Professional Documents

Culture Documents

Invoice No. 2407100344

Invoice No. 2407100344

Uploaded by

sunnyrunninginamazonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invoice No. 2407100344

Invoice No. 2407100344

Uploaded by

sunnyrunninginamazonCopyright:

Available Formats

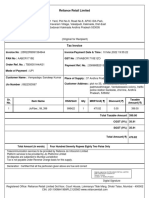

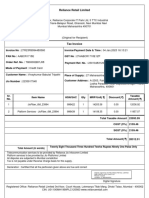

RailTel Corporation of India Limited

(A Government Of India Undertaking, Ministry Of Railways)

Tax Invoice

RCIL Address for state DELHI:- 6th Floor, III Block, Delhi IT Park, Shastri Park, Delhi 110053

CUSTOMER BILL TO Invoice No. : 2407100344

Customer Name: Haryana State Electronics Development Corporation Limited Invoice Date : 09-MAY-2024

Address: SCO 111-113 Payment Terms : IMMEDIATE

SCO 111-113, Sector 17 B, Chandigarh, 160017 Customer PO No. HARTRON:DE(C&C)"2017:733 /1

Service Type : Lease Line

CUSTOMER Supply Address Sales Order No. 3100024354

State Code: 04 and State : CHANDIGARH Billing Cycle : One Time

Billing Period : 11-SEP-2022 TO 30-JUN-2023

Customer Details RailTel Details

Customer PAN No. : AABCH1532Q Bank Name- Union Bank of India IFSC Code - UBIN0996335

Customer TAN No. : PTLH11258C Bank Account No. 173571942

Customer GSTIN/UIN No.: 04AABCH1532Q1ZM GSTIN : 07AABCR7176C2ZE PAN: AABCR7176C

Contact Person Mr. Dev Kumar

S.No Goods/Service HSN/ SAC Location from Location To Circuit ID DOC Quantity UOM Unit Rate Billing Amount

1 Lease Line - 34 Mbps 998411 Cyber Center, Haryana NIC-NKN, 3rd Floor, 372504 11-MAR-2016 1 MB 259200 259200

Bhawan ,Copernicus Marg, Block-3, Delhi IT Park,

New Delhi Shastri park Delhi

Whether Tax is Payable under Reverse Charge (Yes/No) Gross Value 259200

IGST@18% 46656.00

Amount in words: Three Lakh Five Thousand Eight Hundred Fifty-Six Only Total Invoice Amount 305856.00

Comments:

PARMOD Digitally signed by

PARMOD KUMAR

KUMAR Date: 2024.05.13

(Authorized Signatory.)

11:42:49 +05'30'

Mr. Parmod Kumar

RailTel Corporation Of India Ltd. (A Government Of India Undertaking, Ministry Of Railways)

Corporate Office: 143, Institutional Area, Sector 44, Gurugram , 122003, NCR(India), T: +91 124 2714000, F: +91 124 4236084

CIN-U64202DL2000GOI107905

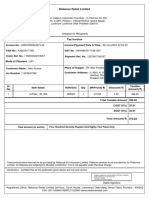

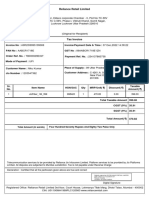

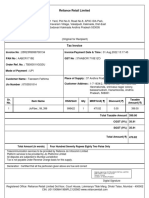

RailTel Corporation of India Limited

(A Government Of India Undertaking, Ministry Of Railways)

IRN Number:- 783464c1422cba989170cab065c24193116c49728406fb1f82c1f17aeac4e48b

Terms and Conditions.

1. TDS May be deducted as per provision of Income Tax Act 1961 of the invoice value (Excluding GST Tax).

2. If payment is not released by due date then interest @15% (or as per agreement) will be charged from the above mentioned due date of payment. GST payable in addition at applicable rates.

