Professional Documents

Culture Documents

Cost and Management Accounting-II (Acct.322)

Cost and Management Accounting-II (Acct.322)

Uploaded by

Dawit Amaha0 ratings0% found this document useful (0 votes)

17 views2 pagesOriginal Title

8. Cost and Management Accounting-II (Acct.322)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesCost and Management Accounting-II (Acct.322)

Cost and Management Accounting-II (Acct.322)

Uploaded by

Dawit AmahaCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

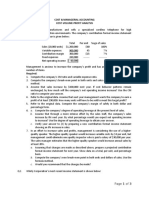

HARAMAYA UNIVERSITY

COLLEGE OF BUSINESS AND ECONOMICS

DEPARTMENT OF ACCOUNTING AND FINANCE

COURSE OUTLINE

Course code: AcFn. 3142 Pre-requisite: Acct. 3141

Course Title: COST AND MANAGEMENT Contact Hours per Semester: 45

ACCOUNTING-II

Credit Hours: 3

Prepared by: Mohammed A.

COURSE DESCRIPTION AND OBJECTIVE:

This course builds on the knowledge acquired from the course “Cost and Management

Accounting- I”, which was studied in the previous semester. It introduces some new concepts and

the use of Accounting tools and techniques in the analysis, planning and control of business

operations and in Management decision making processes. Topics to be covered in this course are

CVP analysis, Master budgets and Flexible budgets, Pricing decisions, Standard costing ,

variance analysis etc. The central focus of this course is to help key managers/other decision

makers to make better decisions by using different managerial tools in their business strategies.

Thus, this course enables the students to apply in actual practice these managerial tools, in a real

world business environment after their graduation.

COURSE CONTENTS:

Chapter-One: COST-VOLUME-PROFIT ANALYSIS

Cost-volume –profit assumptions and terminology

Essentials of CVP analysis

The break even point

Using CVP analysis for making decisions

Sensitivity analysis and uncertainty

Cost planning and CVP

Effect of sales mix on income

Chapter-Two: MASTER BUDGETS AND RESPONSIBILITY ACCOUNTING

Budgets and the budget cycles

Advantages of budgets

Types of budgets

Steps in developing operating budgets

Budgets and responsibility accounting

Responsibility and controllability

Chapter-Three: FLEXIBLE BUDGETS AND VARIANCE ANALYSIS

Static budget and variance

Flexible budget and Variance

Efficiency variance and price variance for input

Chapter-Four : RELEVANT PRICING AND THE DECISION-MAKING

The concept of relevance

Special order

Sell or process further

Deletion or addition of product, service or department

Make or Buy decision

Product mix under capacity constraint

Pricing decision

Chapter-Five: STANDARD COSTING AND VARIANCE ANALYSIS

Material variance

Labor Variance

Overhead Variance

Net manufacturing variance

Sales Variance

Assessment/ The evaluation scheme will be as follows:

Evaluation Test Test Test Case Analysis Assign Fina Total

1 2 3 ment 1 l

10 10 10 10% 10% 50% 100

% % % %

Ch. 1 Ch. Ch. 4 Ch. 5-7 Ch. 1-4 All Ch.

3

REFERENCES:

1. Hongreen,Foster,Datar, Cost Accounting a managerial Emphasis; 10th Ed.

2. Edmonds,Thay, Managerial accounting concepts, 2000

3. Dminiak,Louderbrack , Managerial Accounting, 8th Edition

4. Hilton, Maher, Selto, Cost Management, 2000

You might also like

- Managerial Accounting J 1 1Document519 pagesManagerial Accounting J 1 1rnobleNo ratings yet

- CVP Analyses of Iphone of AppleDocument8 pagesCVP Analyses of Iphone of Appleapi-371549367% (3)

- CVP AnalysisDocument19 pagesCVP Analysisdom baldemor67% (3)

- ACCT 2019 Lecture Notes: Week 1: Introduction To Management AccountingDocument16 pagesACCT 2019 Lecture Notes: Week 1: Introduction To Management AccountingRishabNo ratings yet

- Cost C OlDocument4 pagesCost C OlDawit AmahaNo ratings yet

- Cost Sheet-NEW FORMAT - RevisedDocument3 pagesCost Sheet-NEW FORMAT - RevisedJuhie GuptaNo ratings yet

