Professional Documents

Culture Documents

The Global Payments Report Colombia 2022

The Global Payments Report Colombia 2022

Uploaded by

mariano bellenfantCopyright:

Available Formats

You might also like

- The Anatomy of the Swipe: Making Money MoveFrom EverandThe Anatomy of the Swipe: Making Money MoveRating: 4.5 out of 5 stars4.5/5 (6)

- Global Payment Report 2017 - WorldPayDocument57 pagesGlobal Payment Report 2017 - WorldPaytyempuser100% (1)

- #1210 Nilson ReportDocument18 pages#1210 Nilson ReportChristian Javier VillafuerteNo ratings yet

- Worldpay Global Payment Report 2016Document47 pagesWorldpay Global Payment Report 2016ipsitaNo ratings yet

- André Maggi Participacoes Sa AmaggiDocument88 pagesAndré Maggi Participacoes Sa AmaggiJefferson AnacletoNo ratings yet

- 2018 Worldpay Global Payments ReportDocument108 pages2018 Worldpay Global Payments ReportBeny Perez-ReyesNo ratings yet

- UKF Payment Markets Summary 2022Document10 pagesUKF Payment Markets Summary 2022vetemNo ratings yet

- 2021 Debit Issuer Study White PaperDocument18 pages2021 Debit Issuer Study White PaperJack PurcherNo ratings yet

- GPR 2020Document133 pagesGPR 2020Jugal Asher0% (1)

- 2014 Worldpay Alternative Payments 2nd Edition ReportDocument36 pages2014 Worldpay Alternative Payments 2nd Edition ReporteffeviNo ratings yet

- ALLPAGO Brazil Online PaymentsDocument5 pagesALLPAGO Brazil Online PaymentsBernard PortNo ratings yet

- Competitive Environmental AnalysisDocument11 pagesCompetitive Environmental Analysisdivyasj100% (2)

- Case Study 1Document4 pagesCase Study 1Ernie Batayola100% (1)

- CM1 Assignment Y1 Solutions 2019 (FINAL)Document8 pagesCM1 Assignment Y1 Solutions 2019 (FINAL)Swapnil SinghNo ratings yet

- Planday Restaurant KPIs Checklist Web FinalDocument4 pagesPlanday Restaurant KPIs Checklist Web FinalÓscar Correia100% (1)

- Local Payments in Latin AmericaDocument14 pagesLocal Payments in Latin AmericaPaul Antonio Rios MurrugarraNo ratings yet

- Local Payments in Latin AmericaDocument16 pagesLocal Payments in Latin AmericaLuiz Henrique AraujoNo ratings yet

- ENGPR2022Document156 pagesENGPR2022Trader CatNo ratings yet

- GPR Digital All Pages Singles RGB FNL8BDocument138 pagesGPR Digital All Pages Singles RGB FNL8BAndré Oliveira VenancioNo ratings yet

- GPR Digital All Pages Singles RGB FNL9Document138 pagesGPR Digital All Pages Singles RGB FNL9André Carvalho de AndradeNo ratings yet

- How OEM Pay Is Disrupting The Contactless Payments Landscape Whitepaper PDFDocument11 pagesHow OEM Pay Is Disrupting The Contactless Payments Landscape Whitepaper PDFAndrew HungNo ratings yet

- Ipsos Udapte - Payment OptionsDocument15 pagesIpsos Udapte - Payment OptionsMarkus OdarNo ratings yet

- E-Payments, E-Wallet and The Future of Payments: Ho Chi Minh City, 19 April 2019Document24 pagesE-Payments, E-Wallet and The Future of Payments: Ho Chi Minh City, 19 April 2019icemainNo ratings yet

- Summary Uk Payment Markets 2021 FinalDocument8 pagesSummary Uk Payment Markets 2021 FinalvetemNo ratings yet

- Vietnam Retail Banking 2022 D1tru0Document39 pagesVietnam Retail Banking 2022 D1tru0ankyanky122No ratings yet

- Comercial BlueprintsDocument4 pagesComercial BlueprintsMax RojitasNo ratings yet

- SAMA National - Payments - Usage - Study - enDocument36 pagesSAMA National - Payments - Usage - Study - enShalabhNo ratings yet

- India Digital Payments ReportDocument21 pagesIndia Digital Payments ReportKunal SinghNo ratings yet

