Professional Documents

Culture Documents

Stocks

Stocks

Uploaded by

HELTONRGS54980 ratings0% found this document useful (0 votes)

1 views22 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views22 pagesStocks

Stocks

Uploaded by

HELTONRGS5498Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 22

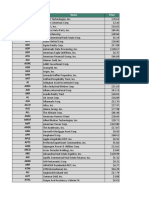

cod Company Name Stock Price Industry

BWLP BW LPG Limited 14.93 -

WPP WPP plc 51.03 Advertising Agencies

DLX Deluxe Corporation 21.23 Advertising Agencies

TSQ Townsquare Media, Inc. 12.47 Advertising Agencies

EVC Entravision Communications Corporation 2.15 Advertising Agencies

UAN CVR Partners, LP 79.26 Agricultural Inputs

SAVE Spirit Airlines, Inc. 3.76 Airlines

PAC Grupo Aeroportuario del Pacífico, SAB de CV 182.95 Airports & Air Services

JRSH Jerash Holdings (US), Inc. 3.13 Apparel Manufacturing

CATO The Cato Corporation 4.88 Apparel Retail

MAIN Main Street Capital Corporation 50.28 Asset Management

AB AllianceBernstein Holding L.P. 33.18 Asset Management

JHG Janus Henderson Group plc 32.64 Asset Management

TYG Tortoise Energy Infrastructure Corporation 31.34 Asset Management

CSWC Capital Southwest Corporation 26.10 Asset Management

SAR Saratoga Investment Corp. 23.67 Asset Management

BEN Franklin Resources, Inc. 23.27 Asset Management

LRFC Logan Ridge Finance Corporation 22.24 Asset Management

GLAD Gladstone Capital Corporation 21.36 Asset Management

TSLX Sixth Street Specialty Lending, Inc. 20.95 Asset Management

ARCC Ares Capital Corporation 20.58 Asset Management

FDUS Fidus Investment Corporation 20.05 Asset Management

HTGC Hercules Capital, Inc. 19.56 Asset Management

PTMN Portman Ridge Finance Corporation 19.54 Asset Management

FSK FS KKR Capital Corp. 19.20 Asset Management

BANX ArrowMark Financial Corp. 18.45 Asset Management

CCAP Crescent Capital BDC, Inc. 17.46 Asset Management

CGBD Carlyle Secured Lending, Inc. 17.22 Asset Management

GBDC Golub Capital BDC, Inc. 16.86 Asset Management

BCSF Bain Capital Specialty Finance, Inc. 16.68 Asset Management

GSBD Goldman Sachs BDC, Inc. 15.54 Asset Management

SLRC SLR Investment Corp. 15.47 Asset Management

MFIC MidCap Financial Investment Corporation 15.25 Asset Management

IVZ Invesco Ltd. 14.80 Asset Management

SAMG Silvercrest Asset Management Group Inc. 14.67 Asset Management

TRIN Trinity Capital Inc. 14.63 Asset Management

GAIN Gladstone Investment Corporation 14.30 Asset Management

SCM Stellus Capital Investment Corporation 14.07 Asset Management

RAND Rand Capital Corporation 14.04 Asset Management

WHF WhiteHorse Finance, Inc. 12.89 Asset Management

PAX Patria Investments Limited 12.85 Asset Management

WHG Westwood Holdings Group, Inc. 12.09 Asset Management

HRZN Horizon Technology Finance Corporation 11.90 Asset Management

CION CION Investment Corporation 11.64 Asset Management

PFLT PennantPark Floating Rate Capital Ltd. 11.40 Asset Management

VINP Vinci Partners Investments Ltd. 10.70 Asset Management

TCPC BlackRock TCP Capital Corp. 10.35 Asset Management

GECC Great Elm Capital Corp. 10.27 Asset Management

OFS OFS Capital Corporation 9.49 Asset Management

BBDC Barings BDC, Inc. 9.48 Asset Management

TPVG TriplePoint Venture Growth BDC Corp. 9.21 Asset Management

MRCC Monroe Capital Corporation 7.29 Asset Management

PNNT PennantPark Investment Corporation 7.08 Asset Management

BRDG Bridge Investment Group Holdings Inc. 6.94 Asset Management

HNNA Hennessy Advisors, Inc. 6.92 Asset Management

EARN Ellington Residential Mortgage REIT 6.85 Asset Management

PSEC Prospect Capital Corporation 5.24 Asset Management

ICMB Investcorp Credit Management BDC, Inc. 3.30 Asset Management

OXSQ Oxford Square Capital Corp. 3.16 Asset Management

STLA Stellantis N.V. 21.88 Auto Manufacturers

PLOW Douglas Dynamics, Inc. 23.17 Auto Parts

BMO Bank of Montreal 90.63 Banks - Diversified

TD The Toronto-Dominion Bank 55.51 Banks - Diversified

CM Canadian Imperial Bank of Commerce 47.86 Banks - Diversified

BNS The Bank of Nova Scotia 46.79 Banks - Diversified

HSBC HSBC Holdings plc 44.55 Banks - Diversified

NTB The Bank of N.T. Butterfield & Son Limited 35.26 Banks - Diversified

ING ING Groep N.V. 17.14 Banks - Diversified

BBVA Banco Bilbao Vizcaya Argentaria, S.A. 10.49 Banks - Diversified

BOH Bank of Hawaii Corporation 58.50 Banks - Regional

CMA Comerica Incorporated 52.94 Banks - Regional

NRIM Northrim BanCorp, Inc. 49.85 Banks - Regional

TMP Tompkins Financial Corporation 47.33 Banks - Regional

CZFS Citizens Financial Services, Inc. 43.00 Banks - Regional

USB U.S. Bancorp 41.33 Banks - Regional

TFC Truist Financial Corporation 38.85 Banks - Regional

THFF First Financial Corporation 37.38 Banks - Regional

CFG Citizens Financial Group, Inc. 35.37 Banks - Regional

CIB Bancolombia S.A. 33.75 Banks - Regional

CAC Camden National Corporation 32.39 Banks - Regional

WF Woori Financial Group Inc. 31.50 Banks - Regional

BLX Banco Latinoamericano de Comercio Exterior, 30.10 Banks - Regional

PEBO Peoples Bancorp Inc. 29.72 Banks - Regional

WSBC WesBanco, Inc. 28.40 Banks - Regional

TRST TrustCo Bank Corp NY 27.91 Banks - Regional

SBSI Southside Bancshares, Inc. 27.73 Banks - Regional

FIBK First Interstate BancSystem, Inc. 27.65 Banks - Regional

NKSH National Bankshares, Inc. 27.41 Banks - Regional

WASH Washington Trust Bancorp, Inc. 26.52 Banks - Regional

UNB Union Bankshares, Inc. 26.21 Banks - Regional

EVBN Evans Bancorp, Inc. 25.38 Banks - Regional

NWFL Norwood Financial Corp. 25.10 Banks - Regional

MSBI Midland States Bancorp, Inc. 23.77 Banks - Regional

PPBI Pacific Premier Bancorp, Inc. 23.04 Banks - Regional

FNLC The First Bancorp, Inc. 23.00 Banks - Regional

FCNCO First Citizens BancShares, Inc. 22.57 Banks - Regional

BCH Banco de Chile 22.54 Banks - Regional

SASR Sandy Spring Bancorp, Inc. 22.16 Banks - Regional

FHB First Hawaiian, Inc. 21.78 Banks - Regional

CPF Central Pacific Financial Corp. 20.70 Banks - Regional

PFC Premier Financial Corp. 20.64 Banks - Regional

EGBN Eagle Bancorp, Inc. 20.33 Banks - Regional

COLB Columbia Banking System, Inc. 20.00 Banks - Regional

RF Regions Financial Corporation 19.80 Banks - Regional

ATLO Ames National Corporation 19.62 Banks - Regional

DCOM Dime Community Bancshares, Inc. 19.48 Banks - Regional

HFWA Heritage Financial Corporation 19.19 Banks - Regional

PWOD Penns Woods Bancorp, Inc. 18.66 Banks - Regional

AUBN Auburn National Bancorporation, Inc. 18.27 Banks - Regional

SFNC Simmons First National Corporation 17.83 Banks - Regional

FISI Financial Institutions, Inc. 17.82 Banks - Regional

CZNC Citizens & Northern Corporation 17.79 Banks - Regional

WTBA West Bancorporation, Inc. 17.32 Banks - Regional

CVBF CVB Financial Corp. 17.16 Banks - Regional

HAFC Hanmi Financial Corporation 15.80 Banks - Regional

OCFC OceanFirst Financial Corp. 15.43 Banks - Regional

PFS Provident Financial Services, Inc. 15.41 Banks - Regional

PCB PCB Bancorp 15.40 Banks - Regional

BMRC Bank of Marin Bancorp 15.34 Banks - Regional

KEY KeyCorp 14.95 Banks - Regional

LCNB LCNB Corp. 14.50 Banks - Regional

TFSL TFS Financial Corporation 13.10 Banks - Regional

FMNB Farmers National Banc Corp. 12.48 Banks - Regional

HBNC Horizon Bancorp, Inc. 12.48 Banks - Regional

WSBF Waterstone Financial, Inc. 12.36 Banks - Regional

FFIC Flushing Financial Corporation 12.06 Banks - Regional

RMBI Richmond Mutual Bancorporation, Inc. 11.35 Banks - Regional

NEWT Newtek Business Services Corp. 11.21 Banks - Regional

FGBI First Guaranty Bancshares, Inc. 11.17 Banks - Regional

NWBI Northwest Bancshares, Inc. 11.00 Banks - Regional

HOPE Hope Bancorp, Inc. 10.74 Banks - Regional

FLIC The First of Long Island Corporation 10.16 Banks - Regional

BCBP BCB Bancorp, Inc. 9.73 Banks - Regional

OPBK OP Bancorp 9.70 Banks - Regional

SSBI Summit State Bank 9.39 Banks - Regional

NFBK Northfield Bancorp, Inc. (Staten Island, NY) 9.03 Banks - Regional

BRKL Brookline Bancorp, Inc. 8.88 Banks - Regional

MRBK Meridian Corporation 8.88 Banks - Regional

HTBK Heritage Commerce Corp 8.36 Banks - Regional

NWG NatWest Group plc 7.80 Banks - Regional

VLY Valley National Bancorp 7.70 Banks - Regional

UBFO United Security Bancshares 7.31 Banks - Regional

ITUB Itaú Unibanco Holding S.A. 6.38 Banks - Regional

BSBR Banco Santander (Brasil) S.A. 5.85 Banks - Regional

KRNY Kearny Financial Corp. 5.77 Banks - Regional

FNCB FNCB Bancorp, Inc. 5.65 Banks - Regional

GLBZ Glen Burnie Bancorp 5.17 Banks - Regional

CFFN Capitol Federal Financial, Inc. 5.04 Banks - Regional

RVSB Riverview Bancorp, Inc. 4.26 Banks - Regional

NYCB New York Community Bancorp, Inc. 3.57 Banks - Regional

KFFB Kentucky First Federal Bancorp 3.57 Banks - Regional

LYG Lloyds Banking Group plc 2.60 Banks - Regional

ASRV AmeriServ Financial, Inc. 2.46 Banks - Regional

AVAL Grupo Aval Acciones y Valores S.A. 2.40 Banks - Regional

ABEV Ambev S.A. 2.42 Beverages - Brewers

AKO.B Embotelladora Andina S.A. 18.21 Beverages - Non-Alcoholic

AKO.A Embotelladora Andina S.A. 13.57 Beverages - Non-Alcoholic

LENZ LENZ Therapeutics, Inc. 16.52 Biotechnology

GTN Gray Television, Inc. 6.50 Broadcasting

LOMA Loma Negra Compañía Industrial Argentina S 7.43 Building Materials

CPAC Cementos Pacasmayo S.A.A. 5.68 Building Materials

EBF Ennis, Inc. 20.20 Business Equipment & Supplies

ACCO ACCO Brands Corporation 4.95 Business Equipment & Supplies

MC Moelis & Company 51.71 Capital Markets

LAZ Lazard Ltd 38.62 Capital Markets

COHN Cohen & Company Inc. 6.48 Capital Markets

SRL Scully Royalty Ltd. 5.85 Capital Markets

DOW Dow Inc. 56.89 Chemicals

WLKP Westlake Chemical Partners LP 22.25 Chemicals

ARCH Arch Resources, Inc. 158.60 Coking Coal

METCB Ramaco Resources, Inc. 11.12 Coking Coal

ERIC Telefonaktiebolaget LM Ericsson (publ) 5.23 Communication Equipment

NOK Nokia Oyj 3.70 Communication Equipment

CLRO ClearOne, Inc. 1.04 Communication Equipment

MMM 3M Company 97.07 Conglomerates

CODI Compass Diversified 21.54 Conglomerates

CRESY Cresud S.A.C.I.F. y A. 9.75 Conglomerates

RGP Resources Connection, Inc. 11.10 Consulting Services

OMF OneMain Holdings, Inc. 51.24 Credit Services

QFIN Qifu Technology Inc. 19.48 Credit Services

OCSL Oaktree Specialty Lending Corporation 19.27 Credit Services

OBDC Blue Owl Capital Corporation 16.05 Credit Services

WU The Western Union Company 13.32 Credit Services

RWAY Runway Growth Finance Corp. 13.01 Credit Services

MFIN Medallion Financial Corp. 7.95 Credit Services

FINV FinVolution Group 5.02 Credit Services

XYF X Financial 3.87 Credit Services

LX LexinFintech Holdings Ltd. 1.81 Credit Services

KSS Kohl's Corporation 24.53 Department Stores

GILD Gilead Sciences, Inc. 64.72 Drug Manufacturers - General

BMY Bristol-Myers Squibb Company 43.94 Drug Manufacturers - General

PFE Pfizer Inc. 27.60 Drug Manufacturers - General

OGN Organon & Co. 20.16 Drug Manufacturers - General

TAK Takeda Pharmaceutical Company Limited 13.39 Drug Manufacturers - Specialty &

DSWL Deswell Industries, Inc. 2.35 Electronic Components

TAIT Taitron Components Incorporated 3.15 Electronics & Computer Distributio

SBGI Sinclair Broadcast Group, Inc. 13.25 Entertainment

LND BrasilAgro - Companhia Brasileira de Proprie 5.01 Farm Products

RILY B. Riley Financial, Inc. 31.97 Financial Conglomerates

WHR Whirlpool Corporation 95.36 Furnishings, Fixtures & Appliance

ETD Ethan Allen Interiors Inc. 29.52 Furnishings, Fixtures & Appliance

HOFT Hooker Furnishings Corporation 17.68 Furnishings, Fixtures & Appliance

LEG Leggett & Platt, Incorporated 14.03 Furnishings, Fixtures & Appliance

BSET Bassett Furniture Industries, Incorporated 13.80 Furnishings, Fixtures & Appliance

