Professional Documents

Culture Documents

Updated Roi 15.05.2024 To 30.06.2024

Updated Roi 15.05.2024 To 30.06.2024

Uploaded by

Divya MaheshCopyright:

Available Formats

You might also like

- Bangladesh Bank Circular - FinalDocument2 pagesBangladesh Bank Circular - Finalmaka007No ratings yet

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- P Seg Interest Rate From 15.12.2022Document2 pagesP Seg Interest Rate From 15.12.2022amitNo ratings yet

- P Seg Int Rate As On 15.06.2022Document2 pagesP Seg Int Rate As On 15.06.2022Devanathan HbkNo ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- RBI Format ROI PCDocument8 pagesRBI Format ROI PCom vermaNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Rbi Format Roi PCDocument10 pagesRbi Format Roi PCsriramNo ratings yet

- RBI Format ROI PDocument8 pagesRBI Format ROI PSrikanth ReddyNo ratings yet

- PMAY-LIC Housing Finance LimitedDocument6 pagesPMAY-LIC Housing Finance Limitedamir sohailNo ratings yet

- RBI Format ROI PCDocument6 pagesRBI Format ROI PCSandesh ManeNo ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- Trust Deposit Jan09Document5 pagesTrust Deposit Jan09mayurdjNo ratings yet

- RBI Format ROI PC PDFDocument9 pagesRBI Format ROI PC PDFmohana sundaram pNo ratings yet

- Rbi Format Roi PCDocument11 pagesRbi Format Roi PCSumeet TripathiNo ratings yet

- Festive Campaign OfferDocument2 pagesFestive Campaign OfferShubhaNo ratings yet

- About LichflDocument17 pagesAbout LichflHyma KavyaNo ratings yet

- BASKET OF PRODUCTS As On 21.11.19Document3 pagesBASKET OF PRODUCTS As On 21.11.19Virendra K VermaNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- January ExpatDocument5 pagesJanuary ExpatjawadkaNo ratings yet

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDocument7 pagesNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinNo ratings yet

- Housing Loan DetailsDocument9 pagesHousing Loan DetailsPandurangbaligaNo ratings yet

- PNB Loan Interest Rate 04 - 08 - 2021Document9 pagesPNB Loan Interest Rate 04 - 08 - 2021Somasundaram MuthiahNo ratings yet

- Pravasimithram October 2020Document6 pagesPravasimithram October 2020sumesh etsNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI OnretaillendingschemesSaran ManiNo ratings yet

- Ivrcl LTD: Business/Credit Profile - Akhil PawarDocument10 pagesIvrcl LTD: Business/Credit Profile - Akhil PawarKintali VinodNo ratings yet

- Bidvest Investment AccountsDocument1 pageBidvest Investment Accountsshaunvdm777No ratings yet

- SBICAP Sec - India Property - Initiating Coverage-Errclub - Buy For The Cash Flow, Not A Story!Document38 pagesSBICAP Sec - India Property - Initiating Coverage-Errclub - Buy For The Cash Flow, Not A Story!giridesh3No ratings yet

- Sbi Loan DataDocument1 pageSbi Loan DataWHITE DEVILNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- Tax Rates 2009-10Document2 pagesTax Rates 2009-10Mansoor AhmadNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Maha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreDocument2 pagesMaha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreRohith RaoNo ratings yet

- 250123-Festive Campaign Offer Wef 26.01.2023Document2 pages250123-Festive Campaign Offer Wef 26.01.2023CyrilRithikaNo ratings yet

- Soc 2018 (Finall)Document15 pagesSoc 2018 (Finall)Engr Hafiz Qasim AliNo ratings yet

- 061022-Festive Campaign OfferDocument2 pages061022-Festive Campaign OfferDhanush ENo ratings yet

- HL Onepager Revised 05042024Document2 pagesHL Onepager Revised 05042024abhista varmaNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- Latepayment BFL 1222Document1 pageLatepayment BFL 1222Junaid ShaikNo ratings yet

- Campaign OfferDocument2 pagesCampaign OfferAkhilNo ratings yet

- Llpa-Matrix Updated 05-17-23Document9 pagesLlpa-Matrix Updated 05-17-23David GNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- Educative Series LAPDocument2 pagesEducative Series LAPRohith RaoNo ratings yet

- New Salary Structure - Apr 2024Document2 pagesNew Salary Structure - Apr 2024Mani Shankar RajanNo ratings yet

