Professional Documents

Culture Documents

Installment Sales Sample Problems

Installment Sales Sample Problems

Uploaded by

lemvin121003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Installment Sales Sample Problems

Installment Sales Sample Problems

Uploaded by

lemvin121003Copyright:

Available Formats

AFAR 2: Accounting for Special Transactions

Installment Sales

SAMPLE PROBLEMS (Adapted)

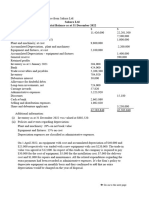

PROBLEM 1 - JOURNAL ENTRIES: Regular Sales and Installment Sales

Assume the following information detailing transactions for the two years of HAE IN Corporation:

2024 2025

Sales:

Regular

2024: Cash, P360,000, On account, P240,000 600,000 -

2025: Cash, P480,000, On account, P600,000 - 1,080,000

Installment Sales

Down payment ----------------------------------------- 60,000 144,000

Balance --------------------------------------------------- 300,000 336,000

Cost of Sales:

Regular----------------------------------------------------------- 480,000 864,000

Installment ----------------------------------------------------- 252,000 312,000

Collections:

Accounts Receivable------------------------------------------ 144,000 360,000

Installment accounts receivable,

2024 sales, applying to

Principal--------------------------------------------------- 72,000 72,000

Interest----------------------------------------------------- 36,000 28,800

2025 sales, applying to

Principal--------------------------------------------------- - 60,000

Interest----------------------------------------------------- - 43,200

Accrued Interest Receivable, December 31:

2024 sales ------------------------------------------------- 1,440 1,080

2025 sales ------------------------------------------------- - 1,800

Operating Expenses paid 90,000 102,000

Requirement: Prepare necessary journal entries for the years 2024 and 2025.

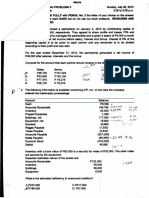

PROBLEM 2 – Repossession

HYUN WOO Corporation started operations on January 1, 2022 selling home appliance and furniture sets both for cash

and on installment basis. Data on the installment sales operations of the company gathered for the years ending December

31,2022 and 2023 were as follows:

2022 2023

Installment Sales 1,200,000 1,500,000

Cost of Installment Sales 720,000 1,050,000

Cash collected on installment sales

2022 installment contracts 630,000 450,000

2023 installment sales 900,000

On January 6, 2023, an installment sale in 2022 was defaulted and the merchandise was repossessed. The estimated

resale value of the merchandise amounted to P20,000. There is a 10% normal profit based on estimated resale value. The

corporation incurred P3,000 disposal costs and P5,000 reconditioning cost. Related installment receivable balance on

January 6, 2023 was P17,000. The operating expenses incurred in 2022 and 2023 amounted to P50,000 and P100,000,

respectively.

Compute for the following:

a. Gross profit rate for 2022 and 2023

b. Deferred gross profit as of 2023 from 2022 and 2023 sales

c. Valuation of the repossessed merchandise at the time of repossession

d. Gain or (loss) on repossession

e. Realized gross profit after gain or (loss) on repossession in 2022 and 2023

PROBLEM 3 – Trade Ins

On March 1, 2024, QUEENS Company sells a sports utility vehicle for P5,700,000 with the vehicle costing P3,850,000. An

old vehicle was accepted as down payment and an allowance of P900,000 was allowed on the trade-in. In addition to the

trade-in vehicle, a downpayment of P2,000,000 cash and the balance to be paid at the end of each month in thirty-five equal

monthly installments of P80,000 commencing the month of sale. The company estimated that the old vehicle has an

estimated resale price of P1,400,000 after reconditioning costs of P350,000. The company expects a 20% profit from the

resale and costs to sell (commission) of 5%.

Questions:

a. How much is the fair value of traded in vehicle?

b. How much is the under/(over) allowance in trade in?

c. What is the gross profit rate?

d. How much is the total realized gross profit in 2024?

