Professional Documents

Culture Documents

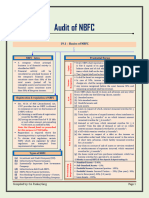

NBFC Flowchart

NBFC Flowchart

Uploaded by

Shumaila0 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageNBFC Flowchart

NBFC Flowchart

Uploaded by

ShumailaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

NBFC Flowchart

Saturday, October 22, 2022 6:08 PM

NBFC Rules General NBFC Regulations

3. Eligibility Criteria 3. Application of this part

Companies Act , 2017

- NBFC may be established Promoters, Proposed Directors, Chief Executive and Chairman of Board - Asset Management Service + Leasing + Housing Finance Service + Investment Advisory Service +

Companies Ordinance, 1984 of Director. Investment Finance Service

- Fit and Proper criteria NBFC Regulations.

282 A Application of this part Schedule IX 9. Prevention - Money Laundering + TF

1. Investment Finance Service. SECP + Federal Government - L&R + Addition

2. Leasing. 4. Permission to Form NBFC - True Identity of Customer and Investment

3. Housing Finance Service. - Person - Application - Commissioner. Accept Money after account opening

4. Discounting Service. Satisfied - ORDER - 6 Months (To Establish NBFC) Effective Procedure for Identification of Customer.

5. Venture Capital Investment. Further 3 Months.

6. Investment Advisory Service. - Comply with Rules and Regulation

7. Asset Management Service 16 5. Condition for Grant of License - Cash Receipt and Payment not exceeding Rs.50,000.

8. Any Other form of Business. - Separate Application to Commission . Exception - Repayment of Finance.

- Fund Management NBFC not Eligible for lending NBFC business and vice versa.

- License Investment Finance Service shall be valid Housing Finance Service + Leasing + Discounting 10. Procedure for Approval for Appointment of Director and Chief Executive

282 B Power to Make Rules, Regulation Service. Before 10 Days After

- Federal Government - Rules - Establishment and Regulation of NBFC.

- Commission - Regulations. Company not part of GC already holding license. A. Appointment of IND Director

- Minimum Equity Requirement + 25% of paid up Share capital to promoters. Data Bank - Companies Act

282 C Incorporation of NBFC - Promoters deposit blocked CDC shall not be sold on

- Prior Approval of SECP - For Incorporation. Exception - Directors - QS - Max 2% Lending NBFC

- Shall not Carry on Business unless it holds License - Chief Executive Officer - Not hold office in any other comp 15. (B) Limit on Aggregate Liabilities of an NBFC

- Commence or Carrying Business minimum equity. Exception - IC Being managed by Limits Non Deposit Taking NBFC

- Shall not change Memorandum of Association AL - Excluding CL + SD

282 D Power to Issue Directions Exception - AC - SECP Approval. Shall not Exceed 10 times of equity.

SECP - Satisfied - Comply with NBFC Rules and Regulation.

- Public Interest. Executive employ Competent. 16. Creation of Reserve Fund

- Prevent the Affairs Detrimental to the Interest of Shareholder. - HOB + Licensed Activity. - Deposit Taking lending NBFC

- Secure proper Management of NBFC.

20% of Profit after tax till equal to PV Capital

Issue Directions If Business not commenced License Cancelled. Thereafter

Valid for 3 years + Renew 1 month. 5% Profit after Tax.

282 E Power to Remove

Continued Association of any Chairman, Director, Chief Executive or Any Officer - REMOVE 7. Conditions Applicable to NBFC Shall 17. Maximum Exposure FB

- BOK + 10 years + T & FV - IAS NFB

282 F Power to Supersede Board of Director Quarterly and Annual Financial Statement - Commissioner Approved

- Total period of supersession does not exceed 3 years Statutory + Auditor + List of Auditor - Single Person - Group

- By such person - Commission may from time to time Appoint. CAO + CO Appoint Internal Auditor + Executives 20% of own Equity 25% of own Equity

E Director FB - 15% Exceed x FB - 20% Exceed x

282 G Power to Require to Furnish Information

No NBFC makes False Information. - Money Laundering - Microfinancing

Obtain and publish rating + Code of Conduct Poor person = 1.3 million HL

282 H Special Audit Membership Rs. 600,000 0.5 million GL

- Order Special Audit + Appoint an Auditor. Shall Not

Director in the other NBFC same licensed - Micro Enterprise = 1.5 million

282 I Inquiry by the Commission Appoint or Change Chief Executive or Director Not Exceeding 10 Employees

- Affairs of the Company

Directors, Managers or Other. - Transaction A. Maintenance of CAR

Exception policy + Board of Director Approval Deposit taking NBFC 10%

- Hold or make Investment in Subsidiary other than FSC

Minimum 5 years B. Asset Liability management System

10% of equity Strategic Investment with Approval of SECP. Board of Director - establish Internal prudential

Limit - for Asset Liabilities MM

Prior Approval of Commissioner

- Subsidiary + SI + Merger Acquisition C. Exposure Limit in Capital Market

Aggregate 50% of own equity - Listed Equity - Single Company

18. Limit on Clean Placement

10% Own Equity

Lower

Paid up capital of

Investee.

