Professional Documents

Culture Documents

3 Years Premium Quotation

3 Years Premium Quotation

Uploaded by

rahulverma007400 ratings0% found this document useful (0 votes)

1 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views4 pages3 Years Premium Quotation

3 Years Premium Quotation

Uploaded by

rahulverma00740Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Mohd Arshad

Unitno.06, Tribhuvan Complex, Gf, Nh-19, Ishwar Nagar, D

Code: BA0000785370

Mobile: 9717180246

Email: arshaddelhi5226@gmail.com

Premium Details for Mr Mayank

Policy: Young Star Policy

Members: 2 Adults & 1 Child

Age: 31 To 33 YRS

Plan: Silver Plan

Term: 3 Years

Sum Insured: 10,00,000

Premium: 53080 (44983 + 8097)

Star Extra Protect: (Optional)

Section I: Applied

Give your loved ones a gift that keeps you along.

Section II: - NA -

Policy Features

Silver & Gold Plan:

Room (Single Private A/C room), Boarding and

Nursing Expenses as provided by the Hospital.

Surgeon, Anesthetist, Medical Practitioner,

Consultants, Specialist Fees.

Anesthesia, Blood, Oxygen, Operation Theatre

charges, ICU charges, etc.

Emergency Road Ambulance charges for emergency

transportation to hospital.

Pre hospitalization expenses up to 60 days prior to

admission in the hospital.

Post hospitalization expenses up to 90 days after

discharge from the hospital.

All Day Care Procedures are covered.

Expenses incurred towards Cost of Health check up

up to the limits mentioned on completion of each

policy year (irrespective of claim).

Give your loved ones a gift that keeps you along.

Upon Partial/full utilization of the limit of coverage,

the basic sum insured shall be automatically restored

by 100%. The unutilized restored sum insured cannot

be carried forward.

The insured person will be eligible for Cumulative

bonus calculated at 20% of basic sum insured for

each claim free year subject to a maximum of 100%

of the basic sum insured.

If the insured person meets with a Road Traffic

Accident resulting in inpatient hospitalization, then

the Basic Sum Insured shall be increased by 25%

subject to a maximum of Rs.10,00,000.This benefit is

payable if the insured person was wearing a helmet

and travelling in a two wheeler either as a rider or as

a pillion rider.

Gold Plan Only:

Expenses for a Delivery including Delivery by

Caesarean section (including pre natal and post natal

expenses) up to Rs.30,000 per delivery is payable.

The Company will pay a Cash Benefit of Rs 1000 for

each completed day of hospitalization subject to a

maximum of 7 days per hospitalization and 14 days

per policy period.

Special Features (Both Plans):

Give your loved ones a gift that keeps you along.

If the Insured person enter this policy before the age

of 36 years and he renewed continuously without any

break, on completion of 40 years of age the insured

person will get a discount of 10% on the premium

applicable at renewal at the age of 40 years for the

sum insured opted at the inception of this policy.

Midterm Inclusion:

Intimation about the marriage/adoption should be

given within 45 days from the date of marriage or

date of adoption.

Intimation about the new born baby should be given

within 90 days from the date of birth. The cover for

new born commences from 91st day of its birth.

Waiting Period:

First 30 days for illness/disease (other than

accidents).

12 months for specified illness/disease/treatments.

12 months for pre existing diseases.

Pre Acceptance Medical Screening:

No Pre Acceptance Medical Screening.

Pre Existing Diseases/Illness:

Are covered after 12 months of continuous Insurance

without break.

Give your loved ones a gift that keeps you along.

