Professional Documents

Culture Documents

RV in Singapore

RV in Singapore

Uploaded by

andyzpooperOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RV in Singapore

RV in Singapore

Uploaded by

andyzpooperCopyright:

Available Formats

Title: Relative Valuation in Singapore: Navigating Investment Opportunities in a Global Financial

Hub

Introduction:

Relative valuation serves as a fundamental method for assessing the value of assets or companies by

comparing them to similar benchmarks, playing a critical role in investment analysis in Singapore. As

one of the leading global financial hubs and a vibrant center for investment activity in Asia, Singapore

offers a dynamic and diverse market landscape for investors. Relative valuation is an indispensable

tool for navigating this market, providing insights into investment opportunities and aiding in

decision-making processes. This essay aims to explore the principles, methodologies, applications,

and significance of relative valuation in the context of Singapore, highlighting its importance in

investment analysis and financial decision-making.

Principles of Relative Valuation:

Relative valuation in Singapore is rooted in the principle of market efficiency, which posits that asset

prices reflect all available information and are determined by supply and demand dynamics. By

comparing the valuation multiples of a target asset to those of comparable assets or benchmarks

within the Singaporean market, investors can assess whether the asset is undervalued, overvalued, or

fairly valued relative to its peers. Common valuation metrics used in Singapore include the price-to-

earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio.

Methodologies of Relative Valuation:

Relative valuation in Singapore encompasses various methodologies tailored to its unique market

dynamics. Comparable companies analysis (CCA) is a prevalent approach, involving the

identification of comparable companies within the same industry or sector and analyzing their

valuation multiples to derive an appropriate valuation range for the target company. Similarly, the

comparable transactions analysis (CTA) compares the valuation multiples of recent M&A transactions

or private placements to assess the value of a similar asset or company. Other approaches include the

use of industry benchmarks, market indices, or historical valuation multiples to gauge the relative

attractiveness of an investment in Singapore.

Applications of Relative Valuation in Singapore:

Relative valuation finds widespread application in Singapore across various financial contexts,

including equity research, investment analysis, mergers and acquisitions (M&A), and corporate

finance decisions. In equity research and investment analysis, relative valuation offers a quick and

intuitive way to compare the valuation of Singaporean stocks, assess their relative attractiveness, and

identify potential investment opportunities. In M&A transactions, relative valuation aids acquirers and

sellers in evaluating deal terms, assessing the fairness of transaction prices, and negotiating favorable

terms. Moreover, in corporate finance decisions such as capital budgeting and investment allocation,

relative valuation assists companies in evaluating potential projects, assessing their relative value, and

effectively allocating capital in the Singaporean market.

Considerations and Limitations of Relative Valuation in Singapore:

While relative valuation is a valuable tool in financial analysis, it is subject to certain considerations

and limitations in the context of Singapore. One consideration is the availability and reliability of

data, as Singaporean companies may have different accounting standards, governance practices, and

reporting requirements compared to counterparts in other countries. Additionally, macroeconomic

factors, regulatory changes, and market sentiment may impact the comparability and reliability of

valuation multiples in Singapore. Moreover, relative valuation should be used in conjunction with

other valuation techniques and qualitative assessments to ensure a comprehensive and accurate

assessment of investment value in the Singaporean market.

Conclusion:

In conclusion, relative valuation plays a vital role in evaluating investment opportunities in Singapore,

a global financial hub in Asia. By comparing valuation multiples to those of similar assets or

benchmarks, relative valuation provides valuable insights into investment opportunities and assists

investors, analysts, and companies in making informed decisions. While relative valuation has its

considerations and limitations, it remains an indispensable tool in the financial toolkit, enabling

stakeholders to navigate the complexities of the Singaporean market and allocate capital effectively.

As Singapore continues to thrive as a leading financial center, relative valuation will remain essential

for unlocking value and identifying investment opportunities in this dynamic and thriving market.