- BCA MateriDocument21 pagesBCA MateriArbi IskandarNo ratings yet

- Industry - Brochure - E-CommerceDocument9 pagesIndustry - Brochure - E-CommerceANo ratings yet

- Ecommerce Challenges in Southeast Asia: Gurmit Singh, CmoDocument14 pagesEcommerce Challenges in Southeast Asia: Gurmit Singh, Cmoumesh nairNo ratings yet

- Brazil Guide MarketDocument9 pagesBrazil Guide MarketWeverton JaquesNo ratings yet

- The Rise of E Wallet in VietnamDocument13 pagesThe Rise of E Wallet in VietnamTrần Thủy VânNo ratings yet

- Payhawk Whitepaper Cashless BusinessDocument14 pagesPayhawk Whitepaper Cashless BusinessCorneliu Bajenaru - Talisman Consult SRLNo ratings yet

- Uk Payment Markets SUMMARY 2020: June 2020Document8 pagesUk Payment Markets SUMMARY 2020: June 2020Ankit GuptaNo ratings yet

- Digital Payment in 2020: Which Solutions and Technologies Will Prevail?Document37 pagesDigital Payment in 2020: Which Solutions and Technologies Will Prevail?Akpknuako1No ratings yet

- MENA Ecommerce Statistics and Opportunities 2021Document18 pagesMENA Ecommerce Statistics and Opportunities 2021Noha NazifNo ratings yet

- Market Overview - e PaymentDocument6 pagesMarket Overview - e Paymentchoechoe.meNo ratings yet

- MASTERCARD FUTURE OF ACCEPTANCE NEW PAYMENT TRENDS OCTOBER 2021 20211021+ (LE) +The+Future+of+AcceptanceDocument26 pagesMASTERCARD FUTURE OF ACCEPTANCE NEW PAYMENT TRENDS OCTOBER 2021 20211021+ (LE) +The+Future+of+Acceptancestan nedNo ratings yet

- Payment System - Group 5Document13 pagesPayment System - Group 5Swapnil JaiswalNo ratings yet

- Understanding Online Payments in 2020Document4 pagesUnderstanding Online Payments in 2020Suhas SalehittalNo ratings yet

- PPRO MEA and Africa Payments and Ecommerce Report 2022Document13 pagesPPRO MEA and Africa Payments and Ecommerce Report 2022omoakadesh01No ratings yet

- 4Q21 & 2021 Earnings ReleaseDocument32 pages4Q21 & 2021 Earnings ReleaseSiyuan LinNo ratings yet

- In Strategy Leading The Cashless Charge NoexpDocument9 pagesIn Strategy Leading The Cashless Charge Noexptarunjain1505No ratings yet

- Consumer Lending in IndiaDocument22 pagesConsumer Lending in IndiadeepakNo ratings yet

- Proposal X Tarak Tarak Booking ServicesDocument3 pagesProposal X Tarak Tarak Booking ServicesNiคo ApostolNo ratings yet

- Commerce E-Volution Report - Mastercard Data & ServicesDocument7 pagesCommerce E-Volution Report - Mastercard Data & ServicesBruno EnriqueNo ratings yet

- Atmos: Presented by FTTDocument19 pagesAtmos: Presented by FTTD SNo ratings yet

- X-Border-Payments-Optimization-Providers Directory PDFDocument36 pagesX-Border-Payments-Optimization-Providers Directory PDFAmbujNo ratings yet

- UAE Fintech Report 2021Document22 pagesUAE Fintech Report 2021Linh ThuỳNo ratings yet

- WorldPay For The WorldDocument19 pagesWorldPay For The WorldM WiqiNo ratings yet

- FIS TheGlobalPaymentsReport 2023Document182 pagesFIS TheGlobalPaymentsReport 2023Erlend ClaessenNo ratings yet

- Digitizing Merchant Payments: What Will It Take?: Peter Zetterli and Rashmi PillaiDocument50 pagesDigitizing Merchant Payments: What Will It Take?: Peter Zetterli and Rashmi PillaiMarcNo ratings yet

- Future of Digital Currency in India 1694942271Document16 pagesFuture of Digital Currency in India 1694942271KeshavNo ratings yet

- Digital Payment - AsiaDocument35 pagesDigital Payment - AsiaRahman ArmenzariaNo ratings yet

