Professional Documents

Culture Documents

PAYE

PAYE

Uploaded by

Sinikiwe Chipo LundakoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PAYE

PAYE

Uploaded by

Sinikiwe Chipo LundakoCopyright:

Available Formats

of 5% will be charged on the amount due, and interest

at the Bank of Zambia (BOZ) discount rate plus 2%.

10) Are allowances taxable?

All cash benefits paid in the form of allowances such as

education, housing, transport, utility and settling etc.

are taxable.

11) Are utility bills, school fees and school associa-

tion fees discharged by the employer taxable under

PAYE?

Where an employer discharges the liability of an

employee by paying his/her rent, electricity, telephone,

water bills, school fees or professional association fees,

club membership fees and similar payments, the

employer is required to add such payments to the

employees emoluments and deduct tax under PAYE.

12) Are there any benefits that are not subjected to

PAYE?

The following benefits are not subjected to PAYE: Call Centre: 4111

Labour Day Awards Email: advice@zra.org.zm

Ex-gratia payments Website: www.zra.org.zm

Medical expenses

Funeral expenses

Sitting allowances for councilors

Benefits that cannot be converted into cash such as

free residential housing provided by the employer,

canteen expenses and personal to holder cars.

13) Are payments for casual workers taxed?

Yes. They are taxed using tax tables for casual workers.

14) Are Zambians who are employed by foreign

missions and international organizations which are

exempted from remitting tax under the Diplomatic

and Immunities Act supposed to be taxed?

In such cases the employee is required to register for

PAYE under direct payment. The employee is required PAY AS YOU EARN

to submit returns and make payments directly to ZRA.

For more information contact:

(PAYE)

1. What is Pay As You Earn (PAYE)? Total tax due - 3,867.50 of the charge year, unemployment repayment may

Total tax payable - 3,867.50 arise due to incorrect use or non-use of tax tables. This

This is a method of deducting tax from employees’ repayment is part of the tax that you may have paid

emoluments in proportion to what they earn. Under during the tax year in which the employment is termi-

this system, the employer is required to: c) Calculation of Net Pay nated.

a) calculate tax payable by every employee; Gross Pay K15, 000.00 6) How can I make a claim?

b) deduct tax due from the emoluments; and Less tax K 3,867.50

c) remit tax deducted to Zambia Revenue Authority Net pay to employee K 11,132.50 You will be required to complete an Income Tax Return

(ZRA). for Individuals (ITF/1A) which is available at any ZRA

Note: Since 1st January 2018, it is no longer necessary offices in the provinces, and attach the following docu-

2. What are emoluments? to deduct the allowable pension contribution before ments:

arriving at taxable pay following the amendment to the - letter of termination of employment;

The term “emoluments” means total earnings of an Income Tax Act. - last pay-slip;

employee from employment. These include wages, - particulars of employee leaving (form ITF/P13 (1));

salaries, overtime, leave pay, commissions, fees, 4) What should I do if I leave employment? and

bonuses and any other payments from employment - any other payment vouchers. This will enable the tax

or office (Section 2 of Income Tax Act). When you leave your current employment, obtain a office to calculate the refund of tax due.

form showing all payroll details (ITF/P13) (2) from your

3. How is tax calculated? former employer. This enables your new employer to A notice of your refund claim will be sent to you via

make the correct tax deductions when you are re-em- email/text message.

Under the PAYE system, the amount of tax which the ployed. If the ITF/P13 (2) is not provided to your new

employer deducts from any pay depends on: employer, the tax deductions could be higher than you Note: Refund claims for 2020 and subsequent charge

a) the employee’s total gross pay; and should suffer. years must be submitted online

b) the applicable tax rates.

If you are not re-employed, you may be entitled to a tax 7) How do I receive the tax refund?

Example: refund as explained below.

An employee with a gross pay of K15, 000.00 / month Refund payments are credited into the bank account of

in January 2021, which is month 1 under the Tax 5) How does a tax refund arise? the claimant as indicated in the refund claim form.

Tables, the tax will be calculated as follows;

A tax refund may arise in the following situations: 8) What if the tax deducted is wrong?

a) Calculation of Taxable Pay K

a) Errors: If there is an over-deduction of tax, a refund will be

Gross pay 15,000.00 made to the employees by the employer and only in

Taxable pay 15,000.00 Payroll errors, for example; the same charge year. If there is an under-deduction of

- Use of wrong tax bands and rates tax, the employer will pay the difference to the Revenue

b) Calculation of tax - Arithmetical errors in calculating tax Authority.

- Complete or partial omission of statutory deductions

First K 4, 000.00 @ 0% - 0 9) What if the tax deducted by the employer is not

Next K 800.00 @ 25% - 200.00 b) Unemployment Repayments: remitted on time to ZRA?

