Professional Documents

Culture Documents

PT - Are Assets Safe Flyer

PT - Are Assets Safe Flyer

Uploaded by

privatebank101Copyright:

Available Formats

You might also like

- Types of Trusts in The PhilippinesDocument7 pagesTypes of Trusts in The PhilippinesPaolo Hechanova100% (1)

- Uppers Various Info DatabaseDocument54 pagesUppers Various Info DatabaseJason BexonNo ratings yet

- Irrevocable TrustDocument11 pagesIrrevocable Trustamazing_pinoy50% (2)

- Trusts and Protecting Assets: Creation of An Inter Vivos TrustDocument16 pagesTrusts and Protecting Assets: Creation of An Inter Vivos TrustVlad Zernov100% (1)

- ItfDocument7 pagesItfRoberto Rivero IIINo ratings yet

- FDIC - Deposit Insurance - No Escrow Accounts Are IncludedDocument4 pagesFDIC - Deposit Insurance - No Escrow Accounts Are IncludeddeboraNo ratings yet

- Insured: Your DepositsDocument32 pagesInsured: Your Depositskhanaun422No ratings yet

- Chapter 7-Bank's Trust DepartmentDocument10 pagesChapter 7-Bank's Trust Departmentnicco100% (2)

- Irrevocable TrustDocument4 pagesIrrevocable TrustNelson Harris100% (2)

- Webster Investment 1 PDFDocument14 pagesWebster Investment 1 PDFrobertpatricia88No ratings yet

- Trust FunctionDocument9 pagesTrust FunctionKarina Blanco100% (2)

- Spotlight On Finance-June 20171Document5 pagesSpotlight On Finance-June 20171pguevarezNo ratings yet

- Family Banking 101Document5 pagesFamily Banking 101Carl SoriaNo ratings yet

- BankingDocument24 pagesBankingHANNA MARE CAIPANGNo ratings yet

- NotesDocument5 pagesNotesAnjelika ViescaNo ratings yet

- Fdic Your Insured Deposits EnglishDocument31 pagesFdic Your Insured Deposits EnglishSamNo ratings yet

- Consumer Loan Granted For Personal (Medical), Family (Education, Vacation), or HouseholdDocument8 pagesConsumer Loan Granted For Personal (Medical), Family (Education, Vacation), or Householdaliwaqas48797No ratings yet

- Understand SecuritisationDocument7 pagesUnderstand Securitisationteachezi100% (2)

- Banking Survival GuideDocument44 pagesBanking Survival Guidetraderpk100% (1)

- Commercial Banking - SVBDocument6 pagesCommercial Banking - SVBAgnes JosephNo ratings yet

- Financial Intermediaries and The Banking SystemDocument38 pagesFinancial Intermediaries and The Banking SystemLim Mei SuokNo ratings yet

- Protected Trust Deed An OverviewDocument10 pagesProtected Trust Deed An OverviewSophia LorennNo ratings yet

- Personal Finance-Module 2Document33 pagesPersonal Finance-Module 2Jhaira BarandaNo ratings yet

- Classification of CreditDocument25 pagesClassification of CreditJohn Nikko LlaneraNo ratings yet

- Revocable Trust Accounts Revocable Trust Accounts DisclaimerDocument43 pagesRevocable Trust Accounts Revocable Trust Accounts DisclaimerJackNo ratings yet

- FDIC Deposit Insurance CoverageDocument2 pagesFDIC Deposit Insurance CoverageSucreNo ratings yet

- Family Trust Guide GWDocument24 pagesFamily Trust Guide GWreydel_santos100% (4)

- FMT - Chap 9 - SolutionsDocument6 pagesFMT - Chap 9 - SolutionsVũ Hương ChiNo ratings yet

- WellsDocument3 pagesWellsForeclosure Fraud100% (1)

- Living Trust ArticleDocument3 pagesLiving Trust ArticlefrevickkNo ratings yet

- What Goes Into A TrustDocument3 pagesWhat Goes Into A TrustPaolo Hechanova100% (1)

- How To Set Up A Family TrustDocument7 pagesHow To Set Up A Family Trustjohnson080880% (5)

- What Is A BankDocument11 pagesWhat Is A BankANCHAL SINGHNo ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk AnalyticsAkshitNo ratings yet

