Professional Documents

Culture Documents

Exercises Bank Recon

Exercises Bank Recon

Uploaded by

azieruga32Copyright:

Available Formats

You might also like

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADocument37 pagesProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- 13 Lamaha Lease 2Document6 pages13 Lamaha Lease 2Elton Austin100% (2)

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Dakota Office ProductssDocument17 pagesDakota Office ProductssSuzan Bakleh100% (5)

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Visa Rules PublicDocument1,031 pagesVisa Rules PublicGabriel Alexandru LipanNo ratings yet

- CincinnatiDocument586 pagesCincinnatiJosephBAndradeIVNo ratings yet

- Bank Reconciliation - Sample ProblemDocument2 pagesBank Reconciliation - Sample ProblemKarl Wilson GonzalesNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationjinyangsuelNo ratings yet

- Lecture No.2 Petty Cash Fund Bank Recon Lecture Problem SolvingDocument2 pagesLecture No.2 Petty Cash Fund Bank Recon Lecture Problem Solvingdelrosario.kenneth996No ratings yet

- Financial Accounting Second QuarterDocument4 pagesFinancial Accounting Second QuarterAnalisa Rañin BaculotNo ratings yet

- Bank Recon LectureDocument4 pagesBank Recon LectureChristopher Mau BambalanNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Reviewer in Accounting - xlsx-3Document59 pagesReviewer in Accounting - xlsx-3Franchesca CortezNo ratings yet

- Proof of CashDocument2 pagesProof of CashRhea Mae CarantoNo ratings yet

- Exercises No1 CCash Equiv and Bank ReconDocument3 pagesExercises No1 CCash Equiv and Bank Recondelrosario.kenneth996No ratings yet

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationnaih marchessaNo ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- AEC 115-Bank Reconciliation AssignmentDocument3 pagesAEC 115-Bank Reconciliation AssignmentJeyssa YermoNo ratings yet

- Control Account Tutorial Questions 2023-2024Document10 pagesControl Account Tutorial Questions 2023-2024nyimbilene23No ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- Bank Reconciliation IllustrationDocument2 pagesBank Reconciliation IllustrationRia BryleNo ratings yet

- ActivityDocument1 pageActivityUwuuUNo ratings yet

- Second Exam Msa1 ReviewerDocument4 pagesSecond Exam Msa1 ReviewerPaul Marben PolinarNo ratings yet

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- 4 5805514475188521061Document8 pages4 5805514475188521061Gena HamdaNo ratings yet

- Problem 57Document1 pageProblem 57YukidoNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Bank Reconciliation: Basic ProblemsDocument25 pagesBank Reconciliation: Basic ProblemsAndrea FontiverosNo ratings yet

- Chapter 13-Cash ControlDocument25 pagesChapter 13-Cash ControlShaila MarceloNo ratings yet

- NOTES Practice Solving - Robles and EmpleoDocument52 pagesNOTES Practice Solving - Robles and EmpleoLeah La MadridNo ratings yet

- LESSON 3.2 - Bank ReconciliationDocument4 pagesLESSON 3.2 - Bank ReconciliationIshi MaxineNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- And POCDocument3 pagesAnd POCjudeaharmony.wamildaNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Chapter 2 Last PartDocument11 pagesChapter 2 Last PartXENA LOPEZ100% (2)

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Bank Reconciliation - SolutionsDocument6 pagesBank Reconciliation - SolutionsNIAZ HUSSAIN100% (1)

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Take Home Exam 1 Cash and Cash EquivalentsDocument2 pagesTake Home Exam 1 Cash and Cash EquivalentsJi Eun VinceNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- ACCT 315 AssignmentDocument11 pagesACCT 315 AssignmenthumaNo ratings yet

- Makeup Test Reviewer PDFDocument43 pagesMakeup Test Reviewer PDFandrea arapocNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- MC - Bank Reconciliation and Proof of CashDocument4 pagesMC - Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Concentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpFrom EverandConcentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpNo ratings yet

- List of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Document2 pagesList of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Vikram PhalakNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1jhefster_81No ratings yet

- Activity 1 - Audit of Receivables and RevenuesDocument2 pagesActivity 1 - Audit of Receivables and RevenuesColeen Joy Sebastian PagalingNo ratings yet

- Increase Credit Limit PDFDocument1 pageIncrease Credit Limit PDFemc2_mcvNo ratings yet

- S.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name RemittanceDocument8 pagesS.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name Remittancejyoti kumariNo ratings yet

- CH 2 - The Philippine Financial SystemDocument14 pagesCH 2 - The Philippine Financial SystemjsmnfrncscNo ratings yet

