Professional Documents

Culture Documents

Shareholder's Equity Solutions 1

Shareholder's Equity Solutions 1

Uploaded by

ncq6dmzmp4Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shareholder's Equity Solutions 1

Shareholder's Equity Solutions 1

Uploaded by

ncq6dmzmp4Copyright:

Available Formats

NATIONAL UNIVERSITY

Manila

SHAREHOLDERS’ EQUITY

PROBLEM 1 – MALAY COMPANY

You have been assigned to the audit of MALAY CO., a manufacturing company. You have been

asked to summarize the transactions for the year ended December 31, 2023, affecting

shareholders’ equity and other related accounts. The shareholders’ equity section of Malay’s

December 31, 2022, statement of financial position follows:

Ordinary share capital, P2 par value, 1,000,000

shares authorized, 180,000 shares issued,

177,580 shares outstanding P 360,000

Share premium - issuance 3,640,000

Share premium – treasury shares 45,000

Retained earnings 649,378

Cost of 2,420 treasury shares (145,200)

Total shareholders’ equity P4,549,178

You have extracted the following information from the accounting records and audit working

papers.

2023

Jan. 15 Malay reissued 1,300 treasury shares for P40 per share. The 2,420 treasury shares on

hand at December 31, 2022, were purchased in one block in 2020.

Feb. 1 Sold 180, P1,000, 9% bonds due February 1, 2033, at 103 with one detachable share

warrant attached to each bond. Interest is payable annually on February 1. The fair

market value of the bonds without the share warrants is 95. The detachable warrants

have a fair value of P50 each and expire on February 1, 2024. Each warrant entitles

the holder to purchase 10 ordinary shares at P40 per share.

Mar. 6 2,800 ordinary shares were subscribed for at P44 per share. 40% of the subscription

was collected.

20 The balance due on 2,400 shares was received and those shares were issued.

Nov. 1 There were 110 share warrants detached from the bonds and exercised.

Malay’s net income for 2023 is P950,000.

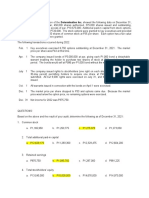

Based on the preceding information, determine the correct December 31, 2023, balance of each

of the following:

1. Ordinary share capital

A. P364,800 B. P375,800 C. P372,600 D. P367,000

2. Share premium – issuance

A. P3,827,200 B. P3,808,200 C. P3,805,065 D. P3,791,400

3. Share premium – treasury shares

A. P19,000 B. P45,000 C. P187,200 D. P192,800

4. Unappropriated retained earnings

A. P1,532,178 B. P1,599,378 C. P1,573,378 D. P1,454,178

5. Total shareholders’ equity

A. P5,722,218 B. P5,716,618 C. P5,720,223 D. P5,717,088

PROBLEM 2 – UBE COMPANY

UBE COMPANY reported the following amounts in the shareholders’ equity section of its December

31, 2022, statement of financial position:

Preference shares, 10%, P10 par (100,000 shares

authorized, 20,000 shares issued) P200,000

Ordinary shares, P5 par (50,000 shares authorized

10,000 shares issued) 50,000

Share premium 96,000

Retained earnings 600,000

Total P946,000

The following transactions occurred during 2023:

1. Paid the annual 2022 P1 per share dividend on preference shares and P0.50 per share

dividend on ordinary shares. These dividends had been declared on December 31, 2022.

2. Purchased 2,000 shares of its own outstanding ordinary shares for P20 per share.

3. Reissued 700 treasury shares for equipment valued at P25,000.

4. Issued 5,000 preference shares at P15 per share.

5. Declared a 10% stock dividend on the outstanding ordinary shares when the shares were

selling for P12 per share.

6. Issued the stock dividend.

7. Declared the annual 2023 P1 per share dividend on preference shares and the P0.50 per

share dividend on ordinary shares. These dividends are payable in 2024.

8. Appropriated retained earnings for plant expansion, P300,000.

9. Appropriated retained earnings for treasury shares.

The net income for 2023 was P470,000.

Based on the above data, determine the correct December 31, 2023, balances of each of the

following accounts:

1. Preference shares

A. P200,000 B. P275,000 C. P250,000 D. P1,000,000

2. Ordinary shares

A. P54,000 B. P54,350 C. P53,500 D. P50,000

3. Share premium

A. P138,090 B. P137,600 C. P127,090 D. P132,000

4. Treasury shares

A. P40,000 B. P15,000 C. P26,000 D. P14,000

5. Unappropriated retained earnings

A. P714,775 B. P709,775 C. P703,775 D. P729,775

PROBLEM 3 – ROBUSTA, INC.

At December 31, 2022, ROBUSTA, INC. had 1,800,000 authorized shares of P10 par value

ordinary shares, of which 600,000 shares were issued and outstanding.

