Professional Documents

Culture Documents

Proforma For Computation of PGBP Income

Proforma For Computation of PGBP Income

Uploaded by

Prateek Mishra0 ratings0% found this document useful (0 votes)

2 views3 pagesProforma For Computation Of PGBP Income - CA INTER

Original Title

Proforma For Computation Of PGBP Income

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProforma For Computation Of PGBP Income - CA INTER

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

2 views3 pagesProforma For Computation of PGBP Income

Proforma For Computation of PGBP Income

Uploaded by

Prateek MishraProforma For Computation Of PGBP Income - CA INTER

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

4.

174 INCOME TAX LAW

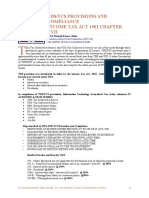

Proforma for computation of income under the head “Profits and gains of

business or profession"

Particulars Amount Amount

(`) (`)

Net profit as per statement of profit and loss A

Add: Expenses debited to statement of profit and loss but

not allowable

• Depreciation as per books of account xxx

• Income-tax [disallowed u/s 40(a)(ii)] xxx

• 30% of sum payable to residents on which tax is not xxx

deducted at source or has not been remitted on or

before the due date u/s 139(1), after deduction,

disallowed under section 40(a)(ia) [The same is

allowable in the year in which the tax is deducted

and remitted]

• Any expenditure incurred, in respect of which xxx

payment is made for goods, services or facilities to a

related person, to the extent the same is excessive or

unreasonable, in the opinion of the A.O, having

regard to its FMV [disallowed u/s 40A(2)]

• Any expenditure incurred in respect of which xxx

payment or aggregate of payments to a person

exceeding ` 10,000 in a single day is made otherwise

than by way of A/c payee cheque/bank draft/ use of

ECS through bank A/c or through such other

prescribed electronic mode (debit card, credit card,

Net banking, RTGS, NEFT, IMPS, BHIM Aadhar Pay)

[disallowed u/s 40A(3)]

• Certain sums payable by the assessee which have xxx

not been paid during the relevant P.Y. in which the

liability was incurred on or before the due date for

filing return u/s 139(1) in respect of that P.Y.

[disallowed u/s 43B]

• Personal expenses [not allowable as per section 37] xxx

• Capital expenditure [not allowable as per section 37] xxx

© The Institute of Chartered Accountants of India

PROFITS AND GAINS OF BUSINESS OR PROFESSION 4.175

• Repairs of capital nature [not allowable as per xxx

Sections 30 & 31]

• Amortization of preliminary expenditure u/s 35D/ xxx

expenditure incurred under voluntary retirement

scheme u/s 35DDA [4/5th of such expenditure to be

added back]

• Fine or penalty paid for infringement or breach of xxx

law [However, penalty in the nature of damages for

delay in completion of a contract, being

compensatory in nature, is allowable]

• All expenses related to income which is not taxable xxx

under this head e.g. municipal taxes in respect of

residential house property

• Any sum paid by the assessee as an employer by

way of contribution to pension scheme u/s 80CCD

exceeding 10% of the salary of the employee xxx B

(A + B) C

Less: Expenditure allowable as deduction but not debited

to statement of profit and loss

• Depreciation computed as per Rule 5 of Income-tax xxx

Rules, 1962

• Additional depreciation@20% of actual cost of new P & xxx

M acquired by an assessee engaged in the business of

manufacture or production of any article or thing or

generation, transmission or distribution of power (10% of

actual cost, if put to use for less than 180 days in the year

of acquisition) [Balance additional depreciation can be

claimed in the next year i.e., P.Y.2023-24]

• Balance additional depreciation @10% of actual cost of P

& M acquired and installed during the P.Y. 2021-22 and

put to use for less than 180 days in that year xxx D

(C - D) E

Less: Income credited in statement of profit and loss but

not taxable/taxable under any other head

• Dividend income xxx

• Agricultural income exempt under section 10(1) xxx

© The Institute of Chartered Accountants of India

4.176 INCOME TAX LAW

• Interest on securities/savings bank account/FD xxx

taxable under the head “Income from other sources”

• Profit on sale of capital asset taxable under the head xxx

“Capital Gains”

• Rent from house property taxable under the head xxx

“Income from house property”

• Winnings from lotteries, horse races, games etc. xxx

taxable under the head “Income from other sources”

• Gifts exempt or taxable under the head “Income xxx

from other sources”

• Income-tax refund not taxable xxx

• Interest on income-tax refund taxable under the

head “Income from other sources” xxx F

(E - F) G

Add: Income chargeable under this head/Deemed Income

• Salary, remuneration, interest received by a partner

from the firm, to the extent the same is deductible

in the hands of the firm as per section 40(b)

• Bad debt allowed as deduction u/s 36(1)(vii) in an xxx

earlier P.Y., now recovered [deemed as income u/s

41(4)]

• Remission or cessation of a trading liability [deemed

as income u/s 41(1)] xxx H

Profits and gains from business or profession (G + H) I

3.1 MEANING OF ‘BUSINESS’ AND ‘PROFESSION’

The tax payable by an assessee on his income under this head is in respect of the

profits and gains of any business or profession, carried on by him or on his

behalf during the previous year.