- FI - Rated At least

Aggregate exposure of deposit taking NBFC shall not exceed its equity.

19. Limit on unsecured

- Aggregate deposit taking NBFC shall not Exceed 50% of Equity.

You might also like

- Dilapidation FinalDocument22 pagesDilapidation FinalShem HaElohim Ejem100% (1)

- Sales Roleplay 022Document10 pagesSales Roleplay 022PIYUSH RAGHUWANSHINo ratings yet

- MCRS Fuel System Overview PDFDocument100 pagesMCRS Fuel System Overview PDFAnonymous ABPUPbK91% (11)

- Rental Property Income Statement and Balance SheetDocument1 pageRental Property Income Statement and Balance SheetCentury 21 Sweyer and Associates71% (7)

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument43 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws Jurisprudencemae ann rodolfoNo ratings yet

- Fema - Ecb and Compounding - Final PDFDocument44 pagesFema - Ecb and Compounding - Final PDFRavi Sankar ELTNo ratings yet

- Build A CMS in An Afternoon With PHP and MySQLDocument45 pagesBuild A CMS in An Afternoon With PHP and MySQLhnguyen_698971No ratings yet

- Ohsu, Sony EtcDocument7 pagesOhsu, Sony EtcCharm Ferrer100% (4)

- NBFC & Notified Entities Regulations 2007Document47 pagesNBFC & Notified Entities Regulations 2007zulfiNo ratings yet

- Non Banking Financial Companies (NBFCS) : Presentation by Ca. Anil SharmaDocument60 pagesNon Banking Financial Companies (NBFCS) : Presentation by Ca. Anil SharmaVikas AroraNo ratings yet

- Queries - Project Logistic Tarahan - MY - GENDocument3 pagesQueries - Project Logistic Tarahan - MY - GENAnonymous DQ4wYUmNo ratings yet

- 731 - 740 Fa-6Document17 pages731 - 740 Fa-6738 Lavanya JadhavNo ratings yet

- Ca Final NBFCDocument5 pagesCa Final NBFCDeepak DhondiyalNo ratings yet

- SEBI Latest News in EnglishDocument2 pagesSEBI Latest News in EnglishCA Dipesh JainNo ratings yet

- Non Banking Financial Companies (NBFCS) : Presentation by Saurabh Suman & Tarun RaiDocument59 pagesNon Banking Financial Companies (NBFCS) : Presentation by Saurabh Suman & Tarun RaiShresth KotishNo ratings yet

- AnujJain 4200794 - 14 00 - 1Document3 pagesAnujJain 4200794 - 14 00 - 1nishant.bNo ratings yet

- Checklist For Issue of CCDDocument1 pageChecklist For Issue of CCDrikitasshahNo ratings yet

- MAS REIT Consultation PaperDocument38 pagesMAS REIT Consultation Paperanon-692744No ratings yet

- SEBI - Board Meeting Sep 22Document10 pagesSEBI - Board Meeting Sep 22Vishwas SharmaNo ratings yet

- NBFCsDocument14 pagesNBFCsDsign SoftechNo ratings yet

- Super 50 Cma Final Dt June 2024Document52 pagesSuper 50 Cma Final Dt June 2024Raja MunagalaNo ratings yet

- Model DPR For End Borrower DIDF Scheme 05 Jan2018Document52 pagesModel DPR For End Borrower DIDF Scheme 05 Jan2018muthukrishnanNo ratings yet

- Bank and Financial Institution Act Highlights 2073Document4 pagesBank and Financial Institution Act Highlights 2073ramita sahNo ratings yet

- Hemant Vijay Pandya: Non-Banking Financial Company An OverviewDocument32 pagesHemant Vijay Pandya: Non-Banking Financial Company An OverviewHashmi SutariyaNo ratings yet

- PNB Compressed Bio GasDocument3 pagesPNB Compressed Bio Gasfreesites485No ratings yet

