Professional Documents

Culture Documents

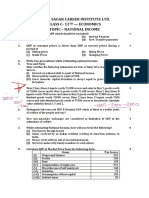

Miscellaneous Numericals NI From ID MANGLA Book

Miscellaneous Numericals NI From ID MANGLA Book

Uploaded by

ashwanikumar172006Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Miscellaneous Numericals NI From ID MANGLA Book

Miscellaneous Numericals NI From ID MANGLA Book

Uploaded by

ashwanikumar172006Copyright:

Available Formats

Ans. (a) Primary sector -1000 crore. Secondary sector 8) erore.

J6. Calculate valuc of output from the Tertiary sector =950 crore: (b) 2470 crore

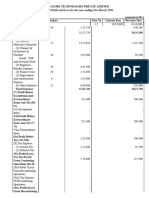

Items

following data : (CBSE F20M91

{(in lakh)

() Subsidy 10

(ii) Intermmediate consumption 150

(ii)) Net addition to stocks (-)13

(iv) Depreciation 30

(v) Excise duty

(vi) Net value added at factor cost

**A2

"$2Ag2 2g 20

250

Ans. 7440 lakh

17, Calculate sales from the following data : (CBSE F 2008)

Items 7 (in lakh)

() Net value added at factor cost 300

(ii) Net addition to stocks (-20

(üi) Sales tax 30

(iv) Depreciation 10

(v) Intermediate consumption 100

(vi) Subsidy

Ans.455 lakh

18. From the following data, estimate compensation of employees :

Items (in thousand)

()) Wages and salaries received by workers in cash 720

(ü) Employer's contribution to social security 80

(iüi) Compensation received by an injured worker from the insurance company

120

(iv) Value of medical facilities

80

(v) Commission received by workers of sales department

Ans. 1,000 thousand

19. Find out compensation of employees from the following data :

Items (in crore)

15

i) Rent

10

(ü) Interest

(iii) Profit

(iv) Gross domestic product at factor cost 175

15

(v) Consumption of fixed capital

Ans,130 crore

20. Calculate the operating surplus:

Items (in crore)

200

(i) Compensation of employees

200

(ii) Indirect taxes

Measurement of National Income 4.78

(ii) Consumption of fixed 100

(iv) Subsidies capital 50

(v) Gross 600

domestic product at MP Ans.150 crore

21, Calculate operating surplus from the following data :

Items (in crore)

()) Value of output 800

(ii) Intermediate consumption 200

(iii) Compensation of 200

(iv) Indirect taxes employees 30

(v) Depreciation 20

(vi) Subsidies S0

(vii)) Mixed income 100

Ans.300 crore

22. Calculate National Income' from the following data : (CBSE F 2013)

Items

(i) Net exports

(in crore)

()300

(ii) Compensation of employees 6000

(iii) Rent

400

(iv) Dividend

200

(v) Consumption of fixed capital

300

(vi) Change in stock

50

(vii) Profits

800

(viii) Net factor income to abroad

(ix) Net indirect taxes ()80

600

(x) Interest

500

Ans. 7780crore

23. Calculate (a) operating surplus and (b)

Items

compensation of employees:

(i)) Indirect taxes (in crore)

250

(i) Depreciation 200

(ii) Royalty

20

(iv) Proft

250

(v) Subsidies

50

(vi) Gross domestic product at MP

(vii) Interest 2,000

40

(viii) Rent

90

(ix) Net factor income from abroad

(40

Ans. (a) {400 crore; (b) 1,200 crore

4.8U A-one Introductory Macroeconomics

24. Calculate National Income from the following data: (CBSE D 2013)

Items 7 (in crore)

(i) Private final consumption expenditure 900

(ii) Profit 100

(ii) Government final consumption expenditure 400

(iv) Net indirect taxes 100'

(v) Gross domestic capital formatian 250

(vi) Change in stock 50

(vii) Net factor income from abroad ()4)

(vii) Consumption of fixed capital 20

(ix) Net imports 30

Ans.1,360 crore

25. From the following data calculate national income by income and expenditure method :

(in crore)

() Government final consumption expenditure 5,000

(i) Indirect taxes 6,000

.(iüü) Subsidies 2,200

17,100

(iv) Mixed income of self-employed

10,000

(v) Gross fixed capital formation

2,000

(vi) Net addition to stocks

8,000

(vii) Operating surplus 2,500

(vii) Consumption of fixed capital

31,000

(ix) Private final consumption expenditure

(x) Exports of goods and services 4,600

5,200

(xi) Impqrts of goods and services

(100

(xii) Net factor income from abroad

16;000

(xHi) Compensation to employees Ans. 41,000 crore

:

26. Calculate GNP by income method and expenditure method from the following data 7(in lakh)

40

(i) Rent

800

(ii) Private final consumption expenditure

20

(ii) Net exports

60

(iv) Interest

120

(v) Profit

200

(vi) Government final consumption expenditure

100

(vii) Net domestic capital formation

800

(vi) Compensation of employees

(ix) Consumption of fixed capital 20

Measurement of National Income 4.81

(x) Net indirect 100

taxes (-)20

(xi) Net factor income from

abroad Ans.1,020 crore

27. From the price by (i) Income method and

following data,

(ii) Expenditure method :calculate

tmarket

Gross National Product at (CBSE D 2004)

(in crore)

() Net domestic capital 375

formation 600

(iü) Compensation of employees

(ii) Net indirect taxes 150

(iv) Profits 450

(v) Rent 200

(vi) Private final consumption 1,100

expenditure

(vii) Consumption of fixed capital 115

(vii) Government final consumption expenditure 700

(ix) Interest 250

(x) Mixed income of self-employed -S00

(xi) Net factorincome from abroad ()15

(xii) Net exports (25

Ans. (i) 2,250 crore; (ii) 2,250 crore

28. Calculate Gross national product at FC from the following data by (i) income methods and

(ii) expenditure method: (CBSE D 2009)

(in crore)

(i) Private final consumption expenditure 1,000

(ii) Net domestic capital formation 200

(iii) Profits s400

(iv) Compensation of employees 800

(v) Rent -250

(vi) Government final consumption expenditure 500

(vii) Consumption of fixed capital 60

(viii) Interest 150

(ix) Net current transfers from rest of the world (-)80

(x) Net factor income from abroad (-10

(xi) Net exports ()20

(xii) Net indirect taxes 80

Ans,1,650 crore

29. From the following data, calculate (a) national income, and (b) gross domestic product at factor cost.

(in crore)

(i) Government final consumption expenditure 1,500

(ii) Change in stock 60

(iii) Gross domestic capital formation 800

4.82 A-One Introductory Macroeconomics

(iv) Private income 4,000

(-)70

(v) Net exports 500

(vi) Corporation tax 250

(vii) Net indirect taxes 2,800

(viii) Private final consumption expenditure

()50

(ix) Net factor income from abroad 200

(x) Consumption of fixedcapital

Ans. (a) 4,530 (b) 4,780 crore

From the followings data calculate (a) NDP,, and(b) NNP.by income and expenditure methods :

30. MP

(in crore)

610

G)' Personalconsumption expenditure 230

i) Wages and salaries 200

(ii) Employers'contribution to social security schemes 180

(iv) Gross business fixed investment 59

(v) Profits 120=

(vi) Gross residential construction investment 95

(vii) Government purchases of goods and services 60

(vii) Gross public investment 70

(ix) Rent

C(x) Inventory investment

(xi) Exports. 60

(xii) IFterésts 60

(xiii) Imports (-)3

(xiv) Net factor income from abroad 380

(xv) Mixed income 40

(xvi) Depreciation 10

(xvii) Subsidies 90

(xviii) Indirect taxes NNP=985 crore.

Ans. (a) NDP=I,070 crore; (b) FC

National Income and (ii) Compensation of Employees from the following data :

31. Calculate (i) (? crore)

15

() Royalty 400

(ii) Private final consumption expenditure world

20

of the

(ii) Net current transfers from rest 100

(iv) Govenment final consumption expenditure ()10

abroad

(v) Net factor income from 80

(vi) Net domestic capital formation 50,

(vi) Consumption of fixed capital 40

(vii) Net exports

Measurement of National Income 4.83

(iN) Net

(x) indirect taxes

Employers contribution to social security schemes

(x0) Rent 60

(I) Interest 90

(KIii) Profits 180

120

32.

Calculate (i) Net Domestic Product at

data :

MP and (ii)

85

Ans. (i)) 7550 crore; (ii) *160 crore

Consumption of Fixed Capital fromthe following

(i) Gross

capital

(ii) Personai formation

consumption ( crore)

(ii) Net fixed 1,700

capital expenditure

formation

(iv) Inventory investment 5,000

(v) Exports 000

S00

(vi) Imports

(vii) Net indirect taxes 200

(viii) Government 250

(ix) Net factor purchases of goods and services 50

income from abroad 2,200

33. From the -10

following data Ans. (i) 8650 crore; (ii) 200 crore

calculate National Income by Income and

Expenditure methods:

(CBSE Sample

() Paper 2010)

Government

(ii). Subsidies

final

consumption expenditure (in crore)

100

(iii) Rent

10-,

(iv) Wages and salaries 200.

(v) Indirect taxes 606

(vi) Private final

(vii) Gross domestic consumption expenditure 60

capital formation 800

(viüi) Social security

(ix) Royalty contributions employers

by 120

(x) Net factor income paid toabroad 25.