- Retail Rate of Interest Updated 15122022Document10 pagesRetail Rate of Interest Updated 15122022srikarNo ratings yet

- Session 12. Capital Structure Decisions Part IDocument21 pagesSession 12. Capital Structure Decisions Part IKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- GAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseDocument5 pagesGAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseTACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- HDFC FD Form For IndividualDocument4 pagesHDFC FD Form For IndividualAmeet ChandanNo ratings yet

- Charges Home NewDocument3 pagesCharges Home Newkirubaharan2022No ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- LOANRATEOFINTERESTDocument10 pagesLOANRATEOFINTERESTgaurav singhNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesAnirudh SharmaNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- SMIF Annual Report 2010-2011Document40 pagesSMIF Annual Report 2010-2011CelticAcesNo ratings yet

- Basic Principles of Demand and SupplyDocument9 pagesBasic Principles of Demand and Supplyna2than-1No ratings yet

- FSC-STD-40-007 V2-0 EN Sourcing Reclaimed MaterialsDocument11 pagesFSC-STD-40-007 V2-0 EN Sourcing Reclaimed MaterialsDodi M HendrawanNo ratings yet

- Instruments Payable at A Bank PDFDocument2 pagesInstruments Payable at A Bank PDFAlondra Joan MararacNo ratings yet

- C1 - Cash and Cash EquivalentsDocument8 pagesC1 - Cash and Cash EquivalentsJcMCariñoNo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- H2 Economics 9757 Paper 1 - Answer - MSDocument20 pagesH2 Economics 9757 Paper 1 - Answer - MSAmanda GohNo ratings yet

- Overview of The Local EconomyDocument45 pagesOverview of The Local Economyabdulkadir55No ratings yet

- Supply Chain Management 1Document26 pagesSupply Chain Management 1taraka krishna kishoreNo ratings yet

- EVIDENCIA 2 Cafe SenaDocument5 pagesEVIDENCIA 2 Cafe SenaDayana AmaroNo ratings yet

- A Consolidated Balance SheetDocument1 pageA Consolidated Balance SheetSagar YadavNo ratings yet

- Watkins Spring Discussion GuideDocument2 pagesWatkins Spring Discussion Guideapi-594514169No ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- Usdaw Activist 106Document3 pagesUsdaw Activist 106USDAWactivistNo ratings yet

- Af201 Revision Package s1, 2021Document4 pagesAf201 Revision Package s1, 2021Rachna ChandNo ratings yet

- PLC & StrategiesDocument32 pagesPLC & StrategiesarushaNo ratings yet

- Corporate Board ResolutionDocument2 pagesCorporate Board ResolutionkimitiNo ratings yet

- Electronic Ticket Receipt, August 17 For MR MOHAMED SAAD MOHAMEDDocument2 pagesElectronic Ticket Receipt, August 17 For MR MOHAMED SAAD MOHAMEDMohamed SaadNo ratings yet

- FSOC Crypto Letter 07.26.2021Document4 pagesFSOC Crypto Letter 07.26.2021ForkLogNo ratings yet

- Hassellhouf Company S Trial Balance at December 31 2015 Is PresentedDocument1 pageHassellhouf Company S Trial Balance at December 31 2015 Is Presentedtrilocksp SinghNo ratings yet

- Cost Concepts Exercises With AnswersDocument7 pagesCost Concepts Exercises With AnswersBRYLL RODEL PONTINONo ratings yet

- Industy AnalysisDocument5 pagesIndusty AnalysisAlif HaqNo ratings yet

- Fa2 BPP Kit 2019Document209 pagesFa2 BPP Kit 2019Zubair RafiqueNo ratings yet

- Mining-Climate Change CrisisDocument13 pagesMining-Climate Change Crisistom villarinNo ratings yet

- Circular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Document3 pagesCircular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Attorney III DOH CHDNo ratings yet

- Sarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Document6 pagesSarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Samir ShaikhNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet

Updated Roi 15.05.2024 To 30.06.2024

Updated Roi 15.05.2024 To 30.06.2024

Uploaded by

Divya MaheshOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Updated Roi 15.05.2024 To 30.06.2024

Updated Roi 15.05.2024 To 30.06.2024

Uploaded by

Divya MaheshCopyright:

Available Formats

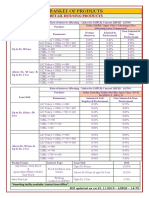

RETAIL LOANS INTEREST RATES UPDATED w.e.f.15.05.2024 to 30.06.

