Professional Documents

Culture Documents

IAS 12 Freddy LTD - Solution

IAS 12 Freddy LTD - Solution

Uploaded by

nonzuzossyCopyright:

Available Formats

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Solution AP Test Bank 2Document9 pagesSolution AP Test Bank 2imaNo ratings yet

- Template Tax Provision Calculation 2021Document3 pagesTemplate Tax Provision Calculation 2021Chiara AnindaNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- Comprehensive National Development Planning FrameworkDocument25 pagesComprehensive National Development Planning FrameworkMichael ButlerNo ratings yet

- ACC117 - Chapter 4-3 - Tutorial - Solution - Textbook Page 95, 98 - 99Document6 pagesACC117 - Chapter 4-3 - Tutorial - Solution - Textbook Page 95, 98 - 99taerrybombNo ratings yet

- IAS 12 Ross LTD SolutionDocument2 pagesIAS 12 Ross LTD SolutionarronyeagarNo ratings yet

- Handouts - CHAPTER 4-3 - ACC117Document3 pagesHandouts - CHAPTER 4-3 - ACC117taerrybombNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- Exam 2 Input Sheet-FinalDocument24 pagesExam 2 Input Sheet-Finalさくら樱花No ratings yet

- New Millennium Assignment2 School of Practical Accounting Darrel SamuelDocument2 pagesNew Millennium Assignment2 School of Practical Accounting Darrel SamuelDarrel SamueldNo ratings yet

- ABC Limited Income Statement: Particulars Amounts 2016 2017 2018Document2 pagesABC Limited Income Statement: Particulars Amounts 2016 2017 2018Rezaul KarimNo ratings yet

- Sampras SolutionDocument3 pagesSampras SolutionSiphesihleNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Revenue: Non-Current AssetsDocument5 pagesRevenue: Non-Current Assetsfahim tusarNo ratings yet

- Solution Feb2021 Far410Document9 pagesSolution Feb2021 Far4102022478048No ratings yet

- Basics LTD - MemoDocument3 pagesBasics LTD - Memoewriteandread.businessNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Nkome TradersDocument2 pagesNkome Tradersrethaxaba82No ratings yet

- Pusat Tuition Jom GemilangTT 2022Document8 pagesPusat Tuition Jom GemilangTT 2022Yenny YapNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- LCCI Level One Final AcctDocument2 pagesLCCI Level One Final AcctStpmTutorialClassNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Section B - Additional QuestionDocument124 pagesSection B - Additional QuestionGodie MaraNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- Answer Q5Document2 pagesAnswer Q5calebNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Unit 12-Question 12-B Sol (2023)Document2 pagesUnit 12-Question 12-B Sol (2023)shirleygebenga020829No ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- IAL Accounting SB2 AnswersDocument91 pagesIAL Accounting SB2 AnswersThaviksha BulathsinhalaNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- AC415 Group 6 Assignment 2022Document3 pagesAC415 Group 6 Assignment 2022portiafadzaiNo ratings yet

- Budgeting: CalculatingDocument5 pagesBudgeting: CalculatingTaetae ElyenNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackNo ratings yet

- House Bill 2526Document17 pagesHouse Bill 2526Kristofer PlonaNo ratings yet

- Tata Consultancy PayslipDocument2 pagesTata Consultancy PayslipSitharth VkrNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Income Tax Rates & Threshold - Guyana Revenue AuthorityDocument5 pagesIncome Tax Rates & Threshold - Guyana Revenue AuthorityStephen FrancisNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- Assignment 5 - Government - Fiscal PolicyDocument3 pagesAssignment 5 - Government - Fiscal PolicypsitaeNo ratings yet

- Tax Review 194RDocument4 pagesTax Review 194RDheeraj YadavNo ratings yet

- Income TaxationDocument4 pagesIncome Taxationralfgerwin inesaNo ratings yet

- 51 Mohd Ifham Khan-Study On GST&its ImplicationDocument100 pages51 Mohd Ifham Khan-Study On GST&its ImplicationFaisal ArifNo ratings yet

- Capital Allowances Lecture Slides (2 Per Page)Document11 pagesCapital Allowances Lecture Slides (2 Per Page)NicolasNo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Applied Maths ProjectDocument16 pagesApplied Maths ProjectLB ψNo ratings yet

- Tax PaidDocument1 pageTax PaidRiya Mazumder Roll 286No ratings yet

- CM 899 20231002 01243899Document2 pagesCM 899 20231002 01243899vineetdoshi7No ratings yet

- CBK Power Limited Vs CIRDocument1 pageCBK Power Limited Vs CIRCarl IlaganNo ratings yet

- Western Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test BankDocument56 pagesWestern Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test Bankroseyoung0No ratings yet

- Tax Breaks To EliminateDocument4 pagesTax Breaks To Eliminatedacoda204No ratings yet

- 27815rmc No. 3-2006 - Annex ADocument2 pages27815rmc No. 3-2006 - Annex AAnn ShizueNo ratings yet