The shareholders’ equity accounts at December 31, 2022, had the following balances.

Ordinary shares..............................................P6,000,000

Share premium.................................................2,250,000

Retained earnings.............................................1,941,000

Transactions during 2023 and other information relating to the shareholders’ equity accounts

were as follows:

1. On January 7, 2023, ROBUSTA issued at P54 per share, 30,000 shares of P50 par value, 9%

cumulative convertible preference shares. Each share of preference is convertible, at the

option of the holder, into two ordinary shares. ROBUSTA had 180,000 authorized

preference shares.

2. On February 2, 2023, ROBUSTA reacquired 6,000 of its ordinary shares for P16 per share.

ROBUSTA uses the cost method to account for treasury shares.

3. On April 29, 2023, ROBUSTA sold 150,000 shares (previously unissued) of P10 par value

ordinary shares at P17 per share.

4. On June 17, 2023, ROBUSTA declared a cash dividend of P1 per ordinary share, payable on

July 14, 2023, to shareholders of record on July 1, 2023.

5. On November 12, 2023, ROBUSTA sold 3,000 treasury shares for P21 per share.

6. On December 15, 2023, ROBUSTA declared the yearly cash dividend on preference shares,

payable on January 14, 2024, to shareholders of record on December 31, 2023.

7. On January 22, 2024, before the books were closed for 2023, ROBUSTA became aware that

the ending inventories at December 31, 2022, were understated by P63,000. The

appropriate correcting entry was recorded the same day.

8. After correcting the beginning inventory, net income for 2023 was P1,350,000. Ignore income

tax implications.

Questions:

1. The retained earnings, as restated, as of January 1, 2023, is

A. P1,941,000 B. P2,004,000 C. P2,031,000 D. P2,034,000

2. The retained earnings balance as of December 31, 2023, is

A. P1,875,000 B. P2,460,000 C. P2,475,000 D. P2,556,000

3. The share premium from preference shares as of December 31, 2023, is

A. P30,000 B. P90,000 C. P105,000 D. P120,000

4. The share premium from ordinary shares (including sale of treasury shares) as of

December 31, 2023, is

A. P3,000,000 B. P3,300,000 C. P3,315,000 D. P3,450,000

5. Total shareholders’ equity as of December 31, 2023, is

A. P14,835,000 B. P14,851,200 C. P14,862,000 D. P14,910,000

PROBLEM 4 – Entity A

At the beginning of year 1, Entity A grants share options to each of its 100 employees working

in the sales department. The share options will vest at the end of year 3, provided that the

employees remain in the entity’s employ, and provided that the volume of sales of a particular

product increases by at least an average of 5 percent per year. If the volume of sales of the

product increases by an average of between 5 percent and 10 percent per year, each employee

will receive 100 share options. If the volume of sales increases by an average of between 11

percent and 15 percent each year, each employee will receive 200 share options. If the volume

of sales increases by an average of 16 percent or more, each employee will receive 300 share

options.

On grant date, Entity A estimates that the share options have a fair value of P20 per option.

Entity A also estimates that the volume of sales of the product will increase by an average of

between 11 percent and 15 percent per year, and therefore expects that, for each employee

who remains in service until the end of year 3, 200 share options will vest. The entity also

estimates, on the basis of a weighted average probability, that 20 percent of employees will

leave before the end of year 3.

By the end of year 1, seven employees have left and the entity still expects that a total of 20

employees will leave by the end of year 3. Hence, the entity expects that 80 employees will

remain in service for the three-year period. Product sales have increased by 12 percent and the

entity expects this rate of increase to continue over the next 2 years.

By the end of year 2, a further five employees have left, bringing the total to 12 to date. The

entity now expects only three more employees will leave during year 3, and therefore expects a

total of 85 employees will remain at the end of year 3. Product sales have increased by 20

percent, resulting in an average of 16 percent over the two years to date. The entity now

expects that sales will average 16 percent or more over the three-year period, and hence

expects each sales employee to receive 300 share options at the end of year 3.

By the end of year 3, a further two employees have left. Hence, 14 employees have left during

the three-year period, and 86 employees remain. The entity’s sales have increased by an

average of 16 percent over the three years.

