Professional Documents

Culture Documents

Activity 9 - Riph

Activity 9 - Riph

Uploaded by

Cassiopeia Amalthea0 ratings0% found this document useful (0 votes)

3 views2 pagescomputation

Original Title

ACTIVITY 9 - RIPH

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcomputation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesActivity 9 - Riph

Activity 9 - Riph

Uploaded by

Cassiopeia Amaltheacomputation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

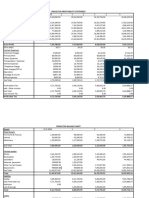

Monthly Income Gross Income % tax Train Tax Withholding tax

1 139,310.35 1,671,724.2 P102,500 + 25% of 320,431.05 26,702.59

the excess over

P800,000

2 56,211.78 674,541.36 P22,500 + 20% of the 77,408.27 6,450.69

excess over

P400,000

3 21,500.99 258,011.88 15% of the excess 1,201.78 100.15

over P250,000

4 250,300.45 3,003,605.4 P402,500 + 30% of 703,581.62 58,631.8

the excess over

P2,000,000

5 88,299.81 1,059,597.72 P102,500 + 25% of 167,399.43 13,949.75

the excess over

P800,000

COMPUTATION:

1. Monthly Income = 139,310.35

Gross Income = 139,310.35 x 12 = 1,671,724.2

% tax = P102,500 + 25% of the excess over P800,000

Train Tax = 1,671,724.2 - 800,000 = 871,724.2

871,724.2 x 0.25 = 217,931.05

217,931.05 + 102,500 = 320,431.05

Withholding tax = 139,310.35 - 66,666,67 = 72,643.68

72,643.68 x 0.25 = 18,160.92

18,160.92 + 8,541.67 = 26,702.59

2. Monthly Income = 56,211.78

Gross Income = 56,211.78 x 12 = 674,541.36

% tax = P22,500 + 20% of the excess over P400,000

Train Tax = 674,541.36 - 400,000 = 274,541.36

274,541.36 x 0.2 = 54,908.27

54,908.27 + 22,500 = 77,408.27

Withholding tax = 56,211.78 - 33,333.33 = 22,878.45

22,878.45 x 0.2 = 4,575.69

4,575.69 + 1,875 = 6,450.69

3. Monthly Income = 21,500.99

Gross Income = 21,500.99 x 12 = 258,011.88

% tax = 15% of the excess over P250,000

Train Tax = 258,011.88 - 250,000 = 8,011.88

8,011.88 x 0.15 = 1,201.78

Withholding tax = 21,500.99 - 20,833.33 = 667.66

667.66 x 0.15 = 100.15

4. Monthly Income = 250,300.45

Gross Income = 250,300.45 x 12 = 3,003,605.4

% tax = P402,500 + 30% of the excess over P2,000,000

Train Tax = 3,003,605.4 - 2,000,000 = 1,003,605.4

1,003,605.4 x 0.3 = 301,081.62

301,081.62 + 402,500 = 703,581.62

Withholding tax = 250,300.45 - 166,666.67 = 83,633.78

83,633.78 x 0.3 = 25,090.13

25,090.13 + 33,541.67 = 58,631.8

5. Monthly Income = 88,299.81

Gross Income = 88,299.81 x 12 = 1,059,597.72

% tax = P102,500 + 25% of the excess over P800,000

Train Tax = 1,059,597.72 - 800,000 = 259,597.72

259,597.72 x 0.25 = 64,899.43

64,899.43 + 102,500 = 167,399.43

Withholding tax = 88,299.81 - 66,666.67 = 21,633.14

21,633.14 x 0.25 = 5,408.25

5,408.25 + 8,541.67 = 13,949.75

You might also like

- AFF's Tax Memorandum On Changes in FB 2024Document13 pagesAFF's Tax Memorandum On Changes in FB 2024Hussain Afzal100% (5)

- Project Report On Training and DevelopmentDocument50 pagesProject Report On Training and Developmentkaur_simran23275% (144)

- A Proposed Agritourism District Complex: Adaptive ReuseDocument1 pageA Proposed Agritourism District Complex: Adaptive ReuseXxx05No ratings yet

- Manage FinanceDocument11 pagesManage FinanceGurjinder Hanjra100% (2)

- Facts and AssumptionsDocument4 pagesFacts and AssumptionsJbNo ratings yet

- Workings 23apr24Document4 pagesWorkings 23apr24Thomas DevaNo ratings yet

- BSBFIM601 Assessment 1: Sales and Profit BudgetsDocument8 pagesBSBFIM601 Assessment 1: Sales and Profit Budgetsprasannareddy9989100% (1)

- UntitledDocument12 pagesUntitledSushil MohantyNo ratings yet

- NPV ClassworkDocument3 pagesNPV ClassworkRicardo PuyolNo ratings yet

- Rem 111 Group 9Document7 pagesRem 111 Group 9Nicole CantosNo ratings yet

- Pro Forma 9pm RealDocument11 pagesPro Forma 9pm Realapi-3710417No ratings yet

- E. Sensitivities and ScenariosDocument3 pagesE. Sensitivities and ScenariosDadangNo ratings yet

