Professional Documents

Culture Documents

2018 Real Estate Book PDF

2018 Real Estate Book PDF

Uploaded by

Gerardo0 ratings0% found this document useful (0 votes)

1 views3,241 pagesOriginal Title

2018 Real Estate Book (PDF)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views3,241 pages2018 Real Estate Book PDF

2018 Real Estate Book PDF

Uploaded by

GerardoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3241

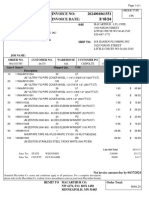

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 1

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-C -03- - 0-00FF003 SIGNAL KNOB STATION 11,000 74,200 85,200 545.28 ACCT- 31584

A & N ENTERPRISES LLC UNIT F3 PHASE 5 FH 272.64

183 ABBY LN SH 272.64

STRASBURG VA 22657 AC .000 CL 1 DAVIS STRASBURG

DB 1696/ 974 PL 972/ 899 # 1

070-A1-05- - 0-44 LOT 44 MADISON VILLAGE 31,000 84,300 115,300 737.92 ACCT- 32804

A & R RENTALS LLC FH 368.96

230 DEPENDENCE LN SH 368.96

MIDDLETOWN VA 22645 AC .060 CL 1 MADISON EDINBURG

DB 1247/ 197 PL 1176/ 79 # 2

045-A2- A- - 4-16 CITY SERVICE STA S MAIN 165,000 317,600 482,600 3,088.64 ACCT- 10395

A A J VENTURES INC ST N PT LTS 119 120 FH 1,544.32

2000 MEADOW DR SH 1,544.32

FREDERICKSBURG VA 22405 AC .344 CL 4 JOHNSTON WOODSTOC

DB 1542/ 165 # 3

085- - A- - 0-07B TRACT 2 126,000 126,000 806.40 ACCT- 29488

A E FOX LLC 115,000 DEFERRED 115,000 736.00 FH 35.20

21 LOWER VALLEY RD SH 35.20

STRASBURG VA 22657 AC 42.000 CL 5 11,000 11,000 70.40 JOHNSTON

DB 1475/ 458 # 4

045-A5- A- - 0-15 S MAIN ST LT 1 109,100 198,300 307,400 1,967.36 ACCT- 23726

A H RHODES INVESTMENTS LLC FH 983.68

867 FISHERS RD SH 983.68

TOMS BROOK VA 22660 AC .334 CL 4 ZN B-1 STONEWALL WOODSTO

DB 1458/ 593 # 5

023- - A- - 1-61E RT 651 1,279,200 2,293,900 3,573,100 22,867.84 ACCT- 22554

A T WILLIAMS OIL COMPANY FH 11,433.92

PROPERTY TAX DEPT SH 11,433.92

539 S MAIN ST AC 8.528 CL 4 DAVIS TB SANITARY

FINDLAY OH 45840 DB 692/ 198 # 6

015- -02- - 1-02 LOT 102 SECTION 5A 46,000 125,200 171,200 1,095.68 ACCT- 31241

A TO Z HOMES LLC THE MEADOWS AT STRASBURG FH 547.84

658 JENKINS LN SH 547.84

STRASBURG VA 22657 AC .387 CL 2 DAVIS

DB 1240/ 518 PL 915/ 878 080 # 7

025- - A- - 0-75A MILLER DR 41,000 113,500 154,500 988.80 ACCT- 6271

A TO Z HOMES LLC FH 494.40

658 JENKINS LN SH 494.40

STRASBURG VA 22657 AC .378 CL 1 DAVIS STRASBURG

DB 1394/ 561 080 # 8

025-A1-04-B0-13 0-48 LOTS 48 & 50 BLK 13 31,000 49,000 80,000 512.00 ACCT- 24569

A TO Z HOMES LLC C STREET FH 256.00

658 JENKINS LN SH 256.00

STRASBURG VA 22657 AC .172 CL 1 DAVIS STRASBURG

DB 1240/ 518 PL 1233/ 873 080 # 9

025-A1-04-B0-15 0-08 LT 8 BLK 15 31,000 47,600 78,600 503.04 ACCT- 27464

A TO Z HOMES LLC STRASBURG LAND & IMPV FH 251.52

658 JENKINS LN SH 251.52

STRASBURG VA 22657 AC .138 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 10

1,870,300 3,303,600 5,173,900 33,112.96

115,000 115,000 736.00

Totals 1,755,300 3,303,600 5,058,900 32,376.96

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

513,600 171,200 4,363,100 126,000

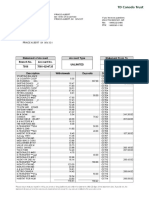

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 2

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-A1-04-B0-15 0-10 LOT 10 BLK 15 STRASBURG L 31,000 35,900 66,900 428.16 ACCT- 30263

A TO Z HOMES LLC IMPROVEMENT CO FH 214.08

658 JENKINS LN SH 214.08

STRASBURG VA 22657 AC .138 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 11

025-A1-04-B0-15 0-12 LT 12 BLK 15 31,000 41,300 72,300 462.72 ACCT- 30280

A TO Z HOMES LLC STRAS LAND & IMPV CO FH 231.36

658 JENKINS LN SH 231.36

STRASBURG VA 22657 AC .138 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 12

025-A1-04-B0-17 0-05 LOT 5 BLK 17 31,000 86,100 117,100 749.44 ACCT- 33336

A TO Z HOMES LLC STRAS LAND & IMP FH 374.72

658 JENKINS LN SH 374.72

STRASBURG VA 22657 AC .128 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 13

025-A1-04-B0-17 0-06 LOT 6 BLK 17 25,000 25,000 160.00 ACCT- 33337

A TO Z HOMES LLC STRAS LAND & IMP FH 80.00

658 JENKINS LN SH 80.00

STRASBURG VA 22657 AC .136 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 14

025-A1-04-B0-19 0-15 D STREET LT 15 BLK 19 31,000 22,900 53,900 344.96 ACCT- 21989

A TO Z HOMES LLC FH 172.48

658 JENKINS LN SH 172.48

STRASBURG VA 22657 AC .138 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 15

025-A3-03- - 0-04 LT 4 CLARK SUBD 56,000 59,600 115,600 739.84 ACCT- 23983

A TO Z HOMES LLC FH 369.92

658 JENKINS LN SH 369.92

STRASBURG VA 22657 AC .143 CL 1 DAVIS STRASBURG

DB 1370/ 692 080 # 16

025-A4-01-B0-69 0-06A E 1/2 LT 6 BLK 69 28,000 85,900 113,900 728.96 ACCT- 16604

A TO Z HOMES LLC LOUDON ST FH 364.48

658 JENKINS LN SH 364.48

STRASBURG VA 22657 AC .072 CL 4 DAVIS STRASBURG

DB 1240/ 518 080 # 17

025-A4-01-B0-69 0-08A E 1/2 LOT 8 BLK 69 10,000 10,000 64.00 ACCT- 30677

A TO Z HOMES LLC FH 32.00

658 JENKINS LN SH 32.00

STRASBURG VA 22657 AC .072 CL 4 DAVIS STRASBURG

DB 1240/ 518 080 # 18

025-A4-08- - 0-02 WASHINGTON COURT SUBD 28,000 62,500 90,500 579.20 ACCT- 22561

A TO Z HOMES LLC VIRGINIA AVENUE LOT 2A FH 289.60

658 JENKINS LN SH 289.60

STRASBURG VA 22657 AC .108 CL 1 DAVIS STRASBURG

DB 1240/ 518 080 # 19

025- -10- - 0-65 LT 65 SEC 3 CRYSTAL HILL 61,000 143,300 204,300 1,307.52 ACCT- 28205

AARON EUGENE OR EDNA FH 653.76

645 CRYSTAL LN SH 653.76

STRASBURG VA 22657 AC .358 CL 1 DAVIS STRASBURG

DB 1337/ 382 PL 930/ 560 # 20

332,000 537,500 869,500 5,564.80

Totals 332,000 537,500 869,500 5,564.80

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

745,600 123,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 3

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-A1-04-B0-04 0-52 WEST A STREET 31,000 58,900 89,900 575.36 ACCT- 17119