CRWS Crown Crafts, Inc. 5.07 Furnishings, Fixtures & Appliance

CMCL Caledonia Mining Corporation Plc 9.85 Gold

DRD DRDGOLD Limited 7.85 Gold

SBSW Sibanye Stillwater Limited 4.64 Gold

BTG B2Gold Corp. 2.51 Gold

SPOK Spok Holdings, Inc. 14.52 Health Information Services

CVS CVS Health Corporation 55.25 Healthcare Plans

NUS Nu Skin Enterprises, Inc. 12.14 Household & Personal Products

XRX Xerox Holdings Corporation 13.48 Information Technology Services

TTEC TTEC Holdings, Inc. 7.66 Information Technology Services

III Information Services Group, Inc. 3.37 Information Technology Services

PRU Prudential Financial, Inc. 111.89 Insurance - Life

LNC Lincoln National Corporation 27.88 Insurance - Life

MFC Manulife Financial Corporation 23.98 Insurance - Life

DGICA Donegal Group Inc. 13.53 Insurance - Property & Casualty

DGICB Donegal Group Inc. 13.27 Insurance - Property & Casualty

OPRA Opera Limited 13.64 Internet Content & Information

MOMO Hello Group Inc. 6.04 Internet Content & Information

NHTC Natural Health Trends Corp. 6.95 Internet Retail

MOV Movado Group, Inc. 26.05 Luxury Goods

ESEA Euroseas Ltd. 35.61 Marine Shipping

ECO Okeanis Eco Tankers Corp. 31.75 Marine Shipping

SBLK Star Bulk Carriers Corp. 24.82 Marine Shipping

ASC Ardmore Shipping Corporation 17.19 Marine Shipping

GRIN Grindrod Shipping Holdings Ltd. 13.87 Marine Shipping

SFL SFL Corporation Ltd. 13.62 Marine Shipping

HAFN Hafnia Limited 7.87 Marine Shipping

PANL Pangaea Logistics Solutions, Ltd. 7.30 Marine Shipping

NAT Nordic American Tankers Limited 3.97 Marine Shipping

DSX Diana Shipping Inc. 3.03 Marine Shipping

USEA United Maritime Corporation 2.47 Marine Shipping

EMBC Embecta Corp. 10.24 Medical Instruments & Supplies

HIHO Highway Holdings Limited 2.05 Metal Fabrication

GHI Greystone Housing Impact Investors LP 15.70 Mortgage Finance

UWMC UWM Holdings Corporation 6.82 Mortgage Finance

KGS Kodiak Gas Services, Inc. 27.43 Oil & Gas Equipment & Services

USAC USA Compression Partners, LP 24.50 Oil & Gas Equipment & Services

SOI Solaris Oilfield Infrastructure, Inc. 9.06 Oil & Gas Equipment & Services

CIVI Civitas Resources, Inc. 74.18 Oil & Gas Exploration & Productio

SBR Sabine Royalty Trust 64.10 Oil & Gas Exploration & Productio

DMLP Dorchester Minerals, L.P. 31.56 Oil & Gas Exploration & Productio

REPX Riley Exploration Permian, Inc. 24.87 Oil & Gas Exploration & Productio

STR Sitio Royalties Corp. 22.90 Oil & Gas Exploration & Productio

VTS Vitesse Energy, Inc. 22.34 Oil & Gas Exploration & Productio

TXO TXO Partners L.P. 18.28 Oil & Gas Exploration & Productio

WDS Woodside Energy Group Ltd 17.96 Oil & Gas Exploration & Productio

BSM Black Stone Minerals, L.P. 16.32 Oil & Gas Exploration & Productio

KRP Kimbell Royalty Partners, LP 16.04 Oil & Gas Exploration & Productio

DEC Diversified Energy Company PLC 13.42 Oil & Gas Exploration & Productio

CRT Cross Timbers Royalty Trust 13.22 Oil & Gas Exploration & Productio

CRK Comstock Resources, Inc. 9.96 Oil & Gas Exploration & Productio

GPRK GeoPark Limited 9.42 Oil & Gas Exploration & Productio

MTR Mesa Royalty Trust 8.69 Oil & Gas Exploration & Productio

NRT North European Oil Royalty Trust 8.01 Oil & Gas Exploration & Productio

BRY Berry Corporation 7.94 Oil & Gas Exploration & Productio

GRNT Granite Ridge Resources, Inc 6.42 Oil & Gas Exploration & Productio

VOC VOC Energy Trust 5.76 Oil & Gas Exploration & Productio

EPM Evolution Petroleum Corporation 5.61 Oil & Gas Exploration & Productio

EPSN Epsilon Energy Ltd. 5.35 Oil & Gas Exploration & Productio

SJT San Juan Basin Royalty Trust 4.25 Oil & Gas Exploration & Productio

PRT PermRock Royalty Trust 4.04 Oil & Gas Exploration & Productio

PVL Permianville Royalty Trust 1.46 Oil & Gas Exploration & Productio

E Eni S.p.A. 31.69 Oil & Gas Integrated

EQNR Equinor ASA 27.26 Oil & Gas Integrated

PBR Petróleo Brasileiro S.A. - Petrobras 16.47 Oil & Gas Integrated

PBR.A Petróleo Brasileiro S.A. - Petrobras 15.71 Oil & Gas Integrated

EC Ecopetrol S.A. 11.55 Oil & Gas Integrated

OKE ONEOK, Inc. 76.73 Oil & Gas Midstream

DTM DT Midstream, Inc. 62.76 Oil & Gas Midstream

INSW International Seaways, Inc. 55.93 Oil & Gas Midstream

CQP Cheniere Energy Partners, L.P. 49.85 Oil & Gas Midstream

GLP Global Partners LP 47.51 Oil & Gas Midstream

LPG Dorian LPG Ltd. 42.55 Oil & Gas Midstream

MPLX MPLX LP 40.98 Oil & Gas Midstream

WMB The Williams Companies, Inc. 38.66 Oil & Gas Midstream

KNTK Kinetik Holdings Inc. 38.24 Oil & Gas Midstream

TRP TC Energy Corporation 37.52 Oil & Gas Midstream

VNOM Viper Energy Partners LP 37.20 Oil & Gas Midstream

ENB Enbridge Inc. 36.55 Oil & Gas Midstream

PBA Pembina Pipeline Corporation 35.60 Oil & Gas Midstream

WES Western Midstream Partners, LP 35.52 Oil & Gas Midstream

TRMD TORM plc 34.83 Oil & Gas Midstream

HESM Hess Midstream LP 33.99 Oil & Gas Midstream

EPD Enterprise Products Partners L.P. 28.02 Oil & Gas Midstream

FLNG FLEX LNG Ltd. 26.45 Oil & Gas Midstream

FRO Frontline Ltd. 24.67 Oil & Gas Midstream

NS NuStar Energy L.P. 21.96 Oil & Gas Midstream

KMI Kinder Morgan, Inc. 18.49 Oil & Gas Midstream

PAGP Plains GP Holdings, L.P. 18.47 Oil & Gas Midstream

PAA Plains All American Pipeline, L.P. 17.52 Oil & Gas Midstream

EURN Euronav NV 16.95 Oil & Gas Midstream

ET Energy Transfer LP 15.98 Oil & Gas Midstream

AM Antero Midstream Corporation 14.12 Oil & Gas Midstream

GEL Genesis Energy, L.P. 12.48 Oil & Gas Midstream

PBT Permian Basin Royalty Trust 11.75 Oil & Gas Midstream

DHT DHT Holdings, Inc. 11.68 Oil & Gas Midstream

CLCO Cool Company Ltd. 11.14 Oil & Gas Midstream

MARPS Marine Petroleum Trust 4.15 Oil & Gas Midstream

SUN Sunoco LP 56.04 Oil & Gas Refining & Marketing

DKL Delek Logistics Partners, LP 39.45 Oil & Gas Refining & Marketing

CVI CVR Energy, Inc. 29.29 Oil & Gas Refining & Marketing

CAPL CrossAmerica Partners LP 22.30 Oil & Gas Refining & Marketing

IEP Icahn Enterprises L.P. 17.39 Oil & Gas Refining & Marketing

CSAN Cosan S.A. 11.59 Oil & Gas Refining & Marketing

SGU Star Group, L.P. 11.25 Oil & Gas Refining & Marketing

RIO Rio Tinto Group 68.76 Other Industrial Metals & Mining

BHP BHP Group Limited 56.38 Other Industrial Metals & Mining

CMP Compass Minerals International, Inc. 12.59 Other Industrial Metals & Mining

VALE Vale S.A. 12.53 Other Industrial Metals & Mining

BGS B&G Foods, Inc. 11.35 Packaged Foods

GEF.B Greif, Inc. 63.75 Packaging & Containers

IP International Paper Company 35.84 Packaging & Containers

AMCR Amcor plc 9.92 Packaging & Containers

AMBP Ardagh Metal Packaging S.A. 3.96 Packaging & Containers

