Professional Documents

Culture Documents

Project Feasibility Analysis Template

Project Feasibility Analysis Template

Uploaded by

Thareq FasyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Feasibility Analysis Template

Project Feasibility Analysis Template

Uploaded by

Thareq FasyaCopyright:

Available Formats

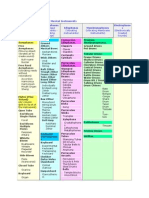

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 2

TAB 1: HOMEBUYER PROJECT - DEVELOPER-DRIVEN MODEL

UNDERWRITING CRITERIA

Mortgage Term

Requirements

Housing to Income Ratio Minimum Maximum

Gross Household Income 25% 33%

Debt to Income Ratio 41%

PROGRAM GUIDELINES

Forms of Assistance

Subsidy Amount Limits Uses

Appraisal Gap

Final Development $80,000 per unit (TDC exceeds Sales Price)

Final Affordability Affordability Gap

$50,000 per unit (Down Payment, Closing Costs

Homebuyer and Mortgage Buy Down)

Maximum $150,000 per unit

Professional Fees

Fee Amount Eligible Service Provider

Developer Fee 12% of TDC less Acquisition Costs Non-Profit and For Profit

Developers

Sales Referral

6% of Sales Price or $4,000 Licensed Real Estate Agents

(whichever greater)

per NSP-assisted unit HUD-certified Housing

Homebuyer Education $500 sold to eligible buyer Counselors

756655061.xls 1. Program Guidelines

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 3

TAB 2: HOMEBUYER PROJECT - DEVELOPER-DRIVEN

PROJECT DESCRIPTION, HOMEBUYER INFORMATION & COMPLIANCE

GENERAL INFORMATION

Address 1965 West Avalon Street, Allentown, PA Census Tract 3205.5

Developer Bidwell Construction

DEVELOPER

A. Is the Developer a Local Government or Subrecipient? Yes or No? NO

If YES, Local Government does not receive Developer Fee. Rather, they will use Administration Funds.

PROPERTY

A. Property Description B. Purchase Price and Appraisal Analysis

As Is As Improved AS-IS Appraised FMV $45,000

# of Bedrooms: 3 4 Date of Appraisal 06/01/10

# of Bathrooms: 1 2 Purchase Price $32,500

Square Feet: 1250 1800 Date of Final Agreement 05/25/10

Year Built: 1980 Purchase Discount 28%

Lead-based paint hazard control needed? NO Meet Discount Requirement?* YES

Appraisal done within 60 days

Estimated As-Improved Sales Price $100,000 prior to Final Agreement date?*

YES

*"Yes" to both questions for purchase to comply with NSP.

C. Property Type & NSP Eligible Use Analysis

1. Is the Property a vacant lot, or a vacant, foreclosed or abandoned single-family home? Yes or No? no NO NSP ELIGIBLE USE

2. Is the Property a vacant, non-foreclosed single family home? Yes or No? yes YES Acquisition?

3. Will the project rehabilitate the existing single family home? Yes or No? yes NO USE E

If No to questions #1 & 2, then property is ineligible for NSP. If No to question #3, then new construction project. Rehab/Redevelop?

USE E

INCOME TARGETING

A. NSP funds may only assist housing that serves families earning less than 120% AMI. Please complete the table below.

B. Will you serve households earning at or below 50% AMI? Yes or No? no NO

Year City or MSA

2009 Allentown Household Size 50% AMI 80% AMI 100% AMI 120% AMI

Link to income limits 1 $20,000 $32,000 $40,000 $48,000

2 $23,600 $37,760 $47,200 $56,640

3 $25,600 $40,960 $51,200 $61,440

4 $27,000 $43,200 $54,000 $64,800

5 $28,500 $45,600 $57,000 $68,400

6 $29,000 $46,400 $58,000 $69,600

7 $31,250 $50,000 $62,500 $75,000

8 $34,000 $54,400 $68,000 $81,600

756655061.xls 2.Proj Description & Compliance

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 4

TAB 3: HOMEBUYER PROJECT - DEVELOPER-DRIVEN

TO BE IDENTIFIED HOMEBUYER AFFORDABILITY ANALYSIS

What Income and Down Payment Can Support Proposed Sale Price?

