Professional Documents

Culture Documents

Issue & Redemption of Debtures - Edu Rev

Issue & Redemption of Debtures - Edu Rev

Uploaded by

Dhiraj BaldotaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Issue & Redemption of Debtures - Edu Rev

Issue & Redemption of Debtures - Edu Rev

Uploaded by

Dhiraj BaldotaCopyright:

Available Formats

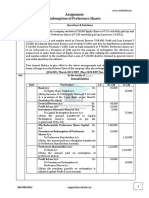

Accounting for Bonus Issue and Right Issue

Q-1 Following is the extract of the Balance Sheet of Xeta Ltd. as at 31st March, 2017

Rs.

Authorised capital:

50,000 12% Preference shares of Rs.10 each 5,00,000

4,00,000 Equity shares of Rs.10 each 40,00,000

45,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of Rs.10 each fully paid 2,40,000

2,70,000 Equity shares of Rs.10 each, Rs.8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Securities premium 1,00,000

Profit and Loss Account 6,00,000

On 1st April, 2017, the Company has made final call@ ` 2 each on 2,70,000 equity shares. The call money was

received by 20th April, 2017. Thereafter, the company decided to capitalize its reserves by way of bonus at

the rate of one share for every four shares held.

Show necessary journal entries in the books of the company and prepare the extract of the balance sheet as

on 30th April, 2017 after bonus issue.

Ans. Journal Entries in the books of Xeta Ltd. Rs. Rs.

1-4-2017 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of Rs.2 per share on 2,70,000 equity shares

due as per Board's Resolution dated....)

20-4-2017 Bank A/c Dr. 5,40,000

Dr. To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 1,00,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c Dr. 2,15,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one

share for every four shares held)

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c 6,75,000

(For issue of bonus shares)

Join Us on Telegram http://t.me/canotes_ipcc

Extract of Balance Sheet as at 30th April, 2017 (after bous issue)

Rs.

Authorised Capital

50,000 12% Preference shares of Rs.10 each 5,00,000

4,00,000 Equity shares of Rs.10 each 40,00,000

Issued and subscribed capital

24,000 12% Preference shares of Rs.10 each, fully paid 2,40,000

3,37,500 Equity shares of Rs.10 each, fully paid 33,75,000

(Out of above, 67,500 equity shares @ ` 10 each were issued by wayof bonus)

Reserves and surplus

Profit and Loss Account 3,85,000

Q-2 Following is the extract of the Balance Sheet of Xeta Ltd. as at 31st March, 2017:

Rs.

Authorised capital:

50,000 12% Preference shares of Rs.10 each 5,00,000

4,00,000 Equity shares of Rs.10 each 40,00,000

45,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of Rs.10 each fully paid 2,40,000

2,70,000 Equity shares of Rs.10 each, Rs.8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Securities premium 1,00,000

Profit and Loss Account 6,00,000

On 1st April, 2017, the Company has made final call @ Rs.2 each on 2,70,000 equity shares. The call money

was received by 20th April, 2017. Thereafter, the company decided to capitalize its reserves by way of bonus

at the rate of one share for every four shares held.

You are required to give necessary journal entries in the books of the company and prepare the extract of

the balance sheet as on 30th April, 2017 after bonus issue.

Ans. Journal Entries in the books of Xeta Ltd.

Rs. Rs.

1-4-2017 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of Rs.2 per share on 2,70,000

equity shares due as per Board's Resolution dated....)

20-4-2017 Bank A/c Dr. 5,40,000

To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 1,00,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c Dr. 2,15,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one

share for every four shares held)

Join Us on Telegram http://t.me/canotes_ipcc

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c (For issue of bonus shares) 6,75,000

Extract of Balance Sheet as at 30th April, 2017 (after bonus issue)

Rs.

Authorised Capital

50,000 12% Preference shares of Rs.10 each 5,00,000

4,00,000 Equity shares of Rs.10 each 40,00,000

Issued and subscribed capital

24,000 12% Preference shares of Rs.10 each, fully paid 2,40,000

3,37,500 Equity shares of Rs.10 each, fully paid 33,75,000

(Out of above, 67,500 equity shares @ Rs.10 each were issued by way of bonus)

Reserves and surplus

Profit and Loss Account 3,85,000

Q-3 Following is the extract of the Balance Sheet of Manoj Ltd. as at 31st March, 20X1

Rs.

Authorized capital:

30,000 12% Preference shares of Rs.10 each 3,00,000

4,00,000 Equity shares of Rs.10 each 40,00,000

43,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of Rs.10 each fully paid 2,40,000

2,70,000 Equity shares of Rs.10 each, Rs.8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 20X1, the Company has made final call @ Rs. 2 each on 2,70,000 equity shares. The call money

was received by 20th April, 20X1. Thereafter, the company decided to capitalize its reserves by way of bonus

at the rate of one share for every four shares held.

You are required to prepare necessary journal entries in the books of the company and prepare the relevant

extract of the balance sheet as on 30th April, 20X1 after bonus issue.

Ans. Journal Entries in the books of Manoj Ltd.

Rs. Rs.

1-4-20x1 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of Rs. 2 per share on 2,70,000

equity shares due as per Board's Resolution dated....)

Join Us on Telegram http://t.me/canotes_ipcc

20-4-20x1 Bank A/c Dr. 5,40,000

To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 75,000

Capital redemption reserve A/c Dr. 1,20,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 1,20,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one

share for every four shares held)

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c 6,75,000

(For issue of bonus shares)

Extract of Balance Sheet as at 30th April, 20X1 (after bonus issue)

Rs.

Authorised Capital

30,000 12% Preference shares of Rs. 10 each 3,00,000

4,00,000 Equity shares of Rs. 10 each 40,00,000

Issued and subscribed capital

24,000 12% Preference shares of Rs.10 each, fully paid 2,40,000

3,37,500 Equity shares of Rs. 10 each, fully paid 33,75,000

(Out of the above, 67,500 equity shares @ Rs.10 each were issued by way of bonus shares)

Reserves and surplus Profit and Loss Account 4,80,000

Q-4 The following is the summarised Balance Sheet of Bumbum Limited as at 31st March, 2019:

`

Sources of funds

Authorized capital

50,000 Equity shares of ` 10 each 5,00,000

10,000 Preference shares of ‘ 100 each (8% redeemable) 10,00,000

15,00,000

Issued, subscribed and paid up

30,000 Equity shares of ` 10 each 3,00,000

5,000, 8%Redeemable Preference shares of ` 100 each 5,00,000

Reserves & Surplus x

Securities Premium 6,00,000

General Reserve 6,50,000

Profit & Loss A/c 40,000

Trade payables 4,20,000

25,10,000

Join Us on Telegram http://t.me/canotes_ipcc

Application of funds

PPE (net) 7,80,000

Investments (market value ` 5,80,000) 4,90,000

Deferred Tax Assets 3,40,000

Trade receivables 6,20,000

Cash & Bank balance 2,80,000

25,10,000

In Annual General Meeting held on 20th June, 2019 the company passed the following resolutions:

(i) To split equity share of ` 10 each into 5 equity shares of ` 2 each from 1st July, 2019.

(ii) To redeem 8% preference shares at a premium of 5%.

(iii) To issue fully paid bonus shares in the ratio of one equity share for every 3 shares held on record

date.

On 10th July, 2019 investments were sold for ` 5,55,000 and preference shares were redeemed.

The bonus issue was concluded by 12th September, 2019

You are required to journalize the above transactions including cash transactions and prepare Balance

Sheet as at 30th September, 2019. All working notes should form part of your answer.

