Professional Documents

Culture Documents

BRI Danareksa Company Update MAPA 2 Feb 2024 Initiate Buy TP Rp1

BRI Danareksa Company Update MAPA 2 Feb 2024 Initiate Buy TP Rp1

Uploaded by

financialshooterOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BRI Danareksa Company Update MAPA 2 Feb 2024 Initiate Buy TP Rp1

BRI Danareksa Company Update MAPA 2 Feb 2024 Initiate Buy TP Rp1

Uploaded by

financialshooterCopyright:

Available Formats

Equity Research – Company Update Friday, 02 February 2024

Buy MAP Active (MAPA)

Initiation Riding on the sustainable momentum of sport and

athleisure trend; initiate with Buy rating

Last Price (Rp) 980 • We expect MAPA’s FY24 earnings to be mainly driven by store growth,

Target Price (Rp) 1,270 amid its proven expansion in domestic and regional markets.

Previous Target Price (Rp) -

• We project FY23-25F revenue CAGR of 23.4% (the highest vs peer) & net

Upside/Downside +29.6%

profit of 18.3% (lower vs AMRT, MIDI with less demanding valuation).

• We initiate coverage on MAPA with Buy rating on its strong growth

No. of Shares (mn) 28,504

outlook and solid ROE, with TP of Rp1,270 (20x FY24F PE).

Mkt Cap (Rpbn/US$mn) 27,934/1,772

Avg, Daily T/O

20.6/1.3

(Rpbn/US$mn) Indonesia’s largest sports retailer with a proven growth track record

Free Float (%) 30.8 We are upbeat on MAPA given the prospect of continued FY24 strong 27.4%

projected top line growth, driven by substantial store growth in FY23 (of

Major Shareholder (%) +18.8% yoy vs 2017-22 CAGR of 10%) and further store expansion in FY24 with

PT Mitra Adiperkasa Tbk 68.8 an additional footprint in overseas markets. In FY19-FY23, MAPA enjoyed net

profit CAGR of 21.4%, driven by solid top line growth (+14.3% CAGR) on the

back of its proven store expansion strategy and higher store productivity.

EPS Consensus (Rp)

2023F 2024F 2025F Resilient target market with continued robust profit growth ahead

BRIDS 52.9 63.4 74.0

The global sports market is projected to grow by 8.8% to EUR395bn in 2020-

Consensus 50.3 60.4 73.7

25F, with the strongest growth in China (+13.7%) and the rest of the world

(+8.9%) including Indonesia, based on McKinsey report. We believe the sport

BRIDS/Cons (%) 5.0 5.0 0.4

and athleisure trend shall continue in FY24-25F and drive solid revenue

growth for MAPA, as its products represent strong brand equity targeting the

resilient mid to upper segments in Indonesia and SEA markets.

MAPA relative to JCI Index

Expect solid earnings growth to continue in FY23-25F (18.3% CAGR)

We forecast FY23-25F revenue CAGR of 23.4% supported by 14.8% growth in

store area and 7.5% growth in store productivity. For FY24, parent MAPI plans

to open 800 new stores (gross) which we expect 250 to be under MAPA,

including 45-50% from overseas expansion. We project MAPA’s FY24 gross

margin to normalize at around 47.5% and a higher opex (at 33% of revenue)

given aggressive store expansion in both domestic and overseas. Despite this,

we expect FY23-25F net profit growth to remain solid at 18.3% CAGR.

Initiate with Buy rating on attractive growth outlook and solid ROE

We initiate coverage on MAPA with a Buy rating and TP of Rp1,270 based on

FY24F PE of 20x, or at around +2SD avg 2-y PE. We believe the premium

Source: Bloomberg valuation is warranted given its solid growth outlook and high ROE. Risks to

our rating include disruption to the purchasing power of the mid-upper

segment and delays in store expansion.

BRI Danareksa Sekuritas Analysts Key Financials

Natalia Sutanto Year to 31 Dec 2021A 2022A 2023F 2024F 2025F

Revenue (Rpbn) 6,042 9,801 13,278 16,911 20,210

(62-21) 5091 4100 ext. 3508

EBITDA (Rpbn) 691 1,795 2,337 2,783 3,307

natalia.sutanto@brids.co.id EBITDA Growth (%) 144.7 159.6 30.2 19.1 18.8

Net Profit (Rpbn) 203 1,175 1,506 1,807 2,109

EPS (Rp) 7.1 41.2 52.9 63.4 74.0

Sabela Nur Amalina EPS Growth (%) 2,982.8 477.5 28.2 20.0 16.7

(62-21) 5091 4100 ext. 4202 BVPS (Rp) 113.8 156.8 205.7 264.0 331.8

DPS (Rp) 0.0 0.0 4.0 5.1 6.2

sabela.amalina@brids.co.id PER (x) 137.3 23.8 18.5 15.5 13.2

PBV (x) 8.6 6.2 4.8 3.7 3.0

Dividend yield (%) 0.0 0.0 0.4 0.5 0.6

EV/EBITDA 40.6 15.5 11.9 10.2 8.7

Source: MAPA, BRIDS Estimate

bridanareksasekuritas.co.id See important disclosure at the back of this report 1

Equity Research – Company Update Friday, 02 February 2024

Riding on the momentum of athleisure trend;

initiate with Buy rating

Steady growth in the global sports market to continue, driven

by the persisting athleisure trend

The global sports market is expected to grow by 8.8% to EUR395bn in 2020-

25F, with the strongest growth in China (+13.7%) and the rest of the world

(+8.9%) including Indonesia, based on McKinsey. The report stated that as

Between 2020-2025F, work and free time intertwined during and after the pandemic, the new

athleisure is estimated to athleisure trend accelerated as casual and sport clothes are more acceptable

grow by 8-9% in a professional setting. Between 2020-2025F, athleisure is estimated to grow

by 8-9% CAGR, which is the fastest growing segment in the global sports

apparel market. Among the different socio-economic groups, affluent

consumers tend to exercise more.

