Professional Documents

Culture Documents

Tampered Couments in Sec9 Application 1715260369

Tampered Couments in Sec9 Application 1715260369

Uploaded by

advsakthinathanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tampered Couments in Sec9 Application 1715260369

Tampered Couments in Sec9 Application 1715260369

Uploaded by

advsakthinathanCopyright:

Available Formats

NATIONAL COMPANY LAW APPELLATE TRIBUNAL

PRINCIPAL BENCH, NEW DELHI

Company Appeal (AT) (Insolvency) No. 670 of 2024

&

I.A. No. 2191, 2405 of 2024

IN THE MATTER OF:

Sanjay Sharma Partner of

MA Jagadamba Enterprises …Appellant

Versus

Super Iron Foundry Pvt. Ltd. …Respondent

Present:

For Appellant : Advocate Mr. Yash Dalmia and Ms. Madhuri

Pandey, PCS.

For Respondent :

ORDER

(Hybrid Mode)

03.05.2024 : Heard Counsel for the Appellant.

2. This appeal has been filed against the order dated 30.11.2023 in

Company Petition (IB) No. 314/KB/2022 passed by the Learned Adjudicating

Authority (National Company Law Tribunal, Division Bench, Court – II,

Kolkata), by which Section 9 application filed by the Appellant has been

rejected.

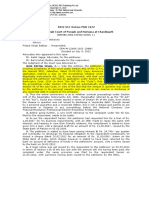

3. Adjudicating Authority in paragraphs 14 to 16 has made following

observations:

“14. It is evident from the invoices filed with this

application by the Operational Creditor, annexed at

Pages 56 – 67 as Annexure “2” that the Operational

Creditor has claimed the interest at the rate of 24% per

annum if the bill is not paid within 30 days. It very

clearly appears at the bottom of the invoices under the

“Terms & Conditions” clause in para 3 that one “4” has

been inserted by pen later after “2” thus “2%” can be

read as “24%”. Further, it is evident that the “7” days

were overwritten by pen as “30” days. The same fact

has rightly been raised by the Ld. Counsel for the

Corporate Debtor in its reply affidavit as well as in the

reply to the demand notice dated 16.08.2022 in para

12.

15. Further, it is evident from the Indian Post Track

Consignment, annexed with the Demand Notice dated

16.08.2022 at Page 19-20 to the Application that the

demand notice was issued on 16.08.2022 at 06:37 PM

and delivered to the Corporate Debtor on 18.08.2022

at 03:16 PM. It is admitted that on 16.08.2022, the

Corporate Debtor has paid Rs. 10 Lakh to the Applicant

at 08:19 PM. Thus, the averment made by the

Applicant that the Respondent has intentionally

transferred the money of Rs. 10 Lakh after receiving

the Demand Notice to reduce the threshold financial

limit as prescribed under Section 4 of the I&B Code is

bald and has no merits. Further mere mention in

invoices about the interest component is not sufficient

to hold that interest is payable by the Corporate

Debtor. To fortify the view, we would reply upon the

decision passed by the Learned NCLT, New Delhi

Bench in the case of Rohit & Company v. Twenty

First Century Wire Rods Ltd. order dated

14.09.2023, reported in (2023) ibclaw.in 627 NCLT

that:

“7. … it is observed that merely citing the interest rate

in the invoices by itself wouldn't render it legally

binding for the Corporate Debtor, …”

(Emphasis Added)

16. Hence, we are of the view that the Operational

Creditor, having a frivolous or vexatious intention, has

filed this application with tempered documents by

claiming 12 times more interest rate with the principal

amount to reach the threshold financial limit as

prescribed under Section 4 of the I&B Code. Further,

the Operational Creditor deliberately did not bring the

payment of Rs. 10 Lakh before filing this application on

record. It is evident that the payment of 10 Lakh was

made on 16.08.2022 by the Corporate Debtor before

the receipt of demand notice under Section 8 of the I&B

Code and the Applicant filed this application with the

Registry of this Adjudicating Authority on 14.09.2022.

Thus, we are of the view that this is a fit case to invoke

the provision of Section 65 of the I&B Code, 2016.”

