Professional Documents

Culture Documents

Taxation - C3 Transfer Pricing - Preclass

Taxation - C3 Transfer Pricing - Preclass

Uploaded by

k60.2112153075Copyright:

Available Formats

You might also like

- Chapter 1 - UAE VAT Laws and Procedures CourseDocument68 pagesChapter 1 - UAE VAT Laws and Procedures Coursenagham100% (2)

- Note 6Document55 pagesNote 6sohamdivekar9867No ratings yet

- Taxation - C1 Fundamentals - PreclassDocument50 pagesTaxation - C1 Fundamentals - PreclassK60 Nguyễn Anh ThưNo ratings yet

- Transfer Pricing TrainingDocument35 pagesTransfer Pricing TrainingViren GandhiNo ratings yet

- Transfer Pricing and Its Effect On Taxation in IndiaDocument12 pagesTransfer Pricing and Its Effect On Taxation in IndiaB.a. KrishnaNo ratings yet

- Transfer Pricing and Thin CapitalisationDocument10 pagesTransfer Pricing and Thin CapitalisationBhargav cr7No ratings yet

- Fundamentals of Beps: After Studying This Chapter, You Would Be Able ToDocument29 pagesFundamentals of Beps: After Studying This Chapter, You Would Be Able ToZ H SolutionsNo ratings yet

- Deloitte Indirect Tax TechnologyDocument32 pagesDeloitte Indirect Tax Technologyhleeatrimini67% (3)

- Transfer PricingDocument18 pagesTransfer PricingYusra RaoufNo ratings yet

- 10 - IR Day 2021 Direct & Indirect Tax (Erin Brown)Document6 pages10 - IR Day 2021 Direct & Indirect Tax (Erin Brown)Anwar MohammedNo ratings yet

- Corporate Tax Planning: TopicDocument12 pagesCorporate Tax Planning: TopicPratiksha TiwariNo ratings yet

- Course Information TpfundamentalsDocument3 pagesCourse Information Tpfundamentals79569zdqtwNo ratings yet

- Beps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Document78 pagesBeps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Tural AbbasovNo ratings yet

- Corporate TAXDocument26 pagesCorporate TAXSucheta SahaNo ratings yet

- Mas Research PaperDocument7 pagesMas Research Paperdiane camansagNo ratings yet

- Guide To Transfer PricingDocument85 pagesGuide To Transfer PricingShrisshaNo ratings yet

- MNC Tax ImplicationsDocument11 pagesMNC Tax ImplicationsShruti AgarwalNo ratings yet

- Transfer Pricing A Quick Run Through 1668336077 PDFDocument16 pagesTransfer Pricing A Quick Run Through 1668336077 PDFHafisMohammedSahibNo ratings yet

- Transfer Pricing - Niraj AgarwalDocument13 pagesTransfer Pricing - Niraj AgarwalNiraj AgarwalNo ratings yet

- Id Kai Transfer Pricing 2016 NewDocument12 pagesId Kai Transfer Pricing 2016 NewMarsheliana PutriNo ratings yet

- WEF Corporate Tax Digitalization and GlobalizationDocument24 pagesWEF Corporate Tax Digitalization and GlobalizationMNo ratings yet

- Income Tax (TP) Regulation Presentation Slide For InductionDocument41 pagesIncome Tax (TP) Regulation Presentation Slide For InductionUmar AbdulkabirNo ratings yet

- Transfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorDocument8 pagesTransfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorchristianNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Ocp114 enDocument42 pagesOcp114 enShaïma BMANo ratings yet

- Maersk Europe Customs Optimisation Blueprint EbookDocument18 pagesMaersk Europe Customs Optimisation Blueprint EbookArnaud DolyNo ratings yet

- 18p36top41 PDFDocument6 pages18p36top41 PDFAmit KumarNo ratings yet

- Tax Dispute Resolution: A New Chapter Emerges: Tax Administration Without BordersDocument64 pagesTax Dispute Resolution: A New Chapter Emerges: Tax Administration Without BorderskelvintkNo ratings yet

- 2020 Mandeley Digital Taxation Around The World 1590804940Document49 pages2020 Mandeley Digital Taxation Around The World 1590804940Dyra FazrianNo ratings yet

- 2017TP D1 02 EN TP-DocumentationDocument6 pages2017TP D1 02 EN TP-DocumentationIoanna ZlatevaNo ratings yet

- Transfer Pricing: Headache To Corporate Governance : AbstractDocument5 pagesTransfer Pricing: Headache To Corporate Governance : AbstractShelviDyanPrastiwiNo ratings yet

- Ey-The-Dawning-Of-Digital-Economy-TaxationDocument8 pagesEy-The-Dawning-Of-Digital-Economy-TaxationStefanny BedoyaNo ratings yet

- Transfer Pricing PPT 190714 FinalDocument268 pagesTransfer Pricing PPT 190714 Finalvijaywin6299No ratings yet

- GX Deloitte Global Mining Tax Trends 2017Document40 pagesGX Deloitte Global Mining Tax Trends 2017Pran RNo ratings yet

- BEPS Implementation in Indonesia - Webinar BPPK - v3Document19 pagesBEPS Implementation in Indonesia - Webinar BPPK - v3tonitoni27No ratings yet

- Crowe Transfer Pricing Handbook 10Document31 pagesCrowe Transfer Pricing Handbook 10lpamgt_674780425No ratings yet

- Aiias Economy Pt365 2022Document63 pagesAiias Economy Pt365 2022Ismart ShankarNo ratings yet

- International Accounting: Learning ObjectivesDocument13 pagesInternational Accounting: Learning ObjectivesNorhan NabilNo ratings yet

- 2021 Yanti PratiwiDocument13 pages2021 Yanti Pratiwi4122220025ineNo ratings yet

- Afm Case StudyDocument9 pagesAfm Case Studynithinkumar.nk59No ratings yet

- Knocking On Tax Haven DoorDocument30 pagesKnocking On Tax Haven Doorheehan6No ratings yet

- Are You Identifying and Managing The Key Tax Risks in TMT M&A?Document1 pageAre You Identifying and Managing The Key Tax Risks in TMT M&A?CcapealNo ratings yet