© The Institute of Chartered Accountants of India

You might also like

- Eopt Act Comparative SummaryDocument6 pagesEopt Act Comparative Summarybbc.moniqueNo ratings yet

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

- Financial Statement Analysis in ExcelDocument1 pageFinancial Statement Analysis in ExcelRaymond100% (1)

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- 74796bos60498 cp3 U3Document172 pages74796bos60498 cp3 U3000 26No ratings yet

- Unit - 3: Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToDocument166 pagesUnit - 3: Profits and Gains of Business or Profession: After Studying This Chapter, You Would Be Able ToSakshi SharmaNo ratings yet

- PGBPDocument189 pagesPGBPumakantNo ratings yet

- PGBP Material PDFDocument182 pagesPGBP Material PDFAmrutha V KNo ratings yet

- Income From Business and ProfessionDocument23 pagesIncome From Business and ProfessionAmit KumarNo ratings yet

- Profits and Gains of Business and ProfessionDocument41 pagesProfits and Gains of Business and ProfessionEsha BafnaNo ratings yet

- Final Tax Audit-JigarDocument20 pagesFinal Tax Audit-JigarJigar MehtaNo ratings yet

- General Principles Regarding Computation of Income Taxable Under The Head " Profits and Gains of Business or Profession "Document14 pagesGeneral Principles Regarding Computation of Income Taxable Under The Head " Profits and Gains of Business or Profession "Ayisha NasnaNo ratings yet

- Profits and Gains of Business or ProfessionDocument35 pagesProfits and Gains of Business or ProfessionnikkiNo ratings yet

- Income TaxationDocument50 pagesIncome Taxationjovicgaming41No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPHarsiddhi KotilaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPJuhi MarmatNo ratings yet

- Unit I: Income From Profits and Gains of Business or Profession'Document20 pagesUnit I: Income From Profits and Gains of Business or Profession'anuNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- 2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtDocument19 pages2) Income From Business (Head of Income) : Hamza Hashmi Advocate Hight CourtArham SheikhNo ratings yet

- Tax Planning and Financial Management Decisions: CA Aarti PatkiDocument50 pagesTax Planning and Financial Management Decisions: CA Aarti PatkiRahul SinghNo ratings yet

- Sec. 34 IRC-DeductionsDocument8 pagesSec. 34 IRC-DeductionsMav ZamoraNo ratings yet

- Business Income NotesDocument10 pagesBusiness Income NotesGODBARNo ratings yet

- Income Under The Head "Profits & Gain of Business or Profession"Document56 pagesIncome Under The Head "Profits & Gain of Business or Profession"Niraj Kumar SinhaNo ratings yet

- PGBPDocument14 pagesPGBPSaurav MedhiNo ratings yet

- Unit 2 B-CDocument20 pagesUnit 2 B-CAnish KartikNo ratings yet

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Deductions From Gross IncomeDocument23 pagesDeductions From Gross IncomeAidyl PerezNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Taxtion of Sole TradersDocument9 pagesTaxtion of Sole TradersAnaemesiobi DukeNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Unit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToDocument45 pagesUnit - 5: Income From Other Sources: After Studying This Chapter, You Would Be Able ToShantanuNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- L-20, 21 and 22: Profits and Gains From Business and ProfessionDocument27 pagesL-20, 21 and 22: Profits and Gains From Business and ProfessionShreyas SrivastavaNo ratings yet

- Some Issues On Practice of TDS Law Seminar by NIRCDocument29 pagesSome Issues On Practice of TDS Law Seminar by NIRCHarish KalidasNo ratings yet

- Income TaxDocument85 pagesIncome TaxvicsNo ratings yet

- Unit 2 - Income From Business or ProfessionDocument13 pagesUnit 2 - Income From Business or ProfessionRakhi DhamijaNo ratings yet

- Profits and Gains From Business or Profession-NotesDocument20 pagesProfits and Gains From Business or Profession-NotesReema Laser60% (5)