ABAL PROPERTIES LLC LOTS 52 AND 54 BLK 4 FH 287.68

431 TALAMORE DR SH 287.68

STEPHENS CITY VA 22655 AC .164 CL 1 DAVIS STRASBURG

DB 1713/ 684 # 21

103-A1- A- - 0-31 JOHN SEVIER RD 31,000 140,200 171,200 1,095.68 ACCT- 4899

ABBOTT CAROLYN F FH 547.84

PO BOX 1045 SH 547.84

NEW MARKET VA 22844-1045 AC .456 CL 1 LEE NEW MARKET

DB 1456/ 391 # 22

058- -05- - 0-07 LOT 7 SEC A 42,000 92,600 134,600 861.44 ACCT- 9608

ABBOTT CLAUDIA P E OF U S 11 SWECKER SUBD FH 430.72

380 E RESERVOIR RD SH 430.72

WOODSTOCK VA 22664-1512 AC .631 CL 2 JOHNSTON

DB 731/ 157 # 23

045-A5-32-S0-00B0-08 LT 8 SEC B HILLCREST 56,000 240,800 296,800 1,899.52 ACCT- 26381

ABBOTT GLORIA HEIGHTS FH 949.76

746 EAGLE ST SH 949.76

WOODSTOCK VA 22664 AC .402 CL 1 JOHNSTON WOODSTOC

DB 1227/ 434 # 24

031- -06- - 0-15 LT 15 FAIRVIEW 58,300 20,000 78,300 501.12 ACCT- 27503

ABBOTT RICHARD C AND NORMA L FH 250.56

TRUSTEES TRUST SH 250.56

219 PARSONS POINT LN AC 3.610 CL 2 STONEWALL

EDINBURG VA 22824 DB 1754/ 315 # 25

066-A2-01- - 0-42 BRYCE MTN SEC 12 LT 42 5,000 5,000 32.00 ACCT- 1

ABDI WONDWOSEN OR FETLEWORK FH 16.00

11210 MCGEE WAY SH 16.00

ELLICOTT CITY MD 21042-6128 AC .356 CL 2 ASHBY SANITARY

DB 333/ 138 # 26

015- - A- - 0-82 RT 757 143,600 201,100 344,700 2,206.08 ACCT- 24560

ABE LARRY W OR SANDRA L 81,500 DEFERRED 81,500 521.60 FH 842.24

850 JUNCTION RD SH 842.24

STRASBURG VA 22657 AC 15.269 CL 2 62,100 201,100 263,200 1,684.48 DAVIS

DB 794/ 909 150 # 27

015- - A- - 0-82C 71,300 71,300 456.32 ACCT- 28521

ABE LARRY W OR SANDRA L 64,500 DEFERRED 64,500 412.80 FH 21.76

850 JUNCTION RD SH 21.76

STRASBURG VA 22657 AC 14.264 CL 2 6,800 6,800 43.52 DAVIS

DB 1221/ 365 # 28

035- -02- - 0-25 LT 25 SEC 1 RIVER OF THE 60,200 60,200 385.28 ACCT- 21889

ABE RICHARD VALLEY FH 192.64

11545 FORT VALLEY RD SH 192.64

FORT VALLEY VA 22652 AC 3.374 CL 2 DAVIS

DB 1683/ 357 # 29

049- - A- - 0-30A RTS 678 AND 771 57,400 180,600 238,000 1,523.20 ACCT- 11979

ABE RICHARD OR KELLY FH 761.60

11545 FORT VALLEY RD SH 761.60

FORT VALLEY VA 22652 AC 3.060 CL 2 JOHNSTON

DB 1744/ 188 # 30

555,800 934,200 1,490,000 9,536.00

146,000 146,000 934.40

Totals 409,800 934,200 1,344,000 8,601.60

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

557,900 932,100

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 4

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

082- - A- - 0-08A RT 765 253,200 253,200 1,620.48 ACCT- 22002

ABEL ELLEN M ESTATE 236,600 DEFERRED 236,600 1,514.24 FH 53.12

% NORMA THOMPSON SH 53.12

450 CHILLY HOLLOW RD AC 63.295 CL 5 16,600 16,600 106.24 MADISON

BERRYVILLE VA 22611 WB 153/ 348 PL 857/ 582 # 31

103- - A- - 0-52 U S 11 N OF NEW MARKET 172,200 96,200 268,400 1,717.76 ACCT- 1729

ABEL MICHAEL LEE OR 114,300 DEFERRED 114,300 731.52 FH 493.12

PATRICIA LOUISE SH 493.12

2157 OLD VALLEY PIKE AC 21.700 CL 5 57,900 96,200 154,100 986.24 LEE

NEW MARKET VA 22844 DB 1290/ 732 PL 1211/ 29 075 # 32

065-A2-06- - 0-06 BRYCE MTN LT 6 SEC 5 55,000 181,600 236,600 1,514.24 ACCT- 17137

ABERT MICHAEL FH 757.12

7514 HONESTY WAY SH 757.12

BETHESDA MD 20817 AC .478 CL 2 ASHBY SANITARY

DB 1502/ 493 # 33

093-A -10- - 0-22 LOTS 22 AND 23 SECTION 8,000 8,000 51.20 ACCT- 7

ABLASHI DHARAM V 10 HIDDEN PASS SUBD FH 25.60

34693 BOOKHAMMER LANDING RD SH 25.60

LEWES DE 19958 AC 1.399 CL 2 ASHBY

DB 1479/ 558 # 34

033-A -08- - 0-35 LOT 35 SEC 3 PHASE 1 56,000 121,200 177,200 1,134.08 ACCT- 35119

ABONCE FRANCISCO MOSQUEDA OR MADISON ESTATES FH 567.04

ROSA M QUESADA PERALTA SH 567.04

89 KALEIGH DR AC .352 CL 2 STONEWALL TB SANI

MAURERTOWN VA 22644 DB 1780/ 113 PL 1681/ 327 075 # 35

023- -08- - 0-04 LT 4 HIGH POINT ESTATES 57,500 140,900 198,400 1,269.76 ACCT- 28141

ABONCE TAMMY D FH 634.88

1054 COUNTRY BROOK RD SH 634.88

TOMS BROOK VA 22660-2512 AC 1.500 CL 2 STONEWALL

DB 1186/ 475 075 # 36

045-A2-27- - 0-26 LT 26 SEC 2 WATERBROOK 28,000 73,500 101,500 649.60 ACCT- 29411

ABRAHAM LISA M HOMES FH 324.80

209 WATERBROOK CT SH 324.80

WOODSTOCK VA 22664 AC .134 CL 1 JOHNSTON WOODSTOC

DB 1734/ 223 075 # 37

065-A1-01- - 0-02 BRYCE MTN LT 1-2 SEC 8 43,500 256,900 300,400 1,922.56 ACCT- 684

ABRAMS JOHN N OR CECELIA FH 961.28

6337 RIVER DOWNS RD SH 961.28

ALEXANDRIA VA 22312 AC .905 CL 2 ASHBY SANITARY

DB 1462/ 747 PL 1462/ 751 075 # 38

065-A1-01- - 0-05 BRYCE MTN LT 5 SEC 8 8,800 8,800 56.32 ACCT- 13829

ABRAMS JOHN N OR CECELIA FH 28.16

6337 RIVER DOWNS RD SH 28.16

ALEXANDRIA VA 22312 AC .395 CL 2 ASHBY SANITARY

DB 1462/ 747 PL 1462/ 751 075 # 39

065-A1-01- - 0-03 BRYCE MTN LT 3 SEC 8 18,800 18,800 120.32 ACCT- 23970

ABRAMS JOHN N OR CECELIA R FH 60.16

6337 RIVER DOWNS RD SH 60.16

ALEXANDRIA VA 22312 AC .407 CL 2 ASHBY SANITARY

DB 1683/ 737 PL 1402/ 720 # 40

701,000 870,300 1,571,300 10,056.32

350,900 350,900 2,245.76

Totals 350,100 870,300 1,220,400 7,810.56

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

101,500 948,200 521,600

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 5

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

065-A1-01- - 0-03A BRYCE MTN STRIP SEC 8 1,000 1,000 6.40 ACCT- 34545

ABRAMS JOHN N OR CECELIA R FH 3.20

6337 RIVER DOWNS RD SH 3.20

ALEXANDRIA VA 22312 AC .075 CL 2 ASHBY SANITARY

DB 1683/ 737 PL 1402/ 720 # 41

065-A1-01- - 0-04 BRYCE MTN LT 4 SEC 8 18,800 18,800 120.32 ACCT- 113

ABRAMS JOHN N OR CECELIA R FH 60.16

6337 RIVER DOWNS RD SH 60.16

ALEXANDRIA VA 22312 AC .289 CL 2 ASHBY SANITARY

DB 1683/ 737 PL 1402/ 720 # 42

061- -07- - 0-06 LT 6 MILFORD HEIGHTS 42,500 36,500 79,000 505.60 ACCT- 2032

ABRAMS JOSEPH E ET AL SUBD RT 769 FH 252.80

5801 JEWELL RD SH 252.80

GRAHAM NC 27253 AC 3.079 CL 2 JOHNSTON

DB 1676/ 84 # 43

053- - A- - 1-44 RT 611 57,500 57,500 368.00 ACCT- 4966

ABRAMS NEAL E OR KATHYRN S FH 184.00

12531 SUPINLICK RIDGE RD SH 184.00

EDINBURG VA 22824 AC 11.500 CL 2 MADISON

DB 1753/ 526 # 44

054- - A- - 0-20 RT 611 79,000 132,900 211,900 1,356.16 ACCT- 4967

ABRAMS NEAL E OR KATHYRN S FH 678.08

12531 SUPINLICK RIDGE RD SH 678.08

EDINBURG VA 22824 AC 6.144 CL 2 MADISON

DB 1753/ 526 # 45

054- - A- - 0-21 RT 611 57,500 57,500 368.00 ACCT- 4965

ABRAMS NEAL E OR KATHYRN S FH 184.00

12531 SUPINLICK RIDGE RD SH 184.00

EDINBURG VA 22824 AC 11.500 CL 2 MADISON

DB 1753/ 526 # 46

025-A3- A- - 0-44 PARCEL A 81,000 260,000 341,000 2,182.40 ACCT- 21252

ABRUZERE RICHARD A OR GWENDOLYN A FH 1,091.20

501 ORCHARD ST SH 1,091.20

STRASBURG VA 22657-2008 AC 1.300 CL 1 DAVIS STRASBURG

DB 532/ 695 # 47

025-A3- A- - 0-44C TO BECOME PART OF PARCEL 37,500 37,500 240.00 ACCT- 23090

ABRUZERE RICHARD A OR GWENDOLYN A A FH 120.00

501 ORCHARD ST SH 120.00

STRASBURG VA 22657-2008 AC .670 CL 1 DAVIS STRASBURG

DB 544/ 196 # 48

076- -10- - 0-04 LT 4 CLOUDLAND SUBD 48,900 117,900 166,800 1,067.52 ACCT- 11968

ABRUZZINO F JOSEPH FH 533.76

2514 SUPINLICK RIDGE RD SH 533.76

MOUNT JACKSON VA 22842 AC 3.187 CL 2 LEE

DB 1157/ 421 PL 1157/ 424 # 49

104- -04- - 0-42 LOT 42 PHASE 2 56,000 219,900 275,900 1,765.76 ACCT- 29143

ABSHER TERESA L OR FAIRWAY MANOR FH 882.88

DIANE A BUTLER SH 882.88

105 TEE CT AC .651 CL 1 LEE NEW MARKET

NEW MARKET VA 22844 DB 1709/ 149 PL 1023/ 834 # 50

479,700 767,200 1,246,900 7,980.16

Totals 479,700 767,200 1,246,900 7,980.16

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

654,400 592,500

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 6

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-A3- A- - 0-37 ORCHARD ST LT 6 51,000 73,800 124,800 798.72 ACCT- 288