- Banking Law NotesDocument6 pagesBanking Law NotesAfiqah IsmailNo ratings yet

- Unsecured DebtDocument3 pagesUnsecured DebtRommelBaldagoNo ratings yet

- Chapter 8 - The Deposit FunctionDocument17 pagesChapter 8 - The Deposit FunctionBoRaHaENo ratings yet

- Are Bank Runs ContagiousDocument12 pagesAre Bank Runs ContagiousVarun DoegarNo ratings yet

- Amanah WadiaDocument1 pageAmanah WadiaNoman H ChowdhuryNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Bank ProductsDocument14 pagesBank ProductsJuhi AgrawalNo ratings yet

- C PPP PPPPPPPPPPPPP P PP PPDocument7 pagesC PPP PPPPPPPPPPPPP P PP PPWahid MuradNo ratings yet

- RRSP MortgagesDocument6 pagesRRSP Mortgagespkgarg_iitkgpNo ratings yet

- Banking AssgnDocument14 pagesBanking AssgnlinaNo ratings yet

- 3 The Nature of DefaultDocument10 pages3 The Nature of DefaultDesara_GJoka123No ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk Analyticsblack canvasNo ratings yet

- Financial InstitutionDocument26 pagesFinancial Institutionfahim khanNo ratings yet

- User Guide - Understanding TrustsDocument12 pagesUser Guide - Understanding TrustswgrajNo ratings yet

- Ringkasan Materi Bahasa Inggris NiagaDocument31 pagesRingkasan Materi Bahasa Inggris NiagaNira IndrianiNo ratings yet

- Family TrustsDocument3 pagesFamily TrustsKudakwashe DzawandaNo ratings yet

- The Family Trust 11 Mar 13 Ws PDFDocument7 pagesThe Family Trust 11 Mar 13 Ws PDFkathyayini advocateNo ratings yet

- Finance Opt 2 Study GuideDocument3 pagesFinance Opt 2 Study GuidejayNo ratings yet

- M Embership Booklet: Effective April 1, 2022Document21 pagesM Embership Booklet: Effective April 1, 2022James CaronNo ratings yet

- Icredit One Page Web 3-17-2015Document3 pagesIcredit One Page Web 3-17-2015api-268321564No ratings yet

- All About Credit Reports - Rev2Document8 pagesAll About Credit Reports - Rev2kabNo ratings yet

- Financial InstrumentsDocument4 pagesFinancial InstrumentslandryNo ratings yet

- Ots Trust Handbook 740Document19 pagesOts Trust Handbook 740LevaanteNo ratings yet

- Pdic LawDocument6 pagesPdic LawJerickho JNo ratings yet

- Liquidity ManagementDocument35 pagesLiquidity ManagementJadMadiNo ratings yet

- Financial Environments Specifically Institutions: Ronil John GarganianDocument11 pagesFinancial Environments Specifically Institutions: Ronil John GarganianSandra LangNo ratings yet

- FI - Reading 42 - Asset-Backed SecuritiesDocument35 pagesFI - Reading 42 - Asset-Backed Securitiesshaili shahNo ratings yet

- The Business Value of Design: InsightsDocument18 pagesThe Business Value of Design: Insightsamber krishanNo ratings yet

- Supermarket CSR 07 Holly WatermanDocument213 pagesSupermarket CSR 07 Holly WatermanRaja Imran KhanNo ratings yet

- T JBN EnôualjbDocument280 pagesT JBN EnôualjbpisterboneNo ratings yet

- 3D CAD Model DownloadsDocument10 pages3D CAD Model DownloadssahirprojectsNo ratings yet

- Civ 2 Quiz Samplex UribeDocument12 pagesCiv 2 Quiz Samplex UribeDuke SucgangNo ratings yet

- Nature of Judicial ProcessDocument10 pagesNature of Judicial ProcessSandesh MishraNo ratings yet

- Incident Investigation ProcedureDocument35 pagesIncident Investigation ProcedureAnonymous yCpjZF1rF100% (3)

- Bus 5102 Group AssignmentDocument10 pagesBus 5102 Group AssignmenthamisNo ratings yet