- Co. OutlineDocument3 pagesCo. Outlineyiberta69No ratings yet

- Cost I Course OutlineDocument3 pagesCost I Course OutlineIliyas IsakeNo ratings yet

- CMA II Course OutlineDocument1 pageCMA II Course OutlineHussen AbdulkadirNo ratings yet

- Course Outline Dac 211Document3 pagesCourse Outline Dac 211raina mattNo ratings yet

- Rift Valley University Bale Robe Campus Department of Accounting and Finance Course OutlineDocument3 pagesRift Valley University Bale Robe Campus Department of Accounting and Finance Course OutlinebikilahussenNo ratings yet

- Cost Course OutlimeDocument3 pagesCost Course OutlimeUserNo ratings yet

- AC 217 - Cost Accounting and Control IIDocument3 pagesAC 217 - Cost Accounting and Control IIMOYO TAMUKANo ratings yet

- 1 Basics of CMADocument39 pages1 Basics of CMAkhushi shahNo ratings yet

- MGT 319Document6 pagesMGT 319Ali Akbar MalikNo ratings yet

- Managerial Accounting Module DescriptorDocument4 pagesManagerial Accounting Module Descriptorవెంకటరమణయ్య మాలెపాటిNo ratings yet

- Management AccountingDocument5 pagesManagement AccountingAtulya JhaNo ratings yet

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDocument4 pagesCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNo ratings yet

- Strategic Cost ManagementDocument3 pagesStrategic Cost ManagementShubakar ReddyNo ratings yet

- MA2 Student SyllabusDocument5 pagesMA2 Student SyllabusNaaNo ratings yet

- Managerial Accounting BBA 2 Years OutlineDocument6 pagesManagerial Accounting BBA 2 Years OutlinemehwishNo ratings yet

- Cost Accounting - Course Study Guide. (Repaired)Document9 pagesCost Accounting - Course Study Guide. (Repaired)syed Hassan100% (1)

- Core BBADocument195 pagesCore BBAMohammed MubeenNo ratings yet

- BFC 5175 Management Accounting NotesDocument94 pagesBFC 5175 Management Accounting NotescyrusNo ratings yet

- BFC 5175 Management Accounting NotesDocument101 pagesBFC 5175 Management Accounting NotesOtim Martin LutherNo ratings yet

- Course OutlineDocument3 pagesCourse OutlineRavi KumarNo ratings yet

- Ma PDFDocument4 pagesMa PDFShubham SinghNo ratings yet

- Unit I-III Cost PDFDocument83 pagesUnit I-III Cost PDFRupak ChandnaNo ratings yet

- Management Accounting PDFDocument6 pagesManagement Accounting PDFSukalp MittalNo ratings yet

- Bac 205 Aeb 403 M.A Course OutlineDocument2 pagesBac 205 Aeb 403 M.A Course OutlineKelvin mwaiNo ratings yet

- Cost-1 Course OutlineDocument2 pagesCost-1 Course OutlineHussen AbdulkadirNo ratings yet

- Cost I Course OutlineDocument2 pagesCost I Course OutlinemathewosNo ratings yet

- BAC302 - 04 Advanced Cost and Management Accounting With Integrated Case StudyDocument2 pagesBAC302 - 04 Advanced Cost and Management Accounting With Integrated Case StudyldlNo ratings yet

- Queens' University College School of Gradutate Studies Badm 682: Accounting and Finance For Managers Credit Hours: 2 Pre-Requisite: NoneDocument3 pagesQueens' University College School of Gradutate Studies Badm 682: Accounting and Finance For Managers Credit Hours: 2 Pre-Requisite: NoneAgatNo ratings yet

- H11FMDocument9 pagesH11FMsimlaislamNo ratings yet

- Acctg 202 - Module 1 - Strategic Cost ManagementDocument47 pagesAcctg 202 - Module 1 - Strategic Cost ManagementMaureen Kaye PaloNo ratings yet

- Sem2 Core SyllabusDocument19 pagesSem2 Core SyllabusNIMISHA DHAWANNo ratings yet

- MADM Course Outline 2020 - 21 - v2Document6 pagesMADM Course Outline 2020 - 21 - v2KaranNo ratings yet