ACANTHUS PROPERTIES LLC 117 ORCHARD ST FH 399.36

3707 FARRAGUT AVE SH 399.36

KENSINGTON MD 20895 AC .140 CL 1 DAVIS STRASBURG

DB 1785/ 358 132 # 51

065-A2-01-B0-00A0-54 BRYCE MTN LT 54 BLK A 4,200 4,200 26.88 ACCT- 24031

ACEVERO NOEL M OR CELIA SEC 6 FH 13.44

5112 CHESHIRE LN SH 13.44

LANHAM MD 20706 AC .419 CL 2 ASHBY SANITARY

DB 1422/ 545 # 52

065-A1-01- - 1-77 BRYCE MTN LT 177 SEC 8 2,500 2,500 16.00 ACCT- 11270

ACHTNER EDWARD J OR ILSE H FH 8.00

90 BLACK LOG RD SH 8.00

KENTFIELD CA 94904 AC .439 CL 2 ASHBY SANITARY

DB 1380/ 419 # 53

067- - A- - 0-35 RT 42 S OF CONICVILLE 40,700 59,600 100,300 641.92 ACCT- 17434

ACKERMAN HEIDI JOAN FH 320.96

6636 S KINGS HWY SH 320.96

ALEXANDRIA VA 22306 AC 1.700 CL 2 ASHBY

WB 144/ 825 # 54

103-D -05- - 0-01 LT 1 SEC 1 PLEASANT VIEW 40,000 153,900 193,900 1,240.96 ACCT- 22299

ACKERMAN PAUL R OR SUBD FH 620.48

WELDON M BAGWELL SH 620.48

9977 S CONGRESS ST AC .450 CL 1 LEE NEW MARKET

NEW MARKET VA 22844 DB 1734/ 860 # 55

080- -06- - 0-08 PT LT 8 SEC 2 96,900 423,800 520,700 3,332.48 ACCT- 27723

ACKERSON GUY A OR KATHLEEN A BEAVER ESTATES FH 1,666.24

512 BEAVER LN SH 1,666.24

MOUNT JACKSON VA 22842 AC 7.986 CL 2 ASHBY

DB 712/ 596 PL 1712/ 231 # 56

073- - A- - 0-52A RT 769 2,700 2,700 17.28 ACCT- 16562

ACKERSON JEFFREY T OR SHARON G FH 8.64

538 HABRON HOLLOW RD SH 8.64

FORT VALLEY VA 22652 AC .444 CL 2 JOHNSTON

DB 1058/ 509 PL 1058/ 514 # 57

073- - A- - 1-12 OFF RT 769 180,100 360,700 540,800 3,461.12 ACCT- 13846

ACKERSON JEFFREY T OR SHARON G FH 1,730.56

538 HABRON HOLLOW RD SH 1,730.56

FORT VALLEY VA 22652 AC 30.411 CL 5 JOHNSTON

DB 1058/ 509 PL 1703/ 67 075 # 58

073- - A- - 1-12A OFF RT 769 24,700 24,700 158.08 ACCT- 16559

ACKERSON JEFFREY T OR SHARON G FH 79.04

538 HABRON HOLLOW RD SH 79.04

FORT VALLEY VA 22652 AC 4.944 CL 2 JOHNSTON

DB 1058/ 509 PL 1058/ 514 # 59

091-A1- A- - 2-39 MAIN ST 82,300 82,700 165,000 1,056.00 ACCT- 18677

ACOSTA FRANCIS T FH 528.00

6012 MAIN ST SH 528.00

MOUNT JACKSON VA 22842 AC .378 CL 4 ZN 0000 ASHBY MT JACKSON

DB 1688/ 906 # 60

525,100 1,154,500 1,679,600 10,749.44

Totals 525,100 1,154,500 1,679,600 10,749.44

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

318,700 655,100 165,000 540,800

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 7

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

080- -06- - 0-03 LT 3 SEC 1 BEAVER ESTATES 62,600 227,000 289,600 1,853.44 ACCT- 27450

ACOSTA RUDY KIDDER OR MYHANH TRAN FH 926.72

182 BEAVER LN SH 926.72

MOUNT JACKSON VA 22842 AC 3.085 CL 2 ASHBY

DB 1615/ 626 075 # 61

065-A1-02-B0-00A1-78 BRYCE MTN LT 178 BLK A 20,000 110,800 130,800 837.12 ACCT- 13275

ACUNA JESUS HECTOR SEC 6 FH 418.56

PO BOX 1067 SH 418.56

NEW MARKET VA 22844 AC .326 CL 2 ASHBY SANITARY

DB 1765/ 388 # 62

045-A3- A- - 0-37A PARCEL 1 1,753,300 1,753,300 11,221.12 ACCT- 26063

AD INVESTMENT PROPERTY LLC 1,749,400 DEFERRED 1,749,400 11,196.16 FH 12.48

2471 CAVE RIDGE RD SH 12.48

MOUNT JACKSON VA 22842 AC 8.050 CL 4 3,900 3,900 24.96 STONEWALL WOODSTO

DB 1588/ 42 PL 1651/ 770 # 63

066-A1-01- - 2-32 BRYCE MTN LT 232 SEC 10 8,000 8,000 51.20 ACCT- 11

ADAIR ROY ERNEST JR OR ROBYN H FH 25.60

334 J AVE SH 25.60

CORONADO CA 92118 AC .436 CL 2 ASHBY SANITARY

DB 293/ 101 # 64

045-A2- A- - 0-96 N CHURCH STREET 36,000 92,100 128,100 819.84 ACCT- 2560

ADAMCZAK MILTON J OR DIANE M FH 409.92

234 N CHURCH ST SH 409.92

WOODSTOCK VA 22664-1715 AC .289 CL 1 JOHNSTON WOODSTOC

DB 707/ 34 # 65

079- - A- - 1-40 RT 715 39,400 132,500 171,900 1,100.16 ACCT- 7598

ADAMCZYK ROBERT G PARCEL 2 FH 550.08

1751 ORCHARD RD SH 550.08

MOUNT JACKSON VA 22842 AC 1.478 CL 2 ASHBY

DB 937/ 531 PL 901/ 232 # 66

016- - A- - 2-55 75,000 75,000 480.00 ACCT- 5848

ADAMS ALFRED T ET AL FH 240.00

1121 SUMMIT AVE SH 240.00

FRONT ROYAL VA 22630-3433 AC 10.000 CL 2 DAVIS

DB 650/ 653 # 67

016- - A- - 2-57 164,800 23,500 188,300 1,205.12 ACCT- 5847

ADAMS ALFRED T ET AL FH 602.56

1121 SUMMIT AVE SH 602.56

FRONT ROYAL VA 22630-3433 AC 20.808 CL 5 DAVIS

DB 650/ 653 # 68

053- - A- - 1-85 RT 711 233,700 94,800 328,500 2,102.40 ACCT- 4080

ADAMS BERNARD A OR PENNY S 178,100 DEFERRED 178,100 1,139.84 FH 481.28

536 PEPPER RD SH 481.28

MOUNT JACKSON VA 22842 AC 64.656 CL 5 55,600 94,800 150,400 962.56 ASHBY

DB 1146/ 569 PL 1320/ 222 # 69

104- -07-S0-03 0-72 LT 72 SEC 3 SUNDANCE 43,000 174,800 217,800 1,393.92 ACCT- 25042

ADAMS DALE WALTER RETREAT SUBD FH 696.96

PO BOX 1155 SH 696.96

NEW MARKET VA 22844-1155 AC 3.001 CL 2 LEE

DB 550/ 58 # 70

2,435,800 855,500 3,291,300 21,064.32

1,927,500 1,927,500 12,336.00

Totals 508,300 855,500 1,363,800 8,728.32

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

128,100 893,100 1,753,300 516,800

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 8

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

104-C -01-B0-07 0-71 E OF NEW MARKET RT 211 25,000 58,000 83,000 531.20 ACCT- 14124

ADAMS DALE WALTER VALLEY VISTAPARK SUBD FH 265.60

PO BOX 1155 LTS 71-73, 106-108 BLK 7 SH 265.60

NEW MARKET VA 22844-1155 AC 1.033 CL 2 LEE

DB 1464/ 556 PL 1468/ 868 # 71

104-C -01-B0-07 1-11 BROOK AVENUE VALLEY VISTA 7,500 97,800 105,300 673.92 ACCT- 16250

ADAMS DALE WALTER PARK SUBD FH 336.96

PO BOX 1155 SH 336.96

NEW MARKET VA 22844-1155 AC .861 CL 2 LEE

DB 1464/ 556 # 72

065-A1-01- - 1-08 BRYCE MTN LT 108 SEC 8 31,000 102,800 133,800 856.32 ACCT- 23505

ADAMS DAVID J JR OR JACQUELINE A FH 428.16

PO BOX 873 SH 428.16

BASYE VA 22810 AC .375 CL 2 ASHBY SANITARY

DB 1742/ 814 075 # 73

025- -10- - 0-52 LT 52 SEC 3 CRYSTAL HILL 86,200 245,800 332,000 2,124.80 ACCT- 28191

ADAMS DAVID M FH 1,062.40

42 CRYSTAL HILL CT SH 1,062.40

STRASBURG VA 22657 AC 2.009 CL 1 DAVIS STRASBURG

DB 1630/ 822 075 # 74

031- - A- - 0-63B RT 623 PARCEL B 43,000 137,100 180,100 1,152.64 ACCT- 13380

ADAMS ERIC T FH 576.32

5371 BACK RD SH 576.32

WOODSTOCK VA 22664 AC .933 CL 2 STONEWALL

DB 1098/ 893 # 75

045-A5- A- - 0-44 PT LTS 133 134 36,000 55,300 91,300 584.32 ACCT- 21704

ADAMS FAYE L FH 292.16

136 E SPRING ST SH 292.16

WOODSTOCK VA 22664-1744 AC .298 CL 1 JOHNSTON WOODSTOC

DB 882/ 830 # 76

025-C -09- - 0-56 UNIT B-1 SIGNAL KNOLLS CO 11,000 140,700 151,700 970.88 ACCT- 33192

ADAMS GENEVIEVE SECTION 4 FH 485.44

28 COURTNEY CIR #B-1 SH 485.44

STRASBURG VA 22657 AC .000 CL 1 DAVIS STRASBURG

DB 1720/ 141 PL 1219/ 659 150 # 77

016-D -03- - 0-49 LOT 49 OXBOW ESTATES 56,000 158,300 214,300 1,371.52 ACCT- 33425

ADAMS GERALD A OR BOBBI J FH 685.76

229 ADEN DR SH 685.76

STRASBURG VA 22657 AC .199 CL 1 DAVIS STRASBURG

DB 1732/ 68 PL 1240/ 505 075 # 78

015- -02- - 0-93 LT 93 SEC 3C THE MEADOWS 46,000 110,800 156,800 1,003.52 ACCT- 29910

ADAMS GLENDA T STRASBURG JUNCTION FH 501.76

251 BRECKENRIDGE CT SH 501.76

STRASBURG VA 22657 AC .230 CL 2 DAVIS

DB 1415/ 641 075 # 79

070- -04- - 0-06 LT 6 CLIFFSIDE SUBD 63,200 312,400 375,600 2,403.84 ACCT- 27666

ADAMS HARBERT L R FH 1,201.92

278 CLIFFSIDE DR SH 1,201.92

EDINBURG VA 22824 AC 1.516 CL 2 MADISON

DB 1706/ 483 PL 1706/ 485 # 80

404,900 1,419,000 1,823,900 11,672.96

Totals 404,900 1,419,000 1,823,900 11,672.96

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

789,300 1,034,600

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 9

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

065-A6-01- - 2-42 BRYCE MTN LT 242 SEC 5,000 5,000 32.00 ACCT- 18227

ADAMS JAMES OR TINA ELEVEN FH 16.00

394 CLAGETT ST SW SH 16.00

LEESBURG VA 20175 AC .323 CL 2 ASHBY SANITARY

DB 1346/ 170 # 81

035-A3-02-S0-03 0-11 LOT 11 SEC III 35,000 35,000 224.00 ACCT- 19

ADAMS JAMES R OR JUDITH A DEER RAPIDS SUBD RTS 648 FH 112.00

8000 STUBBS BRIDGE RD 744 SH 112.00

SPOTSYLVANIA VA 22553-5713 AC .882 CL 2 DAVIS

DB 288/ 166 # 82

035-A3-03-S0-03B0-19 DEER RAPIDS SUBD 26,300 26,300 168.32 ACCT- 18

ADAMS JAMES R OR JUDITH A LOT 19 SEC III-B FH 84.16

8000 STUBBS BRIDGE RD SH 84.16

SPOTSYLVANIA VA 22553-5713 AC .697 CL 2 DAVIS

DB 290/ 347 # 83

065-A3-02- - 0-65 BRYCE MTN LT 65 SEC 9 31,000 173,900 204,900 1,311.36 ACCT- 16420

ADAMS JANICE F OR GEORGE R FH 655.68

5 HARBOR WOODS CIR SH 655.68

SAFETY HARBOR FL 34695 AC .460 CL 2 ASHBY SANITARY

DB 1599/ 913 PL 1142/ 381 075 # 84

045-A2- A- - 3-94 S COMMERCE ST 36,000 82,100 118,100 755.84 ACCT- 8184

ADAMS JEFFREY M FH 377.92

58 FLOUR MILL RD SH 377.92

MAYSVILLE WV 26833 AC .125 CL 1 STONEWALL WOODSTO

DB 1420/ 391 075 # 85

056- - A- - 0-63 RESIDENCE RT 752 57,200 38,000 95,200 609.28 ACCT- 2641

ADAMS JEFFREY M FH 304.64

58 FLOUR MILL RD SH 304.64

MAYSVILLE WV 26833 AC 4.833 CL 2 MADISON

DB 1186/ 284 075 # 86

034-A - A- - 1-00 MAIN ST 31,000 43,900 74,900 479.36 ACCT- 11574

ADAMS JEFFREY M OR LINDA A FH 239.68

58 FLOUR MILL RD SH 239.68

MAYSVILLE WV 26833 AC .188 CL 1 JOHNSTON TOMS BRO

DB 580/ 376 # 87

056- - A- - 1-16 RT 675 28,000 78,300 106,300 680.32 ACCT- 9302

ADAMS JEFFREY M OR LINDA A FH 340.16

58 FLOUR MILL RD SH 340.16

