Professional Documents

Culture Documents

JD Risk Management CMAs

JD Risk Management CMAs

Uploaded by

Azeem KhanCopyright:

Available Formats

You might also like

- Fluid Mechanics Forced Vortex Free Vortex ExperimentDocument7 pagesFluid Mechanics Forced Vortex Free Vortex ExperimentRavi Agarwal100% (14)

- 812591-006 (Service DT3000)Document444 pages812591-006 (Service DT3000)Ivan Trak60% (5)

- Internal Audit Checklist IMSDocument15 pagesInternal Audit Checklist IMSGREENEXE BUSINESS CONSULTANT100% (4)

- CRISC Job Practice Areas 2015Document4 pagesCRISC Job Practice Areas 2015SpipparisNo ratings yet

- IT Audit FormatDocument15 pagesIT Audit FormatAnonymous 9d1jFvNo ratings yet

- Risk and Control Self Assessment IRMDocument27 pagesRisk and Control Self Assessment IRMidrisngr100% (4)

- JDRR Job Delivery LeadDocument1 pageJDRR Job Delivery LeadRitvick shahNo ratings yet

- Awarenessofiatf 16949Document29 pagesAwarenessofiatf 16949AkshaIQ trainingandconsultancyNo ratings yet

- Dimensions of Product QualityDocument1 pageDimensions of Product Qualitygk37765No ratings yet

- SMRP CMRP Combined Overview Study NotesDocument27 pagesSMRP CMRP Combined Overview Study Notesfaysal salimNo ratings yet

- 4 5789480172566612034Document72 pages4 5789480172566612034Pankaj MeenaNo ratings yet

- JD - Head Quality DevelopmentDocument2 pagesJD - Head Quality DevelopmentVivek NarulaNo ratings yet

- BSBOPS504Document20 pagesBSBOPS504Swastika ThapaNo ratings yet

- Yegi Prasad: Experience SummaryDocument3 pagesYegi Prasad: Experience SummaryRohit SrivastavaNo ratings yet

- CMMIDocument4 pagesCMMIclinden5802No ratings yet

- 03 References (Same) - RMG02101ENME - v3 (AD02) - Nov2019Document18 pages03 References (Same) - RMG02101ENME - v3 (AD02) - Nov2019Nizar EnnettaNo ratings yet

- How Management Standards Can Shape The Future Development, Roll-Out and Implementation of Asset Integrity Management SystemDocument23 pagesHow Management Standards Can Shape The Future Development, Roll-Out and Implementation of Asset Integrity Management SystemhdquanNo ratings yet

- Controls Assurance Manager JDDocument2 pagesControls Assurance Manager JDvspNo ratings yet

- 2022 DQ+Production MonitoringDocument2 pages2022 DQ+Production MonitoringganeshNo ratings yet

- GE8077 Total Quality Management QBDocument10 pagesGE8077 Total Quality Management QBRahulNo ratings yet

- GXP Lifeline - Referral Partner Template - Namosol UV - JJ v2Document6 pagesGXP Lifeline - Referral Partner Template - Namosol UV - JJ v2Pavan SaiNo ratings yet

- Performance Metrics: For EMS Self Assessment & Management ReviewDocument24 pagesPerformance Metrics: For EMS Self Assessment & Management ReviewVijaya Seharan NairNo ratings yet

- Strategic Control and OutsourcingDocument5 pagesStrategic Control and OutsourcingSandeep KulkarniNo ratings yet

- Risk AssessmentDocument3 pagesRisk Assessmentsalman100% (1)

- ISO 13485:2016 Compliance: Embedding Risk in Your Quality Management ProcessesDocument48 pagesISO 13485:2016 Compliance: Embedding Risk in Your Quality Management ProcessesHilario AlinabonNo ratings yet

- GRC STAR Scenarios For Interviews - 101623Document12 pagesGRC STAR Scenarios For Interviews - 101623dooshima.doyewoleNo ratings yet

- 12 Takeaways On Control Effectiveness in The First Line of DefenceDocument3 pages12 Takeaways On Control Effectiveness in The First Line of DefenceDostfijiNo ratings yet

- ProfileDocument4 pagesProfilearmrnbio21No ratings yet

- Srilalitha Katta CVDocument7 pagesSrilalitha Katta CVDantuPallaviNo ratings yet

- Operational Key Risk IndicatorsDocument24 pagesOperational Key Risk IndicatorssjvrNo ratings yet

