Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 views1st Puc Important Differences of Accounting Eng Version by Sunil K

1st Puc Important Differences of Accounting Eng Version by Sunil K

Uploaded by

adiveshsindhurCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- BOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form OneDocument8 pagesBOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form Oneoctavian ibrahimNo ratings yet

- C450 - Current Liabilites - Lecture NotesDocument7 pagesC450 - Current Liabilites - Lecture NotesFreelansirNo ratings yet

- MCQ WCM, Sources of FundsDocument5 pagesMCQ WCM, Sources of FundsPushpendra Singh ShekhawatNo ratings yet

- Basics of Accounting in Simlified MannerDocument15 pagesBasics of Accounting in Simlified Mannerricky gargNo ratings yet

- Fabm2-Module 1 - With ActivitiesDocument8 pagesFabm2-Module 1 - With ActivitiesROWENA MARAMBANo ratings yet

- 16Document21 pages16meryroselicaros525No ratings yet

- Key Terms and Chapter Summary-20Document1 pageKey Terms and Chapter Summary-20Rudravisek SahuNo ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- Financial Accounting: The Recording ProcessDocument20 pagesFinancial Accounting: The Recording Processlilyc3105No ratings yet

- E ACCOUNTING GR 10 Revised ATP Worksheet Term 2 Question PaperDocument11 pagesE ACCOUNTING GR 10 Revised ATP Worksheet Term 2 Question PapernazmirakaderNo ratings yet

- How SAK ETAP To Be Implemented in LPDDocument5 pagesHow SAK ETAP To Be Implemented in LPDDayu MirahNo ratings yet

- Chp.7 Cash and ReceivablesDocument104 pagesChp.7 Cash and ReceivablesNurindah W RNo ratings yet

- Functions of Bank State Bank of India Icici Bank Receiving DepositsDocument2 pagesFunctions of Bank State Bank of India Icici Bank Receiving DepositsADVIK GamerzNo ratings yet

- A 1 The Statement Is Entitled Consolidated Balance SheetsDocument1 pageA 1 The Statement Is Entitled Consolidated Balance SheetsM Bilal SaleemNo ratings yet

- NIOS Class 12 ACC Most Important QuestionDocument8 pagesNIOS Class 12 ACC Most Important QuestionKaushil SolankiNo ratings yet

- 06 Objective Type IAS 21 B32Document5 pages06 Objective Type IAS 21 B32Haris IshaqNo ratings yet

- Assessment TemplateDocument3 pagesAssessment Templateanshul singhalNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument58 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeTia NurhayatiNo ratings yet

- Ch02 The Recording ProcessDocument58 pagesCh02 The Recording ProcessAndi Nisrina Nur Izza100% (1)

- Module 8 Reviewer ENTDocument6 pagesModule 8 Reviewer ENTZai TvNo ratings yet

- Trial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksDocument5 pagesTrial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksPriyanka SharmaNo ratings yet

- 320 Accountancy Eng Lesson11Document22 pages320 Accountancy Eng Lesson11Prabhleen KaurNo ratings yet

- Module No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsDocument15 pagesModule No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsPonsica RomeoNo ratings yet

- Ch.02 The Recording Process PDFDocument47 pagesCh.02 The Recording Process PDFSothcheyNo ratings yet

- Financial Accounting and Reporting - SLK - 02Document9 pagesFinancial Accounting and Reporting - SLK - 02Its Nico & SandyNo ratings yet

- Basic Accounting: By: Dr. Alejandro L. MedranoDocument10 pagesBasic Accounting: By: Dr. Alejandro L. Medranoangelika dijamcoNo ratings yet

- Igcse Accounting TheoryDocument32 pagesIgcse Accounting Theorykuanhuining202104No ratings yet

- TRUE FALSE SCANNER by NahtaDocument88 pagesTRUE FALSE SCANNER by NahtaHimanshu RayNo ratings yet

- Financial Statement Analysis: Balance Sheet Liabilities AssetsDocument17 pagesFinancial Statement Analysis: Balance Sheet Liabilities AssetsAman MujeebNo ratings yet

