Professional Documents

Culture Documents

Axi Select Program Withdrawal Cases English

Axi Select Program Withdrawal Cases English

Uploaded by

Francisco Silva CeolinCopyright:

Available Formats

You might also like

- Chapter 18Document5 pagesChapter 18Vidia ProjNo ratings yet

- 2011 Aug Tutorial 10 Working Capital ManagementDocument10 pages2011 Aug Tutorial 10 Working Capital ManagementHarmony TeeNo ratings yet

- (Team 1) Case Study Joan HoltzDocument5 pages(Team 1) Case Study Joan HoltzAlyssa San FelipeNo ratings yet

- ReceivablesDocument61 pagesReceivablesJeanetteNo ratings yet

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonDocument6 pagesAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenNo ratings yet

- Notes 08Document11 pagesNotes 08FantayNo ratings yet

- Chapter 8 Receivable FinancingDocument14 pagesChapter 8 Receivable FinancingBukhani Macabangan100% (2)

- Acc 6 CH 09Document45 pagesAcc 6 CH 09ehab_ghazallaNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Chapter 9 - BUSINESS TRANSACTIONS AND THEIRANALYSIS AS APPLIED TO THEDocument34 pagesChapter 9 - BUSINESS TRANSACTIONS AND THEIRANALYSIS AS APPLIED TO THEmarkalvinlagunero1991No ratings yet

- 05 ReceivablesDocument15 pages05 ReceivablesJean BritoNo ratings yet

- Differentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesDocument9 pagesDifferentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesGmef Syme FerreraNo ratings yet

- Refundable DepositsDocument1 pageRefundable DepositsNicah AcojonNo ratings yet

- FRA Assignment-6Document4 pagesFRA Assignment-6Chinmaya MishraNo ratings yet

- Revenue Reconigtion Principle - ExamplesDocument4 pagesRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Adjusting Entries PDFDocument3 pagesAdjusting Entries PDFreaderNo ratings yet

- Lecture Note - Receivables Sy 2014-2015Document10 pagesLecture Note - Receivables Sy 2014-2015LeneNo ratings yet

- Chapter 1 - Current Liabilities, Provisions and ContingenciesDocument18 pagesChapter 1 - Current Liabilities, Provisions and ContingenciesGetaneh YenealemNo ratings yet

- A AccrualsDocument4 pagesA AccrualsBetelehem ZenawNo ratings yet

- Topic 8 - Receivable Financing - Rev (Students)Document37 pagesTopic 8 - Receivable Financing - Rev (Students)Romzi100% (1)

- Topic 8 Receivable Financing Rev Students 653Document39 pagesTopic 8 Receivable Financing Rev Students 653Nemalai VitalNo ratings yet

- CREDIT UNION BEST PRACTICES TOOLKIT - Tool 2Document16 pagesCREDIT UNION BEST PRACTICES TOOLKIT - Tool 2buguzNo ratings yet

- Adjusting Entries (ASSETS)Document7 pagesAdjusting Entries (ASSETS)heynuhh gNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationAbubaker ShahzadNo ratings yet

- The Budgeting of Account ReceivableDocument5 pagesThe Budgeting of Account ReceivableAnanda RiskiNo ratings yet

- Lecture On Nature of ReceivablesDocument3 pagesLecture On Nature of ReceivablesSara AlbinaNo ratings yet

- Tncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22Document4 pagesTncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22HuatNo ratings yet

- Liability Method of Recording Unearned RevenueDocument18 pagesLiability Method of Recording Unearned RevenuesajjadNo ratings yet

- Chap9 Receivable FinancingDocument17 pagesChap9 Receivable FinancingJD FITNESSNo ratings yet

- AgreementDocument8 pagesAgreementbollionysNo ratings yet

- CH 06 Accounting For Musharakah FinancingDocument23 pagesCH 06 Accounting For Musharakah FinancingMOHAMMAD BORENENo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- ACC 1 WK 10 Adjusting Entries On Revenue DeferralsDocument5 pagesACC 1 WK 10 Adjusting Entries On Revenue Deferralsstaceyelizalde59No ratings yet