In 2021, customers celebrated the return to normality and engaged in so-

called ‘retail therapy’, with 41% spending at restaurants, 39% on apparel and

35% on travel (these are the top 3 categories). Notably, around 24% of

consumers spent money on sports apparel and equipment.

While the growth has partly materialized in 2020-23F, we believe that the

trend of athleisure will continue in 2024-25F especially in the market such as

Indonesia and SEA with resilient middle-up consumer segment.

Exhibit 1. Global Sportswear Market (EURmn) Exhibit 2. Global Sportswear Market CAGR

450

400 395 CAGR 2019-20 CAGR 2020-25F

371

346

350 321

301 295 Rest of world -14.0% 8.9%

300 259

250

UK -14.6% 5.7%

200 Germany -6.9% 4.1%

150

Japan -6.4% 3.0%

100

50 China -1.5% 13.7%

0 USA -19.7% 7.8%

2019 2020 2021F 2022F 2023F 2024F 2025F

Total -13.9% 8.8%

USA China Japan Germany UK RoW

Source: McKinsey Source: McKinsey

bridanareksasekuritas.co.id See important disclosure at the back of this report 2

Equity Research – Company Update Friday, 02 February 2024

Exhibit 3. Sporting apparel enjoyed the highest yoy growth in 2021

Source: McKinsey

More people are engaging in sports, with more spending on

sports apparel

In Indonesia, from the total population in the 10–60-year age group, around

81% engage in physical activity (at least once a week), but with around 33%

perform sports activity more than 3x/week, based on The Ministry of Youth

and Sports. This bodes well for the sports market. According to the Ministry

of Youth and Sports, around 57.7% (in FY22 vs 56% in FY21) of the total

population in the country spend money on sports apparel and services

(including paid TV and personal trainers). It is estimated that the spending on

sports apparel and services may reach as much as Rp5mn/person/year in

2021, implying total annual transactions value of Rp44tr.

Also according to data from the Ministry, around 34% of total spending was

on sports shoes, followed by sports clothing (27%) and sports apparel (13%).

Nonetheless, around 44% of the total population spend less than Rp200,000

on sports products, which we believe is the market supported by the

KJP/KIP/program Indonesia Pintar (around 18.6mn students in 2024).

Meanwhile, around 20% of the total population spend more than Rp500,000,

which we believe should fall in MAPA’s target market.

Exhibit 4. 61% of total spending on shoes and clothes Exhibit 5. Sports economic value in Indonesia

Supplement Books/Magazin Souvenir Amount of Number of Total spending

Median

8% es/Newspapers 1% Sports Percentage Consumers money/year

Shopping

Food & 1% Clothes Spending (mn) (Rpbn)

Beverage 27% <200k 44.10% 100,000 49 4,876

11% 200-500k 36.70% 250,000 41 10,144

0.5-1mn 11.90% 750,000 13 9,868

Accessories

5% 1-2mn 4.00% 1,500,000 4 6,634

2-3mn 1.50% 2,500,000 2 4,146

3-4mn 0.60% 3,500,000 1 2,322

Equipment 4-5mn 0.40% 4,500,000 0 1,990

13% Shoes

>5mn 0.70% 5,000,000 1 3,870

34%

Total 43,848

Source: Ministry of Youth and Sports of the Republic of Indonesia Source: Ministry of Youth and Sports of the Republic of Indonesia

bridanareksasekuritas.co.id See important disclosure at the back of this report 3

Equity Research – Company Update Friday, 02 February 2024

MAPA: Indonesia’s largest seller of sports retail brands with

growing presence in regional markets

MAPA is the largest seller of sports brands in Indonesia with more than 1,500

stores that offer more than 40+ exclusive brands (and around 12 exclusive

brands overseas) across more than 78 cities as of Sept-23. It has multi-brands

retail stores tapping the premium market and established online stores to

provide 24/7 services to customers. From 2019 to 9M23, the digital channel

contribution rose from 1.9% to 9% with a higher contribution from its own

sites (MAP Club and 27 proprietary platforms, with 70% contribution) vs third

party marketplaces (30%).

Exhibit 6. Channel sales breakdown Exhibit 7. Digital sales performance

1000 16%

900 14%

800

12%

3rd 700

600 10%

Marketplace

, 30% 500 8%

400 6%

300

4%

Own store, 200

70% 100 2%

0 0%

2019 2020 2021 2022 9M23

Digital Sales (Rpbn) Contribution, RHS

Source: Company Source: Company

Exhibit 8. Brands under MAPA and category as of Sept23

Sports Leisure Kids

Sportswear Skechers Leisure footwear Birkenstock Apparel Hasbro

Athletic shoes New Balance Apparel Clarks Toys Lego

Sport Reebok Nina west Smiggle

equipment Converse Onitsuka Tiger Oshkosh B'Gosh

Accessories Educational

Planet sports Dr. Martens Crocs

Multi-brand tools

Sports station Staccato Kidz Station

Multi-brand retail Playless ShoeSource Also single brands

chains Linea

and brand-specific

monoband stores

Source: Company

bridanareksasekuritas.co.id See important disclosure at the back of this report 4

Equity Research – Company Update Friday, 02 February 2024

Growing contribution from overseas expansion

In FY19, MAPA started its overseas expansion in Vietnam before heading to

the Philippines and Thailand (in FY20) followed by Singapore and Malaysia in

2022. By end of Sep23, MAPA had a total of 200 stores operating overseas, or

13% of its total stores, contributing to 19% of its 9M23 revenue (vs 10% in

1H22). Going forward, the company aims to continue to make strategic

acquisitions and partnerships, to secure long-term growth throughout

Southeast Asia markets. In Jul23, MAPA acquired the stores and e-com

operations of Foot Locker in Singapore and Malaysia. It also formed JVs and

new partnerships for Converse & Reebok (in Singapore and Malaysia), Aldo

(Singapore, Malaysia, Thailand & Indonesia) and Sports Direct (Indonesia).

