Professional Documents

Culture Documents

MCC Form Nov 2021

MCC Form Nov 2021

Uploaded by

papagabrieloliverOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCC Form Nov 2021

MCC Form Nov 2021

Uploaded by

papagabrieloliverCopyright:

Available Formats

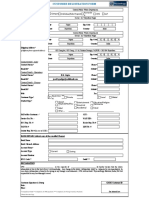

BRANCH APPLICATION

last updated 04/07/2021

Toyota Mastercard* M Free Mastercard Cashback Visa Rewards Plus Visa Titanium Mastercard Femme Signature Visa Travel Platinum Visa Platinum Mastercard World Mastercard

Toyota Mastercard M Free Mastercard Cashback Visa Rewards Plus Visa Titanium Mastercard Femme Signature Visa Travel Platinum Visa Platinum Mastercard World Mastercard

*CHOOSE YOUR Signature Signature Signature Signature Signature Signature Signature Signature Signature

METROBANK CARD You will receive the card/s you are qualified for based on the assessment of your application. *Preferred dealer for Toyota Mastercard: ______________________________________________

Your new Metrobank credit card comes with an ON Virtual Mastercard which you can use for online purchases.

For your security, this virtual card will have a separate credit limit from your other Metrobank credit card and is solely for online transactions.

MY PERSONAL DATA

Card Company Card Number Credit Limit Member Since

MY OTHER CREDIT

CARD(S)

Last Name Given Name Middle Name

*APPLICANT NAME

*NAME TO APPEAR ON CARD

(MAX OF 20 CHARACTERS)

MM DD YYYY GENDER Male Female Single Widowed Co-Habitee

*BIRTHDATE CIVIL STATUS

*NATIONALITY Filipino Others:______ Married Separated

*PLACE OF BIRTH *MOBILE NO. *PERSONAL EMAIL

*SSS / GSIS / UMID *T.I.N. *MOTHER'S MAIDEN NAME

Unit/ House No. Street, Subdivision / Village / Barangay, City/Province

*HOME ADDRESS Zip Code: ________

HOME OWNERSHIP Owned Rented Mortgaged Living with parents Length of stay: _____

*HOME PHONE NO. + +

area code prefix(i.e. 8,7, etc) landline number EDUCATION High School Some College Vocational College Post Graduate

*SOURCE OF FUNDS Private Employment Government Employee Investment Self-Employed Retired others:__________

*OCCUPATION

*COMPANY NAME *NATURE OF BUSINESS / POSITION

Unit/ House No. Street, Subdivision / Village / Barangay, City/Province

*BUSINESS ADDRESS Zip Code: ________

*BUSINESS PHONE NO. + +

Local: ____________________

*BUSINESS EMAIL GROSS ANNUAL

area code prefix(i.e. 8,7, etc) landline number Best time to call: ____________ INCOME

MM DD YYYY TOTAL EMPLOYMENT Regular Project Based

DATE OF HIRE

Years with present employer YEARS WORKING STATUS Probationary Contractual

Are you related to a Metrobank employee? If yes, name of employee: ___________________________________

METROBANK REFERENCE Yes No

Relationship: Spouse Parent / In-law Child Others: ______ Rank: Non-officer Jr. Officer Sr. Officer

YES! I want to enroll in Automatic Debit Arrangement (ADA) Minimum amount due Total amount due

AUTOMATIC DEBIT

Please debit my Peso current / savings account number:_________________________________at Metrobank Branch ____________________

ENROLLMENT Branch officer signature and name _______________________________________ All the information indicated in this application form has been verified and noted by the Branch Officer.

Yes No Home Is this a condo?