- Datasheet VM Seires Solar InverterDocument1 pageDatasheet VM Seires Solar Invertermohamed husseinNo ratings yet

- GP Medium CorrectDocument2 pagesGP Medium CorrectJimmy JoeNo ratings yet

- Lampiran PQ - CSMS Questionnaires Pertamina WiriagarDocument29 pagesLampiran PQ - CSMS Questionnaires Pertamina WiriagarYogi Anggawan100% (3)

- Samala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Document11 pagesSamala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Angelie FloresNo ratings yet

- NCKH ĐỊNH TÍNHDocument75 pagesNCKH ĐỊNH TÍNHnguyennguyen.31221022808No ratings yet

- NX Shop Documentation Plug-In BaseDocument10 pagesNX Shop Documentation Plug-In BaseLÊ VĂN ĐỨCNo ratings yet

- 3 Gimp Size Color Contrast Crop RedeyeDocument2 pages3 Gimp Size Color Contrast Crop Redeyeapi-370628488No ratings yet

- S7 M WE4 RWBu QCCJs EDocument8 pagesS7 M WE4 RWBu QCCJs Eindasijames06No ratings yet

- tr4717Document13 pagestr4717Saurabh LanjekarNo ratings yet

- Arc-Sas CR 06-10-13 Series6Document14 pagesArc-Sas CR 06-10-13 Series6Oleg KostinNo ratings yet

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDocument8 pagesMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamNo ratings yet

- Take Away Material SYFC - September 2022Document11 pagesTake Away Material SYFC - September 2022Akun TumbalNo ratings yet

- Provisional Seniority Lists - LDC UDC and Sr. Clerk-01012024Document21 pagesProvisional Seniority Lists - LDC UDC and Sr. Clerk-01012024shubham patilNo ratings yet

- Capital MArket MCQDocument11 pagesCapital MArket MCQSoumit DasNo ratings yet

- Activity 1Document8 pagesActivity 1Philip Jansen GuarinNo ratings yet

- Your Card Already Registered and It Has Username and PasswordDocument4 pagesYour Card Already Registered and It Has Username and PasswordOmar YousufNo ratings yet

- Total Quiz HRM627Document28 pagesTotal Quiz HRM627Syed Faisal BukhariNo ratings yet

- 07) YHT Realty vs. CA, GR No. 126780, Feb. 17, 2005Document15 pages07) YHT Realty vs. CA, GR No. 126780, Feb. 17, 2005justinmauricioNo ratings yet

- ICFO Slides Part 2Document33 pagesICFO Slides Part 2Bhavesh ChauhanNo ratings yet

- Portable Fire Extinguishers PDFDocument92 pagesPortable Fire Extinguishers PDFznim04No ratings yet

- Current Affairs Made Easy - February 2018 PDFDocument126 pagesCurrent Affairs Made Easy - February 2018 PDFsharathr22No ratings yet

PT - Are Assets Safe Flyer

PT - Are Assets Safe Flyer

Uploaded by

privatebank101Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PT - Are Assets Safe Flyer

PT - Are Assets Safe Flyer

Uploaded by

privatebank101Copyright:

Available Formats

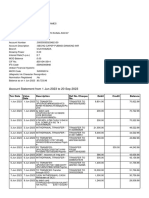

ARE MY TRUST, FIDUCIARY AND CUSTODY ASSETS SAFE?

Understanding the difference between account types.

It’s easy to get confused—and important to know the difference—between assets you have in deposit accounts,

a trust, fduciary or custodial account, and if they are safe. Here are some simple answers:

DEPOSIT ACCOUNTS

Assets you have in a deposit account become assets of the bank. This creates a debtor-creditor relationship

between the bank and you (the depositor), and a contractual promise is made by the bank to repay the

amount on deposit, plus interest (if applicable). The assets in such deposit accounts are insured by the

Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per FDIC-insured bank, per

ownership category.

What happens if the bank fails?

Since deposit account assets become assets of the bank, you (the depositor) become a creditor if the bank

fails and the bank will owe those assets to you. Plus, the FDIC insures each depositor for up to $250,000

per FDIC-insured bank, per ownership category. So as long as your deposit account assets do not exceed that

threshold, per bank, you will get those assets back.