Exhibit 9. Accelerate ASEAN branded commerce Exhibit 10. Geographical Sales 9M23

Kalimantan Sulawesi Bali

2% 3% 4%

Proprietary Mono Others

No of Exclusive multi brand brand 5%

Country SIS*

store brands online online

stores store

Sumatera

Indonesia 1,259 na 40+ 10 17 9%

Philippines 134 563 12 na na

Vietnam 38 20 9 na na

Malaysia 37 3 4 na na Java

28 5 5 na na 58%

Singapore Overseas

Thailand 16 441 12 na na 19%

Cambodia 6 na 3 na na

Source: Company *Store-in-store Source: Company

Solid earnings growth track record, driven by store space

growth, higher productivity and efficiency efforts

In FY16-22, MAPA reported revenue CAGR of 13.7%, supported by 9.4% space

growth and 4% growth in store productivity. In the same period, the company

maintained its gross margin at 45-46% (except in the pandemic area of 2020-

21 at 40-43%), supported by an extensive product portfolio which taps all

segments. At the operating level, opex spending was around 31-33% to

revenue, of which 2/3 was spent on rental/service charges and salaries. At the

bottom line, MAPA reported FY16-22 net profit CAGR of 18.9%, supported by

robust FY22 top line growth (+62% yoy) and higher gross margins.

Given MAPA’s proven scalability and efficiency measures, we expect greater

employee productivity in generating revenue, with Salary expense to be

maintained at a similar percentage (10-11%) to revenue to the historic level

(exhibit 22 & 29).

Exhibit 11. Revenue growth and CAGR, FY16-22 Exhibit 12. Space growth, FY17-22

12,000

30%

10,000

25%

8,000 20%

6,000 15%

10%

4,000

5%

2,000 0%

-5%

-

2017 2018 2019 2020 2021 2022

2016 2017 2018 2019 2020 2021 2022

Source: Company Source: Company

bridanareksasekuritas.co.id See important disclosure at the back of this report 5

Equity Research – Company Update Friday, 02 February 2024

Exhibit 13. Gross margin, FY16-22 Exhibit 14. Major opex composition, FY16-22

50.0% 13.0%

12.5%

48.0%

12.0%

46.0% 11.5%

44.0% 11.0%

10.5%

42.0%

10.0%

40.0% 9.5%

9.0%

38.0%

8.5%

36.0% 8.0%

2016 2017 2018 2019 2020 2021 2022 2016 2017 2018 2019 2020 2021 2022

Rental, SC, ROU Salaries

Source: Company Source: Company

Exhibit 15. Employee productivity yoy growth, FY16-22 Exhibit 16. Inventory days and aging inventory

60%

300 50%

50%

40% 250 40%

30%

200

20% 30%

10% 150

0% 20%

100

-10%

-20% 50 10%

-30%

0 0%

-40%

2019 2020 2021 2022 9M23

-50% Inventory Days Inventory Aging > 6 Months

2016 2017 2018 2019 2020 2021 2022

Source: Company Source: Company,

Expect FY24-25F robust revenue growth of 27.3% to continue

We continue to like MAPA on the prospect of strong top line growth in FY24

stemming from store openings in FY23 (+18.8% yoy store growth) and further

store expansion in FY24 with an additional footprint in overseas markets. In

FY19-9M23, MAPA enjoyed solid SSSG growth (except during the pandemic in

2020 when SSSG was negative - Exhibit 17). Between FY19-9M23, total net

additional space grew by 28%, a higher rate of growth than in the pre-

pandemic era of 10.5% (2014-19). We estimate FY24-25F revenue growth of

27.3% supported by 19% growth in the store area and 7% growth in store

productivity. For FY24, parent MAPI plans to open 800 new stores (gross)

mostly under MAPA with 45-50% from overseas expansion.

Exhibit 17. SSSG from 1Q19 to 9M23 Exhibit 18. Total space growth, FY19-25F

80% 30%

60% 25%

40% 20%

20% 15%

0%

10%

-20%

5%

-40%

0%

-60%

1H19

1H20

1H21

1H22

1H23

2019

2020

2021

FY22

9M19

9M20

9M21

9M22

9M23

1Q19

1Q20

1Q21

1Q22

1Q23

-5%

2019 2020 2021 2022 2023F 2024F 2025F

Source: Company Source: Company, BRIDS Estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 6

Equity Research – Company Update Friday, 02 February 2024

Exhibit 19. Revenue by segment, FY19-22 (Rpbn) Exhibit 20. Store productivity, FY19-25F

12,000 Rpmn/sqm

60

10,000

50

8,000

40

6,000

30

4,000

20

2,000

10

-

0

2019 2020 2021 2022

Sports Leisure Kids 2019 2020 2021 2022 2023F 2024F 2025F

Source: Company Source: Company, BRIDS Estimates

Robust top line growth led to strong FY23-25F net profit CAGR

of 18.3%

Continued healthy lifestyle awareness with the new trend of athleisure

(casual and comfortable clothing for exercise and everyday wear) should

pave the way for solid volume growth of MAPA’s products. The company sells

products with strong brand equity targeting the mid to upper segments. For

FY24-25, we expect MAPA’s gross margin to normalize at around 47.5% (vs.

47.8-48.9% in FY22-23). At the opex level, aggressive store expansion in both

domestic and overseas markets may lead to a higher 33% opex/revenue in

FY24-25. This will filter through to FY23-25F net profit CAGR of 18.3%.