*METROBANK DEPOSITOR *DELIVERY INSTRUCTION

Account No.:__________________________________________________________ Business Yes No

FOR METROBANK USE ONLY

Metrobank Depositor? Yes No Date opened: _________ EMPLOYEE NAME COMPLETE EMPLOYEE ID NO.:

Average 3 months latest net payroll credit per month of >Php 19,000/ month BRANCH NAME BRANCH CODE

(Php ________________________) This certifies that the above identified prospective customer is an existing customer of Metrobank and that the required customer identification process, which includes face-to-face contact and gathering of minimum

information and identification documents, was duly conducted in accordance with the Anti-Money Laundering Act and its implementing rules and regulations, relevant rules and regulations of the Bangko Sentral ng

Total Relationship Balance Pilipinas and Anti-Money Laundering Council and the Money Laundering and Terrorist Financing Prevention Program of Metrobank This further certifies that copies of identification documents are in the custody of

Metrobank and may be provided upon request by relevant regulatory agencies. Access to the identification documents shall be subject to retention limitations specified under relevant laws and regulations.

At least 4 months, TRB of > Php 50,000 or $1,040

(Php ________________________) Branch Officer's Signature Over Printed Name Date

UNDERTAKING

I would like to avail of a Metrobank credit card and I hereby authorize my employer to provide / confirm with Metropolitan Bank and Trust Company ["Metrobank"] my information necessary to facilitate my credit card application. In the event of approval of my application for a Metrobank credit card, I hereby agree to be

governed by the TERMS AND CONDITIONS found on www.metrobankcard.com/about/termsandcondition governing the issuance and use of the Metrobank credit card (made an integral part of this undertaking) which will be issued to me and which I will receive, as evidenced by my signature herein, and/or the signature

of my representative. My use of the Metrobank credit card shall constitute proof that I have read and fully understood the TERMS AND CONDITIONS enclosed and delivered with the credit card and that I consent to be bound by such. I further agree to hold Metrobank free and harmless from any and all liabilities that I

will incur with the use of my Metrobank credit card. I further hold myself liable for all obligations and liabilities that I will incur with the use of my Metrobank credit card.

DECLARATION

I/We hold myself/ourselves liable for all obligations and liabilities incurred with the use of the Metrobank credit card/s issued to me/us. I/We warrant, that I/we shall be jointly and severally liable for the same obligations and that I/we hereby commit myself/ourselves to the following declarations: 1) I/We certify that the

foregoing facts are true and correct; (2) I affirm and confirm my authority and express consent given to my Primary in sharing of my personal data to Metrobank for the processing and issuance of this credit card.; (3) I/We authorize and consent METROPOLITAN BANK & TRUST COMPANY [Metrobank], its affiliates,

subsidiaries, third-party service providers, assigns, to process, transfer, share, disclose and communicate any and all of my/our personal data as defined under the R.A. 10173 (The “Data Privacy Act of 2012”) and its implementing Rules and Regulations, information relating to the credit card accounts, or any of the Card

Member’s or Supplementary credit card Member's basic credit data and any and all information concerning himself, his properties or investments with Metrobank, to any of the offices, branches, subsidiaries, affiliates, agents and representatives of Metrobank and third parties selected by any of them, including other

financial institutions, for purposes of credit verification, collection and credit review and scoring, statistical and risk analysis and to government entities tasked to provide consumer credit reporting or reference schemes, anti-money laundering monitoring, purposes including but not limited to The National Privacy

Commission, CIC or Credit Information Corporation pursuant to R.A. 9510 (the “Credit Information Act of 2008”), Republic Act (R.A.) 9160, as amended by R.A. 9194 (the Anti-Money Laundering Act), R.A. 8484 (the Access Device Act of 1998), and their respective Implementing Rules and Regulations; (4) I/We authorize

and consent Metrobank to share my address and mobile number to Metrobank’s third party delivery courier, strictly following Metrobank’s Privacy Policy, for the purpose of card delivery.(5) I/We authorize and consent Metrobank to acquire my/our personal data and any information from Metropolitan Bank & Trust Company