Next K 2, 100.00 @ 30% - 630.00

Balance K 8, 100.00 @ 37.5% - 3,037.50 If employment ceased at any time, but before the end If tax is not remitted on time by the employer, a penalty

You might also like

- GST HST Return Notice of Assessment 2022 11 17 00 29 29 773897 PDFDocument4 pagesGST HST Return Notice of Assessment 2022 11 17 00 29 29 773897 PDFalex mac dougallNo ratings yet

- Problems - Tax and BSDocument5 pagesProblems - Tax and BSNguyễn Thùy LinhNo ratings yet

- Tax Deduction at SourceDocument62 pagesTax Deduction at SourcePallavisweet100% (1)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Employment Income TaxDocument10 pagesEmployment Income TaxHarsh Nahar100% (1)

- Pay As You Earn PAYE Refunds 1Document2 pagesPay As You Earn PAYE Refunds 1bwalilubemba7No ratings yet

- Employer'S Guide To Pay As You Earn (PAYE)Document20 pagesEmployer'S Guide To Pay As You Earn (PAYE)Curter Lance LusansoNo ratings yet

- 19771ipcc It Vol1 Cp9Document40 pages19771ipcc It Vol1 Cp9Joseph SalidoNo ratings yet

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluNo ratings yet

- Salary Income NotesDocument14 pagesSalary Income NotesHani ShehzadiNo ratings yet

- PFT Chapter 4Document27 pagesPFT Chapter 4DanisaraNo ratings yet

- 30851ipcc May Nov14 It Vol1 CP 9.unlockedDocument43 pages30851ipcc May Nov14 It Vol1 CP 9.unlockedavesatanas13No ratings yet

- Chapter 3 PA IIDocument8 pagesChapter 3 PA IIMule AbuyeNo ratings yet

- Frequently Asked Questions (FAQ) - Monthly Tax Deduction (MTD) As Final TaxDocument4 pagesFrequently Asked Questions (FAQ) - Monthly Tax Deduction (MTD) As Final TaxjCNo ratings yet

- TDS & TCSDocument107 pagesTDS & TCSSANDEEP CHAURENo ratings yet

- Unit 4 PayrollDocument11 pagesUnit 4 PayrollHussen Abdulkadir100% (1)

- How To Compute Withholding Tax On CompensationDocument7 pagesHow To Compute Withholding Tax On CompensationJessica GabejanNo ratings yet

- Withholding TaxesDocument29 pagesWithholding TaxesJoshua NotaNo ratings yet

- Current Liabilities (Payroll)Document13 pagesCurrent Liabilities (Payroll)Bona MisbaNo ratings yet

- Tax Final Notes. 1Document25 pagesTax Final Notes. 1Hannah MeranoNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- 1604 and OthersDocument86 pages1604 and OthersBradley WhiteheadNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- PF CH 4Document13 pagesPF CH 4kukushajossiNo ratings yet

- Tax Deducted at Source TDSDocument55 pagesTax Deducted at Source TDSDhruv SetiaNo ratings yet

- Corporation Returns. - Requirements Final Adjustment ReturnDocument3 pagesCorporation Returns. - Requirements Final Adjustment ReturnDevilleres Eliza DenNo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- Module 1 E - Filing of ReturnsDocument8 pagesModule 1 E - Filing of Returnsshivani singhNo ratings yet

- Tool Kit Salary 2015Document11 pagesTool Kit Salary 2015Farhan JanNo ratings yet

- FABM2 Module 09 (Q2-W3-5)Document9 pagesFABM2 Module 09 (Q2-W3-5)Christian Zebua50% (4)

- Service TaxDocument3 pagesService Taxapi-3822396No ratings yet

- Worksheet 5 Q2 TaxationDocument15 pagesWorksheet 5 Q2 TaxationJennifer FabiaNo ratings yet

- Tax Deduction at SourceDocument4 pagesTax Deduction at SourcevishalsidankarNo ratings yet

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebeNo ratings yet

- Final Indirect Tax ProjectDocument39 pagesFinal Indirect Tax Projectssg1015No ratings yet

- Payment of Tax, PAYE and Employment IncomeDocument20 pagesPayment of Tax, PAYE and Employment IncomeRavihara D.G.KNo ratings yet

- CH 3 PeyrollDocument9 pagesCH 3 PeyrollChalachew Eyob100% (1)

- So Just What Is Fringe Benefit Tax?Document5 pagesSo Just What Is Fringe Benefit Tax?jasrajaNo ratings yet

- Fundamentals of Acc II CH 3 & 4Document13 pagesFundamentals of Acc II CH 3 & 4Sisay Belong To Jesus100% (2)

- Circular No. 285 Dated 21-10-1980Document1 pageCircular No. 285 Dated 21-10-1980Sayan MajumdarNo ratings yet

- All About Tax Deducted at Source (TDS) - Taxguru - inDocument11 pagesAll About Tax Deducted at Source (TDS) - Taxguru - inwaqtkeebaatein12No ratings yet

- VAT Returns and PaymentsDocument12 pagesVAT Returns and Paymentstauseefalam917No ratings yet

- 1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Document5 pages1.7.7.1. Entertainment Allowance (U/s 16 (Ii) ) : 1.7.7. Deduction Out of Gross Salary (Section 16)Vinod PillaiNo ratings yet