Exhibit 21. Gross profit and margin, FY19-25F Exhibit 22. Opex to revenue, FY19-25F

12,000 60% 45%

40%

10,000 50%

35%

8,000 40% 30%

25%

6,000 30%

20%

4,000 20% 15%

10%

2,000 10%

5%

- 0% 0%

2019 2020 2021 2022 2023F 2024F 2025F 2019 2020 2021 2022 2023F 2024F 2025F

Gross Profit Gross Margin, RHS Rental, SC, ROU Salaries Others

Source: Company, BRIDS Estimates Source: Company, BRIDS Estimates

Exhibit 23. Higher employee productivity (Rpbn/year) Exhibit 24. Net profit, FY19-25F

2,500

2019

2,000

2020

1,500

2021 1,000

500

2022

-

0.00 0.20 0.40 0.60 0.80 1.00 1.20 2019 2020 2021 2022 2023F 2024F 2025F

Source: Company, BRIDS Estimates Source: Company, BRIDS Estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 7

Equity Research – Company Update Friday, 02 February 2024

Digital platform and data analytics support inventory efficiency

Efficient inventory management is crucial for retailers including MAPA. Many

initiatives have been implemented to streamline inventory management,

leading to lower aging inventory (>6 months) to near the pre-pandemic level

in 9M23 (21% vs 19% in FY19). MAPA maximizes its omni-channel retail

network to increase sales whilst also using data analytics of its digital

platforms to provide suitable products to its customers. By the end of Sep23,

inventory days had already improved to 180 days (lower vs FY20-21: 240-250

days), closer to the pre-pandemic level of 149 days and lower vs ACES of 270

days.

Exhibit 25. Aging inventory (> 6 months), FY19-9M23 Exhibit 26. Inventory days and cash cycle

50% 300 300

45%

40%

250 250

35% 200 200

30%

25%

150 150

20% 100 100

15%

10%

50 50

5% 0 0

0% 2019 2020 2021 2022 9M23

2019 2020 2021 2022 9M23 Inventory Days Cash Cycle, RHS

Source: Company Source: Company

Recommendation and valuation

MAPA’s valuation has re-rated in 2023 which we believe is attributed to its

consistent high growth (at 21.4% CAGR in FY19-23F). Compared to listed

domestic retailer peers, MAPA’s current FY24 15.5x PE is at a 8% premium

valuation but still at discount to AMRT and MIDI. We believe such premium is

warranted given its solid ROE (similar to AMRT, which trades at 26.6x FY24

PE). We initiate coverage on MAPA with a Buy rating and TP of Rp1,270 based

on FY24F PE of 20x (at +2SD avg 2-y PE) on its still solid FY24-25F growth

outlook (our net profit forecast of 20% and 16.7%, respectively). Compared

to regional and global plays, MAPA also trades at a higher PE multiple (FY24:

15.5x vs avg 13.9x). However, we believe this is also justified by its stronger

2023-25F net profit CAGR and solid ROE.

bridanareksasekuritas.co.id See important disclosure at the back of this report 8