MAYSVILLE WV 26833 AC .117 CL 2 MADISON

DB 983/ 132 075 # 88

071- -09- - 0-04 LT 4 ARROWHEAD 5 71,300 136,000 207,300 1,326.72 ACCT- 22608

ADAMS JOHN QUINCY OR FH 663.36

HELEN K TOTH SH 663.36

244 TOMAHAWK LN AC 6.556 CL 2 MADISON

EDINBURG VA 22824 DB 1094/ 183 PL 1094/ 186 # 89

025-A2-06- - 0-07 LOT 7 TAYLOR'S RIDGE 46,000 309,200 355,200 2,273.28 ACCT- 34146

ADAMS JOSHUA D OR FH 1,136.64

JENNIFER N MOWERY SH 1,136.64

196 KANTER DR AC .418 CL 1 DAVIS STRASBURG

STRASBURG VA 22657 DB 1569/ 105 PL 1334/ 287 075 # 90

366,800 861,400 1,228,200 7,860.48

Totals 366,800 861,400 1,228,200 7,860.48

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

548,200 680,000

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 10

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

045-A5-12- - 0-09 BEVERLY PLACE SUBD LT 9 56,000 76,000 132,000 844.80 ACCT- 5443

ADAMS PAUL E FH 422.40

549 VALLEY MILL RD SH 422.40

WINCHESTER VA 22602 AC .656 CL 1 JOHNSTON WOODSTOC

DB 714/ 769 075 # 91

045-A3-13- - 0-17 LOT 17 HISEY PARK 56,000 203,300 259,300 1,659.52 ACCT- 34094

ADAMS RUSSELL B JR FH 829.76

1028 SUN POPPY CT SH 829.76

WOODSTOCK VA 22664 AC .189 CL 1 STONEWALL WOODSTO

DB 1755/ 597 PL 1330/ 718 # 92

047-D2-01-S0-01 3-10 MINE MTN SUBD SEC 1 LT 5,000 5,000 32.00 ACCT- 12966

ADAMS RUSSELL B JR 310 FH 16.00

388 DRY RUN RD SH 16.00

FORT VALLEY VA 22652 AC .646 CL 2 JOHNSTON

DB 1514/ 972 # 93

060- - A- - 0-03A RT 770 11,000 11,000 70.40 ACCT- 10474

ADAMS RUSSELL B JR FH 35.20

388 DRY RUN RD SH 35.20

FORT VALLEY VA 22652 AC 2.038 CL 2 JOHNSTON

DB 807/ 602 # 94

060- -03- - 0-89 FORT VALLEY FORESTS SEC 3,000 3,000 19.20 ACCT- 16558

ADAMS RUSSELL B JR 1 LT 89 FH 9.60

388 DRY RUN RD SH 9.60

FORT VALLEY VA 22652 AC .626 CL 2 JOHNSTON

DB 1534/ 303 # 95

060- -04- - 0-05 LT 5 SAND PLACE ACRES 62,900 62,900 402.56 ACCT- 13270

ADAMS RUSSELL B JR SUBD FH 201.28

388 DRY RUN RD SH 201.28

FORT VALLEY VA 22652 AC 5.656 CL 2 JOHNSTON

DB 715/ 343 # 96

060- -04- - 0-07 LT 7 SAND PLACE ACRES 58,200 123,900 182,100 1,165.44 ACCT- 13271

ADAMS RUSSELL B JR SUBD FH 582.72

388 DRY RUN RD SH 582.72

FORT VALLEY VA 22652 AC 4.372 CL 2 JOHNSTON

DB 682/ 98 # 97

048- - A- - 0-09 RT 771 46,600 700 47,300 302.72 ACCT- 14148

ADAMS STEPHEN C OR KAREN S FH 151.36

2560 BOYER RD SH 151.36

FORT VALLEY VA 22652 AC 2.438 CL 2 JOHNSTON

DB 843/ 585 # 98

048- - A- - 0-10A RT 771 102,400 16,300 118,700 759.68 ACCT- 14475

ADAMS STEPHEN C OR KAREN S 61,600 DEFERRED 61,600 394.24 FH 182.72

2560 BOYER RD SH 182.72

FORT VALLEY VA 22652 AC 11.738 CL 2 40,800 16,300 57,100 365.44 JOHNSTON

DB 1467/ 612 # 99

048- - A- - 0-19 RT 771 44,300 64,200 108,500 694.40 ACCT- 23091

ADAMS STEPHEN C OR KAREN S FH 347.20

2560 BOYER RD SH 347.20

FORT VALLEY VA 22652 AC 2.048 CL 2 JOHNSTON

DB 538/ 298 # 100

445,400 484,400 929,800 5,950.72

61,600 61,600 394.24

Totals 383,800 484,400 868,200 5,556.48

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

391,300 538,500

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 11

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

048- - A- - 0-19A RT 771 178,400 187,500 365,900 2,341.76 ACCT- 21

ADAMS STEPHEN C OR KAREN S 133,500 DEFERRED 133,500 854.40 FH 743.68

2560 BOYER RD SH 743.68

FORT VALLEY VA 22652 AC 29.071 CL 5 44,900 187,500 232,400 1,487.36 JOHNSTON

DB 1497/ 932 # 101

016- - A- - 2-33 ORANDA 59,300 118,200 177,500 1,136.00 ACCT- 6706

ADAMS STROTHER OR SUSAN S FH 568.00

3524 CEDAR CREEK GRADE SH 568.00

WINCHESTER VA 22602-2745 AC 1.125 CL 2 DAVIS

DB 1462/ 257 PL 1289/ 913 # 102

043- - A- - 0-44 RT 623 20,000 20,000 128.00 ACCT- 23

ADAMS WARREN F OR THERESA F FH 64.00

% PAUL ADAMS EXECUTOR SH 64.00

4006 LAKEVIEW TURN AC .688 CL 2 STONEWALL

DUNKIRK MD 20754-9463 DB 364/ 68 # 103

025- -11- - 0-34 LT 34 SEC 5 56,000 139,100 195,100 1,248.64 ACCT- 28586

ADAMS WILLIAM C OR JEANNE N MADISON HEIGHTS SUBD FH 624.32

564 CHRISTIANSEN DR SH 624.32

STRASBURG VA 22657-2847 AC .271 CL 1 DAVIS STRASBURG

DB 744/ 651 150 # 104

034- - A- - 1-10 RT 654 153,400 93,500 246,900 1,580.16 ACCT- 25077

ADAMS WILLIAM H JR FH 790.08

1509 ZION CHURCH RD SH 790.08

MAURERTOWN VA 22644 AC 15.346 CL 2 JOHNSTON

DB 1418/ 352 # 105

025- - A- - 0-43 PARCEL B RT 648 58,900 58,900 376.96 ACCT- 6908

ADAMSON JOHN H AND BARBARA A FH 188.48

TRUSTEES TRUST SH 188.48

1010 SANDY HOOK RD AC 2.742 CL 2 DAVIS

STRASBURG VA 22657-2928 DB 1519/ 267 # 106

025- - A- - 0-44 PARCEL A RT 648 81,000 124,500 205,500 1,315.20 ACCT- 6910

ADAMSON JOHN H AND BARBARA A FH 657.60

TRUSTEES TRUST SH 657.60

1010 SANDY HOOK RD AC 4.494 CL 2 DAVIS

STRASBURG VA 22657-2928 DB 1519/ 267 # 107

034- - A- - 0-98A RT 657 97,000 190,400 287,400 1,839.36 ACCT- 28705

ADAMY KAREN RHODES FH 919.68

528 OLD SCHOOL HOUSE DR SH 919.68

MAURERTOWN VA 22644-2644 AC 7.280 CL 2 JOHNSTON

DB 884/ 677 075 # 108

097- - A- - 0-04 RT 767 55,100 118,800 173,900 1,112.96 ACCT- 17044

ADAMY P MICHAEL OR JENNIFER L FH 556.48

847 QUICKSBURG RD SH 556.48

QUICKSBURG VA 22847 AC 2.722 CL 2 LEE

DB 1603/ 193 PL 884/ 328 150 # 109

097- - A- - 0-05 RT 767 11,200 2,000 13,200 84.48 ACCT- 17563

ADAMY P MICHAEL OR JENNIFER L FH 42.24

847 QUICKSBURG RD SH 42.24

QUICKSBURG VA 22847 AC 1.600 CL 2 LEE

DB 1603/ 193 PL 884/ 328 150 # 110

770,300 974,000 1,744,300 11,163.52

133,500 133,500 854.40

Totals 636,800 974,000 1,610,800 10,309.12

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

195,100 1,183,300 365,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 12

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

097- - A- - 0-06 HOME TRACT 14,600 14,600 93.44 ACCT- 17043

ADAMY P MICHAEL OR JENNIFER L FH 46.72

847 QUICKSBURG RD SH 46.72

QUICKSBURG VA 22847 AC 2.088 CL 2 LEE

DB 1603/ 193 PL 884/ 328 150 # 111

058-B - A- - 0-04 U S 11 294,100 451,900 746,000 4,774.40 ACCT- 2587

ADDED STORAGE L C STORAGE UNITS FH 2,387.20

% JEFF HAMMAN SH 2,387.20

132 FOX RIDGE RD AC 5.882 CL 4 JOHNSTON

WOODSTOCK VA 22664-4026 DB 895/ 20 PL 897/ 293 # 112

065-A1-01- - 0-75 BRYCE MTN LT 75 SEC 8 6,300 6,300 40.32 ACCT- 1781

ADDERLEY KEVIN OR TAKISA LAMEKA FH 20.16

3802 78TH AVE CT W SH 20.16

APT K201 AC .433 CL 2 ASHBY SANITARY

UNIVERSITY PLACE WA 98466 DB 1537/ 201 # 113

065-A3-02- - 1-57 BRYCE MTN LT 157 SEC 9 2,500 2,500 16.00 ACCT- 24642

ADDERLEY KEVIN OR TAKISA LAMEKA FH 8.00

3802 78TH AVE CT W SH 8.00

APT K201 AC .297 CL 2 ASHBY SANITARY

UNIVERSITY PLACE WA 98466 DB 1537/ 201 # 114

065-A6-01- - 1-60 BRYCE MTN LT 160 SEC 11 2,500 2,500 16.00 ACCT- 22117

ADDERLEY KEVIN OR TAKISA LAMEKA FH 8.00

3802 78TH AVE CT W SH 8.00

APT K201 AC .341 CL 2 ASHBY SANITARY

UNIVERSITY PLACE WA 98466 DB 1537/ 486 # 115

065-A6-01- - 1-63 BRYCE MTN LT 163 SEC 11 2,500 2,500 16.00 ACCT- 9564

ADDERLEY KEVIN OR TAKISA LAMEKA FH 8.00

3802 78TH AVE CT W SH 8.00

APT K201 AC .301 CL 2 ASHBY SANITARY

UNIVERSITY PLACE WA 98466 DB 1537/ 486 # 116

066-A1-02- - 4-20 BRYCE MTN LT 420 SEC 10 2,000 2,000 12.80 ACCT- 7268

ADDERLEY KEVIN OR TAKISA LAMEKA EXTD FH 6.40

3802 78TH AVE CT W SH 6.40

APT K201 AC .433 CL 2 ASHBY SANITARY

UNIVERSITY PLACE WA 98466 DB 1537/ 178 # 117

042-A - A- - 0-01 RT 749 45,000 45,000 288.00 ACCT- 23826

ADDIS SARA K FH 144.00

1123 MILLERTOWN RD SH 144.00

EDINBURG VA 22824 AC 9.000 CL 2 MADISON

DB 1009/ 243 # 118

042-A -01- - 0-01 RT 749 59,000 56,300 115,300 737.92 ACCT- 23356

ADDIS SARA K FH 368.96

1123 MILLERTOWN RD SH 368.96

EDINBURG VA 22824 AC 3.503 CL 2 MADISON

DB 1009/ 243 # 119

042-A -02- - 0-01 RT 749 151,300 113,600 264,900 1,695.36 ACCT- 23827

ADDIS SARA K FH 847.68

1123 MILLERTOWN RD SH 847.68

EDINBURG VA 22824 AC 21.456 CL 5 MADISON

DB 1009/ 243 # 120

579,800 621,800 1,201,600 7,690.24

Totals 579,800 621,800 1,201,600 7,690.24

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

190,700 746,000 264,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 13

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

042-A -02- - 0-01F OFF RT 749 22,100 22,100 141.44 ACCT- 28279

ADDIS SARA K FH 70.72

1123 MILLERTOWN RD SH 70.72

EDINBURG VA 22824 AC 4.412 CL 2 MADISON

DB 1009/ 243 # 121

042-A -02- - 0-02 RT 749 LOT X 4,500 4,500 28.80 ACCT- 26532

ADDIS SARA K FH 14.40

1123 MILLERTOWN RD SH 14.40

EDINBURG VA 22824 AC .906 CL 2 MADISON

DB 1009/ 243 # 122

065-A6-01- - 0-68 BRYCE MTN LT 68 SEC 11 31,000 203,800 234,800 1,502.72 ACCT- 23351

ADDUCCI STEVEN A OR STACY E FH 751.36

7518 BERWICK CT SH 751.36

ALEXANDRIA VA 22315 AC .534 CL 2 ASHBY SANITARY

DB 1694/ 535 PL 875/ 716 150 # 123

061- - A- - 0-55 RT 758; TRACT 2 57,900 225,600 283,500 1,814.40 ACCT- 20194

ADERS WILLIAM BRANDON OR FH 907.20

MARGARET ELLEN SH 907.20

226 SEVEN FOUNTAINS RD AC 5.655 CL 2 JOHNSTON

FORT VALLEY VA 22652 DB 1500/ 532 PL 1060/ 345 # 124

057-B -01- - 0-45 RT 42 VALLEY VIEW SUBD 35,000 35,000 224.00 ACCT- 15279

ADKINS ALUMINIUM INC LT 45 & 46 SEC 3 FH 112.00

348 LANTZ AVE SH 112.00

EDINBURG VA 22824 AC .872 CL 2 MADISON

