Professional Documents

Culture Documents

附件2 listening and blank filling CGTN Explains Understanding China's national carbon emissions trading market

附件2 listening and blank filling CGTN Explains Understanding China's national carbon emissions trading market

Uploaded by

Tian XinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

附件2 listening and blank filling CGTN Explains Understanding China's national carbon emissions trading market

附件2 listening and blank filling CGTN Explains Understanding China's national carbon emissions trading market

Uploaded by

Tian XinCopyright:

Available Formats

Markets 20:05, 17-Jul-2021

CGTN Explains: Understanding China's national carbon emissions trading market

Updated 11:38, 18-Jul-2021

Wang Tianyu , Zeng Hongen

After running pilot projects at the local level for over a decade, China officially launched its long-awaited national

carbon emissions trading market on Friday.

According to China's Ministry of 1)_____________ and 2)_____________ (MEE)[中华人民共和国生态环境部],

China's Emissions Trading Scheme (ETS) has replaced the EU's as the world's largest emissions trading system.

Here's everything you need to know about China's carbon market.

What is a carbon market?

A carbon market is where greenhouse gas emitters can buy and sell greenhouse gas emissions 3)_____________ or

4)_____________.

The government sets the 5)_____________ on the total amount of carbon emissions for the year, then companies

receive or buy emissions quotas within the 5)_____________. A company must provide enough allowances to cover

all its emissions yearly or face a 6)_____________. They can trade carbon emission allowances with one another on

the trading platform.

In China's ETS, the majority of the allowances are given to emitters for 7)_____________; however, in most of the

other carbon markets, they are purchased.

Also, China's version targets 8)_____________ rather than capping emissions.

In the EU and U.S. versions, an overall cap is set on the number of carbon credits. This is the amount of carbon the

signatories of the agreement are happy to emit over a given period. China's scheme will set benchmarks for each

separate power plant, which will vary between facilities. As before, those that do not exceed their quota can sell it to

those that do.

Who's involved?

In the first phase, the system only covers the 9)_____________ sector. Over 2,000 power companies, emitting more

than 4 billion tonnes of greenhouse gases per year or 10)_____________ percent of the country's yearly total, have

participated.

According to MEE, seven more high 11)_____________-intensive industries, including iron and steel and

construction materials, will be covered by the carbon market in the future.

Why build a carbon market?

The country is trying to use the trading scheme to reduce greenhouse gas emissions, as part of its effort to

12)_______________________________ by 2030 and 13)____________________________________ by 2060.

"For the first time, the responsibility for controlling greenhouse gas emissions at the national level is left to the

enterprises," said an earlier statement released by the MEE.

What's the price?

Carbon pricing is a crucial component in deciding how effectively the carbon market can help reduce carbon

emissions.

The first deal in China's ETS was sealed at 52.78 yuan ($8.16) per tonne, with a total of 160,000 tonnes of emissions

worth 7.9 million yuan traded while the average carbon price on the European Union ETS between 2021-2025 is

47.25 euros ($55.67) a tonne, according to a survey by the International Emissions Trading Association.

You might also like

- Tribal Museum, Bhopal Case StudyDocument20 pagesTribal Museum, Bhopal Case StudyRajlaxmi Badavannavar94% (17)

- Carbon EmissionDocument15 pagesCarbon Emissionafatima paintingNo ratings yet

- Energy Economics: Luis M. Abadie, José M. ChamorroDocument24 pagesEnergy Economics: Luis M. Abadie, José M. ChamorroZakiah Darajat NurfajrinNo ratings yet

- SB 19-17Document54 pagesSB 19-17YyyNo ratings yet

- D5 2 Final VersionDocument46 pagesD5 2 Final VersionaamirmubNo ratings yet

- Clean Development Mechanism: According To The World Bank and The International Emissions Trading Association'sDocument4 pagesClean Development Mechanism: According To The World Bank and The International Emissions Trading Association's9990570159No ratings yet

- Carbon Credits MarketDocument14 pagesCarbon Credits MarketAndrei SlipchenkoNo ratings yet

- CO2 Removal in Power PlantsDocument27 pagesCO2 Removal in Power Plantslagr2000No ratings yet

- Methane Emission Mitigation Strategies Info Sheet For Biogas IndustryDocument12 pagesMethane Emission Mitigation Strategies Info Sheet For Biogas IndustryFreddy Negron HuamaniNo ratings yet