MED Medifast, Inc. 25.42 Personal Services

WBA Walgreens Boots Alliance, Inc. 17.86 Pharmaceutical Retailers

PETS PetMed Express, Inc. 3.98 Pharmaceutical Retailers

DALN DallasNews Corporation 3.73 Publishing

RMR The RMR Group Inc. 24.21 Real Estate Services

IRS IRSA Inversiones y Representaciones SA 9.82 Real Estate Services

KW Kennedy-Wilson Holdings, Inc. 8.75 Real Estate Services

RMAX RE/MAX Holdings, Inc. 7.87 Real Estate Services

WPC W. P. Carey Inc. 56.53 REIT - Diversified

VICI VICI Properties Inc. 28.79 REIT - Diversified

OLP One Liberty Properties, Inc. 23.12 REIT - Diversified

AAT American Assets Trust, Inc. 21.30 REIT - Diversified

CTO CTO Realty Growth, Inc. 17.18 REIT - Diversified

BNL Broadstone Net Lease, Inc. 15.15 REIT - Diversified

MDV Modiv Inc. 15.00 REIT - Diversified

GOOD Gladstone Commercial Corporation 13.62 REIT - Diversified

AHH Armada Hoffler Properties, Inc. 10.81 REIT - Diversified

GNL Global Net Lease, Inc. 7.18 REIT - Diversified

GIPR Generation Income Properties, Inc. 3.78 REIT - Diversified

SQFT Presidio Property Trust, Inc. 0.84 REIT - Diversified

NHI National Health Investors, Inc. 64.08 REIT - Healthcare Facilities

UHT Universal Health Realty Income Trust 36.52 REIT - Healthcare Facilities

LTC LTC Properties, Inc. 33.40 REIT - Healthcare Facilities

OHI Omega Healthcare Investors, Inc. 30.96 REIT - Healthcare Facilities

CTRE CareTrust REIT, Inc. 24.93 REIT - Healthcare Facilities

CHCT Community Healthcare Trust Incorporated 24.63 REIT - Healthcare Facilities

DOC Healthpeak Properties, Inc. 18.98 REIT - Healthcare Facilities

HR Healthcare Realty Trust Incorporated 14.77 REIT - Healthcare Facilities

SBRA Sabra Health Care REIT, Inc. 14.19 REIT - Healthcare Facilities

STRW Strawberry Fields REIT LLC 9.58 REIT - Healthcare Facilities

GMRE Global Medical REIT Inc. 8.39 REIT - Healthcare Facilities

MPW Medical Properties Trust, Inc. 4.96 REIT - Healthcare Facilities

PK Park Hotels & Resorts Inc. 16.22 REIT - Hotel & Motel

APLE Apple Hospitality REIT, Inc. 14.71 REIT - Hotel & Motel

SVC Service Properties Trust 6.11 REIT - Hotel & Motel

BHR Braemar Hotels & Resorts Inc. 2.58 REIT - Hotel & Motel

IIPR Innovative Industrial Properties, Inc. 107.44 REIT - Industrial

CUBE CubeSmart 41.85 REIT - Industrial

NSA National Storage Affiliates Trust 36.04 REIT - Industrial

PLYM Plymouth Industrial REIT, Inc. 20.53 REIT - Industrial

LXP LXP Industrial Trust 8.70 REIT - Industrial

SELF Global Self Storage, Inc. 4.20 REIT - Industrial

STWD Starwood Property Trust, Inc. 19.47 REIT - Mortgage

NLY Annaly Capital Management, Inc. 19.34 REIT - Mortgage

ARR ARMOUR Residential REIT, Inc. 19.06 REIT - Mortgage

BXMT Blackstone Mortgage Trust, Inc. 18.07 REIT - Mortgage

REFI Chicago Atlantic Real Estate Finance, Inc. 15.97 REIT - Mortgage

PMT PennyMac Mortgage Investment Trust 14.62 REIT - Mortgage

NREF NexPoint Real Estate Finance, Inc. 13.12 REIT - Mortgage

TWO Two Harbors Investment Corp. 13.01 REIT - Mortgage

FBRT Franklin BSP Realty Trust, Inc. 12.85 REIT - Mortgage

SEVN Seven Hills Realty Trust 12.84 REIT - Mortgage

ABR Arbor Realty Trust, Inc. 12.80 REIT - Mortgage

DX Dynex Capital, Inc. 12.04 REIT - Mortgage

EFC Ellington Financial Inc. 11.68 REIT - Mortgage

RITM Rithm Capital Corp. 11.36 REIT - Mortgage

AOMR Angel Oak Mortgage, Inc. 11.22 REIT - Mortgage

LADR Ladder Capital Corp 11.04 REIT - Mortgage

MFA MFA Financial, Inc. 10.98 REIT - Mortgage

ARI Apollo Commercial Real Estate Finance, Inc. 10.10 REIT - Mortgage

KREF KKR Real Estate Finance Trust Inc. 9.73 REIT - Mortgage

AGNC AGNC Investment Corp. 9.39 REIT - Mortgage

CMTG Claros Mortgage Trust, Inc. 9.20 REIT - Mortgage

IVR Invesco Mortgage Capital Inc. 9.08 REIT - Mortgage

RC Ready Capital Corporation 8.64 REIT - Mortgage

ORC Orchid Island Capital, Inc. 8.55 REIT - Mortgage

TRTX TPG RE Finance Trust, Inc. 8.44 REIT - Mortgage

ACRE Ares Commercial Real Estate Corporation 6.92 REIT - Mortgage

RWT Redwood Trust, Inc. 6.34 REIT - Mortgage

MITT AG Mortgage Investment Trust, Inc. 6.27 REIT - Mortgage

NYMT New York Mortgage Trust, Inc. 6.13 REIT - Mortgage

BRSP BrightSpire Capital, Inc. 6.06 REIT - Mortgage

LOAN Manhattan Bridge Capital, Inc. 5.05 REIT - Mortgage

GPMT Granite Point Mortgage Trust Inc. 4.42 REIT - Mortgage

CIM Chimera Investment Corporation 4.33 REIT - Mortgage

AJX Great Ajax Corp. 3.70 REIT - Mortgage

CHMI Cherry Hill Mortgage Investment Corporation 3.51 REIT - Mortgage

SACH Sachem Capital Corp. 3.25 REIT - Mortgage

LFT Lument Finance Trust, Inc. 2.31 REIT - Mortgage

BXP Boston Properties, Inc. 60.60 REIT - Office

SLG SL Green Realty Corp. 51.93 REIT - Office

KRC Kilroy Realty Corporation 33.86 REIT - Office

HIW Highwoods Properties, Inc. 26.72 REIT - Office

CDP COPT Defense Properties 24.61 REIT - Office

CUZ Cousins Properties Incorporated 23.38 REIT - Office

JBGS JBG SMITH Properties 14.88 REIT - Office

PSTL Postal Realty Trust, Inc. 13.86 REIT - Office

DEI Douglas Emmett, Inc. 13.81 REIT - Office

DEA Easterly Government Properties, Inc. 11.96 REIT - Office

PDM Piedmont Office Realty Trust, Inc. 6.87 REIT - Office

CIO City Office REIT, Inc. 4.87 REIT - Office

BDN Brandywine Realty Trust 4.72 REIT - Office

ONL Orion Office REIT Inc. 3.47 REIT - Office

CMCT Creative Media & Community Trust Corporati 3.07 REIT - Office

AIRC Apartment Income REIT Corp. 38.51 REIT - Residential

NXRT NexPoint Residential Trust, Inc. 34.61 REIT - Residential

BRT BRT Apartments Corp. 18.50 REIT - Residential

UMH UMH Properties, Inc. 15.56 REIT - Residential

ELME Elme Communities 15.17 REIT - Residential

CLPR Clipper Realty Inc. 4.16 REIT - Residential

ALX Alexander's, Inc. 216.43 REIT - Retail

SPG Simon Property Group, Inc. 142.14 REIT - Retail

ADC Agree Realty Corporation 58.22 REIT - Retail

O Realty Income Corporation 55.17 REIT - Retail

NNN NNN REIT Inc 41.49 REIT - Retail

BFS Saul Centers, Inc. 36.57 REIT - Retail

GTY Getty Realty Corp. 27.68 REIT - Retail

FCPT Four Corners Property Trust, Inc. 24.07 REIT - Retail

BRX Brixmor Property Group Inc. 22.19 REIT - Retail

CBL CBL & Associates Properties, Inc. 21.76 REIT - Retail

KRG Kite Realty Group Trust 21.04 REIT - Retail

KIM Kimco Realty Corporation 18.95 REIT - Retail

NTST NETSTREIT Corp. 17.17 REIT - Retail

ALEX Alexander & Baldwin, Inc. 16.40 REIT - Retail

PINE Alpine Income Property Trust, Inc. 15.23 REIT - Retail

MAC The Macerich Company 13.88 REIT - Retail

ROIC Retail Opportunity Investments Corp. 12.35 REIT - Retail

CCI Crown Castle Inc. 97.27 REIT - Specialty