How Much Needed in Homebuyer Affordability Gap Subsidy? As-Is As-Improved

Address 1965 West Avalon Street, Allentown, PA # of Bedrooms: 3 4

Developer Bidwell Construction # of Bathrooms: 1 2

Income Targeting Up to 120% Square Feet: 1,250 1,800

Sales Price: $100,000

Meeting Your Income Level? YES

HOUSEHOLD SIZE AND INCOME:

4 $54,000 $54,000 $54,000 $54,000

Lowest

SMSA Allentown Qualifying

Low Moderate Middle

% Area Median Income of Target Buyers: 36% 50% 80% 120%

Maximum Incomes of Target Buyers $19,344 $27,000 $43,200 $64,800

Monthly Incomes of Target Buyers $1,612 $2,250 $3,600 $5,400

MAXIMUM Housing/Income Ratio 33% 33% 33% 33%

Target Buyers' Maximum Monthly Mrtg Pmt (PITI) $532 $743 $1,188 $1,782

AVERAGE SALE PRICE: $ 100,000 $100,000 $100,000 $100,000

Down Payment-From Buyer 3.00% $3,000 $3,000 $3,000 $3,000

Other Down Payment Assistance 0.00% $0 $0 $0 $0

Amortizing Subordinate Mortgage $0 $0 $0 $0

Deferred Due on Sale 2nd Mortgage $40,000 $17,000 $0 $0

FIRST MORTGAGE AMT BASED ON AFFORDABILITY: $57,000 $80,000 $97,000 $97,000

First Mortgage Loan-to-Value Ratio: 57.00% 80.00% 97.00% 97.00%

First Mortgage Interest Rate: 5.500% 5.500% 5.500% 5.500%

First Mortgage Term: 30 30 30 30

First Mortgage Principal and Interest $324 $454 $551 $551

Second Mortgage Loan-to-Value Ratio: 0.00% 0.00% 0.00% 0.00%

Second Mortgage Interest Rate: 0.00% 0.00% 0.00% 0.00%

Second Mortgage Term: 30 12 12 12

Second Mortgage Principal and Interest: $0 $0 $0 $0

Taxes $2,000 $167 $167 $167 $167

Homeowners Insurance $500 $42 $42 $42 $42

Private Mortgage Insurance required if LTV > or = 80% $0 $0 $49 $49

Homeowners Association Fee $0 $0 $0 $0 $0

TOTAL MONTHLY MORTGAGE PAYMENT: $532 $663 $808 $808

Minimum Qualifying Income $ 19,344 $ 24,093 $ 29,367 $ 29,367

% Area Median Income 36% 45% 54% 54%

Affordable to Target Income Group? Yes Yes Yes Yes

CASH REQUIREMENTS

CDBG requires Buyer pay 50.0% of Down Payment required by Lender $1,500

Down Payment 3.00% $3,000 $3,000 $3,000 $3,000

Closing Costs 4.23% $4,235 $4,235 $4,235 $4,235

Down Pmt & Closing Cost Assistance -5.73% ($5,735) ($5,735) ($5,735) ($5,735)

TOTAL BUYER CASH TO CLOSE: $1,500 $1,500 $1,500 $1,500

Per Unit Affordability

Affordability Subsidy SOURCES Subsidy USE Subsidy Schedule of Closing Costs

NSP DPA Subsidy Down Payment $1,500 Title Insurance

$500

NSP Closing Costs Assistance Closing Costs $4,235 Appraisal

$200

Other Down Payment Assistance DPA $0 Recording

$90

NSP Homebuyer Subsidy Mortgage Write Down $40,000 Deed Prep

$90

Amortizing Subordinate Mortgage Amortizing Subordinate Mortgage $0 Transfer Taxes

TOTAL BUYER AFFORDABILITY SUBSIDY: $45,735 Tax Stamp

Homebuyer Subsidy as a % of Sale Price: 46% Pre-Paid Taxes $2,000

Grantee Maximum Homebuyer Affordability GAP: $50,000 Pre-Paid Insurance $500

NSP Affordability GAP: $45,735 Loan Origination Fee 1.50% $855

Balance from Limit: $4,265 Loan Guarantee Fee $0

Total Closing Costs: $4,235

Homebuyer Subsidy within Limits? PROCEED

756655061.xls 3. Buyer Affordability

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 5

DEVELOPMENT BUDGET

What are the Estimated Costs to Rehab A Scattered-Site Single Family Unit?

