Professional Documents

Culture Documents

06 BRS - Practice Questions

06 BRS - Practice Questions

Uploaded by

Neelanjana RayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

06 BRS - Practice Questions

06 BRS - Practice Questions

Uploaded by

Neelanjana RayCopyright:

Available Formats

Practice Questions – Bank Reconciliation Statement (BRS)

Example – 1

ABC Corp. has a balance of ₹2000 as per passbook as on 31st March 2023. However, the

balance as per cash book as on 31st March 2023 is ₹2210.

Let’s Understand the Transaction Details.

1. A check of ₹500 was deposited, but it is not yet processed by the bank.

2. Bank charges of ₹60 were recorded in the passbook, but not in the cash book.

3. Checks worth ₹300 were issued, but not presented.

4. Bank interest of ₹50 was recorded in the passbook, but not in the cash book.

Example – 2

JPN & Co. has a balance of ₹20,000 as per passbook as on 31st March 2022.

Let’s Understand the Transaction Details.

1. Three checks of ₹1000, ₹1500, ₹1750 were deposited in the bank on 30 th December

2021 but were recorded in the bank statement in January 2022.

2. A check of ₹1000 was issued on 31st December 2021, was not processed.

3. A dividend of ₹500 on stocks was credited to the bank account, but not recorded in

the cash book.

4. A direct deposit of ₹600 was made in a bank account by a customer, which was not

recorded in the cash book.

5. Bank charges of ₹60 were entered only in the bank passbook.

6. Balance as per cash book on 31st December 2021 was ₹22,210.

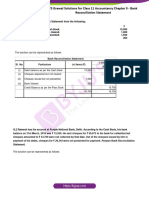

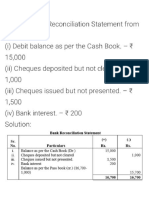

Example – 3

From the following particulars, you are required to find out the errors in cash book and bank

statement by using missing method and prepare Bank Reconciliation Statement as on 31-12-

2016, for Chand Bibi Ltd:

(i) Bank balance overdraft as per cash book – ₹80,000

(ii) Check recorded for collection but not sent to the bank – ₹10,000

(iii) Credit side of the cash book cast short – ₹1,000

(iv) Premium on proprietor’s Life Insurance Policy (LIP) paid on standing order – ₹5,000

(v) Bank Charges recorded twice in the cash book – ₹100

(vi) Customer’s check returned by the bank as dishonored – ₹4,000

(vii) Bill Receivable collected by the bank directly on the behalf of company – ₹20,000

(viii) Check received entered twice in the cash book – ₹6,000.

(ix) Check issued but dishonored on technical grounds – ₹3,000

(x) A check deposited into the bank of worth ₹45,000 but ₹8,000 check was not

collected by bank.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Worksheet BRSDocument2 pagesWorksheet BRSCA Chhavi Gupta100% (1)

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- Dkgoel BRS 11Document15 pagesDkgoel BRS 11DhruvNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- CA F BRS WithDocument10 pagesCA F BRS WithG. DhanyaNo ratings yet

- Adobe Scan Apr 10, 2023Document12 pagesAdobe Scan Apr 10, 2023ineshbanerjee80No ratings yet

- WS - Xi BRS - 2Document5 pagesWS - Xi BRS - 2richshivamshahNo ratings yet

- Problem 1Document7 pagesProblem 1tsegay169No ratings yet

- 0c26dbank Reconciliation Statement Practice QuestionsDocument2 pages0c26dbank Reconciliation Statement Practice QuestionsRahul AgarwalNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- BRS Statement IllustrationsDocument3 pagesBRS Statement Illustrationssurekha khandebharadNo ratings yet