2024

RATE OF INTEREST ON VARIOUS RETAIL LOANS (BASED ON CREDIT VISION SCORE) LINKED WITH BRLLR

BRLLR (w.e.f. 09.02.2023) : 9.15 % Strategic premium (SP) : 0.25%

(Current RBI Repo Rate : 6.50% + Mark Up 2.65%) Restructure Spread : 0.35%

BARODA HOME LOAN & RELATED PRODUCTS

For Salaried & Non-Salaried

CIBIL CUT OFF SCORE (loan amount : 15 lakhs & above)

ROI*

800 and above 8.40%

771 to 799 8.60%

751 to 770 8.60%

726 to 750 8.85%

701 to 725 9.50%

Less than 701 10.60%

-1 9.05%

Baroda Top Up Loan/Overdraft Applicable ROI on linked home loan (based on BRLLR on

the date of availment of top up loan) + SP + 0.60%.

BARODA HOME LOAN ADVANTAGE PRODUCT (For further benefit of interest amount reduction in the Home Loan

account to the extent of daily outstanding credit balance in saving account.)

Upto 75 lakhs ROI As applicable to Baroda Home Loan

Above 75 lakhs ROI As applicable to Baroda Home Loan + 0.25%

BARODA YODDHA HOME LOAN – (For Indian Armed Forces and Indian Central Forces)

CIBIL CUT OFF SCORE For Salaried & Non-Salaried

(loan amount : 15 lakhs & above)

800 and above 8.40%

771 to 799 8.60%

751 to 770 8.60%

726 to 750 8.85%

701 to 725 9.50%

Less than 701 10.50%

-1 9.05%

Baroda Yoddha Top Up Loan Applicable ROI on linked home loan + SP + 0.60%

Baroda Yoddha Home Loan Advantage Upto 75 Lakh – ROI as applicable to Baroda Yoddha HL

Above 75 Lakh – ROI as applicable to Baroda Yoddha HL +

0.25%

BARODA HOME LOAN SCHEME for Central/State Govt. /PSU employees

CIBIL cut off Score For Salaried & Non-Salaried

(loan amount : 15 lakhs & above)

800 and above 8.40%

771 to 799 8.60%

751 to 770 8.60%

726 to 750 8.85%

701 to 725 9.50%

Less than 701 10.50%

-1 9.05%

Baroda Top Up Loan to Govt. employees Applicable ROI on linked home loan (based on BRLLR on

the date of availment of top up loan) + SP + 0.60%.

Upto 75 lakhs ROI As applicable to Baroda HL to Govt. Employee

Above 75 lakhs ROI As applicable to Baroda HL to Govt. Employee+ 0.25%

The above mentioned concessional ROI under “Baroda Home Loan to government employees” will be available only if

Salary Account is with Bank of Baroda. In case salary accounts is with other bank, concession will be available from

the date of credit of salary in Saving Bank (Salary) A/c with Bank of Baroda. Further, if Salary Account is transferred to

other bank, then concession will be withdrawn from that date.

*Risk Premium @ 0.05% over above rates will be applicable as per extant guidelines for customers not obtaining

credit insurance cover.

**Applicable from 14.05.2024 for home loan accounts sanctioned upto 30.06.2024 and disbursed upto 10.07.2024

You might also like

- Bangladesh Bank Circular - FinalDocument2 pagesBangladesh Bank Circular - Finalmaka007No ratings yet

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- P Seg Interest Rate From 15.12.2022Document2 pagesP Seg Interest Rate From 15.12.2022amitNo ratings yet

- P Seg Int Rate As On 15.06.2022Document2 pagesP Seg Int Rate As On 15.06.2022Devanathan HbkNo ratings yet

- Rate of InterestDocument9 pagesRate of InterestUdaydeep SinghNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- RBI Format ROI PCDocument8 pagesRBI Format ROI PCom vermaNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Rbi Format Roi PCDocument10 pagesRbi Format Roi PCsriramNo ratings yet

- RBI Format ROI PDocument8 pagesRBI Format ROI PSrikanth ReddyNo ratings yet

- PMAY-LIC Housing Finance LimitedDocument6 pagesPMAY-LIC Housing Finance Limitedamir sohailNo ratings yet

- RBI Format ROI PCDocument6 pagesRBI Format ROI PCSandesh ManeNo ratings yet

- RBI ROI FormatDocument8 pagesRBI ROI Formatsrinivas.rmbaNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatDevender RajuNo ratings yet