(Metrobank) and Philippine Savings Bank (PSBank) and any of its subsidiaries and affiliates to facilitate the approval of my credit card application as well as credit card transactions, e.g., cash advance, increase in credit limit, etc., initiated upon my/our own initiative and in the event of default arising from non-payment of

credit card obligations with Metrobank; (6) In compliance with the Customer Identification requirements of BSP Circular 950 Subsection 4806Q.2 (d) , I, the Principal Cardholder, attest that I have satisfied the Face-to-Face contact requirement for my Supplementary Cardholder/s on behalf of Metrobank, and to having seen

the original ID of the same. (7) I/We understand that should my/our application be denied, Metrobank has no obligation on its part to furnish the reason for such rejection except when the denial is based on credit data from CIC used in the evaluation of my/our application; (8) I/We authorize Metrobank, its authorized

representative/s and/or agent/s to verify and investigate these facts from whatever source it may deem appropriate; (9) I/We agree to the TERMS AND CONDITIONS governing the issuance of a Metrobank credit card.

Conformity to Terms & Conditions of Metrobank: (1) by signing on the application form or delivery acknowledgment receipt; (2) by signing at the signature portion of the credit cards shall constitute the Card Member’s express consent and shall constitute a waiver of claims and exempt Metrobank, any of the offices, branches,

subsidiaries, affiliates, agents and representatives, and/or Metrobank Group from liability under any and all bank deposit secrecy laws, including but not limited to, R.A. 1405 or The Law on Secrecy of Bank Deposits, R.A. 6426 or The Foreign Currency Deposit Act and R.A. 8791 or The General Banking Law, as well as

R.A. 10173 or the Data Privacy Act of 2012 and other confidentiality laws enforced or which may hereinafter enforced.

I confirm that:

• I agree to the Undertaking and Declaration in this application form

• I agree to the Terms and conditions, and Fees and charges found in www.metrobankcard.com

• I accept/understand that I will be receiving my Statement of Accounts (SOA) via email address and will no longer receive paper SOAs.Please send my statements to: Personal Email Business Email

If no option is chosen, your statement will be sent to your personal email.

*SIGNATURE OF APPLICANT DATE

ON Virtual M Free Toyota Rewards Plus Titanium Cashback Femme Travel Platinum Platinum World

CARD TYPE Mastercard Mastercard Mastercard Visa Mastercard Visa Signature Visa Visa Mastercard Mastercard

Annual Fee Principal / Supplementary P500 Perpetually

waived

P2,500/P1,250 P2,500/P1,500 P2,500/P1,500 P3,500/P1,750 P5,000/P2,500 P5,000/P2,500 P5,000/P2,500 P6,000/P3,000

Waived on 1st Year Waived on 1st Year Waived on 1st Year Waived on 1st Year Waived on 1st Year FREE for life on the 1st Supplementary FREE for life on the 1st Supplementary FREE for life on the 1st Supplementary FREE for life on 2 Supplementary Cards

Retail Monthly Interest Rate/

Finance Charge 2.00% Monthly Interest Rate

Cash Advance Monthly Interest Rate Not Applicable 2.00% Monthly Interest Rate to be computed from the date when cash advance was availed

Cash Advance Fee Not Applicable P200 per transaction regardless of the cash advance amount

Minimum Amount Due P850 or 3% of Outstanding Balance, whichever is higher

Late Payment Fee P1,000 or Unpaid Minimum Amount Due (MAD), whichever is lower

Overlimit Fee P750 per occurrence

Refund Fee 1% of the refund amount or P100, whichever is higher, for every refund request

Account Maintenance Fee P200 or an amount equivalent to the credit balance, whichever is lower, will be charged monthly to accounts with overpayments that are closed or active accounts that have no activity for the past 12 months until the credit balance is zeroed out.

Installment Pre-Termination Fee P550 or 5% of the remaining principal balance, whichever is higher

Gaming Fee 5% of the amount transacted

Card Replacement Fee Not Applicable P400 for every card replacement

Statement Reprinting Fee P100 per request for printing and delivery of monthly statement Not applicable

Bank Certification Fee P100 per copy and delivery of bank certificate Not applicable

Returned Check Fee P1,500 for every returned check

Installment Processing Fee Not Applicable P350 will be charged for every approved Cash2Go or Balance Transfer transaction or P500 will be charged for every approved Balance Conversion transaction