- 13 Cash and ReceivablesDocument14 pages13 Cash and ReceivablesHesham AhmedNo ratings yet

- Financial AccountancyDocument3 pagesFinancial Accountancysayakkarmakarslg1No ratings yet

- CH 02Document46 pagesCH 02martinus linggoNo ratings yet

- Module 3 in FABM2 - EhandoutDocument2 pagesModule 3 in FABM2 - EhandoutJulienne FrancoNo ratings yet

- Chapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesDocument5 pagesChapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesKyleRhayneDiazCaliwagNo ratings yet

- Chapter 4 Statement of Financial PositionDocument4 pagesChapter 4 Statement of Financial PositionDaniel Tan KtNo ratings yet

- Financial Accounting CrashDocument57 pagesFinancial Accounting CrashSAIGAGANNo ratings yet

- Taxation Power Point 2Document41 pagesTaxation Power Point 2Charisse Ahnne TosloladoNo ratings yet

- Chapter 2 - Investments Schemes PPT-EDITEDDocument51 pagesChapter 2 - Investments Schemes PPT-EDITEDjiny benNo ratings yet

- Topic 1Document3 pagesTopic 1KyNo ratings yet

- Topic 1 Topic 1 Introduction To Derivatives Introduction To DerivativesDocument66 pagesTopic 1 Topic 1 Introduction To Derivatives Introduction To DerivativespptvaibhavNo ratings yet

- True & False - ScannerDocument88 pagesTrue & False - ScannerPaulNo ratings yet

- Units 1 - 4Document50 pagesUnits 1 - 4Wakil EllmaaNo ratings yet

- FIN 335 UNCW Phase III NotesDocument23 pagesFIN 335 UNCW Phase III NotesMonydit SantinoNo ratings yet

- F A, B & M 2: Undamentals of Ccountancy Usiness AnagementDocument14 pagesF A, B & M 2: Undamentals of Ccountancy Usiness AnagementDories AndalNo ratings yet

- 1.swot & Product NoteDocument15 pages1.swot & Product Noteashish prasadNo ratings yet

- ch07 - STUDocument97 pagesch07 - STUhaminhdang291020No ratings yet

- What Is Depreciation?Document8 pagesWhat Is Depreciation?jawadNo ratings yet

- Expense But Not Yet Paid: LO1 LO2 LO3 LO4 LO5Document6 pagesExpense But Not Yet Paid: LO1 LO2 LO3 LO4 LO5Shane TorrieNo ratings yet

- Chapter 1 - Statement of Financial PositionDocument33 pagesChapter 1 - Statement of Financial PositionAbyel Nebur78% (9)

- Day 6 Cash and Receivables 2024 FinalDocument18 pagesDay 6 Cash and Receivables 2024 FinalKit KatNo ratings yet

- Chapter26 DividendPolicyDocument12 pagesChapter26 DividendPolicyTeh Chu LeongNo ratings yet

- Final-Non Trading Concerns-Theory1Document17 pagesFinal-Non Trading Concerns-Theory1vikkinikkiNo ratings yet

- Financial 12. UnitDocument17 pagesFinancial 12. UnitBener GüngörNo ratings yet

- Banking ServiceDocument3 pagesBanking ServicePia SolNo ratings yet

- Lecture 02 - Analyzing TransactionsDocument43 pagesLecture 02 - Analyzing Transactions6- Quang BáchNo ratings yet

- M. SC and M. Phil Diaries: 1. Financial EconomicsDocument14 pagesM. SC and M. Phil Diaries: 1. Financial EconomicsSumra KhanNo ratings yet

- What I Know .Use Separate Paper For Your AnswerDocument7 pagesWhat I Know .Use Separate Paper For Your AnswerWhyljyne GlasanayNo ratings yet

- 1st Puc Accountancy Quick Glance Eng Version 2019-20 by Sunil KDocument19 pages1st Puc Accountancy Quick Glance Eng Version 2019-20 by Sunil KadiveshsindhurNo ratings yet

- Nissin Food Holdings (Company Overview)Document5 pagesNissin Food Holdings (Company Overview)rakinski0% (1)