What is the Development Appraisal Gap?

As-Is Improved

1965 West Avalon Street,

Address # of Bedrooms: 3 4

Allentown, PA

Developer Bidwell Construction # of Bathrooms: 1 2

Income Targeting Up to 120% Square Feet: 1,250 1,800

Sales Price: $100,000

USES

PREDEVELOPMENT PER UNIT

Environmental Review and Assessments $500

As-Is URA Appraisal and As-Completed Estimate $400

Title and Recording $125

Architect & Structural Engineer $4,500

Asbestos & Lead Based Paint Testing Year Built: 1980 $400

Property Acquisition Consultant $0

Code Inspections & Preparation of Specifications $550

Survey & Civil Engineering $1,000

Energy Audit and Energy Efficiency Specifications $500

Other $0

Other $0

Other $0

Total Predevelopment: $7,975

BUILDING AND PROPERTY ACQUISITION

Land & Building $32,500

Temporary Relocation* 0 Households $3,000 per Relocation $0

*Contact State if relocation; but assume $3000 for temporary relocation Total Acquisition: $32,500

CONSTRUCTION COSTS

REHAB or NEW CONSTRUCTION $32.84 Average Cost per Square Foot $59,120

Demolition of Blighted Structures for New Construction $0

Infrastructure Improvements $4,000

Lead Based Paint & Asbestos Abatement $2,000

Landscaping $2,500

CONTRACTOR FEE 10.00% / hard cost $6,762

CONSTRUCTION CONTINGENCY 10.00% / hard cost $6,762

Total Construction: $81,145

CARRYING COSTS

Board Up & Lawn Maintenance $0

Utilities $100

Builder's Risk Insurance $400

Fire Insurance (Commercial) $400

Property (General) Liability Insurance $400

Real Estate Taxes $1,000

Other $0

Other $0

Other $0

Total Carrying Costs: $2,300

PROFESSIONAL SERVICES

Legal $2,500

Accounting $3,000

Consultant $1,500

Marketing /Advertising $4,500

Other $0

Other $0

Other $0

Total Professional Fees: $11,500

SELLER'S CLOSING COSTS

Realtor Commission 6.0% of sale price or $4,000 (whichever more) $6,000

Seller's Closing Costs 3.00% of sale price $3,000

Homebuyer Education $500 per unit $500

Seller Paid Transfer Taxes 0.00% of sale price $0

Total Seller's Closing Costs: $9,500

Hard & Soft Costs Sub-Total: $144,920

DEVELOPER FEE

12% of TDC less Acquisition Costs $13,490

Is the Developer a Local Government? NO

If YES, Local Government does not receive Developer Fee. Rather, they will use Administration Funds.

TOTAL DEVELOPMENT COSTS (TDC): $158,410

less SALE Proceeds: $100,000

Development Appraisal GAP: ($58,410) 37%

Maximum Development GAP NSP Subsidy: $80,000

Requested NSP Appraisal GAP Funds $58,410

Balance from Limit: $21,590

Compliant with Sales

Price? YES Within Appraisal Gap Limit? Proceed

756655061.xls 4. Development Budget

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 6

TAB 6: HOMEBUYER PROJECT - DEVELOPER-DRIVEN

CONSTRUCTION BUDGET

What is the Development Appraisal Gap?