Comp. App. (AT) (Ins.) No. 670 of 2024

&

I.A. No. 2191, 2405 of 2024

2 of 3

4. Adjudicating Authority was satisfied that this was not a fit case in which

Section 9 proceeding can be initiated and dismissed the application with the

cost.

5. Learned Counsel for the Appellant sought to contend that an interest

amount was verbally agreed and hence the 24% interest was claimed.

6. Adjudicating Authority has also noted that there is some interpretation

made in the invoices by the Appellant and if the interest is not allowed, the

amount claimed was less than the threshold period.

7. We are of the view that present is not a fit case where this Court in

exercise of Appellate Jurisdiction may interfere with the impugned order.

However, we are satisfied that sufficient case has been made out to delete the

cost of Rs. 5 Lakh penalty imposed on the Applicant.

We, thus subject to deletion of the penalty of Rs. 5 Lakhs, dismiss the

Appeal.

It shall be open for the Appellant to take such other remedy for its claim

as available in law.

[Justice Ashok Bhushan]

Chairperson

[Barun Mitra]

Member (Technical)

[Arun Baroka]

Member (Technical)

himanshu/nn

Comp. App. (AT) (Ins.) No. 670 of 2024

&

I.A. No. 2191, 2405 of 2024

3 of 3

You might also like

- Full Download Advanced Financial Accounting 12th Edition Christensen Solutions ManualDocument35 pagesFull Download Advanced Financial Accounting 12th Edition Christensen Solutions Manuallienanayalaag100% (33)

- Clothing Construction BookDocument172 pagesClothing Construction BookDebbie Bacalso95% (21)

- Jayam Vyapaar Private LimitedDocument4 pagesJayam Vyapaar Private LimitedSachika VijNo ratings yet

- Abdul Hannan vs. Jai Jute and Industries Ltd. - NCLT Kolkata BenchDocument24 pagesAbdul Hannan vs. Jai Jute and Industries Ltd. - NCLT Kolkata BenchSachika VijNo ratings yet

- 2660 2021 33 1502 27520 Judgement 15-Apr-2021Document64 pages2660 2021 33 1502 27520 Judgement 15-Apr-2021Richa KesarwaniNo ratings yet

- Carestream Health India Pvt. Ltd. vs. Seaview Mercantile LLP - NCLAT New DelhiDocument19 pagesCarestream Health India Pvt. Ltd. vs. Seaview Mercantile LLP - NCLAT New DelhiSachika VijNo ratings yet

- IIFL Home Finance Ltd. NCLAT ORDERDocument7 pagesIIFL Home Finance Ltd. NCLAT ORDERSachika VijNo ratings yet

- Tax Refund Amounts During The Moratorium Period Is Not AllowedDocument16 pagesTax Refund Amounts During The Moratorium Period Is Not Alloweddivya20barotNo ratings yet

- Sanam Fashion & Design Exchange Ltd. Vs KtexDocument20 pagesSanam Fashion & Design Exchange Ltd. Vs KtexSachika VijNo ratings yet

- Dena Bank Vs C Shivakumar Reddy and Ors 04082021 SC20210508211806011COM440734Document47 pagesDena Bank Vs C Shivakumar Reddy and Ors 04082021 SC20210508211806011COM440734Sravan KumarNo ratings yet

- In The National Company Law Tribunal Mumbai Bench-Iv CP (IB) No. 545/MB-IV/2020Document13 pagesIn The National Company Law Tribunal Mumbai Bench-Iv CP (IB) No. 545/MB-IV/2020NivasNo ratings yet

- Air IndiaDocument13 pagesAir Indiabluebird PGNo ratings yet

- Rohit MotiwatDocument6 pagesRohit MotiwatarundhatiNo ratings yet

- L&T FinanceDocument17 pagesL&T FinanceSandeep KhuranaNo ratings yet

- STATE TAX OFFICER CaseDocument31 pagesSTATE TAX OFFICER Casedevanshi jainNo ratings yet

- Permalli WallaceDocument3 pagesPermalli WallacearundhatiNo ratings yet

- Harish Chandra Mishra and Deepak Roshan, JJ.: Equiv Alent Citation: (2020) 77GSTR174 (Jha.)Document10 pagesHarish Chandra Mishra and Deepak Roshan, JJ.: Equiv Alent Citation: (2020) 77GSTR174 (Jha.)nidhidaveNo ratings yet

