Professional Documents

Culture Documents

Syllabus F&C

Syllabus F&C

Uploaded by

Devesh KankariyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Syllabus F&C

Syllabus F&C

Uploaded by

Devesh KankariyaCopyright:

Available Formats

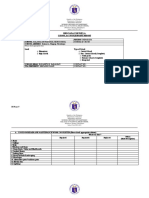

COURSE STRUCTURE

Course Code FET2005B

Course Category HSS

Course Title Finance and Costing

Teaching Scheme and Credits L T Laboratory Credits

Weekly load hrs 2 0 0 2+0+0 = 2

Pre-requisites: Industrial Engineering and Management, Arithmatics, Basic Mathematics

Course Objectives:

1. Knowledge (i) To understand the concepts of Financial Management and its application in

decision making

(ii) To understand Generally Accepted Cost Accounting techniques

2. Skills (i) To develop capability to analyze financial and costing principles

3. Attitude (i) To develop ability to determine analysis and classification of cost components

to facilitate managerial decision making

Course Outcomes: Demonstrable competencies the students will learn after doing this course

1. Understand and explain the conceptual framework of Cost & Management Accounting

(CL-II)

2. Explain the basic concepts and processes in determination of products and services

cost(CL-II)

3. Identify and apply the concepts of Financial Management(CL-I)

Learning Resources:

Concept of Cost and Overhead Costs

Cost, Cost Centre, Cost Unit, Elements of Cost: Material Cost., Labour Cost: Direct& indirect cost,

Cost sheet. Overheads: Classification, collection of overheads, Primary and Secondary

apportionment of overheads, absorption of overheads - Machine hour and labour hour rate. Under

and over absorption of overheads.

Standard and Marginal Costing

Concept, development and use of standard costing, variance analysis. Marginal Costing- Marginal

Costing in decision-making. Cost Volume Profit Analysis, Concept of Break-Even, P/V Ratio and

Margin of Safety, (ROI, IRR, NPV)

Dr. Prasad Khandekar

Dean, FoET

Financial Management and Cash Flow

Nature and Scope of Finance Function; Scope and Functions of Financial Management, Financial

Planning and Forecasting. Budgets & Budgetary Control: Types of Budget, Profit and Loss Account

and Balance Sheet, Cash Flow Statement.

Working Capital Management

Introduction to Working capital, Concept of Working Capital, Assets and liabilities, Fixed and

current assets, types of working capital, sources of working capital. Calculation of working capital.

Ratio Analysis

Concept and Introduction to ratios, Classification of ratios, Objectives, Key financial Ratios-

Solvency ratios, Liquid ratios, Profitability ratios, Efficiency ratios. Ratio Analysis significance and

its limitations.

Reference Books:

1. Prasanna Chandra,

McGraw Hill Education,

2.

Chennai, 2013

3. on 2, 2002, Tata

McGraw Hill Education

4.

5.

Supplementary Reading:

1. Paresh P. Shah, Financial Management, Reprint No. 2 2011, Biztantra, New Delhi,

International Thomson Business; 6th Revised edition, Chapman and Hall London

MOOCs: https://www.mooc-list.com/course/financial-planning-open2study

Pedagogy: Chalk and talk, PPT presentations, Videos, and e- resources.

Assessment Scheme:

Class Continuous Assessment (CCA) : 60 Marks (60% of Total Marks)

Assignments Test Presentations/Any

other

20 Marks 20 Marks 20 Marks

Dr. Prasad Khandekar

Dean, FoET

Term End Examination : 40 Marks (40% of Total Marks)

Module Workload in Hrs

Contents

No. Theory Lab Assess

1 Concept of Cost and Overhead Costs 6 NA

2 Standard and Marginal Costing 6 NA

3 Financial Management and Cash Flow 6 NA

4 Working Capital Management 6 NA

5 Ratio Analysis 6 NA

Prepared By Checked By Approved By

Prof. Surendra H Barhatte Prof. Sanjay Rumde Dr. G M Kakandikar

Asst Proffessor Asst Professor Professor & HoS

Dr. Prasad Khandekar

Dean, FoET

You might also like

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- POM Course OutlineDocument11 pagesPOM Course OutlineSuraj RanaNo ratings yet

- Subject Description Form: A. B. C. DDocument3 pagesSubject Description Form: A. B. C. DLi LianaNo ratings yet

