Professional Documents

Culture Documents

Capital Budgeting

Capital Budgeting

Uploaded by

bheafabedizonCopyright:

Available Formats

You might also like

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Capital Budgeting HandoutDocument15 pagesCapital Budgeting HandoutJoshua Cabinas100% (2)

- Cat Bact 312 June 2018Document4 pagesCat Bact 312 June 2018JohnNo ratings yet

- Capital Budgeting With AnswersDocument9 pagesCapital Budgeting With AnswersishikiconsultancyNo ratings yet

- Mas 9509 Capital Budgeting PDFDocument19 pagesMas 9509 Capital Budgeting PDFjamesaguimanaNo ratings yet

- CAPITAL BUDGETING and COST OF CAPITALDocument4 pagesCAPITAL BUDGETING and COST OF CAPITALChrischelle MagauayNo ratings yet

- (Mas) 07 - Capital BudgetingDocument7 pages(Mas) 07 - Capital BudgetingCykee Hanna Quizo Lumongsod100% (1)

- Mas 08 - Capital BudgetingDocument7 pagesMas 08 - Capital BudgetingCarl Angelo Lopez100% (1)

- HLCapital BudgetingDocument4 pagesHLCapital BudgetingWilmer PascuaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingHamoudy DianalanNo ratings yet

- Capital Budgeting-Lecture NotesDocument6 pagesCapital Budgeting-Lecture NotesAngela Nicole CalimbasNo ratings yet

- Module 3 ARS PCC - Capital Budgeting and Cost of CapitalDocument11 pagesModule 3 ARS PCC - Capital Budgeting and Cost of CapitalJames Bradley HuangNo ratings yet

- Lecture Capital BudgetingDocument5 pagesLecture Capital BudgetingJenelyn FloresNo ratings yet

- MAS 10 - Capital BudgetingDocument10 pagesMAS 10 - Capital BudgetingClint AbenojaNo ratings yet

- MANACC Chapter19Document3 pagesMANACC Chapter19You DontknowmeNo ratings yet

- 09.1 Module in Financial Management 09Document8 pages09.1 Module in Financial Management 09Fire burnNo ratings yet

- Module in Financial Management - 09Document7 pagesModule in Financial Management - 09Karla Mae GammadNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingDianne TorresNo ratings yet

- Fin3 Midterm ExamDocument8 pagesFin3 Midterm ExamBryan Lluisma100% (1)

- Capital-Budgeting Quick NotesDocument6 pagesCapital-Budgeting Quick NotesAlliah Mae ArbastoNo ratings yet

- Alternatives.: Part 1: Factors Affecting Financial Modeling and Decision MakingDocument8 pagesAlternatives.: Part 1: Factors Affecting Financial Modeling and Decision MakingJessica RusNo ratings yet

- Net Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NDocument3 pagesNet Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NMich Elle CabNo ratings yet

- Non Discounted Techniques LectureDocument3 pagesNon Discounted Techniques Lectureamormi2702No ratings yet

- CapitDocument8 pagesCapitjanice100% (1)

- Mas 2 - 1304 Financial Management: Capital BudgetingDocument9 pagesMas 2 - 1304 Financial Management: Capital BudgetingVel JuneNo ratings yet

- Evaluation of Financial FeasibilityDocument25 pagesEvaluation of Financial FeasibilityDr Sarbesh Mishra86% (7)

- WelpDocument14 pagesWelparianas50% (2)

- FM 2marks AllDocument22 pagesFM 2marks AllMohamed AbzarNo ratings yet

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- AFM Exam Focus NotesDocument55 pagesAFM Exam Focus Notesmanish kumarNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingPaulomi LahaNo ratings yet

- Capital Budgeting NotesDocument2 pagesCapital Budgeting Noteszy jeiNo ratings yet

- AB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RDocument18 pagesAB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RElaine TohNo ratings yet

- H.O For Cap BudDocument5 pagesH.O For Cap BudHallie KuronumaNo ratings yet

- AFM Exam Focus Notes 1st PartDocument28 pagesAFM Exam Focus Notes 1st Partmanish kumarNo ratings yet

- FM 2marks AllDocument22 pagesFM 2marks AllKathiresan NarayananNo ratings yet

- Module2 EconDocument45 pagesModule2 EconandreslloydralfNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- AFM - Cost of Capital - AE - Week 1Document41 pagesAFM - Cost of Capital - AE - Week 1AwaiZ zahidNo ratings yet

- UNIT-2 Investment DecisionsDocument17 pagesUNIT-2 Investment DecisionsJanaki Singh RathoreNo ratings yet

- Chapter 09 Im 10th EdDocument24 pagesChapter 09 Im 10th Edsri rahayu desraNo ratings yet

- Capital Budgeting TechniquesDocument4 pagesCapital Budgeting TechniquesVamsi SakhamuriNo ratings yet

- Strategic Cost Management: Module 6 Capital Budgeting Capital BudgetingDocument5 pagesStrategic Cost Management: Module 6 Capital Budgeting Capital BudgetingMon RamNo ratings yet

- Degerleme GelismeDocument32 pagesDegerleme GelismeferahNo ratings yet

- Capital Investments DecisionsDocument21 pagesCapital Investments DecisionsMelisandy LaguraNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingHarshitaNo ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- C2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!Document2 pagesC2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!didi dayana ishakNo ratings yet