As-Is Improved

1965 West Avalon Street,

Address Allentown, PA # of Bedrooms: 3 4

Developer Bidwell Construction # of Bathrooms: 1 2

Income % AMI Up to 120% Square Feet: 1,250 1,800

Sales Price: $100,000

CONSTRUCTION Linear Feet Sq. ft. Quantity Unit Price Total Cost

Demolition (Partial for Rehab only) 0 $0

Excavation 0 $0

Concrete 0 $0

Masonry 0 $0

Roofing 1 $8,000.00 $8,000

Siding Repair and Clean 1 $1,200.00 $1,200

Rough carpentry 1 $7,320.47 $7,320

HVAC (Repair, not Replacement) 0 $0

Plumbing 1 $3,000.00 $3,000

Electrical 1 $3,000.00 $3,000

Finish carpentry 1 $750.00 $750

Interior Doors and Closet 12 $125.00 $1,500

Windows (Refurbish, not Replacement) 0 $0

Drywall 1 $1,000.00 $1,000

Tile 4 $500.00 $2,000

Paint (interior) 10 $250.00 $2,500

Flooring 8 $500.00 $4,000

Basic Insulation (not for Energy Efficiency) 1 $500.00 $500

Energy Efficiency Enhancements See Schedule Below $12,950

Appliances See Schedule Below $3,000

Cabinets & Counter Tops 1 $4,500.00 $4,500

Hardware and Accessories 11 $100.00 $1,100

Window Treatments (mini blinds) 20 $50.00 $1,000

Exterior Door 2 $600.00 $1,200

Storm Door 2 $300.00 $600

Other $0

Other $0

Other $0

Other $0

Other $0

Other $0

Other $0

Other $0

Other $0

Subtotal Materials / Labor: Cost per Sq. ft.: $32.84 $59,120

Energy Efficiency Improvements # Per Unit Per Unit Cost Project

House insulation upgrades 1 $2,000 $2,000

Windows 20 $250 $5,000

HVAC 1 $4,000 $4,000

Blower Door Test 1 $500 $500

House energy monitor $0

Ceiling Fans 6 $100 $600

Electrical: (motion, photovoltaic, dimmers, lt blbs) 11 $50 $550

Low Flow Plumbing Fixtures 3 $100 $300

Tankless water heater $0

Solar Panels - Photovoltaic $0

Other $0

Other $0

Other $0

Other $0

Total Energy Efficiency Improvements: $12,950

Appliance Allowance # Per Unit Per Unit Cost Project

Refrigerator 1 $600 $600

Range/Microwave Hood 1 $500 $500

Dishwasher 1 $400 $400

Garbage Disposal 1 $100 $100

Garage Door Opener 1 $200 $200

Washer / Dryer 1 $1,200 $1,200

Other $0

Other $0

Other $0

Total Appliance Allowance $3,000

756655061.xls 5. Construction Budget

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 7

TAB 6: HOMEBUYER PROJECT - DEVELOPER-DRIVEN

SOURCES AND USES SCHEDULE

PROJECT INFORMATION

What is the Development Appraisal Gap?

1965 West Avalon As-Is Improved

Address Street, Allentown, # of Bedrooms: 3 4

Bidwell

PA # of Bathrooms: 1 2

Developer

Construction

Income Targeting Up to 120% Square Feet: 1,250 1,800

Sales Price: $100,000

INTERIM NSP-FUNDED DEVELOPMENT FINANCING

PER UNIT COSTS

Total Predevelopment: $7,975

Total Acquisition: $32,500

Total Construction: $81,145

Total Carrying Costs: $2,300

Total Professional Fees: $11,500

Total Seller's Closing Costs: $9,500

Total Developer Fee $13,490

TOTAL DEVELOPMENT COSTS: $158,410

I. TOTAL NSP INTERIM LOAN FOR TDC: $158,410

REHABILITATION - DEVELOPMENT SUBSIDY CALCULATE DEVELOPMENT "Appraisal GAP" SUBSIDY

TOTAL DEVELOPMENT COSTS: $158,410

less SALES PRICE $ 100,000

NSP REHAB DEVELOPER SUBSIDY: $58,410

HOMEBUYER AFFORDABILITY - CALCULATE HOMEBUYER "Affordability GAP" SUBSIDY

Minimum Qualifying Income $19,344 Household Size: 4 PER UNIT COSTS

Housing to Income Ratio: 33%

Estimated As-Improved Sales Price $100,000

USES

Closing Costs $4,235

Total Sales Transaction Costs: $104,235

FIRST MORTGAGE AMOUNT

$57,000

DOWN PAYMENT / PRINCIPAL BUY DOWN (Based on incentives to market and sell unit)

NSP Down Payment Assistance $1,500

NSP Closing Cost Assistance $4,235

SOURCES

Other Down Payment Assistance $0

$5,735

AFFORDABILITY BUY DOWN OF MORTGAGE (Based on income & affordability needs)