- Course Outline - Cost & Management AccountingDocument2 pagesCourse Outline - Cost & Management AccountingBhunesh KumarNo ratings yet

- CourseCurriculumDocument3 pagesCourseCurriculumKashish agarwalNo ratings yet

- UntitledDocument6 pagesUntitledAbhilashaNo ratings yet

- Course Information SheetDocument1 pageCourse Information SheetVaishigan ParamananthasivamNo ratings yet

- UKMB4014 IHRM Course PlanDocument19 pagesUKMB4014 IHRM Course PlanDhanis IshwarNo ratings yet

- Course Plan: Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and Management (Fam)Document22 pagesCourse Plan: Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and Management (Fam)Kelvin LeongNo ratings yet

- Course Plan For OptimizationDocument6 pagesCourse Plan For Optimizationgerearegawi721No ratings yet

- NewSyllabus 14b74bb8 Bed6 4bdb 861e 31bb53f6b577Document5 pagesNewSyllabus 14b74bb8 Bed6 4bdb 861e 31bb53f6b577Anusheeka GhoshNo ratings yet

- Course Outline Spring 2022Document2 pagesCourse Outline Spring 2022Wasim Akram TalukderNo ratings yet

- Admas University (Course Outline)Document7 pagesAdmas University (Course Outline)ShaggYNo ratings yet

- Business FinanceDocument5 pagesBusiness FinanceTanmay SinghalNo ratings yet

- KKWIEER NSK FYMBA SEM 2 SyllabusDocument31 pagesKKWIEER NSK FYMBA SEM 2 Syllabusficoki6414No ratings yet

- Security Analysis and Portfolio ManagementDocument5 pagesSecurity Analysis and Portfolio ManagementSandeep SinghNo ratings yet

- AAB CD-01a - Feedback (MGMT201)Document5 pagesAAB CD-01a - Feedback (MGMT201)Chirag NayakNo ratings yet

- II Sem SyallbusDocument109 pagesII Sem SyallbusArvind MallikNo ratings yet

- Course Outline Strategic FinanceDocument8 pagesCourse Outline Strategic FinanceDr. Sajid Mohy Ul DinNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingAjoy TharakanNo ratings yet

- NewSyllabus 1056202071058945Document5 pagesNewSyllabus 1056202071058945divyanshtyagi2005No ratings yet

- HRM Course ContentDocument8 pagesHRM Course Contenthokasov495No ratings yet

- HR Experience in Handling Employees Complaints.Document24 pagesHR Experience in Handling Employees Complaints.concordillanes680No ratings yet

- Course Outline Spring-2020: Department of Management Sciences University of GujratDocument7 pagesCourse Outline Spring-2020: Department of Management Sciences University of Gujrat17460920-076No ratings yet

- BBA431 Cost and Management AccountingDocument17 pagesBBA431 Cost and Management Accountingharsh kaushikNo ratings yet

- Mba (Gen) Syllabus 2018Document59 pagesMba (Gen) Syllabus 2018Mohammad Zia Ul HaqNo ratings yet

- Course Contents: INSTITUTE of MANAGEMENT STUDIES, Devi Ahilya University, INDOREDocument16 pagesCourse Contents: INSTITUTE of MANAGEMENT STUDIES, Devi Ahilya University, INDOREallabout beingsmartNo ratings yet

- SIM335 January 2017 TNE Top-Up AssessmentDocument6 pagesSIM335 January 2017 TNE Top-Up AssessmenttechnicalvijayNo ratings yet

- Semeter 4 SyllabusDocument15 pagesSemeter 4 SyllabusKuldeep RawatNo ratings yet

- Yonsei University - Operations ManagementDocument2 pagesYonsei University - Operations Management기무사No ratings yet

- New SyllabusDocument3 pagesNew SyllabusMelita Stephen NatalNo ratings yet

- Bac 1624 - ObeDocument4 pagesBac 1624 - ObeAmiee Laa PulokNo ratings yet

- Format For Course Curriculum: Annexure CD - 01'Document5 pagesFormat For Course Curriculum: Annexure CD - 01'Udit chaudharyNo ratings yet

- PMS OutlineDocument8 pagesPMS OutlineYukti SutavaniNo ratings yet

- Managerial Accounting Module DescriptorDocument4 pagesManagerial Accounting Module Descriptorవెంకటరమణయ్య మాలెపాటిNo ratings yet

- MR - Course CurriculumDocument17 pagesMR - Course Curriculumyashikaagarwal01122000No ratings yet