(xi) Interest 30

(xii) Consumption fixed capital 20

(xiiü) Profit 10

(xiv) Net exports 130

(xv) Change in stock 70

50

Ans. NI by Income method

NI by Expenditure method

=|000 crore

=I000 crore

4.84 A-One Introductory Macroeconomics

4. From the following data caleulate (a) Gross Domestic Product at factor cost and (b) Factor ineo

to abroad : (CBSE D 2010)

Items T(in000 crore)

() Compensation of eployees 800

(ii) Profits 2004

(ii) Dividends 50

(iv) Gross national product at market price 1,400

(v) Rent 150

(vi) Interest 10,

300

(vi) Gross domestic capital formation

(viii) Net fixed capital formation 200

(ix) Change in stock

(x) Factor income from abroad

120

(xi) Net indirect tax

Ans. (a) 1300 thousand crore; (b) 80 thousand crore

fro. abroad from the

35. Calculate (a) Gross Domestic Product at market price, and(b) Factor income (CBSE Al 2010)

following data :

?(in crore)

Items

500

(i) Profits 40

(ii) Exports 1,500

(i) Compensation of employees 2,800

(iv) Gross national product at factor cost 90

(v) Net current transfer from rest of the world 300

(vi) Rent 400

(vii)) Interest 120

(viii) Factor income to abroad

250

(ix) Net indirect taxes 650

Net domestic capital formation 00

xi) Gross fixed capital formation

(xii) Change in stock

Ans. (a) 3,050 crore:(b)120 crore

by (a) income method, and (b) expenditure method,

36. Calculate Gross National Product at factor cost (CBSE D 2012C)

from the following data:

(in crore)

Items 800

(() Private final consumption expenditure 300

(i) Government finalconsumption expenditure 600

(ii)- Çompensation of employees 50

(iv) Net imports 150

(v) Gross domestic capital formation 20

(vi) Consumption of fixed capital

Measurement of National Income 4.85

(vii) Net indirect taxes 100

(viii) Net factor income fronm abroad (-)70

(ix) Dividend

(x) Rent 120

(xi) Interest 80

(xii) Undistributed profits &0

(xii) Social securitycontributions by enployers 60

(xiv) Coporate tax

Ans. (a) ?1,030 crore; (b) 1,030 crore

37. Calculate National Income expenditure method from the

by (a) income method and (b)

data : following

(CBSE AI 2012C)

Items {(in crore)

i) Profit

(ii) Private final consumption

200

expenditure 440

(ii) Goverhment final consumption expenditure 250

(iv) Compensation of

employees

(v) Gross domestic capital formatier

350

90

(vi) Consumption of fixed capital 20

(vii) Net exports ()20

(viii) Interest

(ix) Rent

60

(x) Net factor income to abroad

?0

50

(xi)) Net indirect taxes 60

Ans. (a) 630 crore; (b) 630 crore

38. From the following data, calculate Gross National Product at factor cost by (a) income method, and

(b) expenditure method : (CBSE AI 2012C)

Items

(in crore)

. (i)Government final consumption expenditure 200

. (ü) Private final consumption expenditure 409

(iii). Profit 160

(iv) Net indirect taxes 60

(v) Rent 70

(vi) Interest 50

(vii) Compensation of employees 300

(vii) Exports 65

(ix) Imports 95

(x) Gross domestic capital formation 86

(xi) Consumption of fxed capital 10

(xii) Net factor income to abroad 50

Ans. (a) S40 crore: (b) 540 crore

4.86 A-One Introductory Macroeconomics

30. Calculate National income by (a) income method and (b) expenditure method from the tolowing

data : (CBSE AT 2012C)

Items ( in crore)

(i) Govermment final consumption expenditure 2,000

(ii) Net domestic capital fomation 600

(ii) Consumption of fixed capital 70

(iv) Net exports 60

(v) Net indirect taxes 200

(vi) Private final consumption expenditure 4,000

(vii) Net factor income to abroad 60

(viii) Compensation of employees 3,660

(ix) Profits 1,500

500

(x) Rent

800

(xi) Interest

300

(xii) Dividend

Ans. (a)6,400 crore; (b) 6,400 crore

(CBSE D 2013)

40. Calculate national income from the following data:

Items (? crore)

900

(i) Private final consumption expenditure 100

(ii) Profit 400

(ii) Govenment finalconsumption expenditure 100

(iv) Net indirect taxes 250

(v) Gross domestic capital formation 50

(vi) Change in stock

(vii) Net factor income from abroad

()40

20

(vii) Consumption of fixed capital 30

(ix) Net imports Ans. 1,360crore

following data : (CBSE AI 2013)

41. Calculate 'GrosS national product at market price' from the ( in crore)

Items

2,000

(i) Compensation of employees 500

(11) Interest 700

(iii) Rent 800

(iv) Profits 200

schemes

(v) Employer's contribution to social security 300

(vi) Dividends 100

(vi) Consumption of fixed capital 250

(vii) Net indirect taxes

(ix) Net exports 150

(x) Net factor income to abroad

(xi) Mixed income of self employed

1,500

Ans. 5,700 crore

Measurement of National Income 4.87

42.

