)

Please quote your TAN(JDHN04529A) in all TDS challans, TDS Certificates, TDS returns, Tax Collection

at Source(TCS) returns as well as other documents pertaining to such transactions.

Quoting of TAN on all TDS returns and challans for payment of TDS is necessary to ensure credit of TDS

paid by you and faster processing of TDS returns.

The above TAN should also be used as Tax Collections at Source Account Number under section 206CA.

Kindly note that it is mandatory to quote TAN while furnishing TDS returns, including e-TDS returns.

e-TDS returns will not be accepted if TAN is not quoted.

Income Tax Department

This is a computer-generated letter. Hence, signature is not required.

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like user

name, password, details of ATM, bank accounts, credit cards, etc. Taxpayers are advised not to part with such information on the

basis of emails.

You might also like

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- Identification of Account Holder: PARTDocument2 pagesIdentification of Account Holder: PARTMuhammad HarisNo ratings yet

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDocument1 pageFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahNo ratings yet

- RTKR20027ADocument1 pageRTKR20027Ajijaboy366No ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961hssharmaNo ratings yet

- TAN UnlockedDocument1 pageTAN UnlockedthimothiNo ratings yet

- Team Ralys TANDocument1 pageTeam Ralys TANrameshNo ratings yet

- TAN CertificateDocument1 pageTAN Certificatesabir hussainNo ratings yet

- TAN - Sanjayrekha Aggregator - PNES82580BDocument1 pageTAN - Sanjayrekha Aggregator - PNES82580BHarshad JathotNo ratings yet

- TAN No - EasyfinDocument1 pageTAN No - EasyfinsantoshrdmcsNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Abu TaherNo ratings yet

- TAN - Khidmat Tours & Travels PVT LTDDocument1 pageTAN - Khidmat Tours & Travels PVT LTDSahab Uddin Ahmed ChoudhuryNo ratings yet

- Annex 882039274666970Document1 pageAnnex 882039274666970sandeep.soniNo ratings yet

- Annex 882038275424342Document1 pageAnnex 882038275424342Shree Nath Transport Co.No ratings yet

- Refund Request FormatDocument1 pageRefund Request FormatRam Narasimha100% (1)

- Annex 055840100375124Document2 pagesAnnex 055840100375124Siddhi PatilNo ratings yet

- TDS 194IA - Information P.RDocument1 pageTDS 194IA - Information P.RRohit ChhabraNo ratings yet

- ANNEX-034729702402334Document1 pageANNEX-034729702402334taranashamdasani0509No ratings yet

- Business License ApplicationDocument2 pagesBusiness License Applicationchern15No ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNo ratings yet

- Acc No: 906827017 BSNO: 19 D: Mr. Srinivasa Rao - SeeramDocument8 pagesAcc No: 906827017 BSNO: 19 D: Mr. Srinivasa Rao - SeeramNavakanth KvNo ratings yet

- Auto Debit Application Form: Detail of Application (As in Nric/Passport)Document1 pageAuto Debit Application Form: Detail of Application (As in Nric/Passport)retrii27No ratings yet

- Account Details Addition / Modification / Deletion Request FormDocument1 pageAccount Details Addition / Modification / Deletion Request Formdeepak.dpersonalNo ratings yet

- Vendor Registration Form - VRF 3 0Document1 pageVendor Registration Form - VRF 3 0Suraj Sankar Mukherjee100% (1)

- E-Toll Confirmation / Change of Direct Debit DetailsDocument1 pageE-Toll Confirmation / Change of Direct Debit DetailsBobdNo ratings yet

- SDFDocument3 pagesSDFShantsmackayNo ratings yet

- 6 Goods and Services TaxDocument15 pages6 Goods and Services TaxKumarVelivelaNo ratings yet

- Annex 881130211969615Document1 pageAnnex 881130211969615saleem shaikhNo ratings yet

- Annex 030409710286616Document1 pageAnnex 030409710286616sameer pashaNo ratings yet

- Howden CPR IT2024051701011507091Document1 pageHowden CPR IT2024051701011507091Aamir malikNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Adnpl4587bsd002 23 09 2011Document1 pageAdnpl4587bsd002 23 09 2011Sunjeeb Kumar ChoudhuryNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- MR Sheshnath H Shahni: Other Bill Payment OptionsDocument4 pagesMR Sheshnath H Shahni: Other Bill Payment OptionsHimanshu SiresiyaNo ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Rajesh Annex-259579700022090Document1 pageRajesh Annex-259579700022090sona singhNo ratings yet