- Capital Budgeting Decision Criteria: Chapter OrientationDocument24 pagesCapital Budgeting Decision Criteria: Chapter OrientationElizabeth StephanieNo ratings yet

- Chapter 13Document9 pagesChapter 13Diana Mark AndrewNo ratings yet

- Toaz - Info Chapter 11 PRDocument45 pagesToaz - Info Chapter 11 PRtaponic390No ratings yet

- S - Cap BudDocument29 pagesS - Cap BudHitesh AgjaNo ratings yet

- FFM Chapter 8Document5 pagesFFM Chapter 8Dawn CaldeiraNo ratings yet

- Economics Unit 2.1 NotesDocument9 pagesEconomics Unit 2.1 Notes3004 Divya Dharshini. MNo ratings yet

- P4 Advanced Financial Management SummaryDocument7 pagesP4 Advanced Financial Management SummaryHubert AnipaNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Fidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Document17 pagesFidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Fidelia AgathaNo ratings yet

- Fin Mar ReviewerDocument2 pagesFin Mar ReviewerPixie CanaveralNo ratings yet

- Slide CfaDocument295 pagesSlide CfaLinh HoangNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Front Page "A STUDY ON FINANCIAL PERFORMANCE WITH SPECIAL REFERENCE TO KSE LTD, IRINJALAKUDA"Document11 pagesFront Page "A STUDY ON FINANCIAL PERFORMANCE WITH SPECIAL REFERENCE TO KSE LTD, IRINJALAKUDA"HIJAS HAMSANo ratings yet

- BUSINESS FINANCE 2nd Quarter AssessmentDocument1 pageBUSINESS FINANCE 2nd Quarter AssessmentPhegiel Honculada MagamayNo ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- WLCON 2022 17A Annual ReportDocument35 pagesWLCON 2022 17A Annual ReportJamaica AlejoNo ratings yet

- Solution Manual For Essentials of Corporate Finance 10th by RossDocument38 pagesSolution Manual For Essentials of Corporate Finance 10th by Rossjohnniewalshhtlw100% (27)

- Hanni: IEOR 4402 #10 HWDocument7 pagesHanni: IEOR 4402 #10 HWZack ZhangNo ratings yet

- Financial Accounting PDFDocument21 pagesFinancial Accounting PDFTangent PcsNo ratings yet

- Investment DetectiveDocument25 pagesInvestment DetectiveTestNo ratings yet

- 2 The Regulatory Framework - PPSXDocument13 pages2 The Regulatory Framework - PPSXAbdelwahab Ahmed IbrahimNo ratings yet

- Financial Modeling CMDocument3 pagesFinancial Modeling CMAreeba Aslam100% (1)

- Beaver Ryan 2000Document23 pagesBeaver Ryan 2000Renan Barros LittigNo ratings yet

- Course Outline FinnDocument11 pagesCourse Outline FinnlaibaNo ratings yet

- Ac1101 Final Exam QuestionnaireDocument11 pagesAc1101 Final Exam QuestionnaireAngel ObligacionNo ratings yet

- The Following Information Is For Brittany Inc 1 To Be More PDFDocument1 pageThe Following Information Is For Brittany Inc 1 To Be More PDFTaimur TechnologistNo ratings yet

- Bank StatementDocument6 pagesBank StatementJayden PrasadNo ratings yet

- Investment Decisions: Capital BudgetingDocument29 pagesInvestment Decisions: Capital BudgetingAditya ChavanNo ratings yet

- Chapter 5 Stock AND Equity ValuationDocument9 pagesChapter 5 Stock AND Equity Valuationtame kibruNo ratings yet

- Case Study: S & S Air Goes Public: Submitted byDocument6 pagesCase Study: S & S Air Goes Public: Submitted byRaisul ZilaniNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1Document5 pagesUniversiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1KAY PHINE NGNo ratings yet

- Unit 9: Investment: Related Keynotes 1. Unit 5 Success (Pre-Intermediate Coursebook)Document3 pagesUnit 9: Investment: Related Keynotes 1. Unit 5 Success (Pre-Intermediate Coursebook)nhNo ratings yet

- Assignment in Interim ReportingDocument3 pagesAssignment in Interim ReportingVevien Anne AbarcaNo ratings yet

- Basic Accounting QuestionnaireDocument5 pagesBasic Accounting Questionnaireangeline bulacanNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- Chapter 14 Retail Inventory MethodDocument2 pagesChapter 14 Retail Inventory MethodDanielleNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- PT Matahari Laporan KeuanganDocument61 pagesPT Matahari Laporan Keuanganwahyu k rahmanNo ratings yet

- Ppfas MF Factsheet For August 2022Document17 pagesPpfas MF Factsheet For August 2022saivenkatesh13No ratings yet

Capital Budgeting

Capital Budgeting

Uploaded by

bheafabedizonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting

Capital Budgeting

Uploaded by

bheafabedizonCopyright:

Available Formats

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

CAPITAL BUDGETING - the process of identifying, evaluating, planning, and financing

capital investment projects of an organization.

