Professional Documents

Culture Documents

Doa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104

Doa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104

Uploaded by

christinageorges417Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Doa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104

Doa Echo Arys DB de Rhe 500M MT103 Via Swift - Com 06march24 - 20240407142104

Uploaded by

christinageorges417Copyright:

Available Formats

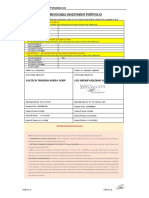

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

DEED OF AGREEMENT

CORPORATE AGREEMENT №: ECHOARYS-RHE-500M€-04032024

INSTRUMENT: SWIFT MT103 CASH TRANSFER via swift.com

This Corporate Agreement via SWIFT MT103 CASH TRANSFER and the attached Annexes (further designated

as the Agreement) are entered on this April 7, 2024, between:

>> ECHO ARYS GMBH at DEUTSCHE BANK GERMANY (INVESTOR or PARTY "A")

and

>> RHEINGOLD HOLDING GMBH at Deutsche Bank AG (RECEIVER or PARTY “B”)

INVESTOR or PARTY "A":

COMPANY NAME: ECHO ARYS GMBH

COMPANY ADDRESS: KREUZSTR. 60, 40210 DUSSELDORF GERMANY

COMPANY REG. №: HRB 81206

REPRESENTED BY: M. JAMES PATRICK NORMOYLE - CEO

PASSPORT NUMBER: PB1463840 - AUSTRALIA

VALIDITY: 01 NOV 2021 I 01 NOV 2031

BANK NAME: DEUTSCHE BANK AG

BANK ADDRESS: TAUNUSANLAGE 12, FRANKFURT AM MAIN, GERMANY

SWIFT CODE: DEUTDEFXXX

IBAN NUMBER: DE27500700100920009870

ACCOUNT NAME: ECHO ARYS GMBH

BO NAME/EMAIL/TEL: M. DAVID LYNNE - DAVID.LYNNE@DB.COM - Tel: +49 69 910-35754

(Hereinafter referred to as the "First Party" or Party “A”)

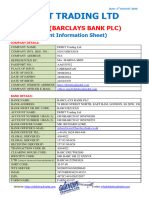

RECEIVER or PARTY “B”:

Company Name RHEINGOLD HOLDING GMBH

Company Address AN DER GÜMPGESBRÜCKE 13 -41464 KAARST -Germany

Company Registration No. HRB 11050

Represented By : Mr.Thomas Steuer

Title Owner

Nationality Germany

Passport No. C71THMNK7

Date of Issue 13.03.2017

Date of Expiration 12.03.1027

Date ofBirth 15.05.1954

Name of Bank Deutsche Bank AG

Bank Address Königsallee 45-47 - Düsseldorf

Account Name RHEINGOLD HOLDING GMBH

Account Signatory Mr.Thomas Steuer

Account No. 300 9370 503 00

BIC(Swift) Code DEUTDEDDXXX

IBAN / Routing No. DE93 3007 0010 0937 0503 00

BANKOFFICER/POSITION Mr. James Von Moltke

PARTY "A" PAGE 1 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

BANKOFFICER PHONE +49 69 91000/+49 69 910-34225

BANKOFFICERE-MAIL james.vonmoltke@db.com

(Hereinafter referred to as "The Second Party” or Party “B”)

RECEIVER is licensed and must abide by Banking Laws and Regulations, set through compliance and due

diligence requirements for International Banking / Business / Commodity transactions worldwide.

RECEIVER has Approvals to accept large deposits / a sum of monies from around the World.

RECEIVER has Bank Approvals to accept / conclude large International / Global Business Transactions.

PARTY "A" PAGE 1 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

WHEREAS: The Party-B is ready and able to receive this Pay Order as a joint venture investments projects by

Parties herein for the execution of various infrastructure development projects in MOROCCO, & Party-B is

ready willing and able to receive said M0 CASH TRANSFERS up to € 500,000,000.00 (Five Hundred Million

Euro) with rollover and extension, VIA SWIFT.COM with instrument MT-103 CASH TRANSFER, from Party-A.