- Trust Deposit Jan09Document5 pagesTrust Deposit Jan09mayurdjNo ratings yet

- RBI Format ROI PC PDFDocument9 pagesRBI Format ROI PC PDFmohana sundaram pNo ratings yet

- Rbi Format Roi PCDocument11 pagesRbi Format Roi PCSumeet TripathiNo ratings yet

- Festive Campaign OfferDocument2 pagesFestive Campaign OfferShubhaNo ratings yet

- About LichflDocument17 pagesAbout LichflHyma KavyaNo ratings yet

- BASKET OF PRODUCTS As On 21.11.19Document3 pagesBASKET OF PRODUCTS As On 21.11.19Virendra K VermaNo ratings yet

- Bank Loan OffersDocument11 pagesBank Loan OffersAnandNo ratings yet

- January ExpatDocument5 pagesJanuary ExpatjawadkaNo ratings yet

- NRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationDocument7 pagesNRI News Letter From SBI Thiruvananthapuram Circle : E Turning Indian TaxationSherinWorinNo ratings yet

- Housing Loan DetailsDocument9 pagesHousing Loan DetailsPandurangbaligaNo ratings yet

- PNB Loan Interest Rate 04 - 08 - 2021Document9 pagesPNB Loan Interest Rate 04 - 08 - 2021Somasundaram MuthiahNo ratings yet

- Pravasimithram October 2020Document6 pagesPravasimithram October 2020sumesh etsNo ratings yet

- ROI OnretaillendingschemesDocument8 pagesROI OnretaillendingschemesSaran ManiNo ratings yet

- Ivrcl LTD: Business/Credit Profile - Akhil PawarDocument10 pagesIvrcl LTD: Business/Credit Profile - Akhil PawarKintali VinodNo ratings yet

- Bidvest Investment AccountsDocument1 pageBidvest Investment Accountsshaunvdm777No ratings yet

- SBICAP Sec - India Property - Initiating Coverage-Errclub - Buy For The Cash Flow, Not A Story!Document38 pagesSBICAP Sec - India Property - Initiating Coverage-Errclub - Buy For The Cash Flow, Not A Story!giridesh3No ratings yet

- Sbi Loan DataDocument1 pageSbi Loan DataWHITE DEVILNo ratings yet

- Administrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008Document3 pagesAdministrative Office: ' Mahaveer ', Shree Shahu Market Yard, Kolhapur - 416 008gmatweakNo ratings yet

- SOC AssetsDocument2 pagesSOC AssetsptsmithrafoundationNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- Tax Rates 2009-10Document2 pagesTax Rates 2009-10Mansoor AhmadNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Maha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreDocument2 pagesMaha Super Housing Loan: Rate of Interest : Starting From 8.00%, Linked With Cibil ScoreRohith RaoNo ratings yet

- 250123-Festive Campaign Offer Wef 26.01.2023Document2 pages250123-Festive Campaign Offer Wef 26.01.2023CyrilRithikaNo ratings yet

- Soc 2018 (Finall)Document15 pagesSoc 2018 (Finall)Engr Hafiz Qasim AliNo ratings yet

- 061022-Festive Campaign OfferDocument2 pages061022-Festive Campaign OfferDhanush ENo ratings yet

- HL Onepager Revised 05042024Document2 pagesHL Onepager Revised 05042024abhista varmaNo ratings yet

- IBS Session 1 With SolutionDocument16 pagesIBS Session 1 With SolutionMOHD SHARIQUE ZAMANo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet

- Latepayment BFL 1222Document1 pageLatepayment BFL 1222Junaid ShaikNo ratings yet

- Campaign OfferDocument2 pagesCampaign OfferAkhilNo ratings yet

- Llpa-Matrix Updated 05-17-23Document9 pagesLlpa-Matrix Updated 05-17-23David GNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- Educative Series LAPDocument2 pagesEducative Series LAPRohith RaoNo ratings yet

- New Salary Structure - Apr 2024Document2 pagesNew Salary Structure - Apr 2024Mani Shankar RajanNo ratings yet

- Retail Rate of Interest Updated 15122022Document10 pagesRetail Rate of Interest Updated 15122022srikarNo ratings yet

- Session 12. Capital Structure Decisions Part IDocument21 pagesSession 12. Capital Structure Decisions Part IKAVYA GOYAL PGP 2021-23 BatchNo ratings yet