- 06971058a9a7a6ade4917c7d3ea993e1Document8 pages06971058a9a7a6ade4917c7d3ea993e1Ramesh KalyanNo ratings yet

- Moot Proposition - 1st National Chambers of Tax Consultants Indirect Tax MCCDocument6 pagesMoot Proposition - 1st National Chambers of Tax Consultants Indirect Tax MCCHarshNo ratings yet

- Heligo Charter Private Limited Vs Dhillon NCLT-CH-2019Document8 pagesHeligo Charter Private Limited Vs Dhillon NCLT-CH-2019Samarth AgarwalNo ratings yet

- Nclat OrderDocument56 pagesNclat Ordershweta mishraNo ratings yet

- Prashant AgarwalDocument10 pagesPrashant AgarwalarundhatiNo ratings yet

- NCLT Sec 9 of IBCDocument7 pagesNCLT Sec 9 of IBCPranay ChauguleNo ratings yet

- Company Appeal (AT) (Ins.) No. 727-728 of 2023Document26 pagesCompany Appeal (AT) (Ins.) No. 727-728 of 2023Surya Veer SinghNo ratings yet

- Umesh Kumar NCLAT DelhiDocument19 pagesUmesh Kumar NCLAT DelhiSachika VijNo ratings yet

- Deccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchDocument14 pagesDeccan Charters Pvt. Ltd. vs. GSEC Monarch and Deccan Aviation Pvt. Ltd. - NCLT Ahmedabad BenchSachika VijNo ratings yet

- Company Appeal (AT) (Ins.) No. 520 of 2023Document12 pagesCompany Appeal (AT) (Ins.) No. 520 of 2023Surya Veer SinghNo ratings yet

- hiren-meghji-bharani-vs-shankeshwar-properties-NCLAT NDDocument12 pageshiren-meghji-bharani-vs-shankeshwar-properties-NCLAT NDNishi AgrawalNo ratings yet

- Allahabad NCLT CASEDocument14 pagesAllahabad NCLT CASESachika VijNo ratings yet

- Piyush Jani, RP For Reward Business Solutions Pvt. Ltd. vs. Sporta Technologies Pvt. Ltd.Document11 pagesPiyush Jani, RP For Reward Business Solutions Pvt. Ltd. vs. Sporta Technologies Pvt. Ltd.Sachika VijNo ratings yet

- National Company Law Appellate Tribunal Principal Bench, New DelhiDocument11 pagesNational Company Law Appellate Tribunal Principal Bench, New DelhiNivasNo ratings yet

- GM Default - 240308 - 182301Document8 pagesGM Default - 240308 - 182301Raghu DattaNo ratings yet

- Smarkworks Coworking Spaces PVT LTD Vs Turbot HQ INC20222505220950011COM988322Document5 pagesSmarkworks Coworking Spaces PVT LTD Vs Turbot HQ INC20222505220950011COM988322Navisha VermaNo ratings yet

- Company Appeal (AT) (Ins.) No. 703 of 2023Document11 pagesCompany Appeal (AT) (Ins.) No. 703 of 2023Surya Veer SinghNo ratings yet

- NCLAT OrderDocument32 pagesNCLAT OrderShiva Rama Krishna BeharaNo ratings yet

- Versus: Efore Anmohan AND Anjeev ArulaDocument9 pagesVersus: Efore Anmohan AND Anjeev Arulaveer vikramNo ratings yet

- Punjab and Haryana High CourtDocument25 pagesPunjab and Haryana High CourtSaddhviNo ratings yet

- Payment of Bonus Act Case LawDocument3 pagesPayment of Bonus Act Case LawShivaNo ratings yet

- 2021 2 1502 46783 Judgement 11-Sep-2023Document12 pages2021 2 1502 46783 Judgement 11-Sep-2023Rahul TiwariNo ratings yet

- Sec10A Period of Default 1715772988Document10 pagesSec10A Period of Default 1715772988advsakthinathanNo ratings yet

- Credai - Reply - FinalDocument8 pagesCredai - Reply - Finalsiddhapura.zianNo ratings yet