CHARACTERISTICS OF CAPITAL INVESTMENT DECISIONS

1. Capital investment decisions usually require large commitments of resources.

2. Most capital investment decisions involve long-term commitments.

3. Capital investment decisions are more difficult to reverse than short-term decisions.

4. Capital investment decisions involve so much risk and uncertainty.

CAPITAL INVESTMENT FACTORS

1. Net investment 2. Net Returns 3. Cost of Capital

* NET INVESTMENT = costs or cash outflows less cash inflows or savings incidental to

the acquisition of the investment projects.

Costs or cash outflows:

1. The initial cash outlay covering all expenditures on the project up to the time

when it is ready for use or operation:

Ex. Purchase price of the asset

Incidental project-related costs such as freight, insurance taxes, handling,

installation, test-runs, etc.

2. Working capital requirements to operate the project at the desired level

3. Market value of an existing, currently idle asset, which will be transferred to or

utilized in the operation of the proposed capital investment project.

Savings or cash inflows:

1. Trade-in value of old asset (in case of replacement)

2. Proceeds from sale of old asset to be disposed due to the acquisition of the new

project (less applicable tax, in case there is gain on sale, or add tax savings, in

case there is loss on sale).

3. Avoidable cost of immediate repairs on old asset to be replaced, net of tax.

*NET RETURNS

1. Accounting net income

2. Net cash inflows

*COST OF CAPITAL

Cost of Capital - the cost of using funds; it is also called hurdle rate, required rate of

return, cut-off rate

- the weighted average rate of return the company must pay to its long-

term creditors and shareholders for the use of their funds.

Computation of COST OF CAPITAL

Source Capital Cost of Capital

Creditors Long-term debt After-tax rate of interest i (1

- TxR)

Stockholders:

Preferred Preferred Stock Preferred dividends per

share

.

Current market price or

Net issuance price

Common Common Stock CAPM or DGM

1. CAPITAL ASSET PRICING MODEL (CAPM)

R = RF + β (RM - RF)

where: R = rate of return

RF = risk-free rate determined by government securities

β = beta coefficient of an individual stock which is the correlation

between the volatility (price variation) of the stock market and

the volatility of the price of the individual stock.

Example: If the price of an individual stock rises 10% and the stock market

15%, the beta is 1.5.

RM = market return

Jasmin May Baniaga, CPA, CMA, MBA Page 1

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

(RM - RF) = market risk premium or the amount above risk-free

rate required to induce average investors to enter

the market.

2. THE DIVIDEND GROWTH MODEL

a. Cost of Retained Earnings D1 + G

P0

where: P0 = current price

D1 = next dividend

G = growth rate in dividends per share (it is assumed that the

dividend payout ration, retention rate, and therefore the

EPS growth rate are constant)

b. Cost of New Common Stock = D1

P0 (1 - Flotation Costs) +G

Flotation Cost = the cost of issuing new securities

COMMONLY USED METHODS OF EVALUATING CAPITAL INVESTMENT PROJECTS

1. Methods that do not consider the time value of money

a. Payback

b. Bail-out

c. Accounting rate of return

2. Methods that consider the time value of money (discounted cash flow methods)

a. Net present value

b. Present value index

c. Present value payback

d. Discounted cash flow rate of return

METHODS THAT DO NOT CONSIDER THE TIME VALUE OF MONEY

PAYBACK PERIOD = Net cost of initial investment = the length of time required

Annual net cash inflows by the project to return the

initial cost of investment

Advantages:

1. Payback is simple to compute and easy to understand. There is need to

compute or consider any interest rate. One just has to answer the question:

“How soon will the investment cost be recovered?”

2. Payback gives information about liquidity of the project.

3. It is a good surrogate for risk. A quick payback period indicates a less risky

project.

Disadvantages:

1. Payback does not consider the time value of money. All cash received during

the payback period is assumed to be of equal value in analyzing the project.

2. It gives more emphasis on liquidity rather than on profitability of the project.

In other words, more emphasis is given on return of investment rather than

the return on investment.

3. It does not consider the salvage value of the project.

4. It ignores the cash flows that may occur after the payback period.

BAIL-OUT PERIOD - cash recoveries include not only the operating net cash inflows

but also the estimated salvage value or proceeds from sale at the

end of each year of the life of the project.

ACCOUNTING RATE OF RETURN - also called book value rate of return, financial

statement method, average return on investment and unadjusted

rate of return.

Accounting Rate of Return = Average annual net income

Investment

Jasmin May Baniaga, CPA, CMA, MBA Page 2

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

Advantages:

1. The ARR computation closely parallels accounting concepts of income

measurement and investment return.

2. It facilitates re-evaluation of projects due to the ready availability of data from

the accounting records.

3. This method considers income over the entire life of the project.

4. It indicates the project’s profitability.

Disadvantages:

1. Like the payback and bail-out methods, the ARR method does not consider the

time value of money.

2. With the computation of income and book value based on the historical cost

accounting data, the effect of inflation is ignored.

METHODS THAT CONSIDER THE TIME VALUE OF MONEY (Discounted Cash Flow

Methods)

NET PRESENT VALUE

Present value of cash inflows

- Present value of cash outflows

Net Present Value

Advantages:

1. Emphasizes cash flows

2. Recognizes the time value of money

3. Assumes discount rate as the reinvestment rate

4. Easy to apply.

Disadvantages:

1. It requires predetermination of the cost of capital or the discount rate to be

used.

2. The net present values of different competing projects may not be comparable

because of differences in magnitudes or sizes of the projects.