Foreign Exchange Transactions All charges, advances or amounts in currencies other than Philippine Peso (Php) shall be converted to Php. Transactions in US Dollar, Hong Kong Dollar, Japanese Yen, Euro, Singapore Dollar, Australian Dollar, British Pound,

Canadian Dollar, Chinese Yuan, Swiss Francs, and Danish Kroner shall be converted using the foreign exhange selling rate of Metrobank on transaction posting date. Transactions denominated in currencies other than the

aforementioned shall be converted using Mastercard/Visa's currency conversion rate at the time of posting. All converted transactions shall be charged Mastercard/Visa's assessment fee plus 2.5% processing fee, the rate of

which may be adjusted from time to time. The assessment fee shall likewise apply to transactions involving foreign currencies converted to Php at point of sale, whether executed in the Philippines, abroad, or online. Service

fees may also be charged to cover costs incurred to discharge the amount(s) due to Mastercard/Visa and/or the acquiring bank and/or foreign merchant affiliates.

SUPPLEMENTARY CARD APPLICATION

You may apply for up to 4 Supplementary Cardholders and assign spending limits to each. The Principal cardholder and supplementary card applicants are required to submit a photocopy of a valid

government-issued ID and complete the fields marked(*). The spending limit given to the Supplementary Cardholder is part of the Principal’s credit limit. If the spending limit indicated is greater than the

approved credit limit, the spending limit to be given to the Supplementary Cardholder will be the same as the approved credit limit, up to a maximum of Php100,000.

Note: Supplementary Cardholder must be 14 to 80 years old.

SUPPLEMENTARY CARD APPLICANT DATA

Last Name Given Name Middle Name

*APPLICANT NAME

*NAME TO APPEAR ON CARD

(MAX OF 20 CHARACTERS)

Unit/ House No. Street, Subdivision / Village / Barangay, City/Province

*HOME ADDRESS Zip Code: ________

MM DD YYYY GENDER Male Female RELATIONSHIP TO

*BIRTHDATE

*NATIONALITY Filipino Others: __________ PRINCIPAL CARDHOLDER

*PLACE OF BIRTH *MOBILE NO. *EMAIL

*SSS / GSIS / UMID *T.I.N. *MOTHER'S MAIDEN NAME

*HOME PHONE NO. *ASSIGNED SPENDING LIMIT 100% OF Principal Credit Limit Other: ________________________________

*SOURCE OF FUNDS Private Employment Government Employee Investment Self-Employed Retired others:__________

*COMPANY NAME *OCCUPATION

*NATURE OF BUSINESS

/ POSITION

SUPPLEMENTARY CARD DATE

APPLICANT SIGNATURE

CARD INSTALLMENT FACILITIES

BALANCE TRANSFER YES! I would like to transfer my balance from my other credit card(s) to my Metrobank credit card(s) Balance Transfer Amount Php

at a monthly add-on rate of 1% if approved.

Credit Card Account Number Card Issuer Preferred Term & Effective Annual Interest Rate:

12 months 18 months 24 months

(21.457%) (21.643%) (21.571%)

36 months 48 months 60 months

(21.200%) (20.754%) (20.310%)

CASH2GO / QUICK CASH YES! I would like to avail of Cash2Go / Quick Cash on my Metrobank credit card at a monthly add-on Preferred Term & Effective Annual Interest Rate:

rate of 1% if approved.

Bank Name Account Number 12 months 18 months 24 months

(21.457%) (21.643%) (21.571%)

36 months 48 months 60 months

Cash2Go / Quick Cash Amount Php (21.200%) (20.754%) (20.310%)

This application for the Installment Facility (Balance Transfer and/or Cash2Go / Quick Cash) is based on my instructions and has no implication on my relationship with any card issuer. Metrobank may approve or reject my request at

its sole discretion.

I understand that this application for the Installment Facility will be declined in the event that my approved credit limit is lower than the applied installment amount. I also understand that should my application be denied, Metrobank has

no obligation on its part to furnish the reason for such rejection.

I understand this application is non-transferable and non-revocable. I also authorize Metrobank to proceed with the Installment Facility processing up to my available credit limit even if my Metrobank credit card has not yet been delivered.