- Laxmi Pat Surana Vs Union Bank of India and Ors 19NL2020310320164246187COM547588Document7 pagesLaxmi Pat Surana Vs Union Bank of India and Ors 19NL2020310320164246187COM547588ananya pandeNo ratings yet

- Ruling NCLATDocument31 pagesRuling NCLATCA Pallavi KNo ratings yet

- 195 Ajay Kumar Radheyshyam Goenka V Tourism Finance Corporation of India LTD 15 Mar 2023 464150Document34 pages195 Ajay Kumar Radheyshyam Goenka V Tourism Finance Corporation of India LTD 15 Mar 2023 464150advmonikarastogiNo ratings yet

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapNo ratings yet

- NCLT Order - Role of ROC Appreciated - Iskon Infra Engineering Pvt. Ltd.Document6 pagesNCLT Order - Role of ROC Appreciated - Iskon Infra Engineering Pvt. Ltd.a_alok25No ratings yet

- EDCL Infrastructure LimitedDocument24 pagesEDCL Infrastructure LimitedSachika VijNo ratings yet

- 29.03.2023 - NCLTDocument11 pages29.03.2023 - NCLTSREEMANTINI MUKHERJEENo ratings yet

- jumbo paper products vs HansrajDocument6 pagesjumbo paper products vs Hansrajsamhith.padmanayakaNo ratings yet

- IA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)Document6 pagesIA No. 843/2020 in CP (IB) No.121/Chd/Pb/2018 (Admitted)NivasNo ratings yet

- Ramesh Kamyal JudgementDocument19 pagesRamesh Kamyal JudgementAvantika singh RajawatNo ratings yet

- Case8 - NewDelhiBenchV-SSP Private Limited V. Govind Jee Dairy Milk Private Limited - 28.03.2023Document3 pagesCase8 - NewDelhiBenchV-SSP Private Limited V. Govind Jee Dairy Milk Private Limited - 28.03.2023priyanka prashantNo ratings yet

- Ashok Bhushan, J. (Chairperson), Jarat Kumar Jain, J. (Member (J) ) and Dr. Alok Srivastava, Member (T)Document6 pagesAshok Bhushan, J. (Chairperson), Jarat Kumar Jain, J. (Member (J) ) and Dr. Alok Srivastava, Member (T)Nita SinghNo ratings yet

- Vrundavan Residency PVT LTD Vs Mars Remedies PVT LNC2023230123165450159COM190648Document4 pagesVrundavan Residency PVT LTD Vs Mars Remedies PVT LNC2023230123165450159COM190648SIMRAN GUPTA 19213232No ratings yet

- Dr. Rajendra M. Ganatra - Approved RPDocument27 pagesDr. Rajendra M. Ganatra - Approved RPyasahitabhardwajNo ratings yet

- Written SubmissionsDocument7 pagesWritten SubmissionsSandeep KumarNo ratings yet

- Cygnus - 13.12.2023 OrderDocument59 pagesCygnus - 13.12.2023 OrderNikhil MaanNo ratings yet

- EPC Constructions India Limited MA 344-2019 IN CP 1832-2017 NCLT ON 15.04.2019 FINAL PDFDocument9 pagesEPC Constructions India Limited MA 344-2019 IN CP 1832-2017 NCLT ON 15.04.2019 FINAL PDFShreeyaNo ratings yet

- Ramesh Kymal Vs Siemens Gamesa Renewable Power PVT LTD LL 2021 SC 72 388896Document19 pagesRamesh Kymal Vs Siemens Gamesa Renewable Power PVT LTD LL 2021 SC 72 388896Surya Veer SinghNo ratings yet

- Syonira Invecasts - Approved RPDocument32 pagesSyonira Invecasts - Approved RPyasahitabhardwajNo ratings yet

- J 2020 SCC OnLine NCLAT 581 Rahulk Sandalawofficescom 20231006 134232 1 9Document9 pagesJ 2020 SCC OnLine NCLAT 581 Rahulk Sandalawofficescom 20231006 134232 1 9rkanoujia54No ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Format For First and Second Motion 1715483513Document37 pagesFormat For First and Second Motion 1715483513advsakthinathanNo ratings yet

- Jaypee 1715769731Document2 pagesJaypee 1715769731advsakthinathanNo ratings yet

- Interlocutory Section 54 of IT Act 1961 1715774290Document16 pagesInterlocutory Section 54 of IT Act 1961 1715774290advsakthinathanNo ratings yet