Equity Research – Company Update Friday, 02 February 2024

Exhibit 27. Peer comparison

Company M.Cap CAGR 2023-25F EBIT EV/ Div PE PEG

USD Revenue Net profit Margin ROE EBITDA P/sales P/BV Yield 2023 2024 2024

MAP Active 1,767 23.4% 18.3% 15% 29.0 11.9 2.1 4.8 0.5 18.5 15.5 0.8

Regional and Global retailers

XTEP INTERNATIONAL HOLDINGS 1,345 14.4% 19.4% 11% 12.0 4.8 0.7 1.1 5.7 9.1 7.6 0.4

TOPSPORTS INTERNATIONAL HOLD 4,190 11.4% 16.2% 10% 23.1 6.2 1.1 2.9 6.9 12.6 10.8 0.6

ANTA SPORTS PRODUCTS LTD 25,373 14.2% 18.5% 23% 23.7 9.7 3.2 4.1 2.5 18.4 15.5 0.8

ABC-MART INC 4,376 4.3% 4.5% 16% 11.6 8.4 1.9 2.0 2.4 17.6 16.8 3.5

POU SHENG INTL HOLDINGS LTD 429 9.9% 47.1% 3% 4.4 1.7 0.2 0.4 5.0 7.0 4.2 0.1

FRASERS GROUP PLC 4,625 4.6% 8.9% 10% 21.2 5.7 0.6 1.7 0.0 9.3 8.3 0.8

FOOT LOCKER INC 2,721 1.7% 40.7% 3% 3.9 7.2 0.3 0.8 4.2 21.0 14.7 0.3

SHOE CARNIVAL INC 701 4.3% 7.5% 9% 13.3 4.5 0.6 na na 9.1 8.5 0.8

Simple average 8.1% 20.3% 10.5% 14.2 6.0 1.1 1.9 13.0 10.8 0.9

Weighted avg 11.0% 17.4% 17.7% 20.2 8.3 2.3 3.1 16.4 13.9 1.0

Domestic retailers

MITRA ADIPERKASA TBK PT 1,969 13.6% 14.3% 11% 21.3 7.5 0.9 3.1 0.4 14.4 12.8 1.1

ACE HARDWARE INDONESIA 890 10.7% 15.5% 11% 12.1 12.4 1.9 2.3 2.9 19.0 16.8 1.2

MATAHARI DEPARTMENT STORE TBK 296 6.6% 14.1% 20% 182.6 5.2 0.7 10.0 25.4 5.4 4.1 0.1

SUMBER ALFARIA TRIJAYA TBK P 6,908 12.1% 20.7% 4% 26.6 15.8 1.0 7.9 0.9 32.3 26.6 1.1

MIDI UTAMA INDONESIA TBK PT 846 12.2% 24.8% 3% 14.9 10.3 0.8 3.7 1.0 24.7 19.4 0.7

ERAJAYA SWASEMBADA TBK PT 418 12.2% 22.2% 3% 11.6 7.1 0.1 0.9 5.3 8.1 6.5 0.3

Simple average 11.2% 18.6% 8.6% 44.8 9.7 0.9 4.6 17.3 14.4 0.8

Weighted avg 12.1% 19.4% 5.9% 27.2 13.1 1.0 6.1 26.0 21.6 1.0

Source: Bloomberg, BRIDS Estimates

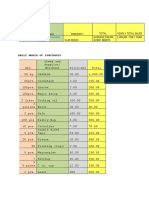

Exhibit 28. Assumptions table

MAPA 2019 2020 2021 2022 2023F 2024F 2025F

GDP growth 5.0% -2.1% 3.7% 5.3% 5.1% 5.1% 5.1%

Infl a tion 2.7% 1.7% 1.9% 5.5% 3.1% 3.0% 3.0%

USD IDR - end of yea r 13,866 14,050 13,785 14,344 15,133 14,780 14,780

USD IDR - a vera ge 14,141 14,544 14,270 14,848 15,665 15,300 15,300

Retai l s pa ce ('000 s qm) 245 250 246 270 321 382 423

yoy growth 2.0% -1.7% 9.8% 18.8% 19.0% 10.7%

Store productivi ty (Rpmn/s qm) 31.7 19.1 24.6 36.3 41.4 44.3 47.8

yoy growth -39.8% 28.6% 47.7% 14.0% 7.0% 8.0%

SSSG 9% -37% 19% 48% 24% 21% 20%

Gros s ma rgi n 47.1% 40.0% 42.8% 47.9% 48.7% 47.5% 47.6%

Major opex component:

As % to s a l es

Rental 9.8% 10.6% 8.6% 9.9% 10.8% 10.3% 9.9%

Sa l a ri es 9.8% 12.4% 11.7% 10.0% 10.2% 10.6% 11.2%

Other opex 10.7% 15.3% 14.6% 11.9% 12.4% 12.1% 12.3%

Source: Bloomberg, BRIDS Estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 9

Equity Research – Company Update Friday, 02 February 2024

Exhibit 29. PE Band Exhibit 30. Premium (discount) PE band MAPA and MAPI

30.0 30%

25.0 20%

10%

20.0

0%

15.0

-10%

10.0

-20%

5.0 -30%

- -40%

Jul/22

Sep/22

Jul/23

Sep/23

Nov/22

Nov/23

May/23

Jan/22

Mar/22

May/22

Jan/23

Mar/23

Jan/24

Premium (discount) to MAPI MAPA MAPI

Source: Bloomberg, BRIDS Estimates Source: Bloomberg, BRIDS Estimates

Key Risks:

• Delays in store expansion

Fewer-than-expected store openings would pose a risk to our top line

growth estimate. We estimate FY24-25 store growth of 19% and 11%,

which would be the key revenue driver for MAPA.

• Disruption in purchasing power of the mid-upper segments

We believe the purchasing power of the mid to upper segments is

relatively more resilient. Nonetheless, any disruption that would

hamper consumption will pose a threat to overall domestic

consumption. This includes changes in personal taxes that would trim

the middle to upper segments’ disposable income for discretionary

spending.

• Currency weakening

Most of MAPA’s products are imported and USD-Linked. Currency

weakening would increase the cost of imported products and the

overall cost of USD linked material

bridanareksasekuritas.co.id See important disclosure at the back of this report 10

Equity Research – Company Update Friday, 02 February 2024

Exhibit 31. Income Statement

Year to 31 Dec (Rpbn) 2021A 2022A 2023F 2024F 2025F

Strong FY24F net profit

growth of 20% … Revenue 6,042 9,801 13,278 16,911 20,210

COGS (3,455) (5,111) (6,812) (8,878) (10,590)

Gross profit 2,587 4,690 6,467 8,033 9,620

EBITDA 691 1,795 2,337 2,783 3,307

Oper. profit 477 1,574 2,037 2,451 2,880

Interest income 6 13 19 24 26

Interest expense 82 68 74 0 0

Forex Gain/(Loss) (5) (18) 3 3 0

Income From Assoc. Co’s 0 0 0 0 0

Other Income (Expenses) (217) (101) (162) (114) (148)

Pre-tax profit 344 1,537 1,971 2,364 2,759

Income tax (114) (364) (466) (559) (653)

Minority interest (27) 1 2 2 3

Net profit 203 1,175 1,506 1,807 2,109

Core Net Profit 208 1,192 1,504 1,804 2,109

Exhibit 32. Balance Sheet

Year to 31 Dec (Rpbn) 2021A 2022A 2023F 2024F 2025F

Cash & cash equivalent 662 1,342 1,933 1,965 2,423

Receivables 317 447 473 616 755

Inventory 2,279 2,733 2,940 3,869 4,800

Other Curr. Asset 246 313 444 566 676

Fixed assets - Net 653 880 1,509 2,361 3,046

Other non-curr.asset 1,159 1,720 2,435 3,267 4,162

Total asset 5,315 7,434 9,733 12,643 15,862

ST Debt 456 667 939 1,261 1,617

Payables 763 994 1,095 1,422 1,739

Other Curr. Liabilities 366 484 655 835 997

Long Term Debt 318 613 900 1,241 1,618

Other LT. Liabilities 169 190 258 328 392

Total Liabilities 2,071 2,949 3,846 5,086 6,363

Shareholder'sFunds 3,244 4,470 5,863 7,524 9,457

Minority interests 0 15 24 33 41

Total Equity & Liabilities 5,315 7,434 9,733 12,643 15,862

bridanareksasekuritas.co.id See important disclosure at the back of this report 11

Equity Research – Company Update Friday, 02 February 2024

Exhibit 33. Cash Flow

Year to 31 Dec (Rpbn) 2021A 2022A 2023F 2024F 2025F

Net income 203 1,175 1,506 1,807 2,109

Depreciation and Amort. 214 220 300 332 427

Change in Working Capital 11 (421) (231) (849) (848)

OtherOper. Cash Flow 18 (6) 0 89 76

Operating Cash Flow 446 968 1,576 1,379 1,763

Capex (139) (447) (929) (1,184) (1,112)

Others Inv. Cash Flow 109 (485) (584) (691) (763)

Investing Cash Flow (29) (932) (1,513) (1,875) (1,874)

Net change in debt (460) 507 558 663 734

New Capital 25 68 11 11 11

Dividend payment 0 0 (114) (146) (175)

Other Fin. Cash Flow 82 68 74 0 0

Financing Cash Flow (353) 643 529 528 569

Net Change in Cash 63 679 591 32 458

Cash - begin of the year 599 662 1,342 1,933 1,965

Cash - end of the year 662 1,342 1,933 1,965 2,423

Exhibit 34. Key Ratio

Year to 31 Dec 2021A 2022A 2023F 2024F 2025F

Growth (%)

