Professional Documents

Culture Documents

Notes To Financial Statements 02 ANSWER KEY

Notes To Financial Statements 02 ANSWER KEY

Uploaded by

Jisoo WinterfordOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes To Financial Statements 02 ANSWER KEY

Notes To Financial Statements 02 ANSWER KEY

Uploaded by

Jisoo WinterfordCopyright:

Available Formats

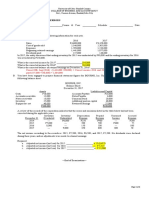

ADAMSON UNIVERSITY

INTERMEDIATE ACCOUNTING 3

QUIZ – NOTES TO FINANCIAL STATEMENTS (02)

1. Grandiose Company’s beginning inventory on January 1 was understated by P260,000 and

the ending inventory was overstated by P520,000. What was the effect of the errors on the cost

of goods sold for the current year?

a. 260,000 understated

b. 260,000 overstated

c. 780,000 understated

d. 780,000 overstated

Understated beginning inventory will understate the cost of goods sold; Overstated

ending inventory will understate the cost of goods sold.

260,000 + 560,000 = 780,000 understated

USE THE FOLLOWING INFORMATION FOR NOS. 2 TO 5

Grand Company failed to record P120,000 of accrued wages at the end of 2011. The wages

were recorded and paid in January 2012. Correct accruals were made on December 31, 2012.

Grand Company had the following financial statements information:

2015 2014

Revenue 1,350,000 1,000,000

Expenses 980,000 650,000

Net income 370,000 350,000

12/31/2015 12/31/2014

Total Assets 1,570,000 1,050,000

Total Liabilities 500,000 350,000

Total Owners’ Equity 1,070,000 700,000

2. What is the corrected net income for 2014?

a. 230,000

b. 350,000

c. 470,000

d. 250,000

Failure to accrue the wages in 2014 understated the liabilities and understated the

expenses. Understated expenses in 2014 overstated the 2014 net income

350,000 - 120,000 = 230,000

3. What is the corrected net income for 2015?

a. 490,000

b. 370,000

c. 250,000

d. 430,000

Since the wages were recorded and paid in 2015, expenses for the said year is

overstated. Overstated expense in 2015 understated the 2015 net income.

370,000 + 120,000 = 490,000

4. What is the correct amount of total liabilities on December 31, 2014?

a. 470,000

b. 230,000

c. 400,000

d. 500,000

Failure to accrue the wages in 2014 understated the 2014 liabilities

350,000 + 120,000 = 470,000

5. What is the correct amount of owners’ equity on December 31, 2015?

a. 1,070,000

b. 1,190,000

c. 1,010,000

d. 950,000

Understated expenses in 2014 overstated the 2014 net income. Hence, the 2014

owners’ equity is overstated by P120,000.

Overstated expense in 2015 understated the 2015 net income. Hence, the 2015

owners’ equity is understated by P120,000

Therefore, the correct owners’ equity on 2015 is P1,070,000 (counter balancing error)

USE THE FOLLOWING INFORMATION FOR NOS. 6 AND 7

On January 1, 2015, the management of Malady Corporation determined that a revision in the

estimate associated with the depreciation of storage facilities was appropriate. The facilities,

purchased on January 1, 2013 for P6,000,000, had been depreciated using the straight-line

method with an estimated residual value of P600,000 and an estimated useful life of 20 years.

Management has determined that the expected remaining useful life of the storage facilities is

10 years and the estimated residual value is P800,000.

6. What is the depreciation for 2015?

a. 270,000

b. 546,000

c. 466,000

d. 582,500

Total depreciation from 2013 to 2014

6,000,000 – 600,000 = 5,400,000/20 = 270,000 per year X 2 years = 540,000

Carrying amount, January 1, 2015

6,000,000 – 540,000 = 5,460,000

Depreciation Expense starting 2015

5,460,000 – 800,000/10 = 466,000

7. What is the carrying amount of the facilities at the end of 2015?

a. 6,000,000

b. 5,190,000

c. 4,440,000

d. 4,994,000

5,460,000 – 466,000 = 4,994,000

USE THE FOLLOWING INFORMATION FOR NOS. 8 TO 10

On January 1, 2019, Brewed Corporation purchased for P4,800,000 a machine with a useful

life of ten years and residual value of P200,000. The machine was depreciated by the double

declining balance until December 31, 2020. On January 1, 2021, Brewed changed to the

straight line method. The residual value did not change.