- Generating Cash From Receivables (Financing of Receivables)Document3 pagesGenerating Cash From Receivables (Financing of Receivables)Cherry joyNo ratings yet

- Adjusting EntriesDocument23 pagesAdjusting Entriestoobaahmedkhan100% (1)

- Adjusting Entry Quiz With AnswersDocument6 pagesAdjusting Entry Quiz With AnswersRenz RaphNo ratings yet

- Current Liabilities, Provisions, and ContingenciesDocument56 pagesCurrent Liabilities, Provisions, and ContingenciesJofandio Alamsyah100% (1)

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Ac101 ch7Document15 pagesAc101 ch7infinite_dreamsNo ratings yet

- M6 (IAS 18) (6th)Document6 pagesM6 (IAS 18) (6th)aslamhamza949No ratings yet

- Accn05b Pre Ol1Document4 pagesAccn05b Pre Ol1VMinKook biasNo ratings yet

- Accounting Concepts and Principles Are A Set of Broad Conventions That Have Been Devised To Provide A Basic Framework For Financial ReportingDocument8 pagesAccounting Concepts and Principles Are A Set of Broad Conventions That Have Been Devised To Provide A Basic Framework For Financial ReportingGesa StephenNo ratings yet

- ACC124 Doubtful-AccountsDocument24 pagesACC124 Doubtful-Accountsジェロスミ プエブラスNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Accounting Application: Tech-FSM 223Document52 pagesAccounting Application: Tech-FSM 223Rey Ann EstopaNo ratings yet

- IA2 02 - Handout - 1 PDFDocument10 pagesIA2 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Capital Budgeting: Present ValueDocument15 pagesCapital Budgeting: Present ValueNoorunnishaNo ratings yet

- Accounts Receivable Inventory Management - .DocmDocument11 pagesAccounts Receivable Inventory Management - .DocmellishNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesMs VampireNo ratings yet

- 2102 Midterm 2 Study GuideDocument13 pages2102 Midterm 2 Study GuideMoses SuhNo ratings yet

- 08 Notes Accounts ReceivableDocument3 pages08 Notes Accounts ReceivablePeter KoprdaNo ratings yet

- Accounting For Receivables Accounts ReceivableDocument18 pagesAccounting For Receivables Accounts Receivablelocomotingkenya.co.keNo ratings yet

- A.2. Asset Valuation ReceivablesDocument9 pagesA.2. Asset Valuation ReceivablesKondreddi SakuNo ratings yet

- Tanauan Institute, Inc.: Adjustments For AccrualsDocument7 pagesTanauan Institute, Inc.: Adjustments For AccrualsHanna CaraigNo ratings yet

- Cash Discount: What Is A Cash Discount? Definition of Cash DiscountDocument12 pagesCash Discount: What Is A Cash Discount? Definition of Cash DiscountHumanityNo ratings yet

- Chapter 3Document2 pagesChapter 3amaliakb5No ratings yet

- 13 Bbfa1103 T9Document25 pages13 Bbfa1103 T9djaljdNo ratings yet

- Unit 9Document5 pagesUnit 9Anonymous Fn7Ko5riKTNo ratings yet

- Accrued InterestDocument4 pagesAccrued InterestNiño Rey LopezNo ratings yet

- Glossary of Professional Wrestling TermsDocument14 pagesGlossary of Professional Wrestling TermsMaría GoldsteinNo ratings yet

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Sample Thesis 2Document127 pagesSample Thesis 2Carlo Troy AcelottNo ratings yet

- Bent Mag-Dec 2009Document80 pagesBent Mag-Dec 2009EcarvalhoStad0% (3)

- 2.preparation and Staining of Thick and Thin BloodDocument31 pages2.preparation and Staining of Thick and Thin Bloodbudi darmantaNo ratings yet