- Transfer PricingDocument16 pagesTransfer PricingAbokingsNo ratings yet

- Transfer Pricing Alert - 1 August 2019Document6 pagesTransfer Pricing Alert - 1 August 2019Sampath KarunarathneNo ratings yet

- Sesi 2 - Bpk. Darussalam - International Taxation DDTC-1Document35 pagesSesi 2 - Bpk. Darussalam - International Taxation DDTC-1ridy venny teffendyNo ratings yet

- Ending Offshore Profit Shifting - OECD Anti-Corruption & IntegrityDocument5 pagesEnding Offshore Profit Shifting - OECD Anti-Corruption & IntegritygeorgeNo ratings yet

- Tax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsDocument13 pagesTax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsFazra SalsabilahNo ratings yet

- Introduction To TaxationDocument32 pagesIntroduction To TaxationAFIFAH NATASYA MOHD GHAZALINo ratings yet

- Factors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected WoredasDocument22 pagesFactors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected Woredasedwin shikukuNo ratings yet

- Chapter 12: International Taxation and Transfer PricingDocument38 pagesChapter 12: International Taxation and Transfer PricingSara AlsNo ratings yet

- Loyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleDocument18 pagesLoyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleIoanna ZlatevaNo ratings yet

- TP 16 Audit ReadinessDocument5 pagesTP 16 Audit ReadinessHai Lúa Miền TâyNo ratings yet

- The New Transfer Pricing Regime in The United Arab Emirates - ITCDocument9 pagesThe New Transfer Pricing Regime in The United Arab Emirates - ITCmarketingNo ratings yet

- Itp 2015 2016 Final PDFDocument1,162 pagesItp 2015 2016 Final PDFht1234222No ratings yet

- PCW Transfer PricingDocument269 pagesPCW Transfer PricingThiago Pereira da Silva100% (1)

- International Transfer PricingDocument21 pagesInternational Transfer PricingAtia IbnatNo ratings yet

- Identifying BusinessDocument11 pagesIdentifying BusinessRosa Noelia Gutierrez CaroNo ratings yet

- Tax Unit 3 DFDocument45 pagesTax Unit 3 DFHabtamu mamoNo ratings yet

- Reform by Numbers: Measurement Applied to Customs and Tax Administrations in Developing CountriesFrom EverandReform by Numbers: Measurement Applied to Customs and Tax Administrations in Developing CountriesNo ratings yet

- Bobby & BettyDocument6 pagesBobby & BettySimon KingNo ratings yet

- Income Tax AuthoritiesDocument10 pagesIncome Tax Authoritiesamb aniNo ratings yet

- How To Tax An Individual 1Document25 pagesHow To Tax An Individual 1Lianna Xenia EspirituNo ratings yet

- IncomeDocument1 pageIncomelehlohonoloskosana9308No ratings yet

- TAX Taxation of Employment IncomeDocument37 pagesTAX Taxation of Employment Incomedarcpamaterials90% (10)

- Vaishali Dna Wifi 2022Document1 pageVaishali Dna Wifi 2022AbhijeetNo ratings yet

- Estate CPA Report SampleDocument5 pagesEstate CPA Report SampleNeptali MarotoNo ratings yet

- Tarun Naib 21-22Document1 pageTarun Naib 21-22Shaheen SobtiNo ratings yet

- Ad Valorem TaxDocument4 pagesAd Valorem TaxManoj KNo ratings yet

- Requirement Solution: Employee Benefits (Part 1)Document6 pagesRequirement Solution: Employee Benefits (Part 1)Regina De LunaNo ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Scrutiny SlipDocument1 pageScrutiny SlipanudeepNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- American Express International v. CIR CTA Case No. 6099 (April 19, 2002)Document2 pagesAmerican Express International v. CIR CTA Case No. 6099 (April 19, 2002)Francis Xavier Sinon100% (1)

- 2307 - Rent My CarDocument10 pages2307 - Rent My CarSoeletraNo ratings yet

- Taxation-Not CompleteDocument13 pagesTaxation-Not CompleteLouie De La TorreNo ratings yet

- OD327306479450600100Document1 pageOD327306479450600100ARVIND KUMAR YADAVNo ratings yet

- Section 54 GB and 54 HDocument2 pagesSection 54 GB and 54 HAbhinav RandevNo ratings yet

- 1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationDocument10 pages1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationMugwanya AsadNo ratings yet

- I 6 G9 IQVhc Ii 0 U3 GeDocument3 pagesI 6 G9 IQVhc Ii 0 U3 GeDioneren Dela CruzNo ratings yet

- Pay Stub TemplateDocument1 pagePay Stub TemplateMichael ShortNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Philippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerDocument4 pagesPhilippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerRenalyn ParasNo ratings yet

- Ca 3916Document4 pagesCa 3916Fernando Mochales GutiérrezNo ratings yet

- Od 328430519389235100Document1 pageOd 328430519389235100chandra2751No ratings yet

- Kristina - MAY 22Document1 pageKristina - MAY 22bktsuna0201No ratings yet

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Alyk CalionNo ratings yet

- Look Inside Pocket Notes Acca TaxationDocument5 pagesLook Inside Pocket Notes Acca TaxationSync ZazoNo ratings yet

- South African Police Service Suid-Afrikaanse Polisiediens: Employee Income Tax Certificate InformationDocument1 pageSouth African Police Service Suid-Afrikaanse Polisiediens: Employee Income Tax Certificate Informationbra9tee9tiniNo ratings yet

Taxation - C3 Transfer Pricing - Preclass

Taxation - C3 Transfer Pricing - Preclass

Uploaded by

k60.2112153075Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation - C3 Transfer Pricing - Preclass

Taxation - C3 Transfer Pricing - Preclass

Uploaded by

k60.2112153075Copyright:

Available Formats

Internatioal Taxation 2024

INTERNATIONAL TAXATION

PhD. Tran Nguyen Chat

Foreign Trade University – Hochiminh City Campus

E-mail: trannguyenchat.cs2@ftu.edu.vn

FOREIGN TRADE UNIVERSITY

HOCHIMINH CITY CAMPUS

1

Chapter 3

TRANSFER PRICING

Ms. Tran Nguyen Chat 1

Internatioal Taxation 2024

CHAPTER OUTLINE

1. Overview of Transfer Pricing

2. Tax competition and challenges

to the tax system

3. Basic solutions against transfer

pricing by goverments

Transfer pricing

Ms. Tran Nguyen Chat 2

Internatioal Taxation 2024

Transfer pricing

Transfer pricing strategies offer many

advantages for a company from a taxation

perspective, although regulatory authorities

often frown upon the manipulation of transfer

prices to avoid taxes. Effective but legal

transfer pricing takes advantage of different tax

regimes in different countries by raising

transfer prices for goods and services

produced in countries with lower tax rates.