I also understand that if approved, all disbursements will be through a check deposit under my name as the cardholder. By signing below, I agree to abide by the Terms and Conditions governing the use of the credit card and the Terms

and Conditions governing the Installment Facility. I also agree to pay all interests, fees and other charges and any government tax that may be levied thereon.

SIGNATURE OF APPLICANT DATE

DEED OF ASSIGNMENT FOR SAVE&SWIPE (SECURED CARD)

Secured Credit Card (and Supplementary Cards where applicable): settlement of my/our aforesaid obligations, the same shall be deposited to my/our other

Issuance accounts with the Bank, and if none exists, the Bank shall issue a cashier’s check in my/our

Change in deposit instrument of credit card account name in the amount equivalent to the balance. I/We shall claim the aforesaid cashier’s check

Increase/decrease in credit limit of card number with the Branch where said TD was maintained.

PLEDGED Amount/Account information: I/We, undertake, finally to hold the Bank and its officers and employees free and harmless

from any and all liabilities, claims and demands of whatever kind and nature in connection

_______________________________________________________________________________ with or arising from reliance on these instructions, it being understood that any and all risk

My/Our Peso/Dollar ( ) Savings ( ) Time ( ) Special Account No. (the “Account”): and costs arising from the above instructions shall be my/our sole and exclusive account.

_______________________________________________________________________________ Date Applied (Mo/Date/Yr)

Metrobank Depository Branch (the “Bank”):

Metrobank Branch Name and Code

_______________________________________________________________________________ Joint Account Signatories (co-depositor needs to sign if Account is a Joint And/Or Account):

Pledged Amount (in words):

ASSIGNOR ASSIGNOR

_______________________________________________________________________________ (Signature over Printed Name) (Signature over Printed Name)

Republic of the Philippines

Php (in

Makati City )

figures):________________________________________________________________________ BEFORE me a Notary Public in and for the City of Makati, this ___________________,

I/We hereby authorize the Bank to hold out the Account and agree not to close it or withdraw the Assignor/s appeared to me and exhibited his/her/their government issued identification

pledged amount from my nominated Account within thirty-five (35) days after cancellation of the documents:

credit card. In case of default in the payment of my/our obligation/s to Metrobank and in accordance Name: Gov’t Issued ID Issued On/Date of Expiry

with the terms of the Agreement granting the use of the credit card, I/we hereby irrevocably authorize

and empower the Bank to debit my/our pledged amount from my nominated Account and remit the known to me to be the persons who signed the foregoing Deed of Assignment and

amount debited to Metrobank for the full/partial settlement of my/our aforesaid obligation/s. I/We acknowledged to me that the same is his/her/their free act and deed.

hereby waive any and all of my/our rights under Section 2 of the R.A. 1405 or “The Law on Secrecy WITNESS MY HAND AND SEAL on the place and date above written.

of Bank Deposits”, R.A. 6426 or “The Foreign Currency Deposit Act, and R.A. 8791 or “The General

Banking Act”. Doc. No.________________;

Page No._______________;

I/We hereby agree, further, that in case the nominated account is a Time Deposit(TD) and there is a Book No._______________;

balance on the nominated account after debit and remittance to Metrobank for the full/partial Series of 2020. NOTARY PUBLIC

You might also like

- Target Financial Analysis Final Paper 1Document50 pagesTarget Financial Analysis Final Paper 1api-24601003050% (2)

- Metrobank Branch Application Form No Cards With PEP 2Document2 pagesMetrobank Branch Application Form No Cards With PEP 2Gil Angelo Del ValleNo ratings yet

- CAMSKRA Latest Form New KYC FormDocument4 pagesCAMSKRA Latest Form New KYC FormVivek SinghalNo ratings yet

- Chapter 16 Sol 2020 WKDocument53 pagesChapter 16 Sol 2020 WKVu Khanh LeNo ratings yet

- BPI Express Credit - Free Annual Fee - FORMDocument1 pageBPI Express Credit - Free Annual Fee - FORMRyan CabusasNo ratings yet