- Tender Bids From March 2012 To April 2017Document62 pagesTender Bids From March 2012 To April 2017scribd_109097762No ratings yet

- Case ReportDocument16 pagesCase ReportSabbir ThePsychoExpressNo ratings yet

- Auto Motivations Digital Cinema and KiarDocument11 pagesAuto Motivations Digital Cinema and KiarDebanjan BandyopadhyayNo ratings yet

- Lesson 9. Phylum Mollusca PDFDocument44 pagesLesson 9. Phylum Mollusca PDFJonard PedrosaNo ratings yet

- Gaps and Challenges in The Mother TongueDocument15 pagesGaps and Challenges in The Mother TongueAngelica RamosNo ratings yet

- Neb Grade XiiDocument20 pagesNeb Grade XiiSamjhana LamaNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Expect Respect ProgramDocument2 pagesExpect Respect ProgramCierra Olivia Thomas-WilliamsNo ratings yet

- Ep08 Measuring The Concentration of Sugar Solutions With Optical ActivityDocument2 pagesEp08 Measuring The Concentration of Sugar Solutions With Optical ActivityKw ChanNo ratings yet

- 08 Package Engineering Design Testing PDFDocument57 pages08 Package Engineering Design Testing PDFLake HouseNo ratings yet

- Old SultanDocument2 pagesOld SultanKimberly MarquezNo ratings yet

- The Art of Perfumery-Septimus PiesseDocument431 pagesThe Art of Perfumery-Septimus PiesseHornoEnElNo ratings yet

- LP in MusicDocument10 pagesLP in MusicContagious Joy VillapandoNo ratings yet

- MEDINA, Chandra Micole P. - Activity 6 Both A and BDocument2 pagesMEDINA, Chandra Micole P. - Activity 6 Both A and BChandra Micole MedinaNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Literary Devices DefinitionsDocument2 pagesLiterary Devices DefinitionsAlanna BryantNo ratings yet

- VHDL Processes: Cwru Eecs 318Document24 pagesVHDL Processes: Cwru Eecs 318KarThikNo ratings yet

- Onomasiology (From GreekDocument4 pagesOnomasiology (From GreekAnonymous hcACjq8No ratings yet

- MCQ of CS507 Information System: Emphasizes The Need ToDocument48 pagesMCQ of CS507 Information System: Emphasizes The Need ToShahid Anwar0% (1)

- ACA - Exam - Objectives - Photoshop - CC 2018Document5 pagesACA - Exam - Objectives - Photoshop - CC 2018Jeffrey FarillasNo ratings yet

- Module 2 UrineDocument17 pagesModule 2 UrineGiulia Nădășan-CozmaNo ratings yet

- Metallic BondingDocument2 pagesMetallic BondingJohanna LipioNo ratings yet

- Grade 7 Sample Class ProgramDocument1 pageGrade 7 Sample Class ProgramRaymart EstabilloNo ratings yet

- The DJ Test: Personalised Report and Recommendations For Alex YachevskiDocument34 pagesThe DJ Test: Personalised Report and Recommendations For Alex YachevskiSashadanceNo ratings yet

- What Do You Know About Jobs - 28056Document2 pagesWhat Do You Know About Jobs - 28056Kadek DharmawanNo ratings yet

Axi Select Program Withdrawal Cases English

Axi Select Program Withdrawal Cases English

Uploaded by

Francisco Silva CeolinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Axi Select Program Withdrawal Cases English

Axi Select Program Withdrawal Cases English

Uploaded by

Francisco Silva CeolinCopyright:

Available Formats

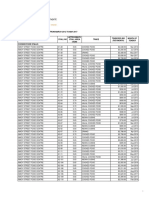

SELECT

Withdrawal cases

Description

Funds in the clients’ Axi Select account can be withdrawn at any time. However, the timing of fund

withdrawals could potentially impact the client’s participation in the programme and

subsequently affect any profits owed to the trader in their Allocation Account.