Ans. Bumbum Limited

Journal Entries

2019 Dr. (`) Cr. (`)

July 1 Equity Share Capital A/c (` 10 each) Dr. 3,00,000

To Equity share capital A/c (` 2 each) 3,00,000

(Being equity share of ` 10 each splitted into 5 equity

shares of ` 2 each) {1,50,000 x 2}

July 10 Cash & Bank balance A/c Dr. 5,55,000

To Investment A/c 4,90,000

To Profit & Loss A/c 65,000

(Being investment sold out and profit on sale credited

to Profit & Loss A/c)

July 10 8% Redeemable preference share capital A/c Dr. 5,00,000

Premium on redemption of preference share A/c Dr. 25,000

To Preference shareholders A/c 5,25,000

(Being amount payable to preference share holders

on redemption)

July 10 Preference shareholders A/c Dr. 5,25,000

To Cash & bank A/c 5,25,000

(Being amount paid to preference shareholders)

July 10 General reserve A/c Dr. 5,00,000

To Capital redemption reserve A/c 5,00,000

(Being amount equal to nominal value of preference

shares transferred to Capital Redemption Reserve A/c

on its redemption as per the law)

Join Us on Telegram http://t.me/canotes_ipcc

Sept. 12 Capital Redemption Reserve A/c Dr. 1,00,000

To Bonus to shareholders A/c 1,00,000

(Being balance in capital redemption reserve

capitalized to issue bonus shares)

Sept. 12 Bonus to shareholders A/c Dr. 1,00,000

To Equity share capital A/c 1,00,000

(Being 50,000 fully paid equity shares of ` 2 each

issued as bonus in ratio of 1 share for every 3 shares held)

Sept. 30 Securities Premium A/c Dr. 25,000

To Premium on redemption of preference shares A/c 25,000

(Being premium on preference shares adjusted from

securities premium account)

Balance Sheet as at 30th September, 2019

Particulars Notes `

Equity and Liabilities

1 Shareholders’ funds

a Share capital 1 4,00,000

b Reserves and Surplus 2 12,30,000

2 Current liabilities

a Trade Payables 4,20,000

Total 20,50,000

Assets

1 Non-current assets

a PPE 7,80,000

b Deferred tax asset 3,40,000

2 Current assets

Trade receivables 6,20,000

Cash and cash equivalents 3,10,000

Total 20,50,000

Notes to accounts

1 Share Capital ` `

Authorized share capital

2,50,000 Equity shares of ` 2 each 5,00,000

10,000 8% Preference shares of `100 each 10,00,000 15,00,000

Issued, subscribed and paid up

2,00,000 Equity shares of ` 2 each 4,00,000

Join Us on Telegram http://t.me/canotes_ipcc

2 Reserves and Surplus

Securities Premium A/c

Balance as per balance sheet 6,00,000

Less: Adjustment for premium on preference Shares (25,000)

Balance 5,75,000

Capital Redemption Reserve (5,00,000-1,00,000) 4,00,000

General Reserve (6,50,000 – 5,00,000) 1,50,000

Profit & Loss A/c 40,000

Add: Profit on sale of investment 65,000 1,05,000

Total 12,30,000

Working Notes:

`

1. Redemption of preference shares

5,000 Preference shares of ` 100 each 5,00,000

Premium on redemption @ 5% 25,000

Amount Payable 5,25,000

2. Issue of Bonus Shares

Existing equity shares after split (30,000 x 5) 1,50,000 shares

Bonus shares (1 share for every 3 shares held) to be issued 50,000 shares

3. Cash and Bank Balance

Balance as per balance sheet 2,80,000

Add: Realization on sale of investment 5,55,000

8,35,000

Less: Paid to preference share holders (5,25,000)

Balance 3,10,000

Q-5 Following is the extract of Balance Sheet of Prem Ltd. as at 31 st March, 2018 :

Authorized capital `

3,00,000 equity shares of ` 10 each 30,00,000

25,000, 10% preference shares of ` 10 each 2,50,000

32,50,000

Issued and subscribed capital:

2,70,000 equity shares of ` 10 each fully paid up 27,00,000

24,000,10% preference shares of ` 10 each fully paid up 2,40,000

29,40,000

Reserves and surplus:

General reserve 3,60,000

Capital redemption reserve 1,20,000

Securities premium (in cash) 75,000

Profit and loss account 6,00,000

11,55,000

Join Us on Telegram http://t.me/canotes_ipcc

On 1st April, 2018, the company decided to capitalize its reserves by way of bonus at the rate of two

shares for every five shares held.. Show necessary journal entries in the books of the company and

prepare the extract of the balance sheet after bonus issue.

Ans. Prem Ltd.

Journal Entries

April 1 Capital Redemption Reserve A/c Dr. 1,20,000

Securities Premium A/c Dr. 75,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 5,25,000

To Bonus to Equity Shareholders A/c 10,80,000

(Bonus issue @ two shares for every five

shares held by utilizing various reserves as per

Board’s Resolution dated...)

Bonus to Shareholders A/c Dr. 10,80,000

To Equity Share Capital A/c 10,80,000

(Issue of bonus shares)

Balance Sheet (Extract) as on 1st April, 2018 (after bonus issue)

Particulars Notes Amount (`)

Equity and Liabilities

1 Shareholders’ funds

a Share capital 1 40,20,000

b Reserves and Surplus 2 75,000

Notes to Accounts

1 Share Capital (` )

Authorized share capital:

3,78,000* Equity shares of ` 10 each 37,80,000*

25,000 10% Preference shares of ` 10 each 2,50,000

Total 40,30,000

Issued, subscribed and fully paid share capital: 3,78,000

Equity shares of ` 10 each, fully paid

(Out of above, 1,08,000 equity shares @ ` 10 each

were issued by way of bonus) 37,80,000

24,000 10% Preference shares of ` 10 each 2,40,000

Total 40,20,000

2 Reserves and Surplus

Capital Redemption Reserve 1,20,000 Nil

Less: Utilized 1,20,000

Securities Premium 75,000

Less: Utilised for bonus issue (75,000) Nil

General reserve 3,60,000

Less: Utilised for bonus issue (3,60,000) Nil

Profit & Loss Account 6,00,000

Less: Utilised for bonus issue (5,25,000) 75,000

Total 75,000

Join Us on Telegram http://t.me/canotes_ipcc

Note: *Authorized capital has been increased by the minimum required amount i.e. ` 7,80,000 (37,80,000

– 30,00,000) in the above solution.

Q-6 Following are the balances appear in the trial balance of Arya Ltd. as at 31st March. 2018.

Issued and Subscribed Capital:

Rs.

10,000; 10% Preference Shares of Rs.10 each fully paid 1,00,000

1,00,00, Equity Shares of Rs.10 each Rs 8 paid up 8,00,000

Reserves and Surplus :

General Reserve 2,40,000

Security Premium (collected in cash) 25,000

Profit and Loss Account 1,20,000

On 1st April, 2018 the company has made final call @ ` 2 each on 1,00,000 Equity Shares. The call money

was received by 15th April, 2018. Thereafter the company decided to issue bonus shares to equity

shareholders at the rate of 1 share for every 5 shares held and for this purpose, it decided that there

should be minimum reduction in free reserves. Pass Journal entries.

Ans. Arya Ltd.

Journal Entries

2018 Dr. Cr.

Rs. Rs.

April 1 Equity Share Final Call A/c Dr. 2,00,000

To Equity Share Capital A/c 2,00,000

(Final call of Rs.2 per share on 1,00,000 equity

shares due as per Board’s Resolution dated....)

April 15 Bank A/c Dr. 2,00,000

To Equity Share final Call A/c 2,00,000

(Final Call money on 1,00,000 eqity shares received)

Securities Premium A/c Dr. 25,000

General Reserve A/c* Dr. 1,75,000

To Bonus to Shareholder A/c 2,00,000

(Bonus issue @ one share for every 5 shares held by utilizing

various reserves as per Board’s resolution dated...)

April 15 Bonus to Shareholders A/c Dr. 2,00,000

To Equity Share Capital A/c (Capitalization of profit) 2,00,000

Note: Profit and Loss Account balance may also be utilized along with General Reserve for the purpose of

issue of Bonus shares.

Q-7 Following items appear in the Trial Balance of Beta Ltd. as on 31st March, 2017:

Particulars Amount

3,000 Equity Shares of Rs. 100 each 3,00,000

Securities Premium (collected in cash) 40,000

Capital Redemption Reserve 30,000

General Reserve 1,00,000

Join Us on Telegram http://t.me/canotes_ipcc

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 3

shares held. Company decided that there should be the minimum reduction in free reserves. Pass

necessary Journal Entries in the books of Beta Ltd.

Ans. Capital Redemption Reserve A/c Dr. 30,000

Securities Premium A/c Dr. 40,000

General Reserve A/c Dr. 30,000

To Bonus to Shareholders 1,00,000

(Being issue of bonus shares by utilization of various

Reserves, as per resolution dated .....)