- New Rbi Norms On NBFCDocument5 pagesNew Rbi Norms On NBFCNikhil HiranandaniNo ratings yet

- Consolidated Issues and Agreements Ver 2Document7 pagesConsolidated Issues and Agreements Ver 2Macky GallegoNo ratings yet

- Digital Lending: KenyaDocument31 pagesDigital Lending: KenyaRick OdomNo ratings yet

- Reliance Small Cap Fund - ProspectusDocument66 pagesReliance Small Cap Fund - ProspectusJessica LeeNo ratings yet

- Final Audit CA SJ Short Notes AC CG FullDocument18 pagesFinal Audit CA SJ Short Notes AC CG FullsimranNo ratings yet

- Master Circular 01072009 - FactoringDocument28 pagesMaster Circular 01072009 - FactoringAlpana SrivastavaNo ratings yet

- CombinepdfDocument39 pagesCombinepdfLoise MorenoNo ratings yet

- Recent Developments Relating To Corporate BondsDocument63 pagesRecent Developments Relating To Corporate Bondsv_sudarshanNo ratings yet

- May2018 99975Document41 pagesMay2018 99975naytik jainNo ratings yet

- Measures To Achieve Higher Economic GrowthDocument16 pagesMeasures To Achieve Higher Economic GrowthJatin SharmaNo ratings yet

- FM Presentation 23 Aug 2019Document25 pagesFM Presentation 23 Aug 2019Moneylife FoundationNo ratings yet

- CA Final NOV 2022 Finalized ScheduleDocument13 pagesCA Final NOV 2022 Finalized ScheduleVeneela ReddyNo ratings yet

- Presentationon NBFCsDocument272 pagesPresentationon NBFCsNaman MalaniNo ratings yet

- Asset Reconstruction Companies (Arcs) : Tax and Regulatory FrameworkDocument34 pagesAsset Reconstruction Companies (Arcs) : Tax and Regulatory Frameworksumit guptaNo ratings yet

- Payment Service Provider/ Emi License.: (Global Accreditation)Document4 pagesPayment Service Provider/ Emi License.: (Global Accreditation)PSP LICENCENo ratings yet

- Debt ManagementDocument55 pagesDebt ManagementAh MhiNo ratings yet

- ObservationsDocument2 pagesObservationsHarshit GuptaNo ratings yet

- Advanced Auditing and Professional Ethics 1688653213Document28 pagesAdvanced Auditing and Professional Ethics 1688653213mdasifraza3196No ratings yet

- economic notesDocument1 pageeconomic notesAnkesh kumarNo ratings yet

- NBFCs MAT 3Document23 pagesNBFCs MAT 3Prashant RatnpandeyNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- CFAP 2 Winter 2020Document10 pagesCFAP 2 Winter 2020Furqan HanifNo ratings yet

- SEC Notifies Amendments in Leasing Companies (Establishment and Regulation) Rules, 2000Document1 pageSEC Notifies Amendments in Leasing Companies (Establishment and Regulation) Rules, 2000Sanwal ShoaibNo ratings yet

- RBIA - NBFC 7th Oct 21 HIU Slides PDFDocument31 pagesRBIA - NBFC 7th Oct 21 HIU Slides PDFHuzeifa UnwalaNo ratings yet

- Dr. Pradiptarathi Panda Lecturer, NismDocument26 pagesDr. Pradiptarathi Panda Lecturer, NismMaunil OzaNo ratings yet

- RMG 500 - December 2022Document25 pagesRMG 500 - December 2022harisbusinessNo ratings yet

- IBC - Anil GoelDocument12 pagesIBC - Anil GoelrebeccaNo ratings yet

- IBC Journey Recent Amendments RRDocument37 pagesIBC Journey Recent Amendments RRmailforwarder mailforwarderNo ratings yet

- Additional Docs NSE 05.01.2022Document192 pagesAdditional Docs NSE 05.01.2022Rmillionsque FinserveNo ratings yet

- Policy On Co-LendingDocument7 pagesPolicy On Co-LendingArbaz KhanNo ratings yet

- Checklist For NBFC Annual Compliance in IndiaDocument6 pagesChecklist For NBFC Annual Compliance in IndiaGourav MandalNo ratings yet

- Chapter 2 Banking An Operations 2Document79 pagesChapter 2 Banking An Operations 2ManavAgarwalNo ratings yet

- AIFC Presentation A Oldland QC & R Busari (Final)Document15 pagesAIFC Presentation A Oldland QC & R Busari (Final)kalinovskayaNo ratings yet