- Top Ten Largest Commercial Banks in The Philippines (Jellynfile)Document21 pagesTop Ten Largest Commercial Banks in The Philippines (Jellynfile)Ralph Evander IdulNo ratings yet

- FIN 401 Final Report BodyDocument9 pagesFIN 401 Final Report Body1711........100% (1)

- Project ReportDocument25 pagesProject ReportAarshiya Mina SheelNo ratings yet

- BPI Family Bank V FrancoDocument1 pageBPI Family Bank V FrancojoyceNo ratings yet

- Study of E-Banking Scenario in India: Shubhara JindalDocument4 pagesStudy of E-Banking Scenario in India: Shubhara JindalSahul RanaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsnikkitaaaNo ratings yet

- Principles of Insurance (1) Total SlidesDocument147 pagesPrinciples of Insurance (1) Total SlidesdaohoaflowerNo ratings yet

- Customer Bank AccountDocument872 pagesCustomer Bank AccountNaresh KumarNo ratings yet

- Itc14 mcp23Document8 pagesItc14 mcp23Lee TeukNo ratings yet

- Coding and Decoding QuestionsDocument28 pagesCoding and Decoding QuestionsAbdulawwal IntisorNo ratings yet

- Annual Report 2007Document20 pagesAnnual Report 2007SolidariteInternationale100% (2)

- Sbi ProjectDocument60 pagesSbi Projectjithu100% (3)

- CertanceDocument22 pagesCertanceZechen MaNo ratings yet

- New Supplier E-Payment FormDocument2 pagesNew Supplier E-Payment FormTareeke ThompsonNo ratings yet

- MM12 - Forex Scandal - WikipediaDocument3 pagesMM12 - Forex Scandal - WikipediaAtul SharmaNo ratings yet

- Statutory Audit ChecklistDocument6 pagesStatutory Audit ChecklistCA SwaroopNo ratings yet

- Basic Accounting Promissory NotesDocument12 pagesBasic Accounting Promissory NotesJean Lewis RossNo ratings yet

- History of PNBDocument2 pagesHistory of PNBAlliah SomidoNo ratings yet

- Bank Reconciliation Assignment 2Document8 pagesBank Reconciliation Assignment 2Caira De AsisNo ratings yet

- Common Law Power of Attorney FormDocument25 pagesCommon Law Power of Attorney Formwhitecliff1100% (3)

Exercises Bank Recon

Exercises Bank Recon

Uploaded by

azieruga32Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises Bank Recon

Exercises Bank Recon

Uploaded by

azieruga32Copyright:

Available Formats

Problem 1.

In preparing the bank reconciliation for the month of December 2023, Case Company

provided the following data:

Balance per bank statement 3,800,000

Deposit in transit 520,000

Amount erroneously credited by bank to Case account 40,000

Bank service charge for December 2023 5,000

NSF Check 50,000

Outstanding checks 675,000

What is the adjusted cash in bank?

What is the unadjusted cash in bank balance per book?

Problem 2. Luzon Company provided the following data for the month of December.

Balance per book 1,000,000

Bank Service Charge 3,000

Outstanding checks 235,000

Deposit in transit 300,000

Customer note collected by the bank 375,000

Interest on customer note 15,000

Customer check returned – NSF 62,000

Depositor’s payment of note payable charged to account 250,000

What is the adjusted cash in bank?

What is the unadjusted cash in bank balance per bank statement?

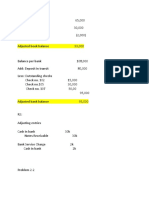

Problem 3. The cash records of Company X show the following for the month of January.

CASH RECEIPTS CASH DISBURSEMENTS

May 5 60,000 Check no. 721 5,000

May 13 20,000 Check no. 722 10,000

May 25 30,000 Check no. 723 18,000

May 31 40,000 Check no. 724 2,000

150,000 Check no. 725 37,000

Check no. 726 28,000

100,000

The balance of the cash in bank on the depositor’s book is 50,000.

The following is the bank statement for May received from the Neu Bank.

Date Check no. Withdrawals Deposits Balance

6-May 60,000 60,000

8-May 721 5,000 55,000

11-May 722 10,000 45,000

12-May 723 18,000 27,000

14-May 20,000 47,000

17-May 724 2,000 45,000

26-May 30,000 75,000

26-May 15,000 CM 90,000

30-May 5,000 RT 85,000

31-May 1,000 SC 84,000

NOTE: The CM represents proceeds of note collected by the bank in favor of the company. The RT

represents check of customer deposited previously but returned by the bank because of NSF. The SC

represents bank service charge.