Benefits of Transfer Pricing

Risks of Transfer Pricing 5

Ms. Tran Nguyen Chat 3

Internatioal Taxation 2024

Transfer pricing

“The art of transfer pricing consists in never losing sight of

the reality of a specific business when applying the arm’s

length principle; to find an appropriate balance between

the business and the tax considerations, you have to

avoid the myopia of a fragmented transaction-by-

transaction type of analysis and instead always be mindful

of the economic essence of the business relationship as a

whole”. (Oliver Treidler, 2020)

Transfer pricing

“Tax administrations should not automatically assume that

associated enterprises have sought to manipulate their

profits. There may be a genuine difficulty in accurately

determining a market price in the absence of market

forces or when adopting a particular commercial strategy.”

(OECD, 2017, Paragraph 1.2.)

Ms. Tran Nguyen Chat 4

Internatioal Taxation 2024

Transfer pricing

Methods:

- The Comparable Uncontrolled Price Method:

Comparing “Like with like” is not a trivial task.

- The Resale Price Method

Comparability doesn’t stop at the gross margin.

- The Transactional Net Margin Method

Arm’s length net margins should make everyone happy.

- The Profit Split Method

Internal negotiations are useful for approximating an arm’s length

allocation of profits within the MNE provided that entities engage in real

negotiations.

- The Cost Plus Method

Arm’s length net margins should make everyone happy.

9

10

10

Ms. Tran Nguyen Chat 5

Internatioal Taxation 2024

Transfer pricing

11

11

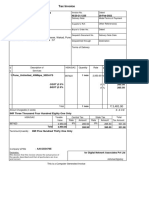

VIETNAM’S TAX SYSTEM

Indirect tax

1. Law on Export and Import Duties

2. Law on Special Sales Tax

3. Law on Environmental Protection Tax

4. Law on Value Added Tax

Direct tax

1. Law on Corporate Income Tax

2. Law on Personal Income Tax

12

12

Ms. Tran Nguyen Chat 6

Internatioal Taxation 2024

Corporate Income Tax

13

13

Corporate Income Tax

Concept

Corporate income taxes are imposed by

governments on business profits, earnings

or taxable income.

Corporates use everything in the tax code

to lower the cost of payable taxes by

reducing their taxable incomes.

14

14

Ms. Tran Nguyen Chat 7

Internatioal Taxation 2024

Corporate Income Tax

Main characteristics/ Properties

▪ A domestic direct tax imposed on corporate

income

▪ Investment incentive - Can be varied without

adding complex tax brackets to incentivize

investors, creating jobs and supporting growth.

▪ In the absence of an agreement, double

taxation could reduce incentives to save and

invest.

15

15

Corporate Income Tax

Main characteristics/ Properties

▪ Progressive effect - If well structured, larger

and more profitable firms pay more taxes.

▪ Complex – numerous deductions and

exemptions to attract investment can make it

very complex and prone to abuse, reducing

16

16

Ms. Tran Nguyen Chat 8

Internatioal Taxation 2024

Vietnam’s legislation on CIT

Law No. 14/2008/QH12 dated 03 June 2008

(effective from 01 Jan 2009) was amended by:

- Law No. 32/2013/QH13 dated 19 June 2013

(effective from 01 Jan 2014);

- Law No. 71/2014/QH13 dated 26 Nov 2014

(effective from 01 Jan 2015).

17

17

Law on Corporate Income Tax

Chapter I: GENERAL PROVISIONS

Article 1. Scope

Article 2. Taxpayers

Article 3. Taxable income

Article 4. Tax-free incomes

Article 5. Tax period

18

18

Ms. Tran Nguyen Chat 9

Internatioal Taxation 2024

Law on Corporate Income Tax

Chapter II: BASIS AND METHODS OF TAX

CALCULATION

Article 6. Basis for tax calculation

Article 7. Determination of assessable income

Article 8. Revenue

Article 9. Deductible and non-deductible expenses

Article 10. Tax rate

Article 11. Tax calculation method

Article 12. Tax-collecting authorities

19

19

Law on Corporate Income Tax

Chapter III: CORPORATE INCOME TAX

INCENTIVES

Article 13. Preferential CIT rates

Article 14. Duration of tax exemption and reduction

Article 15. Other cases of CIT reduction

Article 16. Loss carryforward

Article 17. Contribution to science and technology

development fund

Article 18. Conditions for applying CIT incentives

20

20

Ms. Tran Nguyen Chat 10

Internatioal Taxation 2024

Law on Corporate Income Tax

Chapter IV: IMPLEMENTATION

Article 19. Effect

Article 20. Guidelines for implementation

21

21

Law on Corporate Income Tax

Article 2. Taxpayers

1. Taxpayers are organizations related to goods

and services production and business which have

taxable incomes under the provisions of this Law

(below referred to as enterprises), including:

a/ Enterprises established under Vietnamese law;

b/ Enterprises established under foreign laws (below

referred to as foreign enterprises) with or without

Vietnam-based permanent establishments;

c/ Organizations established under the Law on

Cooperatives; 22

22

Ms. Tran Nguyen Chat 11

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 2. Taxpayers

1. Taxpayers are organizations related to goods

and service production and business which have

taxable incomes under the provisions of this Law

(below referred to as enterprises), including:

d/ Non-business units established under Vietnamese

law;

e/ Other organizations engaged in income-generating

production and business activities.