Based on the preceding information, answer the following:

1. What is the compensation expense for year 1?

A. P53,333 B. P106,667 C. P160,000 D. P172,000

2. What is the compensation expense for year 2?

A. P168,000 B. P180,000 C. P233,333 D. P286,667

3. What is the compensation expense for year 3?

A. P114,667 B. P176,000 C. P188,000 D. P282,667

4. What is the cumulative compensation expense for years 1, 2, and 3?

A. P172,000 B. P320,000 C. P344,000 D. P516,000

5. At the end of year 2, the entity should report share options outstanding of

A. P226,667 B. P286,667 C. P328,000 D. P340,000

You might also like

- Segregation of Duties MatrixDocument1 pageSegregation of Duties MatrixAbubakar Siddique100% (6)

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Document28 pagesACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloNo ratings yet

- Shareholders EquityDocument2 pagesShareholders EquityAudrey LiberoNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- Ap 9101 2 SheDocument5 pagesAp 9101 2 Shejohn paulNo ratings yet

- Ch2 + 5 ExercisesDocument9 pagesCh2 + 5 ExercisesMunira AlfaizNo ratings yet

- Investment in Equity Securities - SeatworkDocument2 pagesInvestment in Equity Securities - SeatworkLester ColladosNo ratings yet

- 2022 Accele4 M5 AssignmentDocument6 pages2022 Accele4 M5 AssignmentPYM MataasnakahoyNo ratings yet

- SHE LimheyaDocument12 pagesSHE LimheyaxjammerNo ratings yet

- Aaca Audit of She CtaDocument7 pagesAaca Audit of She CtaShannel Angelica Claire RiveraNo ratings yet

- Audit of Shareholders EquityDocument10 pagesAudit of Shareholders Equityaira nialaNo ratings yet

- Auditing Problem 1 22 22 PDFDocument26 pagesAuditing Problem 1 22 22 PDFKate NuevaNo ratings yet

- Audit Pre TestDocument13 pagesAudit Pre Testpwcpresident.nfjpia2324No ratings yet

- Consolidated Financial Statements - IntercomapnyDocument6 pagesConsolidated Financial Statements - IntercomapnyCORNADO, MERIJOY G.No ratings yet

- AACA2 Midterm QDocument10 pagesAACA2 Midterm QChristen HerceNo ratings yet

- Audit of Liabilities QuizDocument13 pagesAudit of Liabilities QuizAldrin DagamiNo ratings yet

- AUD.2024 5. Substantive Tests of InvestmentsDocument4 pagesAUD.2024 5. Substantive Tests of InvestmentskrizmyrelatadoNo ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsGiane Bernard PunayanNo ratings yet

- Ap 9101-1 SheDocument4 pagesAp 9101-1 SheSydney De NievaNo ratings yet

- HO6 Consolidation Subsequent To Acqusition DateDocument6 pagesHO6 Consolidation Subsequent To Acqusition Dateitzadizazta01No ratings yet

- InventoriesDocument22 pagesInventoriesJane T.No ratings yet

- Open ReSA B45 FAR Final PB Exam Questions Answers SolutionsDocument21 pagesOpen ReSA B45 FAR Final PB Exam Questions Answers SolutionsZOEZEL ANNLEIH LAYONGNo ratings yet

- Ilovepdf Merged 1Document14 pagesIlovepdf Merged 1BATISATIC, EDCADIO JOSE E.No ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- 8901 Audit of Shareholders Equity Self TestDocument6 pages8901 Audit of Shareholders Equity Self TestYahlianah LeeNo ratings yet

- ACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Document3 pagesACCTG 105 Midterm - Quiz No. 01 - Statement of Changes in Equity, Cash Flows, and Notes To FS (Answers)Lucas BantilingNo ratings yet

- Long Quiz 1Document3 pagesLong Quiz 1Ryan Jayson EnriquezNo ratings yet

- SM09 4thExamReview-2 054657Document4 pagesSM09 4thExamReview-2 054657Hilarie JeanNo ratings yet

- Exercises Audit of She No AnsDocument11 pagesExercises Audit of She No AnsG18 Yna RecintoNo ratings yet

- EXERCISES Investment in AssociateDocument4 pagesEXERCISES Investment in AssociateMeeka CalimagNo ratings yet

- Ap 9001-2 SheDocument5 pagesAp 9001-2 SheSirNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- ExtAud 3 Quiz 5 Wo AnswersDocument8 pagesExtAud 3 Quiz 5 Wo AnswersJANET ILLESESNo ratings yet

- Ap 9402-1 LiabilitiesDocument5 pagesAp 9402-1 LiabilitiesSilver LilyNo ratings yet

- Audit of Liabilities For SendingDocument35 pagesAudit of Liabilities For SendingNye NyeNo ratings yet

- Quiz 1Document2 pagesQuiz 1mkrisnaharq99No ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsMark Lord Morales Bumagat43% (7)

- Ap 9401-1 SheDocument4 pagesAp 9401-1 SheLuzviminda SaspaNo ratings yet

- Accounting For Investments: TheoriesDocument20 pagesAccounting For Investments: TheoriesJohn AlbateraNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Quiz 3 With Correct AnswersDocument10 pagesQuiz 3 With Correct AnswersmarietorianoNo ratings yet

