Professional Documents

Culture Documents

Inv Snps e Vdym9v

Inv Snps e Vdym9v

Uploaded by

rakeshreddy2398Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inv Snps e Vdym9v

Inv Snps e Vdym9v

Uploaded by

rakeshreddy2398Copyright:

Available Formats

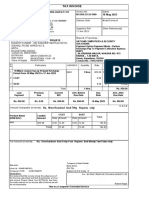

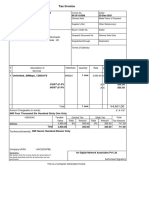

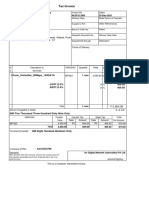

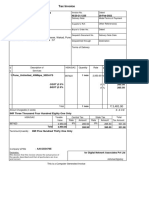

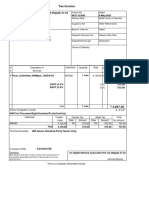

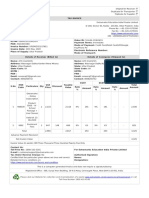

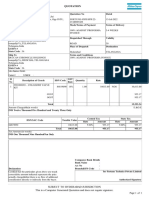

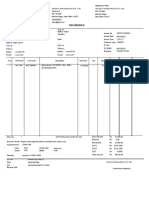

SYNOPSYS INDIA PRIVATE LIMITED

TAX INVOICE Original for receipt

Address: Tower A , 3rd,4th & 5th Floors, RMZ Infinity, Benniganahalli, Old Madras Road, Bengaluru - 560016, Karnataka

Shipped from: Tower A , 3rd,4th & 5th Floors, RMZ Infinity, Benniganahalli, Old Madras Road, Bengaluru - 560016, Karnataka State: Karnataka State Code: 29 GSTIN: 08BBHSD8713F2Y

Invoice No: LK1RI2021102498 Doc. Ref.: Delivery Terms: Online (E-Learning) Shipment Via: Special Instructions: The course will be valid for 240 days with

Invoice Date: 14/04/2023 PO. Ref: 101300000551926 Category: Product Foundation Training (Self paced) Docket No: 75425497792 downloading access, please try to complete the course and download

Customer Order No: LKOCO183689 Payment Terms: Prepaid EWB No: Against InvoiceNo: the ceritifcate in time.

Bill To Address: Narem Mohith Reddy Place of Supply Delivery Address: Narem Mohith Reddy

Sathyanarayana Puram, Jeevakona Road, Tirupati, Balaji District -

State Code: 37 Sathyanarayana Puram, Jeevakona Road, Tirupati, Balaji District - 517501, Andhra Pradesh

517501, Andhra Pradesh

State (Code): Andhra Pradesh (37) State: Andhra Padesh Mobile Number: +91-7093787144

PAN No: Secondary Contact Number: +91-8074735271

Email: mohithreddynarem23@gmail.com State (Code): Andhra Pradesh (37)

Discount GST

Sr.N Name of the Product / Course Description / Generic Basic Freight TCS Rate (%)

Course ID Qty Rate Taxable Value Invoice Amount Receivable Amount

o Name Value Amount Amount

Type Amount CGST (9%)SGST (9%)

1 E-VDYM9V Language: SystemVerilog Verification using UVM 1 $700 $700 Client 16% $588 $588 $105.84 $693.84 $693.84

Employee

Sub Total: Total Qty : 1 $700 $588 $588 $105.84 $693.84 $693.84

Net Amount Payable (In Words): INR Fifty Six Thousand Eight Hundred Fifty Seven Rupees and Zero Paise Only

Cash Discount (CD) Total: 16.00%, Trade Discount (TD) Total : 0.00, Rate Discount (RD) Total:0.00 Total Receivable Amount: INR 56,857.00/-

Declaration: Certified that the Particulars given above are true and correct GST payable on Reverse charge basis. N. A

TDS Declaration: In terms of Notice No. 21/2012 dt. 13.06.2012, we hereby declare and confirm that in case of sale of software, software is acquired in a subsequent transfer and is transferred without

any modification and tax is deducted at soiurce u/s 195 and/or u/s 194J as applicable while making payment to the previous transfer of suck software or while making payment to OEM / supplier. You Not required its auto generated invoice

are not required to deduct tax at source on this account.

