Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsOther Taxpayers Problems

Other Taxpayers Problems

Uploaded by

RaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Mastering Apache SparkDocument1,044 pagesMastering Apache SparkArjun Singh100% (6)

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Problem Solving Posttest Week2Document3 pagesProblem Solving Posttest Week2Cale HenituseNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- TaxationDocument8 pagesTaxationPeligrino MacNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Exam - Taxation MSA 206Document4 pagesExam - Taxation MSA 206Juan FrivaldoNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- 01 Audit of Income Tax Exercise SetDocument2 pages01 Audit of Income Tax Exercise SetBecky GonzagaNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Problem & Solution_June 2019_FDocument3 pagesProblem & Solution_June 2019_FMohammed Shihab UddinNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- LG W1943C Chass LM92C PDFDocument23 pagesLG W1943C Chass LM92C PDFDaniel Paguay100% (1)

- Mccsemi: 1N746 A Thru 1N759 ADocument3 pagesMccsemi: 1N746 A Thru 1N759 AЕвгений ИвановNo ratings yet

- Cincinnati Retirement System Update: March 28, 2022Document24 pagesCincinnati Retirement System Update: March 28, 2022WVXU NewsNo ratings yet

- Recounttext 160409104911Document9 pagesRecounttext 160409104911Anif Ough GtuwNo ratings yet

- BeachesDocument32 pagesBeachesnympheasandhuNo ratings yet

- Fee Payment Method: Bank Islam Malaysia BerhadDocument1 pageFee Payment Method: Bank Islam Malaysia BerhadmerlinNo ratings yet

- Essay Outline - Flaws in Our Education System Are Causing Some of Our Failures PDFDocument3 pagesEssay Outline - Flaws in Our Education System Are Causing Some of Our Failures PDFToufiq IbrahimNo ratings yet

- DixonbergDocument2 pagesDixonbergLuis OvallesNo ratings yet

- SDocument8 pagesSdebate ddNo ratings yet

- Ulangan Harian Exposition TextDocument3 pagesUlangan Harian Exposition Textgrenninja949No ratings yet

- Physics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 ADocument21 pagesPhysics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 AShubham BaghelNo ratings yet

- Rev29jan2019oftemplate OSHprogram Asof 290119Document12 pagesRev29jan2019oftemplate OSHprogram Asof 290119GelinaNo ratings yet

- Sucker Rod Elevators (25-Ton)Document1 pageSucker Rod Elevators (25-Ton)CESAR SEGURANo ratings yet

- Exp 7 Colloids ChemistryDocument8 pagesExp 7 Colloids ChemistryNur Fadhilah100% (1)

- Lab 8 - PWMDocument4 pagesLab 8 - PWMlol100% (1)

- 0RBIAR0B4E1ADocument321 pages0RBIAR0B4E1AAnkur VermaNo ratings yet

- Classification of Common Musical InstrumentsDocument3 pagesClassification of Common Musical InstrumentsFabian FebianoNo ratings yet

- SSP Assignment Problems - FinalDocument2 pagesSSP Assignment Problems - FinalVadivelan AdaikkappanNo ratings yet

- World Colleges Information: WWW - Worldcolleges.infoDocument4 pagesWorld Colleges Information: WWW - Worldcolleges.infoharish risonthNo ratings yet

- Rela Tori OhhDocument1,830 pagesRela Tori OhhLeandro MedeirosNo ratings yet

- Case Study Emirates AirlinesDocument4 pagesCase Study Emirates Airlinesuzzmapk33% (9)

- Applied Economics Module 3 Q1Document21 pagesApplied Economics Module 3 Q1Jefferson Del Rosario100% (1)

- Midtown Ratepayers Association's Letter To Ontario OmbudsmenDocument3 pagesMidtown Ratepayers Association's Letter To Ontario OmbudsmenAndrew GrahamNo ratings yet

- Actividades 1º ESO Bilingüe T5Document6 pagesActividades 1º ESO Bilingüe T5davidbio_nrNo ratings yet

- NBA 2K12 Ext Manual Wii FinalDocument10 pagesNBA 2K12 Ext Manual Wii FinalEthan TampusNo ratings yet

- Specification - MechanicalDocument5 pagesSpecification - MechanicalEDEN FALCONINo ratings yet

- Rahmawati IndikatorDocument2 pagesRahmawati IndikatorDaffa amri MaulanaNo ratings yet

- Heat, Temperature, and Heat Transfer: Cornell Doodle Notes FREE SAMPLERDocument13 pagesHeat, Temperature, and Heat Transfer: Cornell Doodle Notes FREE SAMPLERShraddha PatelNo ratings yet

- Dna Microarray Technology: Fatoki John OlabodeDocument9 pagesDna Microarray Technology: Fatoki John Olabodejohn tokiNo ratings yet