- Sugar Promo DeckDocument14 pagesSugar Promo DeckJiten ThummarNo ratings yet

- Cobecon Midterm Project Group 2Document1 pageCobecon Midterm Project Group 2joshuapierrechingNo ratings yet

- WorldPay - Global Payments Report Nov-2015Document27 pagesWorldPay - Global Payments Report Nov-2015surambaya100% (1)

- Study - Id41122 - Fintech Report Digital PaymentsDocument28 pagesStudy - Id41122 - Fintech Report Digital PaymentsAiyush BahlNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Yudha Sidhikoro AjiNo ratings yet

- Stripe's Guide To Payment MethodsDocument33 pagesStripe's Guide To Payment MethodsYogesh Gutta100% (1)

- Fight Real-Time Payments Fraud in Three Simple Steps WhitepaperDocument11 pagesFight Real-Time Payments Fraud in Three Simple Steps WhitepaperLim Siew LingNo ratings yet

- Worldpay Alternative Payments 2nd Edition ReportDocument37 pagesWorldpay Alternative Payments 2nd Edition ReportDiablonNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Gideon ListanoNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Status of Test - Blank FormxlsDocument36 pagesStatus of Test - Blank FormxlsKyndree PadsingNo ratings yet

- Szymoniak False Claims Act Complaint - SCDocument74 pagesSzymoniak False Claims Act Complaint - SCMartin Andelman100% (2)

- Physical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseDocument10 pagesPhysical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseAung Phyoe ThetNo ratings yet

- Managing A Lean-Agile Leadership Transformation in A Traditional OrganizationDocument128 pagesManaging A Lean-Agile Leadership Transformation in A Traditional OrganizationAiouaz OthmenNo ratings yet

- Ratan TataDocument15 pagesRatan TataIT2013Dipak DhummaNo ratings yet

- A Khulna BARAK BANKDocument1 pageA Khulna BARAK BANKogaNo ratings yet

- Technical 1672641Document1 pageTechnical 1672641Rajesh KadamNo ratings yet

- IFM-OB-Tender-Brief-Slides (Done Excel, Done CC) PDFDocument25 pagesIFM-OB-Tender-Brief-Slides (Done Excel, Done CC) PDFCK AngNo ratings yet

- Screenshot 2024-02-17 at 13.43.15Document6 pagesScreenshot 2024-02-17 at 13.43.15jrchen777No ratings yet

- IE 2 - Unit 1 - Labour Market in StatesDocument11 pagesIE 2 - Unit 1 - Labour Market in StatesApoorva Sharma100% (1)

- Module 4 Macro Perspective of Tourism and HospitalityDocument52 pagesModule 4 Macro Perspective of Tourism and HospitalityRoy Cabarles100% (1)

- 6d39f86a-c233-4140-8aa2-3830fafa991aDocument14 pages6d39f86a-c233-4140-8aa2-3830fafa991aHARSH KATARE MA ECO KOL 2021-23No ratings yet

- Board Resolution Format (Boom Pump)Document2 pagesBoard Resolution Format (Boom Pump)T YeshwathNo ratings yet

- American Fork & Hoe 1910 HDocument272 pagesAmerican Fork & Hoe 1910 HJay SNo ratings yet

- Project Quality Plan With All Forms & Checklists - Method Statement HQDocument4 pagesProject Quality Plan With All Forms & Checklists - Method Statement HQsvsrnbNo ratings yet

- The Impact of Artificial Intelligence On SocietyDocument2 pagesThe Impact of Artificial Intelligence On SocietychristineNo ratings yet

- Monthly Departmental Meeting For The Month of DECEMBER - 2020Document14 pagesMonthly Departmental Meeting For The Month of DECEMBER - 2020atiqNo ratings yet

- Toaz - Info Advacc Corporate Liquidationdoc PRDocument4 pagesToaz - Info Advacc Corporate Liquidationdoc PRRica BarbozaNo ratings yet

- Municipality of San Clemente - Citizens CharterDocument155 pagesMunicipality of San Clemente - Citizens CharterFree FlixnetNo ratings yet

- Catalog of Engineering Maintenance Heavy Machinery From JaneDocument5 pagesCatalog of Engineering Maintenance Heavy Machinery From JaneJose PeresNo ratings yet

- Deed of Assignment of Shares and Subscription Rights - SampleDocument2 pagesDeed of Assignment of Shares and Subscription Rights - SampleFelot100% (2)

