Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

17 viewsSOC332L

SOC332L

Uploaded by

Keri HamnerCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Consent and Declaration: For Online Income Support ApplicationsDocument3 pagesConsent and Declaration: For Online Income Support ApplicationsBrent Hladun0% (1)

- Adverse Action LettersDocument7 pagesAdverse Action LettersRobat Kooc100% (3)

- UCD35 Katrina ToyneDocument3 pagesUCD35 Katrina ToyneKatrinaNo ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- FW 10Document1 pageFW 10Florence Smith SlusarskiNo ratings yet

- Chapter 1 HomeworkDocument3 pagesChapter 1 Homeworkdustintaylor67467No ratings yet

- SOC426ADocument3 pagesSOC426AKeri HamnerNo ratings yet

- Distributor Application and AgreementDocument2 pagesDistributor Application and Agreementapi-300687941No ratings yet

- Official Seal or Stamp of Service/Employing Agency (If None, ADocument2 pagesOfficial Seal or Stamp of Service/Employing Agency (If None, Aมดน้อย ผู้น่ารักNo ratings yet

- Membership Update FormDocument4 pagesMembership Update FormbmapiraNo ratings yet

- NM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)Document7 pagesNM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)ShellyJacksonNo ratings yet

- YMCA Childcare Resource Service Stage 1 Child Care: Parent Agreement IDocument1 pageYMCA Childcare Resource Service Stage 1 Child Care: Parent Agreement ITa Tien ThanhNo ratings yet

- Flex ClaimDocument2 pagesFlex ClaimDonna RobertsNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Education Related DefermentDocument3 pagesEducation Related Defermentmyedaccount.orgNo ratings yet

- POEA Documents 2Document14 pagesPOEA Documents 2Win CeeNo ratings yet

- FAFDocument3 pagesFAFFritz PrejeanNo ratings yet

- Local Notices v8 9-20-2018Document13 pagesLocal Notices v8 9-20-2018Katherine EcheverriaNo ratings yet

- SOC 846 Provider Enrollment Agreement (Rev 10-2019) - ENDocument6 pagesSOC 846 Provider Enrollment Agreement (Rev 10-2019) - ENDoinita TaranNo ratings yet

- Wrapa Er Registration App 054147Document7 pagesWrapa Er Registration App 054147lekeadekayode1990No ratings yet

- 10 Steps To HiringDocument4 pages10 Steps To HiringjasoniohNo ratings yet

- Description: Tags: GEN0401Document4 pagesDescription: Tags: GEN0401anon-542677No ratings yet

- Uhip Claim Form July 2006-1-40Document1 pageUhip Claim Form July 2006-1-40CollinNo ratings yet

- Employee's Initials - Employer's InitialsDocument4 pagesEmployee's Initials - Employer's InitialsBenedict PabalanNo ratings yet

- Instructions For Volunteers and InternsDocument6 pagesInstructions For Volunteers and Internsapi-345593837No ratings yet

- Employment Contract - FormatDocument5 pagesEmployment Contract - Formatcarmina villarealNo ratings yet

- Take This Form With You If You Go To File A Claim Unemployment Compensation For Federal Employees (Ucfe) Program Notice To Federal Employee About Unemployment InsuranceDocument2 pagesTake This Form With You If You Go To File A Claim Unemployment Compensation For Federal Employees (Ucfe) Program Notice To Federal Employee About Unemployment InsuranceOky IkhramullahNo ratings yet

- STD Claim FormDocument8 pagesSTD Claim Formapi-314323052No ratings yet

- ConsentDocument3 pagesConsenttcrothers99No ratings yet

- Piw MouDocument3 pagesPiw Moujbentertainment00No ratings yet

- SOC426A Recipient Designation of ProviderDocument2 pagesSOC426A Recipient Designation of Providersri nanduNo ratings yet

- Phil Health ClaimForm GuidelinesDocument7 pagesPhil Health ClaimForm GuidelinesFerdinand CordovizNo ratings yet