You might also like

- Lobj19 - 0000055 CR 1907 02 A PDFDocument28 pagesLobj19 - 0000055 CR 1907 02 A PDFqqqNo ratings yet

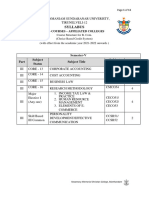

- Bab 3 Interim PaymentDocument23 pagesBab 3 Interim Paymentamyamirulali100% (2)

- Book Understanding Act Practice PDFDocument14 pagesBook Understanding Act Practice PDFLuisCarlos0% (3)

- Module 5 - Fundamental Principles of ValuationDocument55 pagesModule 5 - Fundamental Principles of ValuationTricia Angela Nicolas100% (1)

- CAF5-Financial Accounting and Reporting I - QuestionbankDocument216 pagesCAF5-Financial Accounting and Reporting I - QuestionbankSajid Ali100% (4)

- Chandrakant SampatDocument10 pagesChandrakant SampatskalidasNo ratings yet

- RV in ThailandDocument2 pagesRV in ThailandandyzpooperNo ratings yet

- RV in USADocument2 pagesRV in USAandyzpooperNo ratings yet

- Group 1 Relative Valuation PDFDocument4 pagesGroup 1 Relative Valuation PDFGiddel Ann Kristine VelasquezNo ratings yet

- RV in UKDocument2 pagesRV in UKandyzpooperNo ratings yet

- SG Chapter 5 Valuation Concepts and MethodologiesDocument11 pagesSG Chapter 5 Valuation Concepts and MethodologiesTACIPIT, Rowena Marie DizonNo ratings yet

- Capital MarketDocument12 pagesCapital MarketVarun MandalNo ratings yet

- Projec Report On Stock ValuationDocument42 pagesProjec Report On Stock Valuationshaikhmohib93No ratings yet

- Valuation Based On Securities PricesDocument4 pagesValuation Based On Securities PricesShiena Marie VillapandoNo ratings yet

- Equity Valuation Using Price Multiples Evidence FRDocument21 pagesEquity Valuation Using Price Multiples Evidence FRastri febiaNo ratings yet

- Finance ProjectDocument82 pagesFinance Projectvikas_rathour01No ratings yet

- Project Report On Portfolio Management Services-An Investment Option atDocument31 pagesProject Report On Portfolio Management Services-An Investment Option atsurya4searchNo ratings yet

- A Study On Risk and Return Analysis With Special References To Reliance CapitalDocument15 pagesA Study On Risk and Return Analysis With Special References To Reliance CapitalManoj MondalNo ratings yet

- Corporate ValuationDocument23 pagesCorporate ValuationRakesh GuptaNo ratings yet

- Literature Review of Performance Evaluation of Mutual FundDocument8 pagesLiterature Review of Performance Evaluation of Mutual FundafdtsadhrNo ratings yet

- PEIGG Valuation Guidelines - Final Version - 1Document14 pagesPEIGG Valuation Guidelines - Final Version - 1cjende1No ratings yet

- What Is Valuation?Document14 pagesWhat Is Valuation?aswinvignesh38No ratings yet

- The Integration of Fundamental and Technical Analysis in Predicting The Stock PriceDocument10 pagesThe Integration of Fundamental and Technical Analysis in Predicting The Stock PriceMarwiyahNo ratings yet

- Valuation Matters The Complete Guide to Company Valuation TechniquesFrom EverandValuation Matters The Complete Guide to Company Valuation TechniquesNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationPulkitAgrawalNo ratings yet

- Equity Research and AnalysisDocument60 pagesEquity Research and AnalysisSmit VyasNo ratings yet

- What Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMDocument4 pagesWhat Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMRohit BajpaiNo ratings yet

- Financial Statement AnalysisDocument17 pagesFinancial Statement Analysisshrinidhisenthil2001No ratings yet

- Three Valuation Methods Income Approach (Intrinsic Value or DCF Analysis)Document3 pagesThree Valuation Methods Income Approach (Intrinsic Value or DCF Analysis)Eilyn Serelia WidodoNo ratings yet

- Chapter Six 6. Asset Valuation For Financial Reporting Contents of ChapterDocument6 pagesChapter Six 6. Asset Valuation For Financial Reporting Contents of Chaptergetahunb97No ratings yet

