Professional Documents

Culture Documents

Lesson 13 - Accounts Receivable #1 - BE8 - 1, BE8-1, E8 - 1, E8-2 - 2021

Lesson 13 - Accounts Receivable #1 - BE8 - 1, BE8-1, E8 - 1, E8-2 - 2021

Uploaded by

Kelis SmithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 13 - Accounts Receivable #1 - BE8 - 1, BE8-1, E8 - 1, E8-2 - 2021

Lesson 13 - Accounts Receivable #1 - BE8 - 1, BE8-1, E8 - 1, E8-2 - 2021

Uploaded by

Kelis SmithCopyright:

Available Formats

Accounts Receivable

Brief Exercises & Exercises

BE8-1

2

Presented below are three receivables transactions.

Indicate whether these receivables are reported as

accounts receivable, notes receivable, or other

receivables on a balance sheet.

(a) Sold merchandise on account for $64,000 to a

customer.

(b) Received a promissory note of $57,000 for

services performed.

(c) Advanced $10,000 to an employee.

David A . A. Weatherhead 05/23/2024 01:25 PM

(a) Sold merchandise on account for $64,000 to a

customer.

3

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(a) A/R – ‘Customer’ 64,000

Sales 64,000

Accounts receivable

David A . A. Weatherhead 05/23/2024 01:25 PM

(b) Received a promissory note of $57,000 for services

performed.

4

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(b) Note Receivable 57,000

Service Revenue 57,000

Note receivable

David A . A. Weatherhead 05/23/2024 01:25 PM

(c) Advanced $10,000 to an employee.

5

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(c) Loan Receivable 10,000

Cash 10,000

Other receivable

David A . A. Weatherhead 05/23/2024 01:25 PM

BE8-2

6

Record the following transactions on the books of RAS

Co.

(a) On July 1, RAS Co. sold merchandise on account to

Waegelein Inc. for $17,200, terms 2/10, n/30.

(b) On July 8, Waegelein Inc. returned merchandise

worth $3,800 to RAS Co.

(c) On July 11, Waegelein Inc. paid for the merchandise.

David A . A. Weatherhead 05/23/2024 01:25 PM

(a) On July 1, RAS Co. sold merchandise on account to

Waegelein Inc. for $17,200, terms 2/10, n/30.

7

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(a) A/R – Waegelein 17,200

Sales 17,200

(Record sales on account)

David A . A. Weatherhead 05/23/2024 01:25 PM

(b) On July 8, Waegelein Inc. returned merchandise worth

$3,800 to RAS Co.

8

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(b) Sales Returns & Allowances 3,800

A/R - Waegelein 3,800

(Record return of goods)

David A . A. Weatherhead 05/23/2024 01:25 PM

(c) On July 11, Waegelein Inc. paid for the

merchandise.

9

How much is owed?

$17,200 - $3,800 = $13,400

Is customer entitled to discount?

Yes! 2%

Discount = 2% x $13,400 = $268

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

(c) Cash 13,132

Sales Discount

(2% x $13,400 = $268) 268

A/R – Waegelein 13,400

(Received payment on a/c)

David A . A. Weatherhead 05/23/2024 01:25 PM

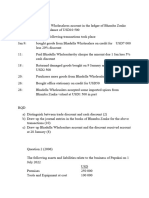

E8-1

10

Presented below are selected transactions of Molina Company. Molina sells

in large quantities to other companies and also sells its product in a small

retail outlet.

March 1 Sold merchandise on account to Dodson Company for $5,000,

terms 2/10, n/30.

3 Dodson Company returned merchandise worth $500 to Molina.

9 Molina collected the amount due from Dodson Company from the

March 1 sale.

15 Molina sold merchandise for $400 in its retail outlet. The customer

used his Molina credit card.

31 Molina added 1.5% monthly interest to the customer’s credit card

balance.

Instructions

Prepare journal entries for the transactions above.

David A . A. Weatherhead 05/23/2024 01:25 PM

March 1 Sold merchandise on account to Dodson Company

for $5,000, terms 2/10, n/30.

