Professional Documents

Culture Documents

Market Report

Market Report

Uploaded by

arafat ali0 ratings0% found this document useful (0 votes)

3 views1 pageOriginal Title

Market report

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views1 pageMarket Report

Market Report

Uploaded by

arafat aliCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

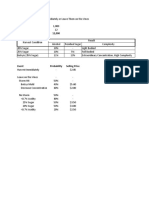

Q1: what is the applicable TAX/VAT/SD applicable for locally manufacturing beer?

SD-

HS Code Description SD Rate

2203.00.00 Beer made from Malt 250%

2206.00.00 Undenatured ethyl alcohol of an 350%

alcoholic strength by volume of

less than 80% volume, Spirits,

Liquors and other spirituous

beverages

2202.91.00 Non-alcoholic beer 150%

1901.90.91 Malt extract/food preparations 20%

imported in bulk by VAT

registered food processing

Industries

VAT

Standard Rate 15%

TDS Rate

will be consider under the supplier rate if it is done B2B

Supplier TDS Rate

Where the base the base amount does not 3%

exceed 50 lakhs

Where the base the base amount exceeds 50 5%

lakhs but does not exceed 2 crores

Where the base the base amount exceeds 2 7%

crores

You might also like

- Alcohol HS CodeDocument27 pagesAlcohol HS Codekvan_7No ratings yet

- Beverage List: Drinks On Per Consumption BasisDocument1 pageBeverage List: Drinks On Per Consumption BasisjoksnosamkarezNo ratings yet

- Excise Tax RateDocument23 pagesExcise Tax RateKaleo QueenNo ratings yet

- PNL Template For Restaurant SuccessDocument4 pagesPNL Template For Restaurant Successnqobizitha giyaniNo ratings yet

- PNL Template For Restaurant SuccessDocument4 pagesPNL Template For Restaurant Successnqobizitha giyaniNo ratings yet

- Section IV Chapter-22: ITC (HS), 2012 Schedule 1 - Import PolicyDocument5 pagesSection IV Chapter-22: ITC (HS), 2012 Schedule 1 - Import PolicyDharmendra KhatriNo ratings yet

- AHTN2022 CHAPTER22 wNOTESDocument5 pagesAHTN2022 CHAPTER22 wNOTESdoookaNo ratings yet

- CH 22Document4 pagesCH 22dkhatri01No ratings yet

- Section-Iv Chapter-22: Beverages, Spirits and VinegarDocument7 pagesSection-Iv Chapter-22: Beverages, Spirits and Vinegarshalini kanojiaNo ratings yet

- Beverage List: Full Bar Consumption BasisDocument1 pageBeverage List: Full Bar Consumption BasisDarwin Dionisio ClementeNo ratings yet

- BETA VitaHop CaseSty R2Document1 pageBETA VitaHop CaseSty R2ALEJANDRO AstudilloNo ratings yet

- Section-IV Chapter-22: Beverages, Spirits and VinegarDocument5 pagesSection-IV Chapter-22: Beverages, Spirits and VinegarankurNo ratings yet

- I. Excise TaxDocument21 pagesI. Excise TaxMaha CastroNo ratings yet

- RR 01 07 2023Document1 pageRR 01 07 2023peacocks denNo ratings yet

- Deposit Rate Sheet-ED 14 November 2022 EBL WEB VersionDocument5 pagesDeposit Rate Sheet-ED 14 November 2022 EBL WEB VersionAbid Hasan MuminNo ratings yet

- Deposit Rate sheet-ED 01 October 2022 EBL WEB VersionDocument5 pagesDeposit Rate sheet-ED 01 October 2022 EBL WEB VersionMd. MarufuzzamanNo ratings yet

- 28 - VAT Short SummaryDocument1 page28 - VAT Short SummaryRam SbhatlaNo ratings yet

- Non Alcohol BeerDocument20 pagesNon Alcohol BeerrusoexpressNo ratings yet

- Deposit Rate sheet-ED 17 Oct 2023 EBL WEB VersionDocument5 pagesDeposit Rate sheet-ED 17 Oct 2023 EBL WEB VersionAbdul HamidNo ratings yet

- Ab - Und Aufzinsungstabelle Anlage BDocument50 pagesAb - Und Aufzinsungstabelle Anlage BManu CfNo ratings yet

- Deposit Rate sheet-ED 23 July 2023 EBL WEB Version-2Document5 pagesDeposit Rate sheet-ED 23 July 2023 EBL WEB Version-2Shanto BossNo ratings yet

- Deposit Rate sheet-ED 02 May 2023 EBL WEB VersionDocument5 pagesDeposit Rate sheet-ED 02 May 2023 EBL WEB VersionSabbir AhmeedNo ratings yet