NSP Affordability Buy Down of Purchase Mortgage $40,000

$40,000

CASH FROM HOMEBUYER

$1,500

NSP HOMEBUYER SUBSIDY ANALYSIS

NSP Funded Mortgage Buy Down $40,000

NSP Funded Down Payment Assistance $1,500

NSP Funded Closing Cost Assistance $4,235

TOTAL NSP HOMEBUYER AFFORDABILITY SUBSIDY (Mortgage Buydown & DPA): $45,735

II. FINAL COMBINED NSP SUBSIDY: $104,145

756655061.xls 6. Sources & Uses

05/21/2024 NSP Homebuyer Purchase Feasibility Analysis 8

TAB 7: HOMEBUYER PROJECT - DEVELOPER-DRIVEN

FUNDS MANAGEMENT ANALYSIS

PROJECT INFORMATION

Address 1965 West Avalon Street, Allentown, PA As-Is Improved

Developer Bidwell Construction # of Bedrooms: 3 4

Income Level Up to 120% # of Bathrooms: 1 2

Square Feet: 1250 1800

Sales Price: $100,000

FUNDS MANAGEMENT INFORMATION

TOTAL DEVELOPMENT COST $158,410 100% interim financing

Sales Price $100,000

NSP Development Subsidy $58,410

Sales Transaction Costs $104,235 Sales Price + Closing Costs

Buyer Purchase Power $58,500 1st Mortgage + Buyer Down Payment

NSP Homebuyer Subsidy $45,735 DPA + Mortgage Buy Down + Closing Cost Assistance

NSP OBLIGATION AMOUNT: $162,645 TDC + Closing Cost Assistance

FINAL NSP SUBSIDY: $104,145 Development plus Homebuyer Subsidy

NSP PROGRAM INCOME $58,500 Buyer Purchase Power

SUBSIDY ANALYSIS

Max Per Unit Total NSP Subisdy $150,000

Requested NSP Subsidy $104,145

Balance from Limit: $45,855

Within Maximum Subsidy

YES. PROCEED.

Limits?

DISASTER RECOVERY GRANTS REPORTING SYSTEM

Income Level: 36% of AMI

Meet 25% Set-aside? NO

NSP Eligible

Obligation Amount Use

Acquisition $40,475 USE E

Disposition $11,800 USE E

Rehabilitation / Redevelopment * $106,135 USE E

Demolition of Blighted Structures $0 USE D

Homebuyer Assistance ** $4,235 USE E

Total $162,645

* Because of 100% financing and assumes developer-driven model, mortgage buydown and downpayment assistance are covered though total development

costs. But, mortgage buydown and downpayment assistance affects program income returning to Grantee.

** Closing cost assistance is paid through a CDBG activity "Homebuyer Assistance."

756655061.xls 7. Funds Management

You might also like

- QuintoAndar - Series D Pitch Deck Vfinal - May 16, 2019Document40 pagesQuintoAndar - Series D Pitch Deck Vfinal - May 16, 2019Cesar Mendes Junior100% (9)

- California Real Estate Principles, 10.1e - PowerPoint - CH 10Document28 pagesCalifornia Real Estate Principles, 10.1e - PowerPoint - CH 10romi moriNo ratings yet

- Real Estate Pitch Deck TemplateDocument10 pagesReal Estate Pitch Deck Templatejoel ositaNo ratings yet

- Services Marketing Airbnb Audit 1 PDFDocument22 pagesServices Marketing Airbnb Audit 1 PDFhrishikeshNo ratings yet

- Service-manual-SG Emachines E725 E525 031809Document236 pagesService-manual-SG Emachines E725 E525 031809andhrimnirNo ratings yet

- PD 1096 Arch Pedro Santos JR PDFDocument342 pagesPD 1096 Arch Pedro Santos JR PDFMonique Gaw33% (3)

- OpenDoor Series ADocument20 pagesOpenDoor Series AJohn DoeNo ratings yet

- Uniform Residential Appraisal Report: File #Document4 pagesUniform Residential Appraisal Report: File #Alex MaslovskyNo ratings yet

- Property Analyser CalculatorDocument14 pagesProperty Analyser Calculator3m4illistNo ratings yet

- PPP Models For Affordable Housing - IndiaDocument22 pagesPPP Models For Affordable Housing - Indiamandamachyus100% (1)

- Powerpoint Presentation On PPP Models For Affordable Housing PDFDocument22 pagesPowerpoint Presentation On PPP Models For Affordable Housing PDFDhruval Jignesh PatelNo ratings yet