3. Amount of TDS required to be deducted by the deductee to Income Tax Department and the same should reflect in the 26AS statement of RailTel. If not reflected then a debit note will be issued equivalent to the

amount of TDS for the realization of the same.

4. While Making payment full details of TDS and invoice along with recovery if any to be informed to RailTel (Invoice Section).

RailTel Corporation Of India Ltd. (A Government Of India Undertaking, Ministry Of Railways)

Corporate Office: 143, Institutional Area, Sector 44, Gurugram , 122003, NCR(India), T: +91 124 2714000, F: +91 124 4236084

CIN-U64202DL2000GOI107905

You might also like

- Bill Sample of CementDocument2 pagesBill Sample of Cementshadanjamia96No ratings yet

- Y Broadband Bill Feb2020 PDFDocument1 pageY Broadband Bill Feb2020 PDFvijaya lakshmiNo ratings yet

- Posonic HomeAlarm EX10 & EX18 Installation Manual - Rev1.0Document54 pagesPosonic HomeAlarm EX10 & EX18 Installation Manual - Rev1.0Vlad Florescu100% (3)

- Ecolab Social Media PolicyDocument4 pagesEcolab Social Media PolicyJavier GonzalezNo ratings yet

- Invoice No. 2404100030Document2 pagesInvoice No. 2404100030sunnyrunninginamazonNo ratings yet

- Ultra Tech Bill SampleDocument2 pagesUltra Tech Bill Sampleshadanjamia96No ratings yet

- Railtel Corporation of India Limited: Tax InvoiceDocument3 pagesRailtel Corporation of India Limited: Tax InvoicesunnyrunninginamazonNo ratings yet

- Compliance MSVRG August 2021 TL29T2122 17954Document1 pageCompliance MSVRG August 2021 TL29T2122 17954Saurabh KatiyarNo ratings yet

- Railtel Corporation of India Limited: Tax InvoiceDocument3 pagesRailtel Corporation of India Limited: Tax InvoicesunnyrunninginamazonNo ratings yet

- Rust Remover WRDocument2 pagesRust Remover WRsseem52kgpw003No ratings yet

- STS1036Document2 pagesSTS1036Shilpa AmitNo ratings yet

- 2593 GwaliorDocument2 pages2593 GwaliorUtkarsh MalhotraNo ratings yet

- Invoice BillDocument1 pageInvoice BillsricharitaNo ratings yet

- WR 11 Jan 24Document3 pagesWR 11 Jan 24piyush singhNo ratings yet

- Compliance MSVRG May 2021 TL29T2122 7099Document1 pageCompliance MSVRG May 2021 TL29T2122 7099Saurabh KatiyarNo ratings yet

- My - Invoice - 3 May 2022, 12 - 00 - 43 - 299375983617Document2 pagesMy - Invoice - 3 May 2022, 12 - 00 - 43 - 299375983617121710407054 VEMPADAPU SANDEEP KUMARNo ratings yet

- InvoiceDocument1 pageInvoicekuldeepNo ratings yet

- 25 - LH221323101207 SCR LallagudaDocument3 pages25 - LH221323101207 SCR LallagudaAbhishek DahiyaNo ratings yet

- Jio Broadband BillDocument3 pagesJio Broadband Billpoojendra2No ratings yet

- ZEE5 Invoice 11 03 2022Document1 pageZEE5 Invoice 11 03 2022Shajin NambiarNo ratings yet

- Reliance Retail LimitedDocument2 pagesReliance Retail LimitedKarna Satish KumarNo ratings yet

- Hog TestDocument3 pagesHog TestsujaraghupsNo ratings yet

- InvoiceDocument2 pagesInvoiceNiksNo ratings yet

- Goflistgtkbmvkak2362 Booking InvoiceDocument1 pageGoflistgtkbmvkak2362 Booking Invoiceakssingh239No ratings yet