GLPI Gaming and Leisure Properties, Inc. 43.22 REIT - Specialty

EPR EPR Properties 42.08 REIT - Specialty

HASI Hannon Armstrong Sustainable Infrastructure C 25.53 REIT - Specialty

OUT Outfront Media Inc. 14.94 REIT - Specialty

AFCG AFC Gamma, Inc. 12.10 REIT - Specialty

UNIT Uniti Group Inc. 5.00 REIT - Specialty

GSL Global Ship Lease, Inc. 23.20 Rental & Leasing Services

ALTG Alta Equipment Group Inc. 11.63 Rental & Leasing Services

AAN The Aaron's Company, Inc. 6.89 Rental & Leasing Services

CBRL Cracker Barrel Old Country Store, Inc. 57.17 Restaurants

DIN Dine Brands Global, Inc. 43.97 Restaurants

WEN The Wendy's Company 19.81 Restaurants

ARKR Ark Restaurants Corp. 13.82 Restaurants

FAT FAT Brands Inc. 7.41 Restaurants

FATBB FAT Brands Inc. 6.00 Restaurants

NVEC NVE Corporation 79.66 Semiconductors

IMOS ChipMOS TECHNOLOGIES INC. 28.17 Semiconductors

ASX ASE Technology Holding Co., Ltd. 10.50 Semiconductors

UMC United Microelectronics Corporation 8.09 Semiconductors

HIMX Himax Technologies, Inc. 5.15 Semiconductors

UPBD Upbound Group, Inc. 30.64 Software - Application

MNDO MIND C.T.I. Ltd 1.88 Software - Application

KSPI Kaspi.kz JSC 119.19 Software - Infrastructure

ARC ARC Document Solutions, Inc. 2.70 Specialty Business Services

NTIP Network-1 Technologies, Inc. 1.93 Specialty Business Services

LYB LyondellBasell Industries N.V. 99.13 Specialty Chemicals

KRO Kronos Worldwide, Inc. 11.92 Specialty Chemicals

SSL Sasol Limited 7.05 Specialty Chemicals

FSI Flexible Solutions International, Inc. 2.10 Specialty Chemicals

BBY Best Buy Co., Inc. 73.93 Specialty Retail

BWMX Betterware de México, S.A.P.I. de C.V. 16.90 Specialty Retail

BGFV Big 5 Sporting Goods Corporation 3.38 Specialty Retail

BGSF BGSF, Inc. 8.78 Staffing & Employment Services

TX Ternium S.A. 40.39 Steel

MSB Mesabi Trust 16.63 Steel

GGB Gerdau S.A. 3.85 Steel

SID Companhia Siderúrgica Nacional 2.83 Steel

CCOI Cogent Communications Holdings, Inc. 63.69 Telecom Services

VZ Verizon Communications Inc. 38.86 Telecom Services

BCE BCE Inc. 33.52 Telecom Services

PHI PLDT Inc. 23.48 Telecom Services

SKM SK Telecom Co.,Ltd 20.80 Telecom Services

TLK Telkom Indonesia (Persero) Tbk PT 19.63 Telecom Services

TIMB TIM S.A. 18.20 Telecom Services

T AT&T Inc. 16.84 Telecom Services

TU TELUS Corporation 16.37 Telecom Services

TDS Telephone and Data Systems, Inc. 14.30 Telecom Services

KT KT Corporation 12.80 Telecom Services

ORAN Orange S.A. 11.21 Telecom Services

VIV Telefônica Brasil S.A. 10.00 Telecom Services

VOD Vodafone Group PLC 8.59 Telecom Services

TEF Telefónica, S.A. 4.56 Telecom Services

ARLP Alliance Resource Partners, L.P. 23.08 Thermal Coal

PM Philip Morris International Inc. 97.04 Tobacco

UVV Universal Corporation 52.56 Tobacco

MO Altria Group, Inc. 43.49 Tobacco

BTI British American Tobacco p.l.c. 29.77 Tobacco

VGR Vector Group Ltd. 9.48 Tobacco

NWE NorthWestern Corporation 50.81 Utilities - Diversified

AVA Avista Corporation 37.24 Utilities - Diversified

BIP Brookfield Infrastructure Partners L.P. 29.08 Utilities - Diversified

CIG Cia Energetica DE Minas Gerais - Cemig 2.68 Utilities - Diversified

KEN Kenon Holdings Ltd. 23.05 Utilities - Independent Power Prod

PNW Pinnacle West Capital Corporation 75.41 Utilities - Regulated Electric

NGG National Grid plc 68.45 Utilities - Regulated Electric

ES Eversource Energy 59.44 Utilities - Regulated Electric

EVRG Evergy, Inc. 53.67 Utilities - Regulated Electric

D Dominion Energy, Inc. 50.77 Utilities - Regulated Electric

AGR Avangrid, Inc. 36.44 Utilities - Regulated Electric

OGE OGE Energy Corp. 34.83 Utilities - Regulated Electric

CEPU Central Puerto S.A. 10.77 Utilities - Regulated Electric

HE Hawaiian Electric Industries, Inc. 10.27 Utilities - Regulated Electric

ENIC Enel Chile S.A. 2.93 Utilities - Regulated Electric

SR Spire Inc. 61.17 Utilities - Regulated Gas

BKH Black Hills Corporation 55.52 Utilities - Regulated Gas

NWN Northwest Natural Holding Company 38.25 Utilities - Regulated Gas

BIPC Brookfield Infrastructure Corporation 33.45 Utilities - Regulated Gas

UGI UGI Corporation 23.68 Utilities - Regulated Gas

SPH Suburban Propane Partners, L.P. 20.00 Utilities - Regulated Gas

NEP NextEra Energy Partners, LP 31.05 Utilities - Renewable

BEPC Brookfield Renewable Corporation 28.52 Utilities - Renewable

BEP Brookfield Renewable Partners L.P. 26.35 Utilities - Renewable

CWEN Clearway Energy, Inc. 24.56 Utilities - Renewable

CWEN.A Clearway Energy, Inc. 22.68 Utilities - Renewable

AY Atlantica Sustainable Infrastructure plc 21.91 Utilities - Renewable

AQN Algonquin Power & Utilities Corp. 6.64 Utilities - Renewable

Sector Div. Yield Last Div, 5.12 câmbio

- 24.11% 0.90 76.44 4.61

Communication Services 4.79% 1.54 261.27 7.88

Communication Services 5.67% 0.30 108.70 1.54

Communication Services 6.35% 0.20 63.85 1.02

Communication Services 9.37% 0.05 11.01 0.26

Materials 9.74% 1.92 405.81 9.83

Industrials 25.69% 0.10 19.25 0.51

Industrials 4.68% 2.16 936.70 11.06

Consumer Discretionary 6.39% 0.05 16.03 0.26

Consumer Discretionary 13.89% 0.17 24.99 0.87

Financials 5.73% 0.24 257.43 1.23

Financials 8.78% 0.73 169.88 3.74

Financials 4.77% 0.39 167.12 2.00

Financials 9.06% 0.71 160.46 3.64

Financials 9.45% 0.63 133.63 3.23

Financials 12.37% 0.73 121.19 3.74

Financials 5.32% 0.31 119.14 1.59

Financials 5.76% 0.32 113.87 1.64

Financials 9.25% 0.17 109.36 0.87

Financials 11.32% 0.46 107.26 2.36

Financials 9.33% 0.48 105.37 2.46

Financials 14.28% 0.65 102.66 3.33

Financials 9.41% 0.48 100.15 2.46

Financials 14.18% 0.69 100.04 3.53

Financials 16.07% 0.05 98.30 0.26

Financials 9.76% 0.45 94.46 2.30

Financials 9.96% 0.41 89.40 2.10

Financials 11.15% 0.48 88.17 2.46

Financials 9.25% 0.39 86.32 2.00

Financials 7.31% 0.45 85.40 2.30

Financials 11.59% 0.45 79.56 2.30

Financials 10.61% 0.41 79.21 2.10

Financials 9.97% 0.38 78.08 1.95

Financials 5.51% 0.21 75.78 1.08

Financials 5.24% 0.19 75.11 0.97

Financials 13.95% 0.51 74.91 2.61

Financials 6.72% 0.08 73.22 0.41

Financials 11.38% 0.13 72.04 0.67

Financials 5.25% 0.25 71.88 1.28

Financials 11.94% 0.39 66.00 2.00

Financials 7.95% 0.18 65.79 0.92

Financials 4.93% 0.15 61.90 0.77

Financials 11.11% 0.11 60.93 0.56

Financials 11.52% 0.34 59.60 1.74

Financials 10.80% 0.10 58.37 0.51

Financials 7.48% 0.20 54.78 1.02

Financials 13.15% 0.34 52.99 1.74

Financials 13.54% 0.35 52.58 1.79

Financials 14.28% 0.34 48.59 1.74

Financials 10.97% 0.26 48.54 1.33

Financials 17.35% 0.40 47.16 2.05

Financials 13.72% 0.25 37.32 1.28

Financials 11.82% 0.07 36.25 0.36

Financials 8.08% 0.07 35.53 0.36