- Total Projected CostDocument15 pagesTotal Projected CostElla AbelardoNo ratings yet

- Terracebudget 17Document3 pagesTerracebudget 17api-354468897No ratings yet

- Financial AnalysisDocument1 pageFinancial Analysisjay kudiNo ratings yet

- Assignment 2 Question 1: 1A) Statement of Comprehensive IncomeDocument17 pagesAssignment 2 Question 1: 1A) Statement of Comprehensive IncomesmaNo ratings yet

- Akuntansi Keuangan Lanjutan IIDocument6 pagesAkuntansi Keuangan Lanjutan IIlistianiNo ratings yet

- Ten Years Performance at A GlanceDocument1 pageTen Years Performance at A GlancerahulNo ratings yet

- Fs Squash CookiesDocument10 pagesFs Squash CookiesDanah Jane GarciaNo ratings yet

- 1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionDocument3 pages1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionHana AlisaNo ratings yet

- Horlicks: A Glaxosmith Kline CompanyDocument13 pagesHorlicks: A Glaxosmith Kline CompanyShyam KrishnanNo ratings yet

- Business PlanDocument10 pagesBusiness PlanDanah Jane GarciaNo ratings yet

- BTL FraDocument5 pagesBTL Frak21clca1 hvnhNo ratings yet

- Realisasi GBI Fin Jan - Mar 2017Document1 pageRealisasi GBI Fin Jan - Mar 2017YudhiNo ratings yet

- Comparative September 2021Document36 pagesComparative September 2021Jessa Jane NaboNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Income Statement: USD $000s 2014A 2015A 2016E 2017E 2018EDocument3 pagesIncome Statement: USD $000s 2014A 2015A 2016E 2017E 2018EAgyei DanielNo ratings yet

- Ishika GuptaDocument5 pagesIshika GuptaGarvit JainNo ratings yet

- UNITED SPIRITS LTD-SIrDocument39 pagesUNITED SPIRITS LTD-SIrnishantNo ratings yet

- FS SquashDocument10 pagesFS SquashDanah Jane GarciaNo ratings yet

- Common Size Analisis & Arus Kas 2015Document6 pagesCommon Size Analisis & Arus Kas 2015Muhammad Najibulloh ImadaNo ratings yet

- EugeneDocument20 pagesEugeneapi-3740993No ratings yet

- A Feasibility Study On The Establishment of Housekeeping Recruitment AgencyDocument10 pagesA Feasibility Study On The Establishment of Housekeeping Recruitment AgencyMary Joy SumapidNo ratings yet

- Accounting ModelingDocument7 pagesAccounting Modelingdanielabera046No ratings yet

- Sachin DaneshwariDocument2 pagesSachin DaneshwariADARSH PATTARNo ratings yet

- Final Cookies FsDocument8 pagesFinal Cookies FsDanah Jane GarciaNo ratings yet

- 2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021eDocument1 page2014a 2015a 2016e 2017e 2018e 2019e 2020e 2021evivianclementNo ratings yet

- Financial AnalysisDocument5 pagesFinancial AnalysisEdeline MitrofanNo ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- Ruchi SoyaDocument10 pagesRuchi SoyaANJALI SHARMANo ratings yet

- Practice 1Document2 pagesPractice 1gautam48128No ratings yet

- 2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2Document2 pages2014A 2015A 2016E 2017E 2018E 2019E 2020E: Income Statement Revenue 181,500.0 199,650.0 219,615.0 241,576.5 265,734.2raskaNo ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- BSBFIM601 Appendix E Budget TemplateDocument5 pagesBSBFIM601 Appendix E Budget TemplatekanejNo ratings yet

- FFM-slide mẫu cũDocument17 pagesFFM-slide mẫu cũĐại HoàngNo ratings yet

- Kamayo Travel and ToursDocument31 pagesKamayo Travel and ToursJay ArNo ratings yet

- IT ComputationDocument3 pagesIT ComputationJonalyn BalerosNo ratings yet

- Kudal FMR: Total LP (91.22%)Document8 pagesKudal FMR: Total LP (91.22%)Herrika Red Gullon RoseteNo ratings yet

- Bajaj Auto Financial StatementsDocument19 pagesBajaj Auto Financial StatementsSandeep Shirasangi 986No ratings yet

- AnalyzeDocument29 pagesAnalyzeazeem hussainNo ratings yet

- Vertical Analysis: AssetsDocument10 pagesVertical Analysis: AssetstayyabasdNo ratings yet

- Asses Income Statement BrightDocument2 pagesAsses Income Statement BrightJoanna JacksonNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- ITC Presentation2.1Document10 pagesITC Presentation2.1Rohit singhNo ratings yet