DB 1676/ 181 PL 1482/ 751 # 125

057-B -01- - 0-12 RT 42 VALLEY VIEW SUBD 52,300 52,300 334.72 ACCT- 15260

ADKINS ALUMINUM INC LT 12 SEC 3 FH 167.36

348 LANTZ RD SH 167.36

EDINBURG VA 22824 AC 4.719 CL 2 MADISON

DB 1490/ 598 PL 1592/ 181 # 126

057-B -01- - 0-12A LOT 12A SEC 3 35,000 35,000 224.00 ACCT- 34970

ADKINS ALUMINUM INC VALLEY VIEW SUBD FH 112.00

348 LANTZ RD SH 112.00

EDINBURG VA 22824 AC 1.024 CL 2 MADISON

PL 1592/ 181 # 127

057-B -01- - 0-48 RT 42 VALLEY VIEW SUBD 43,000 161,700 204,700 1,310.08 ACCT- 15282

ADKINS ALUMINUM INC LT 48 SEC 3 FH 655.04

348 LANTZ RD SH 655.04

EDINBURG VA 22824 AC .436 CL 2 MADISON

DB 1490/ 598 # 128

057- - A- - 0-48 41,800 41,800 267.52 ACCT- 15290

ADKINS ALUMINUM INC ET AL FH 133.76

348 LANTZ RD SH 133.76

EDINBURG VA 22824 AC 1.973 CL 2 MADISON

DB 1428/ 261 PL 1526/ 179 # 129

025- -11- - 0-81 SEC 7 LOT 81 MADISON 56,000 145,600 201,600 1,290.24 ACCT- 29606

ADKINS CHAD D OR BRANDY HEIGHTS FH 645.12

1056 SELDON DR SH 645.12

STRASBURG VA 22657 AC .360 CL 1 DAVIS STRASBURG

DB 1596/ 698 PL 869/ 727 075 # 130

378,600 736,700 1,115,300 7,137.92

Totals 378,600 736,700 1,115,300 7,137.92

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

201,600 913,700

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 14

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

069- - A- - 0-37C RT 687 56,300 56,300 360.32 ACCT- 27281

ADKINS CURTIS W OR CHERYL L FH 180.16

348 LANTZ RD SH 180.16

EDINBURG VA 22824 AC 4.049 CL 2 MADISON

DB 1593/ 746 # 131

069- - A- - 0-37F RT 687 57,000 125,700 182,700 1,169.28 ACCT- 27399

ADKINS CURTIS W OR CHERYL L FH 584.64

348 LANTZ RD SH 584.64

EDINBURG VA 22824 AC 3.001 CL 2 MADISON

DB 1228/ 706 # 132

069- - A- - 0-37G RT 687 114,700 297,800 412,500 2,640.00 ACCT- 27398

ADKINS CURTIS W OR CHERYL L FH 1,320.00

348 LANTZ RD SH 1,320.00

EDINBURG VA 22824 AC 12.949 CL 2 MADISON

DB 1228/ 706 # 133

016- -08- - 0-08 CEDAR RIDGE SUBD 128,500 202,800 331,300 2,120.32 ACCT- 22224

ADKINS DEVIN L OR CASSIE R LT 8 SEC A FH 1,060.16

176 OXBOW DR SH 1,060.16

STRASBURG VA 22657 AC 11.783 CL 2 DAVIS

DB 1703/ 94 075 # 134

045-A5-03- - 0-06 INDIAN SPRINGS PARK LT 6 41,000 63,200 104,200 666.88 ACCT- 7736

ADKINS ENTERPRISES LLC FH 333.44

348 LANTZ RD SH 333.44

EDINBURG VA 22824 AC .285 CL 1 JOHNSTON WOODSTOC

DB 1525/ 957 501 # 135

057-B -02- - 0-03 RT 42 VALLEY VIEW SUBD 40,000 133,900 173,900 1,112.96 ACCT- 15258

ADKINS ENTERPRISES LLC LT 3 SEC 4 FH 556.48

348 LANTZ RD SH 556.48

EDINBURG VA 22824 AC .736 CL 2 MADISON

DB 1667/ 370 # 136

057-B -02- - 0-04 RT 42 VALLEY VIEW SUBD 40,000 111,900 151,900 972.16 ACCT- 15259

ADKINS ENTERPRISES LLC LT 4 SEC 4 FH 486.08

348 LANTZ RD SH 486.08

EDINBURG VA 22824 AC .587 CL 2 MADISON

DB 1667/ 367 # 137

016- - A- - 0-09A OFF RT 631 120,700 280,400 401,100 2,567.04 ACCT- 24921

ADKINS NANCY V FH 1,283.52

448 BARN OWL LN SH 1,283.52

STRASBURG VA 22657 AC 5.299 CL 2 DAVIS

DB 1672/ 159 # 138

025- -01- - 0-02B OUTLOT SECTION I-A 56,000 126,100 182,100 1,165.44 ACCT- 32697

ADOLPHSON MARK A JR OR KATELYNN F CRYSTAL HILL FH 582.72

507 CRIM DR SH 582.72

STRASBURG VA 22657 AC .428 CL 1 DAVIS STRASBURG

DB 1624/ 733 PL 1624/ 735 075 # 139

045-A2-02- - 0-04 SUMMIT AVE LT 4 IN OUT 56,000 219,600 275,600 1,763.84 ACCT- 25449

ADREANCE ALLEN OR PATRICIA M LT 77 FH 881.92

253 N SUMMIT AVE SH 881.92

WOODSTOCK VA 22664 AC .794 CL 1 STONEWALL WOODSTO

DB 1757/ 416 # 140

710,200 1,561,400 2,271,600 14,538.24

Totals 710,200 1,561,400 2,271,600 14,538.24

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

561,900 1,709,700

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 15

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

069- -08- - 0-06 GATEWAY ESTATES 64,000 129,700 193,700 1,239.68 ACCT- 30558

AEF PROPERTIES LLC SEC 2 LOT 6 FH 619.84

2395 HAMBURG RD SH 619.84

EDINBURG VA 22824 AC 2.995 CL 2 MADISON

DB 1202/ 823 # 141

024- -04- - 0-07 LT 7 PEACH TREE ESTATES 64,200 168,600 232,800 1,489.92 ACCT- 16427

AFFLECK ERNEST A OR CATHERINE D FH 744.96

1108 GREEN ACRES DR SH 744.96

STRASBURG VA 22657 AC 3.031 CL 2 DAVIS

DB 943/ 550 075 # 142

065-A5-01- - 1-82 BRYCE MTN LT 182 SEC 9 2,500 2,500 16.00 ACCT- 13014

AGAPAO CENTER INC FH 8.00

FEI# 59-2041773 SH 8.00

1407 CAMBRIDGE DR AC .268 CL 2 ASHBY SANITARY

CLEARWATER FL 33756 DB 1333/ 449 # 143

025-A2-05- - 0-18 LOT 18 HUPP'S RIDGE 28,000 111,600 139,600 893.44 ACCT- 32035

AGEE JESSE J FH 446.72

503 FRONTIER FORT LN SH 446.72

STRASBURG VA 22657 AC .059 CL 1 DAVIS STRASBURG

DB 1611/ 142 PL 1037/ 371 075 # 144

025-A1-04-B0-12 0-09 B ST LTS 9 AND 11 BLK 12 31,000 33,300 64,300 411.52 ACCT- 7707

AGK RENTAL PROPERTIES LLC FH 205.76

1651 MILLBRIDGE RD SH 205.76

SALEM VA 24153-4681 AC .138 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 145

025-A1-04-B0-12 0-27 B STREET 26,000 54,800 80,800 517.12 ACCT- 7697

AGK RENTAL PROPERTIES LLC LOT 27 BLK 12 FH 258.56

1651 MILLBRIDGE RD SH 258.56

SALEM VA 24153-4681 AC .069 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 146

025-A1-04-B0-12 0-29 B STREET 26,000 58,500 84,500 540.80 ACCT- 7698

AGK RENTAL PROPERTIES LLC LOT 29 BLK 12 FH 270.40

1651 MILLBRIDGE RD SH 270.40

SALEM VA 24153-4681 AC .069 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 147

025-A1-04-B0-12 0-31 B STREET 10,000 10,000 64.00 ACCT- 7702

AGK RENTAL PROPERTIES LLC LOTS 31 33 AND 35 BLK 12 FH 32.00

1651 MILLBRIDGE RD SH 32.00

SALEM VA 24153-4681 AC .207 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 148

025-A1-04-B0-13 0-14 LOT 14 BLK 13 36,000 51,600 87,600 560.64 ACCT- 7701

AGK RENTAL PROPERTIES LLC FH 280.32

1651 MILLBRIDGE RD SH 280.32

SALEM VA 24153-4681 AC .258 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 149

025-A1-04-B0-13 0-20 C STREET 36,000 42,200 78,200 500.48 ACCT- 7700

AGK RENTAL PROPERTIES LLC LOTS 20 22 AND 24 BLK 13 FH 250.24

1651 MILLBRIDGE RD SH 250.24

SALEM VA 24153-4681 AC .258 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 150

323,700 650,300 974,000 6,233.60

Totals 323,700 650,300 974,000 6,233.60

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

545,000 429,000

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 16

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-A3- A- - 1-01 NORTH ST AT WATER TANK 56,000 44,000 100,000 640.00 ACCT- 7692

AGK RENTAL PROPERTIES LLC PART LOT 124 FH 320.00

1651 MILLBRIDGE RD SH 320.00

SALEM VA 24153-4681 AC .195 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 151

025-A3- A- - 1-42 STORE ROOMS AND APT KING 173,100 207,500 380,600 2,435.84 ACCT- 7704

AGK RENTAL PROPERTIES LLC ST PT LT 40 FH 1,217.92

1651 MILLBRIDGE RD SH 1,217.92

SALEM VA 24153-4681 AC .265 CL 4 DAVIS STRASBURG

DB 1262/ 757 # 152

025-A3- A- - 2-52 HOLLIDAY ST PT LT 89 56,000 128,300 184,300 1,179.52 ACCT- 7705

AGK RENTAL PROPERTIES LLC FH 589.76

1651 MILLBRIDGE RD SH 589.76

SALEM VA 24153-4681 AC .196 CL 1 DAVIS STRASBURG

DB 1262/ 757 PL 1658/ 350 # 153

025-A3- A- - 2-83 STORE AND APT E KING ST 160,300 73,700 234,000 1,497.60 ACCT- 7703

AGK RENTAL PROPERTIES LLC PT LT 57 FH 748.80

1651 MILLBRIDGE RD SH 748.80

SALEM VA 24153-4681 AC .184 CL 4 DAVIS STRASBURG

DB 1262/ 757 # 154

025-A3- A- - 2-84 E KING ST PT LT 58 212,000 238,600 450,600 2,883.84 ACCT- 7708

AGK RENTAL PROPERTIES LLC FH 1,441.92

1651 MILLBRIDGE RD SH 1,441.92

SALEM VA 24153-4681 AC .243 CL 4 DAVIS STRASBURG

DB 1262/ 757 # 155

025-A3- A- - 2-85 STORE AND OFFICE E KING 7,800 53,900 61,700 394.88 ACCT- 7706

AGK RENTAL PROPERTIES LLC ST PT LT 58 FH 197.44

1651 MILLBRIDGE RD SH 197.44

SALEM VA 24153-4681 AC .009 CL 4 DAVIS STRASBURG

DB 1262/ 757 # 156

025-A4-02-B0-66 0-01 THOMPSON ST LT 1 BLK 66 46,000 130,000 176,000 1,126.40 ACCT- 7731

AGK RENTAL PROPERTIES LLC FH 563.20

1651 MILLBRIDGE RD SH 563.20

SALEM VA 24153-4681 AC .264 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 157

025-A4-02-B0-66 0-02 LOT 2 BLK 66 31,000 300 31,300 200.32 ACCT- 20487

AGK RENTAL PROPERTIES LLC WALTON ST FH 100.16

1651 MILLBRIDGE RD SH 100.16

SALEM VA 24153-4681 AC .137 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 158

025-A4-07- - 0-11 LOT 11 LEMLEY ADDITION 31,000 63,200 94,200 602.88 ACCT- 30735

AGK RENTAL PROPERTIES LLC FH 301.44

1651 MILLBRIDGE RD SH 301.44

SALEM VA 24153-4681 AC .184 CL 1 DAVIS STRASBURG

DB 1262/ 762 # 159

025-A4-07- - 0-12 LOT 12 LEMLEY ADDITION 31,000 63,800 94,800 606.72 ACCT- 30736

AGK RENTAL PROPERTIES LLC FH 303.36

1651 MILLBRIDGE RD SH 303.36

SALEM VA 24153-4681 AC .184 CL 1 DAVIS STRASBURG

DB 1262/ 760 # 160

804,200 1,003,300 1,807,500 11,568.00

Totals 804,200 1,003,300 1,807,500 11,568.00

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

680,600 1,126,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 17

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025-A4-07- - 0-13 LEMLEY ADDITION LTS 13 93,000 222,100 315,100 2,016.64 ACCT- 7730