Financials 7.95% 0.14 35.43 0.72

Financials 14.08% 0.08 35.07 0.41

Financials 13.74% 0.06 26.83 0.31

Financials 18.84% 0.15 16.90 0.77

Financials 13.21% 0.04 16.18 0.20

Consumer Discretionary 7.52% 1.65 112.03 8.45

Consumer Discretionary 5.08% 0.30 118.63 1.54

Financials 4.87% 1.10 464.03 5.63

Financials 5.39% 0.75 284.21 3.84

Financials 5.53% 0.66 245.04 3.38

Financials 6.67% 0.78 239.56 3.99

Financials 13.90% 1.55 228.10 7.94

Financials 4.99% 0.44 180.53 2.25

Financials 7.01% 0.82 87.76 4.20

Financials 5.56% 0.42 53.71 2.15

Financials 4.77% 0.70 299.52 3.58

Financials 5.34% 0.71 271.05 3.64

Financials 4.92% 0.61 255.23 3.12

Financials 5.16% 0.61 242.33 3.12

Financials 4.63% 0.49 220.16 2.51

Financials 4.73% 0.49 211.61 2.51

Financials 5.34% 0.52 198.91 2.66

Financials 4.80% 0.45 191.39 2.30

Financials 4.74% 0.42 181.09 2.15

Financials 10.74% 0.91 172.80 4.66

Financials 5.17% 0.42 165.84 2.15

Financials 18.23% 1.43 161.28 7.32

Financials 6.67% 0.50 154.11 2.56

Financials 5.36% 0.40 152.17 2.05

Financials 5.07% 0.36 145.41 1.84

Financials 5.15% 0.36 142.90 1.84

Financials 5.17% 0.36 141.98 1.84

Financials 6.78% 0.47 141.57 2.41

Financials 5.49% 0.78 140.34 3.99

Financials 8.39% 0.56 135.78 2.87

Financials 5.49% 0.36 134.20 1.84

Financials 5.20% 0.66 129.95 3.38

Financials 4.78% 0.30 128.51 1.54

Financials 5.21% 0.31 121.70 1.59

Financials 5.71% 0.33 117.96 1.69

Financials 6.09% 0.35 117.76 1.79

Financials 6.25% 0.35 115.56 1.79

Financials 7.52% 1.69 115.40 8.65

Financials 6.14% 0.34 113.46 1.74

Financials 4.76% 0.26 111.51 1.33

Financials 5.01% 0.26 105.98 1.33

Financials 5.98% 0.31 105.68 1.59

Financials 8.86% 0.45 104.09 2.30

Financials 7.17% 0.36 102.40 1.84

Financials 4.84% 0.24 101.38 1.23

Financials 5.51% 0.27 100.45 1.38

Financials 5.08% 0.25 99.74 1.28

Financials 4.79% 0.23 98.25 1.18

Financials 6.86% 0.32 95.54 1.64

Financials 5.84% 0.27 93.54 1.38

Financials 4.69% 0.21 91.29 1.08

Financials 6.71% 0.30 91.24 1.54

Financials 6.40% 0.28 91.08 1.43

Financials 5.74% 0.25 88.68 1.28

Financials 4.63% 0.20 87.86 1.02

Financials 6.31% 0.25 80.90 1.28

Financials 5.17% 0.20 79.00 1.02

Financials 6.21% 0.24 78.90 1.23

Financials 4.68% 0.18 78.85 0.92

Financials 6.54% 0.25 78.54 1.28

Financials 5.46% 0.21 76.54 1.08

Financials 6.07% 0.22 74.24 1.13

Financials 8.63% 0.28 67.07 1.43

Financials 5.45% 0.17 63.90 0.87

Financials 5.11% 0.16 63.90 0.82

Financials 4.85% 0.15 63.28 0.77

Financials 7.29% 0.22 61.75 1.13

Financials 4.93% 0.14 58.11 0.72

Financials 6.77% 0.19 57.40 0.97

Financials 5.73% 0.16 57.19 0.82

Financials 7.26% 0.20 56.32 1.02

Financials 5.20% 0.14 54.99 0.72

Financials 8.25% 0.21 52.02 1.08

Financials 6.62% 0.16 49.82 0.82

Financials 4.94% 0.12 49.66 0.61

Financials 5.11% 0.12 48.08 0.61

Financials 5.77% 0.13 46.23 0.67

Financials 6.09% 0.14 45.47 0.72

Financials 5.60% 0.13 45.47 0.67

Financials 6.21% 0.13 42.80 0.67

Financials 7.32% 0.29 39.94 1.48

Financials 5.67% 0.11 39.42 0.56

Financials 6.58% 0.12 37.43 0.61

Financials 7.47% 0.00 32.67 0.00

Financials 5.56% 0.08 29.95 0.41

Financials 7.61% 0.11 29.54 0.56

Financials 6.37% 0.09 28.93 0.46

Financials 7.74% 0.10 26.47 0.51

Financials 6.71% 0.09 25.80 0.46

Financials 5.70% 0.06 21.81 0.31

Financials 11.35% 0.01 18.28 0.05

Financials 5.60% 0.10 18.28 0.51

Financials 5.37% 0.09 13.31 0.46

Financials 4.88% 0.03 12.60 0.15

Financials 5.27% 0.01 12.29 0.05

Consumer Staples 6.23% 0.15 12.39 0.77

Consumer Staples 5.76% 0.22 93.24 1.13

Consumer Staples 7.02% 0.20 69.48 1.02

Healthcare 43.83% 7.21 84.58 36.92

Communication Services 4.90% 0.08 33.28 0.41

Materials 11.57% 0.46 38.04 2.36

Materials 9.52% 0.54 29.08 2.76

Industrials 4.95% 0.25 103.42 1.28

Industrials 6.07% 0.08 25.34 0.41

Financials 4.66% 0.60 264.76 3.07

Financials 5.16% 0.50 197.73 2.56

Financials 15.41% 0.25 33.18 1.28

Financials 10.09% 0.17 29.95 0.87

Materials 4.93% 0.70 291.28 3.58

Materials 8.49% 0.47 113.92 2.41

Materials 4.94% 1.11 812.03 5.68

Materials 8.68% 0.24 56.93 1.23

Technology 4.77% 0.13 26.78 0.67

Technology 4.64% 0.04 18.94 0.20

Technology 48.08% 0.50 5.32 2.56

Industrials 6.22% 1.51 497.00 7.73

Industrials 4.66% 0.25 110.28 1.28

Industrials 7.11% 0.36 49.92 1.84

Industrials 5.05% 0.14 56.83 0.72

Financials 8.09% 1.04 262.35 5.32

Financials 5.54% 0.58 99.74 2.97

Financials 11.41% 0.55 98.66 2.82

Financials 8.53% 0.37 82.18 1.89

Financials 7.05% 0.24 68.20 1.23

Financials 14.09% 0.47 66.61 2.41

Financials 5.05% 0.10 40.70 0.51

Financials 4.71% 0.24 25.70 1.23

Financials 8.78% 0.17 19.81 0.87

Financials 10.14% 0.07 9.27 0.36

Consumer Discretionary 8.11% 0.50 125.59 2.56

Healthcare 4.78% 0.77 331.37 3.94

Healthcare 5.46% 0.60 224.97 3.07

Healthcare 6.08% 0.42 141.31 2.15

Healthcare 5.53% 0.28 103.22 1.43

Healthcare 4.64% 0.30 68.56 1.54

Technology 8.51% 0.10 12.03 0.51

Technology 6.35% 0.05 16.13 0.26

Communication Services 7.49% 0.25 67.84 1.28

Consumer Staples 12.78% 0.64 25.65 3.28

Financials 11.03% 0.50 163.69 2.56

Consumer Discretionary 7.31% 1.75 488.24 8.96

Consumer Discretionary 5.27% 0.39 151.14 2.00

Consumer Discretionary 5.20% 0.23 90.52 1.18

Consumer Discretionary 10.12% 0.05 71.83 0.26

Consumer Discretionary 5.22% 0.18 70.66 0.92

Consumer Discretionary 6.31% 0.08 25.96 0.41

Materials 5.69% 0.14 50.43 0.72

Materials 5.71% 0.11 40.19 0.56

Materials 8.15% 0.11 23.76 0.56

Materials 6.40% 0.04 12.85 0.20

Healthcare 8.59% 0.31 74.34 1.59

Healthcare 4.81% 0.67 282.88 3.43

Consumer Staples 10.07% 0.06 62.16 0.31

Technology 7.41% 0.25 69.02 1.28

Technology 7.54% 0.06 39.22 0.31

Technology 5.36% 0.05 17.25 0.26

Financials 4.64% 1.30 572.88 6.66

Financials 6.44% 0.45 142.75 2.30

Financials 5.03% 0.40 122.78 2.05

Financials 5.10% 0.17 69.27 0.87

Financials 4.67% 0.16 67.94 0.82

Communication Services 5.90% 0.40 69.84 2.05

Communication Services 8.96% 0.54 30.92 2.76

Consumer Discretionary 11.51% 0.20 35.58 1.02

Consumer Discretionary 5.37% 0.35 133.38 1.79

Industrials 6.76% 0.60 182.32 3.07

Industrials 13.76% 0.66 162.56 3.38

Industrials 5.72% 0.45 127.08 2.30

Industrials 4.90% 0.21 88.01 1.08

Industrials 19.42% 1.65 71.01 8.45

Industrials 7.64% 0.26 69.73 1.33

Industrials 12.78% 0.24 40.29 1.23

Industrials 5.44% 0.10 37.38 0.51

Industrials 11.65% 0.12 20.33 0.61

Industrials 16.99% 0.08 15.51 0.41

Industrials 12.15% 0.08 12.65 0.41

Healthcare 5.83% 0.15 52.43 0.77

Industrials 9.76% 0.05 10.50 0.26

Financials 9.40% 0.37 80.38 1.89

Financials 5.84% 0.10 34.92 0.51

Energy 5.56% 0.38 140.44 1.95