- Safelink Enrollment FormDocument2 pagesSafelink Enrollment FormSet UpNo ratings yet

- Applicant Disclosure and Release For Consumer and Investigative Consumer ReportsDocument3 pagesApplicant Disclosure and Release For Consumer and Investigative Consumer Reportsmarcela batchanNo ratings yet

- Vacancy No 10-2016 Support Enforcement Specialistt CS-11Document3 pagesVacancy No 10-2016 Support Enforcement Specialistt CS-11Office on Latino Affairs (OLA)No ratings yet

- Labor Standards CASE DIGESTfor Midterms. 2014Document271 pagesLabor Standards CASE DIGESTfor Midterms. 2014puditz21No ratings yet

- CT OrrientationDocument35 pagesCT OrrientationDeo Montero OrquejoNo ratings yet

- Handbook On Workers' Compensation AND Occupational DiseasesDocument41 pagesHandbook On Workers' Compensation AND Occupational Diseases0micethornbNo ratings yet

- Background Release Form - Offer DocumentDocument9 pagesBackground Release Form - Offer DocumentLatasha wilson100% (1)

- Employer GuideDocument34 pagesEmployer GuideJoshua MangrooNo ratings yet

- Description: Tags: 2008LenSerOPADocument5 pagesDescription: Tags: 2008LenSerOPAanon-804606No ratings yet

- Description: Tags: GEN0511Attach2Document3 pagesDescription: Tags: GEN0511Attach2anon-315755No ratings yet

- Application Form A SchoolsDocument8 pagesApplication Form A SchoolsStAugustinesSchoolNo ratings yet

- RTPMST05081618Da FFL WE (1) Att Wireless LinkupDocument5 pagesRTPMST05081618Da FFL WE (1) Att Wireless LinkupTanya ParsonsNo ratings yet

- 5star Family Protection Plan: Term Life Insurance To Age 100 ApplicationDocument2 pages5star Family Protection Plan: Term Life Insurance To Age 100 Applicationimi_swimNo ratings yet

- Health Statement Form PDFDocument1 pageHealth Statement Form PDFAnonymous H1lWZBPQGzNo ratings yet

- CD 9600Document6 pagesCD 9600api-2812926660% (1)

- Test 1 AnswersDocument5 pagesTest 1 AnswersAditya sonawaneNo ratings yet

- Opt Out Affidavit Revision June 2015Document2 pagesOpt Out Affidavit Revision June 2015Association of American Physicians and SurgeonsNo ratings yet

- Anthem Dental Enrollment Enrollment Form 2014Document2 pagesAnthem Dental Enrollment Enrollment Form 2014Tanveer ShaikhNo ratings yet

- NLRC-Memorandum of Appeal (Yambao) - 10june2022Document8 pagesNLRC-Memorandum of Appeal (Yambao) - 10june2022Michael Anthony Del RosarioNo ratings yet

- In-School Deferment RequestDocument3 pagesIn-School Deferment RequestSirLockInBottomNo ratings yet

- Description: Tags: G02339eFINALSCHDocument2 pagesDescription: Tags: G02339eFINALSCHanon-461039No ratings yet

- Ethan and Joy ExpressDocument2 pagesEthan and Joy ExpressSamantha Nicole CarlotoNo ratings yet

- CMS L564e PDFDocument3 pagesCMS L564e PDFSponge BobNo ratings yet

- Description: Tags: GEN0304aDocument3 pagesDescription: Tags: GEN0304aanon-11358No ratings yet

- General ForbearanceDocument2 pagesGeneral Forbearancemyedaccount.orgNo ratings yet

- Request For Employment Information: What Is The Purpose of This Form? What Do I Do With The Form?Document3 pagesRequest For Employment Information: What Is The Purpose of This Form? What Do I Do With The Form?humejraNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Reading 11Document1 pageReading 11Olya NovakNo ratings yet

- National Service Training Program Service Learning ProgramDocument10 pagesNational Service Training Program Service Learning ProgramTiffany Nicole NavarroNo ratings yet