AGK RENTAL PROPERTIES LLC 14 AND 15 16 17 18 FH 1,008.32

1651 MILLBRIDGE RD 19 SH 1,008.32

SALEM VA 24153-4681 AC 1.365 CL 1 DAVIS STRASBURG

DB 1262/ 757 # 161

035-A1-01-S0-04 0-45 LOT 45 SEC 4 35,000 35,000 224.00 ACCT- 34386

AGLIOTTA MARY DEER RAPIDS FH 112.00

147 VALLEY VIEW DR SH 112.00

STRASBURG VA 22657 AC .783 CL 2 DAVIS

DB 1774/ 794 PL 612/ 478 # 162

035-A1-01-S0-04 0-46 LOT 46 SEC 4 43,000 98,800 141,800 907.52 ACCT- 24866

AGLIOTTA MARY DEER RAPIDS FH 453.76

147 VALLEY VIEW DR SH 453.76

STRASBURG VA 22657 AC .827 CL 2 DAVIS

DB 1774/ 794 PL 612/ 478 # 163

016- - A- - 0-46A RT 55 96,600 376,700 473,300 3,029.12 ACCT- 34330

AGNEW JONATHAN W OR AUDRA S FH 1,514.56

2973 JOHN MARSHALL HWY SH 1,514.56

STRASBURG VA 22657 AC 4.857 CL 2 DAVIS

DB 1369/ 22 PL 1369/ 25 150 # 164

065- - A- - 0-54B RT 611 67,600 211,600 279,200 1,786.88 ACCT- 18416

AGNEW ROBERT F OR SUSAN P FH 893.44

1276 N WAYNE ST PH22 SH 893.44

ARLINGTON VA 22201 AC 4.941 CL 2 ASHBY

DB 1145/ 551 PL 1145/ 553 # 165

065- -06- - 0-13 LT 13 SUNRISE RIDGE SUBD 33,100 33,100 211.84 ACCT- 16807

AGRI OF VIRGINIA INC FH 105.92

PO BOX 336 SH 105.92

BROADWAY VA 22815 AC 2.623 CL 2 ASHBY

DB 1400/ 372 # 166

065-A6-01- - 1-04 BRYCE MTN LT 104 SEC 2,500 2,500 16.00 ACCT- 8338

AGRI OF VIRGINIA INC ELEVEN FH 8.00

PO BOX 336 SH 8.00

BROADWAY VA 22815 AC .334 CL 2 ASHBY SANITARY

DB 1414/ 14 # 167

065-A6-01- - 1-10 BRYCE MTN LT 110 SEC 2,500 2,500 16.00 ACCT- 338

AGRI OF VIRGINIA INC ELEVEN FH 8.00

PO BOX 336 SH 8.00

BROADWAY VA 22815 AC .331 CL 2 ASHBY SANITARY

DB 1414/ 14 # 168

065-A6-01- - 3-13 SEC 11 LT 313 BRYCE MTN 10,000 10,000 64.00 ACCT- 1127

AGRI OF VIRGINIA INC FH 32.00

PO BOX 336 SH 32.00

BROADWAY VA 22815 AC .418 CL 2 ASHBY SANITARY

DB 1414/ 14 # 169

023- - A- - 0-75C PART OF PARCEL B RT 646 168,500 305,400 473,900 3,032.96 ACCT- 21254

AHLERS EDWARD W OR ETHEL M FH 1,516.48

2190 MT HEBRON RD SH 1,516.48

STRASBURG VA 22657-3808 AC 24.706 CL 5 DAVIS

DB 521/ 116 # 170

551,800 1,214,600 1,766,400 11,304.96

Totals 551,800 1,214,600 1,766,400 11,304.96

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

315,100 977,400 473,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 18

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

023- - A- - 0-75F 22,200 22,200 142.08 ACCT- 28383

AHLERS EDWARD W OR ETHEL M FH 71.04

2190 MT HEBRON RD SH 71.04

STRASBURG VA 22657-3808 AC 2.780 CL 2 DAVIS

DB 635/ 472 # 171

096- - A- - 0-41B PARCEL 3 19,200 19,200 122.88 ACCT- 29184

AICHUS LLC FH 61.44

75 WATERMAN DR SH 61.44

HARRISONBURG VA 22802 AC 3.195 CL 2 LEE

DB 1426/ 200 # 172

066-A2-01- - 2-82 BRYCE MTN SEC 12 LT 282 26,000 127,200 153,200 980.48 ACCT- 5936

AILES CLARA J TRUSTEE TRUST FH 490.24

6103 HARMON PL SH 490.24

SPRINGFIELD VA 22152 AC .321 CL 2 ASHBY SANITARY

DB 1540/ 541 # 173

059-A -02-B0-01 0-29 LT 29 MTN VIEW SEC 20,000 20,000 128.00 ACCT- 43

AILLS JACK E AND MARGUERITE M LEISURE POINT FH 64.00

TRUSTEES TRUST SH 64.00

7903 FAIRFAX RD AC .680 CL 2 JOHNSTON

ALEXANDRIA VA 22308-1139 DB 1543/ 152 # 174

016-C -02- - 1-02A UNIT 1 FOUNDERS LANDING 76,500 198,100 274,600 1,757.44 ACCT- 33707

AIRPORT BUSINESS CENTER LLC OFFICE CONDOMINIUMS FH 878.72

PO BOX 2168 SH 878.72

LEESBURG VA 20177 AC .207 CL 4 DAVIS STRASBURG

DB 1608/ 965 PL 1276/ 622 # 175

016-C -02- - 1-02B UNIT 2 FOUNDERS LANDING 76,500 252,400 328,900 2,104.96 ACCT- 33708

AIRPORT BUSINESS CENTER LLC OFFICE CONDOMINIUMS FH 1,052.48

PO BOX 2168 SH 1,052.48

LEESBURG VA 20177 AC .207 CL 4 DAVIS STRASBURG

DB 1608/ 965 PL 1276/ 622 # 176

025-A4- A- - 2-05 N OF STRASBURG 38,000 171,900 209,900 1,343.36 ACCT- 3273

AKERS MICHAEL D OR KATHY A FH 671.68

442 CRIM DR SH 671.68

STRASBURG VA 22657 AC .350 CL 1 DAVIS STRASBURG

DB 1759/ 51 # 177

093-A -04- - 0-34 LOT 34 SEC IV 22,000 47,800 69,800 446.72 ACCT- 25048

AKERS SCOTT RT 616 HIDDEN PASS FH 223.36

54 LAKE DR SH 223.36

NEW MARKET VA 22844 AC .928 CL 2 ASHBY

WB 137/ 950 # 178

093-A -04- - 0-36 LOT 36 SEC IV RT 616 2,900 2,900 18.56 ACCT- 35252

AKERS SCOTT PIERRE HIDDEN PASS FH 9.28

54 LAKE DR SH 9.28

NEW MARKET VA 22844 AC .643 CL 2 ASHBY

DB 1783/ 453 # 179

065-A1-02-B0-00A2-00 BRYCE MTN LOT 200 BLK A 14,000 14,000 89.60 ACCT- 17371

AKHAVAN-LEILABADI HORMOZ OR SEC 6 FH 44.80

MARY K KRAMER SH 44.80

13208 GRAND JUNCTION DR AC .337 CL 2 ASHBY SANITARY

FAIRFAX VA 22033-1327 DB 610/ 458 # 180

317,300 797,400 1,114,700 7,134.08

Totals 317,300 797,400 1,114,700 7,134.08

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

209,900 301,300 603,500

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 19

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

080- -02- - 0-02 N OF MT JACKSON 33,000 85,900 118,900 760.96 ACCT- 17832

AKIYAMA BENJAMIN FH 380.48

155 CANNON HILL RD SH 380.48

MOUNT JACKSON VA 22842 AC .456 CL 2 ASHBY

DB 1610/ 925 075 # 181

081-B -01-B0-01 0-36 PARCEL B 81,000 81,000 518.40 ACCT- 30647

AL-ALTIAYA HAMAD HAMAD I FH 259.20

8220 CRESTWOOD HEIGHT DR SH 259.20

APT 1114 AC .620 CL 4 ASHBY MT JACKSON

MCLEAN VA 22102 DB 1777/ 732 PL 807/ 290 # 182

045-A1- A- - 0-03 W NORTH ST 128,100 128,100 819.84 ACCT- 13946

AL-ATIAYA HAMAD HAMAD I LTS 92 93 94 AND 95 FH 409.92

8220 CRESTWOOD HEIGHT DR SH 409.92

APT 1114 AC 12.812 CL 1 ZN R1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 183

045-A1-22- - 0-00A OPEN SPACE & SWIM AREA #1 1,000 1,000 6.40 ACCT- 34408

AL-ATIAYA HAMAD HAMAD I SUNSET CREST PHASE 1 FH 3.20

8220 CRESTWOOD HEIGHT DR SH 3.20

APT 1114 AC .961 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 184

045-A1-22- - 0-01 LOT 1 PHASE 1 40,000 40,000 256.00 ACCT- 34409

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 185

045-A1-22- - 0-02 LOT 2 PHASE 1 40,000 40,000 256.00 ACCT- 34410

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 186

045-A1-22- - 0-03 LOT 3 PHASE 1 40,000 40,000 256.00 ACCT- 34411

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 187

045-A1-22- - 0-04 LOT 4 PHASE 1 40,000 40,000 256.00 ACCT- 34412

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 188

045-A1-22- - 0-19 LOT 19 PHASE 1 40,000 40,000 256.00 ACCT- 34413

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .412 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 189

045-A1-22- - 0-20 LOT 20 PHASE 1 40,000 40,000 256.00 ACCT- 34414

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .421 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 190

483,100 85,900 569,000 3,641.60

Totals 483,100 85,900 569,000 3,641.60

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

369,100 118,900 81,000

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 20

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

045-A1-22- - 0-21 LOT 21 PHASE 1 40,000 40,000 256.00 ACCT- 34415

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .403 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 191

045-A1-22- - 0-23 LOT 23 PHASE 1 40,000 40,000 256.00 ACCT- 34417

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 192

045-A1-22- - 0-24 LOT 24 PHASE 1 40,000 40,000 256.00 ACCT- 34418

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .544 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 193

045-A1-22- - 0-25 LOT 25 PHASE 1 40,000 40,000 256.00 ACCT- 34419

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .456 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 194

045-A1-22- - 0-26 LOT 26 PHASE 1 40,000 40,000 256.00 ACCT- 34420

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 195

045-A1-22- - 0-37 LOT 37 PHASE 1 40,000 40,000 256.00 ACCT- 34421

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .402 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 196