8. What is the accumulated depreciation of the machine on December 31, 2019?

a. 836,400

b. 872,700

c. 920,000

d. 960,000

Compute for the double declining rate:

4,800,000/10 = 480,000; 480,000/4,800,000 X 2 = 0.2

2019 Depreciation using double declining balance method

4,800,000 X 0.2 = 960,000

9. What is the accumulated depreciation of the machine on December 31, 2020?

a. 1,589,100

b. 1,658,200

c. 1,728,000

d. 1,840,000

2020 Depreciation using double declining balance method

4,800,000 – 960,000 X 0.2 = 768,000

2020 Accumulated depreciation

960,000 + 768,000 = 1,728,000

10. What is the depreciation expense on this machine for the year ended December 31, 2021?

a. 287,200

b. 384,000

c. 460,000

d. 359,000

Carrying amount, December 31, 2020

4,800,000 – (960,000 + 768,000) = 3,072,000

Depreciation expense starting 2021

3,072,000 – 200,000 = 2,872,000;

2,872,000/8 = 359,000

You might also like

- Finance For Non Financial Managers 7th Edition Bergeron Solutions ManualDocument9 pagesFinance For Non Financial Managers 7th Edition Bergeron Solutions ManualAzaliaSanchezNo ratings yet

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- A221 MC 5 - StudentDocument6 pagesA221 MC 5 - StudentNajihah RazakNo ratings yet

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- pg.565-593 of Financial Accounting Book 2014 ValixDocument29 pagespg.565-593 of Financial Accounting Book 2014 ValixPeter Paul Enero Perez50% (2)

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionszeyyahjiNo ratings yet

- MCB Financial AnalysisDocument28 pagesMCB Financial AnalysisSana KazmiNo ratings yet

- Financial Accounting Q&aDocument4 pagesFinancial Accounting Q&aGlen JavellanaNo ratings yet

- AP 1st Monthly AssessmentDocument6 pagesAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Auditing Problems QaDocument12 pagesAuditing Problems QaSheena CalderonNo ratings yet

- Learning Objective: Daftar Komponen Biaya PensiunDocument3 pagesLearning Objective: Daftar Komponen Biaya Pensiuntes doangNo ratings yet

- Accounting ChangesDocument3 pagesAccounting ChangesAbby NavarroNo ratings yet

- Final Term, Quiz 1Document2 pagesFinal Term, Quiz 1jhell de la cruzNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Assignment 02 Correction of Errors Answer KeyDocument1 pageAssignment 02 Correction of Errors Answer KeyDan Andrei BongoNo ratings yet

- Acctg Changes, Error Correction, Prior ErrorDocument3 pagesAcctg Changes, Error Correction, Prior ErrorLayJohn LacadenNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- Semi-Finals Financial Accounting and ReportingDocument23 pagesSemi-Finals Financial Accounting and Reportingjoyce KimNo ratings yet

- Correction of ErrorsDocument4 pagesCorrection of ErrorsKris Van HalenNo ratings yet

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- Practical Accounting 1Document8 pagesPractical Accounting 1Mina Bianca AutencioNo ratings yet

- Financial Accounting Part 3Document6 pagesFinancial Accounting Part 3Christopher Price67% (3)

- Receivables Solution PDFDocument10 pagesReceivables Solution PDFbanannannaNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- College of Business & Accountancy Manila City 1 Sem SY 2021-22Document2 pagesCollege of Business & Accountancy Manila City 1 Sem SY 2021-22Shiela Mae Pon AnNo ratings yet

- BS & Is (Questions)Document7 pagesBS & Is (Questions)Dale JimenoNo ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- AP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryDocument4 pagesAP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryAngela AlejandroNo ratings yet

- 03 Resa Pas 8 ScanDocument21 pages03 Resa Pas 8 Scanby ScribdNo ratings yet

- Ap103 ReceivablesDocument5 pagesAp103 Receivablesbright SpotifyNo ratings yet

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Finac3 Quiz1 PrelimsDocument2 pagesFinac3 Quiz1 PrelimsGloria BeltranNo ratings yet

- Problems - Final ExaminationDocument3 pagesProblems - Final Examinationjhell de la cruzNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- DAYAG 2015 Installment SalesDocument9 pagesDAYAG 2015 Installment SalesChriz VillasNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- ACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamDocument8 pagesACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamMariefel OrdanezNo ratings yet

- SCALP Handout 038 PDFDocument2 pagesSCALP Handout 038 PDFAine Arie HNo ratings yet

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Afar 104 Installment SalesDocument3 pagesAfar 104 Installment SalesReyn Saplad PeralesNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Q1. ProblemsDocument9 pagesQ1. ProblemsAldrin ZolinaNo ratings yet