- The Jammu & Kashmir Bank LTD: AccountDocument5 pagesThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçNo ratings yet

- GAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseDocument5 pagesGAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseTACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- HDFC FD Form For IndividualDocument4 pagesHDFC FD Form For IndividualAmeet ChandanNo ratings yet

- Charges Home NewDocument3 pagesCharges Home Newkirubaharan2022No ratings yet

- Personal Loan - Governement emDocument2 pagesPersonal Loan - Governement emrajesh.dhawan74No ratings yet

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- LOANRATEOFINTERESTDocument10 pagesLOANRATEOFINTERESTgaurav singhNo ratings yet

- ROI OnretaillendingschemesDocument9 pagesROI OnretaillendingschemesAnirudh SharmaNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- SMIF Annual Report 2010-2011Document40 pagesSMIF Annual Report 2010-2011CelticAcesNo ratings yet

- Basic Principles of Demand and SupplyDocument9 pagesBasic Principles of Demand and Supplyna2than-1No ratings yet

- FSC-STD-40-007 V2-0 EN Sourcing Reclaimed MaterialsDocument11 pagesFSC-STD-40-007 V2-0 EN Sourcing Reclaimed MaterialsDodi M HendrawanNo ratings yet

- Instruments Payable at A Bank PDFDocument2 pagesInstruments Payable at A Bank PDFAlondra Joan MararacNo ratings yet

- C1 - Cash and Cash EquivalentsDocument8 pagesC1 - Cash and Cash EquivalentsJcMCariñoNo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- H2 Economics 9757 Paper 1 - Answer - MSDocument20 pagesH2 Economics 9757 Paper 1 - Answer - MSAmanda GohNo ratings yet

- Overview of The Local EconomyDocument45 pagesOverview of The Local Economyabdulkadir55No ratings yet

- Supply Chain Management 1Document26 pagesSupply Chain Management 1taraka krishna kishoreNo ratings yet

- EVIDENCIA 2 Cafe SenaDocument5 pagesEVIDENCIA 2 Cafe SenaDayana AmaroNo ratings yet

- A Consolidated Balance SheetDocument1 pageA Consolidated Balance SheetSagar YadavNo ratings yet

- Watkins Spring Discussion GuideDocument2 pagesWatkins Spring Discussion Guideapi-594514169No ratings yet

- Solved Paper I - 2021Document41 pagesSolved Paper I - 2021Eswar AnaparthiNo ratings yet

- Usdaw Activist 106Document3 pagesUsdaw Activist 106USDAWactivistNo ratings yet

- Af201 Revision Package s1, 2021Document4 pagesAf201 Revision Package s1, 2021Rachna ChandNo ratings yet

- PLC & StrategiesDocument32 pagesPLC & StrategiesarushaNo ratings yet

- Corporate Board ResolutionDocument2 pagesCorporate Board ResolutionkimitiNo ratings yet

- Electronic Ticket Receipt, August 17 For MR MOHAMED SAAD MOHAMEDDocument2 pagesElectronic Ticket Receipt, August 17 For MR MOHAMED SAAD MOHAMEDMohamed SaadNo ratings yet

- FSOC Crypto Letter 07.26.2021Document4 pagesFSOC Crypto Letter 07.26.2021ForkLogNo ratings yet

- Hassellhouf Company S Trial Balance at December 31 2015 Is PresentedDocument1 pageHassellhouf Company S Trial Balance at December 31 2015 Is Presentedtrilocksp SinghNo ratings yet

- Cost Concepts Exercises With AnswersDocument7 pagesCost Concepts Exercises With AnswersBRYLL RODEL PONTINONo ratings yet

- Industy AnalysisDocument5 pagesIndusty AnalysisAlif HaqNo ratings yet

- Fa2 BPP Kit 2019Document209 pagesFa2 BPP Kit 2019Zubair RafiqueNo ratings yet

- Mining-Climate Change CrisisDocument13 pagesMining-Climate Change Crisistom villarinNo ratings yet

- Circular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Document3 pagesCircular No. 444 - Amendments To Pag-IBIG Fund Circular No. 388Attorney III DOH CHDNo ratings yet

- Sarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Document6 pagesSarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Samir ShaikhNo ratings yet

- Economic Turbulence in GreeceDocument9 pagesEconomic Turbulence in GreeceSatish BindumadhavanNo ratings yet