PROFITABILITY INDEX

Total present value of cash inflows

Profitability Index = Total present value of cash outflows

DISCOUNTED CASH FLOW RATE OF RETURN - the rate of return which equates the

present value (PV) of cash inflows to PV of cash outflows.

1. Determine the present value factor (PVF) for the discounted cash flow rate of

return (DCFRR) with the use of the following formula:

PVF for DCFRR = Net Cost of investment

Net cash inflows

2. Using Table 2 (present value annuity table), fine on line n (economic life) the PVF

obtained in Step 1. The corresponding rate is the DCFRR.

Advantages:

1. Emphasizes cash flows

2. Recognizes the time value of money

3. Computes true return of project

Disadvantages:

1. Assumes that the IRR is the re-investment rate.

2. When project includes negative earnings during their economic life, different

rates of return may result.

PAYBACK RECIPROCAL - a reasonable estimate of the discounted cash flows rate of

return, provided that the following conditions are met:

1. The economic life of the project is at least twice the payback period.

2. The net cash inflows are constant (uniform) throughout the life of the project.

Jasmin May Baniaga, CPA, CMA, MBA Page 3

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

Net cash inflows

Payback Reciprocal = Investment

or

1

Payback Reciprocal =

Payback period

EXERCISES:

COST OF CAPITAL

1. Aves Corporation has P 1,000 par value bond outstanding with 5 years to maturity.

The bond carries an annual interest payment of P 90 and is currently selling for P

1,100 per bond. The corporation pays the corporate tax rate of 30%. It wishes to

know that the after-tax cost of a new bond issue is likely to be. The yield to maturity

(YTM) on the new issue will be the same as the yield to maturity on the old issue

because the risk and maturity date will be similar

REQUIRED:

a. Compute the approximate yield to maturity on the old issue and use this as

the yield for the new issue. What is the after-tax cost of debt?

b. Compute the new after-tax cost of debt if the bond is issued at P 970 per

bond.

c. Compute the current yield if the bond is issued at P 970 per bond.

2. Havana Corporation is about to issue preferred stock that pays an annual dividend of

10%. It has a price of P 125 and a par value of P 100. The issue of these preferred

shares will cost the company P 5 in flotation cost. The corporate tax rate is 30%.

REQUIRED:

What is the required rate of return (yield) on the preferred stocks?

3. The preferred stock of C Corporation pays an annual dividend of P 5.60. It has a

required rate of return of 8%.

REQUIRED:

Compute the price of the preferred stock.

4. Full Hours Productions paid a dividend of P 2.40 per share on its common stock last

year. Over the next 12 months, the dividend is expected to grow at P 5%, which is

the constant growth rate (g) for the firm. The common stock currently sells for P 84

per share.

REQUIRED:

Compute the required rate of the return on the common stock.

5. D Corporation currently pays a P 2.10 annual cash dividend. It plans to maintain the

dividend at this level as no future growth is anticipated in the foreseeable future.

REQUIRED:

If the required rate of return is 12%, what is the price of the common stock?

6. Bella Corporation just paid a dividend of P 7.20 per share on its stock. The dividends

are expected to grow at a constant rate of 6% per year, indefinitely.

REQUIRED:

a. If investors require a 12% return on Bella stocks, what is the current price?

b. What will the price be in three years?

7. H Corporation’s common stock has a beta of 1.2. The risk-free rate is 7.5% and the

market rate is 12%. Determine the

a. market risk premium c. required return

b. risk premium d. cost of the common stock equity

8. Use the basic equation for the capital asset pricing model (CAPM) to work on each of

the following:

Jasmin May Baniaga, CPA, CMA, MBA Page 4

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

a. Find the required rate of return for an asset with a beta of 0.90 when the

risk-free rate and market return are 8% and 12%, respectively.

b. Find the required rate of return for an asset with a beta of 1.25 when the

risk-free rate of return is 5%, and the market risk premium is 3%.

c. Find the beta for an asset with a required return of 15% when the risk-free

rate and market return are 10% and 12.50%, respectively.

9. The I corporation finds it necessary to determine its marginal cost of capital. I’s

current capital structure calls for calls for 45% debt, 15% preferred stock, and 40%

common equity. Initially, common equity will be in the form of retained earnings (K-

e), and then new common stock (Kn). The costs of the various sources of financing

are as follows: debt, 6.2%, preferred stock, 9.4%, retained earnings, 12%, and new

common stock, 13.4%.

a. What is the initial weighted average of capital? (Include debt, preferred stock,

and common equity in the form of retained earnings.)

b. If the firm has P 20 million in retained earnings, at what size of capital

structure will the firm run out of retained earnings?

c. What will the marginal cost of capital be immediately after that point? (Equity

will remain at 40% of the capital structure but will be in the form of new

common stock <Kn>.)

d. The 6.2% cost of debt referred to above applies only to the first P 36 million

of debt. After that, the cost of debt will be 7.8%. At what size of capital

structure will there be a change in the cost of debt?

e. What will the marginal cost of capital be immediately after that point?

(Consider the facts if both Parts c and d.)

RETURNS

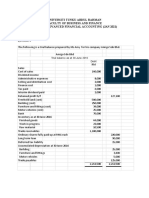

1. NET INVESTMENT. Lupe Company is planning to purchase new equipment costing

P 500,000. Freight and installation costs are P 50,000. The new equipment will be

purchased to replace an old unit that was acquired several years ago at a cost of P

300,000, for which an accumulated depreciation of P 270,000 has been recorded.