TRUST, FIDUCIARY AND CUSTODIAL ACCOUNTS

Assets you have in a trust, fduciary or custodial account do NOT become assets of the bank. With a trust or

fduciary account, the bank acts as trustee or fduciary to the account, providing investment management,

investment advice and other services. With a custodial account, the bank’s role is to keep the assets safe,

collect dividends and interest and provide other similar services. In all cases, account ownership remains

vested in the individuals or entities for whose beneft the bank is acting as trustee, fduciary or custodian.

What happens if the bank fails?

Since assets held in a trust, fduciary or custodial account do NOT become assets of the bank, none of the

property is subjected to the claims of the bank’s creditors. Therefore, a bank failure will have no adverse

effect on such accounts and those assets will remain the property of the account owner(s).

However, the FDIC will try to transfer the administration of those accounts to a successor trust institution

as quickly as possible. If successful, the benefciaries would need to either accept this new arrangement or

make alternative arrangements. If the transfer is not successful, the FDIC will notify all affected benefciaries

to reclaim their property or designate an alternative institution to transfer their assets.

Therefore, the safety of trust, fduciary and custodial assets is not dependent upon whether the bank has

assets greater than its liabilities. Property held in these accounts belongs to the owner(s) of the accounts and

would be unaffected by bank failure.

If you have any questions or concerns

about your accounts, give us a call.

We’re always here to help.

(262) 522-7400 | www.prairiewealth.com

You might also like

- Types of Trusts in The PhilippinesDocument7 pagesTypes of Trusts in The PhilippinesPaolo Hechanova100% (1)

- Uppers Various Info DatabaseDocument54 pagesUppers Various Info DatabaseJason BexonNo ratings yet

- Irrevocable TrustDocument11 pagesIrrevocable Trustamazing_pinoy50% (2)

- Trusts and Protecting Assets: Creation of An Inter Vivos TrustDocument16 pagesTrusts and Protecting Assets: Creation of An Inter Vivos TrustVlad Zernov100% (1)

- ItfDocument7 pagesItfRoberto Rivero IIINo ratings yet

- FDIC - Deposit Insurance - No Escrow Accounts Are IncludedDocument4 pagesFDIC - Deposit Insurance - No Escrow Accounts Are IncludeddeboraNo ratings yet

- Insured: Your DepositsDocument32 pagesInsured: Your Depositskhanaun422No ratings yet

- Chapter 7-Bank's Trust DepartmentDocument10 pagesChapter 7-Bank's Trust Departmentnicco100% (2)

- Irrevocable TrustDocument4 pagesIrrevocable TrustNelson Harris100% (2)

- Webster Investment 1 PDFDocument14 pagesWebster Investment 1 PDFrobertpatricia88No ratings yet

- Trust FunctionDocument9 pagesTrust FunctionKarina Blanco100% (2)

- Spotlight On Finance-June 20171Document5 pagesSpotlight On Finance-June 20171pguevarezNo ratings yet

- Family Banking 101Document5 pagesFamily Banking 101Carl SoriaNo ratings yet

- BankingDocument24 pagesBankingHANNA MARE CAIPANGNo ratings yet

- NotesDocument5 pagesNotesAnjelika ViescaNo ratings yet

- Fdic Your Insured Deposits EnglishDocument31 pagesFdic Your Insured Deposits EnglishSamNo ratings yet

- Consumer Loan Granted For Personal (Medical), Family (Education, Vacation), or HouseholdDocument8 pagesConsumer Loan Granted For Personal (Medical), Family (Education, Vacation), or Householdaliwaqas48797No ratings yet

- Understand SecuritisationDocument7 pagesUnderstand Securitisationteachezi100% (2)

- Banking Survival GuideDocument44 pagesBanking Survival Guidetraderpk100% (1)

- Commercial Banking - SVBDocument6 pagesCommercial Banking - SVBAgnes JosephNo ratings yet

- Financial Intermediaries and The Banking SystemDocument38 pagesFinancial Intermediaries and The Banking SystemLim Mei SuokNo ratings yet

- Protected Trust Deed An OverviewDocument10 pagesProtected Trust Deed An OverviewSophia LorennNo ratings yet

- Personal Finance-Module 2Document33 pagesPersonal Finance-Module 2Jhaira BarandaNo ratings yet