Goods received in good condition with proper materials which are downloadable for a limited time (240 days) Terms & Conditions of this sale are mentioned overleaf

Customer Care: 650-584-5000, 800-541-7737 Email: training.solvnet@synopsys.com

Goods shipped / sold under This Invoice are for personal use and not for resale Authorized Signatory

Regd. Office: Tower A , 3rd,4th & 5th Floors, RMZ Infinity, Benniganahalli, Old Madras Road, Bengaluru - 560016. Website: training.synopsys.com Email: training.solvnet@synopsys.com

You might also like

- Accounts Payable Process - Account ViewDocument5 pagesAccounts Payable Process - Account ViewEmmanuel HernandezNo ratings yet

- Invoice SHADOWFAXDocument1 pageInvoice SHADOWFAXAinta GaurNo ratings yet

- Tax Invoice: TÜV Rheinland (India) Pvt. LTDDocument2 pagesTax Invoice: TÜV Rheinland (India) Pvt. LTDHansraj GargNo ratings yet

- 406 5727746 9085963 Credit NoteDocument1 page406 5727746 9085963 Credit Noteharish gowdaNo ratings yet

- BPML FIT v1.1Document12 pagesBPML FIT v1.1nguyencaohuygmailNo ratings yet

- Sarayu Dna Wifi 2021Document1 pageSarayu Dna Wifi 2021AbhijeetNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Vaishali Dna Wifi 2021Document1 pageVaishali Dna Wifi 2021AbhijeetNo ratings yet

- Triple Play Internet BillDocument1 pageTriple Play Internet BillAbhishek Kumar SinghNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailssrinivasNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge Detailsniladridey12345No ratings yet

- Sof 14388 696Document3 pagesSof 14388 696RAJENDRA MODNo ratings yet

- Vaishali Dna Wifi 2022Document1 pageVaishali Dna Wifi 2022AbhijeetNo ratings yet

- Babar - Dna - Wifi - Jan-May 2022Document1 pageBabar - Dna - Wifi - Jan-May 2022AbhijeetNo ratings yet

- 7e5c64 10361419 INV 2021 17611Document1 page7e5c64 10361419 INV 2021 17611arjun singhaNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument2 pagesContract: Organisation Details Buyer DetailsashishNo ratings yet

- Invoice - Dhanraj1992 FEB-23 PDDocument1 pageInvoice - Dhanraj1992 FEB-23 PDAinta GaurNo ratings yet

- Gemc 511687727232162 30082022Document3 pagesGemc 511687727232162 30082022Prathmesh ThetendersNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument3 pagesContract: Organisation Details Buyer DetailsNSTI AKKINo ratings yet

- Monitor BillDocument1 pageMonitor BillGulf JobsNo ratings yet

- 811ffa 10363313 INV 2021 17655Document1 page811ffa 10363313 INV 2021 17655arjun singhaNo ratings yet

- Modular Kitchen InvoiceDocument1 pageModular Kitchen InvoiceShubham MishraNo ratings yet

- Invoice: APS University Road Rewa Gstin/Uin: 23AABAR8770L1Z4 State Name: Madhya Pradesh, Code: 23Document1 pageInvoice: APS University Road Rewa Gstin/Uin: 23AABAR8770L1Z4 State Name: Madhya Pradesh, Code: 23Kamta Prasad PatelNo ratings yet

- Spaze TowerDocument1 pageSpaze TowerShubhamvnsNo ratings yet

- ACC_090711VOUCHER (1)Document1 pageACC_090711VOUCHER (1)lavanyaNo ratings yet

- Proforma Invoice 002Document1 pageProforma Invoice 002Priyanka YadavNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailsRohit SharmaNo ratings yet