Bonus to Shareholders A/c Dr. 1,00,000

To Equity Share Capital 1,00,000

(Being capitalization of Profit)

Q-8 Omega company offers new shares of Rs. 100 each at 25% premium to existing shareholders on the basis

one for five shares. The cum-right market price of a share is Rs. 200.

You are required to calculate the (i) Ex-right value of a share; (ii) Value of a right share?

Ans. Ex-right value of the shares

= (Gum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of shares + N o.

of right shares) = (Rs. 200 x 5 Shares + Rs. 125 x 1 Share) / (5 + 1) Shares

= Rs. 1,125 / 6 shares = Rs. 187.50 per share.

Value of right = Gum-right value of the share - Ex-right value of the share

= Rs. 200-Rs. 187.50 = Rs. 12.50 per share.

Q-9 The following notes pertain to Brite Ltd.'s Balance Sheet as on 31st March, 20X1:

Notes Rs. in Lakhs

(1) Share Capital

Authorised :

20 crore shares of Rs. 10 each 20,000

Issued and Subscribed :

10 crore Equity Shares of Rs. 10 each 10,000

2 crore 11% Cumulative Preference Shares of Rs. 10 each 2,000

Total 12,000

Called and paid up:

10 crore Equity Shares of Rs. 10 each, Rs. 8 per share called and paid up 2 crore 8,000

11% Cumulative Preference Shares of Rs. 10 each, fully called and paid up 2,000

Total 10,000

(2) Reserves and Surplus:

Capital Redemption Reserve 1,485

Securities Premium (collected in cash) 2,000

General Reserve 1,040

Surplus i.e. credit balance of Profit & Loss Account 273

Total 4,798

On 2nd April 20X1, the company made the final call on equity shares @ Rs. 2 per share. The entire money

was received in the month of April, 20X1.

Join Us on Telegram http://t.me/canotes_ipcc

On 1st June 20X1, the company decided to issue to equity shareholders bonus shares at the rate of 2

shares for every 5 shares held .

Youa re required to prepare journal entries for all the above mentioned transactions. Also prepare the

notes on Share Capital and Reserves and Surplus relevant to the Balance Sheet of the company

immediately after the issue of bonus shares.

Ans. Journal Entries in the books of Brite Ltd.

20x1 Dr. Cr.

Rs.in lakhs Rs. in lakhs

April 2 Equity Share Final Call A/c Dr. 2,000

To Equity Share Capital A/c 2,000

(Final call of Rs. 2 per share on 10 crore equity shares made due)

Bank A/c Dr. 2,000

To Equity Share Final Call A/c 2,000

(Final call money on 10 crore equity shares received)

June 1 Capital Redemption Reserve A/c Dr. 1,485

Securities Premium A/c Dr. 2,000

General Reserve A/c (b.f.) Dr. 515

To Bonus to Shareholders A/c 4,000

(Bonus issue of two shares for every five shares held, by utilising

various reserves as per Board's resolution dated.......)

Bonus to Shareholders A/c Dr. 4,000

To Equity Share Capital A/c 4,000

(Capitalisation of profit)

Notes to Accounts

1 Share Capital

Authorised share capital

20 crores shares of Rs.10 each 20,000

Issued, subscribed and fully paid up share capital

14 crore Equity shares of Rs. 10 each, fully paid up 14,000

(Out of the above, 4 crore equity shares @ Rs.10 each

were issued by way of bonus)

2 crore, 11% Cumulative Preference share capital of Rs. 10 each, fully paid up 2,000

16,000

2. Reserves and Surplus

Capital Redemption reserve 1,485

Less: Utilised for bonus issue 1,485

Securities Premium 2,000

Less: Utilised for bonus issue (2,000)

General Reserve 1,040

Less: Utilised for bonus issue 515 515

Surplus (Profit and Loss Account) 273

Total 798

Join Us on Telegram http://t.me/canotes_ipcc

Q-10 The following notes pertain to Brite Ltd.'s Balance Sheet as on 31st March, 20X1:

Notes Rs. in Lakhs

(1) Share Capital

Authorised :

20 crore shares of Rs. 10 each 20,000

Issued and Subscribed :

10 crore Equity Shares of Rs. 10 each 10,000

2 crore 11% Cumulative Preference Shares of Rs. 10 each 2,000

Total 12,000

Called and paid up:

10 crore Equity Shares of Rs. 10 each, Rs. 8 per share called and paid up 2 crore 8,000

11% Cumulative Preference Shares of Rs. 10 each, fully called and paid up 2,000

Total 10,000

(2) Reserves and Surplus:

Capital Redemption Reserve 1,485

Securities Premium (collected in cash) 2,000

General Reserve 1,040

Surplus i.e. credit balance of Profit & Loss Account 273

Total 4,798

On 2nd April 20X1, the company made the final call on equity shares @ Rs. 2 per share. The entire money

was received in the month of April, 20X1.

On 1st June 20X1, the company decided to issue to equity shareholders bonus shares at the rate of 2

shares for every 5 shares held .

Youa re required to prepare journal entries for all the above mentioned transactions. Also prepare the

notes on Share Capital and Reserves and Surplus relevant to the Balance Sheet of the company

immediately after the issue of bonus shares.

Ans. Journal Entries in the books of Brite Ltd.

20x1 Dr. Cr.

Rs.in lakhs Rs. in lakhs

April 2 Equity Share Final Call A/c Dr. 2,000

To Equity Share Capital A/c 2,000

(Final call of Rs. 2 per share on 10 crore equity shares made due)

Bank A/c Dr. 2,000

To Equity Share Final Call A/c 2,000

(Final call money on 10 crore equity shares received)

June 1 Capital Redemption Reserve A/c Dr. 1,485

Securities Premium A/c Dr. 2,000

General Reserve A/c (b.f.) Dr. 515

To Bonus to Shareholders A/c 4,000

Join Us on Telegram http://t.me/canotes_ipcc

(Bonus issue of two shares for every five shares held, by utilising

various reserves as per Board's resolution dated.......)

Bonus to Shareholders A/c Dr. 4,000

To Equity Share Capital A/c 4,000

(Capitalisation of profit)

Notes to Accounts

1 Share Capital

Authorised share capital

20 crores shares of Rs.10 each 20,000

Issued, subscribed and fully paid up share capital

14 crore Equity shares of Rs. 10 each, fully paid up 14,000

(Out of the above, 4 crore equity shares @ Rs.10 each

were issued by way of bonus)

2 crore, 11% Cumulative Preference share capital of Rs. 10 each, fully paid up 2,000

16,000

2. Reserves and Surplus

Capital Redemption reserve 1,485

Less: Utilised for bonus issue 1,485

Securities Premium 2,000

Less: Utilised for bonus issue (2,000)

General Reserve 1,040

Less: Utilised for bonus issue 515 515

Surplus (Profit and Loss Account) 273

Total 798

Q-11 Following items appear in the Trial Balance of Hello Ltd. as on 31st March, 2017:

Particulars Amount

9,000 Equity Shares of Rs.100 each 9,00,000

Securities Premium 80,000

Capital Redemption Reserve 1,40,000

General Reserve 2,10,000

Profit and Loss Account (Cr. Balance) 90,000

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 3

shares held. Company decided that there should be the minimum reduction in free reserves.

You are required to give the necessary Journal Entries in the books Hello Ltd.

Ans. Journal Entries in the books of Hello Ltd.

Capital Redemption Reserve A/c Dr. 1,40,000

Securities Premium A/c Dr. 80,000

General Reserve A/c (balancing figure) Dr. 80,000

To Bonus to Shareholders 3,00,000

Join Us on Telegram http://t.me/canotes_ipcc

(Being issue of bonus shares by utilization of various

Reserves, as per resolution dated .......)

Bonus to Shareholders A/c Dr.3,00,000

To Equity Share Capital 3,00,000

(Being capitalization of profit)

Q-12 Omega company offers new shares of Rs. 100 each at 25% premium to existing shareholders on the

basis one for five shares. The cum -right market price of a share is Rs. 200.

You are required to calculate the (i) Ex -right value of a share; (ii) Value of a right share?

Ans. Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of shares + No.

of right shares)

= (Rs. 200 x 5 Shares + Rs. 125 x 1 Share) / (5 + 1) Shares

= Rs. 1,125 / 6 shares = Rs. 187.50 per share.