- Tax Invoice: Digitally Signed by Alka Virmani Date: 2023.05.24 14:33:30 +05'30'Document1 pageTax Invoice: Digitally Signed by Alka Virmani Date: 2023.05.24 14:33:30 +05'30'Ankit SethiNo ratings yet

- Tax Invoice: Advance Receipt Voucher NoDocument2 pagesTax Invoice: Advance Receipt Voucher NoAditya KataraNo ratings yet

- InvoiceDocument1 pageInvoicesalonipatel12721No ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account SummaryAvijitNo ratings yet

- Invl 21957 Scom10837Document1 pageInvl 21957 Scom10837Shashank PalaiNo ratings yet

- Invoice No.62 BBM (Foundation Bolts)Document2 pagesInvoice No.62 BBM (Foundation Bolts)sales.saimedhaNo ratings yet

- InvoiceDocument2 pagesInvoiceNiksNo ratings yet

- InvoiceDocument2 pagesInvoiceNiksNo ratings yet

- RT 2021-22 01078Document1 pageRT 2021-22 01078M A InteriorsNo ratings yet

- 012-PSS - IGL - GorakhpurDocument1 page012-PSS - IGL - GorakhpurNishant KumarNo ratings yet

- InvoiceDocument2 pagesInvoiceNiksNo ratings yet

- DB 245156100357Document2 pagesDB 245156100357mitzz39No ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)Pratap GunnuNo ratings yet

- My - Invoice - 4 Jan 2023, 21 - 35 - 56 - 400119028653Document2 pagesMy - Invoice - 4 Jan 2023, 21 - 35 - 56 - 400119028653Divyang TiwariNo ratings yet

- CRB 1706 Acldax 4Document3 pagesCRB 1706 Acldax 4Rahul DevkarNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument2 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decisionaniketgupta05No ratings yet

- Invoice No.59 Durga Stone (Sedum)Document2 pagesInvoice No.59 Durga Stone (Sedum)sales.saimedhaNo ratings yet

- Invoice HistoryDocument2 pagesInvoice HistoryMujaser RahmanNo ratings yet

- BHD 23 24 007606Document1 pageBHD 23 24 007606rajugoud6231No ratings yet

- March BillDocument1 pageMarch Billsahilmalik0123No ratings yet

- 24 - 38221544103291 SCR GuntupalliDocument3 pages24 - 38221544103291 SCR GuntupalliAbhishek DahiyaNo ratings yet

- 2324BM357873_1Document2 pages2324BM357873_1Gaurav guptaNo ratings yet

- Megahertz Internet Network Pvt. LTD.: Retail InvoiceDocument1 pageMegahertz Internet Network Pvt. LTD.: Retail InvoiceAyush ThapliyalNo ratings yet

- Lucknow Travel ItemsDocument2 pagesLucknow Travel ItemsManikanth Reddy BandiNo ratings yet

- Tax Invoice Jan-24 Income ProofDocument3 pagesTax Invoice Jan-24 Income Proofjsmreddy19111987No ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Accounting VoucherDocument2 pagesAccounting Vouchervenkat johnNo ratings yet

- InvoiceDocument2 pagesInvoiceNiksNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account Summarychethankrgowda8570No ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayYoGesh PaWarNo ratings yet

- Blotter Spot Paper PODocument3 pagesBlotter Spot Paper POKalyan Diesel Lab Diesel Loco ShedNo ratings yet

- FEB InvoiceHistoryDocument1 pageFEB InvoiceHistoryUday SaiNo ratings yet

- 27 Taxi RedDocument3 pages27 Taxi RedAfeeq kNo ratings yet

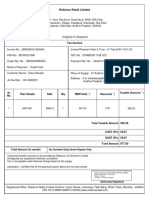

- Reliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValueDocument3 pagesReliance Retail Limited: Sr. No. Item Name Hsn/Sac Qty Price/Unit Discount ValuemukeshNo ratings yet

