Professional Documents

Culture Documents

FIN202 Chap 4 Excel Practice

FIN202 Chap 4 Excel Practice

Uploaded by

thaothuvg20040 ratings0% found this document useful (0 votes)

1 views3 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

1 views3 pagesFIN202 Chap 4 Excel Practice

FIN202 Chap 4 Excel Practice

Uploaded by

thaothuvg2004Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

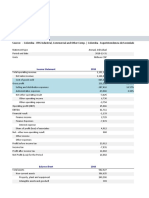

The following are the financial statements for

Nederland Consumer Products Company for

the fiscal year ended December 31, 20xx.

a) Calculate all the ratios in liquidity,

efficiency, leverage, profitability raios.

b) Compare all the ratios, for which industry

figures are available below, for Nederland

and compare the firm's ratios with the

industry ratios.

c) Using the DuPont identity, calculate the

return on equity for Nederland, after

calculating the ratios that make up the

DuPont identity.

Nederland Consumer Products Company

Income Statement for the Fiscal Year

Ended December 31, 20xx

Net Sales 51,407

Cost of product sold 25,076

Gross Profit 26,331

Marketing, research, administrative expense 15,746

Depreciation 758

Operating income (loss) 9,827

Interest Expense 477

Earning (Loss) before incomes taxes 9,350

Income taxes 2,869

Net Earnings (loss) 6,481

Nederland Consumer Products Company

Balance Sheet as of December 31, 20xx

ASSETS

Cash and marketable securities 5,469

ST Investment securities 423

Accounts Receivable 4,062

Inventory 4,400

Deffered income taxes 958

Prepaid expenses and other receivable 1,803

Total Current Assets 17,115

Property, plant, and equipement at cost 25,304

Less: Accumulated Depreciation (11,196)

Net Property, plan, and equipment 14,108

Net goodwill and other intangible assets 23,900

Other noncurrent assets 1,925

TOTAL ASSETS 57,048

LIABILITIES AND EQUITY

Accounts payable 3,617

Accrued and other liabilities 7,689

Taxes payable 2,554

Debt due within one year 8,287

Total Current Liabilities 22,147

LT Debt 12,554

Deffered income taxes 2,261

Other noncurrent liabilities 2,808

TOTAL LIABILITIES 39,770

Convertible Class A preferred stock 1,526

Common Stock 2,141

Retained Earnings 13,611

Treasury Stock -

TOTAL STOCKHOLDERS' EQUITY 17,278

TOTAL LIABILITIES AND EQUITY 57,048

RATIO INDUSTRY AVERAGE

Current Ratio 2.05

Quick Ratio 0.78

Gross Profit Margin 23.90%

Net Profit Margin 12.30%

Debt Ratio 0.23

LT debt to equity 0.98

Interest coverage 5.62

ROA 5.30%

ROE 18.80%

You might also like

- Strategic-Management-Analysis of "MEGHNA GROUP OF INDUSTRIES"Document10 pagesStrategic-Management-Analysis of "MEGHNA GROUP OF INDUSTRIES"SanaullahSunny100% (1)

- André Maggi Participacoes Sa AmaggiDocument88 pagesAndré Maggi Participacoes Sa AmaggiJefferson AnacletoNo ratings yet

- A Case Study On Intel Corporation, 1992: Group-62 (B Section)Document33 pagesA Case Study On Intel Corporation, 1992: Group-62 (B Section)asifabdullah khanNo ratings yet

- Assignment On Financial Statement Ratio AnalysisDocument27 pagesAssignment On Financial Statement Ratio AnalysisShourav87% (23)

- Case 50 Flinder Valves and Controls IncDocument24 pagesCase 50 Flinder Valves and Controls IncBlatta Orientalis0% (1)

- San MiguelDocument9 pagesSan MiguelAngel Buitizon100% (1)

- Espresso Software Financial Statements and Supplementary DataDocument38 pagesEspresso Software Financial Statements and Supplementary DataAnwar AshrafNo ratings yet

- BUS101 Working PapersDocument388 pagesBUS101 Working PapersftcuserNo ratings yet

- Income Statement For The Fiscal Year, September 30, 2018Document1 pageIncome Statement For The Fiscal Year, September 30, 2018Trần Dương Mai PhươngNo ratings yet

- Extra Ex QTTC28129Document4 pagesExtra Ex QTTC28129Quang TiếnNo ratings yet

- Chapter 8 - Financial AnalysisDocument4 pagesChapter 8 - Financial AnalysisLưu Ngọc Tường ViNo ratings yet