- ICO of An AssetDocument24 pagesICO of An Assetconsultnadeem70No ratings yet

- Williamstown Five-Year Revenue Projection 2010Document1 pageWilliamstown Five-Year Revenue Projection 2010iBerkshires.comNo ratings yet

- Lounge FS PresentationDocument136 pagesLounge FS PresentationJeremiah GonzagaNo ratings yet

- External Funds Need-Spring 2020Document8 pagesExternal Funds Need-Spring 2020sabihaNo ratings yet

- INR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EDocument5 pagesINR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EJatin MittalNo ratings yet

- PT Prima Hidup Lestari Profit and Loss Projection Periode 2022 S/D 2024Document7 pagesPT Prima Hidup Lestari Profit and Loss Projection Periode 2022 S/D 2024Asyam AbyaktaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Exemplar Introduction For A ReportDocument1 pageExemplar Introduction For A ReportRamm PknnNo ratings yet

- Search Business Name Registered Agent Name Availability Charter NoDocument2 pagesSearch Business Name Registered Agent Name Availability Charter NoHelpin HandNo ratings yet

- Business Laws and RegulationsDocument32 pagesBusiness Laws and RegulationsRizza Vallestero100% (1)

- FM Assignment 2Document2 pagesFM Assignment 2waqar HaiderNo ratings yet

- Luftman (2000)Document52 pagesLuftman (2000)Siti FauziahNo ratings yet

- A Comparative Study of Online and OfflinDocument6 pagesA Comparative Study of Online and OfflinMelody BautistaNo ratings yet

- Chunni Case StudyDocument6 pagesChunni Case Studysunny0% (1)

- 3-5 - Thailand - 20080526 - Thailand Single Window E-Logistics - Seoul v2.0Document38 pages3-5 - Thailand - 20080526 - Thailand Single Window E-Logistics - Seoul v2.0glassyglassNo ratings yet

- Contract Management in Construction IndustryDocument3 pagesContract Management in Construction IndustryShubham KesarwaniNo ratings yet

- Global Securities OperationsDocument264 pagesGlobal Securities Operationsnishant hawelia100% (1)

- Relativity Media, LLC PetitionDocument23 pagesRelativity Media, LLC PetitionEriq GardnerNo ratings yet

- What Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeDocument4 pagesWhat Is Meant by Protectionism?: Chapter Three: Protectionism and Free TradeBenazir HitoishiNo ratings yet

- Assessing Consumer's Perception Regarding The Quality of Pure Spice (A Popular Food Brand by ACI Limited) "Document21 pagesAssessing Consumer's Perception Regarding The Quality of Pure Spice (A Popular Food Brand by ACI Limited) "md.jewel ranaNo ratings yet

- Personal Finance SyllabusDocument3 pagesPersonal Finance SyllabusLigia LandowNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Investment Vs FinancingDocument6 pagesInvestment Vs FinancingSolomon, Heren Mae M.No ratings yet

- The Intelligent Investor NotesDocument19 pagesThe Intelligent Investor NotesJack Jacinto100% (6)

- AUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsDocument19 pagesAUDIT REPORT OLGATUNI CAMP LIMITED - 2020 - Financial StatementsRohit RathiNo ratings yet

- Case Study On Consumer Protection ActDocument2 pagesCase Study On Consumer Protection ActNeha Chugh100% (4)

- A Study On The Emerging Opportunities and Scope of Serviced Apartments in TamilnaduDocument6 pagesA Study On The Emerging Opportunities and Scope of Serviced Apartments in TamilnaduarcherselevatorsNo ratings yet

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNo ratings yet

- Ewellery Ndustry: Presentation OnDocument26 pagesEwellery Ndustry: Presentation Onharishgnr0% (1)

- Nigeria's Leading SME-friendly Microfinance BanksDocument8 pagesNigeria's Leading SME-friendly Microfinance BanksGabe JnrNo ratings yet

- SAP TM 93 OverviewDocument52 pagesSAP TM 93 OverviewNaveen Kumar100% (2)

- (Bruno Vallespir, Thecle Alix) Advances in Product (BookFi) PDFDocument679 pages(Bruno Vallespir, Thecle Alix) Advances in Product (BookFi) PDFNitol RahmanNo ratings yet

- Factors Influencing Customers' Acceptance of E-Commerce in Zimbabwe's Retail Hardware IndustryDocument77 pagesFactors Influencing Customers' Acceptance of E-Commerce in Zimbabwe's Retail Hardware IndustryGabriel ChibandaNo ratings yet

- Corporate Social Responsibility: An Overview of The Companies Act, 2013Document22 pagesCorporate Social Responsibility: An Overview of The Companies Act, 2013Nilesh ShobhaneNo ratings yet

- Geography Class 12 Notes Chapter 13 Human DevelopmentDocument6 pagesGeography Class 12 Notes Chapter 13 Human Developmenthc170156No ratings yet