- Retro Reflective Equipment Number Plates For Isolator WR PO 81236155101097 DTD 09.10.23Document3 pagesRetro Reflective Equipment Number Plates For Isolator WR PO 81236155101097 DTD 09.10.23SSE TRD JabalpurNo ratings yet

- Invoice Tel TNPL - 1149 - 24 25Document5 pagesInvoice Tel TNPL - 1149 - 24 25vedash0000No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- B 8.4 Student Activity: Using GreenhousesDocument3 pagesB 8.4 Student Activity: Using GreenhousesCK BNo ratings yet

- Research Proposal PDFDocument29 pagesResearch Proposal PDFZele Kaemba100% (1)

- BioulDocument29 pagesBioulvangoetheNo ratings yet

- RSPDocument24 pagesRSPMassrNo ratings yet

- MTH 401 - Practice QuestionsDocument3 pagesMTH 401 - Practice Questionsmona_shahNo ratings yet

- Women's Intercultural Center BrochureDocument2 pagesWomen's Intercultural Center BrochureMary CarterNo ratings yet

- Costing Perfume1Document30 pagesCosting Perfume1Jophet Banabana Magalona100% (1)

- Final Acts For WRC-15Document552 pagesFinal Acts For WRC-15jay_pNo ratings yet

- Project Proposal of Maratua Homestay Scheme ResearchDocument6 pagesProject Proposal of Maratua Homestay Scheme ResearchAndre Prakoso100% (1)

- Mule Core ComponentsDocument7 pagesMule Core ComponentsRameshChNo ratings yet

- Photoelectric Sensor: E3S-LSDocument8 pagesPhotoelectric Sensor: E3S-LSAnggi PrasetyoNo ratings yet

- Strategic Management Unit - 3Document17 pagesStrategic Management Unit - 3RajatNo ratings yet

- 3GPP TS 38.508-2: Technical SpecificationDocument14 pages3GPP TS 38.508-2: Technical SpecificationAhmedMa'moonNo ratings yet

- Procter & Gamble: Balance SheetDocument4 pagesProcter & Gamble: Balance SheetAvantika SaxenaNo ratings yet

- ZLJ5459JQZ70V: Qy7v532/f32yDocument174 pagesZLJ5459JQZ70V: Qy7v532/f32yFabiano Cunha da Silva100% (1)

- Application Form - HSSC - VerificationDocument3 pagesApplication Form - HSSC - VerificationMuhammad Junaid AslamNo ratings yet

- BT CottonDocument33 pagesBT Cottony_alkuddsi100% (1)

- Fls FHT Proj MGT Presentation 26aug13Document19 pagesFls FHT Proj MGT Presentation 26aug13Marquis HowardNo ratings yet

- Strategy and Competitive Advantage Chapter 6Document7 pagesStrategy and Competitive Advantage Chapter 6Drishtee DevianeeNo ratings yet

- Oriental Happy Family Brochure PDFDocument10 pagesOriental Happy Family Brochure PDFRajat GuptaNo ratings yet

- R9说明书2019 10 11增加下挂Document21 pagesR9说明书2019 10 11增加下挂Tsu Min YiNo ratings yet

- LTM 05Document8 pagesLTM 05SolNo ratings yet

- A Study On Personality That Influences Teaching EffectivenessDocument9 pagesA Study On Personality That Influences Teaching EffectivenessLovely May CarinoNo ratings yet

- Tohnichi - Katalog 2020 ENDocument76 pagesTohnichi - Katalog 2020 END.T.No ratings yet

- The TeachersDocument3 pagesThe TeachersBisag AsaNo ratings yet

- Hydraulic IndustrialDocument56 pagesHydraulic IndustrialKuni Faizah100% (1)

- Load Dispatch Centre: By-Siddharth KumarDocument16 pagesLoad Dispatch Centre: By-Siddharth KumarSIDDHARTHNo ratings yet

- Oracle Golden Gate 11g SyllabusDocument4 pagesOracle Golden Gate 11g SyllabusksknrindianNo ratings yet