Professional Documents

Culture Documents

Accounting & Financial Management For Bankers

Accounting & Financial Management For Bankers

Uploaded by

Aditya Kaushal0 ratings0% found this document useful (0 votes)

10 views2 pagesACCOUNTING & FINANCIAL MANAGEMENT FOR BANKERS

Original Title

ACCOUNTING & FINANCIAL MANAGEMENT FOR BANKERS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACCOUNTING & FINANCIAL MANAGEMENT FOR BANKERS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesAccounting & Financial Management For Bankers

Accounting & Financial Management For Bankers

Uploaded by

Aditya KaushalACCOUNTING & FINANCIAL MANAGEMENT FOR BANKERS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

CONTENTS

Foreword N

MODULE A: ACCOUNTINGPRINCIPLESAND PROCESSES

1. Definition, Scope & Accounting Standards including Ind AS

2. Basic Accountancy Procedures 79

3. Maintenance of Cash/Subsidiary Books and Ledger 93

4. Bank Reconciliation Statement 127

5. Trial Balance, Rectification of Errors and Adjusting & Closing Entries 141

6. Depreciation and its Accounting 157

7. Capital and Revenue Expenditure 169

8. Bills of Exchange 175

9. Operational Aspects of Accounting Entries 195

10. Back Ofice Functions/Handling Unreconciled Entries in Banks 203

11. Bank Audit & Inspection 215

MODULE B: FINANCIAL STATEMENTS AND CORE BANKING SYSTEMS

12. Balance Sheet Equation 229

13. Preparation of Final Accounts 235

14. Company Accounts-I 251

15. Company Accounts - II 285

16. Cash Flow and Funds Flow 311

17. Final Accounts of Banking Companies 323

18. Core Banking Systems and Accounting in Computerised Environment 371

MODULE C: FINANCIAL MANAGEMENT

19. Financial Management- An Overview 391

20. Ratio Analysis 407

21. Financial Mathematics-Calculation ofInterest and Annuities 421

443

22. Financial Mathematics Calculation of YTM

23. Financial Mathematics - Forex Arithmetic 461

xiv| CONTENTS

24. Capital Structure and Cost of Capital 471

25. Capital Investment Decisions/Tem Loans 485

26. Equipment Leasing/Lease Financing 499

27. Working Capital Management S11

28. Derivatives 525

MODULE D: TAXATION AND FUNDAMENTALs OF COSTING

29. Taxation: Income Tax/TDS/Deferred Tax 537

30. Goods & Services Tax 547

31. An Overview of Cost & Management Accounting 555

32. Costing Methods 569

33. Standard Costing 587

34. Marginal Costing 599

35. Budgets and Budgetary Control 609

Bibliography 618

You might also like

- SOP - Finance and Accounting DepartmentDocument52 pagesSOP - Finance and Accounting Departmentcoffee Dust100% (23)

- ICAEW Accounting QB 2023Document322 pagesICAEW Accounting QB 2023diya p100% (2)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Corporate Reporting - L3 PDFDocument1,040 pagesCorporate Reporting - L3 PDFAndy Asante83% (6)

- Ast Ans KeyDocument189 pagesAst Ans KeySofia SerranoNo ratings yet

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- Business Manuals CEO PDFDocument13 pagesBusiness Manuals CEO PDFRehan HamidNo ratings yet

- Financial Accounting .2013 PDFDocument317 pagesFinancial Accounting .2013 PDFhalime100% (1)

- Prospective Analysis Theory and ConceptDocument32 pagesProspective Analysis Theory and ConceptEster Sabatini100% (1)

- Module B: Principles of BookkeepingDocument4 pagesModule B: Principles of BookkeepingKapilNo ratings yet

- Training Material - Tamil PFM Reform CellDocument303 pagesTraining Material - Tamil PFM Reform CellnithyaNo ratings yet

- Foreword: Module A: Basics of Business MathematicsDocument4 pagesForeword: Module A: Basics of Business MathematicsKapilNo ratings yet

- Earned Value Management System Interpretation Handbook (Evmsih)Document456 pagesEarned Value Management System Interpretation Handbook (Evmsih)Navi GuptaNo ratings yet

- Full Download Advanced Accounting and Financial Reporting 2016 1St Edition George Primentas Online Full Chapter PDFDocument69 pagesFull Download Advanced Accounting and Financial Reporting 2016 1St Edition George Primentas Online Full Chapter PDFfddybrett28100% (3)

- Advanced Accounting and Financial Reporting 2016 1st Edition George Primentas Full Chapter Download PDFDocument57 pagesAdvanced Accounting and Financial Reporting 2016 1st Edition George Primentas Full Chapter Download PDFmiilalils100% (1)

