Professional Documents

Culture Documents

The Future of Digital Payments

The Future of Digital Payments

Uploaded by

suneel66229Copyright:

Available Formats

You might also like

- NCB Deposit SlipDocument2 pagesNCB Deposit Slipgeeman97870% (1)

- Report & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Document15 pagesReport & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Ario Wibisono100% (1)

- Looking Forward To 2030Document3 pagesLooking Forward To 2030quynhanhNo ratings yet

- Digital Payment IndustryDocument6 pagesDigital Payment Industrywubetie SewunetNo ratings yet

- Black Book Jatin Vaja 52Document29 pagesBlack Book Jatin Vaja 52Jatin VajaNo ratings yet

- 5 Trending Changes in FinTech IndustryDocument3 pages5 Trending Changes in FinTech IndustryABHIGYAN MISHRA100% (1)

- Digital Banking and Alternative SystemsDocument31 pagesDigital Banking and Alternative SystemsRameen ZafarNo ratings yet

- Digital Payment SystemDocument15 pagesDigital Payment Systemmental7555No ratings yet

- Digital Payments STDocument11 pagesDigital Payments STdeepak kumarNo ratings yet

- Digital Payments in IndiaDocument23 pagesDigital Payments in Indiaabhinav sethNo ratings yet

- Going Contactless - The Next Stage of Banking EvolutionDocument3 pagesGoing Contactless - The Next Stage of Banking EvolutionSuntec SNo ratings yet

- The Future of Payments: India Digital Payments ReportDocument24 pagesThe Future of Payments: India Digital Payments ReporttanmayamohanNo ratings yet

- The Evolution of The Digital WalletDocument2 pagesThe Evolution of The Digital WalletMuskan KhanNo ratings yet

- Technological Advances in Recent Years Have Led To A Growing Number of FastDocument4 pagesTechnological Advances in Recent Years Have Led To A Growing Number of Fastnabila tasanNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- Digital Transformation in India - S Banking SectorDocument4 pagesDigital Transformation in India - S Banking SectorT ForsythNo ratings yet

- FintechDocument18 pagesFintechDIVYANo ratings yet

- Abstract Wps OfficeDocument9 pagesAbstract Wps Officeussy9iceNo ratings yet

- Digital PaymentsDocument13 pagesDigital PaymentsTai SankioNo ratings yet

- Chapter 2 RRLDocument6 pagesChapter 2 RRLkrizette alfelorNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Yudha Sidhikoro AjiNo ratings yet

- Understanding Online Payments in 2020Document4 pagesUnderstanding Online Payments in 2020Suhas SalehittalNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Gideon ListanoNo ratings yet

- Background of The StudyDocument8 pagesBackground of The StudySol TheresaNo ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- Digi WallDocument57 pagesDigi WallS ShuklaNo ratings yet

- Financial Technology (Fintech) Technology Presentation in Green White Illu - 20231109 - 100859 - 0000Document17 pagesFinancial Technology (Fintech) Technology Presentation in Green White Illu - 20231109 - 100859 - 0000Bien Joshua Martinez PamintuanNo ratings yet

- Running Head: Digital Payments and Digital Lending 1Document6 pagesRunning Head: Digital Payments and Digital Lending 1Beloved SonNo ratings yet

- Digital Payments in IndiaDocument3 pagesDigital Payments in IndiaSona DuttaNo ratings yet

- The Future of The Mobile Payment As Electronic Payment System PDFDocument6 pagesThe Future of The Mobile Payment As Electronic Payment System PDFRohan MehtaNo ratings yet

- Biometric Payment TechnologiesDocument3 pagesBiometric Payment TechnologiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Recent Developments 1. Off-Line and On-Line IntegrationDocument2 pagesRecent Developments 1. Off-Line and On-Line IntegrationHarshit ThukralNo ratings yet

- Literature Review of Online Payment SystemDocument5 pagesLiterature Review of Online Payment Systemrobin75% (4)

- As of NowDocument4 pagesAs of Nowladierojayar22No ratings yet

- Beyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3From EverandBeyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3No ratings yet

- Banking After PanademicDocument2 pagesBanking After PanademicNitin GargNo ratings yet

- CAYC Focus CollectionDocument23 pagesCAYC Focus CollectionRana100% (1)

- E Generation of Banking in IndiaDocument2 pagesE Generation of Banking in IndiaSharath Srinivas BudugunteNo ratings yet