These funds will be invested/disbursed by Party-B as per PAYOUT LIST instructions defined by Party “A”, and

signed by Parties.

Funds sent by Party “A” are M0 Cash Funds, with Instrument SWIFT MT103 CASH TRASNFER, BY SWIFT.COM

SYSTEM SO DIRECTCLY TO RECEIVER COMMON ACCOUNT

Party-B confirms that the transaction via swift.com system will be managed by the Receiver Bank Officer.

WHEREAS: The Party-A represents and warrants, with full corporate and legal responsibility, that he has

permission to enter into this Joint Venture Investment Agreement, as well as declares under penalty of perjury

that the funds as per Party A bank statement hereby noted as Annex are good, clean, clear, and free of non

criminal origin, are free and clear of MT103 liens,encumbrances and third parties interests.

DESCRIPTION OF TRANSACTION

Sender's Instrument: SWIFT MT103 CASH TRANSFER, VIA SWIFT.COM SYSTEM

Total face value: € 500,000,000.00 (Five Hundred Million Euro)

First tranche: € 49,250,000.00 (Forty Nine Million and Two Fifty Hundred

Thousand Euro)

Second tranche: TO BE DEFINED BY PARTIES

Remittance by: VIA SWIFT.COM, MT103 CASH TRANSFER

Payment by: Wire Transfer within max 5 Banking Days after slip 2 (final code)

1. PROCEDURE:

1.1 Party “A” completes/signs/seals this Agreement with all annexes and submits them to Party“B” viae-

mail, along with the compliance documents.

1.2 Party “B” verifies, approves, completes and counter signs/seals this Agreement with all annexes and

sends viae-mail in PDF format to Party “A”.

1.3 Each Party places the copy of this Agreement in its nominated bank via e-mail (hard copies to be

exchanged by courier service, if requested) and notifies the other Party.

NO BO to BO COMMUNICATION

1.4 Party “A” will send a MT199 pre-advice to Party “B” via swift.com system and will provide a copy of it to

the Consultants. The Bank Officer of Party “B” shall reply with MT199 RWA via swift.com system, in order to

confirm he is ready to receive funds via swift.com, accordingly to the procedure below, and will provide a

copy of it to the Consultants.

1.5 Party “A” will transfer the first tranche of 49,250 M€ by SWIFT MT103 CASH TRANSFER, via swift.com to

Party “B”, and provides a clear Copy of the TRANSACTION SLIP 1 of the SWIFT MT103 CASH TRANSFER.

Funds will directly reach the Party “B” Bank Common Account.

1.6 Party “B” confirms to Party “A” that the funds are in Party “B” Common Account and Party “B” Bank

Officer is required to send the proof of it with a screenshot. Then Party “B” provides the Corporate Payment

Guarantee Letter, prepared by Party “A”, that shall be endorsed by Party “B” Bank Officer.

1.7 Within maximum 3 (three) Banking days after receiving the PGL endorsed by BO Receiver, Party “A”

shall process the Final Release Code (TRANSACTION SLIP 2) that will allow “Party B” to discharge the funds

in Receiver account. Then Party ”B” shall notify Party “A” through their consultants that the funds had been

discharged in Receiver account.

1.8 All legalization and cost for liberation of funds will be done and completed solely by Party “B”. Party “A”

will provide white slip, remittance, debit note and tracer.

1.9 Within maximum 5 (Five) banking days after receiving TRANSACTION SLIP 2, Party “B” will execute the

PGL endorsed by BO Receiver.

PARTY "A" PAGE 2 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

Then Party “A” will define the timing of the Second Tranche, and will inform Party “B” with the same

procedure from point 1.5.

