Professional Documents

Culture Documents

PARCOR - Dividends

PARCOR - Dividends

Uploaded by

awoods3681280Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PARCOR - Dividends

PARCOR - Dividends

Uploaded by

awoods3681280Copyright:

Available Formats

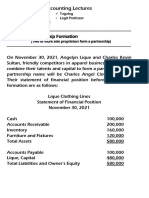

PARTNERSHIP AND CORPORATION

DIVIDENDS

Course and Section: BSBA

Subject: Partnership and Corporation

1. The CBA Corporation’s board of directors declared a P1 cash dividend for every

share held to outstanding shareholders. What is the balance of the total

shareholders’ equity after the date of declaration?

Balances

Balances after

Declared P1 per(outstanding) share cash

before Dividends dividends

dividends

dividends declared and declared and

paid paid

Cash -150,000

Cash dividends Payable 0

Ordinary Shares, 150,000 shares issued, P15

2,250,000

par 2,250,000

Share Premium 300,000 300,000

Retained Earnings 580,000 -150,000 430,000

Total Shareholders' Equity 3,130,000 -150,000 2,980,000

Entries:

Retained Earnings 150,000

Cash Dividends Payable 150,000

Cash Dividends Payable 150,000

Cash 150,000

Dividend per share 1.00

2. The effect on the balance of Total Shareholders' Equity between the date of

declaration and date of payment after the board of directors declared a 25% share

dividend and a 10% share dividend.

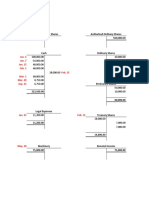

25% Share Dividend

Large dividends: 20% or more based Before 25% Share After share

on outstanding shares use Par Value distribution of declaration and distribution

new shares distribution

Ordinary Shares, 400,000 shares 2,250,000.00 562,500.00 2,812,500.00

authorized, 150,000 shares issued and

outstanding, P15 par

Share Premium 300,000.00 300,000.00

Retained Earnings 580,000.00 -562,500.00 17,500.00

Total Shareholders' Equity 3,130,000.00 0.00 3,130,000.00

No. of shares authorized 400,000 400,000

No. of shares issued and outstanding 150,000 37,500 187,500

Entries:

Retained Earnings 562,500.00

Share Distributable 562,500.00

Share Distributable 562,500.00

Ordinary Shares 562,500.00

10% Share Dividend

Small dividends: Less than 20% based Before 10% Share After share

on outstanding shares, use FMV distribution of declaration and distribution

new shares distribution, FMV

at P30

Ordinary Shares, 400,000 shares 2,250,000.00 225,000.00 2,475,000.00

authorized, 150,000 shares issued and

outstanding, P15 par

Share Premium 300,000.00 225,000.00 525,000.00

Retained Earnings 580,000.00 -450,000.00 130,000.00

Total Shareholders' Equity 3,130,000.00 0.00 3,130,000.00

No. of shares authorized 400,000 100,000

No. of shares issued and outstanding 150,000 15,000 165,000

Entries:

Retained Earnings 450,000.00

Share Distributable (at par 225,000.00

value)

Share Premium 225,000.00

Share Distributable 225,000.00

Ordinary Shares 225,000.00

3. The CBA Corporation’s board of directors declared a 3:1 share split. How many

shares are outstanding after issuance of the new shares?

Share Split: Increasing the number of Before share Declared 3:1 After share split

shares authorized, issued, outstanding split share split

and treasury with corresponding

decrease in Par Value per share

Ordinary Shares, 400,000 shares 2,250,000.00 2,250,000.00

authorized, 150,000 shares issued, P15

par

Share Premium 300,000.00 300,000.00

Retained Earnings 580,000.00 580,000.00

Balance 3,130,000.00 0.00 3,130,000.00

Treasury Stock, 1,000 shares 16,000.00 16,000.00

Total Shareholders' Equity 3,114,000.00 0.00 3,114,000.00

No. of shares authorized 400,000.00 1,200,000.00 1,600,000.00

No. of shares issued (Issued = 150,000.00 450,000.00 600,000.00

Outstanding + Treasury)

No. of shares outstanding 149,000.00 447,000.00 596,000.00

No. of shares in treasury 1,000.00 3,000.00 4,000.00

Par Value 15.00 15.00

Cost of Treasury Stock per share 16.00 16.00

Entries:

The board of directors declared a 3:1 share split.

No changes in account balances

Increase in no. of shares authorized, issued, outstanding and in

treasury

Decrease in par values and cost per share of treasury stock

4. The CBA Corporation’s board of directors declared a 3:1 share split. Before the share

split, the shareholders’ equity included Treasury shares, 20,000 shares at P15 per

share, P300,000. After the share split, the entity sold 20,000 treasury stock at P15 per

share. What is the balance of the total shareholders’ equity after the share split and

selling the 20,000 treasury stock?