- Classification of CreditDocument25 pagesClassification of CreditJohn Nikko LlaneraNo ratings yet

- Revocable Trust Accounts Revocable Trust Accounts DisclaimerDocument43 pagesRevocable Trust Accounts Revocable Trust Accounts DisclaimerJackNo ratings yet

- FDIC Deposit Insurance CoverageDocument2 pagesFDIC Deposit Insurance CoverageSucreNo ratings yet

- Family Trust Guide GWDocument24 pagesFamily Trust Guide GWreydel_santos100% (4)

- FMT - Chap 9 - SolutionsDocument6 pagesFMT - Chap 9 - SolutionsVũ Hương ChiNo ratings yet

- WellsDocument3 pagesWellsForeclosure Fraud100% (1)

- Living Trust ArticleDocument3 pagesLiving Trust ArticlefrevickkNo ratings yet

- What Goes Into A TrustDocument3 pagesWhat Goes Into A TrustPaolo Hechanova100% (1)

- How To Set Up A Family TrustDocument7 pagesHow To Set Up A Family Trustjohnson080880% (5)

- What Is A BankDocument11 pagesWhat Is A BankANCHAL SINGHNo ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk AnalyticsAkshitNo ratings yet

- Banking Law NotesDocument6 pagesBanking Law NotesAfiqah IsmailNo ratings yet

- Unsecured DebtDocument3 pagesUnsecured DebtRommelBaldagoNo ratings yet

- Chapter 8 - The Deposit FunctionDocument17 pagesChapter 8 - The Deposit FunctionBoRaHaENo ratings yet

- Are Bank Runs ContagiousDocument12 pagesAre Bank Runs ContagiousVarun DoegarNo ratings yet

- Amanah WadiaDocument1 pageAmanah WadiaNoman H ChowdhuryNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Bank ProductsDocument14 pagesBank ProductsJuhi AgrawalNo ratings yet

- C PPP PPPPPPPPPPPPP P PP PPDocument7 pagesC PPP PPPPPPPPPPPPP P PP PPWahid MuradNo ratings yet

- RRSP MortgagesDocument6 pagesRRSP Mortgagespkgarg_iitkgpNo ratings yet

- Banking AssgnDocument14 pagesBanking AssgnlinaNo ratings yet

- 3 The Nature of DefaultDocument10 pages3 The Nature of DefaultDesara_GJoka123No ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk Analyticsblack canvasNo ratings yet

- Financial InstitutionDocument26 pagesFinancial Institutionfahim khanNo ratings yet

- User Guide - Understanding TrustsDocument12 pagesUser Guide - Understanding TrustswgrajNo ratings yet

- Ringkasan Materi Bahasa Inggris NiagaDocument31 pagesRingkasan Materi Bahasa Inggris NiagaNira IndrianiNo ratings yet

- Family TrustsDocument3 pagesFamily TrustsKudakwashe DzawandaNo ratings yet

- The Family Trust 11 Mar 13 Ws PDFDocument7 pagesThe Family Trust 11 Mar 13 Ws PDFkathyayini advocateNo ratings yet

- Finance Opt 2 Study GuideDocument3 pagesFinance Opt 2 Study GuidejayNo ratings yet

- M Embership Booklet: Effective April 1, 2022Document21 pagesM Embership Booklet: Effective April 1, 2022James CaronNo ratings yet

- Icredit One Page Web 3-17-2015Document3 pagesIcredit One Page Web 3-17-2015api-268321564No ratings yet

- All About Credit Reports - Rev2Document8 pagesAll About Credit Reports - Rev2kabNo ratings yet

- Financial InstrumentsDocument4 pagesFinancial InstrumentslandryNo ratings yet

- Ots Trust Handbook 740Document19 pagesOts Trust Handbook 740LevaanteNo ratings yet

- Pdic LawDocument6 pagesPdic LawJerickho JNo ratings yet

- Liquidity ManagementDocument35 pagesLiquidity ManagementJadMadiNo ratings yet

- Financial Environments Specifically Institutions: Ronil John GarganianDocument11 pagesFinancial Environments Specifically Institutions: Ronil John GarganianSandra LangNo ratings yet