Withdrawal at month-end following Performance Fees pay out, Max

Multiplier

Once the month has ended, clients will be paid their performance fee, and the Allocation Account

will reset before the new month begins. At this stage, clients can withdraw funds without incurring

any penalties. This withdrawal essentially sets their Allocation Account funding multiplier for this

period. There is no specific deadline for this action; rather, the withdrawal window remains open

until a trade has been placed. Once a trade is executed, the funding multiplier will be set, and any

subsequent withdrawals will be considered as mid-month transactions.

Example

The client started the month with $1,000 in their Axi Select account and during the month the

account is up to $1,200. As the multiplier is 10x, the Allocation Account will be at $12,000.

Once the month has completed, client is paid out their percentage of profits in Allocation

Account. Assuming the client is in Incubation, they will be entitled to $800 (2,000*40%). The

client’s Axi Select account will now be at $2,000 and the Allocation Account gets reset to $20,000

and the multiplier 10x.

If a client now withdrawals the $50, we will withdraw $500 (50x10) from the Allocation Account.

Withdrawal at month-end following Performance Fees pay out, No Max

Multiplier

This example illustrates how the multiplier adjusts when the Axi Select account holds more funds

than the required amount.

The client started the month in the Incubation stage with $4,000 in their Axi Select account. The

maximum allowable Allocation size during this stage is $20,000, leading to a multiplier of 5x

(20,000 / 4,000). Throughout the month, the account balance grew to $5,000, resulting in balance

of $25,000 at the Allocation Account.

Once the month has completed, client is paid out their percentage of profits in the Allocation

Account. In the Incubation stage, they are entitled to $2,000 (5,000*40%). The client’s Axi Select

account balances increases to $7,000, and the Allocation Account resets to $20,000. The

multiplier decreases to 2.86x (20,000 / 7,000).

Should the client decide to withdraw $4,500, the Axi Select account will stand at $2,500. Given

that the maximum allowable Allocation size for the Incubation stage is $20,000, the multiplier

becomes 8x (20,000 / 2,500).

Mid-month withdrawal with loss of profit

Should a client withdraw funds during the month, then all profits earned in the Allocation Account

will be lost. Consequently, the Allocation Account will return to its initial amount and a new

multiplier will be created based on funds in both the Axi Select account and the Allocation

Account.

Example

At the beginning of the month, the client’s Axi Select account contained $1,000. Over the course

of the month, the account balance increased to $1,500, resulting in an Allocation Account

balance of $15,000. If the client decides to make a withdrawal, let’s say $250 in this case, the

$5,000 profit in the Allocation Account will be lost.

As a result, the Allocation Account will reset to the $10,000 level. The client’s Axi Select account

balance will decrease to $1,250 due to the withdrawal, and the new multiplier going forward will

be 8x (10,000 / 1,250).

Please note that loss of profit also affects Profit target requirement for each stage. Profit target

will be rolled back proportionally to the profit lost in the Allocation Account. For instance, if the

client started with a 10% Profit target level, and during the month, the client achieved a 50%

profit which was added to their Profit target, the subsequent withdrawal resulting in the loss of the

profit will cause the Profit target to revert back to the initial 10% level established at the

beginning of the month.

Large withdrawal below Equity stop level resulting in Quarantine

Whenever a client decided to withdraw funds, we assess the withdrawal amount against the

multiplier to determine whether the Equity stop level will be breached. If the withdrawal would

cause the Allocation Account to fall below the Equity stop level, the client’s account will be

transitioned into Quarantine.

Example

The client started the month with $1,000 in their Axi Select account. With a 10x multiplier, the

Allocation Account would be at $10,000. The Equity stop level is set to –10% of Allocation Account,

amounting to $9,000 in this instance.

Throughout the month, the account balance increased to $1,500. If the client then decides to

withdraw funds, in this example let’s say $700, the Allocation account funds will be reduced in

accordance with the multiplier.

As a result, the Allocation Account balance reaches the $8,000 level, falling below the Equity stop

level, and the client’s account is moved into Quarantine for a duration of 14 days, leading to the

subsequent loss of the $5,000 USD profit in the Allocation Account.