Share Split: Increasing the number of Before share Declared 3:1 After share split

shares authorized, issued, outstanding split share split

and treasury with corresponding

decrease in Par Value per share

Ordinary Shares, 400,000 shares 1,800,000.00 1,800,000.00

authorized, 150,000 shares issued, P12

par

Share Premium 300,000.00 300,000.00

Retained Earnings 580,000.00 580,000.00

Balance 2,680,000.00 0.00 2,680,000.00

20,000 Treasury shares at P15 per 300,000.00 300,000.00

share, P300,000 (Given)

Sold Treasury Shares -300,000.00

Total Shareholders' Equity 2,380,000.00 0.00 2,080,000.00

No. of shares authorized 400,000.00 1,200,000.00 1,600,000.00

No. of shares issued (Issued = 150,000.00 450,000.00 600,000.00

Outstanding + Treasury)

No. of shares outstanding 130,000.00 390,000.00 520,000.00

No. of shares in treasury 20,000.00 60,000.00 80,000.00

Sold shares after split 20,000.00

Par Value 12.00

Cost of Treasury Stock per share 15.00

Remaining no of shares in treasury 60,000.00

(after sale)

No of shares issued (after sale) 580,000.00

5. At December 31, 2023, CBA Corporation’s shareholders’ equity included P100 par

value 8% Preference Cumulative shares, 2 years in arrears; P10 par value Ordinary

Shares, Share Premium, Retained Earnings, and Treasury Ordinary shares, 20,000

shares at P15 per share. The board of directors declared P400,000 cash dividend.

Compute the cash dividend per preference share and per ordinary share.

Declared P200,000 cash dividends, Balances Dividends Balances after

Preference shares are cumulative before declared and dividends

and non-participating; dividends are dividends paid declared and

2 years in arrears. paid

Cash -400,000.00

Cash dividends Payable 0.00

8% Preference Shares, 15,000 shares, 1,500,000.00 1,500,000.00

P100

Ordinary Shares, 50,000 shares, P10 500,000.00 500,000.00

par

Share Premium 300,000.00 300,000.00

Retained Earnings 580,000.00 -400,000.00 180,000.00

Balance 2,880,000.00 -400,000.00 2,480,000.00

Treasury (20,000 shares at P15) 300,000.00

Total Shareholders' Equity 2,580,000.00 -400,000.00 2,480,000.00

Preference Ordinary Total

2 years arrears 240,000.00 240,000.00

Current year 120,000.00 40,000.00 160,000.00

Non-Participating 0.00 0.00 0.00

Total 360,000.00 40,000.00 400,000.00

Dividend per share 24.00 0.80

Entries:

Retained Earnings 400,000.00

Cash Dividends Payable 400,000.00

Cash Dividends Payable 400,000.00

Cash 400,000.00

6. At December 31, 2023, CBA Corporation’s shareholders’ equity included P100 par

value 8% Preference Cumulative shares, 2 years in arrears; P10 par value Ordinary

Shares, Share Premium; Retained Earnings, and Treasury Ordinary shares, 20,000

shares at P15 per share. Compute the book values per preference share and per

ordinary share.

8% Cumulative Preference Shares, 15,000

1,500,000

shares, P100, 2 years in arrears

Ordinary Shares, 50,000 shares, P10 par 500,000

Share Premium - Preference 180,000

Share Premium - Ordinary 120,000

Retained Earnings 580,000

Total Shareholders' Equity 2,880,000

No liquidation value; use par value per

preference share.

Preference equity 1,860,000

Par value per preference share 1,500,000

Dividends in arrears 240,000

Dividend for the current year 120,000

Book value per preference share 124.00

Ordinary equity 1,020,000

Book value per ordinary share 20.40

You might also like

- ISSA Catalogue 2018 NewDocument4 pagesISSA Catalogue 2018 Newseamanship990% (1)

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- Toyota CompanyDocument2 pagesToyota Companykel data100% (2)

- Chapter 6 ParcorDocument10 pagesChapter 6 Parcornikki syNo ratings yet

- Patria Bank S.A: Extras de Cont / Account StatementDocument3 pagesPatria Bank S.A: Extras de Cont / Account StatementRommel FrumuseluNo ratings yet

- Chapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelDocument3 pagesChapter-7 Pracrice Exercise (Seatwork) Marato, Jedediah SamuelJedediah Samuel Marato0% (1)

- CHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Document7 pagesCHAPTER 15 - CORPORATION - Problem 4 - Multiple Choice - Page 569-572Penelope Palcon100% (5)