- Real Estate Presentation: By: Ashley JohnsonDocument14 pagesReal Estate Presentation: By: Ashley JohnsonAshley JohnsonNo ratings yet

- HL PresentationDocument22 pagesHL Presentationতীর হারা তরীNo ratings yet

- Specialty Leasing Program Opportunities: CostsDocument2 pagesSpecialty Leasing Program Opportunities: Costskirandeep kaurNo ratings yet

- Broker Price Opinion: File # Subject InformationDocument6 pagesBroker Price Opinion: File # Subject InformationRahul TalekarNo ratings yet

- 3-31-2023 - Report Format (Fannie Mae)Document24 pages3-31-2023 - Report Format (Fannie Mae)sreerahNo ratings yet

- Property Rental Market AnalysisDocument9 pagesProperty Rental Market AnalysisNoorULAinNo ratings yet

- Developer ProgramsDocument30 pagesDeveloper ProgramsApril ToweryNo ratings yet

- Lansing Housing Commission's Sale Documents Submitted To HUDDocument613 pagesLansing Housing Commission's Sale Documents Submitted To HUDLansingStateJournalNo ratings yet

- 5115 Cascade Palmetto Hwy Fairburn Buyer's Info PacketDocument18 pages5115 Cascade Palmetto Hwy Fairburn Buyer's Info PacketSonal KaliaNo ratings yet

- IA - CS010 - Valuing A Multi Tenant InvestmentDocument8 pagesIA - CS010 - Valuing A Multi Tenant InvestmentapoorvnigNo ratings yet

- Broker Price Opinion: File # Subject InformationDocument6 pagesBroker Price Opinion: File # Subject InformationRahul TalekarNo ratings yet

- Blue Sheet - BMC PuneDocument11 pagesBlue Sheet - BMC PuneShipra Singh0% (1)

- Valuation BasicsDocument18 pagesValuation BasicsRonak SinghNo ratings yet

- reif id tafDocument9 pagesreif id tafyewjun14No ratings yet

- Asset Investment Decisions and Capital Rationing: Margarita KouloumbriDocument31 pagesAsset Investment Decisions and Capital Rationing: Margarita KouloumbriInga ȚîgaiNo ratings yet

- Planning and Environment: PO Box 57 Campbelltown 2560 Phone 4645 4608 Fax 4645 4111Document2 pagesPlanning and Environment: PO Box 57 Campbelltown 2560 Phone 4645 4608 Fax 4645 4111Anonymous gbxaO5VNo ratings yet

- Becavefinal PDFDocument10 pagesBecavefinal PDFAnonymous NGl4tXMVuNo ratings yet

- HouseHacking-v1 1Document210 pagesHouseHacking-v1 1Cris MárquezNo ratings yet

- Chapter 5 - Asset Investment Decisions and Capital RationingDocument31 pagesChapter 5 - Asset Investment Decisions and Capital RationingInga ȚîgaiNo ratings yet

- Real Estate Land Development ProposalDocument8 pagesReal Estate Land Development Proposaldebrah.debbie1195No ratings yet

- JAIIB Paper 4 Module E Additional Reading Material On Home Loans PDFDocument31 pagesJAIIB Paper 4 Module E Additional Reading Material On Home Loans PDFAssr MurtyNo ratings yet

- Tools Hitung Stock Financing (3)Document105 pagesTools Hitung Stock Financing (3)seveyama1No ratings yet

- Useful Information To Buy or Build?: TopicsDocument4 pagesUseful Information To Buy or Build?: TopicsJoel RaoNo ratings yet

- Home Buying: The Complete Guide ToDocument32 pagesHome Buying: The Complete Guide ToPrem .A. NandakumarNo ratings yet

- Hud 221D4Document2 pagesHud 221D4eimg20041333No ratings yet

- 3rd TID Mr. Tanchis Presentation On Mass HousingDocument38 pages3rd TID Mr. Tanchis Presentation On Mass HousingCyril CartallaNo ratings yet

- 2023 Project Destined Week 3 FinalDocument18 pages2023 Project Destined Week 3 FinalSaul VillarrealNo ratings yet

- 4 PM PST Cutoff Time. 3PM PST Cutoff For NON QM Rate Lock RequestDocument1 page4 PM PST Cutoff Time. 3PM PST Cutoff For NON QM Rate Lock RequestAnonymous Dxq7D7kN9No ratings yet