You might also like

- Chapter 18Document5 pagesChapter 18Vidia ProjNo ratings yet

- 2011 Aug Tutorial 10 Working Capital ManagementDocument10 pages2011 Aug Tutorial 10 Working Capital ManagementHarmony TeeNo ratings yet

- (Team 1) Case Study Joan HoltzDocument5 pages(Team 1) Case Study Joan HoltzAlyssa San FelipeNo ratings yet

- ReceivablesDocument61 pagesReceivablesJeanetteNo ratings yet

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonDocument6 pagesAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenNo ratings yet

- Notes 08Document11 pagesNotes 08FantayNo ratings yet

- Chapter 8 Receivable FinancingDocument14 pagesChapter 8 Receivable FinancingBukhani Macabangan100% (2)

- Acc 6 CH 09Document45 pagesAcc 6 CH 09ehab_ghazallaNo ratings yet

- Accounts Receivables and Payables A&BDocument9 pagesAccounts Receivables and Payables A&BAb PiousNo ratings yet

- Chapter 9 - BUSINESS TRANSACTIONS AND THEIRANALYSIS AS APPLIED TO THEDocument34 pagesChapter 9 - BUSINESS TRANSACTIONS AND THEIRANALYSIS AS APPLIED TO THEmarkalvinlagunero1991No ratings yet

- 05 ReceivablesDocument15 pages05 ReceivablesJean BritoNo ratings yet

- Differentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesDocument9 pagesDifferentiate Fiscal and Calendar Year: 2. Define Adjusting EntriesGmef Syme FerreraNo ratings yet

- Refundable DepositsDocument1 pageRefundable DepositsNicah AcojonNo ratings yet

- FRA Assignment-6Document4 pagesFRA Assignment-6Chinmaya MishraNo ratings yet

- Revenue Reconigtion Principle - ExamplesDocument4 pagesRevenue Reconigtion Principle - Examplesmazjoa100% (1)

- Adjusting Entries PDFDocument3 pagesAdjusting Entries PDFreaderNo ratings yet

- Lecture Note - Receivables Sy 2014-2015Document10 pagesLecture Note - Receivables Sy 2014-2015LeneNo ratings yet

- Chapter 1 - Current Liabilities, Provisions and ContingenciesDocument18 pagesChapter 1 - Current Liabilities, Provisions and ContingenciesGetaneh YenealemNo ratings yet

- A AccrualsDocument4 pagesA AccrualsBetelehem ZenawNo ratings yet

- Topic 8 - Receivable Financing - Rev (Students)Document37 pagesTopic 8 - Receivable Financing - Rev (Students)Romzi100% (1)

- Topic 8 Receivable Financing Rev Students 653Document39 pagesTopic 8 Receivable Financing Rev Students 653Nemalai VitalNo ratings yet

- CREDIT UNION BEST PRACTICES TOOLKIT - Tool 2Document16 pagesCREDIT UNION BEST PRACTICES TOOLKIT - Tool 2buguzNo ratings yet

- Adjusting Entries (ASSETS)Document7 pagesAdjusting Entries (ASSETS)heynuhh gNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationAbubaker ShahzadNo ratings yet

- The Budgeting of Account ReceivableDocument5 pagesThe Budgeting of Account ReceivableAnanda RiskiNo ratings yet

- Lecture On Nature of ReceivablesDocument3 pagesLecture On Nature of ReceivablesSara AlbinaNo ratings yet

- Tncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22Document4 pagesTncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22HuatNo ratings yet

- Liability Method of Recording Unearned RevenueDocument18 pagesLiability Method of Recording Unearned RevenuesajjadNo ratings yet

- Chap9 Receivable FinancingDocument17 pagesChap9 Receivable FinancingJD FITNESSNo ratings yet