Sales 26.4 62.2 35.5 27.4 19.5

EBITDA 144.7 159.6 30.2 19.1 18.8

Operating profit 496.1 229.7 29.4 20.3 17.5

Net profit 2,982.8 477.5 28.2 20.0 16.7

Profitability (%)

Gross margin 42.8 47.9 48.7 47.5 47.6

EBITDA margin 11.4 18.3 17.6 16.5 16.4

Operating margin 7.9 16.1 15.3 14.5 14.3

Net margin 3.4 12.0 11.3 10.7 10.4

ROAA 3.8 18.4 17.6 16.2 14.8

ROAE 6.5 30.5 29.2 27.0 24.8

Leverage

Net Gearing (x) 0.0 0.0 0.0 0.1 0.1

Interest Coverage (x) (5.8) (23.1) (27.4) 0.0 0.0

Source: MAPA, BRIDS Estimates

bridanareksasekuritas.co.id See important disclosure at the back of this report 12

Equity Research – Company Update Friday, 02 February 2024

BRI Danareksa Equity Research Team

Erindra Krisnawan, CFA Head of Equity Research, Strategy, Coal erindra.krisnawan@brids.co.id

Natalia Sutanto Consumer, Cigarettes, Pharmaceuticals, Retail natalia.sutanto@brids.co.id

Niko Margaronis Telco, Tower, Technology, Media niko.margaronis@brids.co.id

Hasan Barakwan Metal, Oil and Gas hasan.barakwan@brids.co.id

Victor Stefano Banks, Poultry victor.stefano@brids.co.id

Ismail Fakhri Suweleh Healthcare, Property, Industrial Estate ismail.suweleh@brids.co.id

Richard Jerry, CFA Automotive, Cement richard.jerry@brids.co.id

Ni Putu Wilastita Muthia Sofi Research Associate wilastita.sofi@brids.co.id

Naura Reyhan Muchlis Research Associate naura.muchlis@brids.co.id

Sabela Nur Amalina Research Associate sabela.amalina@brids.co.id

Christian Immanuel Sitorus Research Associate christian.sitorus@brids.co.id

BRI Danareksa Economic Research Team

Helmy Kristanto Chief Economist, Macro Strategy helmy.kristanto@brids.co.id

Dr. Telisa Aulia Falianty Senior Advisor telisa.falianty@brids.co.id

Kefas Sidauruk Economist kefas.sidauruk@brids.co.id

BRI Danareksa Institutional Equity Sales Team

Yofi Lasini Head of Institutional Sales and Dealing yofi.lasini@brids.co.id

Novrita Endah Putrianti Institutional Sales Unit Head novrita.putrianti@brids.co.id

Ehrliech Suhartono Institutional Sales Associate ehrliech@brids.co.id

Yunita Nababan Institutional Sales Associate yunita@brids.co.id

Adeline Solaiman Institutional Sales Associate adeline.solaiman@brids.co.id

Andreas Kenny Institutional Sales Associate andreas.kenny@brids.co.id

Christy Halim Institutional Sales Associate christy.halim@brids.co.id

Jason Joseph Institutional Sales Associate Jason.joseph@brids.co.id

BRI Danareksa Sales Traders

Mitcha Sondakh Head of Sales Trader mitcha.sondakh@brids.co.id

Suryanti Salim Sales Trader suryanti.salim@brids.co.id

INVESTMENT RATING

BUY Expected total return of 10% or more within a 12-month period

HOLD Expected total return between -10% and 10% within a 12-month period

SELL Expected total return of -10% or worse within a 12-month period

bridanareksasekuritas.co.id See important disclosure at the back of this report 13

You might also like

- Applied Biopharmaceutics & Pharmacokinetics, 5th EditionDocument1 pageApplied Biopharmaceutics & Pharmacokinetics, 5th Editionbencleese14% (7)

- Credit Risk QuestionnaireDocument4 pagesCredit Risk QuestionnaireBhaumik Nayak100% (1)

- BRI Danareksa Company Update FY24 Outlook AVIA 7 Mar 2024 MaintainDocument7 pagesBRI Danareksa Company Update FY24 Outlook AVIA 7 Mar 2024 MaintainCandra Adyasta100% (1)

- BRI Danareksa Company Update KLBF 28 Feb 2024 Keep Hold TP Rp1,600Document7 pagesBRI Danareksa Company Update KLBF 28 Feb 2024 Keep Hold TP Rp1,600Candra AdyastaNo ratings yet

- BRI Danareksa Company Update FY23 ROTI 7 Mar 2024 Maintain Buy LowerDocument6 pagesBRI Danareksa Company Update FY23 ROTI 7 Mar 2024 Maintain Buy LowerCandra AdyastaNo ratings yet

- Tanla - Update - Jul23 - HSIE-202307191442519944993Document13 pagesTanla - Update - Jul23 - HSIE-202307191442519944993jatin khannaNo ratings yet

- Avenue Supermarts (DMART IN) : Q1FY20 Result UpdateDocument8 pagesAvenue Supermarts (DMART IN) : Q1FY20 Result UpdatejigarchhatrolaNo ratings yet

- ICICI Securities Initiating Coverage On Nazara Technologies WithDocument27 pagesICICI Securities Initiating Coverage On Nazara Technologies Withagarwal.deepak6688No ratings yet

- Avenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthDocument10 pagesAvenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthLucifer GamerzNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- Abfrl 20240215 Mosl Ru PG012Document12 pagesAbfrl 20240215 Mosl Ru PG012krishna_buntyNo ratings yet

- Mitra Adiperkasa: Indonesia Company GuideDocument14 pagesMitra Adiperkasa: Indonesia Company GuideAshokNo ratings yet

- Long Term Recommendation Bata India LTD.: The Growth SprintDocument38 pagesLong Term Recommendation Bata India LTD.: The Growth SprintPANo ratings yet