- Case StudiesDocument6 pagesCase Studiesamanbhardwaj5No ratings yet

- Generic BPODocument1 pageGeneric BPOqtipfiveNo ratings yet

- Home Energy Efficiency Rebate Program: How To ApplyDocument7 pagesHome Energy Efficiency Rebate Program: How To ApplysandyolkowskiNo ratings yet

- GeM Bidding 2920423 - 2Document4 pagesGeM Bidding 2920423 - 2Sulvine CharlieNo ratings yet

- Single Family Development Three RiversDocument54 pagesSingle Family Development Three RiversRaviNo ratings yet

- Business Development Proposal - Real EstateDocument7 pagesBusiness Development Proposal - Real EstatemiratheonebeautyNo ratings yet

- Ebook SanantionioDocument19 pagesEbook Sanantioniovarma98No ratings yet

- 221d4 Term Sheet V5Document2 pages221d4 Term Sheet V5nader313No ratings yet

- DardenConsultingCasebook 2010Document98 pagesDardenConsultingCasebook 2010Piyush Soni100% (1)

- GeM Bidding 3591761Document11 pagesGeM Bidding 3591761myname nameNo ratings yet

- Rental guarantee leasing strategyDocument1 pageRental guarantee leasing strategym.zakiNo ratings yet

- Plus Loans Training Deck 23062021115312Document28 pagesPlus Loans Training Deck 23062021115312ronak voraNo ratings yet

- Group 1 A Assignment ExampleDocument13 pagesGroup 1 A Assignment ExampleRahulNo ratings yet

- Slides - Alternative Investments - Real Estate Performance Valuation and Due DiligenceDocument15 pagesSlides - Alternative Investments - Real Estate Performance Valuation and Due DiligencejargonNo ratings yet

- Summary 22feb24Document3 pagesSummary 22feb24syafik.iqiNo ratings yet

- The Real Estate Development Process: Lot and Unit Assumptions - Bateman ApartmentsDocument7 pagesThe Real Estate Development Process: Lot and Unit Assumptions - Bateman Apartmentsw_fibNo ratings yet

- Aditya UrbanCompanyDocument18 pagesAditya UrbanCompanyaditya khandelwalNo ratings yet

- 80 BIWS RE DevelopmentDocument7 pages80 BIWS RE DevelopmentziuziNo ratings yet

- Real Estate Modeling Quick Reference ReaDocument7 pagesReal Estate Modeling Quick Reference ReaKaren Balisacan Segundo RuizNo ratings yet

- FSV Investor PresentationDocument21 pagesFSV Investor PresentationGraziella CathleenNo ratings yet

- CSC Check - Volume 1 - Practice Test 2Document32 pagesCSC Check - Volume 1 - Practice Test 2LiamNo ratings yet

- Home Energy Efficiency Rebate Program: How To ApplyDocument7 pagesHome Energy Efficiency Rebate Program: How To ApplymmorcillNo ratings yet

- Riyadh Market Study Report 2015Document32 pagesRiyadh Market Study Report 2015Nasr Al FarsiNo ratings yet

- CBRE - Saudi Arabia Real Estate Market Review Q1 2022-vsDocument7 pagesCBRE - Saudi Arabia Real Estate Market Review Q1 2022-vsNasr Al FarsiNo ratings yet

- JLL Global Real Estate Transparency Index 2022Document64 pagesJLL Global Real Estate Transparency Index 2022Nasr Al FarsiNo ratings yet

- IKEA India-The CaseDocument11 pagesIKEA India-The CaseNasr Al FarsiNo ratings yet

- Value of Professional Property Managers in ResidenDocument12 pagesValue of Professional Property Managers in ResidenNasr Al FarsiNo ratings yet

- Real Estate Investment AnalysisDocument8 pagesReal Estate Investment AnalysisNasr Al FarsiNo ratings yet

- Revision - International Business ManagementDocument5 pagesRevision - International Business ManagementNasr Al FarsiNo ratings yet

- Ulangan Harian Exposition TextDocument3 pagesUlangan Harian Exposition Textgrenninja949No ratings yet

- PMP Exam EVOVLE Free SampleDocument47 pagesPMP Exam EVOVLE Free SampleEvolve trainingmaterialsNo ratings yet