You might also like

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- AKM 2 - Forum 7 - Andres - 43220110067Document13 pagesAKM 2 - Forum 7 - Andres - 43220110067tes doangNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- What Is A Birth CertificateDocument39 pagesWhat Is A Birth CertificateJake Morse100% (3)

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- 1.3 Merger - Contingent ConsiderationDocument8 pages1.3 Merger - Contingent ConsiderationRENZ ALFRED ASTRERONo ratings yet

- Installment-Sales-Supplementary-Problems & NotesDocument3 pagesInstallment-Sales-Supplementary-Problems & NotesAlliah Mae ArbastoNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- I. Contingent Consideration Based On Future Earnings With Measurement Period Rule ApplicationDocument5 pagesI. Contingent Consideration Based On Future Earnings With Measurement Period Rule Applicationjerald cerezaNo ratings yet

- INSTALLMENT SALES Part 2Document1 pageINSTALLMENT SALES Part 2Shaina GarciaNo ratings yet

- Installment SalesDocument2 pagesInstallment SalesJULLIE CARMELLE H. CHATTONo ratings yet

- 11 17 AnswersDocument9 pages11 17 AnswersRizalito SisonNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- 7169 - Noncurrent Asset Held For Sale and Discountinued OperationDocument2 pages7169 - Noncurrent Asset Held For Sale and Discountinued Operationjsmozol3434qcNo ratings yet

- Week 03 - Accounts ReceivablesDocument4 pagesWeek 03 - Accounts ReceivablesPj ManezNo ratings yet

- Single Entry Method and COE - AUD23Document4 pagesSingle Entry Method and COE - AUD23giofrancis.baledaNo ratings yet

- ACC 108 Assignment Dec w3 2s2324Document3 pagesACC 108 Assignment Dec w3 2s2324Ghie RodriguezNo ratings yet

- Illustrative Problem On Contingent Consideration and Measurement PeriodDocument8 pagesIllustrative Problem On Contingent Consideration and Measurement PeriodasdasdaNo ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- Practice Exercises For Confras Units 5 and 6 - Part 1Document3 pagesPractice Exercises For Confras Units 5 and 6 - Part 1xylynn myka cabanatanNo ratings yet

- Inbound 9210653396620867995Document37 pagesInbound 9210653396620867995bossfibeeNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Receivables ProblemsDocument5 pagesReceivables ProblemsAbbygailNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- 15 Business CombinationDocument6 pages15 Business CombinationTinNo ratings yet

- 8921 - Intercompany Transactions Fixed AssetsDocument2 pages8921 - Intercompany Transactions Fixed AssetsThalia BontigaoNo ratings yet

- Cpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesDocument15 pagesCpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesSophia PerezNo ratings yet

- Seatwork-Liabilities1st2023 StudentDocument5 pagesSeatwork-Liabilities1st2023 StudentpadayonmhieNo ratings yet

- 8908 - Installment Consignment SalesDocument5 pages8908 - Installment Consignment Salesxara mizpahNo ratings yet

- Wa0003.Document6 pagesWa0003.joanNo ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS - Installment SalesDocument25 pagesACCOUNTING FOR SPECIAL TRANSACTIONS - Installment SalesDewdrop Mae RafananNo ratings yet

- AdvaccDocument1 pageAdvaccTrisha Danisse IlanNo ratings yet

- Homework 5 - Current Liabilities - RevisedDocument3 pagesHomework 5 - Current Liabilities - RevisedalvarezxpatriciaNo ratings yet

- AFAR 1.4 - Installment SalesDocument7 pagesAFAR 1.4 - Installment SalesKile Rien MonsadaNo ratings yet

- Audit of Inventories and Trade Payables BA 123 Exercise Set BDocument6 pagesAudit of Inventories and Trade Payables BA 123 Exercise Set BBecky GonzagaNo ratings yet

- Bac 2211 Cat&assignment Sep 2023Document5 pagesBac 2211 Cat&assignment Sep 2023toniruii98No ratings yet

- PartnershipDocument2 pagesPartnershiplearningcantstop561No ratings yet

- G 2audit of Other Income Statement Items Prblem 1 15 1Document10 pagesG 2audit of Other Income Statement Items Prblem 1 15 1Werpa PetmaluNo ratings yet

- Contentitemfile Clal2k5hpdzlu0a21e4vwwola PDFDocument4 pagesContentitemfile Clal2k5hpdzlu0a21e4vwwola PDFJoseph OndariNo ratings yet

- Problem 1: Finals - ReceivablesDocument4 pagesProblem 1: Finals - ReceivablesLeslie Beltran ChiangNo ratings yet

- Chapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsDocument4 pagesChapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsKeay ParadoNo ratings yet

- 9016 - IFRS 3 Business Combination MergerDocument4 pages9016 - IFRS 3 Business Combination Mergerせい じよNo ratings yet

- AccrDocument2 pagesAccrlearningcantstop561No ratings yet

- B2 2022 May QNDocument11 pagesB2 2022 May QNRashid AbeidNo ratings yet

- Ilovepdf Merged 1Document14 pagesIlovepdf Merged 1BATISATIC, EDCADIO JOSE E.No ratings yet