You might also like

- International Bill of Exchange TemplateDocument1 pageInternational Bill of Exchange Templatejj86% (95)

- Sheraton: Employment Contract/Service AgreementDocument1 pageSheraton: Employment Contract/Service AgreementSURYA100% (2)

- Content Analysis of Textbook From Human Rights Perspective - RukhsanaDocument13 pagesContent Analysis of Textbook From Human Rights Perspective - RukhsanaWaseem Khan67% (3)

- New India Flexi Floater For Canara Exisitng Policy Holderrs 2017Document10 pagesNew India Flexi Floater For Canara Exisitng Policy Holderrs 2017pavan kumar50% (2)

- MSDS Liquid Shoe PolishDocument4 pagesMSDS Liquid Shoe PolishAhmAd GhAziNo ratings yet

- 06 Ex Parte App To Stay JudgmentDocument11 pages06 Ex Parte App To Stay JudgmentGregory Russell100% (1)

- The Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenuesDocument23 pagesThe Effect of Profit or Loss On Capital and The Double Entry System For Expenses and RevenuesEricKHLeawNo ratings yet

- 1 Year Premium QuotationDocument4 pages1 Year Premium Quotationrahulverma00740No ratings yet

- Mediclassic NewDocument2 pagesMediclassic NewPiyush KantNo ratings yet

- Star Comprehensive Insurance PolicyDocument4 pagesStar Comprehensive Insurance Policynarumanu1120No ratings yet

- Medi-Pac English PDSDocument3 pagesMedi-Pac English PDSfalken1988No ratings yet

- Allianz Care Individual BrochureDocument20 pagesAllianz Care Individual BrochureLeonard YangNo ratings yet

- Manipalcigna Prohealth Insurance: A Pro in Every WayDocument8 pagesManipalcigna Prohealth Insurance: A Pro in Every Wayaniket shahNo ratings yet

- Easy-Health Premium PWDocument13 pagesEasy-Health Premium PWama2amalNo ratings yet

- Health Companion 12 - 2011an-02Document2 pagesHealth Companion 12 - 2011an-02sprashant5No ratings yet

- PSS PrimeMediPlusDocument9 pagesPSS PrimeMediPlusMarco1998No ratings yet

- Sbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessDocument12 pagesSbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessYOGESHNo ratings yet

- Group Mediclaim Policy CIPLADocument31 pagesGroup Mediclaim Policy CIPLAShaileena UnwalaNo ratings yet

- Product BrochureDocument10 pagesProduct BrochuresmshekarsapNo ratings yet

- SNEA KTK GHI Terms ConditionsDocument2 pagesSNEA KTK GHI Terms ConditionsKanakadurga BNo ratings yet

- Ikhlaslink Mediplan Secure Takaful Rider Brochure Eng.v2Document7 pagesIkhlaslink Mediplan Secure Takaful Rider Brochure Eng.v2inkypinkygurlNo ratings yet

- Myhealth SurakshaDocument12 pagesMyhealth SurakshaAshokNo ratings yet

- B-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Document16 pagesB-623, Gate No. 7, Green Field, Surajkund Mall Road, Faridabad, Haryana - 121003Neeraj KatnaNo ratings yet

- Knowledge Series 8 - Mediclaim Insurance Policy With Oriental Insurance CompanyDocument8 pagesKnowledge Series 8 - Mediclaim Insurance Policy With Oriental Insurance CompanyRahul Rao MKNo ratings yet

- Greenply-Benefit Manual - PPSXDocument28 pagesGreenply-Benefit Manual - PPSXArkadev ChakrabartiNo ratings yet

- My+Health+Medisure+Classic Web+Brochure 02Document16 pagesMy+Health+Medisure+Classic Web+Brochure 02Preeti KatiyarNo ratings yet

- Medical ConventionalDocument6 pagesMedical ConventionalshamsulNo ratings yet

- Bro 074 Allianz Care Individual 120928Document20 pagesBro 074 Allianz Care Individual 120928nusthe2745No ratings yet

- CST WordDocument42 pagesCST WordKISHORE STUDIOS OFFICIALNo ratings yet

- Health Insurance: For Your Group & Their Family MembersDocument2 pagesHealth Insurance: For Your Group & Their Family MembersSudhir JadhavNo ratings yet

- Citibank Insurance Services - Know All About InsuranceDocument26 pagesCitibank Insurance Services - Know All About InsurancekartheekbeeramjulaNo ratings yet

- Baroda Health Mediclaim Insurance PolicyDocument13 pagesBaroda Health Mediclaim Insurance Policyabdulyunus_amirNo ratings yet