Value of right = Cum-right value of the share – Ex-right value of the share

= Rs. 200 – Rs. 187.50 = Rs. 12.50 per share.

Q-13 Following is the extract of the Balance Sheet of Manoj Ltd. as at 31st March, 20X1

Authorised capital: Rs.

30,000 12% Preference shares of Rs. 10 each 3,00,000

3,00,000 Equity shares of Rs. 10 each 30,00,000

33,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of Rs. 10 each fully paid 2,40,000

2,70,000 Equity shares of Rs. 10 each, Rs. 8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 20X1, the Company has made final call @ Rs. 2 each on 2,70,000 equity shares.

The call money was received by 20th April, 20X1. Thereafter, the company decided to capitalise its

reserves by way of bonus at the rate of one share for every four shares held.

Prepare necessary journal entries in the books of the company .

Ans. Journal Entries in the books of Manoj Ltd.

Rs. Rs.

1-4-20X1 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of Rs. 2 per share on 2,70,000 equity

shares due as per Board’s Resolution dated….)

Join Us on Telegram http://t.me/canotes_ipcc

20-4- 20X1 Bank A/c Dr. 5,40,000

To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 75,000

Capital redemption Reserve A/c Dr. 1,20,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 1,20,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one share for

every four shares held)

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c 6,75,000

(For issue of bonus shares)

Q-14 Following items appear in the Trial Balance of Beta Ltd. as on 31st March, 2017:

Particulars Amount

3,000 Equity Shares of Rs. 100 each 3,00,000

Securities Premium (collected in cash) 40,000

Capital Redemption Reserve 30,000

General Reserve 1,00,000

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 3

shares held. Company decided that there should be the minimum reduction in free reserves. Pass

necessary Journal Entries in the books of Beta Ltd.

Ans. Capital Redemption Reserve A/c Dr. 30,000

Securities Premium A/c Dr. 40,000

General Reserve A/c Dr. 30,000

To Bonus to Shareholders 1,00,000

(Being issue of bonus shares by utilization of various

Reserves, as per resolution dated …….)

Bonus to Shareholders A/c Dr. 1,00,000

To Equity Share Capital 1,00,000

(Being capitalization of Profit)

Q-15 Following is the extract of the Balance Sheet of Manoj Ltd. as at 31st March, 20X1

`

Authorised capital:

30,000 12% Preference shares of ` 10 each 3,00,000

4,00,000 Equity shares of ` 10 each 40,00,000

43,00,000

Join Us on Telegram http://t.me/canotes_ipcc

Issued and Subscribed capital:

24,000 12% Preference shares of ` 10 each fully paid 2,40,000

2,70,000 Equity shares of ` 10 each, ` 8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 20X1, the Company has made final call @ ` 2 each on 2,70,000 equity shares. The call

money was received by 20th April, 20X1. Thereafter, the company decided to capitalize its reserves by

way of bonus at the rate of one share for every four shares held.

Show necessary journal entries in the books of the company and prepare the relevant extract of the

balance sheet as on 30th April, 20X1 after bonus issue.

Ans. Journal Entries in the books of Manoj Ltd.

` `

1-4-20X1 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of ` 2 per share on 2,70,000

equity shares due as per Board’s Resolution dated....)

20-4-20X1 Bank A/c Dr. 5,40,000

To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 75,000

Capital Redemption Reserve A/c Dr. 1,20,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 1,20,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one share for

every four shares held)

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c 6,75,000

(For issue of bonus shares)

Extract of Balance Sheet as at 30th April, 20X1 (after bonus issue)

`

Authorized Capital

30,000 12% Preference shares of ` 10 each 3,00,000

4,00,000 Equity shares of ` 10 each 40,00,000

Issued and subscribed capital

24,000 12% Preference shares of `10 each, fully paid 2,40,000

3,37,500 Equity shares of ` 10 each, fully paid 33,75,000

(Out of the above, 67,500 equity shares @ ` 10 each were issued by way of bonus shares)

Reserves and surplus

Profit and Loss Account 4,80,000

Join Us on Telegram http://t.me/canotes_ipcc

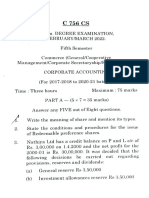

Q-16 Aman Ltd. has issued 2,000, 12% convertible debentures of ` 100 each redeemable after a period of fi ve

years. According to the terms & conditions of the issue, these debentures were redeemabl e at a

premium of 5%. The debenture holders also had the option at the time of redemption to convert 20%

of their holdings into equity shares of ` 10 each at a price of ` 20 per share and balance in cash. Debenture

holders amounting ‘ 40,000 opted to get their debentures converted into equity shares as per terms of

the issue.

You are required to calculate the number of shares issued and cash paid for redemption of ` 40,000

debenture holders and also pass journal entry for conversion and redemption of debentures.

OR

Following is the extract of the Balance Sheet of ABC Ltd. as at 31st March, 2021:

`

Authorised capital:

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

64,50,000

Issued and Subscribed capital:

36,000 12% Preference shares of ` 10 each fully paid 3,60,000

4,05,000 Equity shares of ` 10 each, ` 8 paid up 32,40,000

Reserves and surplus:

General Reserve 5,40,000

Capital Redemption Reserve 1,80,000

Securities premium (collected in cash) 1,12,500

Profit and Loss Account 9,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 4,05,000 equity shares. The call money

was received by 20th April, 2021. Thereafter, the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held.

You are required to give necessary journal entries in the books of the ABC Ltd. and prepare the rele vant

extract of the balance sheet as on 30th April, 2021 after bonus issue.

Ans. Calculation of number of shares issued

Number of

debentures

Debenture holders opted for conversion (40,000 /100) 400

Option for conversion 20%

Number of debentures to be converted (20% of 400) 80

Redemption value of 80 debentures at a premium of 5% [80 x (100+5)] ` 8,400

Equity shares of ` 10 each issued on conversion

[` 8,400/ ` 20 ] 420 shares

Calculation of cash to be paid : `

Number of debentures 400

Less: number of debentures to be converted into equity shares (80)

320

Redemption value of 320 debentures (320 × ` 105) ` 33,600

Join Us on Telegram http://t.me/canotes_ipcc

Journal Entry

Debentures A/c Dr. 40,000

Premium on redemption A/c Dr. 2,000

To Debenture holders A/c 42,000

(Being amount due to debenture holders at redemption)

Debenture holders A/c Dr. 42,000

To Equity Share capital A/c 4,200

To Securities premium A/c Dr. 4,200

To Cash A/c 33,600

(Discharge of amount due to Debenture holders)

OR

Journal Entries in the books of ABC Ltd.

` `

1-4-2021 Equity share final call A/c Dr. 8,10,000

To Equity share capital A/c 8,10,000

(For final calls of ` 2 per share on 4,05,000 equity

shares due as per Board’s Resolution dated….)

20-4-2021 Bank A/c Dr. 8,10,000

To Equity share final call A/c 8,10,000

(For final call money on 4,05,000 equity shares

received)

Securities Premium A/c Dr. 1,12,500

Capital redemption reserve A/c Dr. 1,80,000

General Reserve A/c Dr. 5,40,000

Profit and Loss A/c (b.f.) Dr. 1,80,000

To Bonus to shareholders A/c 10,12,500

(For making provision for bonus issue of one

share for every four shares held)

Bonus to shareholders A/c Dr. 10,12,500

To Equity share capital A/c 10,12,500

(For issue of bonus shares)

Extract of Balance Sheet as at 30th April, 2021 (after bonus issue)

`

Authorized Capital

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

Issued and subscribed capital

36,000 12% Preference shares of `10 each, fully paid 3,60,000

5,06,250 Equity shares of ` 10 each, fully paid 50,62,500

(Out of the above, 1,01,250 equity shares @ ` 10 each were issued by

way of bonus shares)

Reserves and surplus

Profit and Loss Account 7,20,000

Join Us on Telegram http://t.me/canotes_ipcc

Q-17 Following items appear in the Trail Balance of Star Ltd. as on 31st March, 2019:

Particulars `

80,000 Equity shares of `10 each, ` 8 paid-up 6,40,000

Capital Reserve (including `45,000 being profit on sale of Machinery) 1,10,000

Revaluation Reserve 80,000

Capital Redemption Reserve 75,000

Securities Premium 60,000

General Reserve 2,10,000

Profit & Loss Account (Cr. Balance) 1,00,000

On 1st April,2019, the Company has made final call on Equity shares @` 2 per share.