- BRS PPT StudentDocument26 pagesBRS PPT StudentgganyanNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- BRS Class 11Document1 pageBRS Class 11tarun aroraNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- BRS Ca FoundationDocument9 pagesBRS Ca FoundationJunaid Iqbal MastoiNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Bank Reconciliation Statement Practice ProblemsDocument2 pagesBank Reconciliation Statement Practice ProblemsHaya DanishNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- Exercises of Bank Reconciliation Statement: Exercise No. IDocument9 pagesExercises of Bank Reconciliation Statement: Exercise No. ITayyab AliNo ratings yet

- Bank Reconciliaton Statement Practice Questions: ST ST STDocument2 pagesBank Reconciliaton Statement Practice Questions: ST ST STHuma SamuelNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- Accts Test - BRS & InventoriesDocument2 pagesAccts Test - BRS & Inventoriesprashanttiwari155282No ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- 06 SLLC - 2021 - Acc - Review Question - Set 03Document7 pages06 SLLC - 2021 - Acc - Review Question - Set 03Chamela MahiepalaNo ratings yet

- Practice Set BRSDocument15 pagesPractice Set BRSvishwajeetnmoreNo ratings yet

- CA Foundation BRS Practice Questions - DRS - CTC ClassesDocument2 pagesCA Foundation BRS Practice Questions - DRS - CTC ClassesAnas AzeemNo ratings yet

- BRS WorksheetDocument8 pagesBRS WorksheetMayank VermaNo ratings yet

- Accountancy XI Half Yearly WorksheetDocument8 pagesAccountancy XI Half Yearly WorksheetDeivanai K CSNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- Accounting For Manager: - CA Ankita JainDocument13 pagesAccounting For Manager: - CA Ankita JainrahulthexNo ratings yet

- Bank Reconciliation Statement AssignmentDocument3 pagesBank Reconciliation Statement AssignmentDev KumarNo ratings yet

- CA Foundation - Test 4 Chapters - Answer PaperDocument8 pagesCA Foundation - Test 4 Chapters - Answer PaperKrishna SurekaNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Bank Reconciliation StatementDocument22 pagesBank Reconciliation StatementasimaNo ratings yet

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation Statement20232024s5r14leungjacobNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- CA Foundation June 23 BRS Problem - CTC ClassesDocument2 pagesCA Foundation June 23 BRS Problem - CTC ClassesMohit SharmaNo ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- CHP 2 - BRSDocument5 pagesCHP 2 - BRSPayal Mehta DeshpandeNo ratings yet

- AC101 Quiz 2Document2 pagesAC101 Quiz 2irene TogaraNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- Accounting RevisionDocument8 pagesAccounting RevisionAnish KanthetiNo ratings yet

- Brs Practise SheetDocument1 pageBrs Practise Sheetapi-252642432No ratings yet

- Bank ReconciliationDocument7 pagesBank ReconciliationMohammad Faizan Farooq Qadri AttariNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Bank Reconcilement Statement (BRS) AccountsDocument5 pagesBank Reconcilement Statement (BRS) AccountsVedanth RamNo ratings yet

- B.R.S. Test 3Document5 pagesB.R.S. Test 3Sudhir SinhaNo ratings yet

- Q-10 Prepare Bank Reconciliation Statement As On 31Document2 pagesQ-10 Prepare Bank Reconciliation Statement As On 31krish mehtaNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- The Direct and Indirect Taxes Applic: Bank Reconciliation Statement Problems and SolutionsDocument8 pagesThe Direct and Indirect Taxes Applic: Bank Reconciliation Statement Problems and SolutionskoshkoshaNo ratings yet

- Paper6 Syl22 Dec23 Set2 SolDocument16 pagesPaper6 Syl22 Dec23 Set2 Solbatmam7589No ratings yet

- Marks of 15 Students in Their EconomicDocument1 pageMarks of 15 Students in Their Economickrishna1234shuklaNo ratings yet

- Chapter EightDocument5 pagesChapter EightEng Abdulkadir MahamedNo ratings yet

- Test of BRSDocument3 pagesTest of BRSPervaiz AkhterNo ratings yet

- Bank Reconciliation QuestionDocument2 pagesBank Reconciliation QuestionFinnNo ratings yet