- Mobile ATM WP To-LaunchDocument10 pagesMobile ATM WP To-Launchsumit8510No ratings yet

- BM - A-19bsphh01c0302Document11 pagesBM - A-19bsphh01c0302Chirag LaxmanNo ratings yet

- Digital Payment Dec 2023Document9 pagesDigital Payment Dec 2023Rameshwar BhatiNo ratings yet

- 13 - Chapter VIDocument61 pages13 - Chapter VIAnudhyan RayNo ratings yet

- Manish Kumar-11541465720895Document18 pagesManish Kumar-11541465720895Kavya ReddyNo ratings yet

- Cashless Society Is Underway and InevitableDocument4 pagesCashless Society Is Underway and Inevitableg-00288166No ratings yet

- JURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175Document21 pagesJURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175hahaha123No ratings yet

- IEEE FormateDocument12 pagesIEEE FormateLekha WararkarNo ratings yet

- Cyber Security Assignment 2Document4 pagesCyber Security Assignment 2mehak3066.bbaa21No ratings yet

- JASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedDocument10 pagesJASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedAnand SinghNo ratings yet

- E-Payment System in Saudi Arabia PDFDocument16 pagesE-Payment System in Saudi Arabia PDFRohan MehtaNo ratings yet

- Paper-Christophe Darren Lesmana-Digital TransformationDocument5 pagesPaper-Christophe Darren Lesmana-Digital TransformationDArrenNo ratings yet

- Chapter: 3: E Banking 1. What Is E BankingDocument7 pagesChapter: 3: E Banking 1. What Is E Bankingrupak.asifNo ratings yet

- The Future of Commerce Payme 441515Document12 pagesThe Future of Commerce Payme 441515HungNo ratings yet

- The Imperative of Online Payment System in Developing CountriesDocument7 pagesThe Imperative of Online Payment System in Developing CountriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review of Related Literature and StudiesDocument16 pagesReview of Related Literature and StudiesMikay MendozaNo ratings yet

- An Analysis of Challenges in Digital Finance TechnologiesDocument7 pagesAn Analysis of Challenges in Digital Finance TechnologiesAswin RNo ratings yet

- Study On Impact of Covid - 19 On Acceptance of Digital PaymentsDocument18 pagesStudy On Impact of Covid - 19 On Acceptance of Digital PaymentsPankaj GuravNo ratings yet

- 13 Prime Indexes Mobile Payments Industry Review 11102018Document20 pages13 Prime Indexes Mobile Payments Industry Review 11102018AmanNo ratings yet

- DBK Publi Chapter 9 2022 89 109Document21 pagesDBK Publi Chapter 9 2022 89 109Balakrishna DammatiNo ratings yet

- Case Study - Egielyn DacutanDocument35 pagesCase Study - Egielyn DacutanegielynruizdacutanNo ratings yet

- BLACKBOOK (CHP 1)Document30 pagesBLACKBOOK (CHP 1)jk93243061No ratings yet

- Full PaperDocument11 pagesFull Paperasra_ahmedNo ratings yet

- Detailed StatementDocument2 pagesDetailed StatementtestNo ratings yet

- Account StatementDocument1 pageAccount StatementИван ИвановNo ratings yet

- L JBBN L764 U L4 QFJZDocument15 pagesL JBBN L764 U L4 QFJZDevendra KunjamNo ratings yet

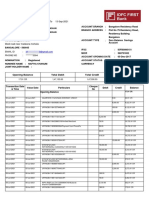

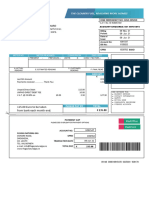

- IDFC FIRST Bank Statement 13 000 2021 120000 - 3948Document4 pagesIDFC FIRST Bank Statement 13 000 2021 120000 - 3948chandra kiranNo ratings yet

- 232 e-StatementBRImo 7oct2023 20231216 165619Document3 pages232 e-StatementBRImo 7oct2023 20231216 165619Jero SuhendraNo ratings yet

- OpTransactionHistoryTpr02 08 2022Document46 pagesOpTransactionHistoryTpr02 08 2022sanket enterprisesNo ratings yet

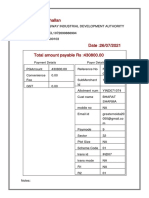

- NEFT/RTGS Challan: Yamuna Expressway Industrial Development Authority ICL1072699866994 ICIC0000103Document2 pagesNEFT/RTGS Challan: Yamuna Expressway Industrial Development Authority ICL1072699866994 ICIC0000103Bharat SharmaNo ratings yet