23

23

Law on Corporate Income Tax

Article 2. Taxpayers

2. Enterprises having taxable incomes under Article

3 of this Law shall pay CIT as follows:

a/ Enterprises established under Vietnamese law shall

pay tax on taxable incomes generated in and outside

Vietnam;

b/ Foreign enterprises with Vietnam-based permanent

establishments shall pay tax on taxable incomes

generated in Vietnam and taxable incomes generated

outside Vietnam which are related to the operation of

such establishments;

24

24

Ms. Tran Nguyen Chat 12

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 2. Taxpayers

2. Enterprises having taxable incomes under Article

3 of this Law shall pay CIT as follows:

c/ Foreign enterprises with Vietnam-based permanent

establishments shall pay tax on taxable incomes

generated in Vietnam which are NOT related to the

operation of such permanent establishments.

d/ Foreign enterprises WITHOUT Vietnam-based

permanent establishments shall pay tax on taxable

incomes generated in Vietnam.

25

25

Law on Corporate Income Tax

Article 2. Taxpayers

3. The permanent establishments of a foreign

enterprise are the places through which the foreign

enterprise carries out part or the whole business in

Vietnam, including: (Law No. 32/2013/QH13)

a) Branches, executive offices, factories, workshops,

means of transport, oil fields, gas files, miles or other

natural resource extraction sites in Vietnam;

b) Construction sites;

26

26

Ms. Tran Nguyen Chat 13

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 2. Taxpayers

3. The permanent establishments of a foreign

enterprise, including: (Law No. 32/2013/QH13)

c) Service providing centers, including counseling

services via employees or other organizations or

individuals;

d) Agents of foreign enterprises;

dd) Representatives in Vietnam that are competent to

sign contracts under the name of the foreign enterprise

or that are not competent to sign contracts under the

name of the enterprise but regularly provide goods 27or

services in Vietnam

27

Law on Corporate Income Tax

Article 3. Taxable incomes

1. Taxable incomes include income from

goods and service production and business

activities and other incomes specified in

Clause 2 of this Article.

28

28

Ms. Tran Nguyen Chat 14

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 3. Taxable incomes

2. Other incomes include: income from transfer of capital,

transfer of the right to capital contribution; income from real

estate transfer, transfer of construction projects, transfer of the

right to participate in construction projects, transfer of the right to

mineral exploration, mineral extraction, and mineral processing;

income from the right to enjoyment of property, right to

ownership of property, including income from intellectual

property rights defined by law; income from transfer, lease,

liquidation of assets, including valuable papers; income from

deposit interest, loan interest, sale of foreign exchange;

collection of debts that were cancelled; receipts from debts

without creditors; incomes from business operation in previous

years that were committed, and other incomes (Law No. 29

71/2014/QH13)

29

Law on Corporate Income Tax

Article 3. Taxable incomes

With regard to Vietnamese companies making investments

in the countries with which Vietnam have Double Taxation

Agreement and transfer incomes exclusive of corporate

income tax paid overseas to Vietnam, regulations of such

Double Taxation Agreements shall apply. If investments are

made in countries with which Vietnam has not had Double

Taxation Agreements, and if corporate income tax incurred

in such countries is lower than that imposed by the Law on

Corporate income tax of Vietnam, the tax difference shall be

paid.

30

30

Ms. Tran Nguyen Chat 15

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 4. Non-taxable incomes

1. Income from farming, breeding, cultivation and

processing of agriculture and aquaculture products, salt

production of cooperatives; income of cooperatives

engaged in agriculture, forestry, aquaculture, or salt

production in disadvantaged areas or extremely

disadvantaged areas; income of companies from farming,

breeding, cultivation and processing of agriculture and

aquaculture products in disadvantaged areas; income from

marine fisheries. (Law No. 71/2014/QH13)

31

31

Law on Corporate Income Tax

Article 4. Non-taxable incomes

2. Income from the application of technical services

directly for agriculture.

3. Income from the performance of contracts on

scientific research and technological development,

trial products and products turned out with

technologies applied for the first time in Vietnam.

32

32

Ms. Tran Nguyen Chat 16

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 4. Non-taxable incomes

4. Incomes from production and sale of goods and

services of enterprises that have at least 30% of

the employees are disabled people, detoxified

people, suffers of HIV/AIDS, and have at least 20

employees, except for enterprises engaged in

finance and real estate business. (Law No.

32/2013/QH13)

33

33

Law on Corporate Income Tax

Article 4. Non-taxable incomes

5. Income from job-training activities exclusively

reserved for ethnic minority people, the disabled,

children in extremely disadvantaged circumstances

and persons involved in social evils.

6. Incomes divided for capital contribution, joint

venture or association with domestic enterprises,

after enterprise income tax has been paid under

the provisions of this Law.

34

34

Ms. Tran Nguyen Chat 17

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 4. Non-taxable incomes

7. Received financial supports used for

educational, scientific research, cultural, artistic,

charitable, humanitarian and other social activities

in Vietnam.

8. Incomes from the transfer of Certified Emissions

Reductions (CERs) of enterprises issued with

CERs. (Law No. 32/2013/QH13)

35

35

Law on Corporate Income Tax

Article 4. Non-taxable incomes

9. Incomes from the performance of tasks of the Vietnam

Development Bank, which are assigned by the State, in

credit for development and export; incomes from granting

credit to the poor and beneficiaries of policies of Vietnam

Bank for Social Policies; incomes of state financial funds

and other state funds serving non-profit purpose incomes of

organizations, of which 100% charter capital is possessed

by the State, that are established by the Government to

settle bad debts of Vietnamese credit institutions. (Law No.

32/2013/QH13)

36

36

Ms. Tran Nguyen Chat 18

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 4. Non-taxable incomes

10. Undistributed incomes of private organizations,

which make investment in education, health, and

other fields, that are kept to serve their

development in accordance with the laws on

education, health, and other fields; the incomes

that form the undistributed assets of cooperatives

established and operating in accordance with the

Law on Cooperatives. (Law No. 32/2013/QH13)

37

37

Law on Corporate Income Tax

Article 4. Non-taxable incomes

11. Incomes from transfer of technologies that are

prioritized to be to organizations and individuals in

localities facing extreme socio-economic

difficulties. (Law No. 32/2013/QH13)

38

38

Ms. Tran Nguyen Chat 19

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 5. Tax period

1. An enterprise income tax period is the

calendar year or fiscal year, except the

cases defined in Clause 2 of this Article.