- Home Assignment - JUNK BOND Subject: Corporate FinanceDocument3 pagesHome Assignment - JUNK BOND Subject: Corporate FinanceAsad Mazhar100% (1)

- IBM Storwize V7000: Maximising Storage Efficiency To Transform The Economics of Data StorageDocument8 pagesIBM Storwize V7000: Maximising Storage Efficiency To Transform The Economics of Data StorageSaqib AzizNo ratings yet

- Prototyping & Storyboarding: IT2622 Chapter 4Document16 pagesPrototyping & Storyboarding: IT2622 Chapter 4empresscpy crackerNo ratings yet

- 5 Leadership LessonsDocument2 pages5 Leadership LessonsnyniccNo ratings yet

- Icest2030 AzureDocument4 pagesIcest2030 AzureJorge RoblesNo ratings yet

- Nunez v. Sec - y of HHS - 2019 U.S. Claims LEXIS 644Document40 pagesNunez v. Sec - y of HHS - 2019 U.S. Claims LEXIS 644Kirk HartleyNo ratings yet

- RMO 2016 Detailed AnalysisDocument6 pagesRMO 2016 Detailed AnalysisSaksham HoodaNo ratings yet

- 01 - Manish Sharma Timilsina - Conduction Heat Transfer Beyond Fourier LawDocument10 pages01 - Manish Sharma Timilsina - Conduction Heat Transfer Beyond Fourier LawShrestha RishavNo ratings yet

- Midtown Ratepayers Association's Letter To Ontario OmbudsmenDocument3 pagesMidtown Ratepayers Association's Letter To Ontario OmbudsmenAndrew GrahamNo ratings yet

- Product Risk Management Report For Spine ProductsDocument25 pagesProduct Risk Management Report For Spine ProductsAlejandro Landinez100% (1)

- Classification of Common Musical InstrumentsDocument3 pagesClassification of Common Musical InstrumentsFabian FebianoNo ratings yet

- Rela Tori OhhDocument1,830 pagesRela Tori OhhLeandro MedeirosNo ratings yet

- Chemical Engineering Plant Economics Questions and AnswersDocument32 pagesChemical Engineering Plant Economics Questions and AnswersLily Antonette Agustin100% (1)

- A G Gardiner EssaysDocument50 pagesA G Gardiner Essaysngisjqaeg100% (2)

- Common Service Data Model (CSDM) 3.0 White PaperDocument31 pagesCommon Service Data Model (CSDM) 3.0 White PaperЕвгения МазинаNo ratings yet

- Cell City IntroDocument6 pagesCell City Intromayah12No ratings yet

- Join The Club: C207 - Database Systems 2012Document237 pagesJoin The Club: C207 - Database Systems 2012hamzahNo ratings yet

- KX71 3 en - HDDocument8 pagesKX71 3 en - HDסטניסלב טלשבסקיNo ratings yet

- 1097-1136 Metallogenic Provinces in An Evolving Geodynamic FrameworkDocument40 pages1097-1136 Metallogenic Provinces in An Evolving Geodynamic FrameworkLYNAMARICELA83No ratings yet

- Public Sector Accounting Tutorial (Ain)Document2 pagesPublic Sector Accounting Tutorial (Ain)Ain FatihahNo ratings yet

- Physics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 ADocument21 pagesPhysics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 AShubham BaghelNo ratings yet

- Zon Kota Damansara-2Document29 pagesZon Kota Damansara-2amirul rashidNo ratings yet

- Podman Part4Document5 pagesPodman Part4anbuchennai82No ratings yet

- Pinoy Development of Groups and TeamsDocument19 pagesPinoy Development of Groups and TeamsSarah Jane SeñaNo ratings yet

- DBA ResumeDocument5 pagesDBA ResumeBheema ReddyNo ratings yet

- Ethel Schuster, Haim Levkowitz, Osvaldo N. Oliveira JR (Eds.) - Writing Scientific Papers in English Successfully - Your Complete Roadmap-Hyprtek (2014)Document154 pagesEthel Schuster, Haim Levkowitz, Osvaldo N. Oliveira JR (Eds.) - Writing Scientific Papers in English Successfully - Your Complete Roadmap-Hyprtek (2014)Fellype Diorgennes Cordeiro Gomes100% (1)