- TNG Ewallet TransactionsDocument2 pagesTNG Ewallet TransactionsGerney OngNo ratings yet

- StatementDocument14 pagesStatementAbulkhair AFSARULLAH KHANNo ratings yet

- Statement of Account: No 11 Peringkat 3 Felda Bukit Tajau 26500 MARAN, PAHANGDocument8 pagesStatement of Account: No 11 Peringkat 3 Felda Bukit Tajau 26500 MARAN, PAHANGFaqihah ZamzamiNo ratings yet

- My Secret Pass Account FixDocument9 pagesMy Secret Pass Account FixDylan ThomasNo ratings yet

- Cis WST - RB - Aken#2Document3 pagesCis WST - RB - Aken#2Heri SetyantoNo ratings yet

- HagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesaDocument1 pageHagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesaMario MihalceaNo ratings yet

- Are You Thereaa PDFDocument4 pagesAre You Thereaa PDFMahesh Kumar K BNo ratings yet

- Before Babylon, Beyond BitcoinDocument4 pagesBefore Babylon, Beyond BitcoinAr 3sNo ratings yet

- Statement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)Document13 pagesStatement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)ma.shehlaintNo ratings yet

- CRYPTO CURRENCY EXCHANGE Massimo FerrariDocument1 pageCRYPTO CURRENCY EXCHANGE Massimo Ferrarijoseperez18265438No ratings yet

- Xeiis 7 CL 952 L 7 EIaDocument3 pagesXeiis 7 CL 952 L 7 EIaVivek DenganiNo ratings yet

- Ireland Flogas Natural GasDocument1 pageIreland Flogas Natural GasMyt WovenNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceReema KhatiNo ratings yet

- 371 Idbi Statement PDFDocument6 pages371 Idbi Statement PDFSurendra TiwariNo ratings yet

- 1-Introduction To Blockchain AnalyticsDocument42 pages1-Introduction To Blockchain AnalyticsTejasruti GeridipudiNo ratings yet

- Febrero 24Document12 pagesFebrero 24micasacontractors893No ratings yet

- Cryptocurrency and Its Impact On Indian EconomyDocument6 pagesCryptocurrency and Its Impact On Indian EconomyShriya VaidyaNo ratings yet

- Account StatementDocument16 pagesAccount Statementjasonhileni8No ratings yet

- IDFCFIRSTBankstatement 10111794196Document10 pagesIDFCFIRSTBankstatement 10111794196dabu choudharyNo ratings yet

- Uhht BG 0 P Il 6 MP 6 GMDocument8 pagesUhht BG 0 P Il 6 MP 6 GMpaappaapNo ratings yet

- Tink - The Future of Payments Is OpenDocument46 pagesTink - The Future of Payments Is OpenDavid HelmanNo ratings yet

- Article 1 - Best Crypto Wallet AustraliaDocument11 pagesArticle 1 - Best Crypto Wallet AustraliaNelsonCecereNo ratings yet

The Future of Digital Payments

The Future of Digital Payments

Uploaded by

suneel66229Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Future of Digital Payments

The Future of Digital Payments

Uploaded by

suneel66229Copyright:

Available Formats

### The Future of Digital Payments

Digital payments have revolutionized the way we conduct transactions, offering convenience, speed,

and security. From contactless payments to mobile wallets, the future of digital payments promises

even greater innovation and integration, transforming the global financial landscape.

#### Mobile Payments and Contactless Technology

One of the key drivers of digital payment adoption is the proliferation of smartphones and internet

connectivity. Mobile payment platforms like Apple Pay, Google Wallet, and Samsung Pay enable users to

make purchases with just a tap of their phone, eliminating the need for cash or physical cards. This

convenience has led to widespread adoption, particularly among younger consumers.

#### Impact of the COVID-19 Pandemic

The COVID-19 pandemic further accelerated the shift towards digital payments. With concerns about

physical contact and hygiene, consumers and businesses alike have embraced contactless payment

methods. This trend is likely to continue, as people become accustomed to the ease and safety of digital

transactions.

#### Blockchain and Cryptocurrencies

Blockchain technology is also poised to play a significant role in the future of digital payments.

Cryptocurrencies like Bitcoin and Ethereum offer decentralized payment systems that can operate

without traditional banking infrastructure. Additionally, central banks around the world are exploring

the development of central bank digital currencies (CBDCs) to modernize their monetary systems and

enhance financial inclusion.