- Lecture - 9 Introduction To Business and EntrepreneurshipDocument19 pagesLecture - 9 Introduction To Business and Entrepreneurshipwajahat badshahNo ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- Module 3A The Architect's Regular ServicesDocument23 pagesModule 3A The Architect's Regular ServicesNikkoSaleRegaladoNo ratings yet

- Anshu Samsung Project ReportDocument58 pagesAnshu Samsung Project ReportJay PrakashNo ratings yet

The Global Payments Report Colombia 2022

The Global Payments Report Colombia 2022

Uploaded by

mariano bellenfantCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Global Payments Report Colombia 2022

The Global Payments Report Colombia 2022

Uploaded by

mariano bellenfantCopyright:

Available Formats

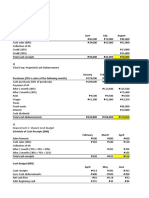

The Colombian economy rebounded in 2021 from

COLOMBIA Fast Facts

the pandemic-induced recession with 9% overall

and 14% e-com CAGR projected through 2025. Cards Market data

accounted for over half of e-com transaction value 2021 e-com sales 2021 m-com 2021* - 2025** 2021* - 2025** 2025 e-com sales 2025 m-com sales

in 2021, with credit (34.7%) outpacing debit (18.9%). as % commerce sales as % e-com e-com CAGR POS CAGR as %** commerce as %** e-com

Bank transfers earned 16.5% share in 2021, digital

wallets continue to grow (13.6%) and COD is holding

strong with 10.4% share. Cash remains essential

6% 54% 14% 8% 8% 62%

among Colombian consumers, rebounding from a dip

in 2020 to represent 42.4% share. Gradual increases

Real-time payments

in credit (25.1%) and debit (21.5%) will lead to cards

accounting for a majority of POS payment transaction Name Year live

value by 2023. Transfiya 2019

Initially only supporting small merchants, the Average daily volume Average daily value

new real-time payments service in Colombia is

soon expanding with business-focused payment 3,560 N/A

services through its open API. Developed by Bogota-

based fintech Minka and ACH Colombia, Transfiya

is a blockchain-based instant payment solution. It Overlay Services:

already has 11 participants, including seven banks Proxy for payments using mobile number (recipient must accept and indicate which institution should

receive the money), B2B payments with request to pay, QR code payments are in development

(covering most of the domestic market), two mobile

wallets, a financial cooperative and fintech Sedpe.

With a maximum of 250,000 Colombian pesos per

transaction, users can make up to five transfers daily,

equivalent to a maximum of 1.25 million pesos per day. 82

Did you know?

Colombian consumers are embracing innovative payment

COLOMBIA

2020 card brand breakdowns (e-com and POS)

methods, especially in e-commerce. Pagos Seguros en Línea

54% 43%

(PSE), a bank transfer method that works on ACH, is the most

popular alternative payment method. Bogotá-based Rappi is an

emerging super app capturing the imagination – and spend – of MASTERCARD VISA

consumers across Colombia.

2021 e-com mix by payment method 1%

AMERICAN EXPRESS

1%

DINERS CLUB

1%

OTHERS

Credit/Charge Card 35%

Debit Card 19%

Bank Transfer 17%

Digital/Mobile Wallet 14%

POS and e-com projected growth

Cash on Delivery 10%

PostPay 5%

US$209bn

Buy Now, Pay Later 1%

US$17bn

US$153bn

US$11bn

2021 point of sale mix by payment method

US$10bn

Cash 42% US$7bn

US$6bn

Credit/Charge Card 25% US$5bn

Debit Card 22% 2021* 2025**

Digital/Mobile Wallet 7%

e-com turnover POS

Retailer/Bank Financing 2%

Prepaid Card 1% Desktop

Buy Now, Pay Later 1% Mobile

Popular alternative

* Estimated **Forecasted payment methods

83

Numbers adjusted for rounding may impact totals.