2. The CIT period upon each time of income

generation applies to foreign enterprises

specified at Points c and d, Clause 2, Article

2 of this Law.

39

39

Law on Corporate Income Tax

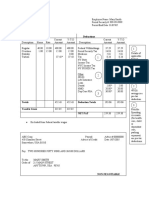

Article 6. Tax bases

Tax bases include taxed income (assessable

income) and tax rate of CIT.

Payable amount Assessable The CIT

= x

of CIT income of CIT rate (%)

40

40

Ms. Tran Nguyen Chat 20

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 7. Determination of taxed income

1. Taxed income in a tax period is the

taxable income minus non-taxable incomes

and losses carried forward from previous

years.

Non- Losses

Assessable Taxable - -

= taxable carried

income income

income forward

41

41

Law on Corporate Income Tax

Article 7. Determination of taxed income

2. Taxable income is turnover minus

deductible expenses for production and

business activities plus other incomes,

including income received outside Vietnam.

Taxable - Other

= Turnover Expenses +

income incomes

42

42

Ms. Tran Nguyen Chat 21

Internatioal Taxation 2024

Law on Corporate Income Tax

Payable amount Assessable The CIT

= x

of CIT income rate (%)

Non- Losses

Assessable Taxable - -

= taxable carried

income income

income forward

Taxable - Other

= Turnover Expenses +

income incomes

43

43

Law on Corporate Income Tax

Article 7. Determination of taxed income

3. Incomes from transfers of real estate, project of

investment, the right to participate in projects of

investments, the right to explore, extract, and process

minerals must be separated. The loss on transfers of

projects of investment (except for mineral exploration and

mineral extraction projects), incomes from transfers of the

right to participate in projects of investment (except for the

mineral exploration and mineral extraction projects),

incomes from transfer of real estate shall be offset against

the profit in the tax period. (Law No. 32/2013/QH13)

The Government shall provide detailed regulation on the 44

implementation of this Article.

44

Ms. Tran Nguyen Chat 22

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 8. Turnover

Turnover is the total sales, processing

remuneration, service provision charges,

subsidies and surcharges enjoyed by

enterprises.

The Government shall detail and guide the

implementation of this Article.

(Law No. 71/2014/QH13)

45

45

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

upon determination of taxable incomes

1. Except the expenses specified in Clause 2 of this

Article, enterprises are entitled to deduction of all

expenses which fully meet the following conditions:

a) Actual expenditures on business operation of the

company; expenditures on vocational education;

expenditures on the company’s national defense and

security duties as prescribed by law

b/ They are accompanied with adequate invoices and

documents as prescribed by law.

46

46

Ms. Tran Nguyen Chat 23

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 9. Deductible and non-deductible

expenses

2. Non-deductible expenses upon determination of

taxable incomes include:

a/ Expense not fully satisfying the conditions specified in

Clause 1 of this Article, except the uncompensated

value of losses caused by natural disasters, epidemics

or other force majeure circumstances;

b/ Fine for administrative violations;

c/ Expense already covered by other funding sources;

47

47

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

2. Non-deductible expenses upon determination of taxable

incomes include:

d/ Business administration expense allocated by foreign

enterprises to their Vietnam-based permanent

establishments in excess of the level calculated according

to the allocation method prescribed by Vietnamese law;

e/ Expense in excess of the law-prescribed norm for the

deduction and setting up of provisions;

f/ Expense for raw materials, materials, fuel, energy or

goods in excess of the wastage rate set by enterprises and

notified to tax offices and the actual ex-warehousing price;48

48

Ms. Tran Nguyen Chat 24

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

2. Non-deductible expenses upon determination of taxable

incomes include:

g/ Payment for interests on loans for production and

business activities of entities other than credit institutions or

economic organizations in excess of 150% of the basic

interest rate announced by the State Bank of Vietnam at the

time of loaning;

h/ Fixed asset depreciation made in contravention of law;

i/ Expenses advanced in contravention of law;

49

49

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

2. Non-deductible expenses upon determination of taxable

incomes include:

j/ Salaries and wages of owners of private enterprises;

remuneration paid to enterprise founders who do not

personally administer production and business activities;

salaries, wages and other accounted amounts payable to

laborers which have actually not been paid to them or paid

without invoices or documents as prescribed by law;

k/ Loan interests paid corresponding to the insufficient

amount of the charter capital;

50

50

Ms. Tran Nguyen Chat 25

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

2. Non-deductible expenses upon determination of taxable

incomes include:

l/ Credited input value-added tax, value-added tax to be

paid according to the credit method, and enterprise income

tax;

m/ Expense for advertisement (omitted by Law No.

71/2014/QH13)

n/ Financial supports, excluding those for educational and

healthcare activities and for mitigating natural disaster

consequences and building houses of gratitude for the poor

as prescribed by law. 51

51

Law on Corporate Income Tax

Article 9. Deductible and non-deductible expenses

2. Non-deductible expenses upon determination of taxable

incomes include:

o) Voluntary payments to retirement funds or social security

funds, payments for voluntary retirement insurance for

employees that exceed the limits imposed by law; (Law No.

32/2013/QH13)

p) Expenditures on businesses: banking, insurance, lottery,

securities, and some other special businesses specified by

the Minister of Finance. (Law No. 32/2013/QH13)

52

52

Ms. Tran Nguyen Chat 26

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 10. Tax rates (Law No. 32/2013/QH13)

1. The enterprise income tax rate is 22%, except

for the cases in Clause 2 and Clause 3 of this

Article and beneficiaries of tax incentives defined in

Article 13 of this Article.

The cases to which the tax rate of 22% in this

Clause shall apply the tax rate of 20% from

January 01, 2016.

53

53

Law on Corporate Income Tax

Article 10. Tax rates (Law No. 32/2013/QH13)

2. Any enterprise of which the total revenue does not

exceed 20 billion VND per year are eligible for the tax rate

of 20%.