- Review Literature Investment PatternDocument6 pagesReview Literature Investment Patternafmzsgbmgwtfoh100% (1)

- Intro To ValuationDocument6 pagesIntro To ValuationDEVERLYN SAQUIDONo ratings yet

- Analysis of Financial Statements of Reliance Industries LimitedDocument2 pagesAnalysis of Financial Statements of Reliance Industries LimitedAnkit VermaNo ratings yet

- Basics of Financial AnalysisDocument17 pagesBasics of Financial AnalysisRy De VeraNo ratings yet

- Determinants of Price Earnings Ration in The Indian Corporate SectorDocument74 pagesDeterminants of Price Earnings Ration in The Indian Corporate SectorRikesh DaliyaNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Mutual Funds - Research Papers Reviews: Nihil Agrawal & Salil Aryan 19021141073 - 19021141097Document8 pagesMutual Funds - Research Papers Reviews: Nihil Agrawal & Salil Aryan 19021141073 - 19021141097Salil AryanNo ratings yet

- Chapter 8 - Summary - Fundamanental of Corporate FinanceDocument2 pagesChapter 8 - Summary - Fundamanental of Corporate Financelethuytinh705No ratings yet

- Fundamental Analyses Vs Technical AnalysesDocument91 pagesFundamental Analyses Vs Technical AnalysesNilesh PandeyNo ratings yet

- SAPM1Document5 pagesSAPM1Shaan MahendraNo ratings yet

- Black BookDocument136 pagesBlack BookDeepak YadavNo ratings yet

- Basic Finance ConecptDocument6 pagesBasic Finance ConecptmwlwajiNo ratings yet

- AFA Chapter SixDocument8 pagesAFA Chapter SixSalih AkadarNo ratings yet

- Study The Relationship Between Financial Ratios and Profitability To Market Value of Companies Listed On The Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryDocument12 pagesStudy The Relationship Between Financial Ratios and Profitability To Market Value of Companies Listed On The Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Basic Valuation Concept: M.M.M (SEM - II) 2011-2014. Subject: Financial Management Prof. Arun D. ChandaranaDocument20 pagesBasic Valuation Concept: M.M.M (SEM - II) 2011-2014. Subject: Financial Management Prof. Arun D. ChandaranaVenky PragadaNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Project of Pe RatioDocument9 pagesProject of Pe RatioAshit SharmaNo ratings yet

- Module 4 Corporate ValuationDocument6 pagesModule 4 Corporate ValuationYounus ahmedNo ratings yet

- Roots Industries India LimitedDocument12 pagesRoots Industries India LimitedNandha Kumar100% (2)

- What Is ValuationDocument15 pagesWhat Is ValuationAli SengerNo ratings yet

- Top 50 Report-Malaysian BrandsDocument28 pagesTop 50 Report-Malaysian Brandsfrancistsy100% (1)

- TP MicroeconomicsDocument1 pageTP Microeconomicsjohn johnNo ratings yet

- Note On Precedent TransactionsDocument2 pagesNote On Precedent TransactionsTamim HasanNo ratings yet

- Executive SummaryDocument63 pagesExecutive SummarymaisamNo ratings yet

- The Impact of IFRS On Value Relevance of AccountingDocument6 pagesThe Impact of IFRS On Value Relevance of AccountingSarah Yasmin Mat YasinNo ratings yet

- Chapter - 1 Introduction: 1.1 Background of The StudyDocument78 pagesChapter - 1 Introduction: 1.1 Background of The StudyPRIYA RANANo ratings yet

- Portfolio Management CH 3Document11 pagesPortfolio Management CH 3Prakash KumarNo ratings yet

- The Investment Attractiveness EvaluDocument7 pagesThe Investment Attractiveness Evalusarahfhd7rbiNo ratings yet

- Performance Evaluation of RONIN Petroleum Through Trend Percentage Research DesignDocument36 pagesPerformance Evaluation of RONIN Petroleum Through Trend Percentage Research DesignRayan ShamsadenNo ratings yet

- The Power of Charts: Using Technical Analysis to Predict Stock Price MovementsFrom EverandThe Power of Charts: Using Technical Analysis to Predict Stock Price MovementsNo ratings yet