- Cin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1Document20 pagesCin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1patelmitulvNo ratings yet

- CanmediclaimmrpdDocument5 pagesCanmediclaimmrpdHemant GuptaNo ratings yet

- myhealth-koti-suraksha-brochureDocument12 pagesmyhealth-koti-suraksha-brochureAnshul SahuNo ratings yet

- Peace Corps in Country Staff Group Medical RFQDocument3 pagesPeace Corps in Country Staff Group Medical RFQAccessible Journal Media: Peace Corps DocumentsNo ratings yet

- Star Package 240811Document2 pagesStar Package 240811rproperty_2No ratings yet

- MyShield N MyHealthPlus Brochure April2016Document24 pagesMyShield N MyHealthPlus Brochure April2016CaddyTanNo ratings yet

- Myhealth Koti Suraksha BrochureDocument12 pagesMyhealth Koti Suraksha BrochureAmiDebNo ratings yet

- Complete Health Insurance BrochureDocument21 pagesComplete Health Insurance BrochurePankaj GuptaNo ratings yet

- K Bank Healthcare Plus ProspectusDocument9 pagesK Bank Healthcare Plus ProspectusRajesh NayakNo ratings yet

- Prospectus New India Floater Medi Claim 21042023Document22 pagesProspectus New India Floater Medi Claim 21042023riyashaluriyaNo ratings yet

- Family Health Optima 16Document6 pagesFamily Health Optima 16Muhammad AhsunNo ratings yet

- Bharati SHIP BrochureDocument2 pagesBharati SHIP Brochurehrocking1No ratings yet

- Family Health Optima Insurance PlanDocument16 pagesFamily Health Optima Insurance PlanAmit GargNo ratings yet

- MaximaDocument3 pagesMaximaSaurabh SoodNo ratings yet

- Star Outpatient Care Insurance Policy Prospectus V.1 - WebDocument4 pagesStar Outpatient Care Insurance Policy Prospectus V.1 - WebarunveluNo ratings yet

- Complete Health Insurance BrochureDocument5 pagesComplete Health Insurance BrochureRaghib ShakeelNo ratings yet

- Lifeline Supreme BrochureDocument5 pagesLifeline Supreme BrochureSumit BhandariNo ratings yet

- Medi Claim FAQsDocument9 pagesMedi Claim FAQsMOVIES BRONo ratings yet

- Retail Health BrochureDocument2 pagesRetail Health BrochurejoinmeifyoucanNo ratings yet

- A-Plus Med BrochureDocument24 pagesA-Plus Med BrochureRoberto BeneventiNo ratings yet

- Prospectus New India Floater Mediclaim 21012020 - 1Document20 pagesProspectus New India Floater Mediclaim 21012020 - 1mail2sranjanNo ratings yet

- Medi Care Plus Prospectus Cb8fdfbba9Document10 pagesMedi Care Plus Prospectus Cb8fdfbba9etyala maniNo ratings yet

- Arogya Sanjeevani Policy, Icici Lombard Prospectus: What Is Covered?Document11 pagesArogya Sanjeevani Policy, Icici Lombard Prospectus: What Is Covered?pradiphdasNo ratings yet

- Medi-Major Brochure and PDSDocument16 pagesMedi-Major Brochure and PDSChrisYapNo ratings yet

- Star Health Medi Premier BrochureDocument2 pagesStar Health Medi Premier BrochureBhaktha SinghNo ratings yet

- Senior Med: Securing The Cost of Old AgeDocument12 pagesSenior Med: Securing The Cost of Old AgeHASIRULNIZAM BIN HASHIMNo ratings yet

- Happy Family Floater Prospectus 06052015Document16 pagesHappy Family Floater Prospectus 06052015Soumen PaulNo ratings yet

- Complete Health Insurance BrochureDocument5 pagesComplete Health Insurance BrochureDeepak SureshNo ratings yet

- Diabetes Safe Insurance PolicyDocument11 pagesDiabetes Safe Insurance PolicyJyothika JayashriNo ratings yet