- A) B) C) D) E)Document25 pagesA) B) C) D) E)SHIVAM SINGHNo ratings yet

- SCB EMI Terms and ConditionsDocument2 pagesSCB EMI Terms and ConditionsSanam PandeyNo ratings yet

- 6.1 Futures and Options AnalysisDocument2 pages6.1 Futures and Options AnalysisSuraj DecorousNo ratings yet

- The Impact of The First World War and Its Implications For Europe TodayDocument9 pagesThe Impact of The First World War and Its Implications For Europe TodayNanee DNo ratings yet

- Beginner - S Guide To Mutual Fund - Abhishek Raja RamDocument81 pagesBeginner - S Guide To Mutual Fund - Abhishek Raja Ramk praNo ratings yet

- Translation Ftierra WebpageDocument4 pagesTranslation Ftierra WebpageVictor Arturo Clavijo RiveroNo ratings yet

- ViorelDocument4 pagesViorelITNo ratings yet

- PPT1 The Economic and Business EnvironmentDocument13 pagesPPT1 The Economic and Business EnvironmentLinda Astri Dwi WulandariNo ratings yet

- Annuity DueDocument27 pagesAnnuity Duebayu fajarNo ratings yet

- International Trade LawDocument257 pagesInternational Trade LawAnusha V RNo ratings yet

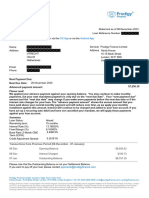

- Invoice LifeDocument1 pageInvoice Lifelondon2gowdaNo ratings yet

- Porter's Five ForcesDocument6 pagesPorter's Five ForcesHumberto SusunagaNo ratings yet

- 12 02 20Document47 pages12 02 20Rommel John SandovalNo ratings yet

- Internship: Log BookDocument8 pagesInternship: Log Booklooloo sxribdNo ratings yet

- List of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Document1 pageList of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Yogesh MittalNo ratings yet

- Exercise Chapter 5-Past Year Exam QuestionDocument2 pagesExercise Chapter 5-Past Year Exam QuestionDeelah MawarNo ratings yet

- Loan StatementDocument2 pagesLoan StatementTien NguyenNo ratings yet

- Rate of Interest - Odisha Gramya BankDocument1 pageRate of Interest - Odisha Gramya BankshibayanNo ratings yet

- Rebar Cutlist-Footing Tie Beam Rebar 1Document1 pageRebar Cutlist-Footing Tie Beam Rebar 1Edxer MagpantayNo ratings yet

- Region Xi RiceDocument460 pagesRegion Xi RiceMarie DanielesNo ratings yet

- FRM - Syllabus PDFDocument64 pagesFRM - Syllabus PDFAnonymous x5odvnNVNo ratings yet

- Theoretical Approaches: BBA 261B Elective SessionDocument14 pagesTheoretical Approaches: BBA 261B Elective SessionVarun BaliNo ratings yet

- Errata - Unit 1 History Coursebook - Elective - Finalised - 30 OctDocument3 pagesErrata - Unit 1 History Coursebook - Elective - Finalised - 30 Octfreddiemercury13780No ratings yet

- Central Bank Digital Currencies: Design Is All That Matters by Tony KurianDocument3 pagesCentral Bank Digital Currencies: Design Is All That Matters by Tony KurianTony KurianNo ratings yet

- Insurance Survey 2023.low Res - SMLDocument192 pagesInsurance Survey 2023.low Res - SMLmoodley.vadynNo ratings yet

- Angle Weight ChartDocument7 pagesAngle Weight ChartAbhinav KumarNo ratings yet

- Literature Review FinalDocument7 pagesLiterature Review FinalAJ Stockwell100% (1)

- Veerabadreshwara Medicals BillsDocument1 pageVeerabadreshwara Medicals BillsPavan KNo ratings yet

1st Puc Important Differences of Accounting Eng Version by Sunil K

1st Puc Important Differences of Accounting Eng Version by Sunil K

Uploaded by

adiveshsindhur0 ratings0% found this document useful (0 votes)

3 views2 pagesOriginal Title

870386343403609876 1st Puc Important Differences of Accounting Eng Version by Sunil k