3. The rates of enterprise income tax on the

exploration and extraction of oil and other rare

resources in Vietnam range between 32% and 50%

depending on each project and each business

establishment.

The Government shall elaborate and provide guidance on

the implementation of this Article. 54

54

Ms. Tran Nguyen Chat 27

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 11. Tax calculation method

1. The CIT amount payable in a tax period is the

taxed income (assessable income) multiplied by

the tax rate

Payable amount Assessable The CIT

= x

of CIT income of CIT rate (%)

In case an enterprise has paid income tax outside

Vietnam, the paid tax amount may be subtracted but

must not exceed the CIT amount payable under the

provisions of this Law. 55

55

Law on Corporate Income Tax

Article 11. Tax calculation method

2. The tax calculation method applicable to

enterprises listed at Points c and d, Clause 2,

Article 2 of this Law complies with the

Governments regulations.

56

56

Ms. Tran Nguyen Chat 28

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 12. Places for tax payment

Enterprises shall pay tax at places where they are

headquartered.

In case an enterprise has a dependent cost-accounting

production establishment operating in a province or centrally run

city other than the place of its headquarters, the payable tax

amount shall be calculated based on the ratio of expenses

between the place where the production establishment is located

and the place where the enterprise is headquartered. The

decentralization, management and use of tax revenues comply

with the State Budget Law.

The Government shall detail and guide the implementation of this

Article. 57

57

Law on Corporate Income Tax

Article 13. Tax rate incentives

Article 14. Tax exemption and reduction duration

incentives

Article 15. Other cases eligible for tax reduction

58

58

Ms. Tran Nguyen Chat 29

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 16. Transferring loss (Law No.

32/2013/QH13)

1. An enterprise may transfer its loss to the next

year; this loss is deducted from assessable income

(taxed income).

The period of loss transfer must not exceed 5 years

from the year succeeding the year in which the loss

is incurred.

59

59

Law on Corporate Income Tax

Article 16. Transferring loss (Law No.

32/2013/QH13)

2. Any enterprise which is still at a loss after offsetting its

loss on transfers of real estate, transfers of projects of

investment, transfers of the right to participate in project of

investment, according to Clause 3 Article 7 of this Law, and

any enterprise which makes a loss from transfers of the

right to explore and extract minerals may transfer the loss to

the next year and offset it against the assessable incomes

from such activities. The period of loss transfer shall comply

with Clause 1 of this Article

60

60

Ms. Tran Nguyen Chat 30

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 17. Deduction for setting up of

enterprises scientific and technological

development funds (STDF)

1. Any enterprise established and operating within

Vietnam’s law may use no more than 10% of the

annual assessable income (taxed income) to

establish its STDF. (Law No. 32/2013/QH13)

Apart from establishing the STDF, state-owned

enterprise must ensure the minimum amount for the

fund according to the laws on science and technology

61

61

Law on Corporate Income Tax

Payable The CIT

Assessable - STDF x

amount = rate (%)

income

of CIT

Non- Losses

Assessable Taxable - -

= taxable carried

income income

income forward

Taxable - Other

= Turnover Expenses +

income incomes

62

62

Ms. Tran Nguyen Chat 31

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 17. Deduction for STDF

2. Within five years after being set up, if a STDF is not used,

has been used below 70% or used for improper purposes,

the enterprise shall remit into the state budget the CIT

amount calculated on the income already deducted for

setting up the fund but not used or used for improper

purposes and the interest on that CIT amount.

The CIT rate used for calculating the to-be-recovered tax

amount is the tax rate applicable to the enterprise during the

time of operating the fund.

63

63

Law on Corporate Income Tax

Article 17. Deduction for STDF

2.

The interest rate for calculating the interest on the to-be-

recovered tax amount calculated on the unused fund

amount is the interest rate for one-year term treasury bonds

applicable at the time of recovery, and the interest payment

period is two years.

The interest rate for calculating the interest on the to-be-

recovered tax amount calculated on the fund amount used

for improper purposes is the interest used for late payment

fines under the provisions of the Tax Administration Law,

and the interest payment period is counted from the time64 a

fund is set up to the time of recovery.

64

Ms. Tran Nguyen Chat 32

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 17. Deduction for STDF

3. Enterprises shall not account expenses covered by their

STDF as deductible ones upon the determination of taxable

incomes in a tax period.

4. Enterprises STDF may be used only for scientific and

technological investment in Vietnam.

65

65

Law on Corporate Income Tax

Article 18. Conditions for tax incentives

1. The enterprise income tax incentives provided

for in Article 13, 14, 15, 16, and 17 of this law are

applicable to the enterprises that follow the regime

for accounting and invoicing, and pay tax according

to declarations.

Enterprise income tax incentives for new project of

investment defined in Article 13 and Article 14 of this Law

are not applicable to division, merger, amalgamation, and

conversion of enterprises, change of ownership, and other

cases according to law. 66

66

Ms. Tran Nguyen Chat 33

Internatioal Taxation 2024

Law on Corporate Income Tax

Article 18. Conditions for tax incentives

2. Enterprises must separate the incomes from the

operations eligible for tax incentives defined in Article 13

and Article 14 of this Law from the incomes from the

operations that are not eligible for tax incentives; if such

incomes are not able to be separated, the income from the

operations eligible for tax incentives shall be determined

based on the ratio of the revenue from the operations

eligible for tax incentives to the total revenue of the

enterprise.

67

67

Law on Corporate Income Tax

Article 18. Conditions for tax incentives

3. The tax rate of 20% (amended)

4. If an enterprise is eligible to multiple tax incentives for the

same income at the same time, it may choose the most

advantageous incentive.

68

68

Ms. Tran Nguyen Chat 34

Internatioal Taxation 2024

Law on Corporate Income Tax

Chapter IV: IMPLEMENTATION

Article 19. Effect

Article 20. Guidelines for implementation

69

69

70

70

Ms. Tran Nguyen Chat 35

Internatioal Taxation 2024

Please be sure that

YOU ARE READY FOR YOUR NEXT CLASS!