Estimate

Items National Income from the following data :

(i) Opening stock (? crore)

(i) Closing stock 50

(iii)

Consumption

(iv) Private final of fixed capital

60

10

(v) Net exports

(vi) Net factor

consumption expenditure S00

(vii) income from abroad

Compensation

(viii) Direct of

employees paid by general government (10

100

(ix) Direct purchases goods by general

of government

purchases goods by

(x) Net capital of general government from abroad

10

100

(xi) Net indirectformation 60

Hint : taxes

CalculateGovernment final consumption expenditure =(vi) +(vii) +(ix).

50

43. Ans.705 crore

GDPby product and income method.

Items

(i) Value of (? crore)

output of primary sector

(ii) Value of output of secondary sector 1,000

(iii) Value of output of 800

(iv) tertiary sector

(V) Intermediate consumption of primary sector

600

Intermediate

(vi) Intermediate consumption of secondary sector

400

300

(vii) consumption of tertiary sector

(vii) Rent Compensation

of employees 100

S00

(ix) Consumption of fixed 40

(x) Indirect taxes capital 80

(xi) Net factor income from abroad 30

(xii) Subsidies 20

(xiii) Interest 10

, (xiv) Profit 50

(xv) Mixed income 200

710

44. Find National Income from Ans. (a)?1580 crore; (b) R1580 crore

following using expenditure method :

(CBSE Sample Question Paper 2018)

(i) Current transfers from rest of the world ( crore)

50

(ii) Net indirect taxes

100

(iii) Net exports

(iv) Rent ()25

90

(v) Private final consumption expenditure 900

4.B8 A-One Introductory Macroeconomics

(vi) Net domestic capital 200

fonation

(vii) Compensation of employees 500

(viii) Net factor income from abroad (O10

(ix) Govemment final 400

(x) Profit

consumption cxpenditure 220

(xi) Mixed income of self-employed 400

(xii) Interest 230

Ans.1365 crore

45. Calculate net exports from the following data :

Items (?in crore)

(i) NDPFC 2,600

(i) Private final consumption expenditure 1100

(iii) Government final consumption expenditure 470

30

(iv) Consumption of fixed capital

70

(v) Closing stock

850

(vi) Gross domestic fxed capital formation

60

(vii) Opening stock

150

(viii) Net indirect taxes

Ans.350 crore

Hint: (a) GDP=) + (iv) +(viil)

(b) GDP,= (ii) +(üi) t (v)- (vii) + Net exports

46. Calculate consumption of fixed capital from the following data :

( in crore)

Items

30

() Closing stock 870

(ii) Net fixed capital formation

50

(iii) Opening stock 890

(iv) Gross domestic capital formation

Ans.40 crore

47. Calculate depreciation from following data: (?in crore)

Items

65

(i) Opening stock 95

(ii) Closing stock 730

(ii) Gross fixed capital formation 690

(iv) Net capital formation Ans.70crore

the following data :

48. Calculate gross domestic capital formation from

Items

(? in crore)

8690

(i) NDP,MP

300

(i) Exports 5200

(ii) Private final consumption cxpenditure

Measurement of National Income 4.89

(iv) 2140

Govermment final consumption expenditure

(v) Imports 400

(vi)

Consumption

Hint : GDP. of fixed capital

MP ) + (vi).

160

Ans. 1610 crore

49.

Estimate (a) NNP. and (b) Consumption of fixed capital fromthe following

MP

data:

Items (in crore)

() Govermment final consumption expenditure 24

(ii) Net indirect 23

taxes

(iii) NNPe 159

(iv) Gross domestic

(v) Net exports

capital formation 24

4

(vi) Private final

consumption expenditure

(vii) Net factor income

161

from abroad ()1

(viii) Change in stock 3

Ans. (a) 182 crore; (b) ?22 crore

50 Calculate (a) Gross domestic product at market price and (b) Net Exports from the following data:

Items 7(in crore)

(1) Income from domestic

product

(i1) Income from domestic product accuring private sector

to 1600

(iii) Consumption of fixed accuring to public sector S00

(iv) Net capital 100

indirect taxes 300

(v) Private final

(vi) Government consumption expenditure 1200

final consumption expenditure 600

(vii) Gross capital formation

400

(viii) Net factor income from abroad

(100

Ans. (a) 2500crore; (b) 300crore

51. Calculate (a) Net national product at market price,and (b)

Gross domestic product at factor cost :