Energy 8.53% 0.53 125.44 2.71

Energy 5.30% 0.12 46.39 0.61

Energy 5.25% 0.50 379.80 2.56

Energy 10.07% 0.54 328.19 2.76

Energy 9.90% 0.78 161.59 3.99

Energy 5.80% 0.36 127.33 1.84

Energy 8.31% 0.51 117.25 2.61

Energy 8.99% 0.50 114.38 2.56

Energy 12.63% 0.58 93.59 2.97

Energy 7.61% 0.58 91.96 2.97

Energy 9.20% 0.38 83.56 1.95

Energy 10.71% 0.43 82.12 2.20

Energy 15.21% 0.29 68.71 1.48

Energy 11.03% 0.14 67.69 0.72

Energy 5.03% 0.13 51.00 0.67

Energy 5.78% 0.14 48.23 0.72

Energy 11.11% 0.02 44.49 0.10

Energy 5.78% 0.20 41.01 1.02

Energy 9.02% 0.26 40.65 1.33

Energy 6.87% 0.11 32.87 0.56

Energy 12.46% 0.18 29.49 0.92

Energy 8.59% 0.12 28.72 0.61

Energy 4.67% 0.06 27.39 0.31

Energy 8.12% 0.02 21.76 0.10

Energy 9.10% 0.03 20.68 0.15

Energy 11.00% 0.08 7.48 0.41

Energy 6.32% 0.50 162.25 2.56

Energy 7.89% 0.70 139.57 3.58

Energy 13.46% 0.43 84.33 2.20

Energy 14.97% 0.34 80.44 1.74

Energy 27.77% 0.80 59.14 4.10

Energy 5.17% 0.99 392.86 5.07

Energy 4.69% 0.74 321.33 3.79

Energy 10.05% 1.32 286.36 6.76

Energy 6.55% 0.81 255.23 4.15

Energy 5.98% 0.71 243.25 3.64

Energy 9.39% 1.00 217.86 5.12

Energy 8.31% 0.85 209.82 4.35

Energy 4.92% 0.48 197.94 2.46

Energy 7.87% 0.75 195.79 3.84

Energy 7.56% 0.71 192.10 3.64

Energy 5.58% 0.59 190.46 3.02

Energy 7.31% 0.67 187.14 3.43

Energy 5.57% 0.49 182.27 2.51

Energy 7.34% 0.88 181.86 4.51

Energy 15.61% 1.36 178.33 6.96

Energy 7.71% 0.65 174.03 3.33

Energy 7.36% 0.52 143.46 2.66

Energy 11.36% 0.75 135.42 3.84

Energy 6.01% 0.37 126.31 1.89

Energy 7.29% 0.40 112.44 2.05

Energy 6.23% 0.29 94.67 1.48

Energy 6.34% 0.32 94.57 1.64

Energy 7.25% 0.32 89.70 1.64

Energy 18.69% 0.57 86.78 2.92

Energy 7.97% 0.32 81.82 1.64

Energy 6.38% 0.23 72.29 1.18

Energy 4.83% 0.15 63.90 0.77

Energy 5.83% 0.09 60.16 0.46

Energy 7.56% 0.22 59.80 1.13

Energy 14.75% 0.41 57.04 2.10

Energy 9.79% 0.10 21.25 0.51

Energy 6.03% 0.84 286.92 4.30

Energy 11.18% 1.03 201.98 5.27

Energy 6.86% 0.50 149.96 2.56

Energy 9.45% 0.53 114.18 2.71

Energy 23.03% 1.00 89.04 5.12

Energy 5.83% 0.34 59.34 1.74

Energy 6.20% 0.17 57.60 0.87

Materials 6.32% 2.58 352.05 13.21

Materials 5.37% 1.44 288.67 7.37

Materials 4.77% 0.15 64.46 0.77

Materials 11.31% 0.54 64.15 2.76

Consumer Staples 6.68% 0.19 58.11 0.97

Consumer Discretionary 4.89% 0.78 326.40 3.99

Consumer Discretionary 5.16% 0.46 183.50 2.36

Consumer Discretionary 5.03% 0.13 50.79 0.67

Consumer Discretionary 10.05% 0.10 20.28 0.51

Consumer Discretionary 12.89% 1.65 130.15 8.45

Healthcare 8.17% 0.25 91.44 1.28

Healthcare 14.96% 0.30 20.38 1.54

Communication Services 17.16% 0.16 19.10 0.82

Real Estate 7.43% 0.45 123.96 2.30

Real Estate 14.67% 0.87 50.28 4.45

Real Estate 10.93% 0.24 44.80 1.23

Real Estate 5.75% 0.23 40.29 1.18

Real Estate 6.10% 0.87 289.43 4.45

Real Estate 5.76% 0.42 147.40 2.15

Real Estate 7.79% 0.45 118.37 2.30

Real Estate 6.28% 0.34 109.06 1.74

Real Estate 8.86% 0.38 87.96 1.95

Real Estate 7.51% 0.29 77.57 1.48

Real Estate 7.67% 0.10 76.80 0.51

Real Estate 8.82% 0.10 69.73 0.51

Real Estate 7.60% 0.21 55.35 1.08

Real Estate 15.25% 0.28 36.76 1.43

Real Estate 12.37% 0.04 19.35 0.20

Real Estate 8.20% 0.02 4.30 0.10

Real Estate 5.60% 0.90 328.09 4.61

Real Estate 7.95% 0.73 186.98 3.74

Real Estate 6.81% 0.19 171.01 0.97

Real Estate 8.66% 0.67 158.52 3.43

Real Estate 4.63% 0.29 127.64 1.48

Real Estate 7.45% 0.46 126.11 2.36

Real Estate 6.31% 0.30 97.18 1.54

Real Estate 8.38% 0.31 75.62 1.59

Real Estate 8.44% 0.30 72.65 1.54

Real Estate 5.01% 0.12 49.05 0.61

Real Estate 10.01% 0.21 42.96 1.08

Real Estate 12.06% 0.15 25.40 0.77

Real Estate 6.16% 0.25 83.05 1.28

Real Estate 6.52% 0.08 75.32 0.41

Real Estate 13.08% 0.20 31.28 1.02

Real Estate 7.75% 0.05 13.21 0.26

Real Estate 6.74% 1.82 550.09 9.32

Real Estate 4.87% 0.51 214.27 2.61

Real Estate 6.20% 0.56 184.52 2.87

Real Estate 4.68% 0.24 105.11 1.23

Real Estate 5.97% 0.13 44.54 0.67

Real Estate 6.85% 0.07 21.50 0.36

Real Estate 9.84% 0.48 99.69 2.46

Real Estate 13.43% 0.65 99.02 3.33

Real Estate 15.06% 0.24 97.59 1.23

Real Estate 13.66% 0.62 92.52 3.17

Real Estate 8.75% 0.47 81.77 2.41

Real Estate 10.95% 0.40 74.85 2.05

Real Estate 19.31% 0.50 67.17 2.56

Real Estate 13.85% 0.45 66.61 2.30

Real Estate 11.05% 0.36 65.79 1.84

Real Estate 10.93% 0.35 65.74 1.79

Real Estate 13.21% 0.43 65.54 2.20

Real Estate 12.95% 0.13 61.64 0.67

Real Estate 13.33% 0.13 59.80 0.67

Real Estate 8.78% 0.25 58.16 1.28

Real Estate 11.50% 0.32 57.45 1.64

Real Estate 8.29% 0.23 56.52 1.18

Real Estate 12.73% 0.35 56.22 1.79

Real Estate 13.79% 0.35 51.71 1.79

Real Estate 15.80% 0.25 49.82 1.28

Real Estate 15.32% 0.12 48.08 0.61

Real Estate 10.81% 0.25 47.10 1.28

Real Estate 17.55% 0.40 46.49 2.05

Real Estate 13.84% 0.30 44.24 1.54

Real Estate 16.88% 0.12 43.78 0.61

Real Estate 11.37% 0.24 43.21 1.23

Real Estate 13.11% 0.25 35.43 1.28

Real Estate 10.13% 0.16 32.46 0.82

Real Estate 11.59% 0.18 32.10 0.92

Real Estate 13.08% 0.20 31.39 1.02

Real Estate 13.20% 0.20 31.03 1.02

Real Estate 9.11% 0.12 25.86 0.61

Real Estate 16.93% 0.15 22.63 0.77

Real Estate 10.16% 0.11 22.17 0.56

Real Estate 10.83% 0.10 18.94 0.51

Real Estate 17.09% 0.15 17.97 0.77

Real Estate 13.62% 0.11 16.64 0.56

Real Estate 12.17% 0.07 11.83 0.36

Real Estate 6.43% 0.98 310.27 5.02

Real Estate 5.74% 0.25 265.88 1.28

Real Estate 6.38% 0.54 173.36 2.76

Real Estate 7.43% 0.50 136.81 2.56

Real Estate 4.79% 0.30 126.00 1.54

Real Estate 5.46% 0.32 119.71 1.64

Real Estate 4.69% 0.18 76.19 0.92

Real Estate 6.92% 0.24 70.96 1.23

Real Estate 5.47% 0.19 70.71 0.97

Real Estate 8.86% 0.27 61.24 1.38

Real Estate 7.22% 0.13 35.17 0.67

Real Estate 8.34% 0.10 24.93 0.51

Real Estate 12.65% 0.15 24.17 0.77

Real Estate 11.49% 0.10 17.77 0.51

Real Estate 10.88% 0.09 15.72 0.46

Real Estate 4.67% 0.45 197.17 2.30

Real Estate 5.36% 0.46 177.20 2.36

Real Estate 5.41% 0.25 94.72 1.28

Real Estate 5.53% 0.22 79.67 1.13

Real Estate 4.75% 0.18 77.67 0.92

Real Estate 9.09% 0.10 21.30 0.51

Real Estate 8.32% 4.50 1108.12 23.04

Real Estate 5.48% 1.95 727.76 9.98

Real Estate 5.14% 0.25 298.09 1.28

Real Estate 5.59% 0.26 282.47 1.33

Real Estate 5.44% 0.57 212.43 2.92

Real Estate 6.53% 0.59 187.24 3.02

Real Estate 6.51% 0.45 141.72 2.30

Real Estate 5.71% 0.35 123.24 1.79

Real Estate 4.90% 0.27 113.61 1.38

Real Estate 7.38% 0.40 111.41 2.05

Real Estate 4.73% 0.25 107.72 1.28

Real Estate 5.05% 0.24 97.02 1.23

Real Estate 4.77% 0.21 87.91 1.08

Real Estate 5.43% 0.22 83.97 1.13

Real Estate 7.24% 0.28 77.98 1.43

Real Estate 4.90% 0.17 71.07 0.87

Real Estate 4.84% 0.15 63.23 0.77