- Room 205Document1 pageRoom 205Hotel EkasNo ratings yet

- Payroll Assignment - 2015Document3 pagesPayroll Assignment - 2015Negese MinaluNo ratings yet

- MULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5 PDFDocument1 pageMULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5 PDFKyll MarcosNo ratings yet

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDocument6 pagesComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Social Science Scoring Package 2022 - 23.finalDocument23 pagesSocial Science Scoring Package 2022 - 23.finalMonika Acharya100% (1)

- Fee - International Conference MSMF10Document1 pageFee - International Conference MSMF10Kamal MankariNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet

IAS 12 Freddy LTD - Solution

IAS 12 Freddy LTD - Solution

Uploaded by

nonzuzossyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 12 Freddy LTD - Solution

IAS 12 Freddy LTD - Solution

Uploaded by

nonzuzossyCopyright:

Available Formats

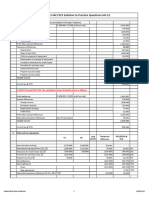

BCOM ACC- FA3: Freddy Ltd

Freddy Ltd Solution

1. Taxable income

Profit before tax 42,500

Exempt differences 15,370

Legal Fees 900

SARS interest 720

Depreciation office building 18,750

Dividend income (5,000)

"Matching" profit 28,935

Temporary differences 11,000

Depreciation Plant & Machinery 43,750

Wear & Tear Plant & Machinery (35,000)

Loss on disposal of machinery (12 500 – 18 750) (Loss as CA exceeds proceeds) 6,250

Scrapping allowance on machinery (12 500 – 15 000) (2,500)

Increase in allowance for credit losses 4,000

Allowance for credit losses: 2022 (6 000 x 25%) 1,500

Allowance for credit losses: 2023 (10 000 x 25%) (2,500)

Prepaid insurance (4,500)

Taxable income before assessed loss 68,870

Assessed loss carried forward (29,000)

Taxable income 39,870

2. Deferred tax calculation

100% Temporary

CV TB (DTL) / DTA

OR 80% difference

Office building 356,250 375,000 80% Exempt -

Plant and machinery 32,500 26,000 100% 6,500 (1,820) DTL

Prepaid insurance 4,500 - 100% 4,500 (1,260) DTL

Allowance for credit losses (10,000) (2,500) 100% (7,500) 2,100 DTA

Closing Balance 3,500 (980) DTL

Opening Balance (Taxable TDS R4 060 / 28% = R14 500) -29,000 -8,120 DTL

Deductible temporary difference (CR P/L, DR DT SFP) 32,500 7,140

3. Income tax expense note

FREDDY LIMITED

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 28 FEBRUARY 2023

Income tax expense

Major components of tax expense

SA Normal tax

Current 11,164

- Current year (39 870 x 28%) 11,164

Deferred 15,260

- Movement in temporary differences 7,140

- Unused tax loss utilised (29 000 x 28%) 8,120

26,424

Prepared by Shan Anderson 1 05/23/2024

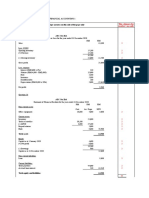

BCOM ACC- FA3: Freddy Ltd

Freddy Ltd Solution

Tax reconciliation

Profit before tax 42,500

Standard tax @ 28% 11,900

Exempt differences

Legal Fees (900 x 28%) 252

SARS interest (720 x 28%) 202

Depreciation office building (18 750 x 28%) 5,250

Dividend income (5000 x 28%) (1,400)

16,204

Prepared by Shan Anderson 2 05/23/2024

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Solution AP Test Bank 2Document9 pagesSolution AP Test Bank 2imaNo ratings yet

- Template Tax Provision Calculation 2021Document3 pagesTemplate Tax Provision Calculation 2021Chiara AnindaNo ratings yet

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- Comprehensive National Development Planning FrameworkDocument25 pagesComprehensive National Development Planning FrameworkMichael ButlerNo ratings yet

- ACC117 - Chapter 4-3 - Tutorial - Solution - Textbook Page 95, 98 - 99Document6 pagesACC117 - Chapter 4-3 - Tutorial - Solution - Textbook Page 95, 98 - 99taerrybombNo ratings yet

- IAS 12 Ross LTD SolutionDocument2 pagesIAS 12 Ross LTD SolutionarronyeagarNo ratings yet

- Handouts - CHAPTER 4-3 - ACC117Document3 pagesHandouts - CHAPTER 4-3 - ACC117taerrybombNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- BAF11Document3 pagesBAF11tembo groupNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- PYQ January 2018Document4 pagesPYQ January 2018Nur Amira NadiaNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- Exam 2 Input Sheet-FinalDocument24 pagesExam 2 Input Sheet-Finalさくら樱花No ratings yet