You might also like

- Problem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer ADocument37 pagesProblem 15-1 (AICPA Adapted) : Solution 15 - 1 Answer AAldrin Lozano87% (15)

- 13 Lamaha Lease 2Document6 pages13 Lamaha Lease 2Elton Austin100% (2)

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- Dakota Office ProductssDocument17 pagesDakota Office ProductssSuzan Bakleh100% (5)

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Activity 2Document3 pagesActivity 2kathie alegarmeNo ratings yet

- Bank Reconciliation: QuizDocument4 pagesBank Reconciliation: QuizBrgy Baloling50% (2)

- Visa Rules PublicDocument1,031 pagesVisa Rules PublicGabriel Alexandru LipanNo ratings yet

- CincinnatiDocument586 pagesCincinnatiJosephBAndradeIVNo ratings yet

- Bank Reconciliation - Sample ProblemDocument2 pagesBank Reconciliation - Sample ProblemKarl Wilson GonzalesNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationjinyangsuelNo ratings yet

- Lecture No.2 Petty Cash Fund Bank Recon Lecture Problem SolvingDocument2 pagesLecture No.2 Petty Cash Fund Bank Recon Lecture Problem Solvingdelrosario.kenneth996No ratings yet

- Financial Accounting Second QuarterDocument4 pagesFinancial Accounting Second QuarterAnalisa Rañin BaculotNo ratings yet

- Bank Recon LectureDocument4 pagesBank Recon LectureChristopher Mau BambalanNo ratings yet

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoNo ratings yet

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Reviewer in Accounting - xlsx-3Document59 pagesReviewer in Accounting - xlsx-3Franchesca CortezNo ratings yet

- Proof of CashDocument2 pagesProof of CashRhea Mae CarantoNo ratings yet

- Exercises No1 CCash Equiv and Bank ReconDocument3 pagesExercises No1 CCash Equiv and Bank Recondelrosario.kenneth996No ratings yet

- 5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0Document14 pages5 D35 J1 XIzyh 2 HN 4 C OI59 N PVLG ISz 8 e Re CG TOm UTGbm WHWD WYhthrce 0ramosmikay0222No ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationnaih marchessaNo ratings yet

- Module 6 Part 2 Internal ControlDocument15 pagesModule 6 Part 2 Internal ControlKRISTINA CASSANDRA CUEVASNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- AEC 115-Bank Reconciliation AssignmentDocument3 pagesAEC 115-Bank Reconciliation AssignmentJeyssa YermoNo ratings yet

- Control Account Tutorial Questions 2023-2024Document10 pagesControl Account Tutorial Questions 2023-2024nyimbilene23No ratings yet

- Bank ReconciliationDocument12 pagesBank ReconciliationJieniel ShanielNo ratings yet

- Bank Reconciliation IllustrationDocument2 pagesBank Reconciliation IllustrationRia BryleNo ratings yet

- ActivityDocument1 pageActivityUwuuUNo ratings yet

- Second Exam Msa1 ReviewerDocument4 pagesSecond Exam Msa1 ReviewerPaul Marben PolinarNo ratings yet

- Module 6 P2 Internal Control - BSA & BSMADocument14 pagesModule 6 P2 Internal Control - BSA & BSMAramosmikay0222No ratings yet

- Classroom Exercises On Receivables AnswersDocument4 pagesClassroom Exercises On Receivables AnswersJohn Cedfrey Narne100% (1)

- 4 5805514475188521061Document8 pages4 5805514475188521061Gena HamdaNo ratings yet

- Problem 57Document1 pageProblem 57YukidoNo ratings yet

- ACGA 504/ HCGA 507 General Accounting - Part 2Document17 pagesACGA 504/ HCGA 507 General Accounting - Part 2Eliza BethNo ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- Proof of Cash ProblemsDocument2 pagesProof of Cash ProblemsSamantha Marie Arevalo100% (1)

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- P01. Cash and Cash Equivalents AnswersDocument8 pagesP01. Cash and Cash Equivalents AnswersIosif DzhugasviliNo ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Bank Reconciliation: Basic ProblemsDocument25 pagesBank Reconciliation: Basic ProblemsAndrea FontiverosNo ratings yet

- Chapter 13-Cash ControlDocument25 pagesChapter 13-Cash ControlShaila MarceloNo ratings yet

- NOTES Practice Solving - Robles and EmpleoDocument52 pagesNOTES Practice Solving - Robles and EmpleoLeah La MadridNo ratings yet