2. NON-SOLICITATION

Receiver hereby confirms and declares that its associates or representatives, or any other person(s) on its

behalf, has/have never been solicited by any party, its shareholders or associates or representatives in any

way whatsoever that can be construed as a solicitation for this future transactions. Any delay in or failure of

performance by either party of their respective obligations under this Agreement shall constitute a breach

hereunder and will give rise to claims for damages if, and to the extent that such delay(s) or failure(s) in

performance is(are) not caused by event(s) or circumstance beyond the control of such party in default.

The term Beyond the Control of Such Party include Act of War, Rebellion, Fire, Flood, Earthquake or other

natural disasters, and any other cause not within the control of such non performing party, or which the

non-performing party by exercise of reasonable diligence is unable to foresee or prevent or remedy.

3. REPRESENTATIONS AND WARRANTIES

(a) Organization. It is duly organized, validly existing and in good standing under the laws of its jurisdiction

of formation with all requisite power and authority to enter into this Agreement, to perform its

obligations hereunder and to conduct the business of this transaction.

(b) Enforceability. This Agreement constitutes the legal, valid and binding obligation of such party

enforceable in accordance with its terms.

(c) Consents and Authority. No consents or approvals are required from any of the governmental

authority or other person for it to enter into this Agreement. All actions on the part of such acting party

necessary for the authorization, execution and delivery of this Agreement, and the consummation of

the transactions contemplated hereby by such party, have been duly taken.

(d) No Conflict. The execution and delivery of this Agreement by it and the consummation of the

transactions contemplated hereby by it do not conflict with or contravene the provisions of its

organizational documents or any agreement or instrument by which it or its properties or assets are

bound or any law, rule, regulation, order or decree to which it or its properties or assets are subject.

(e) Receiver. It has been afforded the opportunity to seek and rely upon the advice of its own attorney,

accountant or other professional advisor in connection with the execution of this Agreement. Both

Parties shall do so in respect of each other and under this Agreement written conditions.

4. MISCELLANEOUS

(a) Notice(s). The two authorized signatories will execute any modifications, amendments, and

addendums or follow on contracts respectively. When signed and referenced to this Agreement,

whether received by mail or facsimile transmission as all and any facsimile or photocopies certified as

true copies of the originals by both Parties hereto shall be considered as an original, both legally

binding and enforceable for the term of this Agreement.

(b) Specific Performance; Other Rights. The Parties recognize that several of the rights granted underthis

Agreement are unique and, accordingly, the Parties shall in addition to such other remedies as may

be available to them at law or inequity, have the right to enforce their rights under this Agreement by

actions for injunctive relief and specific performance.

(c) Prior Agreements; Construction; Entire Agreement. This Agreement, including the Exhibits and other

documents referred to herein (which form a part hereof), constitutes the entire agreement of the

Parties with respect to the subject matter hereof, and supersedes all prior agreements and

understandings between them as to such subject matter and all such prior agreements and

understandings are merged herein and shall not survive the execution and delivery hereof. In the

event of any conflict between the provisions of this Agreement and those of any Joint Ventures

Agreement, the provisions of the applicable Joint Venture Agreementshall control.

PARTY "A" PAGE 3 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

(d) Amendments. This Agreement may not be amended, altered or modified except (i) upon the

unanimous by instrument in writing and signed by each of the Investor and Asset Manager.

(e) Severability. If any provision of this Agreementshall be held or deemed by a final order of a competent

authority to be invalid, inoperative or unenforceable, such circumstance shall not have the effect of

rendering any other provision or provisions herein contained invalid, inoperative or unenforceable, but

this Agreement shall be construed as if such invalid, inoperative or unenforceable provision had never

been contained herein so as to give full force and effect to the remaining such terms and provisions.

(f) Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be

considered one and the same agreement, and shall become effective when one or more such

counterparts have been signed by and delivered to each of the Parties.