- SheDocument5 pagesSheLorie Jae Domalaon0% (1)

- Problem 32 Retained Earnings ParcorDocument3 pagesProblem 32 Retained Earnings Parcornikki syNo ratings yet

- Copy Treasury StocksDocument213 pagesCopy Treasury StocksJuren Demotor Dublin100% (2)

- Accounting Quiz 2Document8 pagesAccounting Quiz 2Camille G.No ratings yet

- Finals SolutionsDocument24 pagesFinals SolutionsFrancine Esther CruzNo ratings yet

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraNo ratings yet

- Shadden PanaoDocument5 pagesShadden PanaoJoebin Corporal LopezNo ratings yet

- Corporation Accounting ReviewDocument26 pagesCorporation Accounting ReviewAliyah Francine Gojo CruzNo ratings yet

- Shareholders EquityDocument11 pagesShareholders EquityJasmine ActaNo ratings yet

- Exercise 4 Shareholders EquityDocument9 pagesExercise 4 Shareholders EquityNimfa SantiagoNo ratings yet

- Flores Assignment Corporation PDFDocument13 pagesFlores Assignment Corporation PDFGwen Stefani DaugdaugNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Comprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFDocument9 pagesComprehensive Illustration of Consolidated Financial Statements - Intercompany Sale of Inventories PDFamie honnagNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Quiz 14 SolutionsDocument16 pagesQuiz 14 SolutionsAlex OzfordNo ratings yet

- Exercises Module 9 For UploadDocument14 pagesExercises Module 9 For UploadjpNo ratings yet

- Audit of EquityDocument6 pagesAudit of EquityEdmar HalogNo ratings yet

- Finalchapter 23Document7 pagesFinalchapter 23Jud Rossette ArcebesNo ratings yet

- LeahDocument6 pagesLeahJoebin Corporal LopezNo ratings yet

- 001 AdvanceDocument6 pages001 AdvanceSa BilNo ratings yet

- Toyota CompanyDocument2 pagesToyota Companykel dataNo ratings yet

- Audit of Shareholders Equity ActivityDocument31 pagesAudit of Shareholders Equity ActivityIris FenelleNo ratings yet

- Ac6 ProblemsDocument21 pagesAc6 ProblemsLysss EpssssNo ratings yet

- Handout - 02 - Subsequent TransactionsDocument3 pagesHandout - 02 - Subsequent TransactionsPrincess NozalNo ratings yet

- Class Activity 1 Cash Flow StatementDocument2 pagesClass Activity 1 Cash Flow StatementHacker SKNo ratings yet

- Book Value Per ShareDocument4 pagesBook Value Per ShareNica CezarNo ratings yet

- NC LiabilitiesDocument12 pagesNC LiabilitiesErin LumogdangNo ratings yet

- ACCTG 111B - Chapter 7 ReportDocument41 pagesACCTG 111B - Chapter 7 ReporttempoNo ratings yet

- Shareholders EquityDocument16 pagesShareholders Equitymirasolledesma7No ratings yet

- Corporation Issuance of Shares Illutsrative ProblemDocument15 pagesCorporation Issuance of Shares Illutsrative ProblemHoney MuliNo ratings yet

- Ap She Exam ProbDocument3 pagesAp She Exam Problois martinNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Module 2 Shareholders Equity Students ReferenceDocument7 pagesModule 2 Shareholders Equity Students ReferencecynangelaNo ratings yet

- 3 AFM - 002 - NEW - Assessing - Organisational - Performance - Using - Ratios - and - Trends - NotesDocument7 pages3 AFM - 002 - NEW - Assessing - Organisational - Performance - Using - Ratios - and - Trends - NotesDerickNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- I. Distribution of Profits: RequiredDocument3 pagesI. Distribution of Profits: RequiredJennette ToNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Finman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The FollowingDocument22 pagesFinman 2A Midterm Quiz 1 October 2021 34 Points Test 1 Prepare Journal Entries in The Books of COVID Partnership To Record The Followingella alfonsoNo ratings yet

- Soal Kuis 2Document6 pagesSoal Kuis 2Rahajeng SantosoNo ratings yet

- Accounting AssignmentDocument13 pagesAccounting AssignmentPetrinaNo ratings yet

- Chapter 14 Fitria Windyasari - Tugas Manajemen Keuangan Payout PolicyDocument6 pagesChapter 14 Fitria Windyasari - Tugas Manajemen Keuangan Payout PolicyDhea Nuralifiani SafitriNo ratings yet