- Course Outllin MA English Final - Docx2021Document3 pagesCourse Outllin MA English Final - Docx2021islam hamdyNo ratings yet

- Syllabus AML Gasal 21 22Document6 pagesSyllabus AML Gasal 21 22Lia AmeliaNo ratings yet

- BFIA 2nd SEM COREDocument6 pagesBFIA 2nd SEM COREChetan SinghNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- Advanced Cost and MGMT ControlDocument4 pagesAdvanced Cost and MGMT ControlGetachew Mulu100% (1)

- Cost and Management Accounting IIDocument3 pagesCost and Management Accounting IIfirewNo ratings yet

- Public Finance ReadingDocument241 pagesPublic Finance ReadingTushar Rana100% (1)

- AMA SyllabusDocument3 pagesAMA SyllabusneerzaNo ratings yet

- Cost Acct I-ShegerDocument191 pagesCost Acct I-Shegerwendmagegn.gebremeskelNo ratings yet

- Course Outline Managment AccountingDocument2 pagesCourse Outline Managment Accountingbakhtawar soniaNo ratings yet

- ACC350 Outline FinalDocument12 pagesACC350 Outline FinalHamza AsifNo ratings yet

- Financial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesDocument38 pagesFinancial Management For Decision Making: Marian G. Magcalas Ishmael Y. ReyesJordan Mathew Alcaide MalapayaNo ratings yet

- Cost & MGMT Acct I - ModuleDocument213 pagesCost & MGMT Acct I - ModuleBereket DesalegnNo ratings yet

- Ethiopia Adventist CollegeDocument3 pagesEthiopia Adventist CollegeSamuel DebebeNo ratings yet

- Cost Accounting PDFDocument261 pagesCost Accounting PDFRaksha Sharma100% (1)

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- AG920 MA Outline May 2019Document2 pagesAG920 MA Outline May 2019Tono IndraNo ratings yet

- Basa Mikhaella BM1 A1 Aec101 Final OutputDocument19 pagesBasa Mikhaella BM1 A1 Aec101 Final OutputMikha Ella BasaNo ratings yet

- Responsibility Accounting Reporting 111212Document18 pagesResponsibility Accounting Reporting 111212gopi krishnaNo ratings yet

- Course Outline Standard-Cost & Manageraial Acc IIDocument4 pagesCourse Outline Standard-Cost & Manageraial Acc IIsubeyr963No ratings yet

- Course Outline Managerial AccountingDocument5 pagesCourse Outline Managerial AccountingShobha SheikhNo ratings yet

- Acte 2301: Cost Accounting: Course DescriptionDocument2 pagesActe 2301: Cost Accounting: Course DescriptionkmillatNo ratings yet

- BBA 3rd Semester Syllabus 2023Document17 pagesBBA 3rd Semester Syllabus 2023chaurasiya6369No ratings yet

- Advanced Financial Statement AnalysisDocument6 pagesAdvanced Financial Statement AnalysisIshan PandeyNo ratings yet

- Mbcii 5 Cost Accounting 2019Document115 pagesMbcii 5 Cost Accounting 2019Kanchan Mishra100% (1)

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsFrom EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNo ratings yet

- Chap 5 (Cost II)Document6 pagesChap 5 (Cost II)Dawit AmahaNo ratings yet

- Decision Making NewDocument11 pagesDecision Making NewDawit AmahaNo ratings yet

- Budget Matterial For The Students NewDocument14 pagesBudget Matterial For The Students NewDawit AmahaNo ratings yet

- Sells or Process FurtherDocument1 pageSells or Process FurtherDawit AmahaNo ratings yet

- Detailed Variance AnalysisDocument6 pagesDetailed Variance AnalysisDawit AmahaNo ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- DecentralizationDocument2 pagesDecentralizationDawit AmahaNo ratings yet

- CVP New + LastDocument19 pagesCVP New + LastDawit AmahaNo ratings yet

- Pricing Decisions (Theory)Document4 pagesPricing Decisions (Theory)Dawit AmahaNo ratings yet

- Standards For Material and LaborDocument1 pageStandards For Material and LaborDawit AmahaNo ratings yet

- Capital Expenditures BudgetDocument4 pagesCapital Expenditures BudgetDawit AmahaNo ratings yet