(g) Applicable Law; Jurisdiction. This Agreement shall be governed by and construed in accordance with

the laws of the Paris. The Parties consent to the exclusive jurisdiction of the Paris shall be preceded

with the according to the principal of the ICC, with any civil action concerning any controversy, dispute

or claim arising out of or relating to this Agreement, or any other agreement contemplated by, or

otherwise with respect to, this Agreement or the breach hereof, unless such court would not have

subject matter jurisdiction thereof, in which event the Parties consent to the jurisdiction of the ICC as

above indicated. The Parties hereby waive and agree not to assert in any litigation concerning this

Agreement the doctrine of forum non-convenient.

(h) Waiver of Jury Trial. The Parties Hereto Hereby Irrevocably And Unconditionally Waive Trial By Jury In

Any Legal Action Or Proceeding Relating To This Agreement And For Any Counterclaim Therein.

(i) No Rights of Third Parties. This Agreement is made solely and specifically between and for the benefit

of the Parties hereto and their respective members, successors and assigns subject to the express

provisions hereof relating to successors and assigns, and (ii) no other Person whatsoever shall have any

rights, interest, or claims hereunder or be entitled to any benefits under or on account of this

Agreement as a third party beneficiary or otherwise.

(j) Survival. The covenants contained in this Agreement which, by their terms, require performance after

the expiration or termination of this Agreementshall be enforceable notwithstanding the expiration or

other termination of this Agreement.

(k) Headings. Headings are included solely for convenience of reference and if there is any conflict

between headings and the text of this Agreement, the text shall control.

(l) No Broker. Each of Investor and Asset Manager represent and warrant that it has not dealt with any

broker in connection with this Agreement and agrees to indemnify, defend and hold harmless each

other party hereto and its Affiliates from all claims and/or damages as a result of this representation

and warranty being false.

(m) Currency. Any exchange of funds between Sender and Receiver shall be made in the same currency in

which the Sender transferred the investment fund. In addition, all calculations pursuant to this

Agreement and any Joint Venture Agreementshall be based on ICC regulations in Paris.

5. ARBITRATION

(a) All disputes and questions whatsoever which arises between the Parties to this Agreement and

touching on this Agreement on the construction or application thereof or any account cost, liability to

be made hereunder or as to any act or way relating to this Agreement shall be settled by the

arbitration in accordance with the arbitration laws of the ICC, Paris, France.

(b) Every attempt shall be made to resolve disputes arising from unintended or inadvertent violation of

this contractual Agreement as far as possible amicably. In the event that adjudication is required local

legal process shall be preceded with according to the principal of the ICC as above indicated. Where

judicial resolution is not thereby achieved, this mattershall be settled by the ICCitself and the decision

of which all Parties shall consider to be final and binding. No State court of any nation shall have

subject matter jurisdiction over matters arising under this Agreement.

(c) This Agreement contains the entire agreement and understanding concerning the subject matter

hereof and supersedes and replaces all prior negotiations and proposed agreements, written or oral.

PARTY "A" PAGE 4 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

Neither of the Parties may alter, amend, nor modify this Agreement, except by an instrument in

writing signed by both Parties.

(d) This Agreement will be governed by and construed in accordance with the laws of United Kingdom. In

the event that either party shall be required to bring any legal actions against the other in order to

enforce any of the terms of this Agreement the prevailing party shall be entitled to recover reasonably

attorney fees and costs.

(e) All Communications will take place on the account to account only. No exceptions,e-mail, attachments

of this document, when duly executed are to be considered originals and binding documents.

This Agreement once executed by both Parties will become effective as of the date first written above. Any

official notice(s) exchanged by the Parties hereto, shall be sent to the first mentioned address(s) herein or as

may be attached by addenda hereto. A facsimile or electronically transferred copy of this Agreement, duly

signed by both Parties, shall be deemed original.