- Software - Engg Chap 05.4Document25 pagesSoftware - Engg Chap 05.4mylove6947No ratings yet

- DMAIC Is A DataDocument4 pagesDMAIC Is A DataShubham sharmaNo ratings yet

- Chapter Six Strategic Control and EvaluationDocument68 pagesChapter Six Strategic Control and EvaluationbutwalserviceNo ratings yet

- Gaining Momentum For Requirements Improvement: By: Patrick HeembrockDocument8 pagesGaining Momentum For Requirements Improvement: By: Patrick HeembrockfatimamaiaalmeidaNo ratings yet

- Pmi RMP PRSNT MSTR NuDocument18 pagesPmi RMP PRSNT MSTR Nugulam mustafaNo ratings yet

- Evaluating Performance - Is To Appraise Work in Progress, Assess JobsDocument6 pagesEvaluating Performance - Is To Appraise Work in Progress, Assess JobsElite OsiganNo ratings yet

- Process Improvement and Six Sigma: Managing For Quality and Performance Excellence, 10E, © 2017 Cengage PublishingDocument52 pagesProcess Improvement and Six Sigma: Managing For Quality and Performance Excellence, 10E, © 2017 Cengage PublishingSambil MukwakunguNo ratings yet

- Shaik Mohammed SaleemDocument5 pagesShaik Mohammed SaleemRamya NagarajuNo ratings yet

- Sample MGRDocument3 pagesSample MGRMottu2003No ratings yet

- 360 Degree Risk ManagementDocument7 pages360 Degree Risk Managementmaconny20No ratings yet

- Business Continuity Planning Audit Work Program Sample 3Document19 pagesBusiness Continuity Planning Audit Work Program Sample 3Juan Pascual Cosare100% (1)

- Strategic Control CH IXDocument51 pagesStrategic Control CH IXsujata dawadiNo ratings yet

- RCSA Session 1 Revised - FINAL PDFDocument9 pagesRCSA Session 1 Revised - FINAL PDFTejendrasinh GohilNo ratings yet

- Six Sigma Quality: Chapter TwelveDocument25 pagesSix Sigma Quality: Chapter TwelveTopan ArdiansyahNo ratings yet

- Risk Management Exam OutlineDocument21 pagesRisk Management Exam OutlineJuanNo ratings yet

- Process Safety Performance Indicators PDFDocument15 pagesProcess Safety Performance Indicators PDFsgraureNo ratings yet

- CP 6Document8 pagesCP 6Abhijit BhongNo ratings yet

- Operational Risk Management Framework and Control Self AssessmentDocument51 pagesOperational Risk Management Framework and Control Self AssessmentTejendrasinh GohilNo ratings yet

- Tejendrasinh Gohil: TH THDocument7 pagesTejendrasinh Gohil: TH THSureshArigelaNo ratings yet

- SriniDasari ResumeDocument5 pagesSriniDasari ResumeMandeep BakshiNo ratings yet

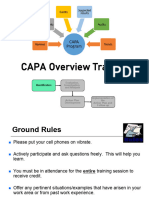

- CAPA Overview Training 1686363145Document35 pagesCAPA Overview Training 1686363145Nurul FikriNo ratings yet

- Governance, Risk and Compliance Management - GRCDocument3 pagesGovernance, Risk and Compliance Management - GRCszha0% (1)

- Blue Economy Integration Education and Community DevelopmentDocument41 pagesBlue Economy Integration Education and Community DevelopmentFirda BasbethNo ratings yet

- The CRISC Job Practice Areas Reflect The Vital and Evolving Responsibilities of IT Risk and IS Control PractitionersDocument3 pagesThe CRISC Job Practice Areas Reflect The Vital and Evolving Responsibilities of IT Risk and IS Control PractitionersAleAle0% (1)

- JD Operations Analyst B2B and B2C OAB2B2C Internal CandidateDocument5 pagesJD Operations Analyst B2B and B2C OAB2B2C Internal CandidateGRACENo ratings yet

- Risk Assessment ISO31000Document61 pagesRisk Assessment ISO31000André Santos50% (2)

- Roles and Resp REs 14 07 2013Document2 pagesRoles and Resp REs 14 07 2013ramaiitrNo ratings yet

- Risk Management Exam OutlineDocument28 pagesRisk Management Exam OutlineTran Van HienNo ratings yet