- Income Tax Returns Filing: Marked Fields Are MandatoryDocument18 pagesIncome Tax Returns Filing: Marked Fields Are MandatoryashwinmjoshiNo ratings yet

- Bh2010maym27 854281471 977042308Document2 pagesBh2010maym27 854281471 977042308Deepmala ChoudhuryNo ratings yet

- Income Tax Payment Challan: PSID #: 143186538Document1 pageIncome Tax Payment Challan: PSID #: 143186538talhaNo ratings yet

- Annex 910243305921740Document1 pageAnnex 910243305921740modi27483No ratings yet

- It 000134579920 2022 00 PDFDocument1 pageIt 000134579920 2022 00 PDFMuhammad AslamNo ratings yet

- Photon Bill Nov Dec MonthDocument2 pagesPhoton Bill Nov Dec Monthmub_scribdNo ratings yet

- Sharmin Sultana: Tax Information AuthorizationDocument1 pageSharmin Sultana: Tax Information AuthorizationIam GalactorNo ratings yet

- MR Rajnan Kumar: Other Bill Payment OptionsDocument2 pagesMR Rajnan Kumar: Other Bill Payment OptionsMukesh BohraNo ratings yet

- Vendor Master FormDocument5 pagesVendor Master Formsus01No ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- Ms Roopa - Rangaswamy: Other Bill Payment OptionsDocument4 pagesMs Roopa - Rangaswamy: Other Bill Payment OptionsDasarath RamNo ratings yet

- Checklist For Enrolment With GST Portal 09012017Document8 pagesChecklist For Enrolment With GST Portal 09012017Mahaveer P UpadhyeNo ratings yet

- Acc No: 906484771 Bsno: 2: MR Ravinder Verma .Document2 pagesAcc No: 906484771 Bsno: 2: MR Ravinder Verma .verma_ravinderNo ratings yet

- Acc No: 917805912 BSNO: 15 D: MR V Siva Kumar - ReddyDocument8 pagesAcc No: 917805912 BSNO: 15 D: MR V Siva Kumar - ReddySivaReddyNo ratings yet

- Acc No: 207345071 BSNO: 47 D: MR Amitava GhoshDocument3 pagesAcc No: 207345071 BSNO: 47 D: MR Amitava GhoshAmitava GhoshNo ratings yet

- Dl2011novm05 1134415034 906495033Document2 pagesDl2011novm05 1134415034 906495033sumeshkumarsharmaNo ratings yet

- ReturnDocument1 pageReturnFaisal Islam ButtNo ratings yet

- Please Confirm Your Information Before Proceeding: Form 26QB Confirmation PageDocument5 pagesPlease Confirm Your Information Before Proceeding: Form 26QB Confirmation PageRevecons LLPNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- Payment SlipDocument1 pagePayment Sliphariom86No ratings yet

- Search FileDocument3 pagesSearch FileArunava BanerjeeNo ratings yet

- Annex 881038200955301Document1 pageAnnex 881038200955301cads vjaNo ratings yet

- Income Tax Payment Challan: PSID #: 141441493Document1 pageIncome Tax Payment Challan: PSID #: 141441493Syed Mudassar GillaniNo ratings yet

- Clarification On No TDS DeductionDocument2 pagesClarification On No TDS DeductionCA Alpesh TatedNo ratings yet

- APC Approved As On 31-12-2019Document10 pagesAPC Approved As On 31-12-2019CA Alpesh TatedNo ratings yet

- Lok Sabha Commitee17 Agriculture 7Document129 pagesLok Sabha Commitee17 Agriculture 7CA Alpesh TatedNo ratings yet

- Study Material 2018 Czc-BhopalDocument233 pagesStudy Material 2018 Czc-BhopalCA Alpesh TatedNo ratings yet

- MBD Brochure PDFDocument4 pagesMBD Brochure PDFCA Alpesh TatedNo ratings yet

- Lok Sabha Commitee17 Agriculture 7Document129 pagesLok Sabha Commitee17 Agriculture 7CA Alpesh TatedNo ratings yet