The entire money was received in the month of April, 2019.

On 1st June, 2019, the Company decided to issue to Equity shareholders bonus shares at the rate of

2 shares for every 5 shares held and for this purpose, it was decided that there should be minimum

reduction in free reserves.

Pass necessary journal entries in the Books of Star Ltd.

Ans. Journal Entries in the books of Star Ltd.

2019 Dr. Cr.

` `

April 1 Equity Share Final Call A/c Dr. 1,60,000

To Equity Share Capital A/c 1,60,000

(Final call of ` 2 per share on 80,000

equity shares made due)

Bank A/c Dr. 1,60,000

To Equity Share Final Call A/c 1,60,000

(Final call money on 80,000 equity

shares received)

June 1 Capital Redemption Reserve A/c Dr. 75,000

Capital Reserve Dr. 45,000*

Securities Premium A/c Dr. 60,000

General Reserve A/c (b.f.) Dr. 1,40,000**

To Bonus to Shareholders A/c 3,20,000

(Bonus issue of two shares for every

five shares held, by utilizing various

reserves as per Board’s resolution

dated…….)

Bonus to Shareholders A/c Dr. 3,20,000

To Equity Share Capital A/c 3,20,000

(Capitalization of profit)

* considering it as free reserve as it has been realized.

** Alternatively, different combination of profit and loss balance and general reserve may also be

used.

Join Us on Telegram http://t.me/canotes_ipcc

Q-18 Raman Ltd. gives the following information as at 31st March, 2021:

`

Authorised capital:

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

64,50,000

Issued and Subscribed capital:

36,000 12% Preference shares of ` 10 each fully paid 3,60,000

4,05,000 Equity shares of ` 10 each, ` 8 paid up 32,40,000

Reserves and surplus:

General Reserve 5,40,000

Capital Redemption Reserve 1,80,000

Securities premium (collected in cash) 1,12,500

Profit and Loss Account 9,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 4,05,000 equity shares. The call money

was received by 20th April, 2021. Thereafter, the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held.

Show necessary journal entries in the books of the company.

Ans. Journal Entries in the books of Raman Ltd.

` `

1-4-2021 Equity share final call A/c Dr. 8,10,000

To Equity share capital A/c 8,10,000

(For final calls of ` 2 per share on 4,05,000

equity shares due as per Board’s Resolution

dated….)

20-4-2021 Bank A/c Dr. 8,10,000

To Equity share final call A/c 8,10,000

(For final call money on 4,05,000 equity

shares received)

Securities Premium A/c Dr. 1,12,500

Capital Redemption Reserve A/c Dr. 1,80,000

General Reserve A/c Dr. 5,40,000

Profit and Loss A/c (b.f.) Dr. 1,80,000

To Bonus to shareholders A/c 10,12,500

(For making provision for bonus issue of

one share for every four shares held)

Bonus to shareholders A/c Dr. 10,12,500

To Equity share capital A/c 10,12,500

(For issue of bonus shares)

Join Us on Telegram http://t.me/canotes_ipcc

Q-19 Following is the information of Umesh Ltd. as at 31st March, 2021:

`

Authorized capital:

30,000 12% Preference shares of ` 10 each 3,00,000

4,00,000 Equity shares of ` 10 each 40,00,000

43,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of ` 10 each fully paid 2,40,000

3,00,000 Equity shares of ` 10 each, ` 8 paid up 24,00,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 3,00,000 equity shares. The call money

was received by 20th April, 2021. Thereafter, the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held.

You are required to prepare necessary journal entries in the books of the company.

Ans. Journal Entries in the books of Umesh Ltd.

` `

1-4-2021 Equity share final call A/c Dr. 6,00,000

To Equity share capital A/c 6,00,000

(For final calls of ‘ 2 per share on 3,00,000

equity shares due as per Board’s Resolution

dated….)

20-4-2021 Bank A/c Dr. 6,00,000

To Equity share final call A/c 6,00,000

(For final call money on 3,00,000 equity

shares received)

Securities Premium A/c Dr. 75,000

Capital redemption reserve A/c Dr. 1,20,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 1,95,000

To Bonus to shareholders A/c 7,50,000

(For making provision for bonus issue of one

share for every four shares held)

Bonus to shareholders A/c Dr. 7,50,000

To Equity share capital A/c 7,50,000

(For issue of bonus shares)

Join Us on Telegram http://t.me/canotes_ipcc

Q-20 Alpha Ltd. furnishes the following information as at 31st March, 2021:

` In lakhs ` In lakhs

Shareholders’ Funds

Equity share capital (fully paid up shares of ‘ 10 each) 2,400

Reserves and Surplus

Securities Premium 350

General Reserve 530

Capital Redemption Reserve 400

Profit & Loss Account 340 1,620

Non-current Liabilities

12% Debentures 1,500

Current Liabilities

Trade PayabIes 1,490

Other Current Liabilities 390 1,880

Non-current Assets

Property, plant and equipment 4,052

Current Assets

Current Investments 148

Inventories 1,200

Trade Receivables 520

Cash and Bank 1,480 3,348

(i) On 1st April, 2021, the company announced buy-back of 25% of its equity shares @ ` 15 per share. For

this purpose, it sold all its investment for ` 150 lakhs.

(ii) On 10th April, 2021 the company achieved the target of buy-back.

(iii) On 30th April, 2021, the company issued one fully paid up equity share of ` 10 each by way of bonus for

every four equity shares held by the equity shareholders by capitalization of Capital Redemption

Reserve. Premium (excess of buy-back price over the par value) paid on buy-back should be adjusted

against securities premium account.

You are required to pass necessary journal entries and prepare the Balance Sheet of Alpha Ltd. after

bonus issue.

Ans. In the books of Alpha Limited

Journal Entries

Date Particulars Dr. Cr.

2021 (` in lakhs)

April 1 Bank A/c Dr. 150

To Investment A/c 148

To Profit on sale of investment 2

(Being investment sold on profit)

April 10 Equity share capital A/c Dr. 600

Securities premium A/c Dr. 300

To Equity shares buy back A/c 900

Join Us on Telegram http://t.me/canotes_ipcc

(Being the amount due to equity shareholders on buy

back)

Equity shares buy back A/c Dr. 900

To Bank A/c 900

(Being the payment made on account of buy back of ` 60

Lakh Equity Shares)

April 10 General reserve A/c Dr. 530

Profit and Loss A/c Dr. 70

To Capital redemption reserve (CRR) A/c 600

(Being amount equal to nominal value of buy back shares

from free reserves transferred to capital redemption reserve

account as per the law)

April 30 Capital redemption reserve A/c Dr. 450

To Bonus shares A/c (W.N.1) 450

(Being the utilization of capital redemption reserve to

issue bonus shares)

Bonus shares A/c Dr. 450

To Equity share capital A/c 450

(Being issue of one bonus equity share for every four

equity shares held)

Profit on sale of Investment Dr. 2

To Profit and Loss A/c 2

(Profit on sale transfer to Profit and Loss A/c)

Note: For transferring amount equal to nominal value of buy back shares from free reserves to capital

redemption reserve account, the amount of ` 340 lakhs from P & L A/c and the balance from general

reserve may also be utilized. The combination of different set of amounts (from General Reserve and

Profit and Loss Account) aggregating ` 600 lakhs may also be considered for the purpose of transfer to

CRR.