- Day 6 - QualityDocument33 pagesDay 6 - QualityAlok SharmaNo ratings yet

- It Application Lifecycle Management Vendor Landscape Storyboard SampleDocument12 pagesIt Application Lifecycle Management Vendor Landscape Storyboard SampleRobson MamedeNo ratings yet

- Corrective and Preventive ActionDocument35 pagesCorrective and Preventive ActionConrad ConradmannNo ratings yet

- Senior Manager, CCR ReportingDocument5 pagesSenior Manager, CCR ReportingAkhilNo ratings yet

- Fiche Technique 5978600PG PDFDocument7 pagesFiche Technique 5978600PG PDFVILLEROY JEAN-PIERRENo ratings yet

- SET-71. SMS Based DC Motor Speed Controller With Password ProtectionDocument3 pagesSET-71. SMS Based DC Motor Speed Controller With Password ProtectionAkula VaishnaviNo ratings yet

- Jessore Felicity BigData Data Center Solution - V1.0Document19 pagesJessore Felicity BigData Data Center Solution - V1.0Muhtadin IqbalNo ratings yet

- Angular Gripper CT-40M-RE 180 Degree SeriesDocument1 pageAngular Gripper CT-40M-RE 180 Degree SeriesBe HappyNo ratings yet

- CEE 9531 Wind Energy Course Outline - January - April 2018Document4 pagesCEE 9531 Wind Energy Course Outline - January - April 2018Anonymous fYHyRa2XNo ratings yet

- OpenText Content Server CE 21.3 - Module Installation and Upgrade Guide English (LLESCOR210300-IMO-En-01)Document22 pagesOpenText Content Server CE 21.3 - Module Installation and Upgrade Guide English (LLESCOR210300-IMO-En-01)nippanisasiNo ratings yet

- ProBook 455 15.6 Inch G9 c08108676Document105 pagesProBook 455 15.6 Inch G9 c08108676StefanGarnetNo ratings yet

- CD70Navi ManualDocument70 pagesCD70Navi ManualRoel PlmrsNo ratings yet

- Segmentation of Urban Areas Using Road Networks: Nicholas Jing Yuan Yu Zheng Xing XieDocument5 pagesSegmentation of Urban Areas Using Road Networks: Nicholas Jing Yuan Yu Zheng Xing XieMuhammad FarhanNo ratings yet

- Timothy Leary Bibliography: ArticlesDocument8 pagesTimothy Leary Bibliography: ArticlesLeandroNo ratings yet

- Auditorium Acoustics: Sound Propagation in An AuditoriumDocument3 pagesAuditorium Acoustics: Sound Propagation in An AuditoriumAL SAQF ENGINEERING CONSULTANCYNo ratings yet

- Total Teaching Staff Name Total Subject Name (I To XII) Input ÂDocument58 pagesTotal Teaching Staff Name Total Subject Name (I To XII) Input ÂajaythermalNo ratings yet

- Asp-AdoDocument18 pagesAsp-AdoVivek JamwalNo ratings yet

- Significance of The Study Sample Term PaperDocument8 pagesSignificance of The Study Sample Term Paperafdtsxuep100% (1)

- EPLRSDocument6 pagesEPLRSs-hadeNo ratings yet

- Q Series-1Document4 pagesQ Series-1williams vasquezNo ratings yet

- Influocial Digital Portfolio-2021Document11 pagesInfluocial Digital Portfolio-2021Influocial Technologies Pvt Ltd100% (1)

- Permanent Magnet Motor Speed Controller MODEL 1212P: FEATURES ContinuedDocument3 pagesPermanent Magnet Motor Speed Controller MODEL 1212P: FEATURES ContinuedWillian Anchundia100% (1)

- Introduction To Microdevices and Microsystems: Module On Microsystems & MicrofabricaDocument31 pagesIntroduction To Microdevices and Microsystems: Module On Microsystems & MicrofabricaBanshi Dhar GuptaNo ratings yet

- Torque Wrench Pump: Hydraulic/ElectricDocument1 pageTorque Wrench Pump: Hydraulic/Electricherbert madariagaNo ratings yet

- Mechanics For Healthy Cooking Contest - NM2021 - For PaxDocument3 pagesMechanics For Healthy Cooking Contest - NM2021 - For PaxFe An CabreraNo ratings yet