- Chapter 3 ExercisesDocument9 pagesChapter 3 ExercisesDyenNo ratings yet

- Metrobank Branch Application Form Ao Feb 2023Document2 pagesMetrobank Branch Application Form Ao Feb 2023shanelynmg100% (1)

- Ibong AdarnaDocument2 pagesIbong Adarnadelmundonicole2No ratings yet

- Metrobank CC ApplicationDocument2 pagesMetrobank CC Applicationjoel BautistaNo ratings yet

- MWC Aapplication Form - New IssuanceDocument3 pagesMWC Aapplication Form - New IssuanceAbhishek ShatagopachariNo ratings yet

- RBL Application Form1680992689896 - 9540523355Document5 pagesRBL Application Form1680992689896 - 9540523355Vikram SharmaNo ratings yet

- VVVVH TypifDocument4 pagesVVVVH TypifBiman SahaNo ratings yet

- Credit Card Application V3 - tcm9 70586Document4 pagesCredit Card Application V3 - tcm9 70586Maan AliNo ratings yet

- Credit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Document2 pagesCredit/Debit Card Authorisation (Autopay) (Visa / Mastercard / Amex)Hafiz IbrahimNo ratings yet

- Food Card Application Form - ICICI Bank PDFDocument1 pageFood Card Application Form - ICICI Bank PDFshawn1mathias8055No ratings yet

- Activ Care Proposal FormDocument4 pagesActiv Care Proposal FormHarish HuddarNo ratings yet

- Two Wheeler Comprehensive Policy New PDFDocument2 pagesTwo Wheeler Comprehensive Policy New PDFhappy maheruNo ratings yet

- RBL Application Form1667462750930 - 6300267540Document5 pagesRBL Application Form1667462750930 - 6300267540Subhash SharmaNo ratings yet

- New Debit Card Application FormDocument1 pageNew Debit Card Application Formuseful secondsNo ratings yet

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- Current and Savings Account Opening Form For Non IndividualsDocument14 pagesCurrent and Savings Account Opening Form For Non IndividualsJohn GoldbergNo ratings yet

- Credit Card Application Form: Personal InformationDocument5 pagesCredit Card Application Form: Personal InformationHansi PereraNo ratings yet

- Vehicle Insurance Certificate in IndiaDocument2 pagesVehicle Insurance Certificate in IndiaED STORYNo ratings yet

- MA3493088 AOF SignedDocument22 pagesMA3493088 AOF SignedTanuku Taraka RamaraoNo ratings yet

- DD MM Y Y Y Y N Y: Current AccountDocument2 pagesDD MM Y Y Y Y N Y: Current AccountjithgrucoNo ratings yet

- Debit Card Application Form: A. Applicant' DetailsDocument2 pagesDebit Card Application Form: A. Applicant' DetailsRahul BhatNo ratings yet

- Citizen Registration Details: Check Status Register LoginDocument2 pagesCitizen Registration Details: Check Status Register Loginrajasarfraz13100% (1)

- Channel Request Form: Tracker/ID No.: Branch CodeDocument2 pagesChannel Request Form: Tracker/ID No.: Branch CodeikmNo ratings yet

- MR Vijay Bhatt: AESPB5466PDocument4 pagesMR Vijay Bhatt: AESPB5466Pfnopulse100% (1)

- RBL App Form 18 01 2019Document1 pageRBL App Form 18 01 2019Yasar AliNo ratings yet

- RBL App Form 18 01 2019 PDFDocument1 pageRBL App Form 18 01 2019 PDFAnmolNo ratings yet

- Navi Amc Kyc FormDocument6 pagesNavi Amc Kyc Formpradeepkumar116803No ratings yet

- AL Form Individual RevisedDocument3 pagesAL Form Individual RevisedMicaela ImperialNo ratings yet

- CASA AOF Soft PDFDocument6 pagesCASA AOF Soft PDFAXIS Section GNo ratings yet

- Kyc - Form - Ri (2) HDFC byDocument2 pagesKyc - Form - Ri (2) HDFC byMayank guptaNo ratings yet