- LESSON 3.2 - Bank ReconciliationDocument4 pagesLESSON 3.2 - Bank ReconciliationIshi MaxineNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- And POCDocument3 pagesAnd POCjudeaharmony.wamildaNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Chapter 2 Last PartDocument11 pagesChapter 2 Last PartXENA LOPEZ100% (2)

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Bank Reconciliation - SolutionsDocument6 pagesBank Reconciliation - SolutionsNIAZ HUSSAIN100% (1)

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- Take Home Exam 1 Cash and Cash EquivalentsDocument2 pagesTake Home Exam 1 Cash and Cash EquivalentsJi Eun VinceNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- ACCT 315 AssignmentDocument11 pagesACCT 315 AssignmenthumaNo ratings yet

- Makeup Test Reviewer PDFDocument43 pagesMakeup Test Reviewer PDFandrea arapocNo ratings yet

- Timing Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeDocument6 pagesTiming Difference: Check Payment (Receivable) But Not Yet Deposited by PayeeannyeongNo ratings yet

- UntitledDocument5 pagesUntitledShevina Maghari shsnohsNo ratings yet

- MC - Bank Reconciliation and Proof of CashDocument4 pagesMC - Bank Reconciliation and Proof of CashGwen Ashley Dela PenaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Concentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpFrom EverandConcentrating Solar Power in Developing Countries: Regulatory and Financial Incentives for Scaling UpNo ratings yet

- List of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Document2 pagesList of Scheduled Commercial Banks: (Refer To para 2 (B) of Notification Dated October 08, 2018)Vikram PhalakNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1jhefster_81No ratings yet

- Activity 1 - Audit of Receivables and RevenuesDocument2 pagesActivity 1 - Audit of Receivables and RevenuesColeen Joy Sebastian PagalingNo ratings yet

- Increase Credit Limit PDFDocument1 pageIncrease Credit Limit PDFemc2_mcvNo ratings yet

- S.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name RemittanceDocument8 pagesS.No Student'S Name A/C Holder Name A/C Number Ifsc Code Bank Name Remittancejyoti kumariNo ratings yet

- CH 2 - The Philippine Financial SystemDocument14 pagesCH 2 - The Philippine Financial SystemjsmnfrncscNo ratings yet

- Top Ten Largest Commercial Banks in The Philippines (Jellynfile)Document21 pagesTop Ten Largest Commercial Banks in The Philippines (Jellynfile)Ralph Evander IdulNo ratings yet

- FIN 401 Final Report BodyDocument9 pagesFIN 401 Final Report Body1711........100% (1)

- Project ReportDocument25 pagesProject ReportAarshiya Mina SheelNo ratings yet

- BPI Family Bank V FrancoDocument1 pageBPI Family Bank V FrancojoyceNo ratings yet

- Study of E-Banking Scenario in India: Shubhara JindalDocument4 pagesStudy of E-Banking Scenario in India: Shubhara JindalSahul RanaNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsnikkitaaaNo ratings yet

- Principles of Insurance (1) Total SlidesDocument147 pagesPrinciples of Insurance (1) Total SlidesdaohoaflowerNo ratings yet

- Customer Bank AccountDocument872 pagesCustomer Bank AccountNaresh KumarNo ratings yet

- Itc14 mcp23Document8 pagesItc14 mcp23Lee TeukNo ratings yet

- Coding and Decoding QuestionsDocument28 pagesCoding and Decoding QuestionsAbdulawwal IntisorNo ratings yet

- Annual Report 2007Document20 pagesAnnual Report 2007SolidariteInternationale100% (2)

- Sbi ProjectDocument60 pagesSbi Projectjithu100% (3)

- CertanceDocument22 pagesCertanceZechen MaNo ratings yet

- New Supplier E-Payment FormDocument2 pagesNew Supplier E-Payment FormTareeke ThompsonNo ratings yet

- MM12 - Forex Scandal - WikipediaDocument3 pagesMM12 - Forex Scandal - WikipediaAtul SharmaNo ratings yet

- Statutory Audit ChecklistDocument6 pagesStatutory Audit ChecklistCA SwaroopNo ratings yet

- Basic Accounting Promissory NotesDocument12 pagesBasic Accounting Promissory NotesJean Lewis RossNo ratings yet

- History of PNBDocument2 pagesHistory of PNBAlliah SomidoNo ratings yet

- Bank Reconciliation Assignment 2Document8 pagesBank Reconciliation Assignment 2Caira De AsisNo ratings yet

- Common Law Power of Attorney FormDocument25 pagesCommon Law Power of Attorney Formwhitecliff1100% (3)