The old unit will be sold for P 20,000. Other assets that are to be retired as a result

of the acquisition of the new machine can be salvaged and sold for P 100,000. The

gain on the retirement of these other assets is P 6,000, which will increase income

taxes by P 1,800.

If the new equipment is not purchased, extensive repairs on the old equipment will

have to be made at an estimated cost of P 30,000. This repairs expense can be

avoided by purchasing the equipment.

Additional gross working capital of P 50,000 will be needed to support operations

planned with the new equipment.

REQUIRED:

Compute the amount of investment for decision-making purposes.

2. RETURNS. The management of Lobo Trade School plans to install popcorn vending

machines in its school. Annual sales of popcorn are estimated at 3,000 units at a

price of P 8 per unit. Variable costs are estimated at P 3 per unit, while incremental

fixed costs, excluding depreciation, are at P 2,000 per year.

Lobo will acquire three vending machines at P 10,000 each, including installation

costs of P 1,000 per machine. The machines are expected to have a service life of 5

years, with no salvage value.

Depreciation will be computed on a straight-line basis. The company’s income tax

rate is 30%.

REQUIRED:

a. Determine the increase in annual net income of Lobo if the pop corn vending

machines were installed.

b. Determine the annual net cash inflows that will be generated by the project.

Jasmin May Baniaga, CPA, CMA, MBA Page 5

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

3. RETURNS. LRT is planning to buy trains cleaning equipment that can reduce trains

wash service cost and other cash expenses by an average of P 180,000 per year.

The new cleaning equipment will cost P 300,000 and will be depreciated for 5 years

on a straight-line basis. No salvage value is expected at the end of the equipment’s

life. Income tax is estimated at 30% of income before tax.

REQUIRED:

Determine the annual net returns (net income) and net cash inflows for the

proposed investment.

4. ALTERNATIVE PRODUCTION PROCESS. Manekin Statuary uses a labor-intensive

manufacturing process. Existing equipment has a book value of P 20,000, a five-

year remaining life, and a P 12,000 market value. Annual depreciation is P 4,000

and cash operating costs is P 64,000. The proposed process requires machinery

costing P 100000 with a useful life of five years and no salvage value. The new

machinery, which will replace the old one, requires P 40,000 in annual cash costs.

Straight-line depreciation will be used for tax purposes for the new machine. The tax

rate is 30% and the cost of capital is 12%.

REQUIRED:

a. What is the net investment on the new equipment?

b. What is the annual net cash inflow from the new equipment?

EVALUATION TECHNIQUES

1. PAYBACK AND ACCOUNTING RATE OF RETURN. Antigo Company is

contemplating the replacement of old equipment. The annual cost of operating the

old equipment is P 600,000, excluding depreciation, while the estimate fro the new

equipment is P 240,000. The cost of the new equipment is P 800,000 with a useful

life estimate of 5 years and no salvage value. Assume an income tax rate of 30%,

and a 20% cost of capital. The book value of the old machine is zero.

REQUIRED:

a. Payback period.

b. Accounting rate of return based on (a) original investment and (b) average

investment.

2. PAYBACK PERIOD COMPUTATION WITH UNEVEN CASH FLOWS. Footok

Cologne is considering the purchase of a special-purpose bottling machine for P

400,000. It is expected to have a useful life of five years with a zero terminal

disposal price. The plant manager estimates the following savings in cash-operating

costs, net of income tax:

Year Amount

1 P 176,000

2 160,000

3 112,000

4 80,000

5 64,000

Total P 592,000

Footok Cologne is using a required rate of return of 15% in its capital budgeting

decisions. It pays income tax at the rate of 30% of income before income tax.

REQUIRED:

Compute the payback period.

3. PAYBACK AND BAILOUT PAYBACK. Apple Company purchased a new machine on

January 1 of this year for P 180,000, with an estimated useful life of 5 years and a

salvage value of P 10,000. The machine will be depreciated using the straight-line

method. The machine is expected to produce cash flow from operations, net of

income taxes, of P 70,000 a year in each of the next five years. The new machine’s

salvage value is P20,000 in years 1 and 2, and P 15,000 in years 3 and 4.

REQUIRED:

Compute: (1) Payback period

(2) Bail-out period

Jasmin May Baniaga, CPA, CMA, MBA Page 6

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

4. NET PRESENT VALUE - UNIFORM CASH FLOWS. Kasalukuyan Company plans to

buy a new machine costing P 500,000. The new machine is expected to have a

salvage value of P 50,000 at the end of its economic life of 5 years. The annual

cash inflow before income tax from this machine has been estimated at P 200,000.

The tax rate is 30%. The company desires a minimum of 10% on invested capital.

REQUIRED:

Compute the net present value (NPV)

5. NET PRESENT VALUE WITH ENEVEN CASH FLOWS. Alexis Company is

evaluating a capital investment proposal that will require an initial cash investment

of P 600,000. The project will have a five-year life. The net after tax cash flows

form the project are expected to be P 200,000 in the first year, P 180,000 in the

second year, P 120,000 in the third year, P 100,000 in the fourth year, and P 60,000

in the fifth year. Salvage value of P 10,000 is expected to be received at the end of

the end of the life of the project. The straight-line method will be used to depreciate

the project. Income tax rate is 30%, and the company’s cost of capital is 10%.