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pages1st Puc Important Differences of Accounting Eng Version by Sunil K

1st Puc Important Differences of Accounting Eng Version by Sunil K

Uploaded by

adiveshsindhurCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

IMPORNTANT DIFFERNCES OF ACCOUNTING

Sunil K. M.com B.Ed, PGDFM,

1. Difference Between Trial Balance and Balance Sheet.

TRIAL BALANCE BALANCE SHEET

1. It includes both Debit and Credit Balances 1. It includes both Assets and Liabilities

2. It includes Opening Stock value 2. It includes closing Stock Value

3. It shows the summary of Ledger Balances 3. It shows the summary of Finance Positions

2. Difference Between Journal and Ledger.

JOURNAL LEDGER

1. It is the subsidiary book 1. It is the final book of account

2. The book of prime or original entry book 2. The book of second entry and statement of account

3. It does not have any side 3. It has two sides like, debit and credit side

3. Difference Between Assets and Liabilities.

ASSETS LIABILITIES

1. It provide a future economic benefit, 1. It present a future obligation.

2. It gets Depreciation 2. It doesn't get depreciation

3. It have fixed values and flucuating values 3. here Interest is charged

4. Difference Between Real A/c and Nominal A/c.

REAL A/C NOMINAL A/C

1.It consider Assets and properties 1. It consider Incomes and Expenses

2. It include long term transections 2.It includes short term transections

3. example building, land, furniture 3.example salary, rent, discount

5. Difference Between Cash Transactions and Credit Transactions.

CASH TRANSACTIONS CREDIT TRANSACTIONS

1. here the payment is settled immediately. 1. here the payment is settled at a later date.

2. there is no interest charged 2. the interest is charged at a fixed percentage

3. it is done between buyer and seller 3. it is done between debtors and creditors

6. Difference Between Fixed Assets and Floating Assets

FIXED ASSETS FLOATING ASSETS

1. It have specific values 1. It doesn't have specific values

2. It is used for long term finance 2. It is used for short term finance

3. It have Depreciation values 3.there is no depreciation is charged

Use E-Papers, Save Trees

Above line hide when print out

7. Difference Between Double Entry and Single Entry System.

SINGLE ENTRY SYSTEM DOUBLE ENTRY SYSTEM

1. It is easy to ascertain and low cost 1. It have procedure to ascertain and heigh cost

2. It is applicable to Sole trade concerns 2. It is applicable to all business concerns

3. Here difficult to find Error 3. Here easy to find Error

8. Difference Between Receipts & Payments A/c and Income & Expenditure A/c.

RECEIPTS & PAYMENST A/c INCOME & EXPENDITURE A/c

1. It is a Real A/c 1. It is a nominal A/c

2. It doesnt include non cash items 2. It includes non cash items

3. It is the summary of Cash book 3. It is the summary of P&L a/c

9. Difference Between Out standing and Prepaid Expenses.

OUT STANDING EXPENSES PREPAID EXPENSES

1. It is the Due amount on expenses 1. It is the advance amonut on expenses

2. It should be added 2. It should be deducted

3. It is shown under Liabilities head in Balance sheet 3. It is shown under Assets head in Balance sheet

10. Difference Between Capital Receipts and Revenue Receipts

CAPITAL RECEIPTS REVENUE RECEIPTS

1. It is the Long term Incomes 1. It is the short term incomes

2. It is shown in Balance Sheet 2. It is shown in P&L a/c

3. Non Recurring items 3. Recurring items

11. Difference Between Capital Expenses and Revenue Expenses.

CAPITAL EXPENSES REVENUE EXPENSES

1. It is incurred on Long term Finance 1. It is incurred on Short term Finance

2. It is an Asset Account 2. It is an Expenses Account

3. It is a Non recurring item 3. It is a Recurring item

12. Difference Between Provisions and Reserves.

PROVISIONS RESERVE

1. It is arise from known liability 1. to retain some money from the profit to for future use

2. It cannot be used to pay off dividends 2. It can be used to pay off dividends

3. Known liabilities and anticipated losses 3. Increase in capital employed

Use E-Papers, Save Trees

Above line hide when print out

You might also like

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- BOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form OneDocument8 pagesBOOK KEEPING SYLLABUS 2 0 10 Edition, For Ordinary Level: Form Oneoctavian ibrahimNo ratings yet