- AgreementDocument8 pagesAgreementbollionysNo ratings yet

- CH 06 Accounting For Musharakah FinancingDocument23 pagesCH 06 Accounting For Musharakah FinancingMOHAMMAD BORENENo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- ACC 1 WK 10 Adjusting Entries On Revenue DeferralsDocument5 pagesACC 1 WK 10 Adjusting Entries On Revenue Deferralsstaceyelizalde59No ratings yet

- Generating Cash From Receivables (Financing of Receivables)Document3 pagesGenerating Cash From Receivables (Financing of Receivables)Cherry joyNo ratings yet

- Adjusting EntriesDocument23 pagesAdjusting Entriestoobaahmedkhan100% (1)

- Adjusting Entry Quiz With AnswersDocument6 pagesAdjusting Entry Quiz With AnswersRenz RaphNo ratings yet

- Current Liabilities, Provisions, and ContingenciesDocument56 pagesCurrent Liabilities, Provisions, and ContingenciesJofandio Alamsyah100% (1)

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Ac101 ch7Document15 pagesAc101 ch7infinite_dreamsNo ratings yet

- M6 (IAS 18) (6th)Document6 pagesM6 (IAS 18) (6th)aslamhamza949No ratings yet

- Accn05b Pre Ol1Document4 pagesAccn05b Pre Ol1VMinKook biasNo ratings yet

- Accounting Concepts and Principles Are A Set of Broad Conventions That Have Been Devised To Provide A Basic Framework For Financial ReportingDocument8 pagesAccounting Concepts and Principles Are A Set of Broad Conventions That Have Been Devised To Provide A Basic Framework For Financial ReportingGesa StephenNo ratings yet

- ACC124 Doubtful-AccountsDocument24 pagesACC124 Doubtful-Accountsジェロスミ プエブラスNo ratings yet

- Accounting Adjusting EntryDocument20 pagesAccounting Adjusting EntryClemencia Masiba100% (1)

- Accounting Application: Tech-FSM 223Document52 pagesAccounting Application: Tech-FSM 223Rey Ann EstopaNo ratings yet

- IA2 02 - Handout - 1 PDFDocument10 pagesIA2 02 - Handout - 1 PDFMelchie RepospoloNo ratings yet

- Capital Budgeting: Present ValueDocument15 pagesCapital Budgeting: Present ValueNoorunnishaNo ratings yet

- Accounts Receivable Inventory Management - .DocmDocument11 pagesAccounts Receivable Inventory Management - .DocmellishNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesMs VampireNo ratings yet

- 2102 Midterm 2 Study GuideDocument13 pages2102 Midterm 2 Study GuideMoses SuhNo ratings yet

- 08 Notes Accounts ReceivableDocument3 pages08 Notes Accounts ReceivablePeter KoprdaNo ratings yet

- Accounting For Receivables Accounts ReceivableDocument18 pagesAccounting For Receivables Accounts Receivablelocomotingkenya.co.keNo ratings yet

- A.2. Asset Valuation ReceivablesDocument9 pagesA.2. Asset Valuation ReceivablesKondreddi SakuNo ratings yet

- Tanauan Institute, Inc.: Adjustments For AccrualsDocument7 pagesTanauan Institute, Inc.: Adjustments For AccrualsHanna CaraigNo ratings yet

- Cash Discount: What Is A Cash Discount? Definition of Cash DiscountDocument12 pagesCash Discount: What Is A Cash Discount? Definition of Cash DiscountHumanityNo ratings yet

- Chapter 3Document2 pagesChapter 3amaliakb5No ratings yet

- 13 Bbfa1103 T9Document25 pages13 Bbfa1103 T9djaljdNo ratings yet

- Unit 9Document5 pagesUnit 9Anonymous Fn7Ko5riKTNo ratings yet

- Accrued InterestDocument4 pagesAccrued InterestNiño Rey LopezNo ratings yet

- Glossary of Professional Wrestling TermsDocument14 pagesGlossary of Professional Wrestling TermsMaría GoldsteinNo ratings yet