- 2Document2 pages2RahulNo ratings yet

- For Education Purpose: International StandardDocument40 pagesFor Education Purpose: International StandardChristianieAnn100% (1)

- Scale of Data MeasurementDocument11 pagesScale of Data MeasurementSaudulla Jameel JameelNo ratings yet

- Bug Bounty ToolsDocument1 pageBug Bounty ToolsxixiyNo ratings yet

- AN17810A PanasonicDocument7 pagesAN17810A PanasonicManikmoyoNo ratings yet

- Mathematical Logic or ConnectivesDocument16 pagesMathematical Logic or ConnectivesMerrypatel2386No ratings yet

JD Risk Management CMAs

JD Risk Management CMAs

Uploaded by

Azeem KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JD Risk Management CMAs

JD Risk Management CMAs

Uploaded by

Azeem KhanCopyright:

Available Formats

Objective:

Design and execute Risk Management process based on defined Group Risk management Framework to manage risks.

The standard Risk Management process conducted as part of Day to Day Risk Management and Business & Strategic

Risk Management covers setting business objectives, identifying risk events with their causes and consequences,

assessing risks, implementing risk responses, monitoring and reporting risks.

As a Risk Manager at RJIL, you will be responsible for proactively identifying, assessing, and mitigating risks for our

operations. Your role will be critical in ensuring the continuity of our operations and optimizing its efficiency.

KEY RESPONSIBILITIES/ ACCOUNTABILITIES:

1. Risk team member has to lead the identification, communication, assessment and management of Risks

pertaining to Operations.

2. Partnering with key stakeholders to develop & implement standards, processes, programs and best practices

related to Risk Management.

3. Manage relationship with the functional heads & CFTs for implementation of Risk Management Framework

across different domains and Incident reporting.

4. Risk team member would be defining the Manual Test Plan for functional assurance (LoD2 Testing)

5. Draft the detailed test step and procedure for evaluating control effectiveness

6. Execution of test procedure at different geographical location through online or offline mode

7. Compliance and Regulations:

Stay updated on relevant regulations and industry standards related to the functional units.

Ensure the company's practices comply with all applicable laws and regulations.

8. Data Analysis: Utilize data analytics and technology tools to monitor key performance indicators and identify

emerging risks.

9. Continuous Improvement:

Proactively identify opportunities for process improvement and optimization within the functional units.

Implement best practices and track performance metrics.

10. Reporting:

Prepare regular reports and presentations on risk status, mitigation progress.

Reporting of issue in GRC noted during reviews and coordinate with issue owner or action owner for

implementation of action plan identified

11. Risk team member will draft and propose the Scope of process review

12. Execution of field work by adopting multiple methodologies i.e. process walkthrough, desktop review, data

analysis, observing or verifying etc.

13. Notify the observation, discuss and obtain agreement with local control or process owner to establish the

findings or improvement area noted during the review.

Preparation of report with highlighting the Control failure (Operating or Design), Causes, Consequences, Action plan,

Action responsible & Timelines, other recommendation agreed with process owner (if any)

Key Performance Indicators:

1. % Adherence to risk management coverage vs. scope

2. % completion of process review

3. % completion of controls self‐assessment

4. % completion of functional assurance (LoD2) testing

5. % of identified key control failure vis a vis Remediation plan

6. % closure of issues identified during CSA/FA/Process review

Confidential Reliance Jio Infocomm Limited Page 1

Education:

“Professional Certification” from a reputed institute.

Skills & Competencies

1. Stakeholder Management.

2. Knowledge of industry best practices and regulatory requirements.

3. Strong analytical and problem‐solving skills.

4. Excellent communication and presentation skills.

5. Ability to work collaboratively and cross‐functionally within a team.

6. Certification in IRM or Risk Management is a plus.

Location

Reliance Corporate Park, Navi Mumbai

Component CMA Cadre Program

(Annual) 1st Attempts (Direct)

Fixed Pay Rs. 10.90 Lacs

Variable Rs. 1.09 Lacs

Total Pay Rs. 12 Lacs

Confidential Reliance Jio Infocomm Limited Page 2

You might also like

- Fluid Mechanics Forced Vortex Free Vortex ExperimentDocument7 pagesFluid Mechanics Forced Vortex Free Vortex ExperimentRavi Agarwal100% (14)

- 812591-006 (Service DT3000)Document444 pages812591-006 (Service DT3000)Ivan Trak60% (5)