11

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 01 A/R – Dodson 5,000

Sales 5,000

David A . A. Weatherhead 05/23/2024 01:25 PM

March 3 Dodson Company returned merchandise worth $500

to Molina.

12

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 03 Sales Returns & Allowances 500

A/R - Dodson 500

Reverse (kind of) original entry

David A . A. Weatherhead 05/23/2024 01:25 PM

March 9 Molina collected the amount due from Dodson

Company from the March 1 sale.

13

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 09 Cash 4,410

Sales Discount 90

A/R - Dodson 4,500

How much is owed?

$5,000 - $500 = $4,500

Is customer entitled to discount?

Yes! 2%

Discount = 2% x $4,500 = $90

Cash received = $4,500 - $90 = $4,410

David A . A. Weatherhead 05/23/2024 01:25 PM

March 15 Molina sold merchandise for $400 in its retail

outlet. The customer used his Molina credit card.

14

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 15 A/R – ‘Customer’ 400

Sales 400

David A . A. Weatherhead 05/23/2024 01:25 PM

March 31 Molina added 1.5% monthly interest to the customer’s

credit card balance.

15

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 31 A/R – ‘Customer’ 6

Interest Revenue 6

David A . A. Weatherhead 05/23/2024 01:25 PM

E8-2

16

Presented below are two independent situations.

(a) On January 6, Brumbaugh Co. sells merchandise on account

to Pryor Inc. for $7,000, terms 2/10, n/30.

On January 16, Pryor Inc. pays the amount due.

Prepare the entries on Brumbaugh’s books to record the sale

and related collection.

David A . A. Weatherhead 05/23/2024 01:25 PM

On January 6, Brumbaugh Co. sells merchandise on account

to Pryor Inc. for $7,000, terms 2/10, n/30.

17

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Jan 06 A/R – Pryor 7,000

Sales 7,000

David A . A. Weatherhead 05/23/2024 01:25 PM

On January 16, Pryor Inc. pays the amount due.

18

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Jan 16 Cash 6,860

Sales Discounts 140

A/R – Pryor 7,000

David A . A. Weatherhead 05/23/2024 01:25 PM

E8-2

19

(b) On January 10, Andrew Farley uses his Paltrow Co. credit

card to purchase merchandise from Paltrow Co. for $9,000.

On February 10, Farley is billed for the amount due of $9,000.

On February 12, Farley pays $5,000 on the balance due.

On March 10, Farley is billed for the amount due, including

interest at 1% per month on the unpaid balance as of February

12.

Prepare the entries on Paltrow Co.’s books related to the

transactions that occurred on January 10, February 12, and

March 10.

David A . A. Weatherhead 05/23/2024 01:25 PM

On January 10, Andrew Farley uses his Paltrow Co. credit

card to purchase merchandise from Paltrow Co. for $9,000.

20

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Jan 10 A/R – Farley 9,000

Sales 9,000

David A . A. Weatherhead 05/23/2024 01:25 PM

On February 10, Farley is billed for the amount due of

$9,000.

21

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

No entry required

David A . A. Weatherhead 05/23/2024 01:25 PM

On February 12, Farley pays $5,000 on the balance due.

22

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Feb 12 Cash 5,000

A/R – Farley 5,000

David A . A. Weatherhead 05/23/2024 01:25 PM

March 10, Farley is billed for the amount due, including interest

at 1% per month on the unpaid balance as of February 12.

23

GENERAL JOURNAL

Date Account Titles and Explanation Ref. Debit Credit

Mar 10 A/R – ‘Customer’ 40

Interest Revenue 40

David A . A. Weatherhead 05/23/2024 01:25 PM

The End

David A . A. Weatherhead 24 05/23/2024 01:25 PM

You might also like

- Bank of America Statement Nov 2023 1Document9 pagesBank of America Statement Nov 2023 1raheemtimo1No ratings yet

- WELS FARGO Bank - Statement - 123123Document7 pagesWELS FARGO Bank - Statement - 123123Alex Nezi50% (2)

- Fa2 Mock Exam 2Document10 pagesFa2 Mock Exam 2Iqra Hafeez100% (1)