#### Integration of Artificial Intelligence

Another emerging trend is the integration of artificial intelligence (AI) in digital payments. AI can

enhance fraud detection by analyzing transaction patterns and identifying anomalies in real-time. This

not only improves security but also streamlines the user experience by reducing the incidence of false

declines and enhancing the speed of transactions.

#### Regulatory and Security Considerations

As digital payments continue to evolve, regulatory frameworks will need to adapt to ensure consumer

protection and market stability. Issues such as data privacy, cybersecurity, and interoperability between

different payment systems will be critical areas of focus for regulators and industry stakeholders.

#### Conclusion

In summary, the future of digital payments is bright, with ongoing advancements in technology driving

innovation and adoption. As the world moves towards a cashless society, digital payments will play an

increasingly central role in the global economy, offering enhanced convenience, security, and efficiency

for consumers and businesses alike.

You might also like

- NCB Deposit SlipDocument2 pagesNCB Deposit Slipgeeman97870% (1)

- Report & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Document15 pagesReport & Analysis About The Market of Payment Gateway Industry in Indonesia and A Strategic Plan On How To Survive The Market.Ario Wibisono100% (1)

- Looking Forward To 2030Document3 pagesLooking Forward To 2030quynhanhNo ratings yet

- Digital Payment IndustryDocument6 pagesDigital Payment Industrywubetie SewunetNo ratings yet

- Black Book Jatin Vaja 52Document29 pagesBlack Book Jatin Vaja 52Jatin VajaNo ratings yet

- 5 Trending Changes in FinTech IndustryDocument3 pages5 Trending Changes in FinTech IndustryABHIGYAN MISHRA100% (1)

- Digital Banking and Alternative SystemsDocument31 pagesDigital Banking and Alternative SystemsRameen ZafarNo ratings yet

- Digital Payment SystemDocument15 pagesDigital Payment Systemmental7555No ratings yet

- Digital Payments STDocument11 pagesDigital Payments STdeepak kumarNo ratings yet

- Digital Payments in IndiaDocument23 pagesDigital Payments in Indiaabhinav sethNo ratings yet

- Going Contactless - The Next Stage of Banking EvolutionDocument3 pagesGoing Contactless - The Next Stage of Banking EvolutionSuntec SNo ratings yet

- The Future of Payments: India Digital Payments ReportDocument24 pagesThe Future of Payments: India Digital Payments ReporttanmayamohanNo ratings yet

- The Evolution of The Digital WalletDocument2 pagesThe Evolution of The Digital WalletMuskan KhanNo ratings yet

- Technological Advances in Recent Years Have Led To A Growing Number of FastDocument4 pagesTechnological Advances in Recent Years Have Led To A Growing Number of Fastnabila tasanNo ratings yet

- Digital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz TajDocument6 pagesDigital Payments: Challenges and Solutions: Srihari Kulkarni, Abdul Shahanaz Tajnilofer shallyNo ratings yet

- Digital Transformation in India - S Banking SectorDocument4 pagesDigital Transformation in India - S Banking SectorT ForsythNo ratings yet

- FintechDocument18 pagesFintechDIVYANo ratings yet

- Abstract Wps OfficeDocument9 pagesAbstract Wps Officeussy9iceNo ratings yet

- Digital PaymentsDocument13 pagesDigital PaymentsTai SankioNo ratings yet

- Chapter 2 RRLDocument6 pagesChapter 2 RRLkrizette alfelorNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Yudha Sidhikoro AjiNo ratings yet

- Understanding Online Payments in 2020Document4 pagesUnderstanding Online Payments in 2020Suhas SalehittalNo ratings yet

- Bnbpay Whitepaper V 1Document25 pagesBnbpay Whitepaper V 1Gideon ListanoNo ratings yet

- Background of The StudyDocument8 pagesBackground of The StudySol TheresaNo ratings yet

- Digital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesDocument9 pagesDigital Payment Systems - An Overview of Categories and Extant Opportunities and ChallengesIJRASETPublicationsNo ratings yet

- Digi WallDocument57 pagesDigi WallS ShuklaNo ratings yet

- Financial Technology (Fintech) Technology Presentation in Green White Illu - 20231109 - 100859 - 0000Document17 pagesFinancial Technology (Fintech) Technology Presentation in Green White Illu - 20231109 - 100859 - 0000Bien Joshua Martinez PamintuanNo ratings yet