- FI - Reading 42 - Asset-Backed SecuritiesDocument35 pagesFI - Reading 42 - Asset-Backed Securitiesshaili shahNo ratings yet

- The Business Value of Design: InsightsDocument18 pagesThe Business Value of Design: Insightsamber krishanNo ratings yet

- Supermarket CSR 07 Holly WatermanDocument213 pagesSupermarket CSR 07 Holly WatermanRaja Imran KhanNo ratings yet

- T JBN EnôualjbDocument280 pagesT JBN EnôualjbpisterboneNo ratings yet

- 3D CAD Model DownloadsDocument10 pages3D CAD Model DownloadssahirprojectsNo ratings yet

- Civ 2 Quiz Samplex UribeDocument12 pagesCiv 2 Quiz Samplex UribeDuke SucgangNo ratings yet

- Nature of Judicial ProcessDocument10 pagesNature of Judicial ProcessSandesh MishraNo ratings yet

- Incident Investigation ProcedureDocument35 pagesIncident Investigation ProcedureAnonymous yCpjZF1rF100% (3)

- Bus 5102 Group AssignmentDocument10 pagesBus 5102 Group AssignmenthamisNo ratings yet

- Datasheet VM Seires Solar InverterDocument1 pageDatasheet VM Seires Solar Invertermohamed husseinNo ratings yet

- GP Medium CorrectDocument2 pagesGP Medium CorrectJimmy JoeNo ratings yet

- Lampiran PQ - CSMS Questionnaires Pertamina WiriagarDocument29 pagesLampiran PQ - CSMS Questionnaires Pertamina WiriagarYogi Anggawan100% (3)

- Samala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Document11 pagesSamala vs. Valencia 512 SCRA 1 A.C. No. 5439 January 22 2007Angelie FloresNo ratings yet

- NCKH ĐỊNH TÍNHDocument75 pagesNCKH ĐỊNH TÍNHnguyennguyen.31221022808No ratings yet

- NX Shop Documentation Plug-In BaseDocument10 pagesNX Shop Documentation Plug-In BaseLÊ VĂN ĐỨCNo ratings yet

- 3 Gimp Size Color Contrast Crop RedeyeDocument2 pages3 Gimp Size Color Contrast Crop Redeyeapi-370628488No ratings yet

- S7 M WE4 RWBu QCCJs EDocument8 pagesS7 M WE4 RWBu QCCJs Eindasijames06No ratings yet

- tr4717Document13 pagestr4717Saurabh LanjekarNo ratings yet

- Arc-Sas CR 06-10-13 Series6Document14 pagesArc-Sas CR 06-10-13 Series6Oleg KostinNo ratings yet

- Monopoly Oligopoly Monopolistic Competition Perfect CompetitionDocument8 pagesMonopoly Oligopoly Monopolistic Competition Perfect CompetitionDerry Mipa SalamNo ratings yet

- Take Away Material SYFC - September 2022Document11 pagesTake Away Material SYFC - September 2022Akun TumbalNo ratings yet

- Provisional Seniority Lists - LDC UDC and Sr. Clerk-01012024Document21 pagesProvisional Seniority Lists - LDC UDC and Sr. Clerk-01012024shubham patilNo ratings yet

- Capital MArket MCQDocument11 pagesCapital MArket MCQSoumit DasNo ratings yet

- Activity 1Document8 pagesActivity 1Philip Jansen GuarinNo ratings yet

- Your Card Already Registered and It Has Username and PasswordDocument4 pagesYour Card Already Registered and It Has Username and PasswordOmar YousufNo ratings yet

- Total Quiz HRM627Document28 pagesTotal Quiz HRM627Syed Faisal BukhariNo ratings yet

- 07) YHT Realty vs. CA, GR No. 126780, Feb. 17, 2005Document15 pages07) YHT Realty vs. CA, GR No. 126780, Feb. 17, 2005justinmauricioNo ratings yet

- ICFO Slides Part 2Document33 pagesICFO Slides Part 2Bhavesh ChauhanNo ratings yet

- Portable Fire Extinguishers PDFDocument92 pagesPortable Fire Extinguishers PDFznim04No ratings yet

- Current Affairs Made Easy - February 2018 PDFDocument126 pagesCurrent Affairs Made Easy - February 2018 PDFsharathr22No ratings yet