You might also like

- The Anatomy of the Swipe: Making Money MoveFrom EverandThe Anatomy of the Swipe: Making Money MoveRating: 4.5 out of 5 stars4.5/5 (6)

- Global Payment Report 2017 - WorldPayDocument57 pagesGlobal Payment Report 2017 - WorldPaytyempuser100% (1)

- #1210 Nilson ReportDocument18 pages#1210 Nilson ReportChristian Javier VillafuerteNo ratings yet

- Worldpay Global Payment Report 2016Document47 pagesWorldpay Global Payment Report 2016ipsitaNo ratings yet

- André Maggi Participacoes Sa AmaggiDocument88 pagesAndré Maggi Participacoes Sa AmaggiJefferson AnacletoNo ratings yet

- 2018 Worldpay Global Payments ReportDocument108 pages2018 Worldpay Global Payments ReportBeny Perez-ReyesNo ratings yet

- UKF Payment Markets Summary 2022Document10 pagesUKF Payment Markets Summary 2022vetemNo ratings yet

- 2021 Debit Issuer Study White PaperDocument18 pages2021 Debit Issuer Study White PaperJack PurcherNo ratings yet

- GPR 2020Document133 pagesGPR 2020Jugal Asher0% (1)

- 2014 Worldpay Alternative Payments 2nd Edition ReportDocument36 pages2014 Worldpay Alternative Payments 2nd Edition ReporteffeviNo ratings yet

- ALLPAGO Brazil Online PaymentsDocument5 pagesALLPAGO Brazil Online PaymentsBernard PortNo ratings yet

- Competitive Environmental AnalysisDocument11 pagesCompetitive Environmental Analysisdivyasj100% (2)

- Case Study 1Document4 pagesCase Study 1Ernie Batayola100% (1)

- CM1 Assignment Y1 Solutions 2019 (FINAL)Document8 pagesCM1 Assignment Y1 Solutions 2019 (FINAL)Swapnil SinghNo ratings yet

- Planday Restaurant KPIs Checklist Web FinalDocument4 pagesPlanday Restaurant KPIs Checklist Web FinalÓscar Correia100% (1)

- Local Payments in Latin AmericaDocument14 pagesLocal Payments in Latin AmericaPaul Antonio Rios MurrugarraNo ratings yet

- Local Payments in Latin AmericaDocument16 pagesLocal Payments in Latin AmericaLuiz Henrique AraujoNo ratings yet

- ENGPR2022Document156 pagesENGPR2022Trader CatNo ratings yet

- GPR Digital All Pages Singles RGB FNL8BDocument138 pagesGPR Digital All Pages Singles RGB FNL8BAndré Oliveira VenancioNo ratings yet

- GPR Digital All Pages Singles RGB FNL9Document138 pagesGPR Digital All Pages Singles RGB FNL9André Carvalho de AndradeNo ratings yet

- How OEM Pay Is Disrupting The Contactless Payments Landscape Whitepaper PDFDocument11 pagesHow OEM Pay Is Disrupting The Contactless Payments Landscape Whitepaper PDFAndrew HungNo ratings yet

- Ipsos Udapte - Payment OptionsDocument15 pagesIpsos Udapte - Payment OptionsMarkus OdarNo ratings yet

- E-Payments, E-Wallet and The Future of Payments: Ho Chi Minh City, 19 April 2019Document24 pagesE-Payments, E-Wallet and The Future of Payments: Ho Chi Minh City, 19 April 2019icemainNo ratings yet

- Summary Uk Payment Markets 2021 FinalDocument8 pagesSummary Uk Payment Markets 2021 FinalvetemNo ratings yet

- Vietnam Retail Banking 2022 D1tru0Document39 pagesVietnam Retail Banking 2022 D1tru0ankyanky122No ratings yet

- Comercial BlueprintsDocument4 pagesComercial BlueprintsMax RojitasNo ratings yet

- SAMA National - Payments - Usage - Study - enDocument36 pagesSAMA National - Payments - Usage - Study - enShalabhNo ratings yet

- India Digital Payments ReportDocument21 pagesIndia Digital Payments ReportKunal SinghNo ratings yet

- BCA MateriDocument21 pagesBCA MateriArbi IskandarNo ratings yet

- Industry - Brochure - E-CommerceDocument9 pagesIndustry - Brochure - E-CommerceANo ratings yet

- Ecommerce Challenges in Southeast Asia: Gurmit Singh, CmoDocument14 pagesEcommerce Challenges in Southeast Asia: Gurmit Singh, Cmoumesh nairNo ratings yet

- Brazil Guide MarketDocument9 pagesBrazil Guide MarketWeverton JaquesNo ratings yet