EDT (ELECTRONIC DOCUMENT TRANSMISSIONS)

EDT (Electronic document transmissions) shall be deemed valid and enforceable in respect of any provisions of this Contract,and

as applicable, this Agreementshall incorporate:

• U.S. Public Law 106-229, Electronic Signatures in “Global and National Commerce Act” or such other applicable law

conforming to the UNCITRAL Model Law on Electronic Signatures (2001);

• ELECTRONIC COMMERCE AGREEMENT (ECE/TRADE/257, Geneva, May 2000) adopted by the United Nations Centre for

Trade Facilitation and Electronic Business (UN/CEFACT); and□

• EDT documents shall be subject to European Community Directive No.95/46/EEC, as applicable. Either Party may

request hard copy of any document that has been previously transmitted by electronic means provided however, that any such

requestshall in no manner delay the Parties from performing their respective obligations and duties under EDT instruments.

PARTY "A" PAGE 5 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

IN WITNESS WHEREOF, the Parties hereto do set their hands and are witnessed with seals upon this

PARTNERSHIP AGREEMENT N° ECHOARYS-XXXX-500M€-04032024 as of this date of MARCH 06th, 2024.

INVESTOR OR PARTY “A”: ECHO ARYS GMBH RECEIVER OR PARTY “B”: RHEINGOLD

HOLDING GMBH

Represented By M. JAMES PATRICK Represented By Mr.Thomas Steuer

NORMOYLE - CEO

Passport No. PB1463840 - AUSTRALIA Passport No. C71THMNK7

Date of Expiry 01 NOV 2031 Date of Expiry 12.03.2027

Place of Issue Australia Place of Issue Germany

PARTY "A" PAGE 6 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

PASSPORT COPY OF SENDER/PARTY “A”:

PARTY "A" PAGE 7 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

CERTIFICATE OF INCORPORATION OF SENDER/PARTY “A”:

PARTY "A" PAGE 8 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

PASSPORT COPY OF RECEIVER/PARTY “B”:

PARTY "A" PAGE 9 OF 10 PARTY "B"

AGREEMENT №: ECHOARYS-RHE-500M€-04032024

DATE: April 07, 2024

CERTIFICATE OF INCORPORATION OF RECEIVER/PARTY “B”:

***END OF THE AGREEMENT***

PARTY "A" PAGE 10 OF 10 PARTY "B"

You might also like

- Screenshot 2024-04-17 at 16.20.58Document10 pagesScreenshot 2024-04-17 at 16.20.58ganlax108No ratings yet

- DB Gracia 2B (120424)Document3 pagesDB Gracia 2B (120424)christinageorges417No ratings yet

- UntitledDocument3 pagesUntitledTiga Nusa Artha SekawabNo ratings yet

- mt199 Bank of AmericaDocument1 pagemt199 Bank of Americaxhxbxbxbbx79100% (1)

- Dwtransfer 2024Document8 pagesDwtransfer 2024hromax76No ratings yet

- Doa - Gpi Semi - Auto - Uetr - Aqts-Oceanic - 500BDocument13 pagesDoa - Gpi Semi - Auto - Uetr - Aqts-Oceanic - 500BNANJING JINGMENG INDUSTRY CO.,LTD.No ratings yet

- Client Information Sheet-Invest Estate LTDDocument4 pagesClient Information Sheet-Invest Estate LTDalitechbelgiumNo ratings yet

- Wilo White Direct 501-2Document1 pageWilo White Direct 501-2cspinks641No ratings yet

- Delivery Status:: Network Appli Session Holder FileoutputDocument2 pagesDelivery Status:: Network Appli Session Holder FileoutputgrrcNo ratings yet

- MT DraftDocument1 pageMT DraftVentasXmyd50% (2)

- (Authorisation LETTER PDFDocument1 page(Authorisation LETTER PDFSethNo ratings yet

- As 4920-2003 (Reference Use Only) General Conditions of Contract For The Provision of Asset Maintenance and SDocument9 pagesAs 4920-2003 (Reference Use Only) General Conditions of Contract For The Provision of Asset Maintenance and SSAI Global - APACNo ratings yet

- Investment Agreement Via L2LDocument15 pagesInvestment Agreement Via L2LGremlini HieronimoNo ratings yet

- Agr. Swift Gpi Aquantus-Rv 5T 28.03.2024Document16 pagesAgr. Swift Gpi Aquantus-Rv 5T 28.03.20245h9fcn8jfjNo ratings yet