71

71

Ms. Tran Nguyen Chat 36

You might also like

- Chapter 1 - UAE VAT Laws and Procedures CourseDocument68 pagesChapter 1 - UAE VAT Laws and Procedures Coursenagham100% (2)

- Note 6Document55 pagesNote 6sohamdivekar9867No ratings yet

- Taxation - C1 Fundamentals - PreclassDocument50 pagesTaxation - C1 Fundamentals - PreclassK60 Nguyễn Anh ThưNo ratings yet

- Transfer Pricing TrainingDocument35 pagesTransfer Pricing TrainingViren GandhiNo ratings yet

- Transfer Pricing and Its Effect On Taxation in IndiaDocument12 pagesTransfer Pricing and Its Effect On Taxation in IndiaB.a. KrishnaNo ratings yet

- Transfer Pricing and Thin CapitalisationDocument10 pagesTransfer Pricing and Thin CapitalisationBhargav cr7No ratings yet

- Fundamentals of Beps: After Studying This Chapter, You Would Be Able ToDocument29 pagesFundamentals of Beps: After Studying This Chapter, You Would Be Able ToZ H SolutionsNo ratings yet

- Deloitte Indirect Tax TechnologyDocument32 pagesDeloitte Indirect Tax Technologyhleeatrimini67% (3)

- Transfer PricingDocument18 pagesTransfer PricingYusra RaoufNo ratings yet

- 10 - IR Day 2021 Direct & Indirect Tax (Erin Brown)Document6 pages10 - IR Day 2021 Direct & Indirect Tax (Erin Brown)Anwar MohammedNo ratings yet

- Corporate Tax Planning: TopicDocument12 pagesCorporate Tax Planning: TopicPratiksha TiwariNo ratings yet

- Course Information TpfundamentalsDocument3 pagesCourse Information Tpfundamentals79569zdqtwNo ratings yet

- Beps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Document78 pagesBeps Webcast 8 Launch 2015 Final Reports 151005150005 Lva1 App6891Tural AbbasovNo ratings yet

- Corporate TAXDocument26 pagesCorporate TAXSucheta SahaNo ratings yet

- Mas Research PaperDocument7 pagesMas Research Paperdiane camansagNo ratings yet

- Guide To Transfer PricingDocument85 pagesGuide To Transfer PricingShrisshaNo ratings yet

- MNC Tax ImplicationsDocument11 pagesMNC Tax ImplicationsShruti AgarwalNo ratings yet

- Transfer Pricing A Quick Run Through 1668336077 PDFDocument16 pagesTransfer Pricing A Quick Run Through 1668336077 PDFHafisMohammedSahibNo ratings yet

- Transfer Pricing - Niraj AgarwalDocument13 pagesTransfer Pricing - Niraj AgarwalNiraj AgarwalNo ratings yet

- Id Kai Transfer Pricing 2016 NewDocument12 pagesId Kai Transfer Pricing 2016 NewMarsheliana PutriNo ratings yet

- WEF Corporate Tax Digitalization and GlobalizationDocument24 pagesWEF Corporate Tax Digitalization and GlobalizationMNo ratings yet

- Income Tax (TP) Regulation Presentation Slide For InductionDocument41 pagesIncome Tax (TP) Regulation Presentation Slide For InductionUmar AbdulkabirNo ratings yet

- Transfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorDocument8 pagesTransfer Pricing' - An International Taxation Issue Concerning The Balance of Interest Between The Tax Payer and Tax AdministratorchristianNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Future Taxation of Company Profits 1558972582 PDFDocument21 pagesFuture Taxation of Company Profits 1558972582 PDFJORGESHSSNo ratings yet

- Ocp114 enDocument42 pagesOcp114 enShaïma BMANo ratings yet

- Maersk Europe Customs Optimisation Blueprint EbookDocument18 pagesMaersk Europe Customs Optimisation Blueprint EbookArnaud DolyNo ratings yet

- 18p36top41 PDFDocument6 pages18p36top41 PDFAmit KumarNo ratings yet

- Tax Dispute Resolution: A New Chapter Emerges: Tax Administration Without BordersDocument64 pagesTax Dispute Resolution: A New Chapter Emerges: Tax Administration Without BorderskelvintkNo ratings yet

- 2020 Mandeley Digital Taxation Around The World 1590804940Document49 pages2020 Mandeley Digital Taxation Around The World 1590804940Dyra FazrianNo ratings yet

- 2017TP D1 02 EN TP-DocumentationDocument6 pages2017TP D1 02 EN TP-DocumentationIoanna ZlatevaNo ratings yet

- Transfer Pricing: Headache To Corporate Governance : AbstractDocument5 pagesTransfer Pricing: Headache To Corporate Governance : AbstractShelviDyanPrastiwiNo ratings yet

- Ey-The-Dawning-Of-Digital-Economy-TaxationDocument8 pagesEy-The-Dawning-Of-Digital-Economy-TaxationStefanny BedoyaNo ratings yet

- Transfer Pricing PPT 190714 FinalDocument268 pagesTransfer Pricing PPT 190714 Finalvijaywin6299No ratings yet

- GX Deloitte Global Mining Tax Trends 2017Document40 pagesGX Deloitte Global Mining Tax Trends 2017Pran RNo ratings yet

- BEPS Implementation in Indonesia - Webinar BPPK - v3Document19 pagesBEPS Implementation in Indonesia - Webinar BPPK - v3tonitoni27No ratings yet

- Crowe Transfer Pricing Handbook 10Document31 pagesCrowe Transfer Pricing Handbook 10lpamgt_674780425No ratings yet

- Aiias Economy Pt365 2022Document63 pagesAiias Economy Pt365 2022Ismart ShankarNo ratings yet

- International Accounting: Learning ObjectivesDocument13 pagesInternational Accounting: Learning ObjectivesNorhan NabilNo ratings yet

- 2021 Yanti PratiwiDocument13 pages2021 Yanti Pratiwi4122220025ineNo ratings yet

- Afm Case StudyDocument9 pagesAfm Case Studynithinkumar.nk59No ratings yet

- Knocking On Tax Haven DoorDocument30 pagesKnocking On Tax Haven Doorheehan6No ratings yet