(CBSE 2018)

Items

(i) Rent and interest (in crore)

6000

(ii) Wages and salaries

1800

(ii) Undistributed profit 400

(iv) Net indirect taxes

100

(v) Subsidies

20

(vi) Corporation tax 120

(vii) Net factor income to abroad 70

(vii) Dividends

80

(ix) Consumption of fixed capital 50

(x) Social security contribution by employers 200

(xi) Mixed income

1000

4.JU A-One Introductory Macroeconomics

Ans. (a) 9630 crore: (b) 9650crore

52. Calculate (a) Operating surplus,and (b) Domestic income : (CBSE D2018)

Items (in crore)

(i) Compensation of employees 2000

(ii) Rent and interest 800

(iii) Indirect taxes 120

(iv) Corporation tax 460

(v) Consumption of fixed capital 100

(vi) Subsidies 20

(vii) Dividend 940

(viii) Undistributed profits 300

(ix) Net factor income to abroad 150

200

(x) Mixed income

Ans. (a) 2500 crore: (b) 74700 crore

53. Calculate (a) Gross domestic product at market price, and (b)National income : (CBSE AI 2018)

Items (in crore)

4000

(i) Govermment final consumption expenditure 3500

(ii) Private final consumption expenditure 1100

(ii) Gross domestic capital formation 500

(iv) Net exports 100

(v) Net factor income from abroad

300

(vi) Net indirect taxes 40

(vii) Subsidies

80

(vii) Change in stock 120

(ix) Consumption of fixed capital

Ans. (a) 9100crores; (b)8780 crores

expenditure method and (b) income method.

54. Calculate Gross National Product at market prices by (a) (CBSE D 2018C)

7(in crore)

Items 100

() Compensation of employees 200

(i) Private final consumption expenditure 20

(iii) Rent 50

(iv) Government final consumption expenditure 10

(v) Profits 10

(vi) Interest

60

(vii) Gross domestic capital formation 10

(vii) Net imports 20

(ix) Consumption of fixed capital 30

(x) Net indirect taxes

Measurement of National Income 4.31

(\1) Net factor income from (-)20

(x) Change in stock abroad 10

(Xii) MiNed income 110

Ans. (a) 280 crores; (b) 280

S5. Given the Consumption crore

and 'Mixedfollowing data, find the missing

Income of Self

values of"Govern1nent Final Expenditure'

(CBSE Delhi Region 2019)

Particulars Employed'.

() National lncome (Rcrore)

71,000

(i) Gross

Domestic Capital Formation 10,000

(i) Government Final Consumption Expenditure

(iv) Mixcd Income of Self

(v) Net Factor Income Employed

From Abroad 1,000

(i) Net Indirect Taxes

(vii) Profits 2,000

1,200

(vii) Wages And Salaries

(ix) Net Exports 15,000

(x) Private Final 5,000

(xi) Consumption Consumption Expenditure

Of Fixed Capital 40,000

(xii) Operating Surplus 3,000

30,000

Ans. (i) Govt. final consumption expenditure = 20,000 crore:

(ii) Mixed income of self employes = 25,000crore.

56. Given the following data, find the

missing values of Private Final Consumption

'Operating Surplus'. Expenditure' and

Particulars (CBSE DelhiRegion 2019)

(i) National Income Tcrore)

(ii) Net Indirect Taxes S0,000

(iii) Private Final 1,000

(iv) Gross DomesticConsumption Expenditure

Capital Formation

(v) Profits 17,000

(vi) Government Final 1,000

(vii) Wages And SalariesConsumption Expenditure 12,500

(vii) Consumption of Fixed Capital 20,000

(ix) Mixed Income of Self Employed 700

(x) Operating Surplus 13,000

(xi) Net Factor Income From Abroad

(xii) Net Exports S00

2,000

Ans. (i) Operating Surplus =

(ii) Private final 16,500 crore;

s7. Given the following data, find the consumption expenditure =19,700 crore.

missing values of 'Gross Domestic Capital

and Salaries'.

Formation' and 'Wages

(CBSE DelhiRegion 2019)

4.92 A-One Introductory Macroeconomics

Particulars crore)

(i) Mixed Income of Self 3,500

(ii) Net Indirect Taxes Employed 300

(ii) Wages And Salaries

(iv) Govemment Final 14,000

(v) Net Exports

Consumption Expenditure

3.00)

(vi) Consumption of Fixed Capital 300

(vii) Net Factor Income From Abroad 700

(vii) Operating Surplus 12,000

(ix) National Income 30,000

(x) Profits 500

(xi) Gross Domestic Capital Formation

(xii) Private Final Consumption Expenditure 11,000

Ans. (i) Wages and Salaries = 13,800 crore

(ii) Gross Domestic Capital Formation = 1900 crore.