- Contract S2S - 23-02-2024Document10 pagesContract S2S - 23-02-20245h9fcn8jfjNo ratings yet

- Sports Capital Partners LTD 5bDocument3 pagesSports Capital Partners LTD 5bEllerNo ratings yet

- Db-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117Document2 pagesDb-799pof+999-77m-Ecoucd Usa-Raiff-Albania-171117almawest.llpNo ratings yet

- 50M Annex - LeoDocument1 page50M Annex - LeoEllerNo ratings yet

- 2-Cis ZoliDocument4 pages2-Cis Zolirasool mehrjooNo ratings yet

- TT Amount For ISGF SpainDocument2 pagesTT Amount For ISGF SpainAmar ParajuliNo ratings yet

- Terragarda GMBH - CISDocument4 pagesTerragarda GMBH - CISadmon.opeyloNo ratings yet

- Ubs Cis SummitDocument3 pagesUbs Cis SummitVictor HernandezNo ratings yet

- AGR 103 - DraftDocument11 pagesAGR 103 - DraftSeymour AhmedbeyliNo ratings yet

- 950 M MT103 Contract-2Document21 pages950 M MT103 Contract-2michaelgracias700No ratings yet

- Forty-Eight Million One Hundred and Fifty Thousand Euro)Document2 pagesForty-Eight Million One Hundred and Fifty Thousand Euro)Gremlini HieronimoNo ratings yet

- Mt103 Icicbank 500m EuroDocument2 pagesMt103 Icicbank 500m Eurorasool mehrjooNo ratings yet

- Ger HSBC SurongDocument3 pagesGer HSBC SurongJash SinghNo ratings yet

- Mt199., Proof of Funds, CustomerDocument2 pagesMt199., Proof of Funds, CustomerSWIFT S.CNo ratings yet

- LC ApplicationDocument2 pagesLC ApplicationShruti BudhirajaNo ratings yet

- Swift Automated Westpac Banking CorporationDocument1 pageSwift Automated Westpac Banking Corporationrasool mehrjooNo ratings yet

- Cis Bona 1Document3 pagesCis Bona 1lovasjdNo ratings yet

- MT 199 de 0902202412180404548Document2 pagesMT 199 de 0902202412180404548james.vonmoltkeNo ratings yet

- O F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulDocument2 pagesO F F E R 2 B MT 103 2way Swift 10+4 Etf 1302 KulPool AtalayaNo ratings yet

- 0090 Cis Debit Trading LTD Marina Shin Ipip Ipid s2s 2020 8288 8255 Barclays 1Document4 pages0090 Cis Debit Trading LTD Marina Shin Ipip Ipid s2s 2020 8288 8255 Barclays 1rasool mehrjooNo ratings yet

- Aa Future Sunshine HSBC10710463 1 9M 24 05 2023Document7 pagesAa Future Sunshine HSBC10710463 1 9M 24 05 2023xhxbxbxbbx79No ratings yet

- MT760 Blocked Funds Confirmation Draft WordingDocument1 pageMT760 Blocked Funds Confirmation Draft WordingWasis WidjajadiNo ratings yet

- Isep Grand S2S ContractDocument17 pagesIsep Grand S2S Contractalexrina71No ratings yet

- PRIVILEGED Memorandum Re Dillon EntitiesDocument3 pagesPRIVILEGED Memorandum Re Dillon EntitieslennbcNo ratings yet

- CIS UnionPay Wahyudiono Akhmad-1-1 - 230810 - 091232Document3 pagesCIS UnionPay Wahyudiono Akhmad-1-1 - 230810 - 091232YUHDHC LUNo ratings yet

- Doa MR - IpulDocument29 pagesDoa MR - IpulShindu NagaraNo ratings yet

- Cryptohost Procedure and Detail, 28 April 24 Via Updated Api OnlyDocument1 pageCryptohost Procedure and Detail, 28 April 24 Via Updated Api Onlynamina9631No ratings yet

- AMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2ADocument23 pagesAMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2AJamaluddin SaidNo ratings yet

- MT103 Gpi Semi-Automatic Asa Energy Sa To Kdemrtas Mi̇marlik Ti̇c - Ltd.sti̇. 49MDocument1 pageMT103 Gpi Semi-Automatic Asa Energy Sa To Kdemrtas Mi̇marlik Ti̇c - Ltd.sti̇. 49Mİbrahim KocakNo ratings yet

- Un-Frankfurt - I - Updated 02-01-24 - 105059Document3 pagesUn-Frankfurt - I - Updated 02-01-24 - 105059planetamundo2017No ratings yet

- 18,500 New Update Mp2112 Turkey Gpi 103 Cash TTDocument6 pages18,500 New Update Mp2112 Turkey Gpi 103 Cash TTMmahsima98No ratings yet

- Doa-3t-20230831 - 20230831183837 1 1Document10 pagesDoa-3t-20230831 - 20230831183837 1 1Mark Owens100% (1)

- CIS - SWISS-A - TTI - GMBH - HSBC - DE - 230328 - 113325 AsılDocument5 pagesCIS - SWISS-A - TTI - GMBH - HSBC - DE - 230328 - 113325 AsılJash SinghNo ratings yet

- 900Document1 page900mantanha066No ratings yet

- KTT TELEX CODE PAYMENT (Signed)Document4 pagesKTT TELEX CODE PAYMENT (Signed)ChristianMNo ratings yet

- TT Black - ArabiaDocument2 pagesTT Black - ArabiaEllerNo ratings yet

- Kinpro CisDocument2 pagesKinpro Cisalexrina71No ratings yet

- 10 - 16088 PGL Duklloyds 98M Ramera Australia ReceverDocument7 pages10 - 16088 PGL Duklloyds 98M Ramera Australia ReceverRakibul IslamNo ratings yet

- PGL Ipip Bodennet-Quaestus 4b v2Document8 pagesPGL Ipip Bodennet-Quaestus 4b v2christinageorges417No ratings yet

- Cis - DurnezDocument3 pagesCis - Durnezhendrick villegasNo ratings yet

- Cis - L2LDocument3 pagesCis - L2LapisayottoNo ratings yet

- CTR GPI Draft 20221116Document9 pagesCTR GPI Draft 20221116Sr. Nico.No ratings yet

- Golden Shipping and Trading Company IncDocument8 pagesGolden Shipping and Trading Company IncSkyline Music GroupNo ratings yet

- CIS - Weybright FSL LimitedDocument5 pagesCIS - Weybright FSL Limited一叶一木一席100% (1)

- Message 1 Message Identifier: Report HeaderDocument3 pagesMessage 1 Message Identifier: Report Header배동식No ratings yet

- HSBC Schweiz CisDocument4 pagesHSBC Schweiz CischachouNo ratings yet

- Server Tracker-05122023-2m-Gpi Semi Automatic Cash Transfer#Document2 pagesServer Tracker-05122023-2m-Gpi Semi Automatic Cash Transfer#Giuseppe SahachielNo ratings yet

- Gcube Gpi Contract 240TDocument14 pagesGcube Gpi Contract 240TLaert RuttembergNo ratings yet

- 25bb Fake OneDocument7 pages25bb Fake Onechristinageorges417100% (1)

- Mr. Khalid Mohsen Doa 2Document24 pagesMr. Khalid Mohsen Doa 2christinageorges417No ratings yet

- Deed of AgreemeDocument4 pagesDeed of Agreemechristinageorges417No ratings yet

- United States v. Jerry v. Mitchell and Roger Woods, 954 F.2d 663, 11th Cir. (1992)Document7 pagesUnited States v. Jerry v. Mitchell and Roger Woods, 954 F.2d 663, 11th Cir. (1992)Scribd Government DocsNo ratings yet