- Long Term Recommendation Bata India LTD.: The Growth SprintDocument38 pagesLong Term Recommendation Bata India LTD.: The Growth SprintPANo ratings yet

- Indopremier Company Update 4Q23 ACES 1 Apr 2024 Upgrade To Buy TPDocument6 pagesIndopremier Company Update 4Q23 ACES 1 Apr 2024 Upgrade To Buy TPfinancialshooterNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- (Kotak) Trent, February 08, 20241Document12 pages(Kotak) Trent, February 08, 20241pradeep kumarNo ratings yet

- DolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Document10 pagesDolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Reshmi GanapathyNo ratings yet

- Sansera-Engineering 30052024 ICICI-SecuritiesDocument5 pagesSansera-Engineering 30052024 ICICI-SecuritiesgreyistariNo ratings yet

- UNVR SekuritasDocument7 pagesUNVR Sekuritasfaizal ardiNo ratings yet

- VMART Q4FY22 ResultDocument6 pagesVMART Q4FY22 ResultKhush GosraniNo ratings yet

- Indopremier Company Update SIDO 5 Mar 2024 Reiterate Buy HigherDocument7 pagesIndopremier Company Update SIDO 5 Mar 2024 Reiterate Buy Higherprima.brpNo ratings yet

- NH Korindo CTRA - Focus On Existing ProjectsDocument6 pagesNH Korindo CTRA - Focus On Existing ProjectsHamba AllahNo ratings yet

- Ajanta PharmaDocument10 pagesAjanta Pharmakarnasutputra0No ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Mindtree-Q4FY22 MOFSLDocument12 pagesMindtree-Q4FY22 MOFSLdarshanmadeNo ratings yet

- Wipro LTD (WIPRO) : Growth and Margin Visibility Improving..Document13 pagesWipro LTD (WIPRO) : Growth and Margin Visibility Improving..ashok yadavNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Nazara Technologies - Prabhu - 14022022140222Document8 pagesNazara Technologies - Prabhu - 14022022140222saurabht11293No ratings yet

- 1.8. Jarir Aljazira Capital 2022.8Document3 pages1.8. Jarir Aljazira Capital 2022.8robynxjNo ratings yet

- Infosys (INFO IN) : Q1FY22 Result UpdateDocument13 pagesInfosys (INFO IN) : Q1FY22 Result UpdatePrahladNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- DMART - RR - 17102022 - Retail 17 October 2022 104478400Document13 pagesDMART - RR - 17102022 - Retail 17 October 2022 104478400Dhruval KabariyaNo ratings yet

- ITC 020822 MotiDocument12 pagesITC 020822 Motinitin sonareNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Vinati Organics LTD: Growth To Pick-Up..Document5 pagesVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNo ratings yet

- L&T Technology Services (LTTS IN) : Q3FY19 Result UpdateDocument9 pagesL&T Technology Services (LTTS IN) : Q3FY19 Result UpdateanjugaduNo ratings yet

- Affle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Document8 pagesAffle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Bharti PuratanNo ratings yet

- Vip 27 1 23 PLDocument6 pagesVip 27 1 23 PLJohn SukumarNo ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- Motilal Oswal Financial Services2Document9 pagesMotilal Oswal Financial Services2Bhav Bhagwan HaiNo ratings yet

- Realigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationDocument8 pagesRealigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationJajahinaNo ratings yet

- CCL Products LTD - Q4FY24 Result Update - 14052024 - 14-05-2024 - 12Document8 pagesCCL Products LTD - Q4FY24 Result Update - 14052024 - 14-05-2024 - 12captainsingh179No ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Voltas Dolat 140519 PDFDocument7 pagesVoltas Dolat 140519 PDFADNo ratings yet

- Golden Stocks PortfolioDocument6 pagesGolden Stocks PortfoliocompangelNo ratings yet

- Ipca RRDocument9 pagesIpca RRRicha P SinghalNo ratings yet

- Latent View Analytics LTD.: Leading Data Analytics Company Within A Growing IndustryDocument21 pagesLatent View Analytics LTD.: Leading Data Analytics Company Within A Growing IndustryAJ WalkerNo ratings yet

- DivisLabs MotilalOswal Feb9-2016Document10 pagesDivisLabs MotilalOswal Feb9-2016rohitNo ratings yet

- Stock Report On Baja Auto in India Ma 23 2020Document12 pagesStock Report On Baja Auto in India Ma 23 2020PranavPillaiNo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- Sterlite Technologies (STETEC) : Export Demand Drives GrowthDocument10 pagesSterlite Technologies (STETEC) : Export Demand Drives Growthsaran21No ratings yet

- AsiiDocument10 pagesAsiifinancialshooterNo ratings yet

- RBL Bank - 4QFY19 - HDFC Sec-201904191845245959765Document12 pagesRBL Bank - 4QFY19 - HDFC Sec-201904191845245959765SachinNo ratings yet

- Maruti Suzuki: Healthy Realisations Provide Operating Boost BUY'Document5 pagesMaruti Suzuki: Healthy Realisations Provide Operating Boost BUY'SIDNo ratings yet

- Mrs. Bectors Food Specialities: Sustaining Volume Growth Trajectory With PremiumisationDocument1 pageMrs. Bectors Food Specialities: Sustaining Volume Growth Trajectory With PremiumisationPrathamesh SinghNo ratings yet

- View: Good Quarter, Better Show From Q3FY21E Maintain Buy: Scrip DetailsDocument9 pagesView: Good Quarter, Better Show From Q3FY21E Maintain Buy: Scrip DetailsDhavalNo ratings yet

- Dmart 14 1 23 PLDocument7 pagesDmart 14 1 23 PLDhruval KabariyaNo ratings yet

- Granules - India BP - Wealth 151121Document7 pagesGranules - India BP - Wealth 151121Lakshay SainiNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Bahana Fixed Income Market Outlook 2023Document47 pagesBahana Fixed Income Market Outlook 2023financialshooterNo ratings yet