- EPM-1183 Ethics, Code of Conduct & Professional PracticeDocument41 pagesEPM-1183 Ethics, Code of Conduct & Professional PracticeDev ThackerNo ratings yet

- Sample Thesis 2Document127 pagesSample Thesis 2Carlo Troy AcelottNo ratings yet

- Bent Mag-Dec 2009Document80 pagesBent Mag-Dec 2009EcarvalhoStad0% (3)

- 2.preparation and Staining of Thick and Thin BloodDocument31 pages2.preparation and Staining of Thick and Thin Bloodbudi darmantaNo ratings yet

- Tender Bids From March 2012 To April 2017Document62 pagesTender Bids From March 2012 To April 2017scribd_109097762No ratings yet

- Case ReportDocument16 pagesCase ReportSabbir ThePsychoExpressNo ratings yet

- Auto Motivations Digital Cinema and KiarDocument11 pagesAuto Motivations Digital Cinema and KiarDebanjan BandyopadhyayNo ratings yet

- Lesson 9. Phylum Mollusca PDFDocument44 pagesLesson 9. Phylum Mollusca PDFJonard PedrosaNo ratings yet

- Gaps and Challenges in The Mother TongueDocument15 pagesGaps and Challenges in The Mother TongueAngelica RamosNo ratings yet

- Neb Grade XiiDocument20 pagesNeb Grade XiiSamjhana LamaNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- Expect Respect ProgramDocument2 pagesExpect Respect ProgramCierra Olivia Thomas-WilliamsNo ratings yet

- Ep08 Measuring The Concentration of Sugar Solutions With Optical ActivityDocument2 pagesEp08 Measuring The Concentration of Sugar Solutions With Optical ActivityKw ChanNo ratings yet

- 08 Package Engineering Design Testing PDFDocument57 pages08 Package Engineering Design Testing PDFLake HouseNo ratings yet

- Old SultanDocument2 pagesOld SultanKimberly MarquezNo ratings yet

- The Art of Perfumery-Septimus PiesseDocument431 pagesThe Art of Perfumery-Septimus PiesseHornoEnElNo ratings yet

- LP in MusicDocument10 pagesLP in MusicContagious Joy VillapandoNo ratings yet

- MEDINA, Chandra Micole P. - Activity 6 Both A and BDocument2 pagesMEDINA, Chandra Micole P. - Activity 6 Both A and BChandra Micole MedinaNo ratings yet

- Karakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceDocument14 pagesKarakteristik Material Baja St.37 Dengan Temperatur Dan Waktu Pada Uji Heat Treatment Menggunakan FurnaceYudii NggiNo ratings yet

- Literary Devices DefinitionsDocument2 pagesLiterary Devices DefinitionsAlanna BryantNo ratings yet

- VHDL Processes: Cwru Eecs 318Document24 pagesVHDL Processes: Cwru Eecs 318KarThikNo ratings yet

- Onomasiology (From GreekDocument4 pagesOnomasiology (From GreekAnonymous hcACjq8No ratings yet

- MCQ of CS507 Information System: Emphasizes The Need ToDocument48 pagesMCQ of CS507 Information System: Emphasizes The Need ToShahid Anwar0% (1)

- ACA - Exam - Objectives - Photoshop - CC 2018Document5 pagesACA - Exam - Objectives - Photoshop - CC 2018Jeffrey FarillasNo ratings yet

- Module 2 UrineDocument17 pagesModule 2 UrineGiulia Nădășan-CozmaNo ratings yet

- Metallic BondingDocument2 pagesMetallic BondingJohanna LipioNo ratings yet

- Grade 7 Sample Class ProgramDocument1 pageGrade 7 Sample Class ProgramRaymart EstabilloNo ratings yet

- The DJ Test: Personalised Report and Recommendations For Alex YachevskiDocument34 pagesThe DJ Test: Personalised Report and Recommendations For Alex YachevskiSashadanceNo ratings yet

- What Do You Know About Jobs - 28056Document2 pagesWhat Do You Know About Jobs - 28056Kadek DharmawanNo ratings yet