045-A1-22- - 0-38 LOT 38 PHASE 1 40,000 40,000 256.00 ACCT- 34422

AL-ATIAYA HAMAD HAMAD I SUNSET CREST FH 128.00

8220 CRESTWOOD HEIGHT DR SH 128.00

APT 1114 AC .416 CL 1 STONEWALL WOODSTO

MCLEAN VA 22102 DB 1777/ 759 PL 1399/ 803 # 197

016-C -02- - 0-11 LOT 11 PHASE 1 56,000 156,800 212,800 1,361.92 ACCT- 31921

ALAMOURI YOUSEF FOUNDERS LANDING FH 680.96

118 POTTER CIR SH 680.96

STRASBURG VA 22657 AC .132 CL 1 DAVIS STRASBURG

DB 1671/ 225 PL 1038/ 175 # 198

065-A6-01- - 0-70 BRYCE MTN LT 70 SEC 11 31,000 161,700 192,700 1,233.28 ACCT- 26950

ALBANESE MARK S FH 616.64

3752 CENTER WAY SH 616.64

FAIRFAX VA 22033 AC .269 CL 2 ASHBY SANITARY

DB 1149/ 304 150 # 199

056- - A- - 1-93D RT 681 49,000 154,500 203,500 1,302.40 ACCT- 23093

ALBAUGH PATRICIA ANN FH 651.20

1378 STONEBURNER RD SH 651.20

EDINBURG VA 22824-2901 AC 3.209 CL 2 MADISON

DB 526/ 320 # 200

416,000 473,000 889,000 5,689.60

Totals 416,000 473,000 889,000 5,689.60

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

492,800 396,200

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 21

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

056- - A- - 2-00 RT 681 278,900 1,300 280,200 1,793.28 ACCT- 23094

ALBAUGH PATRICIA ANN 248,900 DEFERRED 248,900 1,592.96 FH 100.16

1378 STONEBURNER RD SH 100.16

EDINBURG VA 22824-2901 AC 62.596 CL 5 30,000 1,300 31,300 200.32 MADISON

DB 481/ 543 # 201

025- -11- - 1-21 LOT 121 SECTION 8 56,000 166,300 222,300 1,422.72 ACCT- 31014

ALBERS DANIEL MADISON HEIGHTS SUBD FH 711.36

693 CHRISTIANSEN DR SH 711.36

STRASBURG VA 22657 AC .345 CL 1 DAVIS STRASBURG

DB 1676/ 312 PL 881/ 321 075 # 202

065-A3-04- - 3-51 BRYCE MTN SEC 9XX LT 351 34,000 317,000 351,000 2,246.40 ACCT- 18621

ALBERS RICHARD F ET AL & 351A FH 1,123.20

PO BOX 322 SH 1,123.20

BASYE VA 22810 AC .670 CL 2 ASHBY SANITARY

DB 1498/ 786 PL 1477/ 413 # 203

033- - A- - 2-51 RT 642 87,400 148,500 235,900 1,509.76 ACCT- 9387

ALBERT BENJAMIN J OR GOLDA L FH 754.88

150 DEAN RD SH 754.88

TOMS BROOK VA 22660 AC 5.817 CL 2 STONEWALL

DB 1703/ 666 PL 1313/ 575 075 # 204

098- - A- - 0-14B TRACT A RT 626 45,000 45,000 288.00 ACCT- 33482

ALBERT JOHN C OR MARY E FH 144.00

101 BOILING SPRINGS LN SH 144.00

QUICKSBURG VA 22847 AC 3.500 CL 2 LEE

DB 1413/ 605 PL 1248/ 322 # 205

098- - A- - 0-14A TRACT B RT 626 54,500 202,400 256,900 1,644.16 ACCT- 28092

ALBERT JOHN CHARLES OR MARY ELLEN FH 822.08

101 BOILING SPRINGS LN SH 822.08

QUICKSBURG VA 22847 AC 3.743 CL 2 LEE

DB 1298/ 313 PL 1248/ 322 150 # 206

016-C -02- - 0-29 LOT 29 PHASE 1 36,000 116,900 152,900 978.56 ACCT- 31939

ALBERT WILLIAM C OR HOPE L FOUNDERS LANDING FH 489.28

41927 QUICKSTEP PL SH 489.28

ALDIE VA 20105 AC .045 CL 1 DAVIS STRASBURG

DB 1137/ 936 PL 1038/ 175 075 # 207

045-A7-05- - 0-03 LT 3 SEC 3 LAKEVIEW 26,000 77,400 103,400 661.76 ACCT- 29073

ALBERTSON BRETT A OR SAMANTHA E FARMS DEVELOPMENT FH 330.88

12284 KINGS HWY SH 330.88

KING GEORGE VA 22485 AC .058 CL 1 JOHNSTON WOODSTOC

DB 1679/ 213 075 # 208

025- - A- - 1-23 RT 55 53,000 66,900 119,900 767.36 ACCT- 3231

ALBRIGHT DALE FH 383.68

423 FRONT ROYAL RD SH 383.68

STRASBURG VA 22657-2713 AC 1.000 CL 2 DAVIS

DB 85/ 41 150 # 209

034- - A- - 1-44B RT 653 50,400 200 50,600 323.84 ACCT- 23095

ALBRIGHT DIANE V FH 161.92

34 SANITARY LN SH 161.92

TOMS BROOK VA 22660 AC 1.550 CL 2 JOHNSTON TB SANIT

DB 1672/ 965 # 210

721,200 1,096,900 1,818,100 11,635.84

248,900 248,900 1,592.96

Totals 472,300 1,096,900 1,569,200 10,042.88

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

478,600 1,059,300 280,200

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 22

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

055- - A- - 0-05 RT 779 50,100 99,800 149,900 959.36 ACCT- 20803

ALBRIGHT DONALD W OR LORRIE L FH 479.68

2301 RIDGE HOLLOW RD SH 479.68

EDINBURG VA 22824 AC 1.887 CL 2 MADISON

DB 1637/ 824 075 # 211

034- -03- - 0-00C LT C RT 11 BROOK HOLLOW 41,000 61,400 102,400 655.36 ACCT- 23330

ALBRIGHT HARRY F JR OR TAMELA A ESTATES FH 327.68

26223 OLD VALLEY PIKE SH 327.68

TOMS BROOK VA 22660-1847 AC .450 CL 2 STONEWALL TB SANI

DB 821/ 743 075 # 212

065-A5-01- - 2-41 BRYCE MTN SEC 9 LT 241 31,000 95,300 126,300 808.32 ACCT- 51

ALBRIGHT RICHARD OR SHEILA HARRIS FH 404.16

61 PROSPECT BAY DR W SH 404.16

GRASONVILLE MD 21638-1184 AC .432 CL 2 ASHBY SANITARY

DB 426/ 822 075 # 213

070-A1- A- - 0-09D006 UNIT 65 11,000 43,300 54,300 347.52 ACCT- 30383

ALCOTT JOHN C ROSE HILL SOUTH CONDOMINI FH 173.76

302 DAWN AVE SH 173.76

WOODSTOCK VA 22664 AC .000 CL 1 MADISON EDINBURG

DB 1328/ 522 132 # 214

045-A5- A- - 0-66A HOLLINGSWORTH RD 46,000 253,600 299,600 1,917.44 ACCT- 16822

ALCOTT JOHN P OR KATHLEEN A FH 958.72

410 EAGLE ST SH 958.72

WOODSTOCK VA 22664 AC .409 CL 1 JOHNSTON WOODSTOC

DB 896/ 794 # 215

045-A2-06- - 0-02 MUELLERSTADT HEIGHTS 41,000 106,800 147,800 945.92 ACCT- 2592

ALCOTT KATHLEEN JEAN SUBD LOT 2 FH 472.96

351 LOGAN CIR SH 472.96

WOODSTOCK VA 22664 AC .220 CL 1 STONEWALL WOODSTO

DB 1716/ 242 075 # 216

045-A1-07-S0-03 0-02 DAWN AVE DELWOOD HEIGHTS 46,000 113,600 159,600 1,021.44 ACCT- 12567

ALCOTT KRISTA DAWN OR SUBD LT 2 SEC 3 FH 510.72

JOHN CHRISTIAN SH 510.72

302 DAWN AVE AC .439 CL 1 STONEWALL WOODSTO

WOODSTOCK VA 22664 DB 1700/ 123 # 217

013- - A- - 0-79A TRACT 1 RT 621 75,500 280,300 355,800 2,277.12 ACCT- 7292

ALDERMAN HAROLD H AND CLAUDIA L FH 1,138.56

4025 CONNECTICUT AVE NW SH 1,138.56

APT 101 AC 9.495 CL 2 STONEWALL

WASHINGTON DC 20008 DB 1697/ 479 # 218

013- - A- - 0-79B TRACT 2 RT 621 30,500 30,500 195.20 ACCT- 7291

ALDERMAN HAROLD H AND CLAUDIA L FH 97.60

4025 CONNECTICUT AVE NW SH 97.60

APT 101 AC 5.085 CL 2 STONEWALL

WASHINGTON DC 20008 DB 1697/ 479 # 219

008- -10- - 0-12 LT 12 FOREST COLONY 99,500 263,200 362,700 2,321.28 ACCT- 22980

ALDERMAN WILLIAM R OR PENNY L FH 1,160.64

621 ROLLING ROCK RD SH 1,160.64

STAR TANNERY VA 22654 AC 9.583 CL 2 DAVIS

DB 1163/ 353 # 220

471,600 1,317,300 1,788,900 11,448.96

Totals 471,600 1,317,300 1,788,900 11,448.96

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

661,300 1,127,600

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 23

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

065-A3-02- - 1-88 BRYCE MTN LT 188 SEC 9 38,500 104,900 143,400 917.76 ACCT- 23098

ALDRICH TODD D TRUSTEE TRUST FH 458.88

126 IAN CT SH 458.88

STEPHENS CITY VA 22655 AC .302 CL 2 ASHBY SANITARY

WB 151/ 872 # 221

047-D2-01-S0-01 2-59 MINE MTN SUBD SEC 1 LT 6,000 6,000 38.40 ACCT- 54

ALESHIRE TIMOTHY LEE 259 FH 19.20

248 BENNYS BEACH RD SH 19.20

FRONT ROYAL VA 22630 AC .746 CL 2 JOHNSTON

WB 143/ 579 # 222

016-D -03- - 0-42 LOT 42 OXBOW ESTATES 56,000 260,900 316,900 2,028.16 ACCT- 33418

ALEXANDER BRIAN K FH 1,014.08

123 TRACY DR SH 1,014.08

STRASBURG VA 22657 AC .161 CL 1 DAVIS STRASBURG

DB 1386/ 917 PL 1240/ 505 075 # 223

015- -02- - 0-59 LT 59 SEC 2C THE MEADOWS 46,000 126,000 172,000 1,100.80 ACCT- 29330

ALEXANDER BRIAN T AT STRASBURG JUNCTION FH 550.40

120 WISE AVE SH 550.40

STRASBURG VA 22657-3617 AC .240 CL 2 DAVIS

DB 1187/ 698 132 # 224

045-A6-04- - 0-04 PARKSIDE VILLAGE 41,000 140,400 181,400 1,160.96 ACCT- 33658

ALEXANDER DAVID T LOT 4 FH 580.48

276 PARKSIDE CT SH 580.48

WOODSTOCK VA 22664 AC .083 CL 1 STONEWALL WOODSTO

DB 1487/ 922 PL 1276/ 773 # 225

024- -05- - 0-09 MEADOWOOD ACRES 106,100 102,600 208,700 1,335.68 ACCT- 18388

ALEXANDER EDWARD WALTER IV OR FH 667.84

AMY MICHELLE JAQUAR BROWN SH 667.84

407 BLUE BELL LN AC 6.902 CL 2 DAVIS

STRASBURG VA 22657 DB 1734/ 891 075 # 226

066-A1-02- - 4-12 BRYCE MTN LT 412 SEC 10 4,000 4,000 25.60 ACCT- 58

ALEXANDER HENRY OR PATRICIA M EXTD FH 12.80

15006 MUD COLLEGE RD SH 12.80

THURMONT MD 21788-1331 AC .487 CL 2 ASHBY SANITARY

DB 310/ 505 # 227

025-A4-01-B0-74 0-10 EBERLY STREET 31,000 80,500 111,500 713.60 ACCT- 31500

ALEXANDER JAMES C LOT 10 BLK 74 FH 356.80

163 N EBERLY ST SH 356.80

STRASBURG VA 22657 AC .143 CL 1 DAVIS STRASBURG

DB 1501/ 847 PL 761/ 72 075 # 228

049- -02- - 0-19A LOT 19A SECTION 1 63,000 169,500 232,500 1,488.00 ACCT- 31226

ALEXANDER JAMES CRAIG SPRING MOUNTAIN SUBD FH 744.00

P O BOX 1782 SH 744.00

FRONT ROYAL VA 22630 AC 2.869 CL 2 JOHNSTON

DB 1000/ 537 PL 924/ 332 150 # 229

025-C -03- - 0-00II011 SIGNAL KNOB STATION 11,000 75,500 86,500 553.60 ACCT- 31909

ALEXANDER JOSEPH E OR MARY J UNIT I-11 PHASE 7 FH 276.80

205 HAILEY LN #I11 SH 276.80

STRASBURG VA 22657 AC .000 CL 1 DAVIS STRASBURG

DB 1119/ 475 PL 1043/ 214 # 230

402,600 1,060,300 1,462,900 9,362.56

Totals 402,600 1,060,300 1,462,900 9,362.56

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

696,300 766,600

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 24

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

065- - A- - 0-33A NEAR BASYE 103,400 270,400 373,800 2,392.32 ACCT- 13101

ALEXANDER PROPERTIES II OFFICE BLDG FH 1,196.16

INCORPORATED SH 1,196.16

PO BOX 438 AC 1.034 CL 4 ASHBY SANITARY

BASYE VA 22810-0012 DB 703/ 302 # 231

065- - A- - 0-33C NEAR BASYE RT 836 194,200 16,800 211,000 1,350.40 ACCT- 13103

ALEXANDER PROPERTIES II FH 675.20

INCORPORATED SH 675.20