- Other Payable and Short Term Loans and Advances 1716513048Document11 pagesOther Payable and Short Term Loans and Advances 1716513048advsakthinathanNo ratings yet

- Strike Off 1716464635Document39 pagesStrike Off 1716464635advsakthinathanNo ratings yet

- AFM Case Study Q1,2Document3 pagesAFM Case Study Q1,2lim hui mengNo ratings yet

- Amazon SuitDocument15 pagesAmazon Suitfreddymartinez9No ratings yet

- Mihalis KAVARATZISDocument18 pagesMihalis KAVARATZISPaulo FerreiraNo ratings yet

- The Leela New NormalDocument24 pagesThe Leela New NormalDigvijay SinghNo ratings yet

- E Business Assignment 2Document7 pagesE Business Assignment 2Shikha MishraNo ratings yet

- ArchibusDocument12 pagesArchibusapi-256135737No ratings yet

- The Effect of Implant Abutment Junction Position On Crestal Bone Loss A Systematic Review and Meta AnalysisDocument17 pagesThe Effect of Implant Abutment Junction Position On Crestal Bone Loss A Systematic Review and Meta AnalysisBagis Emre GulNo ratings yet

- LCI Ebook DS PDM v15 PDFDocument8 pagesLCI Ebook DS PDM v15 PDFVrukshwalli KateNo ratings yet

- Individual AssignmentDocument5 pagesIndividual AssignmentHao LimNo ratings yet

- Formulating Specialised Legislation To Address The Growing Spectre of Cybercrime: A Comparative StudyDocument45 pagesFormulating Specialised Legislation To Address The Growing Spectre of Cybercrime: A Comparative Studytech hutNo ratings yet

- Craft: CopywritingDocument216 pagesCraft: CopywritingZaborra100% (1)

- Notes in Fluid MachineryDocument36 pagesNotes in Fluid MachineryIvanNo ratings yet

- GB921-P Primer Release 8-1 v4-9Document31 pagesGB921-P Primer Release 8-1 v4-9Kunall KohliNo ratings yet

- Rob 01.10.2021Document10 pagesRob 01.10.2021RITESHNo ratings yet

- Waste Management: Graça Martinho, Natacha Balaia, Ana PiresDocument10 pagesWaste Management: Graça Martinho, Natacha Balaia, Ana PiresMae SyNo ratings yet

- GM 1927-16 - PcpaDocument12 pagesGM 1927-16 - PcpaNeumar NeumannNo ratings yet

- J4 Alarm ListDocument174 pagesJ4 Alarm ListElvira Nisa SNo ratings yet

- Data Sheet - Quantran Dimmer RacksDocument2 pagesData Sheet - Quantran Dimmer Racksmuqtar4uNo ratings yet

- SOP Mission LiFE - Action Plan UploadDocument5 pagesSOP Mission LiFE - Action Plan Uploadঅভিষেক দাস রাকেশNo ratings yet

- Transcripts CsuDocument3 pagesTranscripts Csuapi-457709071No ratings yet

- TeamWork Intro Slides For IIT DelhiDocument15 pagesTeamWork Intro Slides For IIT DelhiVIVEK KUMARNo ratings yet

- A Research Study of A Three Commercial BuildingDocument12 pagesA Research Study of A Three Commercial BuildingBianca bayangNo ratings yet

- Paul Pignataro Leveraged BuyoutsDocument11 pagesPaul Pignataro Leveraged Buyoutspriyanshu14No ratings yet

- Q Tut Ch2Document8 pagesQ Tut Ch2Damien MarleyNo ratings yet

- Hawke Optics Catalog 2015Document32 pagesHawke Optics Catalog 2015JA SaathoffNo ratings yet

- Bildprospekt HolzumschlagDocument48 pagesBildprospekt HolzumschlagFirman ArifinNo ratings yet

- 587 enDocument2 pages587 enabhayundaleNo ratings yet

- Cure Laboratories Quality Manual: Conforms To ISO 9001:2015Document20 pagesCure Laboratories Quality Manual: Conforms To ISO 9001:2015Mohammed ZubairNo ratings yet