- Shrey Shah - 343 - Anil AgarwalDocument6 pagesShrey Shah - 343 - Anil Agarwalayesha shahNo ratings yet

- Social Welfare Administration CAT 2Document3 pagesSocial Welfare Administration CAT 2Ibrahim Mohamed IbrahimNo ratings yet

- Brgy Ordinancebcpc InstitutionalizationDocument5 pagesBrgy Ordinancebcpc InstitutionalizationAileen Labastida BarcenasNo ratings yet

- 20 Sawang Calero ML DarDocument20 pages20 Sawang Calero ML DarJube Kathreen ObidoNo ratings yet

- Letter To SSS-ECDocument10 pagesLetter To SSS-ECwebmaster crownpvcNo ratings yet

- NRT ID Card_compressedDocument2 pagesNRT ID Card_compressedஇராம் குமார்No ratings yet

- Affidavit of ConsentDocument1 pageAffidavit of ConsentAllan IgbuhayNo ratings yet

- WTW Appointment LetterDocument1 pageWTW Appointment LetterharshbrandoNo ratings yet

- UNSELFDocument1 pageUNSELFRallion RiveraNo ratings yet

- Poverty Incidence Infographics On The 2021 Official Poverty Statistics Among The Basic SectorsDocument1 pagePoverty Incidence Infographics On The 2021 Official Poverty Statistics Among The Basic Sectorsromaechiaraureta0506No ratings yet

- Cert de LeonDocument1 pageCert de LeonFelix John NuevaNo ratings yet

- PPSC Assistant Director Labour Past PaperDocument4 pagesPPSC Assistant Director Labour Past PaperKhadija QayyumNo ratings yet

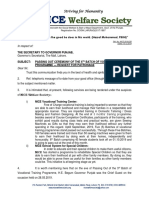

- Welfare Society: Striving For HumanityDocument2 pagesWelfare Society: Striving For HumanitytauqeerNo ratings yet

- Welfare Chapter 3Document17 pagesWelfare Chapter 3Archana RajNo ratings yet

- NAokPIX LGD API Consumer Guidelines v1.1Document1 pageNAokPIX LGD API Consumer Guidelines v1.1mihirmddNo ratings yet

- TrailsCarolinaLetter2 12 24 Docx12Document2 pagesTrailsCarolinaLetter2 12 24 Docx12kc wildmoonNo ratings yet

- Welfare StateDocument9 pagesWelfare StateteamumatteraismvNo ratings yet

- 2022 Consumer Quiz Mechanics For Grades 9-10 High School StudentsDocument3 pages2022 Consumer Quiz Mechanics For Grades 9-10 High School StudentsQuel EvangelistaNo ratings yet

- Motivation Letter Sample For Master in EconomicsDocument3 pagesMotivation Letter Sample For Master in Economicsنور هدىNo ratings yet

- Animal Welfare Board of India: Committees For Animals - Baby Viyana BerwalDocument4 pagesAnimal Welfare Board of India: Committees For Animals - Baby Viyana BerwalNaresh KadyanNo ratings yet

- Safeguarding Policy 2023Document5 pagesSafeguarding Policy 2023api-236191086No ratings yet

- Types of OrganizationDocument9 pagesTypes of OrganizationGerrel Lloyd DistrajoNo ratings yet

- Anti Mendicancy LawDocument4 pagesAnti Mendicancy LawKeemeeDasCuballes100% (1)

- SW7 Social Welfare Programs, Policies and ServicesDocument4 pagesSW7 Social Welfare Programs, Policies and Servicesmda31920No ratings yet

- Amit SAP103 Assessment 3Document10 pagesAmit SAP103 Assessment 3kimutaigeofry048No ratings yet

- Path BrochureDocument2 pagesPath BrochureMara veraNo ratings yet

- Staywell News, Issue 25, Autumn 2023Document4 pagesStaywell News, Issue 25, Autumn 2023anne.brenNo ratings yet