- IGS Digital Center - Commission & SurchargeDocument23 pagesIGS Digital Center - Commission & SurchargeBikash KumarNo ratings yet

- Bebidas InformeDocument15 pagesBebidas InformeREALNo ratings yet

- Assessment FormatDocument8 pagesAssessment FormatsmilenithyaaNo ratings yet

- THB20230814Document5 pagesTHB20230814Norain SallehNo ratings yet

- Part A.1 Tariffs and Imports: Summary and Duty RangesDocument1 pagePart A.1 Tariffs and Imports: Summary and Duty RangesRak ADURNo ratings yet

- The Fern Residency - Karad: Alcoholic Beverage Alcoholic BeverageDocument1 pageThe Fern Residency - Karad: Alcoholic Beverage Alcoholic BeverageSagar ChouguleNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Stefan SmarandacheNo ratings yet

- Ross Paul John - FinalDocument2 pagesRoss Paul John - FinalITNo ratings yet

- Fiche D'instruction Biere Sans-Alcool 20160304Document1 pageFiche D'instruction Biere Sans-Alcool 20160304RiyanNo ratings yet

- RCM FormatDocument3 pagesRCM FormatjsphdvdNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Planilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalDocument4 pagesPlanilla de Sueldos Y Salarios: #Nombre Haber Básico Bono Antigüedad Total Ganado Fecha de Ingreso F-110 TotalAnonymous cASDjraltHNo ratings yet

- Budgeting Assignment YrqDocument32 pagesBudgeting Assignment YrqMuzamil HafeezNo ratings yet

- Updated SOC - 19 Jan 2020Document13 pagesUpdated SOC - 19 Jan 2020Jubaida Alam 203-22-694No ratings yet

- Model FormatDocument175 pagesModel Formatjain93kunalNo ratings yet

- Wine Data Sheets!Document44 pagesWine Data Sheets!Qonita SyafrinaNo ratings yet

- Singapore Consumer Price Index by Household Income Group: July - December and Full Year 2020Document5 pagesSingapore Consumer Price Index by Household Income Group: July - December and Full Year 2020Thu Hương BạchNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesDocument5 pagesTax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesAnni PagkatipunanNo ratings yet

- Catalogue of Longood 2020Document26 pagesCatalogue of Longood 2020José Antonio LeónNo ratings yet

- Case 2 - Freemark Abbey WineryDocument5 pagesCase 2 - Freemark Abbey WineryVieri SuhermanNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Kind of Liquor. Rate of REDDocument13 pagesKind of Liquor. Rate of REDM7 I Ankit 2No ratings yet

- FCA FCA: To RefundDocument1 pageFCA FCA: To Refundbrzezin9No ratings yet

- Beverage Package 2023Document2 pagesBeverage Package 2023Come2borneo UpdateNo ratings yet

- Gokul Agro ResourcesDocument15 pagesGokul Agro Resourcesmadhu priyaNo ratings yet

- Budgeting Template Restaurant-Chain DEMODocument63 pagesBudgeting Template Restaurant-Chain DEMOMuhammad HarisNo ratings yet

- Compilation of Computation Issuances by JLNBDocument218 pagesCompilation of Computation Issuances by JLNBjanna.barbasaNo ratings yet

- Excise TaxDocument8 pagesExcise TaxCurious OneNo ratings yet

- Invoice: Gross Invoice Total Minus Outstanding AmountDocument2 pagesInvoice: Gross Invoice Total Minus Outstanding AmountMadz Alcoy BautistaNo ratings yet

- Beer Duty PDFDocument1 pageBeer Duty PDFjamiebootNo ratings yet

- Sensuous Scents Inc Product Mix Problem ConstantsDocument2 pagesSensuous Scents Inc Product Mix Problem ConstantsPrakhar SinghNo ratings yet

- Green Minimalist Furniture Catalog Inside Page Print TemplateDocument4 pagesGreen Minimalist Furniture Catalog Inside Page Print TemplateNaman KeshanNo ratings yet

- P&L Publico Columbia 01.03.18 - 01.09.18Document1 pageP&L Publico Columbia 01.03.18 - 01.09.18James MarquesNo ratings yet

- Beer SpecificationDocument8 pagesBeer SpecificationjairomarcanoNo ratings yet

- Income Statement: Altos Enterprises Private LimitedDocument1 pageIncome Statement: Altos Enterprises Private LimitedsantoshkumarpanyNo ratings yet

- Base Data: Risk On ?Document40 pagesBase Data: Risk On ?S.KAMBANNo ratings yet