- C450 - Current Liabilites - Lecture NotesDocument7 pagesC450 - Current Liabilites - Lecture NotesFreelansirNo ratings yet

- MCQ WCM, Sources of FundsDocument5 pagesMCQ WCM, Sources of FundsPushpendra Singh ShekhawatNo ratings yet

- Basics of Accounting in Simlified MannerDocument15 pagesBasics of Accounting in Simlified Mannerricky gargNo ratings yet

- Fabm2-Module 1 - With ActivitiesDocument8 pagesFabm2-Module 1 - With ActivitiesROWENA MARAMBANo ratings yet

- 16Document21 pages16meryroselicaros525No ratings yet

- Key Terms and Chapter Summary-20Document1 pageKey Terms and Chapter Summary-20Rudravisek SahuNo ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- Financial Accounting: The Recording ProcessDocument20 pagesFinancial Accounting: The Recording Processlilyc3105No ratings yet

- E ACCOUNTING GR 10 Revised ATP Worksheet Term 2 Question PaperDocument11 pagesE ACCOUNTING GR 10 Revised ATP Worksheet Term 2 Question PapernazmirakaderNo ratings yet

- How SAK ETAP To Be Implemented in LPDDocument5 pagesHow SAK ETAP To Be Implemented in LPDDayu MirahNo ratings yet

- Chp.7 Cash and ReceivablesDocument104 pagesChp.7 Cash and ReceivablesNurindah W RNo ratings yet

- Functions of Bank State Bank of India Icici Bank Receiving DepositsDocument2 pagesFunctions of Bank State Bank of India Icici Bank Receiving DepositsADVIK GamerzNo ratings yet

- A 1 The Statement Is Entitled Consolidated Balance SheetsDocument1 pageA 1 The Statement Is Entitled Consolidated Balance SheetsM Bilal SaleemNo ratings yet

- NIOS Class 12 ACC Most Important QuestionDocument8 pagesNIOS Class 12 ACC Most Important QuestionKaushil SolankiNo ratings yet

- 06 Objective Type IAS 21 B32Document5 pages06 Objective Type IAS 21 B32Haris IshaqNo ratings yet

- Assessment TemplateDocument3 pagesAssessment Templateanshul singhalNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument58 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeTia NurhayatiNo ratings yet

- Ch02 The Recording ProcessDocument58 pagesCh02 The Recording ProcessAndi Nisrina Nur Izza100% (1)

- Module 8 Reviewer ENTDocument6 pagesModule 8 Reviewer ENTZai TvNo ratings yet

- Trial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksDocument5 pagesTrial Balance: Credit Balances of All Accounts in The Ledger With A View To Test Arithmetical Accuracy of The BooksPriyanka SharmaNo ratings yet

- 320 Accountancy Eng Lesson11Document22 pages320 Accountancy Eng Lesson11Prabhleen KaurNo ratings yet

- Module No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsDocument15 pagesModule No. & Title Module No. 3: Intensifying Accounting Knowledge Through The Accounting Equation, Types of Major Accounts, and Books of AccountsPonsica RomeoNo ratings yet

- Ch.02 The Recording Process PDFDocument47 pagesCh.02 The Recording Process PDFSothcheyNo ratings yet

- Financial Accounting and Reporting - SLK - 02Document9 pagesFinancial Accounting and Reporting - SLK - 02Its Nico & SandyNo ratings yet

- Basic Accounting: By: Dr. Alejandro L. MedranoDocument10 pagesBasic Accounting: By: Dr. Alejandro L. Medranoangelika dijamcoNo ratings yet

- Igcse Accounting TheoryDocument32 pagesIgcse Accounting Theorykuanhuining202104No ratings yet

- TRUE FALSE SCANNER by NahtaDocument88 pagesTRUE FALSE SCANNER by NahtaHimanshu RayNo ratings yet