SOC332L

SOC332L

Uploaded by

Keri Hamner0 ratings0% found this document useful (0 votes)

17 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views4 pagesSOC332L

SOC332L

Uploaded by

Keri HamnerCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

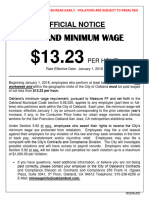

California Health & Human Services Agency California Department of Social Services

IN-HOME SUPPORTIVE SERVICES

RECIPIENT/EMPLOYER RESPONSIBILITY CHECKLIST

I, ______________________________ , HAVE BEEN INFORMED

BY MY SOCIAL WORKER THAT AS A RECIPIENT/EMPLOYER, I

AM RESPONSIBLE FOR THE ACTIVITIES LISTED BELOW.

1. Provide required documentation to my Social Worker

to determine continued eligibility and need for services.

Information to report includes, but is not limited to, changes to

my income, household composition, marital status, property

ownership, phone number, and time I am away from my home.

2. Find, hire, train, supervise, and fire the provider I employ.

3. Comply with laws and regulations relating to wages/hours/

working conditions and hiring of persons under age 18.

NOTE: Refer to Industrial Welfare Commission (IWC)

Order Number 15 regarding wages/hours/working conditions

obtainable from the State Department of Industrial Relations,

Division of Labor Standards and Enforcement listed in the

telephone book. Additional information regarding the hiring of

minors may be obtained by contacting your local school district.

4. Verify that my provider legally resides in the United States. My

provider and I will complete Form I-9. I will retain the I-9 for at

least three (3) years or one (1) year after employment ends,

which ever is longer. I will protect the provider’s confidential

information, such as his/her social security number, address,

and phone number.

SOC 332L (1/19) Page 1 of 4

California Health & Human Services Agency California Department of Social Services

5. Ensure standards of compensation, work scheduling, and

working conditions for my provider.

6. Inform my Social Worker of any future change in my

provider(s), including:

__ Name

__ Address

__ Telephone Number

__ Relationship to me, if any

__ Hours to be worked and services to be performed by each

provider

7. Inform my provider that the gross hourly rate of pay is

$______________, and that Social Security and State Disability

Insurance taxes are deducted from the provider’s wages.

8. Inform my provider that he/she may request that Federal

and/or State income taxes be deducted from his/her wages.

Instruct the provider to submit Form W-4 (for federal income

tax withholding) and/or Form DE 4 (for state income tax

withholding).

9. Inform my provider that he/she is covered by Workers’

Compensation, State Unemployment Insurance benefits, and

State Disability Insurance benefits.

10. Inform my provider that he/she will receive an information sheet

that will state my authorized services and the authorized time

given to perform those services. Payment will not be made for

any services not authorized.

SOC 332L (1/19) Page 2 of 4

California Health & Human Services Agency California Department of Social Services

11. Pay my share of cost, if any.

12. Ensure the total hours reported by each provider for services

provided to me while working for the IHSS program does not

exceed more than my total weekly authorized hours in one

workweek, unless I receive county approval for the increase.

13. Verify and sign my provider’s timesheet for each pay period,

showing the correct day(s) and the total number of hours

worked. I understand I can be prosecuted under Federal

and State laws for reporting false information or concealing

information.

14. Ensure my provider signed his/her timesheet.

15. Advise my provider to mail his/her signed timesheet to the

appropriate address at the end of each pay period.

Recipient’ Signature Date

Printed Name

SOC 332L (1/19) Page 3 of 4

California Health & Human Services Agency California Department of Social Services

INSTRUCTIONS FOR USE OF THE RECIPIENT/EMPLOYER

RESPONSIBILITY CHECKLIST

1. This form is used for review with recipients receiving service

from Individual Providers only.

2. Counties shall use this form to assure that recipients have

been advised of and understand their basic responsibilities as

employers of IHSS providers.

3. Review each item with the recipient and explain how the

recipient can comply with each requirement.