Balance Sheet (After buy back and issue of bonus shares)

Particulars Note No Amount

(` in Lakhs)

I. Equity and Liabilities

(1) Shareholder’s Funds

(a) Share Capital 1 2,250

(b) Reserves and Surplus 2 872

(2) Non-Current Liabilities

(a) Long-term borrowings - 12% Debentures 1,500

Join Us on Telegram http://t.me/canotes_ipcc

(3) Current Liabilities

(a) Trade payables 1,490

(b) Other current liabilities 390

Total 6,502

II. Assets

(1) Non-current assets

(a) Property, plant and equipment 4,052

(2) Current assets

(a) Current investments

(b) Inventory 1,200

(c) Trade receivables 520

(d) Cash and cash equivalents (W.N. 2) 730

Total 6,502

Notes to Accounts

` In lakhs

1. Share Capital

Equity share capital (225 lakh fully paid up shares of

` 10 each) 2,250

2. Reserves and Surplus

General Reserve 530

Less: Transfer to CRR (530) -

Capital Redemption Reserve 400

Add: Transfer due to buy-back of shares from P/L 70

Add: Transfer due to buy-back of shares from Gen. res. 530

Less: Utilisation for issue of bonus shares (450) 550

Securities premium 350

Less: Adjustment for premium paid on buy back (300) 50

Profit & Loss A/c 340

Add: Profit on sale of investment 2

Less: Transfer to CRR (70) 272 872

Working Notes:

1. Amount of equity share capital = 2,400 - 600 (buyback) + 450 (Bonus shares)

= 2,250

2. Cash at bank after issue of bonus shares

` in lakhs

Cash balance as on 1st April, 2021 1480

Add: Sale of investments 150

1630

Less: Payment for buy back of shares (900)

730

Join Us on Telegram http://t.me/canotes_ipcc

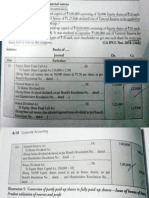

Q-21 Mobile Limited has authorized share capital of 1,00,000 equity shares @ ` 10 each. The company has

already issued 60% of its capital for cash. Now the company wishes to issue bonus shares in the ratio 1:5

to its existing shareholders. The following is the status of Reserve and Surplus of the company:

General Reserve ` 1,60,000

Plant Revaluation Reserve ` 25,000

Securities Premium Account (Realised in cash) ` 60,000

Capital Redemption Reserve ` 80,000

Answer the following questions:

(a) What is the number of Bonus shares to be issued?

(b) Can company issue Bonus out of General Reserve only?

(c) Give Journal Entries and also give the extracts of the balance-sheet after such Bonus issue.

(d) Is it possible for the company to issue partly paid-up bonus shares?

Ans.(a) Number of Bonus shares to be issued:

Existing paid up Capital = 60,000 Shares

Number of Bonus Shares = (60,000 × 1) ÷ 5 = 12,000 Shares (i.e. for ` 1,20,000)

(b) Bonus out of General Reserve:

It is a usual practice to utilize specific reserve (available for specific purpose).

Therefore, if CRR and Securities Premium are available, then company should utilize these reserves i n

priority over other free reserves. It is clear that company should not use General Reserve, in the g iven

example, as Capital Redemption Reserve and Securities Premium are sufficiently available

(c) Journal Entries in the Books of Mobile Ltd.

Particulars Dr. (`) Cr. (`)

Capital Redemption Reserve A/c Dr. 80,000

Securities Premium A/c Dr. 40,000

To Bonus to Shareholders A/c 1,20,000

(Being issue of 1 Share for every 5 Shares held, by utilizing

various reserves as per Board’s Resolution dated …..)

Bonus to Shareholders A/c Dr. 1,20,000

To Equity Share Capital A/c 1,20,000

(Capitalization of profits)

Extracts of the Balance-Sheet after Bonus issue

Particulars Note No. Amount (`)

EQUITY AND LIABILITIES

1. Shareholder’s funds

(a) Share Capital 1 7,20,000

(b) Reserves and Surplus 2 2,05,000

Notes to Accounts

1. Share capital

Authorised Capital

1,00,000 Equity Shares @ ` 10 each 10,00,000

Issued, Called up & Paid up Capital

72,000 Equity Shares @ ` 10 each 7,20,000

Join Us on Telegram http://t.me/canotes_ipcc

(Out of above, 12,000 shares have been

issued as bonus shares).

2. Reserve and Surplus

Plant Revaluation Reserve 25,000

Securities Premium A/c 20,000

General Reserve 1,60,000 2,05,000

(d) Fully Paid up bonus shares only

As per section 63 of the Companies Act, 2013, only fully paid up bonus shares can be issued. Therefore,

it is not possible for the company to issue partly paid-up bonus shares.

Q-22 Manu Ltd. gives the following information as at 31st March, 2021:

`

Issued and Subscribed capital:

24,000 12% Preference shares of ` 10 each fully paid 2,40,000

2,70,000 Equity shares of ` 10 each, ` 8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 2,70,000 equity shares. The call money

was received by 20th April, 2021. Thereafter, the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held. You are required to prepare necessary jou rnal

entries in the books of the company on 30th April, 2021 for these transactions.

Ans. Journal Entries

` `

1-4-2021 Equity share final call A/c Dr. 5,40,000

To Equity share capital A/c 5,40,000

(For final calls of ` 2 per share on 2,70,000 equity shares

due as per Board’s Resolution dated….)

20-4-2021 Bank A/c Dr. 5,40,000

To Equity share final call A/c 5,40,000

(For final call money on 2,70,000 equity shares received)

Securities Premium A/c Dr. 75,000

Capital redemption reserve A/c Dr. 1,20,000

General Reserve A/c Dr. 3,60,000

Profit and Loss A/c (b.f.) Dr. 1,20,000

To Bonus to shareholders A/c 6,75,000

(For making provision for bonus issue of one share

for every four shares held)

Bonus to shareholders A/c Dr. 6,75,000

To Equity share capital A/c 6,75,000

(For issue of bonus shares)

Join Us on Telegram http://t.me/canotes_ipcc

RIGHT ISSUE

Q-1 Omega company offers new shares of ` 100 each at 20% premium to existing shareholders on the basis

of one for four shares. The cum-right market price of a share is ` 190.

You are required to calculate the Value of a right share.

Ans. Value of right share = Cum-right value of the share - Ex-right value of the share (as computed in Working

Note)

= ` 190 - ` 176 = ` 14 per share.

Working Note:

Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of shares + No. of

right shares) = (` 190 x 4 Shares + ` 120 x 1 Share) / (4 + 1) Shares

= ` 880 / 5 shares = ` 176 per share.

Q-2 State under which head these accounts should be classified in Balance Sheet, as per Schedule III of the

Companies Act, 2013:

(i) Share application money received in excess of issued share capital.

(ii) Share option outstanding account.

(iii) Unpaid matured debenture and interest accrued thereon.

(iv) Uncalled liability on shares and other partly paid investments.

(v) Calls unpaid.

Ans. (i) Current Liabilities/ Other Current Liabilities

(ii) Shareholders' Fund/Reserve & Surplus

(iii) Current liabilities/Other Current Liabilities

(iv) Contingent Liabilities and Commitments

(v) Shareholders' Fund / Share Capital

Q-3 A company offers new shares of Rs.100 each at 25% premium to existing shareholders on one for four

basis. Thecum-right market price of a share is ` 150. Calculate the value of a right.

Ans. Ex-right value of the shares = (Gum-right value of the existing shares + Rights shares Issue Price) /

(Existing Number of shares + Rights Number of shares)

= (Rs. 150 x 4 Shares + Rs.125 x 1 Share) / (4 + 1) Shares

= Rs. 725 / 5 shares = Rs.145 per share.

Value of right = Gum-right value of the share - Ex-right value of the share

= Rs.150-Rs.145 = Rs.5 per share.

Q-4 Zeta Ltd. has decided to increase its existing share capital by making rights issue to its existing

shareholders. Zeta Ltd. is offering one new share for every two shares held by the shareholder. The

market value (cum-right) of the share is Rs.360 and the company is offering one right share of Rs.180

each to its existing shareholders. You are required to calculate the value of a right. What should be the

ex-right value of a share?

Join Us on Telegram http://t.me/canotes_ipcc

Ans. Ex-right value of the shares = (Cum-right value of the existing shares + Rights shares x

Issue Price) / (Existing Number of shares + Number of Right shares)

= (Rs. 360 x 2 Shares+ Rs.180 x 1 Share)/(2 + 1) Shares

= Rs.900/3 shares = Rs.300 per share.

Value of right = Cum-right value of the share - Ex-right value of the share

= Rs.360- Rs.300 = Rs.60 per share.

Hence, any one desirous of having a confirmed allotment of one share from the company at Rs. 180 will have

to pay Rs. 120 (2 shares x Rs. 60) to an existing shareholder holding 2 shares and willing to renounce his right

of buying one share in favour of that person.

Q-5 Omega company offers new shares of Rs. 100 each at 25% premium to existing shareholders on the

basis one for five shares. The cum-right market price of a share is Rs.200.

You are required to calculate the (I) Ex-right value of a share; (II) Value of a right share?