- Financial Statement Analysis: Balance Sheet Liabilities AssetsDocument17 pagesFinancial Statement Analysis: Balance Sheet Liabilities AssetsAman MujeebNo ratings yet

- 13 Cash and ReceivablesDocument14 pages13 Cash and ReceivablesHesham AhmedNo ratings yet

- Financial AccountancyDocument3 pagesFinancial Accountancysayakkarmakarslg1No ratings yet

- CH 02Document46 pagesCH 02martinus linggoNo ratings yet

- Module 3 in FABM2 - EhandoutDocument2 pagesModule 3 in FABM2 - EhandoutJulienne FrancoNo ratings yet

- Chapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesDocument5 pagesChapter 9 Part 1-Notes Receivables: Don Honorio Ventura State University College of Business StudiesKyleRhayneDiazCaliwagNo ratings yet

- Chapter 4 Statement of Financial PositionDocument4 pagesChapter 4 Statement of Financial PositionDaniel Tan KtNo ratings yet

- Financial Accounting CrashDocument57 pagesFinancial Accounting CrashSAIGAGANNo ratings yet

- Taxation Power Point 2Document41 pagesTaxation Power Point 2Charisse Ahnne TosloladoNo ratings yet

- Chapter 2 - Investments Schemes PPT-EDITEDDocument51 pagesChapter 2 - Investments Schemes PPT-EDITEDjiny benNo ratings yet

- Topic 1Document3 pagesTopic 1KyNo ratings yet

- Topic 1 Topic 1 Introduction To Derivatives Introduction To DerivativesDocument66 pagesTopic 1 Topic 1 Introduction To Derivatives Introduction To DerivativespptvaibhavNo ratings yet

- True & False - ScannerDocument88 pagesTrue & False - ScannerPaulNo ratings yet

- Units 1 - 4Document50 pagesUnits 1 - 4Wakil EllmaaNo ratings yet

- FIN 335 UNCW Phase III NotesDocument23 pagesFIN 335 UNCW Phase III NotesMonydit SantinoNo ratings yet

- F A, B & M 2: Undamentals of Ccountancy Usiness AnagementDocument14 pagesF A, B & M 2: Undamentals of Ccountancy Usiness AnagementDories AndalNo ratings yet

- 1.swot & Product NoteDocument15 pages1.swot & Product Noteashish prasadNo ratings yet

- ch07 - STUDocument97 pagesch07 - STUhaminhdang291020No ratings yet

- What Is Depreciation?Document8 pagesWhat Is Depreciation?jawadNo ratings yet

- Expense But Not Yet Paid: LO1 LO2 LO3 LO4 LO5Document6 pagesExpense But Not Yet Paid: LO1 LO2 LO3 LO4 LO5Shane TorrieNo ratings yet

- Chapter 1 - Statement of Financial PositionDocument33 pagesChapter 1 - Statement of Financial PositionAbyel Nebur78% (9)

- Day 6 Cash and Receivables 2024 FinalDocument18 pagesDay 6 Cash and Receivables 2024 FinalKit KatNo ratings yet

- Chapter26 DividendPolicyDocument12 pagesChapter26 DividendPolicyTeh Chu LeongNo ratings yet

- Final-Non Trading Concerns-Theory1Document17 pagesFinal-Non Trading Concerns-Theory1vikkinikkiNo ratings yet

- Financial 12. UnitDocument17 pagesFinancial 12. UnitBener GüngörNo ratings yet

- Banking ServiceDocument3 pagesBanking ServicePia SolNo ratings yet

- Lecture 02 - Analyzing TransactionsDocument43 pagesLecture 02 - Analyzing Transactions6- Quang BáchNo ratings yet

- M. SC and M. Phil Diaries: 1. Financial EconomicsDocument14 pagesM. SC and M. Phil Diaries: 1. Financial EconomicsSumra KhanNo ratings yet

- What I Know .Use Separate Paper For Your AnswerDocument7 pagesWhat I Know .Use Separate Paper For Your AnswerWhyljyne GlasanayNo ratings yet