- Vendor Register FormDocument3 pagesVendor Register Formsmitbhivgade1312No ratings yet

- In Voice 7295Document1 pageIn Voice 7295VishwasNo ratings yet

- Info Edge (India) LTD: Tax Invoice Original For RecipientDocument3 pagesInfo Edge (India) LTD: Tax Invoice Original For RecipientGanesh GodaseNo ratings yet

- Screenshot 2024-04-17 at 9.20.00 PMDocument2 pagesScreenshot 2024-04-17 at 9.20.00 PMinfotech.adisanNo ratings yet

- InvoiceDocument2 pagesInvoicersengunthar1No ratings yet

- ORDERACKDocument4 pagesORDERACKAjay Singh06No ratings yet

- Megahertz Internet Network Pvt. LTD.: Retail InvoiceDocument1 pageMegahertz Internet Network Pvt. LTD.: Retail InvoiceAyush ThapliyalNo ratings yet

- Babar - Dna JunDocument1 pageBabar - Dna JunAbhijeetNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument3 pagesContract: Organisation Details Buyer DetailspalharjeetNo ratings yet

- OLA Bill 1Document3 pagesOLA Bill 1bhagya lakshmiNo ratings yet

- Purchase Order: GSTN 27AAHCR3225L1Z6 Phone: 022-Cin No.Document2 pagesPurchase Order: GSTN 27AAHCR3225L1Z6 Phone: 022-Cin No.Sanjay SolankarNo ratings yet

- Babar DnaDocument1 pageBabar DnaAbhijeetNo ratings yet

- Quotation / Performa Invoice: Ghazipur Delhi - State Name: Delhi, Code: 07Document1 pageQuotation / Performa Invoice: Ghazipur Delhi - State Name: Delhi, Code: 07Rajat Verma100% (1)

- Please Visit Our Website For Collection and Channelisation of E-Waste or Call Toll Free Number 1800 419 4140Document1 pagePlease Visit Our Website For Collection and Channelisation of E-Waste or Call Toll Free Number 1800 419 4140arjun singhaNo ratings yet

- MyAstroAdvice 93548Document1 pageMyAstroAdvice 93548aakashbrillsenceNo ratings yet

- Tax Invoice Tab Consulting 3Document1 pageTax Invoice Tab Consulting 3akash.prismartNo ratings yet

- Quotation: Subject To Hyderabad Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureDocument1 pageQuotation: Subject To Hyderabad Jurisdiction This Is A Computer Generated Quotation and Does Not Require SignatureService FTPLNo ratings yet

- 41cf78 10354802 INV 2021 17267Document1 page41cf78 10354802 INV 2021 17267arjun singhaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherSomesh chandraNo ratings yet

- March Internet BillDocument2 pagesMarch Internet Billitsmedilip02No ratings yet

- BeatboxDocument1 pageBeatboxChaitanya MenduNo ratings yet

- Gemc 511687716615337 30082022Document3 pagesGemc 511687716615337 30082022Prathmesh ThetendersNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument3 pagesContract: Organisation Details Buyer DetailsNSTI AKKINo ratings yet

- May HathwayDocument1 pageMay HathwayJitendraNo ratings yet

- Invoice AntivirusDocument1 pageInvoice AntivirusAyush BhartiNo ratings yet

- Tax Invoice: Pest Kare (India) PVT - LTDDocument1 pageTax Invoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- Accounting VoucherDocument1 pageAccounting Voucheramit2352842No ratings yet

- INV NO 327 DREAM CONSULTING SERVICES PVT LTDDocument1 pageINV NO 327 DREAM CONSULTING SERVICES PVT LTDanuNo ratings yet

- Gemc 511687771537841 17102022Document2 pagesGemc 511687771537841 17102022Prathmesh ThetendersNo ratings yet

- GEMC-511687729984232-03122022Document2 pagesGEMC-511687729984232-03122022Prathmesh ThetendersNo ratings yet