Real Estate 6.43% 1.57 498.02 8.04

Real Estate 7.03% 0.76 221.29 3.89

Real Estate 8.14% 0.29 215.45 1.48

Real Estate 6.51% 0.42 130.71 2.15

Real Estate 8.05% 0.30 76.49 1.54

Real Estate 15.89% 0.48 61.95 2.46

Real Estate 12.00% 0.15 25.60 0.77

Industrials 6.48% 0.38 118.78 1.95

Industrials 7.35% 0.06 59.55 0.31

Industrials 7.24% 0.13 35.28 0.67

Consumer Discretionary 9.13% 1.30 292.71 6.66

Consumer Discretionary 4.63% 0.51 225.13 2.61

Consumer Discretionary 5.06% 0.25 101.43 1.28

Consumer Discretionary 5.43% 0.19 70.76 0.97

Consumer Discretionary 7.56% 0.14 37.94 0.72

Consumer Discretionary 9.33% 0.14 30.72 0.72

Technology 5.02% 1.00 407.86 5.12

Technology 5.32% 1.50 144.23 7.68

Technology 5.37% 0.56 53.76 2.87

Technology 7.23% 0.59 41.42 3.02

Technology 9.33% 0.48 26.37 2.46

Technology 4.82% 0.37 156.88 1.89

Technology 12.83% 0.24 9.63 1.23

Technology 6.44% 1.92 610.25 9.83

Industrials 7.42% 0.05 13.82 0.26

Industrials 5.18% 0.05 9.88 0.26

Materials 5.05% 1.25 507.55 6.40

Materials 6.33% 0.19 61.03 0.97

Materials 8.95% 0.11 36.10 0.56

Materials 4.76% 0.10 10.75 0.51

Consumer Discretionary 5.08% 0.94 378.52 4.81

Consumer Discretionary 8.32% 0.35 86.53 1.79

Consumer Discretionary 5.92% 0.05 17.31 0.26

Industrials 6.83% 0.15 44.95 0.77

Materials 8.17% 2.20 206.80 11.26

Materials 6.89% 0.29 85.15 1.48

Materials 7.86% 0.02 19.71 0.10

Materials 13.96% 0.15 14.49 0.77

Communication Services 6.08% 0.97 326.09 4.97

Communication Services 6.84% 0.67 198.96 3.43

Communication Services 8.70% 0.73 171.62 3.74

Communication Services 7.25% 0.82 120.22 4.20

Communication Services 5.39% 0.42 106.50 2.15

Communication Services 5.76% 1.13 100.51 5.79

Communication Services 6.55% 0.54 93.18 2.76

Communication Services 6.60% 0.28 86.22 1.43

Communication Services 6.81% 0.28 83.81 1.43

Communication Services 5.27% 0.19 73.22 0.97

Communication Services 5.57% 0.71 65.54 3.64

Communication Services 6.81% 0.32 57.40 1.64

Communication Services 5.16% 0.04 51.20 0.20

Communication Services 11.50% 0.49 43.98 2.51

Communication Services 7.21% 0.16 23.35 0.82

Energy 12.15% 0.70 118.17 3.58

Consumer Staples 5.35% 1.30 496.84 6.66

Consumer Staples 6.07% 0.80 269.11 4.10

Consumer Staples 9.01% 0.98 222.67 5.02

Consumer Staples 10.00% 0.74 152.42 3.79

Consumer Staples 8.45% 0.20 48.54 1.02

Utilities 5.12% 0.65 260.15 3.33

Utilities 5.10% 0.48 190.67 2.46

Utilities 5.60% 0.41 148.89 2.10

Utilities 10.59% 0.05 13.72 0.26

Utilities 16.65% 3.80 118.02 19.46

Utilities 4.67% 0.88 386.10 4.51

Utilities 5.18% 1.19 350.46 6.09

Utilities 4.78% 0.72 304.33 3.69

Utilities 4.80% 0.64 274.79 3.28

Utilities 5.25% 0.67 259.94 3.43

Utilities 4.83% 0.44 186.57 2.25

Utilities 4.79% 0.42 178.33 2.15

Utilities 8.07% 0.07 55.14 0.36

Utilities 6.95% 0.36 52.58 1.84

Utilities 11.84% 0.03 15.00 0.15

Utilities 4.93% 0.76 313.19 3.89

Utilities 4.67% 0.65 284.26 3.33

Utilities 5.08% 0.49 195.84 2.51

Utilities 4.85% 0.41 171.26 2.10

Utilities 6.32% 0.38 121.24 1.95

Utilities 6.56% 0.33 102.40 1.69

Utilities 11.39% 0.89 158.98 4.56

Utilities 5.03% 0.36 146.02 1.84

Utilities 5.41% 0.36 134.91 1.84

Utilities 6.58% 0.40 125.75 2.05

Utilities 7.09% 0.40 116.12 2.05

Utilities 8.20% 0.45 112.18 2.30

Utilities 6.51% 0.11 34.00 0.56

You might also like

- SS ENERGY LPG AutoGas Station Presentation FinalDocument17 pagesSS ENERGY LPG AutoGas Station Presentation FinalSaeed AwanNo ratings yet

- Procedure Standard and Refainery PDFDocument31 pagesProcedure Standard and Refainery PDFFELICIALOHNo ratings yet

- Manual WG10, 20 458-GB-10-99Document27 pagesManual WG10, 20 458-GB-10-99trpac100% (4)

- April Dividend StocksDocument84 pagesApril Dividend StockshxcdNo ratings yet

- Loan Loss ReservesDocument1 pageLoan Loss ReservesChicago TribuneNo ratings yet

- Ticker Name Best Eps Bf12M Roe LFDocument6 pagesTicker Name Best Eps Bf12M Roe LFjdNo ratings yet

- Largest Banks and Thrifts in The US by Total AssetsDocument4 pagesLargest Banks and Thrifts in The US by Total Assetsht5116No ratings yet

- 2017RevocationPR LendingCompanieswithCancellationofRecording23Mayand06JuneDocument14 pages2017RevocationPR LendingCompanieswithCancellationofRecording23Mayand06JuneLordiel FaderagaoNo ratings yet

- Thrift BanksDocument15 pagesThrift BanksHarry Decillo100% (1)

- 2022LCFC - MJ Lending - Partial Cancellation of Revocation Order - M.J. LendingDocument14 pages2022LCFC - MJ Lending - Partial Cancellation of Revocation Order - M.J. LendingLordiel FaderagaoNo ratings yet

- A Financial System - Treasury Secretary Mnuchin Report #1Document149 pagesA Financial System - Treasury Secretary Mnuchin Report #1The Conservative Treehouse100% (1)

- 2 Banking InstitutionsDocument13 pages2 Banking InstitutionsAsad AkhlaqNo ratings yet

- Treasury Release Tarp 49122308Document1 pageTreasury Release Tarp 49122308FOXBusiness.com100% (3)

- FactSet Bank Tracker 230814 - Banks Are Not Out of The Woods YetDocument9 pagesFactSet Bank Tracker 230814 - Banks Are Not Out of The Woods YetBrianNo ratings yet

- Thrift Banks (TBS) Universal and Commercial Banks (U/Kbs) : Pesonet ParticipantsDocument2 pagesThrift Banks (TBS) Universal and Commercial Banks (U/Kbs) : Pesonet ParticipantsJohn Rey de VeraNo ratings yet

- PESONet ParticipantsDocument2 pagesPESONet ParticipantsMoi SeeNo ratings yet

- COA C2022-003 AnnexADocument3 pagesCOA C2022-003 AnnexAJec JekNo ratings yet

- STRBI Table No. 11 Selected Ratios of Scheduled Commercial BanksDocument273 pagesSTRBI Table No. 11 Selected Ratios of Scheduled Commercial BanksRishiNo ratings yet

- Theory PPDocument15 pagesTheory PPbriliebNo ratings yet

- Ranking As To Total AssetsDocument6 pagesRanking As To Total AssetsJudil BanastaoNo ratings yet

- Credit Agreement JC PenneyDocument235 pagesCredit Agreement JC PenneyLim Ooi PartnersNo ratings yet

- Commercial Mortgage Broker Leads ListDocument102 pagesCommercial Mortgage Broker Leads ListMalik UzairNo ratings yet

- Bank Director Top 150 5B - Up - To - 50BDocument2 pagesBank Director Top 150 5B - Up - To - 50BmonkeymanwahNo ratings yet

- Blue Chip StocksDocument73 pagesBlue Chip Stocksjasminehammond88No ratings yet

- Leverage RatioDocument1 pageLeverage RatioChicago TribuneNo ratings yet

- Madoff's StocksDocument4 pagesMadoff's StocksDenis100% (1)

- Oil and Gas Sector Risks 2Document55 pagesOil and Gas Sector Risks 2Rodrigo AcevedoNo ratings yet

- Complete List of Listed Companies On Philippines Stock Exchange Jan 2021Document14 pagesComplete List of Listed Companies On Philippines Stock Exchange Jan 2021allen zacariasNo ratings yet