- 1st Puc Accountancy Quick Glance Eng Version 2019-20 by Sunil KDocument19 pages1st Puc Accountancy Quick Glance Eng Version 2019-20 by Sunil KadiveshsindhurNo ratings yet

- Nissin Food Holdings (Company Overview)Document5 pagesNissin Food Holdings (Company Overview)rakinski0% (1)

- A) B) C) D) E)Document25 pagesA) B) C) D) E)SHIVAM SINGHNo ratings yet

- SCB EMI Terms and ConditionsDocument2 pagesSCB EMI Terms and ConditionsSanam PandeyNo ratings yet

- 6.1 Futures and Options AnalysisDocument2 pages6.1 Futures and Options AnalysisSuraj DecorousNo ratings yet

- The Impact of The First World War and Its Implications For Europe TodayDocument9 pagesThe Impact of The First World War and Its Implications For Europe TodayNanee DNo ratings yet

- Beginner - S Guide To Mutual Fund - Abhishek Raja RamDocument81 pagesBeginner - S Guide To Mutual Fund - Abhishek Raja Ramk praNo ratings yet

- Translation Ftierra WebpageDocument4 pagesTranslation Ftierra WebpageVictor Arturo Clavijo RiveroNo ratings yet

- ViorelDocument4 pagesViorelITNo ratings yet

- PPT1 The Economic and Business EnvironmentDocument13 pagesPPT1 The Economic and Business EnvironmentLinda Astri Dwi WulandariNo ratings yet

- Annuity DueDocument27 pagesAnnuity Duebayu fajarNo ratings yet

- International Trade LawDocument257 pagesInternational Trade LawAnusha V RNo ratings yet

- Invoice LifeDocument1 pageInvoice Lifelondon2gowdaNo ratings yet

- Porter's Five ForcesDocument6 pagesPorter's Five ForcesHumberto SusunagaNo ratings yet

- 12 02 20Document47 pages12 02 20Rommel John SandovalNo ratings yet

- Internship: Log BookDocument8 pagesInternship: Log Booklooloo sxribdNo ratings yet

- List of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Document1 pageList of Residential Properties (P, GP and SP) of Rohtak Zone For Auction Dated 20.07.2022Yogesh MittalNo ratings yet

- Exercise Chapter 5-Past Year Exam QuestionDocument2 pagesExercise Chapter 5-Past Year Exam QuestionDeelah MawarNo ratings yet

- Loan StatementDocument2 pagesLoan StatementTien NguyenNo ratings yet

- Rate of Interest - Odisha Gramya BankDocument1 pageRate of Interest - Odisha Gramya BankshibayanNo ratings yet

- Rebar Cutlist-Footing Tie Beam Rebar 1Document1 pageRebar Cutlist-Footing Tie Beam Rebar 1Edxer MagpantayNo ratings yet

- Region Xi RiceDocument460 pagesRegion Xi RiceMarie DanielesNo ratings yet

- FRM - Syllabus PDFDocument64 pagesFRM - Syllabus PDFAnonymous x5odvnNVNo ratings yet

- Theoretical Approaches: BBA 261B Elective SessionDocument14 pagesTheoretical Approaches: BBA 261B Elective SessionVarun BaliNo ratings yet

- Errata - Unit 1 History Coursebook - Elective - Finalised - 30 OctDocument3 pagesErrata - Unit 1 History Coursebook - Elective - Finalised - 30 Octfreddiemercury13780No ratings yet

- Central Bank Digital Currencies: Design Is All That Matters by Tony KurianDocument3 pagesCentral Bank Digital Currencies: Design Is All That Matters by Tony KurianTony KurianNo ratings yet

- Insurance Survey 2023.low Res - SMLDocument192 pagesInsurance Survey 2023.low Res - SMLmoodley.vadynNo ratings yet

- Angle Weight ChartDocument7 pagesAngle Weight ChartAbhinav KumarNo ratings yet

- Literature Review FinalDocument7 pagesLiterature Review FinalAJ Stockwell100% (1)

- Veerabadreshwara Medicals BillsDocument1 pageVeerabadreshwara Medicals BillsPavan KNo ratings yet