REQUIRED:

What is the net present value?

6. PROFITABILITY INDEX. Alin Corporation gathered the following data on two

capital investment opportunities:

1 2

Cost of investment P 320,000 P 240,000

Discount rate 20% 20%

Net cash inflows P 128,000 per year for 5 years P 128,000 in the first year,

P96,000 in the next three

years and P 64,000 in the

fifth year

7. INTERNAL RATE OF RETURN. IRR Company is considering buying a new machine,

requiring an immediate P 400,000 cash outlay. The new machine is expected to

increase annual net after tax cash receipts by P 110,000 in each of the next 5 years

of its economic life. No salvage value is expected at the end of 5 years. The

company desires a minimum return of 10% on invested capital.

REQUIRED:

Internal rate of return.

8. DISCOUNTED CASH FLOW RATE OF RETURN WITH UNEVEN CASH FLOWS. A

new machine costing P 50,000 with three years useful life, no salvage value at the

end of three years, is expected to bring in the following cash inflows after tax:

First year P 30,000

Second year 20,000

Third year 10,000

REQUIRED:

Determine the time-adjusted rate of return.

9. PAYBACK RECIPROCAL. Owu Company is planning to buy equipment costing P

240,000 which has an estimated life of 30 years and is expected to produce after-tax

net cash inflows of P 48,000 per year.

REQUIRED:

Estimate the discounted cash flow rate of return without using present value

factors.

10. DISCOUNTED PAYBACK. A new machine costing P 40,000 wit three years useful

life, no salvage value at the end of three years, is expected to bring in the following

cash inflows after tax:

First year P 30,000

Second year 20,000

Third year 10,000

Jasmin May Baniaga, CPA, CMA, MBA Page 7

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

REQUIRED:

If the company’s cost of capital is 10%, what is the discounted

payback period?

11. Belle Co. wants to introduce a new product. The manager’s best estimates follow:

Selling price P 30,000

Variable costs 20,000

Sales volume 10,000

Bringing out the new project requires a P 50,000 increase in working capital, as well

as the purchase of new equipment costing P 250,000 and having a five-year useful

life with no salvage value. The new equipment has cash operating costs of P

100,000 per year and will be depreciated using the straight-line method. Belle pays

income tax at the rate of 40%. Its cost of capital is 12%.

REQUIRED:

Determine the NPV of this investment opportunity.

12. Risa Company manufactures copier equipment and can replace one of its existing

machines with a new model. The existing machine has a net book value of P

120,000 and a market value of P 60,000. It has an estimated remaining life of four

years; at which time it will have no salvage value. The company uses straight line

depreciation of P 30,000 per year on the machine, and its annual cash operating cost

is P 280,000.

The new model costs P 500,000 and has a four-year estimated life with no salvage

value. Its annual cash operating cost is estimated at P 160,000. The firm will use

straight line depreciation. The tax rate is 40% and the cost of capital is 12%. The

purchase of the new, more efficient machine will enable the company to reduce its

investment in inventory by P 80,000.

REQUIRED:

a. Determine the investment required to purchase the new machine.

b. Determine the net present value of the investment.

c. Suppose that the new machine has a 10% salvage value. The company will

consider the salvage value in determining annual depreciation. Determine the

net present value of the investment.

d. Suppose that the new machine has a 10% salvage value. The company will

ignore the salvage value in determining annual depreciation. The applicable

tax rate is 40%. Determine the net present value of the investment.

13. Albania Company expects to sell 100,000 units of its product annually for the next

four years at P 9 each, with variable cost of P 6 per unit, and annual cash fixed costs

of P 250,000. The product requires machinery costing P 320,000 with a four-year

life and no salvage value at the end of four years. The company will depreciate the

machine using the straight-line depreciation method. Additionally, working capital,

in the form of receivables and inventory, will increase by 150,000. This additional

working capital will be returned in full at the end of four years. The tax rate is 40%,

and the cost of capital is 12%.

REQUIRED:

a. Compute the expected net present value for this investment.

b. Compute the profitability index for this investment.

14. Mountain View Hospital has purchased new lab equipment for P 134,650. The

equipment is expected to last for three years and to provide cash inflows as follows:

Year 1 P 45,000

Year 2 60,000

Year 3 ?

REQUIRED:

Assuming that the equipment will yield exactly a 16% rate of return, what is

the expected cash inflows for year three?

Jasmin May Baniaga, CPA, CMA, MBA Page 8

MS Mastery

Financial Management Concepts and Techniques for Planning, Control & Decision Making

15. Union Bay Plastics is investigating the purchase of a piece of automated equipment

that will save P 100,000 each year in direct labor and inventory carrying costs. This

equipment costs P 750,000 and is expected to have a ten-year useful life with no

salvage value. The company requires a minimum of 15% return on all equipment

purchases. Management anticipates that this equipment will provide intangible

benefits such as greater flexibility and higher quality output.

REQUIRED:

What peso value per year would the intangible benefits have to have to make

the equipment an acceptable investment?