- Achieving NeutralityDocument33 pagesAchieving NeutralityBittelNo ratings yet

- 63760d18963d6a3c5708a7a4 - CC Token Whitepaper 17nov2022Document19 pages63760d18963d6a3c5708a7a4 - CC Token Whitepaper 17nov2022NayazNo ratings yet

- Coal Fired Fossil FuelsDocument18 pagesCoal Fired Fossil FuelsaerryawanNo ratings yet

- Forecasting European Carbon MarketDocument20 pagesForecasting European Carbon MarketRaquel CadenasNo ratings yet

- 2006 Jan KBC Part I Refinery CO2 Challenges Michiel SpoorDocument5 pages2006 Jan KBC Part I Refinery CO2 Challenges Michiel Spoorac2475No ratings yet

- UNDP-ova Analiza Zelenih Poslova U HrvatskojDocument14 pagesUNDP-ova Analiza Zelenih Poslova U HrvatskojBranimir KolarekNo ratings yet

- India Case Study May2015Document12 pagesIndia Case Study May2015Kazim RazaNo ratings yet

- Overview of Indonesia's Energy Sector: Current Status & Development PlansDocument35 pagesOverview of Indonesia's Energy Sector: Current Status & Development PlansTri SesiliaNo ratings yet

- Green DealDocument58 pagesGreen DealTegarNo ratings yet

- YenilenebilirenerjidirektifleriDocument8 pagesYenilenebilirenerjidirektifleriKorkutYigitYigitalpNo ratings yet

- Cap and Trade SystemDocument32 pagesCap and Trade SystemMerve Ayvaz KöroğluNo ratings yet

- Alok PaperDocument10 pagesAlok Paperaalokmittal1128No ratings yet

- 5.2.4 CEMENT Industry Externalities (Completing A PESTLE Analysis)Document8 pages5.2.4 CEMENT Industry Externalities (Completing A PESTLE Analysis)MAANAS SINHANo ratings yet

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- Africa Business Forum - Background Reading On Carbon MarketsDocument6 pagesAfrica Business Forum - Background Reading On Carbon MarketsHendraNo ratings yet

- Memo For Road Map of Renewable EnergyDocument4 pagesMemo For Road Map of Renewable EnergySaleh Al-TamimiNo ratings yet

- EN EN: Commission of The European CommunitiesDocument14 pagesEN EN: Commission of The European Communitiesuakauaka31416No ratings yet

- Energy Conservation (Amendment) Bill 2022 - BriefDocument8 pagesEnergy Conservation (Amendment) Bill 2022 - BriefomkarNo ratings yet

- Commission Invests 3 Billion in Innovative Clean Tech Projects To Deliver On REPowerEU and Accelerate Europe S Energy Independence From Russian Fossil FuelsDocument2 pagesCommission Invests 3 Billion in Innovative Clean Tech Projects To Deliver On REPowerEU and Accelerate Europe S Energy Independence From Russian Fossil FuelsDanishbeigh1No ratings yet

- Assessment of CO2 Capture Technologies in Cement Manufacturing ProcessDocument11 pagesAssessment of CO2 Capture Technologies in Cement Manufacturing ProcessSalah SalmanNo ratings yet

- European Summary Report On CHP Support SchemesDocument33 pagesEuropean Summary Report On CHP Support SchemesioanitescumihaiNo ratings yet

- Vehicle To Grid v2g Introduction OperatiDocument41 pagesVehicle To Grid v2g Introduction OperatiAdisuNo ratings yet

- 2020 Energy Consumption in The UK ECUKDocument33 pages2020 Energy Consumption in The UK ECUKNakaret KanoNo ratings yet

- Pat CycleDocument4 pagesPat CyclekgmaheswaranNo ratings yet

- EU ETS Report WebDocument18 pagesEU ETS Report WebTerry Townsend, EditorNo ratings yet

- Guidelines - Co2 EmissionsDocument10 pagesGuidelines - Co2 EmissionsjmpbarrosNo ratings yet

- Green Is The Color of Money: The EU ETS Failure As A Model For The "Green Economy"Document23 pagesGreen Is The Color of Money: The EU ETS Failure As A Model For The "Green Economy"dr_kandimbaNo ratings yet

- 2009 - Italian Biogas (Economics)Document9 pages2009 - Italian Biogas (Economics)ilariofabbianNo ratings yet

- Cellar .0001.02 DOC 1Document130 pagesCellar .0001.02 DOC 1kausihan selvamNo ratings yet