- QuestionsDocument3 pagesQuestionslois martinNo ratings yet

- Far DrillDocument5 pagesFar DrillJung Hwan SoNo ratings yet

- Audit Problem Investments Part 2Document6 pagesAudit Problem Investments Part 2Rio Cyrel CelleroNo ratings yet

- 7210 - Retained EarningsDocument2 pages7210 - Retained Earningsjsmozol3434qcNo ratings yet

- Aud Problem 10 15Document4 pagesAud Problem 10 15Werpa PetmaluNo ratings yet

- CPAR - AFAR - Final PB - Batch89Document18 pagesCPAR - AFAR - Final PB - Batch89MellaniNo ratings yet

- (ACC124) Investment QuizDocument6 pages(ACC124) Investment QuizKloie SanoriaNo ratings yet

- Midterm SheDocument5 pagesMidterm SheKaye Delos SantosNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- IA2 Prelim Exam Invt in AssocDocument5 pagesIA2 Prelim Exam Invt in AssocJoel RagosNo ratings yet

- Test2 AfarDocument24 pagesTest2 AfarZyrelle DelgadoNo ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- Ap 9002-1-LiabilitiesDocument4 pagesAp 9002-1-LiabilitiesSirNo ratings yet

- LiabilitiesDocument9 pagesLiabilitiesNeriza maningasNo ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Accounting CycleDocument24 pagesAccounting Cycletalha ShakeelNo ratings yet

- Monthly Digest September 2020 Eng 30Document33 pagesMonthly Digest September 2020 Eng 30Avi DVNo ratings yet

- Akhil K Bse Nse Indo NextDocument18 pagesAkhil K Bse Nse Indo Nextakhil kNo ratings yet

- ROSCADocument1 pageROSCAAshe FritzNo ratings yet

- CIBILDocument11 pagesCIBILViji RangaNo ratings yet

- Aggregate To Handover Fürst To Creditors 150m Senior Debt Raise To Complete Project (9fin)Document7 pagesAggregate To Handover Fürst To Creditors 150m Senior Debt Raise To Complete Project (9fin)vitacoco127No ratings yet

- First 20 PagesDocument21 pagesFirst 20 Pageszainab.xf77No ratings yet

- NonesDocument15 pagesNonesMary Rose Nones100% (3)

- Ageas JD (2023-2024)Document2 pagesAgeas JD (2023-2024)kakadNo ratings yet

- 3.3 Instalment PurchasedDocument4 pages3.3 Instalment PurchasedharizNo ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Prefinals ExamDocument3 pagesPrefinals ExamKate Crystel reyesNo ratings yet

- Business Capability Model: Quick GuideDocument6 pagesBusiness Capability Model: Quick Guidekadeoye80% (5)

- Practice QuestionsDocument15 pagesPractice QuestionsKumarNo ratings yet

- FPA Worksheet BalanceSheetDocument1 pageFPA Worksheet BalanceSheetMandar BahadarpurkarNo ratings yet

- Finman 1Document49 pagesFinman 1Khai Supleo PabelicoNo ratings yet

- The Banking Ombudsman Scheme 2006 Reserve Bank of India Central Office MumbaiDocument15 pagesThe Banking Ombudsman Scheme 2006 Reserve Bank of India Central Office MumbaiRuchi ChaudharyNo ratings yet

- FM Toc and Chapter 1 Spring 07 BPPDocument27 pagesFM Toc and Chapter 1 Spring 07 BPPVishy Bhatia0% (1)

- Tutorial Ques - Cash BookDocument2 pagesTutorial Ques - Cash BookWan HoonNo ratings yet

- IAI CM1 Syllabus 2024Document7 pagesIAI CM1 Syllabus 2024agnivodeystat1068No ratings yet

- CH 05Document99 pagesCH 05Reinch Closs100% (1)

- Amogh Arora - 00229888821Document15 pagesAmogh Arora - 00229888821Amogh AroraNo ratings yet

- Repot On SBIDocument76 pagesRepot On SBIPrasad SawantNo ratings yet

- 2nd August 2022Document8 pages2nd August 2022Lucas PaixaoNo ratings yet

- Date Description Amount BalanceDocument1 pageDate Description Amount BalanceAzfar ZhafranNo ratings yet

- NYIF Williams Credit Risk Analysis I Aug-2016Document117 pagesNYIF Williams Credit Risk Analysis I Aug-2016victor andrésNo ratings yet

- International Financing Review Asia April 11 2020 PDFDocument44 pagesInternational Financing Review Asia April 11 2020 PDFLêTrọngQuangNo ratings yet

- Comparative Study On Services of Public Sector and Private Sector BanksDocument49 pagesComparative Study On Services of Public Sector and Private Sector BanksvimalaNo ratings yet