- Module 4 Main TaskDocument4 pagesModule 4 Main TaskBC qpLAN CrOwNo ratings yet

- Exam Audit ProblemDocument5 pagesExam Audit ProblemNhel AlvaroNo ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- Allyzza Rey Cassy Alvarado BSA 2-EDocument3 pagesAllyzza Rey Cassy Alvarado BSA 2-EJohn Mikeel FloresNo ratings yet

- Accounting For Managers Financial Statement Analysis: Shahid IlyasDocument7 pagesAccounting For Managers Financial Statement Analysis: Shahid IlyasAmanda LouiseNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Soal AkuntansiDocument4 pagesSoal AkuntansinairobiNo ratings yet

- ACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesDocument5 pagesACCTG 101 Final Quiz: Requirement: Provide The Necessary Journal EntriesCaro, Christilyn L.No ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- Sample Problems With Answer Key Inv. in Equity SecurityDocument23 pagesSample Problems With Answer Key Inv. in Equity SecurityyasherNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Investments in Debt SecuritiesDocument34 pagesInvestments in Debt SecuritiesNobu NobuNo ratings yet

- Textbook Advanced Accounting Twelfth Edition Paul Fischer Ebook All Chapter PDFDocument53 pagesTextbook Advanced Accounting Twelfth Edition Paul Fischer Ebook All Chapter PDFsandra.williams403100% (22)

- Trend Percentage AnalysisDocument33 pagesTrend Percentage AnalysisskylineNo ratings yet

- ValmetDocument7 pagesValmetJulia MercadoNo ratings yet

- FAQs - SBI Dividend Yield FundDocument8 pagesFAQs - SBI Dividend Yield FundAnil Kumar Reddy ChinthaNo ratings yet

- WD Gann NewDocument19 pagesWD Gann NewVishal MahajanNo ratings yet

- Chapter 5 - Bayu Laksono Jati - Capabilities For Learning Costomer MarketDocument14 pagesChapter 5 - Bayu Laksono Jati - Capabilities For Learning Costomer MarketAnja R WulandariNo ratings yet

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- Fixed Income Guest Lecture Maurice Meijers (New)Document27 pagesFixed Income Guest Lecture Maurice Meijers (New)Joe MoretNo ratings yet

- Bbe A1.1Document18 pagesBbe A1.1220004nguyen.hanNo ratings yet

- Cost of Capital and Firm Performance of ESG Companies What Can We Infer From COVID-19 PandemicDocument26 pagesCost of Capital and Firm Performance of ESG Companies What Can We Infer From COVID-19 PandemicChinapratha SitikornchayarpongNo ratings yet

- ADBL 56th Anniversary Special Publication 2079 Magh 7 PDFDocument300 pagesADBL 56th Anniversary Special Publication 2079 Magh 7 PDFSushil LamaNo ratings yet

- Financial StatementsDocument21 pagesFinancial Statementsastute kidNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1Document27 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank 1george100% (45)

- Lokesh Chhajed Bba Project On Axis BankDocument45 pagesLokesh Chhajed Bba Project On Axis BankAditya KolteNo ratings yet

- Unit 3 FD PDFDocument28 pagesUnit 3 FD PDFraj kumarNo ratings yet

- Valuation of GoodwillDocument16 pagesValuation of GoodwillRavi ganganiNo ratings yet

- Practice QuestionsDocument5 pagesPractice QuestionsAlthea Griffiths-BrownNo ratings yet

- ReportDocument10 pagesReportJames SoongNo ratings yet

- FAR Noel B. Summary of Lectures With PWDDocument4 pagesFAR Noel B. Summary of Lectures With PWDFatima AndresNo ratings yet

- Read The MarketdocxDocument127 pagesRead The MarketdocxHamed NabizadehNo ratings yet

- Crypto DictionaryDocument11 pagesCrypto DictionaryKaveen KavyaNo ratings yet

- Testbank CH06Document12 pagesTestbank CH06Kristelle A. RosarioNo ratings yet

- Credit Risk Literature ReviewDocument6 pagesCredit Risk Literature Reviewnelnlpvkg100% (1)

- Pas 1Document26 pagesPas 1Princess Jullyn ClaudioNo ratings yet

- MB Annual FS 2019 (May 12, 2020) - Final DraftDocument164 pagesMB Annual FS 2019 (May 12, 2020) - Final DraftDilip Devidas JoshiNo ratings yet

- Week 002 - CUSTOMER RELATIONSHIP - CUSTOMER SERVICE z2GdBSDocument8 pagesWeek 002 - CUSTOMER RELATIONSHIP - CUSTOMER SERVICE z2GdBSAbdulhakim MautiNo ratings yet

- Sapm Mid II Question PaperDocument2 pagesSapm Mid II Question PaperP PrabhakarNo ratings yet