- Are You Identifying and Managing The Key Tax Risks in TMT M&A?Document1 pageAre You Identifying and Managing The Key Tax Risks in TMT M&A?CcapealNo ratings yet

- Transfer PricingDocument16 pagesTransfer PricingAbokingsNo ratings yet

- Transfer Pricing Alert - 1 August 2019Document6 pagesTransfer Pricing Alert - 1 August 2019Sampath KarunarathneNo ratings yet

- Sesi 2 - Bpk. Darussalam - International Taxation DDTC-1Document35 pagesSesi 2 - Bpk. Darussalam - International Taxation DDTC-1ridy venny teffendyNo ratings yet

- Ending Offshore Profit Shifting - OECD Anti-Corruption & IntegrityDocument5 pagesEnding Offshore Profit Shifting - OECD Anti-Corruption & IntegritygeorgeNo ratings yet

- Tax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsDocument13 pagesTax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsFazra SalsabilahNo ratings yet

- Introduction To TaxationDocument32 pagesIntroduction To TaxationAFIFAH NATASYA MOHD GHAZALINo ratings yet

- Factors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected WoredasDocument22 pagesFactors Affecting Turnover Tax Collection Performance A Case of West Shoa Selected Woredasedwin shikukuNo ratings yet

- Chapter 12: International Taxation and Transfer PricingDocument38 pagesChapter 12: International Taxation and Transfer PricingSara AlsNo ratings yet

- Loyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleDocument18 pagesLoyens Loeff Webinar - Oecd TP Standards - Where To Start - Session 1 - The Arms Length PrincipleIoanna ZlatevaNo ratings yet

- TP 16 Audit ReadinessDocument5 pagesTP 16 Audit ReadinessHai Lúa Miền TâyNo ratings yet

- The New Transfer Pricing Regime in The United Arab Emirates - ITCDocument9 pagesThe New Transfer Pricing Regime in The United Arab Emirates - ITCmarketingNo ratings yet

- Itp 2015 2016 Final PDFDocument1,162 pagesItp 2015 2016 Final PDFht1234222No ratings yet

- PCW Transfer PricingDocument269 pagesPCW Transfer PricingThiago Pereira da Silva100% (1)

- International Transfer PricingDocument21 pagesInternational Transfer PricingAtia IbnatNo ratings yet

- Identifying BusinessDocument11 pagesIdentifying BusinessRosa Noelia Gutierrez CaroNo ratings yet

- Tax Unit 3 DFDocument45 pagesTax Unit 3 DFHabtamu mamoNo ratings yet

- Reform by Numbers: Measurement Applied to Customs and Tax Administrations in Developing CountriesFrom EverandReform by Numbers: Measurement Applied to Customs and Tax Administrations in Developing CountriesNo ratings yet

- Bobby & BettyDocument6 pagesBobby & BettySimon KingNo ratings yet

- Income Tax AuthoritiesDocument10 pagesIncome Tax Authoritiesamb aniNo ratings yet

- How To Tax An Individual 1Document25 pagesHow To Tax An Individual 1Lianna Xenia EspirituNo ratings yet

- IncomeDocument1 pageIncomelehlohonoloskosana9308No ratings yet

- TAX Taxation of Employment IncomeDocument37 pagesTAX Taxation of Employment Incomedarcpamaterials90% (10)

- Vaishali Dna Wifi 2022Document1 pageVaishali Dna Wifi 2022AbhijeetNo ratings yet

- Estate CPA Report SampleDocument5 pagesEstate CPA Report SampleNeptali MarotoNo ratings yet

- Tarun Naib 21-22Document1 pageTarun Naib 21-22Shaheen SobtiNo ratings yet

- Ad Valorem TaxDocument4 pagesAd Valorem TaxManoj KNo ratings yet

- Requirement Solution: Employee Benefits (Part 1)Document6 pagesRequirement Solution: Employee Benefits (Part 1)Regina De LunaNo ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Scrutiny SlipDocument1 pageScrutiny SlipanudeepNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- American Express International v. CIR CTA Case No. 6099 (April 19, 2002)Document2 pagesAmerican Express International v. CIR CTA Case No. 6099 (April 19, 2002)Francis Xavier Sinon100% (1)

- 2307 - Rent My CarDocument10 pages2307 - Rent My CarSoeletraNo ratings yet

- Taxation-Not CompleteDocument13 pagesTaxation-Not CompleteLouie De La TorreNo ratings yet

- OD327306479450600100Document1 pageOD327306479450600100ARVIND KUMAR YADAVNo ratings yet

- Section 54 GB and 54 HDocument2 pagesSection 54 GB and 54 HAbhinav RandevNo ratings yet

- 1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationDocument10 pages1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationMugwanya AsadNo ratings yet

- I 6 G9 IQVhc Ii 0 U3 GeDocument3 pagesI 6 G9 IQVhc Ii 0 U3 GeDioneren Dela CruzNo ratings yet

- Pay Stub TemplateDocument1 pagePay Stub TemplateMichael ShortNo ratings yet

- Itr Ay 2022-23Document1 pageItr Ay 2022-23Soumya SwainNo ratings yet

- Philippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerDocument4 pagesPhilippine Christian University: Income Taxation (1 Quiz) Multiple Choice: Choose The Best Possible AnswerRenalyn ParasNo ratings yet

- Ca 3916Document4 pagesCa 3916Fernando Mochales GutiérrezNo ratings yet

- Od 328430519389235100Document1 pageOd 328430519389235100chandra2751No ratings yet

- Kristina - MAY 22Document1 pageKristina - MAY 22bktsuna0201No ratings yet

- Income Taxation LectureDocument78 pagesIncome Taxation LectureMa Jodelyn RosinNo ratings yet

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018Alyk CalionNo ratings yet

- Look Inside Pocket Notes Acca TaxationDocument5 pagesLook Inside Pocket Notes Acca TaxationSync ZazoNo ratings yet

- South African Police Service Suid-Afrikaanse Polisiediens: Employee Income Tax Certificate InformationDocument1 pageSouth African Police Service Suid-Afrikaanse Polisiediens: Employee Income Tax Certificate Informationbra9tee9tiniNo ratings yet