58. Calculate the value of "Rent" from the following data: (CBSE Allahbad/Punjab Region 2019)

Particulars crore)

(i)) Gross Domestic Product at market price 18,000

(ii) Mixed income of self employed 7,000

(ii) Subsidies 250

(iv) Interest 800

(v) Rent

(vi) Profit 975

(vi) Compensation of Employees 6,000

1000

(vii) Consumption of Fixed Capital

(ix) Indirect Tax 2000

Ans. 475 crore

59. Given the following data find the values of operating surplus and net Exports (CBSE Chandigarh

Region 2019)

Particulars (T crore)

i) Wages and Salaries 2,400

(ii) National Income 4,200

(i) Net Exports

200

(iv) Net Factor Income From Abroad

1,100

(v) Gross Domestic Capital Formation

400

(vi) Mixed Income of Self-Employed

2,000

(vii) Private FinalConsumption Expenditure

150

(vii) Net Indirect Taxes

(ix) Operating Surplus

(x) Government FinalConsumption Expenditure 1,000

Measurement of National Income 4.93

(x1) 100

(xii) Consumption of Fixed Capital

Profits 500

Ans. (i) Net exports = 150 Crore

(ii) Operating surplus = 1900crore

60. Given the following data, find the valucs of "Gross Domestic Capital Formation" and "Operating

Surplus. (CBSE Ajncr Region 2019)

Particulars {crore)

() National Income 22,100

(ii) Wages and 12,000

Salaries

(iii) Private Final 7,200

Consumption Expenditure

(iv) Net Indirect Taxes 700

(v) Gross Domestic Capital ?

(vi) Depreciation Formation 500

(vii) Govermment Final

Consumption Expenditure

(viii) Mixed Income of Self

6,100

Employed 4,800

(ix) Operating Surplus ?

(x) Net Exports 3,400

(xi) Rent 1,200

(xii) Net Factor Income From

Abroad (150

Ans. (i)Operating Surplus = 5,450 crore:

(ii) Gross domestic capital formation = 6,750 crore

ol. Given the following data, find the values of "Government Final

"Mixed Income of Consumption Expenditure" and

Particulars

Self-Employed"

: (CBSE Jharkhand Region 2019)

(? crore)

(i) National Income 7100

(ii) Government Final Consumption

Expenditure ?

(ii) Gross Domestic CapitalFormation 1000

(iv) Mixed Income of

Self-Employed

(v) Net Indirect Taxes

200

(vi) Net Factor Income from Abroad

100

(vii) Private Final Consumption Expenditure

4,000

(viii) Consumption of Fixed Capital 300

(ix) Profits

120

(x) Wages and Salaries 1500

(xi) Net Exports 500

(xii) Operating Surplus 3,000

Ans.; () Mixed income of self employes= 2,500 crore

(ii) Govt. final consumption expenditure=

2,000 crore

4.94 A-One Introductory Macroeconomics

You might also like

- GMCPTechnicalWeekly31 10 2023Document18 pagesGMCPTechnicalWeekly31 10 2023DineshM78100% (1)

- Applied Economics Week 3 With WorksheetDocument12 pagesApplied Economics Week 3 With WorksheetKate D. Paglinawan50% (2)

- National Income Important QuestionsDocument4 pagesNational Income Important Questionsjb7114262No ratings yet

- National Income Practice QuestionsDocument29 pagesNational Income Practice QuestionsSujalNo ratings yet

- National Income QuestionDocument2 pagesNational Income QuestionShivani Karkera100% (1)

- 01 Ch1 Determination of National Income - Practice SheetDocument18 pages01 Ch1 Determination of National Income - Practice SheetVipul SharmaNo ratings yet

- Question With Answer - National IncomeDocument3 pagesQuestion With Answer - National IncomeShardul100% (9)

- N I Value Added MethodDocument4 pagesN I Value Added MethodJ.Abishek SundarNo ratings yet

- Reference: Answers)Document11 pagesReference: Answers)Jaivardhan KanoriaNo ratings yet

- Questions: Income AND Page 359,0Document17 pagesQuestions: Income AND Page 359,0anirudh sharmaNo ratings yet

- National Income Sums - Value AddedDocument14 pagesNational Income Sums - Value AddedShreyas ParekhNo ratings yet

- National Income Class 12 WsDocument19 pagesNational Income Class 12 WsIsha BhattNo ratings yet

- MycbseguideDocument10 pagesMycbseguideBinoy TrevadiaNo ratings yet

- Numericals On NI Value AddedDocument2 pagesNumericals On NI Value AddedDev Darji100% (1)