4. Leave a copy of the form with the recipient.

SOC 332L (1/19) Page 4 of 4

You might also like

- Consent and Declaration: For Online Income Support ApplicationsDocument3 pagesConsent and Declaration: For Online Income Support ApplicationsBrent Hladun0% (1)

- Adverse Action LettersDocument7 pagesAdverse Action LettersRobat Kooc100% (3)

- UCD35 Katrina ToyneDocument3 pagesUCD35 Katrina ToyneKatrinaNo ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- FW 10Document1 pageFW 10Florence Smith SlusarskiNo ratings yet

- Chapter 1 HomeworkDocument3 pagesChapter 1 Homeworkdustintaylor67467No ratings yet

- SOC426ADocument3 pagesSOC426AKeri HamnerNo ratings yet

- Distributor Application and AgreementDocument2 pagesDistributor Application and Agreementapi-300687941No ratings yet

- Official Seal or Stamp of Service/Employing Agency (If None, ADocument2 pagesOfficial Seal or Stamp of Service/Employing Agency (If None, Aมดน้อย ผู้น่ารักNo ratings yet

- Membership Update FormDocument4 pagesMembership Update FormbmapiraNo ratings yet

- NM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)Document7 pagesNM Self/Participant Direction Pre-Hire Packet: Criminal History Authorization For Release of Information (Required)ShellyJacksonNo ratings yet

- YMCA Childcare Resource Service Stage 1 Child Care: Parent Agreement IDocument1 pageYMCA Childcare Resource Service Stage 1 Child Care: Parent Agreement ITa Tien ThanhNo ratings yet

- Flex ClaimDocument2 pagesFlex ClaimDonna RobertsNo ratings yet

- std686 PDFDocument2 pagesstd686 PDFnmkeatonNo ratings yet

- Education Related DefermentDocument3 pagesEducation Related Defermentmyedaccount.orgNo ratings yet

- POEA Documents 2Document14 pagesPOEA Documents 2Win CeeNo ratings yet

- FAFDocument3 pagesFAFFritz PrejeanNo ratings yet

- Local Notices v8 9-20-2018Document13 pagesLocal Notices v8 9-20-2018Katherine EcheverriaNo ratings yet

- SOC 846 Provider Enrollment Agreement (Rev 10-2019) - ENDocument6 pagesSOC 846 Provider Enrollment Agreement (Rev 10-2019) - ENDoinita TaranNo ratings yet

- Wrapa Er Registration App 054147Document7 pagesWrapa Er Registration App 054147lekeadekayode1990No ratings yet

- 10 Steps To HiringDocument4 pages10 Steps To HiringjasoniohNo ratings yet

- Description: Tags: GEN0401Document4 pagesDescription: Tags: GEN0401anon-542677No ratings yet

- Uhip Claim Form July 2006-1-40Document1 pageUhip Claim Form July 2006-1-40CollinNo ratings yet

- Employee's Initials - Employer's InitialsDocument4 pagesEmployee's Initials - Employer's InitialsBenedict PabalanNo ratings yet

- Instructions For Volunteers and InternsDocument6 pagesInstructions For Volunteers and Internsapi-345593837No ratings yet

- Employment Contract - FormatDocument5 pagesEmployment Contract - Formatcarmina villarealNo ratings yet

- Take This Form With You If You Go To File A Claim Unemployment Compensation For Federal Employees (Ucfe) Program Notice To Federal Employee About Unemployment InsuranceDocument2 pagesTake This Form With You If You Go To File A Claim Unemployment Compensation For Federal Employees (Ucfe) Program Notice To Federal Employee About Unemployment InsuranceOky IkhramullahNo ratings yet

- STD Claim FormDocument8 pagesSTD Claim Formapi-314323052No ratings yet

- ConsentDocument3 pagesConsenttcrothers99No ratings yet

- Piw MouDocument3 pagesPiw Moujbentertainment00No ratings yet

- SOC426A Recipient Designation of ProviderDocument2 pagesSOC426A Recipient Designation of Providersri nanduNo ratings yet