- The Rise of E Wallet in VietnamDocument13 pagesThe Rise of E Wallet in VietnamTrần Thủy VânNo ratings yet

- Payhawk Whitepaper Cashless BusinessDocument14 pagesPayhawk Whitepaper Cashless BusinessCorneliu Bajenaru - Talisman Consult SRLNo ratings yet

- Uk Payment Markets SUMMARY 2020: June 2020Document8 pagesUk Payment Markets SUMMARY 2020: June 2020Ankit GuptaNo ratings yet

- Digital Payment in 2020: Which Solutions and Technologies Will Prevail?Document37 pagesDigital Payment in 2020: Which Solutions and Technologies Will Prevail?Akpknuako1No ratings yet

- MENA Ecommerce Statistics and Opportunities 2021Document18 pagesMENA Ecommerce Statistics and Opportunities 2021Noha NazifNo ratings yet

- Market Overview - e PaymentDocument6 pagesMarket Overview - e Paymentchoechoe.meNo ratings yet

- MASTERCARD FUTURE OF ACCEPTANCE NEW PAYMENT TRENDS OCTOBER 2021 20211021+ (LE) +The+Future+of+AcceptanceDocument26 pagesMASTERCARD FUTURE OF ACCEPTANCE NEW PAYMENT TRENDS OCTOBER 2021 20211021+ (LE) +The+Future+of+Acceptancestan nedNo ratings yet

- Payment System - Group 5Document13 pagesPayment System - Group 5Swapnil JaiswalNo ratings yet

- Understanding Online Payments in 2020Document4 pagesUnderstanding Online Payments in 2020Suhas SalehittalNo ratings yet

- PPRO MEA and Africa Payments and Ecommerce Report 2022Document13 pagesPPRO MEA and Africa Payments and Ecommerce Report 2022omoakadesh01No ratings yet

- 4Q21 & 2021 Earnings ReleaseDocument32 pages4Q21 & 2021 Earnings ReleaseSiyuan LinNo ratings yet

- In Strategy Leading The Cashless Charge NoexpDocument9 pagesIn Strategy Leading The Cashless Charge Noexptarunjain1505No ratings yet

- Consumer Lending in IndiaDocument22 pagesConsumer Lending in IndiadeepakNo ratings yet

- Proposal X Tarak Tarak Booking ServicesDocument3 pagesProposal X Tarak Tarak Booking ServicesNiคo ApostolNo ratings yet

- Commerce E-Volution Report - Mastercard Data & ServicesDocument7 pagesCommerce E-Volution Report - Mastercard Data & ServicesBruno EnriqueNo ratings yet

- Atmos: Presented by FTTDocument19 pagesAtmos: Presented by FTTD SNo ratings yet

- X-Border-Payments-Optimization-Providers Directory PDFDocument36 pagesX-Border-Payments-Optimization-Providers Directory PDFAmbujNo ratings yet

- UAE Fintech Report 2021Document22 pagesUAE Fintech Report 2021Linh ThuỳNo ratings yet

- WorldPay For The WorldDocument19 pagesWorldPay For The WorldM WiqiNo ratings yet

- FIS TheGlobalPaymentsReport 2023Document182 pagesFIS TheGlobalPaymentsReport 2023Erlend ClaessenNo ratings yet

- Digitizing Merchant Payments: What Will It Take?: Peter Zetterli and Rashmi PillaiDocument50 pagesDigitizing Merchant Payments: What Will It Take?: Peter Zetterli and Rashmi PillaiMarcNo ratings yet

- Future of Digital Currency in India 1694942271Document16 pagesFuture of Digital Currency in India 1694942271KeshavNo ratings yet

- Digital Payment - AsiaDocument35 pagesDigital Payment - AsiaRahman ArmenzariaNo ratings yet

- Sugar Promo DeckDocument14 pagesSugar Promo DeckJiten ThummarNo ratings yet

- Cobecon Midterm Project Group 2Document1 pageCobecon Midterm Project Group 2joshuapierrechingNo ratings yet

- WorldPay - Global Payments Report Nov-2015Document27 pagesWorldPay - Global Payments Report Nov-2015surambaya100% (1)

- Study - Id41122 - Fintech Report Digital PaymentsDocument28 pagesStudy - Id41122 - Fintech Report Digital PaymentsAiyush BahlNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Yudha Sidhikoro AjiNo ratings yet