- Approved Loan AgreementDocument2 pagesApproved Loan Agreementshaheda siddiqui100% (1)

- Acct11 1hwDocument3 pagesAcct11 1hwRonald James Siruno MonisNo ratings yet

- Csec Poa January 2010 p2Document9 pagesCsec Poa January 2010 p2goseinvarunNo ratings yet

- Case Study Acct MGT - ACCT 102 - FinalDocument5 pagesCase Study Acct MGT - ACCT 102 - FinalbrightsparksintlNo ratings yet

- FA1 BBA122 Final Exams v2Document16 pagesFA1 BBA122 Final Exams v2shimondokadNo ratings yet

- Final OutputDocument8 pagesFinal OutputNoemie DelgadoNo ratings yet

- The Trial Balance, Debtor and Creditors JournalsDocument4 pagesThe Trial Balance, Debtor and Creditors JournalsRambo Chillaz NehadiNo ratings yet

- Depreciation and Amortization Expense (AutoRecovered)Document11 pagesDepreciation and Amortization Expense (AutoRecovered)Bhavy DubeyNo ratings yet

- Xii Accountancy PT II Set A Answer KeyDocument3 pagesXii Accountancy PT II Set A Answer KeyAyush AgarwalNo ratings yet

- Journal and Ledger March 2024Document7 pagesJournal and Ledger March 2024harriselijah242No ratings yet

- CA-Foundation June 2023 Free Test - SUGGESTED ANSWERSDocument17 pagesCA-Foundation June 2023 Free Test - SUGGESTED ANSWERSAastha ShrivastavaNo ratings yet

- Partnership Accounts QuestionsDocument4 pagesPartnership Accounts QuestionsKaleli RockyNo ratings yet

- Assignment #5 Chapter 6.Document15 pagesAssignment #5 Chapter 6.ValentinaNo ratings yet

- Chapters 4 and 5 The LedgerDocument14 pagesChapters 4 and 5 The LedgerSneha DasNo ratings yet

- Debit: 1/2/2003 To Share Capital A/CDocument16 pagesDebit: 1/2/2003 To Share Capital A/Csakshita palNo ratings yet

- AFAR First Preboard May 2023 BatchDocument14 pagesAFAR First Preboard May 2023 BatchRhea Mae CarantoNo ratings yet

- 10 Other Business DocumentDocument3 pages10 Other Business DocumentFrieda Twamonomuntu TaapopiNo ratings yet

- BK Form Iii Package 2023Document9 pagesBK Form Iii Package 2023jasmina.mushy22No ratings yet

- Ledger 23 07 1Document10 pagesLedger 23 07 1Arman AhmedNo ratings yet

- Chapter 2 Governmental AccountingDocument14 pagesChapter 2 Governmental Accountingmohamad ali osmanNo ratings yet

- Sample ProblemsDocument9 pagesSample Problemsbea dinglasan0% (1)

- RASHEDUL HASSAN SIR 01712550075: Accounting Paper #1 Mock-October 2022Document12 pagesRASHEDUL HASSAN SIR 01712550075: Accounting Paper #1 Mock-October 2022Rashedul HassanNo ratings yet

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- SolutionDocument23 pagesSolutionKavita WadhwaNo ratings yet

- BCPC 204 Exams Questions and Submission InstructionsDocument5 pagesBCPC 204 Exams Questions and Submission InstructionsHorace IvanNo ratings yet

- O Level Agriculture CPS BOOK 4Document6 pagesO Level Agriculture CPS BOOK 4sithole.john2006No ratings yet

- Fabm Module 10 Quarter 1Document8 pagesFabm Module 10 Quarter 1Rhea Alipio SadorraNo ratings yet

- Chapter 5 ReceivablesDocument27 pagesChapter 5 ReceivablesCabdiraxmaan GeeldoonNo ratings yet

- Exercise: Partnership (Q & A)Document5 pagesExercise: Partnership (Q & A)Far-east faizahNo ratings yet