- Special Trans Activity 2Document15 pagesSpecial Trans Activity 2Rachelle JoseNo ratings yet

- ACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Document2 pagesACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Lucas BantilingNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Shareholders' Equity p21 28Document19 pagesShareholders' Equity p21 28Rizalito SisonNo ratings yet

- Problem 3 2 RRHDocument10 pagesProblem 3 2 RRHCarl Jaime Dela CruzNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- ACC 2101 CA1 With TemplateDocument8 pagesACC 2101 CA1 With TemplatedeboevaniaNo ratings yet

- Sample Problems (CAT Level 1)Document20 pagesSample Problems (CAT Level 1)Justine LouiseNo ratings yet

- PA T22WSB 3 Group Assignment 1Document4 pagesPA T22WSB 3 Group Assignment 1Pham Minh Thu NguyenNo ratings yet

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Comprehensive ExamDocument37 pagesComprehensive ExamAngeline DionicioNo ratings yet

- Iapm SolutionsDocument81 pagesIapm Solutionsjayaram_polarisNo ratings yet

- Audit of Receivables QuizDocument7 pagesAudit of Receivables QuizJohnel Mislang YangaNo ratings yet

- Sap Fi/Co General Ledger Accounting: Basic Settings: V IewDocument32 pagesSap Fi/Co General Ledger Accounting: Basic Settings: V IewPunit BavadNo ratings yet

- Journal of Business Research: Russell P. Boisjoly, Thomas E. Conine JR, Michael B. Mcdonald Iv TDocument8 pagesJournal of Business Research: Russell P. Boisjoly, Thomas E. Conine JR, Michael B. Mcdonald Iv TOZZYMANNo ratings yet

- Week 2 Tutorial SolutionsDocument23 pagesWeek 2 Tutorial SolutionsalexandraNo ratings yet

- FAR HandoutDocument34 pagesFAR HandoutIamchyNo ratings yet

- Auditing Problems ReviewerDocument9 pagesAuditing Problems Revieweralexis prada0% (1)

- Vertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipDocument35 pagesVertical and Horizontal Analysis of Financial Statement of A Sole ProprietorshipJohn Fort Edwin AmoraNo ratings yet

- Short-Term Debt: Viney & Phillips, Financial Institutions, Instruments and Markets, 9eDocument40 pagesShort-Term Debt: Viney & Phillips, Financial Institutions, Instruments and Markets, 9eThu NguyenNo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- SYSPRO ERP SolutionDocument17 pagesSYSPRO ERP SolutionericonasisNo ratings yet

- 06 - Working Capital Management ProblemsDocument4 pages06 - Working Capital Management ProblemsMerr Fe PainaganNo ratings yet

- Title Proposal For Capstone IDocument8 pagesTitle Proposal For Capstone IHikigaya HachimanNo ratings yet

- Problems On LiquidationDocument13 pagesProblems On LiquidationGrace Roque100% (2)

- B326 Accounting For Branches - Summer 2020Document14 pagesB326 Accounting For Branches - Summer 2020Kennedy OnyangoNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- Change or Die: Inside The Mind of A ConsultantDocument53 pagesChange or Die: Inside The Mind of A ConsultantAdamNo ratings yet

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanNo ratings yet

- Sap Fi Accounts ReceivableDocument70 pagesSap Fi Accounts ReceivableRinaldo PaulinoNo ratings yet

- Equity Valuation.Document70 pagesEquity Valuation.prashant1889No ratings yet

- Chapter 4 MISDocument17 pagesChapter 4 MISGetaneh AwokeNo ratings yet

- 07-ACCA-FA2-Chp 07Document28 pages07-ACCA-FA2-Chp 07SMS PrintingNo ratings yet

- FA1 Chapter 3 PDFDocument7 pagesFA1 Chapter 3 PDFPrincess ThaabeNo ratings yet

- P 1Document8 pagesP 1aneilrosethNo ratings yet

- Cpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsDocument14 pagesCpar Practical Accounting Ii Problems Oct 2010 Final Pre Board W SolutionsKyla MilanNo ratings yet

- Branch MemoDocument20 pagesBranch MemoDenzel Edward CariagaNo ratings yet

- Acctg 16a Final Exam AnswerDocument4 pagesAcctg 16a Final Exam AnswerLy JaimeNo ratings yet

- Below Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsDocument14 pagesBelow Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsQueen ValleNo ratings yet