- Performance Management SyllabusDocument6 pagesPerformance Management SyllabusThảo Thiên ChiNo ratings yet

- DISC 230 - Introduction To Business Process ModelingDocument4 pagesDISC 230 - Introduction To Business Process ModelingHaseeb Nasir SheikhNo ratings yet

- Res 431Document3 pagesRes 431AlaminTanverNo ratings yet

- AF5364Document3 pagesAF5364Chin LNo ratings yet

- Core OM - Term 1 - 2019Document5 pagesCore OM - Term 1 - 2019chandel08No ratings yet

- Co. OutlineDocument3 pagesCo. Outlineyiberta69No ratings yet

- M.B.A. II Semester Syllabus 2017-18 Onwards (2015-16 Scheme)Document56 pagesM.B.A. II Semester Syllabus 2017-18 Onwards (2015-16 Scheme)nitingude214No ratings yet

- New SyllabusDocument4 pagesNew SyllabusAdityaNo ratings yet

- Research Methods in Management - 12Document14 pagesResearch Methods in Management - 12Trairong SwatdikunNo ratings yet

- Class: Course: Instructor:: Qasimali@lrk - Szabist.edu - PKDocument4 pagesClass: Course: Instructor:: Qasimali@lrk - Szabist.edu - PKiMobile TipsNo ratings yet

- Syllabus IMS 2019-20 Executive MBADocument15 pagesSyllabus IMS 2019-20 Executive MBAaskjdfaNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusakanshatyagiNo ratings yet

- FM Course OutlineDocument8 pagesFM Course OutlineTabassamRashidNo ratings yet

- Course Title:: AnnexureDocument6 pagesCourse Title:: AnnexureGeetika RajputNo ratings yet

- RM Course Plan-2021Document13 pagesRM Course Plan-2021Niya ThomasNo ratings yet

- Course Title Business Research Methods Course Code: Qam603 Credit Units: 0 3 Course Level: PGDocument4 pagesCourse Title Business Research Methods Course Code: Qam603 Credit Units: 0 3 Course Level: PGisha_aroraaNo ratings yet

- FM Course StructureDocument4 pagesFM Course Structuresiddhigundecha16No ratings yet

- 2020 SAP - Accounting Theory REV RNS-v2Document8 pages2020 SAP - Accounting Theory REV RNS-v2Dionisius Joachim Marcello Vincent JonathanNo ratings yet

- HRM-Human Resource Management Syllabus SEM 3Document3 pagesHRM-Human Resource Management Syllabus SEM 3Vamshi ValasaNo ratings yet

- Project Appraisal and Financing (Bba643a) - 1543381569183 PDFDocument16 pagesProject Appraisal and Financing (Bba643a) - 1543381569183 PDFlekha1997No ratings yet

- COL COMA ProfDocument12 pagesCOL COMA ProfWasif AhmedNo ratings yet

- Expert Judgment in Project Management: Narrowing the Theory-Practice GapFrom EverandExpert Judgment in Project Management: Narrowing the Theory-Practice GapNo ratings yet

- Implementing the Stakeholder Based Goal-Question-Metric (Gqm) Measurement Model for Software ProjectsFrom EverandImplementing the Stakeholder Based Goal-Question-Metric (Gqm) Measurement Model for Software ProjectsNo ratings yet

- A Measurement Framework for Software Projects: A Generic and Practical Goal-Question-Metric(Gqm) Based Approach.From EverandA Measurement Framework for Software Projects: A Generic and Practical Goal-Question-Metric(Gqm) Based Approach.No ratings yet

- Project Managers as Senior Executives: How the Research Was ConductedFrom EverandProject Managers as Senior Executives: How the Research Was ConductedNo ratings yet

- M&A Unit 2Document97 pagesM&A Unit 2Devesh KankariyaNo ratings yet

- CIMS Unit 1Document73 pagesCIMS Unit 1Devesh KankariyaNo ratings yet

- CIMS Unit 2Document30 pagesCIMS Unit 2Devesh KankariyaNo ratings yet

- Augmented Reality and Mixed RealityDocument44 pagesAugmented Reality and Mixed RealityDevesh KankariyaNo ratings yet

- Cure Laboratories Quality Manual: Conforms To ISO 9001:2015Document20 pagesCure Laboratories Quality Manual: Conforms To ISO 9001:2015Mohammed ZubairNo ratings yet