- Phil Health ClaimForm GuidelinesDocument7 pagesPhil Health ClaimForm GuidelinesFerdinand CordovizNo ratings yet

- Safelink Enrollment FormDocument2 pagesSafelink Enrollment FormSet UpNo ratings yet

- Applicant Disclosure and Release For Consumer and Investigative Consumer ReportsDocument3 pagesApplicant Disclosure and Release For Consumer and Investigative Consumer Reportsmarcela batchanNo ratings yet

- Vacancy No 10-2016 Support Enforcement Specialistt CS-11Document3 pagesVacancy No 10-2016 Support Enforcement Specialistt CS-11Office on Latino Affairs (OLA)No ratings yet

- Labor Standards CASE DIGESTfor Midterms. 2014Document271 pagesLabor Standards CASE DIGESTfor Midterms. 2014puditz21No ratings yet

- CT OrrientationDocument35 pagesCT OrrientationDeo Montero OrquejoNo ratings yet

- Handbook On Workers' Compensation AND Occupational DiseasesDocument41 pagesHandbook On Workers' Compensation AND Occupational Diseases0micethornbNo ratings yet

- Background Release Form - Offer DocumentDocument9 pagesBackground Release Form - Offer DocumentLatasha wilson100% (1)

- Employer GuideDocument34 pagesEmployer GuideJoshua MangrooNo ratings yet

- Description: Tags: 2008LenSerOPADocument5 pagesDescription: Tags: 2008LenSerOPAanon-804606No ratings yet

- Description: Tags: GEN0511Attach2Document3 pagesDescription: Tags: GEN0511Attach2anon-315755No ratings yet

- Application Form A SchoolsDocument8 pagesApplication Form A SchoolsStAugustinesSchoolNo ratings yet

- RTPMST05081618Da FFL WE (1) Att Wireless LinkupDocument5 pagesRTPMST05081618Da FFL WE (1) Att Wireless LinkupTanya ParsonsNo ratings yet

- 5star Family Protection Plan: Term Life Insurance To Age 100 ApplicationDocument2 pages5star Family Protection Plan: Term Life Insurance To Age 100 Applicationimi_swimNo ratings yet

- Health Statement Form PDFDocument1 pageHealth Statement Form PDFAnonymous H1lWZBPQGzNo ratings yet

- CD 9600Document6 pagesCD 9600api-2812926660% (1)

- Test 1 AnswersDocument5 pagesTest 1 AnswersAditya sonawaneNo ratings yet

- Opt Out Affidavit Revision June 2015Document2 pagesOpt Out Affidavit Revision June 2015Association of American Physicians and SurgeonsNo ratings yet

- Anthem Dental Enrollment Enrollment Form 2014Document2 pagesAnthem Dental Enrollment Enrollment Form 2014Tanveer ShaikhNo ratings yet

- NLRC-Memorandum of Appeal (Yambao) - 10june2022Document8 pagesNLRC-Memorandum of Appeal (Yambao) - 10june2022Michael Anthony Del RosarioNo ratings yet

- In-School Deferment RequestDocument3 pagesIn-School Deferment RequestSirLockInBottomNo ratings yet

- Description: Tags: G02339eFINALSCHDocument2 pagesDescription: Tags: G02339eFINALSCHanon-461039No ratings yet

- Ethan and Joy ExpressDocument2 pagesEthan and Joy ExpressSamantha Nicole CarlotoNo ratings yet

- CMS L564e PDFDocument3 pagesCMS L564e PDFSponge BobNo ratings yet

- Description: Tags: GEN0304aDocument3 pagesDescription: Tags: GEN0304aanon-11358No ratings yet

- General ForbearanceDocument2 pagesGeneral Forbearancemyedaccount.orgNo ratings yet

- Request For Employment Information: What Is The Purpose of This Form? What Do I Do With The Form?Document3 pagesRequest For Employment Information: What Is The Purpose of This Form? What Do I Do With The Form?humejraNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Reading 11Document1 pageReading 11Olya NovakNo ratings yet