- Schedule of Roll-Out For The Online Registration SystemDocument20 pagesSchedule of Roll-Out For The Online Registration SystemdignaNo ratings yet

- Abbreviations of BanksDocument13 pagesAbbreviations of BanksDhamodhar ReddyNo ratings yet

- Bank Director Top 150 1B - Up - To - 5BDocument5 pagesBank Director Top 150 1B - Up - To - 5BmonkeymanwahNo ratings yet

- CDFI Cert List 04-14-2021 FinalDocument159 pagesCDFI Cert List 04-14-2021 FinalCalifornia WaterNo ratings yet

- Q3 2016 BDC Master Holdings Combined-3Document1,345 pagesQ3 2016 BDC Master Holdings Combined-3Joshua RosnerNo ratings yet

- Excel Baron AristocratasDocument84 pagesExcel Baron AristocratasEl caminanteNo ratings yet

- ΜΗΝΥΣΗ 12/11/2009 ΚΑΤΑ GOLDMAN SACHS & 45 ΑΛΛΩΝ ΤΡΑΠΕΖΩΝ, ΑΠΟ ΤΗ ΔΗΜΟΤΙΚΗ ΕΠΙΧΕΙΡΗΣΗ ΤΟΥ SACRAMENTO (CALIFORNIA - USA)Document181 pagesΜΗΝΥΣΗ 12/11/2009 ΚΑΤΑ GOLDMAN SACHS & 45 ΑΛΛΩΝ ΤΡΑΠΕΖΩΝ, ΑΠΟ ΤΗ ΔΗΜΟΤΙΚΗ ΕΠΙΧΕΙΡΗΣΗ ΤΟΥ SACRAMENTO (CALIFORNIA - USA)Dr. KIRIAKOS TOBRAS - ΤΟΜΠΡΑΣNo ratings yet

- Institution Location ROA (%) Efficiency Ratio (%)Document10 pagesInstitution Location ROA (%) Efficiency Ratio (%)JasonNo ratings yet

- Woodbridge JudgmentDocument9 pagesWoodbridge JudgmentCCNNo ratings yet

- State 0wned BankDocument7 pagesState 0wned BankFarzana Akter 28No ratings yet

- Problem Background and Aim of Study: List of Scheduled Banks Operational in PakistanDocument7 pagesProblem Background and Aim of Study: List of Scheduled Banks Operational in PakistanAsmara NoorNo ratings yet

- Fatca FundservDocument36 pagesFatca Fundservajaw267No ratings yet

- 2021 Tennessee Businesses Against DiscriminationDocument10 pages2021 Tennessee Businesses Against DiscriminationAnonymous GF8PPILW5No ratings yet

- Encuentre Su Banco InscribirseDocument8 pagesEncuentre Su Banco Inscribirsearmando.corresNo ratings yet

- FY2021 Capital Improvements Budget ProposalDocument587 pagesFY2021 Capital Improvements Budget ProposalHPR NewsNo ratings yet

- Complete List of Philippines PSEi Index Constituents Jan 2 2022Document2 pagesComplete List of Philippines PSEi Index Constituents Jan 2 2022pupubaxNo ratings yet

- Mutual Funds - Load Return Mutual Funds - No Load ReturnDocument1 pageMutual Funds - Load Return Mutual Funds - No Load ReturnKaran TrivediNo ratings yet

- CDFI ERP Award List FINAL ProtectedDocument28 pagesCDFI ERP Award List FINAL ProtectedMike MaybayNo ratings yet

- Credit Union Acronym & Abbreviation ListDocument9 pagesCredit Union Acronym & Abbreviation ListShaw TaylorNo ratings yet

- STOCKS Listed CompaniesDocument6 pagesSTOCKS Listed CompaniesgheecelmarkNo ratings yet

- List of Federal Reserve Member Banks 2015Document10 pagesList of Federal Reserve Member Banks 2015George AntoniouNo ratings yet

- Policy Brief StatementDocument1 pagePolicy Brief StatementQatar home RentNo ratings yet

- Surface Transportation Board's Decision On The Canadian Pacific-Kansas City Southern MergerDocument212 pagesSurface Transportation Board's Decision On The Canadian Pacific-Kansas City Southern MergerCurtisNo ratings yet

- Business Valuation Update: October 2010 Vol. 16 No. 10Document47 pagesBusiness Valuation Update: October 2010 Vol. 16 No. 10bharatramnaniNo ratings yet

- Bank of Credit and Commerce International: An Inisight Into The Biggest Bank Fraud in HistoryDocument26 pagesBank of Credit and Commerce International: An Inisight Into The Biggest Bank Fraud in HistoryTanmay MeenaNo ratings yet

- Quarterly Q2 2022 (EN)Document116 pagesQuarterly Q2 2022 (EN)MUFAIDAHNo ratings yet

- Community BanksDocument10 pagesCommunity BanksGoblin GunNo ratings yet

- Multicap Mutual Funds PerformanceDocument4 pagesMulticap Mutual Funds PerformanceUppala Krishna ChaitanyaNo ratings yet

- Advisors On ED VDRDocument1 pageAdvisors On ED VDRLê Na HoàngNo ratings yet

- Abbreviations - Finance: Sreedhar'sDocument6 pagesAbbreviations - Finance: Sreedhar'skommi kiranNo ratings yet

- Finding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificFrom EverandFinding Balance 2019: Benchmarking the Performance of State-Owned Banks in the PacificNo ratings yet

- Practical Operational Due Diligence on Hedge Funds: Processes, Procedures, and Case StudiesFrom EverandPractical Operational Due Diligence on Hedge Funds: Processes, Procedures, and Case StudiesNo ratings yet

- Decentralization and Governance in the Ghana Health SectorFrom EverandDecentralization and Governance in the Ghana Health SectorNo ratings yet

- BP 200Document35 pagesBP 200HELTONRGS5498No ratings yet

- An Improved Method of Mead ProductionDocument7 pagesAn Improved Method of Mead ProductionHELTONRGS5498No ratings yet

- Smartbracelet Evolio Linkfit User ManualDocument12 pagesSmartbracelet Evolio Linkfit User ManualHELTONRGS5498No ratings yet

- Smartbracelet Evolio Linkfit User ManualDocument12 pagesSmartbracelet Evolio Linkfit User ManualHELTONRGS5498No ratings yet

- The Body Transformation WorkoutDocument16 pagesThe Body Transformation WorkoutHELTONRGS5498No ratings yet

- Save A PrayerDocument1 pageSave A PrayerHELTONRGS5498No ratings yet

- As 5034-2005 Installation and Use of Inert Gases For Beverage DispensingDocument7 pagesAs 5034-2005 Installation and Use of Inert Gases For Beverage DispensingSAI Global - APACNo ratings yet

- Manual Shutdown LPGDocument11 pagesManual Shutdown LPGYoga NugrahaNo ratings yet

- Inward Material Dimension Inspection ReportDocument1 pageInward Material Dimension Inspection ReportPrathamesh OmtechNo ratings yet

- 10 2118@195057-MSDocument14 pages10 2118@195057-MSAlexandra Guamann MendozaNo ratings yet

- 5 Steps To Making Homemade BiogasDocument5 pages5 Steps To Making Homemade BiogasJan Aguilar EstefaniNo ratings yet

- Shell Middle Distillate Synthesis: The Process, The Plant, The ProductsDocument5 pagesShell Middle Distillate Synthesis: The Process, The Plant, The ProductsEan7731451No ratings yet

- GeophysicsDocument392 pagesGeophysicsNAGENDR_006100% (2)

- Coal and Petroleum: Uses and Need For ConservationDocument11 pagesCoal and Petroleum: Uses and Need For ConservationAmarjeet kaurNo ratings yet

- Concept of Green Energy by Mariya Iftekhar - WPS OfficeDocument22 pagesConcept of Green Energy by Mariya Iftekhar - WPS OfficeSavvy Malik100% (1)

- Romania's Funding Sources For Increasing The Share of Renewable Energy Sources and The Reduction of Greenhouse Gas EmissionsDocument12 pagesRomania's Funding Sources For Increasing The Share of Renewable Energy Sources and The Reduction of Greenhouse Gas EmissionsRaluca CalinNo ratings yet

- Ch. 11 Chemical BondsDocument33 pagesCh. 11 Chemical BondsNick Andrew Dequilla NiervaNo ratings yet

- Gas Supply SystemDocument4 pagesGas Supply SystemsheenbergNo ratings yet

- IOGP485 v.5 - Standards and Guidelines For Well Integrity and Well ControlDocument4 pagesIOGP485 v.5 - Standards and Guidelines For Well Integrity and Well ControlPhong HuynhNo ratings yet

- Production of Gas Oil From Used Engine OilDocument3 pagesProduction of Gas Oil From Used Engine OilAshok RathodNo ratings yet

- Horno de SecadoDocument92 pagesHorno de SecadocarlosNo ratings yet

- Energiestudie 2018 enDocument177 pagesEnergiestudie 2018 enEverett F SargentNo ratings yet

- Alcohol As An Alternative Fuel in I.C. EnginesDocument25 pagesAlcohol As An Alternative Fuel in I.C. EnginesSwetha PinksNo ratings yet

- Fracking EssayDocument7 pagesFracking Essaytedwards950% (2)

- Presentation 1Document7 pagesPresentation 1Abdillah StrhanNo ratings yet

- Global WarmingDocument6 pagesGlobal WarmingJehad C. AsiriaNo ratings yet

- Petrophysicist (Geologist)Document42 pagesPetrophysicist (Geologist)56962645No ratings yet

- Well Completion: Assoc. Prof. Issham IsmailDocument36 pagesWell Completion: Assoc. Prof. Issham IsmailKAORU AmaneNo ratings yet

- Resume of Prasad Kambli - Instrument Technician 3Document6 pagesResume of Prasad Kambli - Instrument Technician 3aryi5No ratings yet

- Terms of ReferenceDocument5 pagesTerms of ReferenceSetemi 'sherlock' ObatokiNo ratings yet

- Draft of Project OngcDocument10 pagesDraft of Project Ongcradhika1991No ratings yet

- Q1 Catalyst CatastrophesDocument6 pagesQ1 Catalyst CatastrophesGhulam RasoolNo ratings yet