- Internal Audit Checklist IMSDocument15 pagesInternal Audit Checklist IMSGREENEXE BUSINESS CONSULTANT100% (4)

- CRISC Job Practice Areas 2015Document4 pagesCRISC Job Practice Areas 2015SpipparisNo ratings yet

- IT Audit FormatDocument15 pagesIT Audit FormatAnonymous 9d1jFvNo ratings yet

- Risk and Control Self Assessment IRMDocument27 pagesRisk and Control Self Assessment IRMidrisngr100% (4)

- JDRR Job Delivery LeadDocument1 pageJDRR Job Delivery LeadRitvick shahNo ratings yet

- Awarenessofiatf 16949Document29 pagesAwarenessofiatf 16949AkshaIQ trainingandconsultancyNo ratings yet

- Dimensions of Product QualityDocument1 pageDimensions of Product Qualitygk37765No ratings yet

- SMRP CMRP Combined Overview Study NotesDocument27 pagesSMRP CMRP Combined Overview Study Notesfaysal salimNo ratings yet

- 4 5789480172566612034Document72 pages4 5789480172566612034Pankaj MeenaNo ratings yet

- JD - Head Quality DevelopmentDocument2 pagesJD - Head Quality DevelopmentVivek NarulaNo ratings yet

- BSBOPS504Document20 pagesBSBOPS504Swastika ThapaNo ratings yet

- Yegi Prasad: Experience SummaryDocument3 pagesYegi Prasad: Experience SummaryRohit SrivastavaNo ratings yet

- CMMIDocument4 pagesCMMIclinden5802No ratings yet

- 03 References (Same) - RMG02101ENME - v3 (AD02) - Nov2019Document18 pages03 References (Same) - RMG02101ENME - v3 (AD02) - Nov2019Nizar EnnettaNo ratings yet

- How Management Standards Can Shape The Future Development, Roll-Out and Implementation of Asset Integrity Management SystemDocument23 pagesHow Management Standards Can Shape The Future Development, Roll-Out and Implementation of Asset Integrity Management SystemhdquanNo ratings yet

- Controls Assurance Manager JDDocument2 pagesControls Assurance Manager JDvspNo ratings yet

- 2022 DQ+Production MonitoringDocument2 pages2022 DQ+Production MonitoringganeshNo ratings yet

- GE8077 Total Quality Management QBDocument10 pagesGE8077 Total Quality Management QBRahulNo ratings yet

- GXP Lifeline - Referral Partner Template - Namosol UV - JJ v2Document6 pagesGXP Lifeline - Referral Partner Template - Namosol UV - JJ v2Pavan SaiNo ratings yet

- Performance Metrics: For EMS Self Assessment & Management ReviewDocument24 pagesPerformance Metrics: For EMS Self Assessment & Management ReviewVijaya Seharan NairNo ratings yet

- Strategic Control and OutsourcingDocument5 pagesStrategic Control and OutsourcingSandeep KulkarniNo ratings yet

- Risk AssessmentDocument3 pagesRisk Assessmentsalman100% (1)

- ISO 13485:2016 Compliance: Embedding Risk in Your Quality Management ProcessesDocument48 pagesISO 13485:2016 Compliance: Embedding Risk in Your Quality Management ProcessesHilario AlinabonNo ratings yet

- GRC STAR Scenarios For Interviews - 101623Document12 pagesGRC STAR Scenarios For Interviews - 101623dooshima.doyewoleNo ratings yet

- 12 Takeaways On Control Effectiveness in The First Line of DefenceDocument3 pages12 Takeaways On Control Effectiveness in The First Line of DefenceDostfijiNo ratings yet

- ProfileDocument4 pagesProfilearmrnbio21No ratings yet

- Srilalitha Katta CVDocument7 pagesSrilalitha Katta CVDantuPallaviNo ratings yet

- Operational Key Risk IndicatorsDocument24 pagesOperational Key Risk IndicatorssjvrNo ratings yet

- Software - Engg Chap 05.4Document25 pagesSoftware - Engg Chap 05.4mylove6947No ratings yet

- DMAIC Is A DataDocument4 pagesDMAIC Is A DataShubham sharmaNo ratings yet

- Chapter Six Strategic Control and EvaluationDocument68 pagesChapter Six Strategic Control and EvaluationbutwalserviceNo ratings yet