- Syllabus EntrepreneurshipDocument8 pagesSyllabus Entrepreneurshipchokrib100% (5)

- Prerequisites: Course Information Course DescriptionDocument2 pagesPrerequisites: Course Information Course DescriptionAjit Pal SinghNo ratings yet

- MPOWA Web3Foundation POC ProjectDocument13 pagesMPOWA Web3Foundation POC ProjectKonstantinos PappasNo ratings yet

- CSE-PPT CAR Prof PDFDocument21 pagesCSE-PPT CAR Prof PDFPhilNewsXYZNo ratings yet

- Factors Affecting Customer Satisfaction and Customer Loyalty Toward Myanmar Green TeaDocument17 pagesFactors Affecting Customer Satisfaction and Customer Loyalty Toward Myanmar Green TeaIjbmm JournalNo ratings yet

- Modul 10 Mesin Listrik 1 PDFDocument13 pagesModul 10 Mesin Listrik 1 PDFaswardiNo ratings yet

- fb15 FBCCDocument3 pagesfb15 FBCCBob WattendorfNo ratings yet

- 2.3 Leadership Styles - International Business Management InstituteDocument4 pages2.3 Leadership Styles - International Business Management InstituteLeonardo Andrés Hernández MolanoNo ratings yet

- ASUS RT-AC58U ManualDocument122 pagesASUS RT-AC58U ManualSeungpyo HongNo ratings yet

- RS-3000 Advance / Lite: Optical Coherence TomographyDocument12 pagesRS-3000 Advance / Lite: Optical Coherence TomographydexklauNo ratings yet

- Agreement in Restraint of Trade-ExceptionsDocument15 pagesAgreement in Restraint of Trade-ExceptionsNishita GuptaNo ratings yet

- Delo XLD Multigrade: High Performance Multigrade Diesel Engine LubricantDocument3 pagesDelo XLD Multigrade: High Performance Multigrade Diesel Engine LubricantAymanSayedElantableeNo ratings yet

- GPOADmin Quick Start Guide 58Document25 pagesGPOADmin Quick Start Guide 58Harikrishnan DhanapalNo ratings yet

- Work Readiness InventoryDocument7 pagesWork Readiness InventoryJamesNo ratings yet

- Rubrics For A Well Written and Technology Enhanced Lesson PlanDocument5 pagesRubrics For A Well Written and Technology Enhanced Lesson PlanValencia John EmmanuelNo ratings yet

- BE Form 7 SCHOOL ACCOMPLISHMENT REPORTDocument7 pagesBE Form 7 SCHOOL ACCOMPLISHMENT REPORTRuth LarraquelNo ratings yet

- Siemen 1LE0003 Premium Efficiency Low-Voltage Motor - ManualDocument38 pagesSiemen 1LE0003 Premium Efficiency Low-Voltage Motor - ManualEddy WongNo ratings yet

- p380 4 PDFDocument104 pagesp380 4 PDFwillyone4No ratings yet

- Lenovo Legion Y740 Series User Guide: Downloaded From Manuals Search EngineDocument68 pagesLenovo Legion Y740 Series User Guide: Downloaded From Manuals Search Enginealexa fernandezNo ratings yet

- Lab-Day4 - Lab7&8Document22 pagesLab-Day4 - Lab7&8AARNAV pandeyNo ratings yet

- Virtual LabDocument21 pagesVirtual LabHusain AliNo ratings yet

- Basic College Mathematics 9th Edition Lial Test Bank 1Document39 pagesBasic College Mathematics 9th Edition Lial Test Bank 1james100% (38)

- LCI Ebook DS PDM v15 PDFDocument8 pagesLCI Ebook DS PDM v15 PDFVrukshwalli KateNo ratings yet

- A Research Study of A Three Commercial BuildingDocument12 pagesA Research Study of A Three Commercial BuildingBianca bayangNo ratings yet

- BAYE's TheormDocument27 pagesBAYE's TheormPravalika ReddyNo ratings yet

- CapersJones - Scoring and Evaluating Software Methods, Practices, and ResultsDocument17 pagesCapersJones - Scoring and Evaluating Software Methods, Practices, and ResultsSharing Caring100% (1)

- 1b Topography NotesDocument31 pages1b Topography NotesssalalarNo ratings yet

- EHAQ 4th Cycle Audit Tool Final Feb.10-2022Document51 pagesEHAQ 4th Cycle Audit Tool Final Feb.10-2022Michael Gebreamlak100% (1)