Other Taxpayers Problems

Other Taxpayers Problems

Uploaded by

Rai0 ratings0% found this document useful (0 votes)

3 views12 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views12 pagesOther Taxpayers Problems

Other Taxpayers Problems

Uploaded by

RaiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

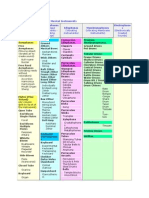

Income Tax: Corporation,

Partnership & Other Taxpayers

(Problem Solving)

ATTY. YASMEEN L. JUNAID, CPA

Instructor

(For Discussion Purposes Only)

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Problem 1

During the 2018, a domestic corporation derived the following items of

revenue:

• Gross receipts from a trading business, P500,000

• Interests from money placements in the banks, P30,000

• Dividends from its stock investments in domestic corporations, P20,000

• Gains from stock transactions through the PSE, P50,000

• Proceeds under the insurance policy of the lost of goods, P100,000

How much should the corporation report as taxable income?

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Solution

Item A – taxable income

Item B – passive income subject to FWT (20%)

Item C – an inter-corporate dividend which is tax-exempt

Item D – subject to Percentage Tax

Item E – a return on investment not subject to tax

ANSWER: P500,000

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Problem 2

EX Company and GF Company formed a joint venture. They agreed to share profit

or loss in the ratio of 70% and 30%, respectively. The results of operations of the

joint venture as well as the co-venturers are as follows:

JV EX Co. GF Co.

Gross Income P5,000,000 3,000,000 2,000,000

OpEx 3,000,000 2,000,000 1,500,000

How much is the income tax payable of the joint venture?

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Solution

Gross income 5,000,000

Operating expense (3,000,000)

Taxable net income 2,000,000

RCIT x 25%

Income Tax Due of JV 500,000

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Problem 3

The following information was taken from the records of YANG Inc., a domestic corporation already in its 5th year of operations:

Gross profit from sales P3,100,000

Capital gain on sale directly to buyer of shares in Domestic corp. 100,000

Dividend from:

Domestic corporation 20,000

Resident foreign corporation 10,000

Interest on:

Bank deposit 20,000

Trade receivables 50,000

Business expenses 2,100,000

Income tax withheld 115,000

Quarterly income tax payments 160,000

Income tax payable prior years (10,000)

How much is the income tax payable at the end of the year?

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Solution

Gross profit from sales 3,100,000

Dividends from FC 10,000

Interest Income on trade receivable 50,000

Total Gross Income 3,160,000

Income Tax Due (HIGHER) 265,000

Less: Business Expenses (2,100,000)

Less:

Taxable Net Income 1,060,000

Quarterly Tax Payments (160,000)

Income tax withheld (115,000)

Excess payments – prior year (10,000)

RCIT (1,060,000 x 25%) 265,000 Whichever is

HIGHER Income Tax Payable 33,000

MCIT (3,160,00 x 1%) 31,600

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Problem 4

Anita died leaving an estate worth P10,000,000. The estate is under

administration. In 2018, the properties in the estate earned a gross

income of P600,000 and incurred expenses of P150,000. Eva, one of

the heirs, received P120,000 from its 2018 income of the estate. How

much is the Estate’s taxable net income?

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Solution

Gross Income 600,000

Operating Expenses (150,000)

Income of the estate distributed to Eva (120,000)

Estate’s taxable income 330,000

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Problem 5

In 2018, Sarah created two trusts for his minor daughter, Ana. During

the year, the two trusts earned net income as follows:

Trust 1 P4,000,000

Trust 2 6,000,000

How much is the total income tax due of the Two Trusts?

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Solution

Net Income – Trust 1 4,000,000

Net Income – Trust 2 6,000,000

Consolidated Taxable Net Income 10,000,000

Consolidated Income Tax Due (Graduated Rates)

First 8,000,000 2,410,000

In excess of 8M (2M x 35%) 700,000

Total Income Tax Due 3,110,000

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

Thank you!

PT-UDZ-001A; Revision 3.0.0; October 05, 2022

You might also like

- Application - Regular Income Tax On Individuals and CorporationsDocument8 pagesApplication - Regular Income Tax On Individuals and CorporationsElla Marie Lopez0% (1)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Mastering Apache SparkDocument1,044 pagesMastering Apache SparkArjun Singh100% (6)

- ST ND RDDocument6 pagesST ND RDCarlos Miguel MendozaNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- Reviewer Finals Tax 301Document4 pagesReviewer Finals Tax 301Jana RamosNo ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Problem Solving Posttest Week2Document3 pagesProblem Solving Posttest Week2Cale HenituseNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- TaxationDocument8 pagesTaxationPeligrino MacNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Exam - Taxation MSA 206Document4 pagesExam - Taxation MSA 206Juan FrivaldoNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Cases On Taxation For Individualss AnswersDocument11 pagesCases On Taxation For Individualss AnswersMitchie Faustino100% (2)