- HK Credit Card Key Facts StatementDocument12 pagesHK Credit Card Key Facts StatementTsea CaronNo ratings yet

- Empower-Employment and Training Department, Govt. of TamilNaduDocument1 pageEmpower-Employment and Training Department, Govt. of TamilNadusivaji420No ratings yet

- Application Form 7202002265506Document4 pagesApplication Form 7202002265506Jammu Jyotish Astrologer ArunNo ratings yet

- FO UEF 0.025 Customer Information Form CIF - Rev.07 PDFDocument2 pagesFO UEF 0.025 Customer Information Form CIF - Rev.07 PDFJoyce HerreraNo ratings yet

- Republic of Ghana: (Regulation 3 (1) )Document2 pagesRepublic of Ghana: (Regulation 3 (1) )Bosmann GhNo ratings yet

- Wholesale Individual Application Form FINAL 1Document1 pageWholesale Individual Application Form FINAL 1Jhay LongakitNo ratings yet

- CAMSKRA Latest FormDocument4 pagesCAMSKRA Latest FormVijay PNo ratings yet

- CAMSKRA - Latest - Form Sept 23-1-2Document2 pagesCAMSKRA - Latest - Form Sept 23-1-2Suresh SharmaNo ratings yet

- Kotak Corporate Application Form V8 Revised PageDocument7 pagesKotak Corporate Application Form V8 Revised PageNitinNo ratings yet

- CKYC-Application Form For Individual 28-10-2022Document4 pagesCKYC-Application Form For Individual 28-10-2022nikendra0219No ratings yet

- Consumer Application SampleDocument1 pageConsumer Application Sampleahmed02_99No ratings yet

- Kyc FormDocument2 pagesKyc FormvaibhavraoNo ratings yet

- KYC Form - IndividualDocument1 pageKYC Form - IndividualAkshay ChaudhryNo ratings yet

- App Form Oap-00000000002749170-ProDocument4 pagesApp Form Oap-00000000002749170-ProPradeep10rNo ratings yet

- App Form Oap-00000000003913704-ProDocument5 pagesApp Form Oap-00000000003913704-ProRHITIQ PATTNAIKNo ratings yet

- Kebenaran Bayaran Melalui Kad Kredit/Debit (Autopay) (Visa / Mastercard / Amex)Document2 pagesKebenaran Bayaran Melalui Kad Kredit/Debit (Autopay) (Visa / Mastercard / Amex)kamal yahayaNo ratings yet

- LAIP OriginalDocument11 pagesLAIP OriginalMcnet WideNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration Certificatenitesh.rfwdNo ratings yet

- Current and Savings Account Opening Form For Non Individuals No Company Seal RequiredDocument14 pagesCurrent and Savings Account Opening Form For Non Individuals No Company Seal RequiredSan ThiyaNo ratings yet

- Psa Membership Application Form April 2022Document1 pagePsa Membership Application Form April 2022geraldlekotaNo ratings yet

- Metrobank Car Loan Application Form Individual Oct 2022Document2 pagesMetrobank Car Loan Application Form Individual Oct 2022rhu penarandaNo ratings yet

- CLC Customer Info Update Form v3Document1 pageCLC Customer Info Update Form v3John Philip Repol LoberianoNo ratings yet

- (If Different From Registered Address) : Contact Details - SalesDocument1 page(If Different From Registered Address) : Contact Details - Salesgajendrabanshiwal8905No ratings yet

- Resident Re Kyc Form NewDocument3 pagesResident Re Kyc Form Newsagaralva7373No ratings yet

- DL 44 Eng PT 1Document2 pagesDL 44 Eng PT 1Tipitaka TripitakaNo ratings yet

- Application Form 8051022036713Document4 pagesApplication Form 8051022036713Shiva reddy KalluriNo ratings yet

- Introduction To Income TaxationDocument10 pagesIntroduction To Income TaxationArielNo ratings yet

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqNo ratings yet

- Custom Clearance Procedures For Imported and Exported GoodsDocument54 pagesCustom Clearance Procedures For Imported and Exported GoodsntamakheNo ratings yet