- Grade 9 Accounting p2Document5 pagesGrade 9 Accounting p2AliNo ratings yet

- Answers-Accounting CB 2nd Ed CambridgeDocument119 pagesAnswers-Accounting CB 2nd Ed Cambridgebk4t7j8g92No ratings yet

- Accounts Textbook AnswersDocument84 pagesAccounts Textbook AnswersVidhi Patel100% (4)

- Chapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oDocument9 pagesChapter 6 Dissolution OF Partnership Firm: Case/Source Based Questions S.N oabi100% (1)

- M4.2 Due Monday July 11 at 4PM OnlyDocument12 pagesM4.2 Due Monday July 11 at 4PM OnlyPaul Lawrence MarasiganNo ratings yet

- Cambridge O Level: Accounting 7707/11Document12 pagesCambridge O Level: Accounting 7707/11Tapiwa MT (N1c3isH)No ratings yet

- Solution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or LiabilitiesDocument7 pagesSolution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or Liabilitiesshafqat aliNo ratings yet

- Unit 2: Ledgers: Learning OutcomesDocument12 pagesUnit 2: Ledgers: Learning OutcomesTanya100% (1)

- S3 MYE QP 2019-20 (Final)Document13 pagesS3 MYE QP 2019-20 (Final)XinYi ChenNo ratings yet

- PROB 2-1: Date Account Titles and Explanation P.R.: General JournalDocument14 pagesPROB 2-1: Date Account Titles and Explanation P.R.: General JournalMinh PhươngNo ratings yet

- HW2 - Ch2 The Recording Process NewDocument17 pagesHW2 - Ch2 The Recording Process Newvico lorenzoNo ratings yet

- Balance Off DemoDocument7 pagesBalance Off DemoNayanza McCawNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice May/June 2005 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice May/June 2005 1 HourOmar BilalNo ratings yet

- BE8-3 Date Account Titles and Explanation Debit CreditDocument4 pagesBE8-3 Date Account Titles and Explanation Debit CreditMai Phương NguyễnNo ratings yet

- Accounts Paper 2Document4 pagesAccounts Paper 2Amisha RamsundarsinghNo ratings yet

- Unit Test: The Accounting Cycle Part A: Completing The Accounting CycleDocument7 pagesUnit Test: The Accounting Cycle Part A: Completing The Accounting CycleKevin PanesarNo ratings yet

- Doubtful DebtsDocument27 pagesDoubtful Debtsmudassar saeedNo ratings yet

- Jawaban Modul PA Jilid 1 (2022-2023) (AutoRecovered)Document26 pagesJawaban Modul PA Jilid 1 (2022-2023) (AutoRecovered)k kNo ratings yet

- Date Account Titles and Explanation P.R. Debit Credit: General JournalDocument48 pagesDate Account Titles and Explanation P.R. Debit Credit: General JournalHồng LamNo ratings yet

- Accounting - The Recording ProcessDocument10 pagesAccounting - The Recording ProcessThuy TruongNo ratings yet

- Toys R Us Debtors Motion For Entry of OrdersDocument124 pagesToys R Us Debtors Motion For Entry of OrdersStephen LoiaconiNo ratings yet

- Cambridge O Level: Commerce 7100/12Document12 pagesCambridge O Level: Commerce 7100/12Afshan Masood8ANo ratings yet

- Grace Tax Levy 2193946 Autographed - United States of America IncDocument5 pagesGrace Tax Levy 2193946 Autographed - United States of America IncGee MeeNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Solved Accounting ExercisesDocument4 pagesSolved Accounting ExercisesScribdTranslationsNo ratings yet

- University of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2004 1 HourDocument12 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Education Accounting Paper 1 Multiple Choice October/November 2004 1 HourSerenaNo ratings yet

- Recording of Business TransactionsDocument30 pagesRecording of Business TransactionsAnthony John BrionesNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- Accounting p2 QP Gr12 Sept 2023 - EnglishDocument11 pagesAccounting p2 QP Gr12 Sept 2023 - Englishbrandon.tabaneNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Personalrecord - Umidcard - Form Falcon, John Alfred OlingayDocument2 pagesPersonalrecord - Umidcard - Form Falcon, John Alfred OlingayMark JNo ratings yet