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- 01 Audit of Income Tax Exercise SetDocument2 pages01 Audit of Income Tax Exercise SetBecky GonzagaNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Questions Business IncomeDocument8 pagesQuestions Business IncomeMbeiza MariamNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Problem & Solution_June 2019_FDocument3 pagesProblem & Solution_June 2019_FMohammed Shihab UddinNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- BT Ias1 (SV)Document3 pagesBT Ias1 (SV)HÀ THỚI NGUYỄN NGÂNNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- 10Document1 page10Bryan KenNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- ASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationDocument4 pagesASSIGNMENT NO. 3 Chapter 7 Regular Income TaxationElaiza Jayne PongaseNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- LG W1943C Chass LM92C PDFDocument23 pagesLG W1943C Chass LM92C PDFDaniel Paguay100% (1)

- Mccsemi: 1N746 A Thru 1N759 ADocument3 pagesMccsemi: 1N746 A Thru 1N759 AЕвгений ИвановNo ratings yet

- Cincinnati Retirement System Update: March 28, 2022Document24 pagesCincinnati Retirement System Update: March 28, 2022WVXU NewsNo ratings yet

- Recounttext 160409104911Document9 pagesRecounttext 160409104911Anif Ough GtuwNo ratings yet

- BeachesDocument32 pagesBeachesnympheasandhuNo ratings yet

- Fee Payment Method: Bank Islam Malaysia BerhadDocument1 pageFee Payment Method: Bank Islam Malaysia BerhadmerlinNo ratings yet

- Essay Outline - Flaws in Our Education System Are Causing Some of Our Failures PDFDocument3 pagesEssay Outline - Flaws in Our Education System Are Causing Some of Our Failures PDFToufiq IbrahimNo ratings yet

- DixonbergDocument2 pagesDixonbergLuis OvallesNo ratings yet

- SDocument8 pagesSdebate ddNo ratings yet

- Ulangan Harian Exposition TextDocument3 pagesUlangan Harian Exposition Textgrenninja949No ratings yet

- Physics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 ADocument21 pagesPhysics Investigatory Project: Made by - Abhishek Choudhary Roll No. - 1 Class - 12 AShubham BaghelNo ratings yet

- Rev29jan2019oftemplate OSHprogram Asof 290119Document12 pagesRev29jan2019oftemplate OSHprogram Asof 290119GelinaNo ratings yet

- Sucker Rod Elevators (25-Ton)Document1 pageSucker Rod Elevators (25-Ton)CESAR SEGURANo ratings yet

- Exp 7 Colloids ChemistryDocument8 pagesExp 7 Colloids ChemistryNur Fadhilah100% (1)

- Lab 8 - PWMDocument4 pagesLab 8 - PWMlol100% (1)

- 0RBIAR0B4E1ADocument321 pages0RBIAR0B4E1AAnkur VermaNo ratings yet

- Classification of Common Musical InstrumentsDocument3 pagesClassification of Common Musical InstrumentsFabian FebianoNo ratings yet

- SSP Assignment Problems - FinalDocument2 pagesSSP Assignment Problems - FinalVadivelan AdaikkappanNo ratings yet

- World Colleges Information: WWW - Worldcolleges.infoDocument4 pagesWorld Colleges Information: WWW - Worldcolleges.infoharish risonthNo ratings yet

- Rela Tori OhhDocument1,830 pagesRela Tori OhhLeandro MedeirosNo ratings yet

- Case Study Emirates AirlinesDocument4 pagesCase Study Emirates Airlinesuzzmapk33% (9)

- Applied Economics Module 3 Q1Document21 pagesApplied Economics Module 3 Q1Jefferson Del Rosario100% (1)

- Midtown Ratepayers Association's Letter To Ontario OmbudsmenDocument3 pagesMidtown Ratepayers Association's Letter To Ontario OmbudsmenAndrew GrahamNo ratings yet

- Actividades 1º ESO Bilingüe T5Document6 pagesActividades 1º ESO Bilingüe T5davidbio_nrNo ratings yet

- NBA 2K12 Ext Manual Wii FinalDocument10 pagesNBA 2K12 Ext Manual Wii FinalEthan TampusNo ratings yet

- Specification - MechanicalDocument5 pagesSpecification - MechanicalEDEN FALCONINo ratings yet

- Rahmawati IndikatorDocument2 pagesRahmawati IndikatorDaffa amri MaulanaNo ratings yet

- Heat, Temperature, and Heat Transfer: Cornell Doodle Notes FREE SAMPLERDocument13 pagesHeat, Temperature, and Heat Transfer: Cornell Doodle Notes FREE SAMPLERShraddha PatelNo ratings yet

- Dna Microarray Technology: Fatoki John OlabodeDocument9 pagesDna Microarray Technology: Fatoki John Olabodejohn tokiNo ratings yet