- Carbon Market Year in Review 2020Document26 pagesCarbon Market Year in Review 2020Sayaka TsugaiNo ratings yet

- CementDocument76 pagesCementAmr Samy100% (3)

- Energy Efficiency in Belgium Summary enDocument20 pagesEnergy Efficiency in Belgium Summary enanon_62910764No ratings yet

- Energies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsDocument31 pagesEnergies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsHuy ĐoànNo ratings yet

- Neoen Equity ReportDocument11 pagesNeoen Equity ReportTiffany SandjongNo ratings yet

- CREW: Council On Environmental Quality: Global Warming Documents: CEQ 007572 - CEQ 007573 Domestic Emissions Trading Programs For Greenhouse GasesDocument2 pagesCREW: Council On Environmental Quality: Global Warming Documents: CEQ 007572 - CEQ 007573 Domestic Emissions Trading Programs For Greenhouse GasesCREWNo ratings yet

- GDIP CommunicationDocument21 pagesGDIP CommunicationIrene CastroNo ratings yet

- Microsoft Word - FPAMR 2011 Carbon Trade Chapter Tissari FAO Final Working Copy As of 15 JulyDocument16 pagesMicrosoft Word - FPAMR 2011 Carbon Trade Chapter Tissari FAO Final Working Copy As of 15 JulyNatalia AvellanedaNo ratings yet

- EU Renewables Policy InitiativesDocument15 pagesEU Renewables Policy InitiativesOmarEnriqueChiqueNo ratings yet

- Benchmarking Report Cement Sector PDFDocument76 pagesBenchmarking Report Cement Sector PDFGuilherme Pierre PaivaNo ratings yet

- Carbon CreditsDocument4 pagesCarbon CreditsGIRIPRASAD T GNo ratings yet

- Overview of Global Carbon Market: Presented byDocument26 pagesOverview of Global Carbon Market: Presented byvideo2063No ratings yet

- Global Carbon Finance: Submitted To: Submitted byDocument14 pagesGlobal Carbon Finance: Submitted To: Submitted bymohammad samiNo ratings yet

- Case Study: The EU Emissions Trading Scheme (EU ETS)Document4 pagesCase Study: The EU Emissions Trading Scheme (EU ETS)sondaNo ratings yet

- Carbon Financing: Carbon Financing: New Business OpportunitiesDocument14 pagesCarbon Financing: Carbon Financing: New Business Opportunitiessunny_mkarNo ratings yet

- Korea's Green Growth Strategy - Implications On Business Fields: Case of Secondary Battery - (Based On Samsung SDI)Document15 pagesKorea's Green Growth Strategy - Implications On Business Fields: Case of Secondary Battery - (Based On Samsung SDI)Eric Britton (World Streets)No ratings yet

- Energies: High-Efficiency Cogeneration Systems: The Case of The Paper Industry in ItalyDocument21 pagesEnergies: High-Efficiency Cogeneration Systems: The Case of The Paper Industry in ItalyCésar Malque GarcíaNo ratings yet

- Brief On Trading of ESCerts (Energy Saving CertificatesDocument2 pagesBrief On Trading of ESCerts (Energy Saving CertificatesEE OPN1TTPSNo ratings yet

- Energies: High-Efficiency Cogeneration Systems: The Case of The Paper Industry in ItalyDocument21 pagesEnergies: High-Efficiency Cogeneration Systems: The Case of The Paper Industry in ItalySumanranuNo ratings yet

- EU China Energy Magazine 2023 April Issue: 2023, #3From EverandEU China Energy Magazine 2023 April Issue: 2023, #3No ratings yet

- EU China Energy Magazine 2022 Christmas Double Issue: 2022, #11From EverandEU China Energy Magazine 2022 Christmas Double Issue: 2022, #11No ratings yet

- EU China Energy Magazine 2023 May Issue: 2023, #5From EverandEU China Energy Magazine 2023 May Issue: 2023, #5No ratings yet

- EU China Energy Magazine 2023 March Issue: 2023, #2From EverandEU China Energy Magazine 2023 March Issue: 2023, #2No ratings yet

- The Role of Critical Minerals in Clean Energy TransitionsDocument287 pagesThe Role of Critical Minerals in Clean Energy TransitionsCristian Villamayor100% (1)

- DNV ETO Main Report 2023 Highres CompDocument211 pagesDNV ETO Main Report 2023 Highres Compmihirp26No ratings yet

- Interflon Food GreaseDocument9 pagesInterflon Food GreaseVaderFistNo ratings yet