- IBC-Current Developments and Road Ahead From Ease of Doing Business To Economic GrowthDocument23 pagesIBC-Current Developments and Road Ahead From Ease of Doing Business To Economic Growthdevashish taranekarNo ratings yet

- Final Audit CA SJ Short Notes Audit of BanksDocument15 pagesFinal Audit CA SJ Short Notes Audit of BankssimranNo ratings yet

- Shortcomings of The PIT Regulations 2015Document2 pagesShortcomings of The PIT Regulations 2015Pratham AryaNo ratings yet

- Bond IssuanceDocument12 pagesBond IssuanceSarita MishraNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Depreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lots Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- Once Upon A Time, in A Small Village, There Lived A Curious Little Girl Named Lily. Lily Loved Exploring and Going On Adventures.Document18 pagesOnce Upon A Time, in A Small Village, There Lived A Curious Little Girl Named Lily. Lily Loved Exploring and Going On Adventures.ShumailaNo ratings yet

- Alif Workbook of PGDocument1 pageAlif Workbook of PGShumailaNo ratings yet

- Welcome Back To SchoolDocument2 pagesWelcome Back To SchoolShumailaNo ratings yet

- HappyDocument67 pagesHappyShumailaNo ratings yet

- CS0005873Document1 pageCS0005873heryantoNo ratings yet

- Engro FoodsDocument42 pagesEngro Foodslovely moon100% (1)

- IDN2001 - TypeBuddy Return BriefDocument37 pagesIDN2001 - TypeBuddy Return BriefIan NeoNo ratings yet

- Compressible Flow Through Convergent-Divergent Nozzle: February 2020Document9 pagesCompressible Flow Through Convergent-Divergent Nozzle: February 2020NHNo ratings yet

- Pricelist Laptop & PrinterDocument7 pagesPricelist Laptop & PrinterKharis FreefireNo ratings yet

- Gate Preparation Strategy: Reservoir EngineeringDocument1 pageGate Preparation Strategy: Reservoir EngineeringHemant SrivastavaNo ratings yet

- Supermarket CSR 07 Holly WatermanDocument213 pagesSupermarket CSR 07 Holly WatermanRaja Imran KhanNo ratings yet

- AX284661889190en 000203Document142 pagesAX284661889190en 000203christian ruiz mosquedaNo ratings yet

- Ranjit's ResumeDocument1 pageRanjit's ResumeRanjit KaranNo ratings yet

- FBI Mandalay Bay FOIA Production 2Document15 pagesFBI Mandalay Bay FOIA Production 2NoloContendere100% (4)

- Open Circuit and Close Circuit Operations: Mechanical Operation (2150502)Document18 pagesOpen Circuit and Close Circuit Operations: Mechanical Operation (2150502)ABHISHEKNo ratings yet

- Centum VP Especificações Gs33j01a10-01en 017Document35 pagesCentum VP Especificações Gs33j01a10-01en 017Wellington MachadoNo ratings yet

- Lampiran PQ - CSMS Questionnaires Pertamina WiriagarDocument29 pagesLampiran PQ - CSMS Questionnaires Pertamina WiriagarYogi Anggawan100% (3)

- Buenavista Central Elementary SchoolDocument2 pagesBuenavista Central Elementary Schoolanon_108827268No ratings yet

- Chapter No 03 Class 6th Notes For Computer Science English MediumDocument5 pagesChapter No 03 Class 6th Notes For Computer Science English MediumAbid HussainNo ratings yet

- Monorail Hoist SystemDocument17 pagesMonorail Hoist SystemypatelsNo ratings yet

- CAMEE Tool 7 2 Agreement MEP Client 2013Document15 pagesCAMEE Tool 7 2 Agreement MEP Client 2013SAID RGONo ratings yet

- Mcookbook PDFDocument271 pagesMcookbook PDFfawwazNo ratings yet

- ISAE 3000 ICI-Pakistan-Sustainability-Report-2019-2020Document69 pagesISAE 3000 ICI-Pakistan-Sustainability-Report-2019-2020saqlain khanNo ratings yet

- CIO VP Director IT in Detroit MI Resume Remi DiesbourgDocument2 pagesCIO VP Director IT in Detroit MI Resume Remi DiesbourgRemi DiesbourgNo ratings yet

- 3D CAD Model DownloadsDocument10 pages3D CAD Model DownloadssahirprojectsNo ratings yet

- Fawaz HadiDocument1 pageFawaz HadiAnonymous LuvhmxPNo ratings yet

- N - M G E: Eher C Rath QuationDocument15 pagesN - M G E: Eher C Rath Quationgerrzen64No ratings yet