- National Service Training Program Service Learning ProgramDocument10 pagesNational Service Training Program Service Learning ProgramTiffany Nicole NavarroNo ratings yet

- Shrey Shah - 343 - Anil AgarwalDocument6 pagesShrey Shah - 343 - Anil Agarwalayesha shahNo ratings yet

- Social Welfare Administration CAT 2Document3 pagesSocial Welfare Administration CAT 2Ibrahim Mohamed IbrahimNo ratings yet

- Brgy Ordinancebcpc InstitutionalizationDocument5 pagesBrgy Ordinancebcpc InstitutionalizationAileen Labastida BarcenasNo ratings yet

- 20 Sawang Calero ML DarDocument20 pages20 Sawang Calero ML DarJube Kathreen ObidoNo ratings yet

- Letter To SSS-ECDocument10 pagesLetter To SSS-ECwebmaster crownpvcNo ratings yet

- NRT ID Card_compressedDocument2 pagesNRT ID Card_compressedஇராம் குமார்No ratings yet

- Affidavit of ConsentDocument1 pageAffidavit of ConsentAllan IgbuhayNo ratings yet

- WTW Appointment LetterDocument1 pageWTW Appointment LetterharshbrandoNo ratings yet

- UNSELFDocument1 pageUNSELFRallion RiveraNo ratings yet

- Poverty Incidence Infographics On The 2021 Official Poverty Statistics Among The Basic SectorsDocument1 pagePoverty Incidence Infographics On The 2021 Official Poverty Statistics Among The Basic Sectorsromaechiaraureta0506No ratings yet

- Cert de LeonDocument1 pageCert de LeonFelix John NuevaNo ratings yet

- PPSC Assistant Director Labour Past PaperDocument4 pagesPPSC Assistant Director Labour Past PaperKhadija QayyumNo ratings yet

- Welfare Society: Striving For HumanityDocument2 pagesWelfare Society: Striving For HumanitytauqeerNo ratings yet

- Welfare Chapter 3Document17 pagesWelfare Chapter 3Archana RajNo ratings yet

- NAokPIX LGD API Consumer Guidelines v1.1Document1 pageNAokPIX LGD API Consumer Guidelines v1.1mihirmddNo ratings yet

- TrailsCarolinaLetter2 12 24 Docx12Document2 pagesTrailsCarolinaLetter2 12 24 Docx12kc wildmoonNo ratings yet

- Welfare StateDocument9 pagesWelfare StateteamumatteraismvNo ratings yet

- 2022 Consumer Quiz Mechanics For Grades 9-10 High School StudentsDocument3 pages2022 Consumer Quiz Mechanics For Grades 9-10 High School StudentsQuel EvangelistaNo ratings yet

- Motivation Letter Sample For Master in EconomicsDocument3 pagesMotivation Letter Sample For Master in Economicsنور هدىNo ratings yet

- Animal Welfare Board of India: Committees For Animals - Baby Viyana BerwalDocument4 pagesAnimal Welfare Board of India: Committees For Animals - Baby Viyana BerwalNaresh KadyanNo ratings yet

- Safeguarding Policy 2023Document5 pagesSafeguarding Policy 2023api-236191086No ratings yet

- Types of OrganizationDocument9 pagesTypes of OrganizationGerrel Lloyd DistrajoNo ratings yet

- Anti Mendicancy LawDocument4 pagesAnti Mendicancy LawKeemeeDasCuballes100% (1)

- SW7 Social Welfare Programs, Policies and ServicesDocument4 pagesSW7 Social Welfare Programs, Policies and Servicesmda31920No ratings yet

- Amit SAP103 Assessment 3Document10 pagesAmit SAP103 Assessment 3kimutaigeofry048No ratings yet

- Path BrochureDocument2 pagesPath BrochureMara veraNo ratings yet

- Staywell News, Issue 25, Autumn 2023Document4 pagesStaywell News, Issue 25, Autumn 2023anne.brenNo ratings yet