- EAE Position Regarding Consultation Financial Support For Energy Efficiency in Buildings 18052012Document9 pagesEAE Position Regarding Consultation Financial Support For Energy Efficiency in Buildings 18052012Εύη ΣαλταNo ratings yet

- IWTC 2017 Full BrochureDocument2 pagesIWTC 2017 Full BrochurenizarazuNo ratings yet

- Population PressureDocument81 pagesPopulation PressureBeni RaharjoNo ratings yet

- Justice and The Environment: Conceptions of Environmental SustainabilityDocument13 pagesJustice and The Environment: Conceptions of Environmental SustainabilityMalvika RajNo ratings yet

- MGP 2023 Open Test GS Paper 3 SolDocument22 pagesMGP 2023 Open Test GS Paper 3 Solshivaraj sebiNo ratings yet

- Book Review - How The World Really Works - A Scientist's Guide To Our Past, Present and Future by Vaclav Smil - Impact of Social SciencesDocument12 pagesBook Review - How The World Really Works - A Scientist's Guide To Our Past, Present and Future by Vaclav Smil - Impact of Social SciencesSadegh SimorghNo ratings yet

- Calculation of Stream Flow Using General Oceanics Mechanical Flow MeterDocument2 pagesCalculation of Stream Flow Using General Oceanics Mechanical Flow MeterandaraniNo ratings yet

- Research Survey QuestionsDocument6 pagesResearch Survey QuestionsQuien CyNo ratings yet

- Soil ErosionDocument10 pagesSoil ErosionAlliah MendozaNo ratings yet

- In Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghDocument1 pageIn Bengal, Erosion Leads To Land Loss: Shiv Sahay SinghRohith KumarNo ratings yet

- Factor Effecting On Climate ChangeDocument13 pagesFactor Effecting On Climate ChangeKhalid BachaNo ratings yet

- Hydrological Drought Investigation Using Streamflow Drought IndexDocument26 pagesHydrological Drought Investigation Using Streamflow Drought IndexSaikat DasNo ratings yet

- Noise Mapping in An Urban Environment: Comparing GIS-based Spatial Modelling and Parametric ApproachesDocument8 pagesNoise Mapping in An Urban Environment: Comparing GIS-based Spatial Modelling and Parametric ApproachesRami MalekNo ratings yet

- Tong D 2012 PHD ThesisDocument246 pagesTong D 2012 PHD Thesismppatilmayur1679No ratings yet

- DimetilglioksinDocument5 pagesDimetilglioksinAnggi FahrunnisaNo ratings yet

- Module 4 Environmental ProtectionDocument50 pagesModule 4 Environmental ProtectionAlyssa Paula AltayaNo ratings yet

- Sultanate of Oman: WWW - Duqm.gov - OmDocument35 pagesSultanate of Oman: WWW - Duqm.gov - OmAli MustafaNo ratings yet

- 1st Periodic Test - Science 10Document5 pages1st Periodic Test - Science 10Lani Bernardo CuadraNo ratings yet

- Water Purifier: Neo Plus (Chp-264L)Document2 pagesWater Purifier: Neo Plus (Chp-264L)species09No ratings yet

- Clouds, Fog and PrecipitationDocument54 pagesClouds, Fog and PrecipitationPedro SousaNo ratings yet

- Lesson 4 Forest Resources of The PhilippinesDocument19 pagesLesson 4 Forest Resources of The PhilippinesJunnell VillafloresNo ratings yet

- SPM - CSR PolicyDocument8 pagesSPM - CSR Policyahlan zulfakhriNo ratings yet

- GREEN ACCOUNTING Transformasi Akuntansi Di Era DigitalDocument11 pagesGREEN ACCOUNTING Transformasi Akuntansi Di Era DigitalRadhiatul Nurul JannahNo ratings yet

- Science Investigatory Project S.Y.-2017-18Document21 pagesScience Investigatory Project S.Y.-2017-18Angelo Siegfrid PadillaNo ratings yet

- Adigrat University Collage of Engineering and Technology Department of ArchitectureDocument9 pagesAdigrat University Collage of Engineering and Technology Department of ArchitectureDawit TesfayNo ratings yet

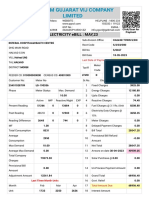

- PGVCL Bill-25401028709Document1 pagePGVCL Bill-25401028709SDH HALVADNo ratings yet