- Far NosolnDocument11 pagesFar NosolnStela Marie CarandangNo ratings yet

- Project Work of Accounts (055) Ratio Analysis: Submitted By-Avishkaar JainDocument30 pagesProject Work of Accounts (055) Ratio Analysis: Submitted By-Avishkaar JainAvishkaar JainNo ratings yet

- Tutorial 1 - QSDocument6 pagesTutorial 1 - QSAzlinaZaidilNo ratings yet

- MODADV2 - Lecture Cases Consolidation Problem 1Document3 pagesMODADV2 - Lecture Cases Consolidation Problem 1Marcus ReyesNo ratings yet

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- 455072634-Chapter-11 - For MergeDocument8 pages455072634-Chapter-11 - For Mergerei gbivNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Year 0 1 2 3 4 Synthetic ResinDocument7 pagesYear 0 1 2 3 4 Synthetic ResinLê Nguyễn Quỳnh HươngNo ratings yet

- Problem 21-02 Wright Company Spreadsheet For The Statement of Cash Flows Dec. 31 Changes Dec. 31 2020 Debits Credits 2021 Balance SheetDocument17 pagesProblem 21-02 Wright Company Spreadsheet For The Statement of Cash Flows Dec. 31 Changes Dec. 31 2020 Debits Credits 2021 Balance SheetVishal P RaoNo ratings yet

- Subject: Financial Management: Indira Institute of Management, PuneDocument23 pagesSubject: Financial Management: Indira Institute of Management, PunePrasad RandheNo ratings yet

- 04 Pfizer AnalysisDocument5 pages04 Pfizer AnalysisKapil AgarwalNo ratings yet

- BP Op Entpr S4hana2021 08 Co Master Data en XXDocument159 pagesBP Op Entpr S4hana2021 08 Co Master Data en XXVinay Borbachhi (IN)No ratings yet

- Ratio Analysis Formula Excel TemplateDocument5 pagesRatio Analysis Formula Excel TemplateTarun MittalNo ratings yet

- PeriodicDocument23 pagesPeriodicalmorsNo ratings yet

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDocument11 pagesChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNo ratings yet

- Marksans Pharma LTD Research Report (For Education Only)Document9 pagesMarksans Pharma LTD Research Report (For Education Only)jaffer.sadiqNo ratings yet

- Hhtfa8e ch03 SMDocument119 pagesHhtfa8e ch03 SMharryNo ratings yet

- Coneptual Frameworks and Accounting Standards Probs and TheoriesDocument17 pagesConeptual Frameworks and Accounting Standards Probs and TheoriesIris MnemosyneNo ratings yet

- Financial Information Act Return 20140331Document188 pagesFinancial Information Act Return 20140331Mukarom AlatasNo ratings yet

- Case 5Document3 pagesCase 5Richie DonatoNo ratings yet

- Zoological Parks Board of New South Wales June 2013Document17 pagesZoological Parks Board of New South Wales June 2013Daniel ManNo ratings yet

- 2022acc Compart 1Document10 pages2022acc Compart 1Jabez JeenaNo ratings yet

- Exam PapersDocument8 pagesExam PapersTASH TASHNANo ratings yet

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersDocument7 pages7110 Principles of Accounts: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersArumugam ManickamNo ratings yet

- Annotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsDocument140 pagesAnnotated Glossary of Terms Used in The Economic Analysis of Agricultural ProjectsMaria Ines Castelluccio100% (1)

- Refer To Exhibit 1 9 Which Contains Balance Sheet Information FromDocument1 pageRefer To Exhibit 1 9 Which Contains Balance Sheet Information FromAmit PandeyNo ratings yet

- LUCKY TRUCKING SERVICES - Worksheet (10column)Document3 pagesLUCKY TRUCKING SERVICES - Worksheet (10column)Bernice Jayne MondingNo ratings yet

- BNVBVBDocument8 pagesBNVBVBsaif ullahNo ratings yet

- ABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v2Document50 pagesABMFABM2 - q1 - Mod2 - Statement of Comprehensive Income v230 Odicta, Justine AnneNo ratings yet

- Balance Sheet Parent ScontroDocument1 pageBalance Sheet Parent Scontrolisna hikmahdianiNo ratings yet

- 1st Term .Sss2 Financial AccountDocument23 pages1st Term .Sss2 Financial Accountsamuel joshuaNo ratings yet

- q2 Week 9 Dll-EntrepDocument9 pagesq2 Week 9 Dll-EntrepRomel PaladoNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument74 pagesChapter 4 - Completing The Accounting CycleNgân TrươngNo ratings yet