- Accounts ManualDocument40 pagesAccounts Manualহাসিন মুসাইয়্যাব আহমাদ পুণ্যNo ratings yet

- Corporate ReportingDocument864 pagesCorporate ReportingIRIBHOGBE OSAJIENo ratings yet

- Accountancy Chapters - NIOSDocument1 pageAccountancy Chapters - NIOSJayNo ratings yet

- Accounting Question Bank 2022Document334 pagesAccounting Question Bank 2022tafsirmhinNo ratings yet

- Financial Reporting Analysis 2 EdgDocument315 pagesFinancial Reporting Analysis 2 EdgPeter Snell100% (2)

- Financial Acctg Reporting 1 Chapter 8Document9 pagesFinancial Acctg Reporting 1 Chapter 8Charise Jane ZullaNo ratings yet

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Document94 pagesMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeNo ratings yet

- Principles & Practices of BankingDocument2 pagesPrinciples & Practices of BankingAditya KaushalNo ratings yet

- p1 Accounting Main Material Nov 2023Document287 pagesp1 Accounting Main Material Nov 2023Thilaga SenthilmuruganNo ratings yet

- Cfap 01 AafrDocument1,052 pagesCfap 01 AafrMuhammad Irfan100% (3)

- Finance Procedure PDFDocument7 pagesFinance Procedure PDFSenthilmani MuthuswamyNo ratings yet

- 832927600Document4 pages832927600ZeeShan IqbalNo ratings yet

- NCERT Book Class XI Accountacy XI Part-IDocument295 pagesNCERT Book Class XI Accountacy XI Part-Inikhilam.comNo ratings yet

- Career Guide 2016.with Correction Latest PDFDocument521 pagesCareer Guide 2016.with Correction Latest PDFDivya YallaturiNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- CFAP-01 CA PakistanDocument630 pagesCFAP-01 CA PakistanMuhammad ShehzadNo ratings yet

- Nas For NposDocument55 pagesNas For NposAashish KHATRINo ratings yet

- Acca ContentsDocument10 pagesAcca ContentsJaved MushtaqNo ratings yet

- Defence Account Code 2014 150714 PDFDocument315 pagesDefence Account Code 2014 150714 PDFGaurav Sunny SharmaNo ratings yet

- BEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationDocument25 pagesBEACTG 03 REVISED MODULE 2 Business Transaction & Acctg EquationChristiandale Delos ReyesNo ratings yet

- Sage 300 2020 Accounts Payable Users GuideDocument605 pagesSage 300 2020 Accounts Payable Users GuideAjisafe TosinNo ratings yet

- Paper 5 Revised PDFDocument576 pagesPaper 5 Revised PDFameydoshiNo ratings yet

- Ca Satyaraju Kolluru Accounts-P-1 1647247673Document287 pagesCa Satyaraju Kolluru Accounts-P-1 1647247673Alankrita100% (1)

- Financial Accounting V1Document76 pagesFinancial Accounting V1bhavya mishraNo ratings yet

- Financial Accounting Book 1 98Document98 pagesFinancial Accounting Book 1 98bhavya mishraNo ratings yet

- Paper 5new PDFDocument600 pagesPaper 5new PDFAbhi100% (1)

- Accountancy XI Smart Skills - 2020-21Document106 pagesAccountancy XI Smart Skills - 2020-21daamansuneja2No ratings yet

- USALIDocument4 pagesUSALISigit WahyudhiNo ratings yet

- A222 Tutorial 2QDocument4 pagesA222 Tutorial 2Qnur afrinaNo ratings yet

- StudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Document58 pagesStudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Amir Ali LiaqatNo ratings yet

- Isg 2023 IfsDocument207 pagesIsg 2023 IfsTeenagers NepalNo ratings yet

- Job Cards - Work Flow For Core Banking Solutions (CBS)Document31 pagesJob Cards - Work Flow For Core Banking Solutions (CBS)dimplenidhi22No ratings yet

- Introduction To Bookkeeping and AccountingDocument57 pagesIntroduction To Bookkeeping and Accountingtapera_mangezi100% (1)

- Company Financial AnalysisDocument38 pagesCompany Financial Analysisk61.2211115118No ratings yet

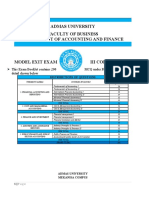

- Model Exam (Aa)Document38 pagesModel Exam (Aa)tsionfisseha3No ratings yet

- Paper-5 Financial Accounting PDFDocument534 pagesPaper-5 Financial Accounting PDFAshish Rai50% (2)

- Paper 5Document534 pagesPaper 5VijayMMuruganNo ratings yet

- Model Exit Exam 4Document38 pagesModel Exit Exam 4abulemhrNo ratings yet

- Sop Finance and Accounting DepartmentDocument54 pagesSop Finance and Accounting DepartmentNurul Nadhilah RoslainiNo ratings yet