- Nicole Rycroft - Why Are We Making Pizza Boxes Out of Endangered Trees? - TED TalkDocument4 pagesNicole Rycroft - Why Are We Making Pizza Boxes Out of Endangered Trees? - TED TalkaiyalaernarNo ratings yet

- Population Growth Chapter 2Document40 pagesPopulation Growth Chapter 2simonsin6a30No ratings yet

- Unit-3 - Part-3 - Harshad Mehta, Satyam, Kingfisher C and Common Governance ProblemsDocument13 pagesUnit-3 - Part-3 - Harshad Mehta, Satyam, Kingfisher C and Common Governance ProblemsStuti RawatNo ratings yet

- Act de INFIINTARE (ESTABLISH) Banca Centrala in UGANDA - ROMANIA NU A INFIINTAT BNR (NOT ESTABLISHED)Document26 pagesAct de INFIINTARE (ESTABLISH) Banca Centrala in UGANDA - ROMANIA NU A INFIINTAT BNR (NOT ESTABLISHED)Nicusor TeodorescuNo ratings yet

- Preliminary Case Grab Petrolida 2023Document9 pagesPreliminary Case Grab Petrolida 2023Priyo Rolandi ManuelNo ratings yet

- Southern University BangladeshDocument1 pageSouthern University BangladeshRaihanNo ratings yet

- AT Samson Freight PVT LTD.: in Partial Fulfillment For PgditDocument31 pagesAT Samson Freight PVT LTD.: in Partial Fulfillment For PgditAkshay ShahNo ratings yet

- Hunter DouglasDocument2 pagesHunter DouglasDisha KhatiNo ratings yet

- Employee Engagement: The Key To Realizing Competitive AdvantageDocument33 pagesEmployee Engagement: The Key To Realizing Competitive Advantageshivi_kashtiNo ratings yet

- Econ 313 Handout 3 Basic Economy Study MethodsDocument41 pagesEcon 313 Handout 3 Basic Economy Study MethodsKyle RagasNo ratings yet

- PWC The Audit Committees Role in Sustainability Esg OversightDocument10 pagesPWC The Audit Committees Role in Sustainability Esg OversightISabella ARndorferNo ratings yet

- Sample Project For Study - Doc VevoDocument34 pagesSample Project For Study - Doc VevoShouvik pal100% (1)

- Financial Statement and The Reporting Entity.Document8 pagesFinancial Statement and The Reporting Entity.Mikki Miks AkbarNo ratings yet

- Marketing Sales Head Job DescriptionDocument2 pagesMarketing Sales Head Job DescriptionFirst LastNo ratings yet

- The Case of The Downsizing DecisionDocument16 pagesThe Case of The Downsizing DecisionLaxman KeshavNo ratings yet

- Study of Recruitment & Selection Process in Aviva Life Insurance by Saumya MehtaDocument85 pagesStudy of Recruitment & Selection Process in Aviva Life Insurance by Saumya MehtaAmogh Desai100% (2)

- 03 The Adjusting ProcessDocument40 pages03 The Adjusting ProcessA1Paran CharityNo ratings yet

- Financial Times UK 2018-05-16Document26 pagesFinancial Times UK 2018-05-16RaycharlesNo ratings yet

- Indian Oil Demand Slowdown - 131226Document5 pagesIndian Oil Demand Slowdown - 131226sabri_hazarika1200No ratings yet

- Chapter-10: Customer OrientationDocument16 pagesChapter-10: Customer Orientationtaranjeet singhNo ratings yet

- 1548435872Document253 pages1548435872Trần Tuấn100% (1)

- Measuring The Cost of Living: Test BDocument7 pagesMeasuring The Cost of Living: Test Bmas_999No ratings yet

- AFJ Annual 2022 FINAL PDFDocument104 pagesAFJ Annual 2022 FINAL PDFEdwin SinginiNo ratings yet

- Philippine Christian UniversityDocument4 pagesPhilippine Christian UniversityMina SaflorNo ratings yet