- Ratio AnalysisDocument15 pagesRatio AnalysisNSTJ HouseNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- Video 2.5-DogamerDocument18 pagesVideo 2.5-DogamerutamiNo ratings yet

- Final AFS 2021 MBA 6th MorDocument3 pagesFinal AFS 2021 MBA 6th MorSyed Mursaleen ShahNo ratings yet

- Fauji Fertilizer Company Limited 20 21Document5 pagesFauji Fertilizer Company Limited 20 21Aliza IshraNo ratings yet

- Bank 2 CitigroupDocument42 pagesBank 2 CitigroupEnock RutoNo ratings yet

- Balance Sheet Asset: Total Current AssetsDocument2 pagesBalance Sheet Asset: Total Current AssetsTrinh VũNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Financial Information Disney Corp: Millons of Dollars Except Per ShareDocument12 pagesFinancial Information Disney Corp: Millons of Dollars Except Per ShareFernando Martin VallejosNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Balance Sheet P&G 2009Document5 pagesBalance Sheet P&G 2009Saad BukhariNo ratings yet

- Revisi Tugas Cash Flow AnalysisDocument29 pagesRevisi Tugas Cash Flow AnalysisNovilia FriskaNo ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- Bajaj Finserv Ltd. (India) : SourceDocument5 pagesBajaj Finserv Ltd. (India) : SourceDivyagarapatiNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- JSC Sistema-Hals and Subsidiaries: Consolidated Financial StatementsDocument39 pagesJSC Sistema-Hals and Subsidiaries: Consolidated Financial Statementsdvolkov2318No ratings yet

- AME - 2022 - Case IDocument5 pagesAME - 2022 - Case IjjpasemperNo ratings yet

- Nvidia ExcelDocument8 pagesNvidia Excelbafsvideo4No ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- Fin - AnalysisDocument2 pagesFin - Analysisajignacio.05No ratings yet

- Daimler Ir Ar2018 Financial TablesDocument28 pagesDaimler Ir Ar2018 Financial TablesAshish PatwardhanNo ratings yet

- Income Statement and Balance Sheet (LV & Parda)Document30 pagesIncome Statement and Balance Sheet (LV & Parda)Pallavi KalraNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Wal-Mart Financials For 2010 MetricsDocument4 pagesWal-Mart Financials For 2010 MetricsGhost FreyNo ratings yet

- Hong Kong and Shanghai Banking CorporationDocument9 pagesHong Kong and Shanghai Banking CorporationArsen AbdyldaevNo ratings yet

- MOD Technical Proposal 1.0Document23 pagesMOD Technical Proposal 1.0Scott TigerNo ratings yet

- Camille ManufacturingDocument4 pagesCamille ManufacturingChristina StephensonNo ratings yet

- Walgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassDocument7 pagesWalgreens Boots Alliance, Inc. and Subsidiaries: Capitalize STMT of Op Lease ReclassHiếu Nguyễn Minh HoàngNo ratings yet

- Grumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsDocument2 pagesGrumpy Cat Company Comparative Statements of Financial Position December 31, 2020 and 2019 2020 2019 AssetsKatherine GablinesNo ratings yet

- Accounting Information System HomeWork 1 Jazan UniversityDocument7 pagesAccounting Information System HomeWork 1 Jazan Universityabdullah.masmaliNo ratings yet

- Globe Vertical AnalysisDocument22 pagesGlobe Vertical AnalysisArriana RefugioNo ratings yet

- T Systems (Report)Document219 pagesT Systems (Report)Prachi SaklaniNo ratings yet

- Microsoft Financial Data - FY19Q1Document26 pagesMicrosoft Financial Data - FY19Q1trisanka banikNo ratings yet

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Document5 pagesFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNo ratings yet

- Fatima Fertilizer Company Limited: Balance SheetDocument44 pagesFatima Fertilizer Company Limited: Balance SheetAroma KousarNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- A Reformulation: Intel CorporationDocument15 pagesA Reformulation: Intel Corporationmnhasan150No ratings yet

- Unilever Income Statement and Balance Sheet 2021Document5 pagesUnilever Income Statement and Balance Sheet 2021Supreme ChoudharyNo ratings yet

- Fatima Jinnah Women University Department of Computer Arts Home Assignment For Class DiscussionDocument6 pagesFatima Jinnah Women University Department of Computer Arts Home Assignment For Class DiscussionHajra ZANo ratings yet

- Star ReportsDocument38 pagesStar ReportsAnnisa DewiNo ratings yet

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloNo ratings yet

- Financial Statement Coca ColaDocument4 pagesFinancial Statement Coca ColaDane LavegaNo ratings yet