- Most Expected Questions Economics Section A MicroDocument3 pagesMost Expected Questions Economics Section A MicroRaju RanjanNo ratings yet

- Consumption DepreciationDocument11 pagesConsumption DepreciationRitishNo ratings yet

- Test 2Document2 pagesTest 2Bhjan GargNo ratings yet

- Pre Board Class XII EconomicsDocument6 pagesPre Board Class XII EconomicsShubhamNo ratings yet

- EcoDocument9 pagesEcoP Janaki RamanNo ratings yet

- Worksheet 8 (Problems Based On Income and Expenditure Method)Document3 pagesWorksheet 8 (Problems Based On Income and Expenditure Method)PradeepNo ratings yet

- N Income Income and Exp Method NewDocument6 pagesN Income Income and Exp Method NewJ.Abishek SundarNo ratings yet

- CBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesDocument6 pagesCBSE Important Questions Class-12 Economics Chapter-5 National Income and Related AggregatesVaibhavNo ratings yet

- NI Sums PDFDocument3 pagesNI Sums PDFSHIVANG SADANINo ratings yet

- FR111. FFA Solution CMA January 2022 ExaminationDocument5 pagesFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNo ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- Aditi Food Products (Projected Report)Document4 pagesAditi Food Products (Projected Report)Rohit KhandelwalNo ratings yet

- The New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeDocument3 pagesThe New Indian School, W.L.L Kingdom of Bahrain Class: Xii Economics Assignment National IncomeHannah Ann JacobNo ratings yet

- Economics WorksheetDocument2 pagesEconomics Worksheetdennis greenNo ratings yet

- NI Problems For Practice: Employer's Contribution To Social 100 Security SchemeDocument4 pagesNI Problems For Practice: Employer's Contribution To Social 100 Security Schemesridharvchinni_21769No ratings yet

- Macro Economics Five Years QP NewDocument23 pagesMacro Economics Five Years QP Newprarabdh shivhareNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- B.A. (H) Economics - 2nd Semester 2022Document20 pagesB.A. (H) Economics - 2nd Semester 2022sanjeev.nagar0108No ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Isc Mock 2Document14 pagesIsc Mock 2anshikajain3474No ratings yet

- National Income ProblemsDocument4 pagesNational Income ProblemsPriyankadevi PrabuNo ratings yet

- 5th Sem (Macro-Economics) Exam Based Practical QuestionDocument5 pages5th Sem (Macro-Economics) Exam Based Practical Questionsadfeel145No ratings yet

- M3 OPEX Decision Making Data Answer 2.10.21Document6 pagesM3 OPEX Decision Making Data Answer 2.10.21hanis nabilaNo ratings yet

- National IncomeDocument2 pagesNational IncomePUTERI SIDROTUL NABIHAH SAARANINo ratings yet

- MA Chapter 3 - ExDocument19 pagesMA Chapter 3 - ExheinNo ratings yet

- F7irl 2008 Dec ADocument10 pagesF7irl 2008 Dec Awaseemhasan85No ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Ational Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1Document4 pagesAtional Income: Archanatrivedi/Nationalincome/Ws/2021-22Page 1BlairNo ratings yet

- GR+XII +Chapter++Test +National+IncomeDocument7 pagesGR+XII +Chapter++Test +National+IncomeAkshatNo ratings yet

- SESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsDocument5 pagesSESSION 2020-21 First Terminal Exam Xii Economics Time: 3 Hour M/M:80 General InstructionsAnupama RawatNo ratings yet

- 12 Economcis t2 sp02Document9 pages12 Economcis t2 sp02ShivanshNo ratings yet

- Macro Unsolved Numericals English PDFDocument18 pagesMacro Unsolved Numericals English PDFNindoNo ratings yet

- TaxationsDocument12 pagesTaxationsKansal AbhishekNo ratings yet

- Wa0000.Document2 pagesWa0000.Adarsh SinghNo ratings yet

- 12 Economics23 24sp11Document14 pages12 Economics23 24sp11Dr. Anuradha ChugNo ratings yet

- Suggested Answer - Syl16 - June2019 - Paper - 15 Final Examination: Suggested Answers To QuestionsDocument26 pagesSuggested Answer - Syl16 - June2019 - Paper - 15 Final Examination: Suggested Answers To QuestionsPola PolzNo ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- Budget and Budgetory ControlDocument25 pagesBudget and Budgetory ControlDisha Commerce AcademyNo ratings yet

- ProfitLoss - FY 22-23Document2 pagesProfitLoss - FY 22-23lekha vesatNo ratings yet

- Dipifra 2002 Jun ADocument16 pagesDipifra 2002 Jun AMeka MeherremovaNo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- Comparative Statement of Profit and LossDocument6 pagesComparative Statement of Profit and LossHimanshi ChopraNo ratings yet