- IDFCFIRSTBankstatement 50001100003 230131263Document3 pagesIDFCFIRSTBankstatement 50001100003 230131263ayush900aNo ratings yet

- Aubreyruivivargumatay: Page1of3 115consuelostacacia 4 6 2 9 - 3 1 1 6 - 5 4 Malaboncity1474 Malabonacacia 1 4 7 4Document4 pagesAubreyruivivargumatay: Page1of3 115consuelostacacia 4 6 2 9 - 3 1 1 6 - 5 4 Malaboncity1474 Malabonacacia 1 4 7 4Aubrey Ruivivar GumatzNo ratings yet

- Carding Tutorial-1Document6 pagesCarding Tutorial-1余子豪67% (3)

- Train TicketDocument2 pagesTrain TicketMeenakshi VermaNo ratings yet

- Cash and Cash EquivalentsDocument10 pagesCash and Cash EquivalentsMs VampireNo ratings yet

- Process of Raising Funds Through Unsecured NCDDocument1 pageProcess of Raising Funds Through Unsecured NCDNisha MunkaNo ratings yet

- Group 1 Chapter 1 3 Quali Research - Docx REVISEDDocument40 pagesGroup 1 Chapter 1 3 Quali Research - Docx REVISEDLeo EspinoNo ratings yet

- XV. Audit of Transaction CyclesDocument30 pagesXV. Audit of Transaction CyclesAlex AtienzaNo ratings yet

- Account Number Amount Due: Due Date: V.A.T. Registration Number: Invoice Number: Invoice DateDocument3 pagesAccount Number Amount Due: Due Date: V.A.T. Registration Number: Invoice Number: Invoice DateRedzone RealkillersNo ratings yet

- Not For Profit Organisation1Document20 pagesNot For Profit Organisation1Harsh ThakurNo ratings yet

- Ghid Tarife Si Comisioane ENDocument28 pagesGhid Tarife Si Comisioane ENLuchianAndreiNo ratings yet

- One Pager Bajaj Finserv DBS Bank 999+ GST First Year FreeDocument2 pagesOne Pager Bajaj Finserv DBS Bank 999+ GST First Year FreeAazad JiiNo ratings yet

- XI-com PPR 21-1-23Document2 pagesXI-com PPR 21-1-23Obaid KhanNo ratings yet

- Intermediate Accounting 1Document22 pagesIntermediate Accounting 1Nemalai VitalNo ratings yet

- Channel Access Request Form - Ind and Non-IndDocument3 pagesChannel Access Request Form - Ind and Non-IndP SinghNo ratings yet

- EmiratesNBD Credit Card Fees ChargesDocument2 pagesEmiratesNBD Credit Card Fees ChargesHanif MohammmedNo ratings yet

- AR Refund-ManualDocument4 pagesAR Refund-ManualAziz KhanNo ratings yet

- ListDocument2 pagesListjjtoomuch1118No ratings yet

- Identifying and Journalizing Transactions: Learning OutcomesDocument51 pagesIdentifying and Journalizing Transactions: Learning OutcomesTip Tap100% (1)

- Togo ReceiptDocument4 pagesTogo ReceiptColin MusaaziNo ratings yet

- ACCTG 6 Midterm ExaminationDocument16 pagesACCTG 6 Midterm ExaminationJudy Anne Ramirez100% (1)

- Blkpay YyyymmddDocument4 pagesBlkpay YyyymmddRamesh PatelNo ratings yet

- IOB79470Canara-Bank MMT Terms & ConditionsDocument4 pagesIOB79470Canara-Bank MMT Terms & ConditionsWaseem AkhtarNo ratings yet

- Fresh N Rebel Twins 2 Tip GrijsDocument4 pagesFresh N Rebel Twins 2 Tip Grijs76xzv4kk5vNo ratings yet

- Statement Emilija BarclaysDocument4 pagesStatement Emilija BarclaysKris TheVillainNo ratings yet

- Topic 6 Multiple Choice QuestionDocument8 pagesTopic 6 Multiple Choice Question黄颀桓No ratings yet