Jasmin May Baniaga, CPA, CMA, MBA Page 9

You might also like

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Capital Budgeting HandoutDocument15 pagesCapital Budgeting HandoutJoshua Cabinas100% (2)

- Cat Bact 312 June 2018Document4 pagesCat Bact 312 June 2018JohnNo ratings yet

- Capital Budgeting With AnswersDocument9 pagesCapital Budgeting With AnswersishikiconsultancyNo ratings yet

- Mas 9509 Capital Budgeting PDFDocument19 pagesMas 9509 Capital Budgeting PDFjamesaguimanaNo ratings yet

- CAPITAL BUDGETING and COST OF CAPITALDocument4 pagesCAPITAL BUDGETING and COST OF CAPITALChrischelle MagauayNo ratings yet

- (Mas) 07 - Capital BudgetingDocument7 pages(Mas) 07 - Capital BudgetingCykee Hanna Quizo Lumongsod100% (1)

- Mas 08 - Capital BudgetingDocument7 pagesMas 08 - Capital BudgetingCarl Angelo Lopez100% (1)

- HLCapital BudgetingDocument4 pagesHLCapital BudgetingWilmer PascuaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingHamoudy DianalanNo ratings yet

- Capital Budgeting-Lecture NotesDocument6 pagesCapital Budgeting-Lecture NotesAngela Nicole CalimbasNo ratings yet

- Module 3 ARS PCC - Capital Budgeting and Cost of CapitalDocument11 pagesModule 3 ARS PCC - Capital Budgeting and Cost of CapitalJames Bradley HuangNo ratings yet

- Lecture Capital BudgetingDocument5 pagesLecture Capital BudgetingJenelyn FloresNo ratings yet

- MAS 10 - Capital BudgetingDocument10 pagesMAS 10 - Capital BudgetingClint AbenojaNo ratings yet

- MANACC Chapter19Document3 pagesMANACC Chapter19You DontknowmeNo ratings yet

- 09.1 Module in Financial Management 09Document8 pages09.1 Module in Financial Management 09Fire burnNo ratings yet

- Module in Financial Management - 09Document7 pagesModule in Financial Management - 09Karla Mae GammadNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingDianne TorresNo ratings yet

- Fin3 Midterm ExamDocument8 pagesFin3 Midterm ExamBryan Lluisma100% (1)

- Capital-Budgeting Quick NotesDocument6 pagesCapital-Budgeting Quick NotesAlliah Mae ArbastoNo ratings yet

- Alternatives.: Part 1: Factors Affecting Financial Modeling and Decision MakingDocument8 pagesAlternatives.: Part 1: Factors Affecting Financial Modeling and Decision MakingJessica RusNo ratings yet

- Net Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NDocument3 pagesNet Proceeds of Bond Sale Market Price NP I (Pvifa: KD, N N KD, NMich Elle CabNo ratings yet

- Non Discounted Techniques LectureDocument3 pagesNon Discounted Techniques Lectureamormi2702No ratings yet

- CapitDocument8 pagesCapitjanice100% (1)

- Mas 2 - 1304 Financial Management: Capital BudgetingDocument9 pagesMas 2 - 1304 Financial Management: Capital BudgetingVel JuneNo ratings yet

- Evaluation of Financial FeasibilityDocument25 pagesEvaluation of Financial FeasibilityDr Sarbesh Mishra86% (7)

- WelpDocument14 pagesWelparianas50% (2)

- FM 2marks AllDocument22 pagesFM 2marks AllMohamed AbzarNo ratings yet

- Capital Budgeting NotesDocument6 pagesCapital Budgeting NotesAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- AFM Exam Focus NotesDocument55 pagesAFM Exam Focus Notesmanish kumarNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingPaulomi LahaNo ratings yet

- Capital Budgeting NotesDocument2 pagesCapital Budgeting Noteszy jeiNo ratings yet

- AB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RDocument18 pagesAB1201 Financial Management Week 7: The Cost of Capital: Wacc W R (1-T) + W R + W RElaine TohNo ratings yet

- H.O For Cap BudDocument5 pagesH.O For Cap BudHallie KuronumaNo ratings yet

- AFM Exam Focus Notes 1st PartDocument28 pagesAFM Exam Focus Notes 1st Partmanish kumarNo ratings yet

- FM 2marks AllDocument22 pagesFM 2marks AllKathiresan NarayananNo ratings yet

- Module2 EconDocument45 pagesModule2 EconandreslloydralfNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- AFM - Cost of Capital - AE - Week 1Document41 pagesAFM - Cost of Capital - AE - Week 1AwaiZ zahidNo ratings yet

- UNIT-2 Investment DecisionsDocument17 pagesUNIT-2 Investment DecisionsJanaki Singh RathoreNo ratings yet

- Chapter 09 Im 10th EdDocument24 pagesChapter 09 Im 10th Edsri rahayu desraNo ratings yet

- Capital Budgeting TechniquesDocument4 pagesCapital Budgeting TechniquesVamsi SakhamuriNo ratings yet

- Strategic Cost Management: Module 6 Capital Budgeting Capital BudgetingDocument5 pagesStrategic Cost Management: Module 6 Capital Budgeting Capital BudgetingMon RamNo ratings yet

- Degerleme GelismeDocument32 pagesDegerleme GelismeferahNo ratings yet

- Capital Investments DecisionsDocument21 pagesCapital Investments DecisionsMelisandy LaguraNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingHarshitaNo ratings yet

- Valuation For Investment BankingDocument27 pagesValuation For Investment BankingK RameshNo ratings yet