- Gaining Momentum For Requirements Improvement: By: Patrick HeembrockDocument8 pagesGaining Momentum For Requirements Improvement: By: Patrick HeembrockfatimamaiaalmeidaNo ratings yet

- Pmi RMP PRSNT MSTR NuDocument18 pagesPmi RMP PRSNT MSTR Nugulam mustafaNo ratings yet

- Evaluating Performance - Is To Appraise Work in Progress, Assess JobsDocument6 pagesEvaluating Performance - Is To Appraise Work in Progress, Assess JobsElite OsiganNo ratings yet

- Process Improvement and Six Sigma: Managing For Quality and Performance Excellence, 10E, © 2017 Cengage PublishingDocument52 pagesProcess Improvement and Six Sigma: Managing For Quality and Performance Excellence, 10E, © 2017 Cengage PublishingSambil MukwakunguNo ratings yet

- Shaik Mohammed SaleemDocument5 pagesShaik Mohammed SaleemRamya NagarajuNo ratings yet

- Sample MGRDocument3 pagesSample MGRMottu2003No ratings yet

- 360 Degree Risk ManagementDocument7 pages360 Degree Risk Managementmaconny20No ratings yet

- Business Continuity Planning Audit Work Program Sample 3Document19 pagesBusiness Continuity Planning Audit Work Program Sample 3Juan Pascual Cosare100% (1)

- Strategic Control CH IXDocument51 pagesStrategic Control CH IXsujata dawadiNo ratings yet

- RCSA Session 1 Revised - FINAL PDFDocument9 pagesRCSA Session 1 Revised - FINAL PDFTejendrasinh GohilNo ratings yet

- Six Sigma Quality: Chapter TwelveDocument25 pagesSix Sigma Quality: Chapter TwelveTopan ArdiansyahNo ratings yet

- Risk Management Exam OutlineDocument21 pagesRisk Management Exam OutlineJuanNo ratings yet

- Process Safety Performance Indicators PDFDocument15 pagesProcess Safety Performance Indicators PDFsgraureNo ratings yet

- CP 6Document8 pagesCP 6Abhijit BhongNo ratings yet

- Operational Risk Management Framework and Control Self AssessmentDocument51 pagesOperational Risk Management Framework and Control Self AssessmentTejendrasinh GohilNo ratings yet

- Tejendrasinh Gohil: TH THDocument7 pagesTejendrasinh Gohil: TH THSureshArigelaNo ratings yet

- SriniDasari ResumeDocument5 pagesSriniDasari ResumeMandeep BakshiNo ratings yet

- CAPA Overview Training 1686363145Document35 pagesCAPA Overview Training 1686363145Nurul FikriNo ratings yet

- Governance, Risk and Compliance Management - GRCDocument3 pagesGovernance, Risk and Compliance Management - GRCszha0% (1)

- Blue Economy Integration Education and Community DevelopmentDocument41 pagesBlue Economy Integration Education and Community DevelopmentFirda BasbethNo ratings yet

- The CRISC Job Practice Areas Reflect The Vital and Evolving Responsibilities of IT Risk and IS Control PractitionersDocument3 pagesThe CRISC Job Practice Areas Reflect The Vital and Evolving Responsibilities of IT Risk and IS Control PractitionersAleAle0% (1)

- JD Operations Analyst B2B and B2C OAB2B2C Internal CandidateDocument5 pagesJD Operations Analyst B2B and B2C OAB2B2C Internal CandidateGRACENo ratings yet

- Risk Assessment ISO31000Document61 pagesRisk Assessment ISO31000André Santos50% (2)

- Roles and Resp REs 14 07 2013Document2 pagesRoles and Resp REs 14 07 2013ramaiitrNo ratings yet

- Risk Management Exam OutlineDocument28 pagesRisk Management Exam OutlineTran Van HienNo ratings yet

- Day 6 - QualityDocument33 pagesDay 6 - QualityAlok SharmaNo ratings yet

- It Application Lifecycle Management Vendor Landscape Storyboard SampleDocument12 pagesIt Application Lifecycle Management Vendor Landscape Storyboard SampleRobson MamedeNo ratings yet

- Corrective and Preventive ActionDocument35 pagesCorrective and Preventive ActionConrad ConradmannNo ratings yet

- Senior Manager, CCR ReportingDocument5 pagesSenior Manager, CCR ReportingAkhilNo ratings yet