- Overhead NewDocument5 pagesOverhead NewDawit AmahaNo ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- Chapter 3 Business CombinationDocument13 pagesChapter 3 Business CombinationDawit AmahaNo ratings yet

- Decision Making NewDocument10 pagesDecision Making NewDawit AmahaNo ratings yet

- Chap 5 (Cost II)Document6 pagesChap 5 (Cost II)Dawit AmahaNo ratings yet

- Chapter 2 InstallmentDocument21 pagesChapter 2 InstallmentDawit AmahaNo ratings yet

- Advanced Financial Accounting I Three Accounting For Biological AssetsDocument33 pagesAdvanced Financial Accounting I Three Accounting For Biological AssetsDawit AmahaNo ratings yet

- Chapter One: Accounting For Agency &principal, Branch &head OfficeDocument25 pagesChapter One: Accounting For Agency &principal, Branch &head OfficeDawit Amaha0% (1)

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Document3 pagesCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- CVP Part2Document24 pagesCVP Part2licamygNo ratings yet

- COST - VOLUME-PROFIT AnalysisDocument17 pagesCOST - VOLUME-PROFIT Analysisasa ravenNo ratings yet

- BAB 2024 CH05 - Cost Volume Profit AnalysisDocument76 pagesBAB 2024 CH05 - Cost Volume Profit Analysismini3110No ratings yet

- Short NotesDocument20 pagesShort NotesMd AlimNo ratings yet

- CVP Analysis - Jan18Document23 pagesCVP Analysis - Jan18Jobert DiliNo ratings yet

- Sample Contemporary Accounting A Strategic Approach For Users 9th 9E-2 PDFDocument38 pagesSample Contemporary Accounting A Strategic Approach For Users 9th 9E-2 PDFWilliam Pinto0% (1)

- Math Accounting by AtaurDocument28 pagesMath Accounting by AtaurShajib KhanNo ratings yet

- Quiz On CVP AnalysisDocument9 pagesQuiz On CVP AnalysisRodolfo ManalacNo ratings yet

- Accounting ProblemDocument27 pagesAccounting ProblemLeo TamaNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMatinChris KisomboNo ratings yet

- Cost Behavior CVP Analysis Break Even Point Quali ReviewDocument3 pagesCost Behavior CVP Analysis Break Even Point Quali ReviewRoisu De KuriNo ratings yet

- Lec 2Document48 pagesLec 2Fernando Miguel De StefanoNo ratings yet

- Mas 9302 CVP Be AnalysisDocument24 pagesMas 9302 CVP Be AnalysisJowel BernabeNo ratings yet

- Ms 3Document6 pagesMs 3KIM RAGANo ratings yet

- CVP AnalysisDocument20 pagesCVP AnalysisKopanang LeokanaNo ratings yet

- Chapter Seven: Cost-Volume-Profit AnalysisDocument48 pagesChapter Seven: Cost-Volume-Profit AnalysisNoni PcyNo ratings yet

- Cost-Volume-Profit and Breakeven AnalysisDocument36 pagesCost-Volume-Profit and Breakeven AnalysisJosartNo ratings yet

- Managerial Accounting Tools For Business Decision Making 7th Edition Weygandt Solutions Manual 1Document42 pagesManagerial Accounting Tools For Business Decision Making 7th Edition Weygandt Solutions Manual 1dorothy100% (50)

- CVP AnalysisDocument2 pagesCVP Analysissakura harunoNo ratings yet

- Cost Accounting A Managerial Emphasis Canadian 15th Edition Horngren Test BankDocument7 pagesCost Accounting A Managerial Emphasis Canadian 15th Edition Horngren Test Bankatwovarusbbn8d97% (31)

- Bobadilla Reviewer MASDocument3 pagesBobadilla Reviewer MASMae CruzNo ratings yet

- MasterbudgetDocument154 pagesMasterbudgetrochielanciolaNo ratings yet

- Bbap2103 Akaun PengurusanDocument10 pagesBbap2103 Akaun PengurusanEima AbdullahNo ratings yet

- CVP Hotel Royal Century Chapter I, II and IIIDocument27 pagesCVP Hotel Royal Century Chapter I, II and IIIMADHU KHANALNo ratings yet

- Cost Volume Profit AnalysisDocument25 pagesCost Volume Profit Analysisnicole bancoro100% (1)