- PAYE ReturnDocument164 pagesPAYE Returnmulabbi brianNo ratings yet

- TDS On Salaries - Income Tax Department, INDIADocument112 pagesTDS On Salaries - Income Tax Department, INDIAArnav MendirattaNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunNo ratings yet

- Tax Assessment-Part ADocument20 pagesTax Assessment-Part Ajoseph lupashaNo ratings yet

- CHAPTER 3 PayrollDocument14 pagesCHAPTER 3 PayrollMahlet AemiroNo ratings yet

- Lecture Notes - Study Module 9 - TDSDocument32 pagesLecture Notes - Study Module 9 - TDSdata.mvgNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- Note For Employment IncomeDocument3 pagesNote For Employment IncomeSupun WanigasekaraNo ratings yet

- 31188sm DTL Finalnew-May-Nov14 Cp28Document66 pages31188sm DTL Finalnew-May-Nov14 Cp28gvcNo ratings yet

- ING Bank v. CIRDocument2 pagesING Bank v. CIRGraceNo ratings yet

- What Is Advance Payment of TaxDocument11 pagesWhat Is Advance Payment of TaxPrakhar KesharNo ratings yet

- Payroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverDocument2 pagesPayroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverJuline CisnerosNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Cash App November 2023 Account Statement 015eca0bd349633e80c101Document8 pagesCash App November 2023 Account Statement 015eca0bd349633e80c101zardvadNo ratings yet

- Cir v. Central Luzon Drug CorpDocument2 pagesCir v. Central Luzon Drug CorpLadyfirst SMNo ratings yet

- Status:Confirmed: Booking Reference: GGN9JR Guest Details 1 Freitzel Ann Gador (Adult)Document2 pagesStatus:Confirmed: Booking Reference: GGN9JR Guest Details 1 Freitzel Ann Gador (Adult)anon_764713026No ratings yet

- BeginDocument2 pagesBeginshawnb_249998No ratings yet

- Super Chem: Certified That The Particulars Given Above Are True and CorrectDocument1 pageSuper Chem: Certified That The Particulars Given Above Are True and CorrectAman PrajapatiNo ratings yet

- Introduction To Taxation: By: Michael Icaro, CpaDocument27 pagesIntroduction To Taxation: By: Michael Icaro, CpaAselleNo ratings yet

- CIR Vs Seagate, GR 153866Document3 pagesCIR Vs Seagate, GR 153866Mar Develos100% (1)

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewNo ratings yet

- Proposal For Custom Clearance FOR ENERGAS LNG TERMINALDocument8 pagesProposal For Custom Clearance FOR ENERGAS LNG TERMINALAsadNo ratings yet

- Chase DecemberDocument3 pagesChase Decemberraheemtimo1No ratings yet

- Tax On Corporation - NotesDocument9 pagesTax On Corporation - NotesMervidelleNo ratings yet

- Latihan Equivalence and Compound InterestDocument2 pagesLatihan Equivalence and Compound InterestRifky FayuzarNo ratings yet

- Custom DutyDocument7 pagesCustom DutyPriyanshuNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Taxation 109Document2 pagesTaxation 109Bisag AsaNo ratings yet

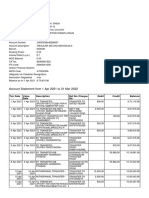

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceNiwadi PremiNo ratings yet

- Noon Doc 80038888 PDFDocument1 pageNoon Doc 80038888 PDFHitler 0070% (1)

- W2 Matthew RussellDocument2 pagesW2 Matthew Russellmatthewrussell661No ratings yet

- Customer Inquiry ReportDocument10 pagesCustomer Inquiry ReportDokter riskiNo ratings yet

- RUPC To DDN 23 Feb PDFDocument1 pageRUPC To DDN 23 Feb PDFSiddhant VohraNo ratings yet

- Interim Payment Certificate No. - 9: Quantity Surveyor Tpf-Rodic JVDocument1 pageInterim Payment Certificate No. - 9: Quantity Surveyor Tpf-Rodic JVvishan kosiNo ratings yet

- Ebook College Accounting A Career Approach 12Th Edition Scott Test Bank Full Chapter PDFDocument57 pagesEbook College Accounting A Career Approach 12Th Edition Scott Test Bank Full Chapter PDFkhucly5cst100% (13)

- US Internal Revenue Service: p54 - 2000Document43 pagesUS Internal Revenue Service: p54 - 2000IRSNo ratings yet

- T24 Induction Business - TellerDocument63 pagesT24 Induction Business - TellerKrishna100% (2)

- NLSIU MBLAll Module Summary SyllabusDocument39 pagesNLSIU MBLAll Module Summary Syllabussap6370No ratings yet

- Assignment 3 Dit0100 ExcellDocument2 pagesAssignment 3 Dit0100 ExcellYuJemClassic'sNo ratings yet

- View StatementDocument1 pageView Statementpierobalassone71No ratings yet

- WWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewDocument2 pagesWWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewSudip AdhikariNo ratings yet