- CLWY Q3 2019 FinancialsDocument3 pagesCLWY Q3 2019 FinancialskdwcapitalNo ratings yet

- RatioDocument8 pagesRatioMaria Raven Joy Espartinez ValmadridNo ratings yet

- 3 - CokeDocument30 pages3 - CokePranali SanasNo ratings yet

- Vietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Document24 pagesVietnam Dairy Products Joint Stock Company Balance Sheet December 31, 2020Như ThảoNo ratings yet

- Public Accountancy PracticeDocument69 pagesPublic Accountancy Practicelov3m3100% (2)

- 2023 Half Year Balance SheetDocument2 pages2023 Half Year Balance SheetsrishtiladdhaNo ratings yet

- Question 2Document3 pagesQuestion 2premsuwaatiiNo ratings yet

- Bank 1 ICBCDocument24 pagesBank 1 ICBCEnock RutoNo ratings yet

- Wipro Ltd. (India) : SourceDocument6 pagesWipro Ltd. (India) : SourceDivyagarapatiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- IDFC Tax Advantage (ELSS) Fund Application FormDocument24 pagesIDFC Tax Advantage (ELSS) Fund Application FormPrajna CapitalNo ratings yet

- Company Acc B.com Sem Iv...Document8 pagesCompany Acc B.com Sem Iv...Sarah ShelbyNo ratings yet

- AStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanyDocument13 pagesAStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanySUNDAR PNo ratings yet

- Bukalapak Com TBK Bilingual Q1 2023 FinalDocument175 pagesBukalapak Com TBK Bilingual Q1 2023 FinalTappp - Elevate your networkingNo ratings yet

- Investment AccountsDocument10 pagesInvestment AccountsMani kandan.GNo ratings yet

- Company Final Accounts PDFDocument31 pagesCompany Final Accounts PDFakshay64% (11)

- The Financial Performance of The Burnley FC Holdings LimitedDocument6 pagesThe Financial Performance of The Burnley FC Holdings LimitedAnthony Van Leeuwenhoek100% (1)

- Intac 2Document7 pagesIntac 2Yza GesmundoNo ratings yet

- BL DeniseDocument10 pagesBL DeniseMaria Denise Belen SaclutiNo ratings yet

- Ration Analysis of M&SDocument72 pagesRation Analysis of M&SRashid JalalNo ratings yet

- UBS Equity Compass May - EN (1) - 1Document41 pagesUBS Equity Compass May - EN (1) - 1Bondi BeachNo ratings yet

- Associative Network TheoryDocument155 pagesAssociative Network TheoryMAY AN QUBINGNo ratings yet

- FAR 2922 Investments in Equity Instruments PDFDocument5 pagesFAR 2922 Investments in Equity Instruments PDFEki OmallaoNo ratings yet

- Capital Structure Analysis OF: BY: Group 5Document36 pagesCapital Structure Analysis OF: BY: Group 5Thanga RajNo ratings yet

- BACNTHIDocument3 pagesBACNTHIFaith CalingoNo ratings yet

- Chapter 4 Raising Equity CapitalDocument28 pagesChapter 4 Raising Equity CapitalSiti Aishah Umairah Naser Binti Abdul RahmanNo ratings yet

- Purchase Consideration - SolutionDocument16 pagesPurchase Consideration - Solutionsarthak mendirattaNo ratings yet

- CH - 01 Introduction To Accounting (Edited)Document38 pagesCH - 01 Introduction To Accounting (Edited)arifhasan953No ratings yet

- BP Amoco (Case Study)Document25 pagesBP Amoco (Case Study)Abhik Tushar Das67% (3)

- Modul 7 - Financial Distress-1Document39 pagesModul 7 - Financial Distress-1Cornelita Tesalonika R. K.No ratings yet

- CombinationDocument8 pagesCombinationNabila Lubna Manuhara PutriNo ratings yet

- Case Study Lone Pine Café: Balance SheetDocument4 pagesCase Study Lone Pine Café: Balance SheetAsutosh Kumar MishraNo ratings yet

- Chapter 2 Financial ManagementDocument58 pagesChapter 2 Financial ManagementCarstene RenggaNo ratings yet

- Annual Report 2020: Meiko Electronics Co., LTDDocument44 pagesAnnual Report 2020: Meiko Electronics Co., LTDLuu Ngoc Phuong (FGW HCM)No ratings yet

- Godrej Industries LimitedDocument8 pagesGodrej Industries LimitedJigarNo ratings yet