- Running Head: Digital Payments and Digital Lending 1Document6 pagesRunning Head: Digital Payments and Digital Lending 1Beloved SonNo ratings yet

- Digital Payments in IndiaDocument3 pagesDigital Payments in IndiaSona DuttaNo ratings yet

- The Future of The Mobile Payment As Electronic Payment System PDFDocument6 pagesThe Future of The Mobile Payment As Electronic Payment System PDFRohan MehtaNo ratings yet

- Biometric Payment TechnologiesDocument3 pagesBiometric Payment TechnologiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Recent Developments 1. Off-Line and On-Line IntegrationDocument2 pagesRecent Developments 1. Off-Line and On-Line IntegrationHarshit ThukralNo ratings yet

- Literature Review of Online Payment SystemDocument5 pagesLiterature Review of Online Payment Systemrobin75% (4)

- As of NowDocument4 pagesAs of Nowladierojayar22No ratings yet

- Beyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3From EverandBeyond Cash - The Evolution of Digital Payment Systems and the Future of Money: Alex on Finance, #3No ratings yet

- Banking After PanademicDocument2 pagesBanking After PanademicNitin GargNo ratings yet

- CAYC Focus CollectionDocument23 pagesCAYC Focus CollectionRana100% (1)

- E Generation of Banking in IndiaDocument2 pagesE Generation of Banking in IndiaSharath Srinivas BudugunteNo ratings yet

- Mobile ATM WP To-LaunchDocument10 pagesMobile ATM WP To-Launchsumit8510No ratings yet

- BM - A-19bsphh01c0302Document11 pagesBM - A-19bsphh01c0302Chirag LaxmanNo ratings yet

- Digital Payment Dec 2023Document9 pagesDigital Payment Dec 2023Rameshwar BhatiNo ratings yet

- 13 - Chapter VIDocument61 pages13 - Chapter VIAnudhyan RayNo ratings yet

- Manish Kumar-11541465720895Document18 pagesManish Kumar-11541465720895Kavya ReddyNo ratings yet

- Cashless Society Is Underway and InevitableDocument4 pagesCashless Society Is Underway and Inevitableg-00288166No ratings yet

- JURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175Document21 pagesJURNAL SIM I Dewa Gde Agrasamdhani Oki Prameswara-1807531175hahaha123No ratings yet

- IEEE FormateDocument12 pagesIEEE FormateLekha WararkarNo ratings yet

- Cyber Security Assignment 2Document4 pagesCyber Security Assignment 2mehak3066.bbaa21No ratings yet

- JASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedDocument10 pagesJASRAE - ISSUE - 4 - VOL - 19 - 306584 Self Attested - CompressedAnand SinghNo ratings yet

- E-Payment System in Saudi Arabia PDFDocument16 pagesE-Payment System in Saudi Arabia PDFRohan MehtaNo ratings yet

- Paper-Christophe Darren Lesmana-Digital TransformationDocument5 pagesPaper-Christophe Darren Lesmana-Digital TransformationDArrenNo ratings yet

- Chapter: 3: E Banking 1. What Is E BankingDocument7 pagesChapter: 3: E Banking 1. What Is E Bankingrupak.asifNo ratings yet

- The Future of Commerce Payme 441515Document12 pagesThe Future of Commerce Payme 441515HungNo ratings yet

- The Imperative of Online Payment System in Developing CountriesDocument7 pagesThe Imperative of Online Payment System in Developing CountriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review of Related Literature and StudiesDocument16 pagesReview of Related Literature and StudiesMikay MendozaNo ratings yet

- An Analysis of Challenges in Digital Finance TechnologiesDocument7 pagesAn Analysis of Challenges in Digital Finance TechnologiesAswin RNo ratings yet

- Study On Impact of Covid - 19 On Acceptance of Digital PaymentsDocument18 pagesStudy On Impact of Covid - 19 On Acceptance of Digital PaymentsPankaj GuravNo ratings yet

- 13 Prime Indexes Mobile Payments Industry Review 11102018Document20 pages13 Prime Indexes Mobile Payments Industry Review 11102018AmanNo ratings yet

- DBK Publi Chapter 9 2022 89 109Document21 pagesDBK Publi Chapter 9 2022 89 109Balakrishna DammatiNo ratings yet

- Case Study - Egielyn DacutanDocument35 pagesCase Study - Egielyn DacutanegielynruizdacutanNo ratings yet