Ans. Ex-right value of the shares

= (Gum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of

shares + No. of right shares)

= (Rs.200 x 5 Shares + Rs.125 x 1 Share) / (5 + 1) Shares

= Rs.1,125 / 6 shares = Rs.187.50 per share.

Value of right = Gum-right value of the share-Ex-right value of the share

= Rs.200-Rs.187.50 =Rs.12.50 per share.

Q-6 Following is the extract of the Balance Sheet of Madhu Ltd.as at 31st March, 2020

`

Authorized capital:

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

64,50,000

Issued and Subscribed capital:

36,000 12% Preference shares of ` 10 each fully paid 3,60,000

4,05,000 Equity shares of ` 10 each, ` 8 paid up 32,40,000

Reserves and surplus:

General Reserve 5,40,000

Capital Redemption Reserve 1,80,000

Securities premium (collected in cash) 1,12,500

Profit and Loss Account 9,00,000

On 1st April, 2020, the Company has made final call @ ` 2 each on 4,05,000 equity shares. The call money

was received by 20th April, 2020. Thereafter, the company decided to capitalize its reserves by way of

bonus at the rate of one share for every four shares held by utilizing the balance of profit and los s

account to the minimum extent.

You are required to prepare necessary journal entries in the books of the company and prepare the

relevant extract of the balance sheet as on 30th April, 2020 after bonus issue.

Join Us on Telegram http://t.me/canotes_ipcc

Ans. Journal Entries in the books of Madhu Ltd.

` `

1-4-2020 Equity share final call A/c Dr. 8,10,000

To Equity share capital A/c 8,10,000

(For final calls of ` 2 per share on 4,05,000

equity shares due as per Board’s Resolution

dated….)

20-4-2020 Bank A/c Dr. 8,10,000

To Equity share final call A/c 8,10,000

(For final call money on 4,05,000 equity

shares received)

Securities Premium A/c Dr. 1,12,500

Capital redemption reserve A/c Dr. 1,80,000

General Reserve A/c Dr. 5,40,000

Profit and Loss A/c (b.f.) Dr. 1,80,000

To Bonus to shareholders A/c 10,12,500

(For making provision for bonus issue of

one share for every four shares held)

Bonus to shareholders A/c Dr. 10,12,500

To Equity share capital A/c 10,12,500

(For issue of bonus shares)

Extract of Balance Sheet as at 30th April, 2020 (after bonus issue)

`

Authorized Capital

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

Issued and subscribed capital

36,000 12% Preference shares of `10 each, fully paid 3,60,000

5,06,250 Equity shares of ` 10 each, fully paid 50,62,500

(Out of the above, 1,01,250 equity shares @ ` 10 each were issued by way of

bonus shares)

Reserves and surplus

Profit and Loss Account 7,20,000

Q-7 Omega company offers new shares of ` 100 each at 25% premium to existing shareholders on the basis

one for five shares. The cum-right market price of a share is ` 200.

You are required to calculate the (i) Ex-right value of a share; (ii) Value of a right share?

Ans. Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing No.

of shares + No. of right shares) = (` 200 x 5 Shares + ` 125 x 1 Share) / (5 + 1) Shares =

` 1,125 / 6 shares = ` 187.50 per share.

Value of right = Cum-right value of the share – Ex-right value of the share

= ` 200 – ` 187.50 = ` 12.50 per share.

Join Us on Telegram http://t.me/canotes_ipcc

Q-8 Beta Ltd. having share capital of 20,000 equity shares of `10 each decides to issue rights share at the

ratio of 1 for every 8 shares held at par value. Assuming all the share holders accepted the rights issue

and all money was duly received, pass journal entry in the books of the company.

Ans.

` `

Bank A/c Dr. 25,000

To Equity share capital A/c 25,000

(For rights share issued at par value in the ratio of 1:8

equity shares due as per Board’s Resolution dated….)

Working Note:

Number of Rights shares to be issued- 20,000/8x1= 2,500 shares

Q-9 Omega Ltd. offers new shares of ` 100 each at 25% premium to existing shareholders on the basis one

for five shares. The cum-right market price of a share is ‘ 200. You are required to calculate the (i) Ex-

right value of a share; (ii) Value of a right share?

Ans. Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of shares + No. of

right shares) = (` 200 x 5 Shares + ` 125 x 1 Share)/(5+1)

Shares

= ` 1,125 / 6 shares = ` 187.50 per share.

Value of right = Cum-right value of the share – Ex-right value of the share = ` 200 – ` 187.50 = ` 12.50

per share.

Q-10 Super company offers new shares of ` 100 each at 20% premium to existing shareholders on the basis

one for four shares. The cum-right market price of a share is ` 190.

You are required to calculate the value of a right share.

Ans. Value of right = Cum-right value of the share – Ex-right value of the share (as computed in Working

Note)

= ` 190 – ` 176 = ` 14 per share.

Working Note:

Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing No. of shares + No. of

right shares) = (` 190 x 4 Shares + ` 120 x 1 Share) / (4 + 1) Shares

= ` 880 / 5 shares = ` 176 per share.

Q-11 A company offers new right shares of ` 100 each at 20% premium to existing shareholders on one for

four shares. The cum-right market price of a share is ` 140.

You are required to calculate (i) Ex-right value of a share; (ii) Value of a right.

Ans.(a) (i) Ex-right value of the shares = (Cum-right value of the existing shares + Rights

shares X Issue Price) / (Existing Number of shares + No. of right shares)

= (` 140 x 4 Shares + ` 120 X 1 Share) / (1 + 4) Shares

= ` 680 / 5 shares = ` 136 per share.

(ii) Value of right = Cum-right value of the share – Ex-right value of the share

= ` 140 – ` 136 = ` 4 per share.

Join Us on Telegram http://t.me/canotes_ipcc

Q-12 A company having 1,00,000 shares of ` 10 each as its issued share capital, and having a market value of

` 45 issues rights shares in the ratio of 1:5 at an issue price of 25. Pass journal entry for issue of right

shares.

Ans.

(b) The entry at the time of subscription of right shares by the existing shareholders will be:

Bank A/c Dr. 5,00,000

To Equity Share Capital A/c 2,00,000

To Securities Premium A/c 3,00,000

(Being issue of 20,000 right shares @ ` 25 offered)

Join Us on Telegram http://t.me/canotes_ipcc

You might also like

- Top 10 Strategies For Profit On Binary OptionsDocument26 pagesTop 10 Strategies For Profit On Binary OptionsBinary Options Profit80% (10)

- The Consistent Traders BlueprintDocument15 pagesThe Consistent Traders BlueprintPaul Vu100% (2)

- Accountancy Assignment Grade 12Document4 pagesAccountancy Assignment Grade 12sharu SKNo ratings yet

- 100 Pip Daily by Karl DittmanDocument18 pages100 Pip Daily by Karl DittmanVinícius Oliveira100% (2)

- IDX 2nd Quarter 2016Document157 pagesIDX 2nd Quarter 2016kid47No ratings yet

- Accounting For Bonus and Right Issue: Topic - 4Document12 pagesAccounting For Bonus and Right Issue: Topic - 4Naga ChandraNo ratings yet

- 9 Bonus and Right IssueDocument4 pages9 Bonus and Right IssueRohith KumarNo ratings yet

- 9 Bonus & Right IssueDocument9 pages9 Bonus & Right Issueanilrj14pc8635jprNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- Internal ReconsrtuctionDocument33 pagesInternal ReconsrtuctionRenuNo ratings yet

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet

- Attachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDocument25 pagesAttachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDipen AdhikariNo ratings yet

- 4 Internal ReconstructionDocument28 pages4 Internal Reconstructionss6555760No ratings yet

- 12 Accountancy Comp Delhi2017 1Document28 pages12 Accountancy Comp Delhi2017 1harshit agrawalNo ratings yet

- Chapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice QuestionsDocument26 pagesChapter: Accounting of Bonus Issue & Right Issue Topic 1: Bonus Issue Practice Questionsnikhil diwan75% (4)

- Recapulitation: Collaborating TechniqueDocument3 pagesRecapulitation: Collaborating TechniqueayeshaNo ratings yet

- Recapulitation: Collaborating TechniqueDocument6 pagesRecapulitation: Collaborating TechniqueayeshaNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Pref Shares. Practice QuestionsDocument34 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Pref Shares. Practice QuestionsMercy GamingNo ratings yet