- Fiche Technique 5978600PG PDFDocument7 pagesFiche Technique 5978600PG PDFVILLEROY JEAN-PIERRENo ratings yet

- SET-71. SMS Based DC Motor Speed Controller With Password ProtectionDocument3 pagesSET-71. SMS Based DC Motor Speed Controller With Password ProtectionAkula VaishnaviNo ratings yet

- Jessore Felicity BigData Data Center Solution - V1.0Document19 pagesJessore Felicity BigData Data Center Solution - V1.0Muhtadin IqbalNo ratings yet

- Angular Gripper CT-40M-RE 180 Degree SeriesDocument1 pageAngular Gripper CT-40M-RE 180 Degree SeriesBe HappyNo ratings yet

- CEE 9531 Wind Energy Course Outline - January - April 2018Document4 pagesCEE 9531 Wind Energy Course Outline - January - April 2018Anonymous fYHyRa2XNo ratings yet

- OpenText Content Server CE 21.3 - Module Installation and Upgrade Guide English (LLESCOR210300-IMO-En-01)Document22 pagesOpenText Content Server CE 21.3 - Module Installation and Upgrade Guide English (LLESCOR210300-IMO-En-01)nippanisasiNo ratings yet

- ProBook 455 15.6 Inch G9 c08108676Document105 pagesProBook 455 15.6 Inch G9 c08108676StefanGarnetNo ratings yet

- CD70Navi ManualDocument70 pagesCD70Navi ManualRoel PlmrsNo ratings yet

- Segmentation of Urban Areas Using Road Networks: Nicholas Jing Yuan Yu Zheng Xing XieDocument5 pagesSegmentation of Urban Areas Using Road Networks: Nicholas Jing Yuan Yu Zheng Xing XieMuhammad FarhanNo ratings yet

- Timothy Leary Bibliography: ArticlesDocument8 pagesTimothy Leary Bibliography: ArticlesLeandroNo ratings yet

- Auditorium Acoustics: Sound Propagation in An AuditoriumDocument3 pagesAuditorium Acoustics: Sound Propagation in An AuditoriumAL SAQF ENGINEERING CONSULTANCYNo ratings yet

- Total Teaching Staff Name Total Subject Name (I To XII) Input ÂDocument58 pagesTotal Teaching Staff Name Total Subject Name (I To XII) Input ÂajaythermalNo ratings yet

- Asp-AdoDocument18 pagesAsp-AdoVivek JamwalNo ratings yet

- Significance of The Study Sample Term PaperDocument8 pagesSignificance of The Study Sample Term Paperafdtsxuep100% (1)

- EPLRSDocument6 pagesEPLRSs-hadeNo ratings yet

- Q Series-1Document4 pagesQ Series-1williams vasquezNo ratings yet

- Influocial Digital Portfolio-2021Document11 pagesInfluocial Digital Portfolio-2021Influocial Technologies Pvt Ltd100% (1)

- Permanent Magnet Motor Speed Controller MODEL 1212P: FEATURES ContinuedDocument3 pagesPermanent Magnet Motor Speed Controller MODEL 1212P: FEATURES ContinuedWillian Anchundia100% (1)

- Introduction To Microdevices and Microsystems: Module On Microsystems & MicrofabricaDocument31 pagesIntroduction To Microdevices and Microsystems: Module On Microsystems & MicrofabricaBanshi Dhar GuptaNo ratings yet

- Torque Wrench Pump: Hydraulic/ElectricDocument1 pageTorque Wrench Pump: Hydraulic/Electricherbert madariagaNo ratings yet

- Mechanics For Healthy Cooking Contest - NM2021 - For PaxDocument3 pagesMechanics For Healthy Cooking Contest - NM2021 - For PaxFe An CabreraNo ratings yet

- 2Document2 pages2RahulNo ratings yet

- For Education Purpose: International StandardDocument40 pagesFor Education Purpose: International StandardChristianieAnn100% (1)

- Scale of Data MeasurementDocument11 pagesScale of Data MeasurementSaudulla Jameel JameelNo ratings yet

- Bug Bounty ToolsDocument1 pageBug Bounty ToolsxixiyNo ratings yet

- AN17810A PanasonicDocument7 pagesAN17810A PanasonicManikmoyoNo ratings yet

- Mathematical Logic or ConnectivesDocument16 pagesMathematical Logic or ConnectivesMerrypatel2386No ratings yet