- QuestionDocument2 pagesQuestionKamoheloNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Solutions Academy: Presented by Raman Sachdeva With Lot of HappinessDocument3 pagesSolutions Academy: Presented by Raman Sachdeva With Lot of HappinessRaman SachdevaNo ratings yet

- Paper19 - Set2 Question Cma FinalDocument5 pagesPaper19 - Set2 Question Cma Finalrehaliya15No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Class 12 Political Science Alternative Centres of Power Term2 LEARN VIBRANTDocument14 pagesClass 12 Political Science Alternative Centres of Power Term2 LEARN VIBRANTFREAK ĞAMINĞNo ratings yet

- Introduction To BookkeepingDocument11 pagesIntroduction To Bookkeepingfauzi villegasNo ratings yet

- United States Chain Scale Forecast SampleDocument19 pagesUnited States Chain Scale Forecast SampledaveNo ratings yet

- ZULUAGA, 2020 - Cash Flow Cycle Analysis TemplateDocument8 pagesZULUAGA, 2020 - Cash Flow Cycle Analysis TemplateandreaNo ratings yet

- The Creative Economy: Speech Given byDocument22 pagesThe Creative Economy: Speech Given byHao WangNo ratings yet

- Your Bank of America Adv Plus Banking: Account SummaryDocument7 pagesYour Bank of America Adv Plus Banking: Account SummaryPbro. José D. BriceñoNo ratings yet

- Business Finance - 12 - Third - Week 3Document10 pagesBusiness Finance - 12 - Third - Week 3AngelicaHermoParasNo ratings yet

- Argus Biofuels (2023!08!08)Document11 pagesArgus Biofuels (2023!08!08)Pitipat LeeNo ratings yet

- Chapter 1 (BOS)Document8 pagesChapter 1 (BOS)Zulhelmi ZainuddinNo ratings yet

- FIN 201 - Introduction To Business Finance: Session 1 - 2Document8 pagesFIN 201 - Introduction To Business Finance: Session 1 - 2Saqib RehanNo ratings yet

- Problem Set 3 - Some Answers FE312 Fall 2010 Rahman: R G R GDocument4 pagesProblem Set 3 - Some Answers FE312 Fall 2010 Rahman: R G R GFeni News 24No ratings yet

- Cat Ladder Sketch-DetailDocument1 pageCat Ladder Sketch-DetailIsmailNassarNo ratings yet

- Unit - 4.6 Hicks Theory.Document4 pagesUnit - 4.6 Hicks Theory.Deeksha KapoorNo ratings yet

- Renshaw4e Furtherexercises Ans ch01Document6 pagesRenshaw4e Furtherexercises Ans ch01SITI HAJAR BINTI MOHD LATEPINo ratings yet

- MHD Trading CatalogueDocument37 pagesMHD Trading CatalogueGiau Ngoc HoangNo ratings yet

- Midterm Exam - Attempt ReviewDocument6 pagesMidterm Exam - Attempt ReviewMahmoud AliNo ratings yet

- Halonix LimitedDocument2 pagesHalonix LimitedSajal MittalNo ratings yet

- Inventory ManagementDocument17 pagesInventory ManagementMunyaradzi MhlangaNo ratings yet

- Ij 3 O4 RO93 G 3 Za 5 B61 Ep LJyqxu M1 GQ 0Document2 pagesIj 3 O4 RO93 G 3 Za 5 B61 Ep LJyqxu M1 GQ 0Stella OktavianiNo ratings yet

- Summary of Regression Results On The Effects of Demographic Change On Economic Growth, Selected Studies Based On Conditional Convergence ModelsDocument2 pagesSummary of Regression Results On The Effects of Demographic Change On Economic Growth, Selected Studies Based On Conditional Convergence ModelssfdfsdfNo ratings yet

- Financial Statements of Non Profit OrganisationDocument11 pagesFinancial Statements of Non Profit OrganisationRahul NegiNo ratings yet

- 954 Deadline 2020 Methodology (1) .OriginalDocument50 pages954 Deadline 2020 Methodology (1) .OriginalMika DeverinNo ratings yet

- PricelineDocument2 pagesPricelineabdelamuzemil8No ratings yet

- PEG Ratio - What It Is and How To Calculate ItDocument4 pagesPEG Ratio - What It Is and How To Calculate ItPatacoNo ratings yet

- Framework Aggrement-RefDocument4 pagesFramework Aggrement-RefMoffat KangombeNo ratings yet

- E.O.D MCQDocument3 pagesE.O.D MCQMuhammad junaid qureshiNo ratings yet

- PLC Assignment 2Document5 pagesPLC Assignment 2givenl193No ratings yet

- Ibt01-Chapter 5Document8 pagesIbt01-Chapter 5Rea Mariz JordanNo ratings yet