- 20240610-BanksDocument18 pages20240610-BanksfinancialshooterNo ratings yet

- Banking - Deposits Superior to Loan GrowthDocument3 pagesBanking - Deposits Superior to Loan GrowthfinancialshooterNo ratings yet

- c6814a083004ec32481b224a97ead10aDocument5 pagesc6814a083004ec32481b224a97ead10afinancialshooterNo ratings yet

- TOWR_IJ_-_MNC_Sekuritas_Equity_Report_(05072024) (1)Document6 pagesTOWR_IJ_-_MNC_Sekuritas_Equity_Report_(05072024) (1)financialshooterNo ratings yet

- Press_Release_Petrosea_Signs_Renewal_of_Mining_Services_AgreementDocument2 pagesPress_Release_Petrosea_Signs_Renewal_of_Mining_Services_AgreementfinancialshooterNo ratings yet

- Property_Sector_Update-MNC_SekuritasDocument4 pagesProperty_Sector_Update-MNC_SekuritasfinancialshooterNo ratings yet

- AsiiDocument10 pagesAsiifinancialshooterNo ratings yet

- Mirae Asset Sekuritas Indonesia ASII 1 Q24 Result 2cf5de2288Document14 pagesMirae Asset Sekuritas Indonesia ASII 1 Q24 Result 2cf5de2288financialshooterNo ratings yet

- Nietzsche Friedrich Ecce Homo 1911Document131 pagesNietzsche Friedrich Ecce Homo 1911financialshooterNo ratings yet

- Data Bulletin Variable Frequency Drives and Short-Circuit Current RatingsDocument12 pagesData Bulletin Variable Frequency Drives and Short-Circuit Current Ratingsrenzo_aspa_orgNo ratings yet

- Computation of ProfitsDocument4 pagesComputation of ProfitsAngela LozanoNo ratings yet

- Cyber Law and Ipr Issues: The Indian Perspective: Mr. Atul Satwa JaybhayeDocument14 pagesCyber Law and Ipr Issues: The Indian Perspective: Mr. Atul Satwa JaybhayeAmit TiwariNo ratings yet

- Summarizing and Note-Taking DFCEDocument11 pagesSummarizing and Note-Taking DFCEMeghnaNo ratings yet

- Unit - Iii Profit Prior To IncorporationDocument33 pagesUnit - Iii Profit Prior To IncorporationShah RukhNo ratings yet

- 71 People v. Pugay DigestDocument3 pages71 People v. Pugay DigestCedrick100% (1)

- Sema V COMELEC DigestDocument5 pagesSema V COMELEC DigestTrizia VeluyaNo ratings yet

- Understanding Price Action Practical Analysis of The 5 Minute Time Frame Full ChapterDocument41 pagesUnderstanding Price Action Practical Analysis of The 5 Minute Time Frame Full Chapterjoseph.chavez825100% (29)

- EAP-1-Agriculture (Reading Materials)Document14 pagesEAP-1-Agriculture (Reading Materials)Tessa Putri DeniaNo ratings yet

- Btap TCQTDocument35 pagesBtap TCQTMai Phạm Hà ThanhNo ratings yet

- Revisions HistoryDocument25 pagesRevisions Historyabdel taibNo ratings yet

- Soil ReportDocument9 pagesSoil ReportHabib Ur RahmanNo ratings yet

- RCC Teen - Task 5 - BandwidthDocument2 pagesRCC Teen - Task 5 - BandwidthRares AndreiNo ratings yet

- Raymond Murphy-English Grammar in Use With Answers and CD ROM - A Self-Study Reference and Practice Book For Intermediate Students of English-Cambridge University Press (2004)Document13 pagesRaymond Murphy-English Grammar in Use With Answers and CD ROM - A Self-Study Reference and Practice Book For Intermediate Students of English-Cambridge University Press (2004)Thiago Dos Reis100% (1)

- Blaupunkt Chicago Ivdm 7002Document4 pagesBlaupunkt Chicago Ivdm 7002Onix AdiNo ratings yet

- 20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4Document2 pages20 Preparation Question: Contract: Contract 1 Contract 2 Contract 3 Contract 4SerenaNo ratings yet

- Comparison Between C and C++ and Lisp and PrologDocument18 pagesComparison Between C and C++ and Lisp and PrologAhmed HeshamNo ratings yet

- Pwwha: Delhi 10RDocument44 pagesPwwha: Delhi 10Rserrano.flia.coNo ratings yet

- HIRARCDocument21 pagesHIRARCAmirul Mukminin Zakaria SymantechNo ratings yet

- Research Methods in Biomechanics: Second Edition (Ebook) : November 2013Document14 pagesResearch Methods in Biomechanics: Second Edition (Ebook) : November 2013Jun KimNo ratings yet

- Sliding Mode Controller Design For Controlling The Speed of A DC MotorDocument5 pagesSliding Mode Controller Design For Controlling The Speed of A DC Motorbokic88No ratings yet

- Architecture Intern Resume ExampleDocument1 pageArchitecture Intern Resume ExampleXing YanNo ratings yet

- The Nature of Bureaucracy in The PhilippDocument5 pagesThe Nature of Bureaucracy in The PhilippChristopher IgnacioNo ratings yet

- 2.5 - S464G1007 Estacion ManualDocument2 pages2.5 - S464G1007 Estacion ManualCarlos Jesus Cañamero GutierrezNo ratings yet

- The Embassy in Jakarta - Overview (2012) PDFDocument17 pagesThe Embassy in Jakarta - Overview (2012) PDFHo Yiu YinNo ratings yet

- The Perfect Site GuideDocument59 pagesThe Perfect Site GuideconstantrazNo ratings yet

- I-765 Online Filing Instructions - FINALDocument13 pagesI-765 Online Filing Instructions - FINALTrân LêNo ratings yet

- Quantitative and Qualitative Research in FinanceDocument18 pagesQuantitative and Qualitative Research in FinanceZeeshan Hyder BhattiNo ratings yet