- New Millennium Assignment2 School of Practical Accounting Darrel SamuelDocument2 pagesNew Millennium Assignment2 School of Practical Accounting Darrel SamuelDarrel SamueldNo ratings yet

- ABC Limited Income Statement: Particulars Amounts 2016 2017 2018Document2 pagesABC Limited Income Statement: Particulars Amounts 2016 2017 2018Rezaul KarimNo ratings yet

- Sampras SolutionDocument3 pagesSampras SolutionSiphesihleNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Revenue: Non-Current AssetsDocument5 pagesRevenue: Non-Current Assetsfahim tusarNo ratings yet

- Solution Feb2021 Far410Document9 pagesSolution Feb2021 Far4102022478048No ratings yet

- Basics LTD - MemoDocument3 pagesBasics LTD - Memoewriteandread.businessNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Nkome TradersDocument2 pagesNkome Tradersrethaxaba82No ratings yet

- Pusat Tuition Jom GemilangTT 2022Document8 pagesPusat Tuition Jom GemilangTT 2022Yenny YapNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- Pay SlipDocument1 pagePay SlipSonuNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- LCCI Level One Final AcctDocument2 pagesLCCI Level One Final AcctStpmTutorialClassNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Section B - Additional QuestionDocument124 pagesSection B - Additional QuestionGodie MaraNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- PRACTICE CLASS 3, 4 and 5Document6 pagesPRACTICE CLASS 3, 4 and 5Zain JamilNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- Answer Q5Document2 pagesAnswer Q5calebNo ratings yet

- Sam's Introductory Accounting AnswersDocument1 pageSam's Introductory Accounting AnswersSamuelNo ratings yet

- Unit 12-Question 12-B Sol (2023)Document2 pagesUnit 12-Question 12-B Sol (2023)shirleygebenga020829No ratings yet

- Direct Tax Solution PDFDocument8 pagesDirect Tax Solution PDFGaurav SoniNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- IAL Accounting SB2 AnswersDocument91 pagesIAL Accounting SB2 AnswersThaviksha BulathsinhalaNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- AC415 Group 6 Assignment 2022Document3 pagesAC415 Group 6 Assignment 2022portiafadzaiNo ratings yet

- Budgeting: CalculatingDocument5 pagesBudgeting: CalculatingTaetae ElyenNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackNo ratings yet

- House Bill 2526Document17 pagesHouse Bill 2526Kristofer PlonaNo ratings yet

- Tata Consultancy PayslipDocument2 pagesTata Consultancy PayslipSitharth VkrNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Income Tax Rates & Threshold - Guyana Revenue AuthorityDocument5 pagesIncome Tax Rates & Threshold - Guyana Revenue AuthorityStephen FrancisNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- Assignment 5 - Government - Fiscal PolicyDocument3 pagesAssignment 5 - Government - Fiscal PolicypsitaeNo ratings yet

- Tax Review 194RDocument4 pagesTax Review 194RDheeraj YadavNo ratings yet

- Income TaxationDocument4 pagesIncome Taxationralfgerwin inesaNo ratings yet

- 51 Mohd Ifham Khan-Study On GST&its ImplicationDocument100 pages51 Mohd Ifham Khan-Study On GST&its ImplicationFaisal ArifNo ratings yet

- Capital Allowances Lecture Slides (2 Per Page)Document11 pagesCapital Allowances Lecture Slides (2 Per Page)NicolasNo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Applied Maths ProjectDocument16 pagesApplied Maths ProjectLB ψNo ratings yet

- Tax PaidDocument1 pageTax PaidRiya Mazumder Roll 286No ratings yet

- CM 899 20231002 01243899Document2 pagesCM 899 20231002 01243899vineetdoshi7No ratings yet

- CBK Power Limited Vs CIRDocument1 pageCBK Power Limited Vs CIRCarl IlaganNo ratings yet

- Western Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test BankDocument56 pagesWestern Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test Bankroseyoung0No ratings yet

- Tax Breaks To EliminateDocument4 pagesTax Breaks To Eliminatedacoda204No ratings yet

- 27815rmc No. 3-2006 - Annex ADocument2 pages27815rmc No. 3-2006 - Annex AAnn ShizueNo ratings yet

- Room 205Document1 pageRoom 205Hotel EkasNo ratings yet

- Payroll Assignment - 2015Document3 pagesPayroll Assignment - 2015Negese MinaluNo ratings yet

- MULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5 PDFDocument1 pageMULTIPLE CHOICE QUESTIONS IN TAX REVIEW Jan 5 PDFKyll MarcosNo ratings yet

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDocument6 pagesComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Social Science Scoring Package 2022 - 23.finalDocument23 pagesSocial Science Scoring Package 2022 - 23.finalMonika Acharya100% (1)

- Fee - International Conference MSMF10Document1 pageFee - International Conference MSMF10Kamal MankariNo ratings yet

- Drill On Gross Income Suggested AnswersDocument5 pagesDrill On Gross Income Suggested AnswersAngel HiaviaNo ratings yet