- Accounting-Bonus Issue and Right-Issue-1653399117076303Document17 pagesAccounting-Bonus Issue and Right-Issue-1653399117076303Badhrinath ShanmugamNo ratings yet

- Crash MysoreDocument40 pagesCrash MysoreyashbhardwajNo ratings yet

- Cor Acc Unit 01Document19 pagesCor Acc Unit 01vignesh iyerNo ratings yet

- Suggested Answer CAP II December 2016Document88 pagesSuggested Answer CAP II December 2016Nirmal ShresthaNo ratings yet

- Redemption of Preference ShareDocument6 pagesRedemption of Preference ShareAkash KamathNo ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Recapulitation: Collaborating TechniqueDocument5 pagesRecapulitation: Collaborating TechniqueayeshaNo ratings yet

- Caa Assignment SolutionsDocument39 pagesCaa Assignment Solutionschikanesakshi2001No ratings yet

- UNIT 2 & 4 MergedDocument41 pagesUNIT 2 & 4 MergedRich ManNo ratings yet

- Shares & Debentures TestDocument10 pagesShares & Debentures TestAthul Krishna KNo ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Redemption of Preference Shares IllustrationsDocument6 pagesRedemption of Preference Shares IllustrationsManya GargNo ratings yet

- CMA Volume 2 MergedDocument153 pagesCMA Volume 2 MergedShyaambhavi NsNo ratings yet

- 5 Internal Reconstruction Learning ObjecDocument20 pages5 Internal Reconstruction Learning ObjeccleoNo ratings yet

- Corporate AccountsDocument17 pagesCorporate AccountsSibam BanikNo ratings yet

- 41 33 AccountsDocument18 pages41 33 AccountsMayur PalNo ratings yet

- Ts Grewal Class 12 Accountancy Chapter 8Document8 pagesTs Grewal Class 12 Accountancy Chapter 8Tarun50% (2)

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- Practical Guide To Issue, Forfeiture and Reissue of Shares: Topic I: Full SubscriptionDocument24 pagesPractical Guide To Issue, Forfeiture and Reissue of Shares: Topic I: Full SubscriptionGANDHI DHRUVINNo ratings yet

- Additional Illustrations 8Document16 pagesAdditional Illustrations 8Thulsi JayadevNo ratings yet

- 12 Accounts Imp Ch3Document11 pages12 Accounts Imp Ch3Ashish GangwalNo ratings yet

- Ch.2 Accounting For Bonus and Right Issue-MergedDocument3 pagesCh.2 Accounting For Bonus and Right Issue-Mergedprakharvaidya5No ratings yet

- Chapter 8-Accounting For Share CapitalDocument5 pagesChapter 8-Accounting For Share Capitalshiv RaghuwanshiNo ratings yet

- AnswersDocument5 pagesAnswersPawan TalrejaNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- 12 Accounts Imp Ch1Document22 pages12 Accounts Imp Ch1Tushar Tyagi100% (1)

- Special Lesson Questions-16 Sep 2017Document1 pageSpecial Lesson Questions-16 Sep 2017ontykerlsNo ratings yet

- 616806cf0cf2b988fbcdbd97 OriginalDocument20 pages616806cf0cf2b988fbcdbd97 OriginalTM GamingNo ratings yet

- Unit-2 Sums SheetDocument8 pagesUnit-2 Sums SheetAstha ParmanandkaNo ratings yet

- 3526 - 25114 - Textbooksolution - PDF 3Document108 pages3526 - 25114 - Textbooksolution - PDF 3dhanuka jiNo ratings yet

- Buyback Share &own DebentureDocument8 pagesBuyback Share &own DebentureGhanshyam LakhaniNo ratings yet

- Sample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Document8 pagesSample Paper-1 (Target Term - 2) Answers: Book Recommended - Ultimate Book of Accountancy Class 12Beena ShibuNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- BuybackDocument6 pagesBuybacksmit9993No ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- Rohit TestDocument9 pagesRohit TestRohitNo ratings yet

- 3 AdmissionDocument14 pages3 AdmissionAman KakkarNo ratings yet

- Additional Questions-8Document13 pagesAdditional Questions-8stynx784No ratings yet

- 19013comp Sugans Pe2 Accounting Cp8 5Document12 pages19013comp Sugans Pe2 Accounting Cp8 5Ubaidulla MachingalNo ratings yet

- AdditionalIllustrationPg 8 102-8 PDFDocument2 pagesAdditionalIllustrationPg 8 102-8 PDFSumant SharmaNo ratings yet

- Ts Grewal Class 12 Accountancy Chapter 7 PDFDocument11 pagesTs Grewal Class 12 Accountancy Chapter 7 PDFmonikaNo ratings yet

- Corporate Accounting Exam Questions PaperDocument7 pagesCorporate Accounting Exam Questions PaperAmmar Bin NasirNo ratings yet

- Bonus ShareDocument2 pagesBonus ShareArpan CHATTERJEENo ratings yet

- US Internal Revenue Service: p938 - 1998Document86 pagesUS Internal Revenue Service: p938 - 1998IRSNo ratings yet

- MTD Decision Robert Ladd CEO MGT CapitalDocument35 pagesMTD Decision Robert Ladd CEO MGT CapitalTeri BuhlNo ratings yet

- Financial Market Problems and FormulasDocument3 pagesFinancial Market Problems and FormulasNufayl KatoNo ratings yet

- Bloomberg Exchange Code To MIC MappingDocument6 pagesBloomberg Exchange Code To MIC Mappingmeatloaf1213No ratings yet

- Valuation and Performance Evaluation of Mutual FundsDocument51 pagesValuation and Performance Evaluation of Mutual FundsSushil Kumar100% (2)

- SEBI Role and FunctionsDocument28 pagesSEBI Role and FunctionsAnurag Singh100% (4)

- Financial InstrumentsDocument68 pagesFinancial Instrumentspsy media100% (3)

- Chapter 6Document14 pagesChapter 6euwilla100% (1)

- Calcul Ating T He Co ST O F CapitalDocument50 pagesCalcul Ating T He Co ST O F CapitalSyrell NaborNo ratings yet

- Asl ProjectDocument55 pagesAsl ProjectL.K pointNo ratings yet

- Module 4 Long-Term Liabilities (Autosaved)Document47 pagesModule 4 Long-Term Liabilities (Autosaved)deer parkNo ratings yet

- Sneha Burud ASWDocument7 pagesSneha Burud ASWPrathmesh KulkarniNo ratings yet

- Tata SteelDocument56 pagesTata SteelG-TYBAF-24- SHRADDHA-JNo ratings yet

- ProblemsDocument1,132 pagesProblemsUNKNOWNNNo ratings yet

- Mutual Fund DataDocument194 pagesMutual Fund DatashreyaNo ratings yet

- Practice 4a EPS & Dilutive EPSDocument2 pagesPractice 4a EPS & Dilutive EPSParal Fabio MikhaNo ratings yet

- Advance Equity Research and ValuationDocument4 pagesAdvance Equity Research and ValuationELO OPSNo ratings yet

- Glossary of Financial Derivatives : WWW - Fbox.vt - edu/filebox/business/finance/dmc/DRUDocument20 pagesGlossary of Financial Derivatives : WWW - Fbox.vt - edu/filebox/business/finance/dmc/DRUMukul ChilwalNo ratings yet

- Other Derivatives: 8.1a AccumulatorsDocument23 pagesOther Derivatives: 8.1a AccumulatorsAnDy YiMNo ratings yet

- CREDO PresentationDocument23 pagesCREDO PresentationPampalini01No ratings yet

- Tax6 12Document182 pagesTax6 12Kaizu KunNo ratings yet

- Samco Active Momentum Fund - KIMDocument25 pagesSamco Active Momentum Fund - KIMArpNo ratings yet

- Assurance SP Reviewer PremidDocument14 pagesAssurance SP Reviewer PremidMica Bengson TolentinoNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

- Assignment 1 - Bonds PayableDocument6 pagesAssignment 1 - Bonds PayableHazel Adelan MugaNo ratings yet

- Sample Mid-Term Exam - v2 - PDFDocument9 pagesSample Mid-Term Exam - v2 - PDFMarcelo ManzoNo ratings yet