- Inter Paper5 Revised PDFDocument1,104 pagesInter Paper5 Revised PDFNaniNo ratings yet

- Accounting: Diploma in Business AdministrationDocument318 pagesAccounting: Diploma in Business Administrationmuchai2000100% (1)

- Intermediate Financial Reporting - IfRS PerspectiveDocument912 pagesIntermediate Financial Reporting - IfRS PerspectiveEjaz Ahmad100% (2)

- All QuestionDocument37 pagesAll QuestionOUSMAN SEIDNo ratings yet

- Brief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMDocument13 pagesBrief Contents: Ros34779 - FM - I-Xxxvi - Indd Xxiv Ros34779 - FM - I-Xxxvi - Indd Xxiv 31/08/12 8:46 PM 31/08/12 8:46 PMĐức NghĩaNo ratings yet

- TestDocument418 pagesTestMathieu LabroNo ratings yet

- Caf7 Far2 ST PDFDocument395 pagesCaf7 Far2 ST PDFawais khanNo ratings yet

- Pas 28 Investment in Associates and Joint VenturesDocument14 pagesPas 28 Investment in Associates and Joint VenturesGenivy SalidoNo ratings yet

- Catur - Gaji Reflek RekeningDocument8 pagesCatur - Gaji Reflek RekeningAurora Marda BimantaraNo ratings yet

- SECTION 35 - TRANSITION TO THE PFRS FOR SMEsDocument14 pagesSECTION 35 - TRANSITION TO THE PFRS FOR SMEsbona veronica viduyaNo ratings yet

- Project Investment AnalysisDocument46 pagesProject Investment AnalysisAbdul ManafNo ratings yet

- Slump SaleDocument13 pagesSlump SaleAnjali kashyapNo ratings yet

- VCCEdge Fin-TechDocument7 pagesVCCEdge Fin-TechsahilsushilboharaNo ratings yet

- Ballance Sheet of Lucky Cement FactoryDocument9 pagesBallance Sheet of Lucky Cement FactoryTanvir Khan MarwatNo ratings yet

- Level I Volume 5 2019 IFT NotesDocument258 pagesLevel I Volume 5 2019 IFT NotesNoor QamarNo ratings yet

- 1.3) Accounting StandardsDocument15 pages1.3) Accounting StandardsF93 SHIFA KHANNo ratings yet

- 0106XXXXXX8428-01-04-21 - 31-03-2022Document27 pages0106XXXXXX8428-01-04-21 - 31-03-2022SabyasachiBanerjeeNo ratings yet

- Principles of Managerial Finance Chapters 1Document50 pagesPrinciples of Managerial Finance Chapters 1sacey20.hbNo ratings yet

- FAR 2 Answer KeyDocument5 pagesFAR 2 Answer KeyMary Rose VillamorNo ratings yet

- How To Build A Pitch Deck: Duvet BusinessDocument24 pagesHow To Build A Pitch Deck: Duvet Businessabhinav5424No ratings yet

- Mutual Fund: Prepared For Empirical Asset Pricing Class at SAIFDocument25 pagesMutual Fund: Prepared For Empirical Asset Pricing Class at SAIFJoe23232232No ratings yet

- AB Bank - 2022Document131 pagesAB Bank - 2022Mostafa Noman DeepNo ratings yet

- Chapter 2 MCQ Single Entry SystemDocument2 pagesChapter 2 MCQ Single Entry Systemimran aliNo ratings yet

- Dividend PolicyDocument24 pagesDividend PolicyKômâl MübéèñNo ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Nike INCDocument7 pagesNike INCUpendra Ks50% (2)

- Costing ChartbookDocument29 pagesCosting ChartbookSHRAVANNo ratings yet

- A Study On Reverse MergerDocument9 pagesA Study On Reverse MergerAsim ChoudhuryNo ratings yet

- The Home DepotDocument7 pagesThe Home DepotWawire WycliffeNo ratings yet

- Spice House Business PlanDocument9 pagesSpice House Business Plananon_22054856No ratings yet

- Chapter 7 Stock ValuationDocument45 pagesChapter 7 Stock ValuationMustafa EyüboğluNo ratings yet

- Audit and Assuranc1Document5 pagesAudit and Assuranc1shaazNo ratings yet

- Illustrative Examples - NCAHFS and Discontinued OperationsDocument2 pagesIllustrative Examples - NCAHFS and Discontinued OperationsMs QuiambaoNo ratings yet

- $RNGDF21Document6 pages$RNGDF21Aan fatandiNo ratings yet

- Ind As BookDocument122 pagesInd As BookanupNo ratings yet