- BLACKBOOK (CHP 1)Document30 pagesBLACKBOOK (CHP 1)jk93243061No ratings yet

- Full PaperDocument11 pagesFull Paperasra_ahmedNo ratings yet

- Detailed StatementDocument2 pagesDetailed StatementtestNo ratings yet

- Account StatementDocument1 pageAccount StatementИван ИвановNo ratings yet

- L JBBN L764 U L4 QFJZDocument15 pagesL JBBN L764 U L4 QFJZDevendra KunjamNo ratings yet

- IDFC FIRST Bank Statement 13 000 2021 120000 - 3948Document4 pagesIDFC FIRST Bank Statement 13 000 2021 120000 - 3948chandra kiranNo ratings yet

- 232 e-StatementBRImo 7oct2023 20231216 165619Document3 pages232 e-StatementBRImo 7oct2023 20231216 165619Jero SuhendraNo ratings yet

- OpTransactionHistoryTpr02 08 2022Document46 pagesOpTransactionHistoryTpr02 08 2022sanket enterprisesNo ratings yet

- NEFT/RTGS Challan: Yamuna Expressway Industrial Development Authority ICL1072699866994 ICIC0000103Document2 pagesNEFT/RTGS Challan: Yamuna Expressway Industrial Development Authority ICL1072699866994 ICIC0000103Bharat SharmaNo ratings yet

- TNG Ewallet TransactionsDocument2 pagesTNG Ewallet TransactionsGerney OngNo ratings yet

- StatementDocument14 pagesStatementAbulkhair AFSARULLAH KHANNo ratings yet

- Statement of Account: No 11 Peringkat 3 Felda Bukit Tajau 26500 MARAN, PAHANGDocument8 pagesStatement of Account: No 11 Peringkat 3 Felda Bukit Tajau 26500 MARAN, PAHANGFaqihah ZamzamiNo ratings yet

- My Secret Pass Account FixDocument9 pagesMy Secret Pass Account FixDylan ThomasNo ratings yet

- Cis WST - RB - Aken#2Document3 pagesCis WST - RB - Aken#2Heri SetyantoNo ratings yet

- HagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesaDocument1 pageHagoBuy - The Best Taobao Agent Help You Shop, Shipping From China - Weidian Agent1688agent - Cross-Border E-Commerce For WholesaMario MihalceaNo ratings yet

- Are You Thereaa PDFDocument4 pagesAre You Thereaa PDFMahesh Kumar K BNo ratings yet

- Before Babylon, Beyond BitcoinDocument4 pagesBefore Babylon, Beyond BitcoinAr 3sNo ratings yet

- Statement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)Document13 pagesStatement of Axis Account No:916010066252060 For The Period (From: 01-04-2021 To: 31-03-2022)ma.shehlaintNo ratings yet

- CRYPTO CURRENCY EXCHANGE Massimo FerrariDocument1 pageCRYPTO CURRENCY EXCHANGE Massimo Ferrarijoseperez18265438No ratings yet

- Xeiis 7 CL 952 L 7 EIaDocument3 pagesXeiis 7 CL 952 L 7 EIaVivek DenganiNo ratings yet

- Ireland Flogas Natural GasDocument1 pageIreland Flogas Natural GasMyt WovenNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceReema KhatiNo ratings yet

- 371 Idbi Statement PDFDocument6 pages371 Idbi Statement PDFSurendra TiwariNo ratings yet

- 1-Introduction To Blockchain AnalyticsDocument42 pages1-Introduction To Blockchain AnalyticsTejasruti GeridipudiNo ratings yet

- Febrero 24Document12 pagesFebrero 24micasacontractors893No ratings yet

- Cryptocurrency and Its Impact On Indian EconomyDocument6 pagesCryptocurrency and Its Impact On Indian EconomyShriya VaidyaNo ratings yet

- Account StatementDocument16 pagesAccount Statementjasonhileni8No ratings yet

- IDFCFIRSTBankstatement 10111794196Document10 pagesIDFCFIRSTBankstatement 10111794196dabu choudharyNo ratings yet

- Uhht BG 0 P Il 6 MP 6 GMDocument8 pagesUhht BG 0 P Il 6 MP 6 GMpaappaapNo ratings yet

- Tink - The Future of Payments Is OpenDocument46 pagesTink - The Future of Payments Is OpenDavid HelmanNo ratings yet

- Article 1 - Best Crypto Wallet AustraliaDocument11 pagesArticle 1 - Best Crypto Wallet AustraliaNelsonCecereNo ratings yet