- Comparative Analysis of Same Sized IT Companies Based On Their Business ValuationDocument5 pagesComparative Analysis of Same Sized IT Companies Based On Their Business ValuationVarsha BhatiaNo ratings yet

- VCM NotesDocument4 pagesVCM NotesMendoza, Kristine Joyce M.No ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 5Document6 pagesBUS 5111 - Financial Management - Written Assignment Unit 5LaVida LocaNo ratings yet

- Module 5Document18 pagesModule 5Midhun George VargheseNo ratings yet

- Fundamental Analysis Principles, Types, and How To Use It $$$$$Document8 pagesFundamental Analysis Principles, Types, and How To Use It $$$$$ACC200 MNo ratings yet

- Notes Lecture IIDocument2 pagesNotes Lecture IICigdemSahinNo ratings yet

- NMCCDocument13 pagesNMCCMaddyNo ratings yet

- Investment ProcessDocument3 pagesInvestment Processq2boby100% (4)

- FM Final ReviewerDocument42 pagesFM Final ReviewerMaryJaneNo ratings yet

- Chapter-13 Preparation of Final Accounts of Sole Proprietors PDFDocument20 pagesChapter-13 Preparation of Final Accounts of Sole Proprietors PDFTarushi Yadav , 51BNo ratings yet

- Concepts in A VC TransactionDocument2 pagesConcepts in A VC TransactionStartup Tool KitNo ratings yet

- EY Tangible Fixed Assets ValuationDocument4 pagesEY Tangible Fixed Assets ValuationBagus Deddy AndriNo ratings yet

- FICA RelatedDocument14 pagesFICA RelatedAJNo ratings yet

- End of The Chapter 07 Question AnswersDocument10 pagesEnd of The Chapter 07 Question AnswersInsanity Workout Shaun TNo ratings yet

- AERA Draft Tariff GuidelinesDocument172 pagesAERA Draft Tariff Guidelineshorse123123No ratings yet

- Unit 4 IAPM FM 01Document42 pagesUnit 4 IAPM FM 01areumkim261No ratings yet

- Case Study Practice Exam Answers - StrategicDocument6 pagesCase Study Practice Exam Answers - StrategicPradeepNo ratings yet

- Syllabus MBA (General) Two Years Full Time Programme: M.J.P. Rohilkhand UniversityDocument31 pagesSyllabus MBA (General) Two Years Full Time Programme: M.J.P. Rohilkhand UniversityMalay PatelNo ratings yet

- Pertemuan 6 - Financial AnalysisDocument35 pagesPertemuan 6 - Financial Analysisdyah ayu kusuma wardhaniNo ratings yet

- Ic-Mineval: Software For The Financial Evaluation of Mineral DepositsDocument67 pagesIc-Mineval: Software For The Financial Evaluation of Mineral DepositstamanimoNo ratings yet

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezNo ratings yet

- JNTUH MBA R17 III Semester SyllabusDocument16 pagesJNTUH MBA R17 III Semester SyllabusNandhiniNo ratings yet

- MAlongDocument253 pagesMAlongerikchoisyNo ratings yet

- Ca Pranav Darvekar: Career ConspectusDocument4 pagesCa Pranav Darvekar: Career Conspectuspranavdarvekar100% (2)

- Company Update: Hyundai E&CDocument11 pagesCompany Update: Hyundai E&CAnant JadhavNo ratings yet

- Intangible AssetsDocument26 pagesIntangible Assetslee jong suk100% (1)

- SAB 107 SEC Share Based PaymentsDocument64 pagesSAB 107 SEC Share Based PaymentsAlycia SkousenNo ratings yet

- Seminar 2 FS Audit - InstructorDocument64 pagesSeminar 2 FS Audit - InstructorLIAW ANN YINo ratings yet

- BBA SyllabusDocument8 pagesBBA SyllabussmartculboflacmNo ratings yet

- 1 CFAP Syllabus Summer 2021Document17 pages1 CFAP Syllabus Summer 2021minhaj farooquiNo ratings yet