- C2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!Document2 pagesC2: Basic Investment Appraisal Techniques: !! ALL Methods Use Relevant Cash Flows EXCEPT For ROCE !!didi dayana ishakNo ratings yet

- Capital Budgeting Decision Criteria: Chapter OrientationDocument24 pagesCapital Budgeting Decision Criteria: Chapter OrientationElizabeth StephanieNo ratings yet

- Chapter 13Document9 pagesChapter 13Diana Mark AndrewNo ratings yet

- Toaz - Info Chapter 11 PRDocument45 pagesToaz - Info Chapter 11 PRtaponic390No ratings yet

- S - Cap BudDocument29 pagesS - Cap BudHitesh AgjaNo ratings yet

- FFM Chapter 8Document5 pagesFFM Chapter 8Dawn CaldeiraNo ratings yet

- Economics Unit 2.1 NotesDocument9 pagesEconomics Unit 2.1 Notes3004 Divya Dharshini. MNo ratings yet

- P4 Advanced Financial Management SummaryDocument7 pagesP4 Advanced Financial Management SummaryHubert AnipaNo ratings yet

- MAS-42N (Capital Budgeting With Investment Risks - Returns)Document16 pagesMAS-42N (Capital Budgeting With Investment Risks - Returns)saligumba mikeNo ratings yet

- Fidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Document17 pagesFidelia Agatha - 2106715765 - Summary & Problem MK - Pertemuan Ke-5Fidelia AgathaNo ratings yet

- Fin Mar ReviewerDocument2 pagesFin Mar ReviewerPixie CanaveralNo ratings yet

- Slide CfaDocument295 pagesSlide CfaLinh HoangNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Front Page "A STUDY ON FINANCIAL PERFORMANCE WITH SPECIAL REFERENCE TO KSE LTD, IRINJALAKUDA"Document11 pagesFront Page "A STUDY ON FINANCIAL PERFORMANCE WITH SPECIAL REFERENCE TO KSE LTD, IRINJALAKUDA"HIJAS HAMSANo ratings yet

- BUSINESS FINANCE 2nd Quarter AssessmentDocument1 pageBUSINESS FINANCE 2nd Quarter AssessmentPhegiel Honculada MagamayNo ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- WLCON 2022 17A Annual ReportDocument35 pagesWLCON 2022 17A Annual ReportJamaica AlejoNo ratings yet

- Solution Manual For Essentials of Corporate Finance 10th by RossDocument38 pagesSolution Manual For Essentials of Corporate Finance 10th by Rossjohnniewalshhtlw100% (27)

- Hanni: IEOR 4402 #10 HWDocument7 pagesHanni: IEOR 4402 #10 HWZack ZhangNo ratings yet

- Financial Accounting PDFDocument21 pagesFinancial Accounting PDFTangent PcsNo ratings yet

- Investment DetectiveDocument25 pagesInvestment DetectiveTestNo ratings yet

- 2 The Regulatory Framework - PPSXDocument13 pages2 The Regulatory Framework - PPSXAbdelwahab Ahmed IbrahimNo ratings yet

- Financial Modeling CMDocument3 pagesFinancial Modeling CMAreeba Aslam100% (1)

- Beaver Ryan 2000Document23 pagesBeaver Ryan 2000Renan Barros LittigNo ratings yet

- Course Outline FinnDocument11 pagesCourse Outline FinnlaibaNo ratings yet

- Ac1101 Final Exam QuestionnaireDocument11 pagesAc1101 Final Exam QuestionnaireAngel ObligacionNo ratings yet

- The Following Information Is For Brittany Inc 1 To Be More PDFDocument1 pageThe Following Information Is For Brittany Inc 1 To Be More PDFTaimur TechnologistNo ratings yet

- Bank StatementDocument6 pagesBank StatementJayden PrasadNo ratings yet

- Investment Decisions: Capital BudgetingDocument29 pagesInvestment Decisions: Capital BudgetingAditya ChavanNo ratings yet

- Chapter 5 Stock AND Equity ValuationDocument9 pagesChapter 5 Stock AND Equity Valuationtame kibruNo ratings yet

- Case Study: S & S Air Goes Public: Submitted byDocument6 pagesCase Study: S & S Air Goes Public: Submitted byRaisul ZilaniNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1Document5 pagesUniversiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1KAY PHINE NGNo ratings yet

- Unit 9: Investment: Related Keynotes 1. Unit 5 Success (Pre-Intermediate Coursebook)Document3 pagesUnit 9: Investment: Related Keynotes 1. Unit 5 Success (Pre-Intermediate Coursebook)nhNo ratings yet

- Assignment in Interim ReportingDocument3 pagesAssignment in Interim ReportingVevien Anne AbarcaNo ratings yet

- Basic Accounting QuestionnaireDocument5 pagesBasic Accounting Questionnaireangeline bulacanNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- Chapter 14 Retail Inventory MethodDocument2 pagesChapter 14 Retail Inventory MethodDanielleNo ratings yet

- Far570 SoalanDocument7 pagesFar570 SoalanNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- PT Matahari Laporan KeuanganDocument61 pagesPT Matahari Laporan Keuanganwahyu k rahmanNo ratings yet

- Ppfas MF Factsheet For August 2022Document17 pagesPpfas MF Factsheet For August 2022saivenkatesh13No ratings yet