- b4b65f86-a937-4920-a8c0-59d848e4de75 - CopyDocument14 pagesb4b65f86-a937-4920-a8c0-59d848e4de75 - CopyassmexellenceNo ratings yet

- Health Suraksha - Ind BrochureDocument2 pagesHealth Suraksha - Ind BrochureSumit BhandariNo ratings yet

- Takaful Health2Document34 pagesTakaful Health2yusofprubsnNo ratings yet

- Air Transport SecurityDocument297 pagesAir Transport Securitytangoenak100% (2)

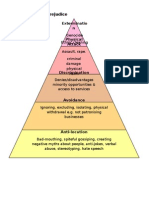

- Allports Scale of PrejudiceDocument1 pageAllports Scale of PrejudicebmckNo ratings yet

- Resident Mammals FIDEC vs. Sec. ReyesDocument4 pagesResident Mammals FIDEC vs. Sec. ReyesDawn Jessa Go0% (1)

- 1 A Copy of The Special Power of Attorney Is Hereto Attached and Made An Integral Part of This InstrumentDocument6 pages1 A Copy of The Special Power of Attorney Is Hereto Attached and Made An Integral Part of This InstrumentBenedict OntalNo ratings yet

- MB Manual B650i-Aorus-Ultra eDocument38 pagesMB Manual B650i-Aorus-Ultra eStelica LeopeaNo ratings yet

- 65 Sand V Abad Santos Educational InstitutionDocument2 pages65 Sand V Abad Santos Educational InstitutionCJ MillenaNo ratings yet

- People V AlcongaDocument3 pagesPeople V AlcongaGeenea VidalNo ratings yet

- Calcium Nitrate Fertilizer PDFDocument2 pagesCalcium Nitrate Fertilizer PDForangebig100% (1)

- Narayan Prasad Lohia v. Nikunj Kumar Lohia, (2009) 17 SCC 359Document6 pagesNarayan Prasad Lohia v. Nikunj Kumar Lohia, (2009) 17 SCC 359Kashish JumaniNo ratings yet

- ASTDocument10 pagesASTJermain BarbadosNo ratings yet

- The Cape Grim MassacreDocument20 pagesThe Cape Grim MassacreGrayce BaxterNo ratings yet

- Employee Release, Waiver and Quitclaim With UndertakingDocument2 pagesEmployee Release, Waiver and Quitclaim With UndertakingChristian RoqueNo ratings yet

- Santander (1) HVKDocument1 pageSantander (1) HVKDianne RayNo ratings yet

- BJMP and BFPDocument2 pagesBJMP and BFPMaelilah MampayNo ratings yet

- Rule If The Builder, Planter, Sower, and Owner of The Land Are DifferentDocument7 pagesRule If The Builder, Planter, Sower, and Owner of The Land Are DifferentJim M. MagadanNo ratings yet

- Invoice FANDocument1 pageInvoice FANVarsha A Kankanala0% (1)

- L5R 1e - S1 The Tomb of Iuchiban GM's GuideDocument42 pagesL5R 1e - S1 The Tomb of Iuchiban GM's GuideCarlos William Lares100% (1)

- Common Law Is A Legal System Based OnDocument4 pagesCommon Law Is A Legal System Based OnMuhammadBadarJamalNo ratings yet

- Cash Book Revision o LevelDocument10 pagesCash Book Revision o Levelnajla nisthar0% (1)

- An Illustrated History of Bangabandu and BangladeshDocument33 pagesAn Illustrated History of Bangabandu and BangladeshEdward Ebb BonnoNo ratings yet

- Certificate of AppearanceDocument1 pageCertificate of Appearanceyada greenNo ratings yet

- SUPREME COURT REPORTS ANNOTATED VOLUME 626 Case 10Document29 pagesSUPREME COURT REPORTS ANNOTATED VOLUME 626 Case 10Marie Bernadette BartolomeNo ratings yet

- Storming Juno Assignment PDFDocument2 pagesStorming Juno Assignment PDFbisbiusaNo ratings yet

- Remember The Titans Leadership EssayDocument8 pagesRemember The Titans Leadership Essayb71g37acNo ratings yet