- 2019 Q2 Lao Changes To FundingDocument5 pages2019 Q2 Lao Changes To FundingMichael BryantNo ratings yet

- Bible Baptist Church Vs CADocument9 pagesBible Baptist Church Vs CAAna AdolfoNo ratings yet

- 6 People v. ChavezDocument12 pages6 People v. ChavezDebbie YrreverreNo ratings yet

- People v. FelicianoDocument2 pagesPeople v. FelicianoAntonio BartolomeNo ratings yet

- Contract of Indemnity and GuaranteeDocument13 pagesContract of Indemnity and GuaranteeSudipta Bhuyan100% (1)

- Renec Ulysse v. Waste Management, Inc. of Florida, 11th Cir. (2015)Document10 pagesRenec Ulysse v. Waste Management, Inc. of Florida, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- Filing A Caveat and Related RulesDocument5 pagesFiling A Caveat and Related RulesSamicannouNo ratings yet

- Public Prosecutor V Lee Eng Kooi - (1993) 2Document13 pagesPublic Prosecutor V Lee Eng Kooi - (1993) 2givamathanNo ratings yet

- Linsangan V Tolentino CASE DIGESTDocument2 pagesLinsangan V Tolentino CASE DIGESTGreenmage LacernoNo ratings yet

- Rule 65 CasesDocument285 pagesRule 65 Casesanon_614984256No ratings yet

- Rent Control Act: Landlaw CHP 5Document23 pagesRent Control Act: Landlaw CHP 5Rasik borkarNo ratings yet

- People Leovillo Agustin - Petitioner Hon. Romeo F. Edu, Land Transportation Commissioner (LTO) - RespondentDocument2 pagesPeople Leovillo Agustin - Petitioner Hon. Romeo F. Edu, Land Transportation Commissioner (LTO) - RespondentPao InfanteNo ratings yet

- Imperfect RecollectionDocument2 pagesImperfect RecollectionMustika ThalibNo ratings yet

- EVANGELINE PATULOT Y GALIA VDocument2 pagesEVANGELINE PATULOT Y GALIA VAli NamlaNo ratings yet

- Vda de Aranas V AranasDocument2 pagesVda de Aranas V AranasiamaequitasveraNo ratings yet

- Lockhead Detective and Watchman Agency v. UPDocument3 pagesLockhead Detective and Watchman Agency v. UPSean GalvezNo ratings yet

- Justice Singh TranscriptDocument60 pagesJustice Singh TranscriptisteypaniflorNo ratings yet

- Dr. Ram Mahohar Lohiya National Law University: Project OnDocument24 pagesDr. Ram Mahohar Lohiya National Law University: Project OnPranav Bhansali100% (2)

- Urgent Motion To Reset (Amparo Salvador)Document3 pagesUrgent Motion To Reset (Amparo Salvador)mrsjpendletonNo ratings yet

- Extra Judicial Settlement - Template2Document3 pagesExtra Judicial Settlement - Template2ghelveraNo ratings yet

- CLJ 101 Midterm ModuleDocument14 pagesCLJ 101 Midterm Modulemv9k6rq5ncNo ratings yet

- PrinciplesDocument14 pagesPrinciplesjaine0305No ratings yet

- CMTC International Marketing Corporation vs. Bhagis International Trading CorporationDocument10 pagesCMTC International Marketing Corporation vs. Bhagis International Trading CorporationCathy BelgiraNo ratings yet

- Reyes Vs ReyesDocument2 pagesReyes Vs ReyesJB BOYNo ratings yet

- Sun Insurance V Asuncion DigestDocument1 pageSun Insurance V Asuncion Digestpj100% (2)

- Final OutlineDocument65 pagesFinal OutlineJason HogganNo ratings yet

- Charan Lal Sahu v. Union of India, PDFDocument118 pagesCharan Lal Sahu v. Union of India, PDFAnushka RungtaNo ratings yet

- Die Kleine HexeDocument2 pagesDie Kleine Hexejuju_batugalNo ratings yet