- Stripe's Guide To Payment MethodsDocument33 pagesStripe's Guide To Payment MethodsYogesh Gutta100% (1)

- Fight Real-Time Payments Fraud in Three Simple Steps WhitepaperDocument11 pagesFight Real-Time Payments Fraud in Three Simple Steps WhitepaperLim Siew LingNo ratings yet

- Worldpay Alternative Payments 2nd Edition ReportDocument37 pagesWorldpay Alternative Payments 2nd Edition ReportDiablonNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Gideon ListanoNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Status of Test - Blank FormxlsDocument36 pagesStatus of Test - Blank FormxlsKyndree PadsingNo ratings yet

- Szymoniak False Claims Act Complaint - SCDocument74 pagesSzymoniak False Claims Act Complaint - SCMartin Andelman100% (2)

- Physical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseDocument10 pagesPhysical Stock Report: Print Date Time: Page No.: Stock Type: From Date: WarehouseAung Phyoe ThetNo ratings yet

- Managing A Lean-Agile Leadership Transformation in A Traditional OrganizationDocument128 pagesManaging A Lean-Agile Leadership Transformation in A Traditional OrganizationAiouaz OthmenNo ratings yet

- Ratan TataDocument15 pagesRatan TataIT2013Dipak DhummaNo ratings yet

- A Khulna BARAK BANKDocument1 pageA Khulna BARAK BANKogaNo ratings yet

- Technical 1672641Document1 pageTechnical 1672641Rajesh KadamNo ratings yet

- IFM-OB-Tender-Brief-Slides (Done Excel, Done CC) PDFDocument25 pagesIFM-OB-Tender-Brief-Slides (Done Excel, Done CC) PDFCK AngNo ratings yet

- Screenshot 2024-02-17 at 13.43.15Document6 pagesScreenshot 2024-02-17 at 13.43.15jrchen777No ratings yet

- IE 2 - Unit 1 - Labour Market in StatesDocument11 pagesIE 2 - Unit 1 - Labour Market in StatesApoorva Sharma100% (1)

- Module 4 Macro Perspective of Tourism and HospitalityDocument52 pagesModule 4 Macro Perspective of Tourism and HospitalityRoy Cabarles100% (1)

- 6d39f86a-c233-4140-8aa2-3830fafa991aDocument14 pages6d39f86a-c233-4140-8aa2-3830fafa991aHARSH KATARE MA ECO KOL 2021-23No ratings yet

- Board Resolution Format (Boom Pump)Document2 pagesBoard Resolution Format (Boom Pump)T YeshwathNo ratings yet

- American Fork & Hoe 1910 HDocument272 pagesAmerican Fork & Hoe 1910 HJay SNo ratings yet

- Project Quality Plan With All Forms & Checklists - Method Statement HQDocument4 pagesProject Quality Plan With All Forms & Checklists - Method Statement HQsvsrnbNo ratings yet

- The Impact of Artificial Intelligence On SocietyDocument2 pagesThe Impact of Artificial Intelligence On SocietychristineNo ratings yet

- Monthly Departmental Meeting For The Month of DECEMBER - 2020Document14 pagesMonthly Departmental Meeting For The Month of DECEMBER - 2020atiqNo ratings yet

- Toaz - Info Advacc Corporate Liquidationdoc PRDocument4 pagesToaz - Info Advacc Corporate Liquidationdoc PRRica BarbozaNo ratings yet

- Municipality of San Clemente - Citizens CharterDocument155 pagesMunicipality of San Clemente - Citizens CharterFree FlixnetNo ratings yet

- Catalog of Engineering Maintenance Heavy Machinery From JaneDocument5 pagesCatalog of Engineering Maintenance Heavy Machinery From JaneJose PeresNo ratings yet

- Deed of Assignment of Shares and Subscription Rights - SampleDocument2 pagesDeed of Assignment of Shares and Subscription Rights - SampleFelot100% (2)

- Lecture - 9 Introduction To Business and EntrepreneurshipDocument19 pagesLecture - 9 Introduction To Business and Entrepreneurshipwajahat badshahNo ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- Module 3A The Architect's Regular ServicesDocument23 pagesModule 3A The Architect's Regular ServicesNikkoSaleRegaladoNo ratings yet

- Anshu Samsung Project ReportDocument58 pagesAnshu Samsung Project ReportJay PrakashNo ratings yet