PO BOX 438 AC 4.854 CL 2 ASHBY SANITARY

BASYE VA 22810-0012 DB 721/ 588 PL 968/ 435 # 232

065- - A- - 0-33D RT 263 13,800 13,800 88.32 ACCT- 18613

ALEXANDER PROPERTIES II INC FH 44.16

PO BOX 438 SH 44.16

BASYE VA 22810 AC .345 CL 4 ASHBY SANITARY

DB 964/ 816 # 233

065-A1-02-B0-00B0-33 BRYCE MTN SUBD LOT 33 7,000 7,000 44.80 ACCT- 16771

ALEXANDER PROPERTIES INC BLK B SEC 6 FH 22.40

PO BOX 438 SH 22.40

BASYE VA 22810-0012 AC .261 CL 2 ASHBY SANITARY

DB 794/ 552 # 234

065-A3-01- - 0-13 BRYCE MTN SUBD LT 13 SEC 6,300 6,300 40.32 ACCT- 7273

ALEXANDER PROPERTIES INC 9 EXTD FH 20.16

PO BOX 438 SH 20.16

BASYE VA 22810-0012 AC .298 CL 2 ASHBY SANITARY

DB 785/ 546 # 235

065-A4-02- - 0-95 BRYCE MTN LT 95 SEC 7A 32,000 32,000 204.80 ACCT- 10905

ALEXANDER PROPERTIES INC FH 102.40

PO BOX 438 SH 102.40

BASYE VA 22810-0012 AC .401 CL 2 ASHBY SANITARY

DB 767/ 413 # 236

065-A4-02- - 0-96 BRYCE MTN LT 96 SEC 7A 32,000 32,000 204.80 ACCT- 10675

ALEXANDER PROPERTIES INC FH 102.40

PO BOX 438 SH 102.40

BASYE VA 22810-0012 AC .647 CL 2 ASHBY SANITARY

DB 767/ 413 # 237

066-A1-01- - 0-49 BRYCE MTN LT 49 SEC 10 15,000 15,000 96.00 ACCT- 5376

ALEXANDER PROPERTIES INC FH 48.00

PO BOX 438 SH 48.00

BASYE VA 22810-0012 AC .298 CL 2 ASHBY SANITARY

DB 771/ 727 # 238

079- -02- - 0-06 RT 715 TRACT 6A ANDRICK 79,700 79,700 510.08 ACCT- 7310

ALEXANDER RAY D LAND FH 255.04

16291 HENKEL LN SH 255.04

TIMBERVILLE VA 22853 AC 13.426 CL 2 ASHBY

DB 1723/ 765 # 239

103-A1- A- - 0-30 JOHN SEVIER RD PART LOT 31,000 85,800 116,800 747.52 ACCT- 22878

ALEXANDER ROBERT D II OR MARGARET T 55 FH 373.76

9248 JOHN SEVIER RD SH 373.76

NEW MARKET VA 22844 AC .487 CL 1 LEE NEW MARKET

DB 1270/ 198 # 240

514,400 373,000 887,400 5,679.36

Totals 514,400 373,000 887,400 5,679.36

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

116,800 383,000 387,600

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 25

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

065-A6-01- - 0-25 BRYCE MTN LT 25 SEC 11 31,000 137,500 168,500 1,078.40 ACCT- 3645

ALEXANDER SANDRA S FH 539.20

12118 QUORN LN SH 539.20

RESTON VA 20191-2636 AC .327 CL 2 ASHBY SANITARY

DB 718/ 111 # 241

098- - A- - 1-30 RT 736 38,000 75,700 113,700 727.68 ACCT- 3365

ALEXANDER TIMOTHY D OR CAROL J FH 363.84

1625 JIGGADY RD SH 363.84

NEW MARKET VA 22844-2061 AC .985 CL 2 LEE

DB 916/ 132 PL 788/ 511 132 # 242

092-B -02- - 0-75 MTN RUN SUBD LT 75 SEC 3 2,200 2,200 14.08 ACCT- 64

ALEXANDER VIRGINIA BROWN FH 7.04

TRUSTEE TRUST SH 7.04

207 STILSON LEEFIELD RD AC .496 CL 2 ASHBY

BROOKLET GA 30415-5701 DB 813/ 236 # 243

055- - A- - 0-56A RT 688 62,300 117,400 179,700 1,150.08 ACCT- 11688

ALEXANDER WAYNE A OR FH 575.04

CAREY ROSE BAILEY SH 575.04

1503 HELSLEY RD AC 2.321 CL 2 MADISON

EDINBURG VA 22824 DB 1611/ 833 PL 1462/ 345 150 # 244

064-D1-03- - 1-19 COTTAGE TRACT RT 263 126,800 3,300 130,100 832.64 ACCT- 1661

ALEXANDER WAYNE DEWEY AND ANNE CAST FH 416.32

LEMAN ALEXANDER TRUSTEE TRUST SH 416.32

4524 FORRESTAL RD AC 2.113 CL 2 ASHBY SANITARY

CHESTER VA 23831 DB 1064/ 238 # 245

065-A1-02-B0-00A1-34 BRYCE MTN LT 134 BLK A 3,500 3,500 22.40 ACCT- 90

ALF REALTY INC SEC 6 FH 11.20

421 RIVERSIDE DR SH 11.20

PORTSMOUTH VA 23707 AC .591 CL 2 ASHBY SANITARY

DB 387/ 201 # 246

057- - A- - 2-99 US 11 LOT X 39,500 94,700 134,200 858.88 ACCT- 11147

ALFARO MARIA L FH 429.44

34 AILEEN RD SH 429.44

EDINBURG VA 22824 AC .462 CL 2 MADISON

DB 1710/ 666 PL 1779/ 203 # 247

045-A6-01- - 0-00A001 PLEASANT VALLEY ESTATES 11,000 55,900 66,900 428.16 ACCT- 30002

ALFARO VASQUEZ ROSA M PHASE 1 UNIT A1 FH 214.08

1282 OX #A-1 SH 214.08

WOODSTOCK VA 22664 AC .000 CL 1 STONEWALL WOODSTO

DB 1742/ 509 # 248

065-A1-01- - 1-31 BRYCE MTN LT 131 SEC 8 10,000 10,000 64.00 ACCT- 15642

ALFONSO ARMANDO OR MARIA FH 32.00

9522 SW 36 SH 32.00

MIAMI FL 33165 AC .533 CL 2 ASHBY SANITARY

DB 1257/ 29 # 249

025-C -03- - 0-00BB006 SIGNAL KNOB STATION 11,000 73,900 84,900 543.36 ACCT- 31215

ALFORD SHELIA M OR UNIT B6 PHASE 2 FH 271.68

JASON E SHANHOLTZ SH 271.68

23 ROBERTS RD AC .000 CL 1 DAVIS STRASBURG

TOMS BROOK VA 22660 DB 1244/ 376 PL 904/ 307 075 # 250

335,300 558,400 893,700 5,719.68

Totals 335,300 558,400 893,700 5,719.68

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

151,800 741,900

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 26

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

103-A1-04- - 0-04 LT 4 C AND P SUBD 41,000 169,600 210,600 1,347.84 ACCT- 21954

ALGER CALVIN BRUCE FH 673.92

PO BOX 1127 SH 673.92

NEW MARKET VA 22844 AC .465 CL 1 LEE NEW MARKET

DB 665/ 658 # 251

045-A2- A- - 4-44 COMMERCE ST 36,000 87,800 123,800 792.32 ACCT- 16747

ALGER CATHY M FH 396.16

326 S COMMERCE ST SH 396.16

WOODSTOCK VA 22664 AC .223 CL 1 STONEWALL WOODSTO

DB 915/ 35 # 252

045-A2- A- - 4-42 S COMMERCE ST LT X 30,000 30,000 192.00 ACCT- 8189

ALGER ELIZABETH C FH 96.00

330 S COMMERCE ST SH 96.00

WOODSTOCK VA 22664 AC .228 CL 1 STONEWALL WOODSTO

DB 1517/ 33 PL 1457/ 96 150 # 253

045-A2- A- - 4-43 S COMMERCE ST 36,000 101,400 137,400 879.36 ACCT- 8188

ALGER ELIZABETH C FH 439.68

330 S COMMERCE ST SH 439.68

WOODSTOCK VA 22664 AC .221 CL 1 STONEWALL WOODSTO

DB 1517/ 33 PL 1457/ 96 150 # 254

090- - A- - 1-22 IN PINE WOODS 32,500 7,500 40,000 256.00 ACCT- 91

ALGER MICHAEL F LIFE ESTATE FH 128.00

2301 PINEWOODS RD SH 128.00

QUICKSBURG VA 22847-1312 AC .500 CL 2 ASHBY

WB 127/ 34 # 255

091-A1-05- - 0-45 DUTCH LANE SUBD LT 45 37,500 66,800 104,300 667.52 ACCT- 92

ALGER SANDRA R FH 333.76

% SANDRA R ALGER-ORTTS SH 333.76

5888 LONAS ST AC .309 CL 1 ASHBY MT JACKSON

MOUNT JACKSON VA 22842-9439 DB 614/ 366 # 256

025-A3- A- - 2-58 HIGH ST 66,000 115,000 181,000 1,158.40 ACCT- 21399

ALIOTTI VIRGINIA B PART LOT FH 579.20

139 HIGH ST SH 579.20

STRASBURG VA 22657-2228 AC .387 CL 1 DAVIS STRASBURG

DB 1060/ 635 # 257

022- -01- - 0-05 LT 5 SEC 1 MT OLIVE 62,900 279,100 342,000 2,188.80 ACCT- 22260

ALKIRE JAMES T OR JENNIFER HEIGHTS FH 1,094.40

5562 SWARTZ RD SH 1,094.40

MAURERTOWN VA 22644-1916 AC 2.857 CL 2 STONEWALL

DB 997/ 547 PL 1287/ 87 # 258

070- -02- - 0-12 MASSANUTTEN VIEW SUBD 41,000 156,100 197,100 1,261.44 ACCT- 1013

ALKIRE SHAUN MICHAEL SR LT 12 SEC 2 FH 630.72

246 MASSANUTTEN DR SH 630.72

EDINBURG VA 22824 AC .456 CL 2 MADISON

DB 1684/ 266 150 # 259

024- - A- - 0-21B RT 757 64,000 119,600 183,600 1,175.04 ACCT- 25053

ALLAMONG JAMES H FH 587.52

1817 COPP RD SH 587.52

STRASBURG VA 22657 AC 3.000 CL 2 DAVIS

DB 562/ 184 # 260

446,900 1,102,900 1,549,800 9,918.72

Totals 446,900 1,102,900 1,549,800 9,918.72

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID

787,100 762,700

DATE: 4/19/2018 TIME: 14:30 TX390BK

RATE .6400 SHENANDOAH COUNTY, VA - REAL ESTATE 2018 - PAGE 27

ALL DISTRICTS

KATHLEEN A. BLACK, Commissioner of the Revenue

Property Code - Owner Description / Location Land Improvement Total Tax

025- - A- - 1-21A RT 55 5,900 5,900 37.76 ACCT- 21324

ALLAMONG JAMES H AND FH 18.88

DOUGLAS C ARTHUR SH 18.88

PO BOX 110 AC .738 CL 2 DAVIS

STRASBURG VA 22657 DB 1083/ 869 # 261

023- - A- - 1-57 OFF RT 601 173,800 99,800 273,600 1,751.04 ACCT- 19563

ALLAMONG LARRY W 116,700 DEFERRED 116,700 746.88 FH 502.08

1920 BATTLEFIELD RD SH 502.08

STRASBURG VA 22657 AC 32.439 CL 5 57,100 99,800 156,900 1,004.16 DAVIS

DB 573/ 164 # 262

070-A2- A- - 0-34 PRINCE ST 41,000 81,400 122,400 783.36 ACCT- 9158

ALLAMONG LARRY WAYNE FH 391.68

1920 BATTLEFIELD RD SH 391.68

STRASBURG VA 22657 AC .183 CL 1 MADISON EDINBURG

DB 1553/ 611 # 263

058- - A- - 1-20D RT 761 53,000 84,400 137,400 879.36 ACCT- 17251

ALLAR JAMES R FH 439.68

1090 LAKEVIEW DR SH 439.68

WOODSTOCK VA 22664 AC 1.000 CL 2 JOHNSTON

DB 1646/ 322 PL 928/ 715 132 # 264

068- - A- - 1-62 RT 708 44,000 58,000 102,000 652.80 ACCT- 6231

ALLAR RANDI L FH 326.40

481 BETHEL CHURCH RD SH 326.40

EDINBURG VA 22824 AC 2.000 CL 2 MADISON

DB 1749/ 271 PL 1749/ 276 132 # 265

068- - A- - 1-63 RT 708 LOT X 500 500 3.20 ACCT- 6230

ALLAR RANDI L FH 1.60

481 BETHEL CHURCH RD SH 1.60

EDINBURG VA 22824 AC .075 CL 2 MADISON

DB 1749/ 271 PL 1749/ 276 132 # 266

068- - A- - 1-64 RT 708 2,600 2,600 16.64 ACCT- 6232

ALLAR RANDI L FH 8.32

481 BETHEL CHURCH RD SH 8.32

EDINBURG VA 22824 AC .439 CL 2 MADISON

DB 1749/ 271 PL 1749/ 276 132 # 267

024- - A- - 0-26A RT 601 TRACT 1 51,200 75,800 127,000 812.80 ACCT- 95

ALLARD JESSE P FH 406.40

2395 BATTLEFIELD RD SH 406.40

STRASBURG VA 22657 AC 1.400 CL 2 DAVIS

DB 1688/ 914 # 268

015- -02- - 0-05 LT 5 SEC 1 THE MEADOWS 46,000 111,300 157,300 1,006.72 ACCT- 28297

ALLARD JOAN E AT STRASBURG JUNCTION FH 503.36

% BOYER JOAN E SH 503.36

172 LITTLE SORREL DR AC .468 CL 2 DAVIS

STRASBURG VA 22657-3614 DB 654/ 166 075 # 269

065-A5-02-B0-00A1-31 BRYCE MTN LOT 131 BLK A 1,300 1,300 8.32 ACCT- 96

ALLEMAND ARNOLD E SEC 7B FH 4.16

AND STEIN KARL A SH 4.16

813 OAK AVENUE EXT AC .926 CL 2 ASHBY SANITARY

WAYNESBORO VA 22980-4420 DB 285/ 193 # 270

419,300 510,700 930,000 5,952.00

116,700 116,700 746.88

Totals 302,600 510,700 813,300 5,205.12

CLASS 1 CLASS 2 CLASS 3 CLASS 4 CLASS 5 CLASS 6 CLASS 7 CLASS 8 CLASS 9 INVALID