- ASTLLPDocument1 pageASTLLPadvancedsporttecNo ratings yet

- Tax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24Document1 pageTax Invoice: Gstin/Uin: 24AABCY0257H1ZI State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Tax InvoiceDocument3 pagesTax InvoiceMishra dtuNo ratings yet

- General Ledger Accounting:: SAP FICO Course ContentDocument10 pagesGeneral Ledger Accounting:: SAP FICO Course ContentsrinivasNo ratings yet

- Invoice PBT3723A00296560Document1 pageInvoice PBT3723A00296560sai kiranNo ratings yet

- Ajio FL0100682752 1568796417726Document1 pageAjio FL0100682752 1568796417726Piyush ManwaniNo ratings yet

- TaxInvoice AIN2223001692434Document2 pagesTaxInvoice AIN2223001692434Pradeep N KNo ratings yet

- En S4 SCC Configuration 03Document24 pagesEn S4 SCC Configuration 03joeindNo ratings yet

- 3 ERP Software RFP Exhibit GDocument575 pages3 ERP Software RFP Exhibit GJacob YeboaNo ratings yet

- Lease API White PaperDocument23 pagesLease API White PapereramitsarohaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Deepal Pallav SutharNo ratings yet

- Handling Tickets SAP SDDocument3 pagesHandling Tickets SAP SDDeepak Mehra100% (1)

- RIB CCS Candy Standard Stand Alone Proposal - ZA - 40th Jubilee Promotion - (1 User) - SignedDocument10 pagesRIB CCS Candy Standard Stand Alone Proposal - ZA - 40th Jubilee Promotion - (1 User) - SignedKyle MoolmanNo ratings yet

- Mobile Banking - User ManualDocument23 pagesMobile Banking - User ManualKhuram MughalNo ratings yet

- Billing DataDocument210 pagesBilling Datakrishnacfp2320% (1)

- EDF Bill InvDocument4 pagesEDF Bill Invmoran64800No ratings yet

- Export Finance-Countertrade and ForfaitingDocument26 pagesExport Finance-Countertrade and ForfaitingRajat LoyaNo ratings yet

- Customer Payments (1S0 - US) : Test Script SAP S/4HANA - 17-09-20Document30 pagesCustomer Payments (1S0 - US) : Test Script SAP S/4HANA - 17-09-20Prakash PrakyNo ratings yet

- StandeeDocument1 pageStandeeInteshar CullenNo ratings yet

- Series 7 Watch BillDocument1 pageSeries 7 Watch BillVedans FinancesNo ratings yet

- Packaging and LabellingDocument5 pagesPackaging and LabellingTaruna NirankariNo ratings yet

- Tuitionfees 1 SttermDocument2 pagesTuitionfees 1 SttermBhaskhar AnnaswamyNo ratings yet

- Uganda Tax Amendment Bills For 2018Document10 pagesUganda Tax Amendment Bills For 2018jadwongscribdNo ratings yet

- Vouchers: Submitted By: Manraj Singh Submitted To: Navneet Singh Badwal (Accountancy Lecturer)Document14 pagesVouchers: Submitted By: Manraj Singh Submitted To: Navneet Singh Badwal (Accountancy Lecturer)Manraj SinghNo ratings yet

- CombinepdfDocument11 pagesCombinepdfSathish KumarNo ratings yet

- Hulpak BemlDocument34 pagesHulpak BemlrushabhNo ratings yet

- Height Restrictions Technical ReportDocument3 pagesHeight Restrictions Technical Reportamryahya4No ratings yet

- Curriculum Vitae: ObjectiveDocument4 pagesCurriculum Vitae: ObjectivePradeep SatwarkarNo ratings yet

- InvoiceDocument1 pageInvoiceGaurang MandalNo ratings yet

- 1 Hampshire Road Singapore 219428 Tel: 1800-CALL LTA (1800-2255582) Fax: (65) 6396 1130Document1 page1 Hampshire Road Singapore 219428 Tel: 1800-CALL LTA (1800-2255582) Fax: (65) 6396 1130Antony LibinNo ratings yet

- 90323396Document1 page90323396Saif KasmaniNo ratings yet