- CH - 4 Public Finace@2015 Part 1Document32 pagesCH - 4 Public Finace@2015 Part 1firaolmosisabonkeNo ratings yet

- Unit 3 Income From PGBP NotesDocument10 pagesUnit 3 Income From PGBP NotesKhushi SinghNo ratings yet

- Income From Other SourcesDocument5 pagesIncome From Other SourcesGovarthanan NarasimhanNo ratings yet

- TRAIN (Changes) ???? Pages 6 - 8Document3 pagesTRAIN (Changes) ???? Pages 6 - 8blackmail1No ratings yet

- Chapter 7 Business IncomeDocument30 pagesChapter 7 Business IncomeKailing KhowNo ratings yet

- Income Tax Law and It's Computation Sandeep KumarDocument33 pagesIncome Tax Law and It's Computation Sandeep KumarThe PaletteNo ratings yet

- CTFP Unit 2 PGBPDocument43 pagesCTFP Unit 2 PGBPKshitishNo ratings yet

- Section 194J: Fees For Professional or Technical ServicesDocument24 pagesSection 194J: Fees For Professional or Technical ServicesSAURABH TIBREWALNo ratings yet

- Icitss Project FileDocument21 pagesIcitss Project FileShrey JainNo ratings yet

- Profit and Gain of Business ProfessionDocument21 pagesProfit and Gain of Business ProfessionSamar GautamNo ratings yet

- Income From Other Sources: Click To Add TextDocument14 pagesIncome From Other Sources: Click To Add TextAlezNo ratings yet

- Profits and Gains From Business or Profession Notes 1Document42 pagesProfits and Gains From Business or Profession Notes 1Kr KvNo ratings yet

- Allowable DeductionsDocument7 pagesAllowable DeductionsCOLLET GAOLEBENo ratings yet

- Sec 30, ITO 1984Document2 pagesSec 30, ITO 1984johny SahaNo ratings yet

- Profits and Gains of Business or ProfessionDocument18 pagesProfits and Gains of Business or ProfessionSurya MuruganNo ratings yet

- 1 Deductions From Gross Income-FinalDocument24 pages1 Deductions From Gross Income-FinalSharon Ann BasulNo ratings yet

- 08 - PGBPDocument42 pages08 - PGBPMujtaba ZaidiNo ratings yet

- Profit and Gain From BusinessDocument12 pagesProfit and Gain From BusinessAlokNo ratings yet

- TAXABLE INCOME ReportDocument6 pagesTAXABLE INCOME ReportTrudgeOnNo ratings yet

- Lab 4Document3 pagesLab 4Sherry Mhay BongcayaoNo ratings yet

- Lesson 5 Global InequalityDocument19 pagesLesson 5 Global InequalityWinterson C. AmbionNo ratings yet

- Tarc Acc t13Document4 pagesTarc Acc t13Shirley VunNo ratings yet

- FM Cia 3Document29 pagesFM Cia 3Tanmay JainNo ratings yet

- Wassim Zhani Federal Taxation For Individuals (Chapter 6)Document38 pagesWassim Zhani Federal Taxation For Individuals (Chapter 6)wassim zhaniNo ratings yet

- Income From Capital GainDocument13 pagesIncome From Capital GainBhuvaneswari karuturiNo ratings yet

- Chapter 7 Measuring National IncomeDocument39 pagesChapter 7 Measuring National Incomehidayatul raihanNo ratings yet

- Basic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, DsnluDocument47 pagesBasic Oncepts of Income Tax: - Dr. P. Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- Chapter 5 - Final Income Taxation Chapter Overview and ObjectivesDocument22 pagesChapter 5 - Final Income Taxation Chapter Overview and ObjectivesCindy Felipe50% (2)

- Accounting Oral ExamDocument5 pagesAccounting Oral ExamalmmuuhNo ratings yet

- FAR 2841 - Equity-summary-DIYDocument4 pagesFAR 2841 - Equity-summary-DIYEira Shane100% (1)

- Page 1 of 10Document10 pagesPage 1 of 10Mercado JessicaNo ratings yet

- QuizDocument11 pagesQuizDanica RamosNo ratings yet

- Technical Note - Income Tax Proclamation No. 979-2016Document226 pagesTechnical Note - Income Tax Proclamation No. 979-2016Muhedin HussenNo ratings yet

- Taxation of Business Entities 2019 Edition 10th Edition Spilker Test BankDocument66 pagesTaxation of Business Entities 2019 Edition 10th Edition Spilker Test BankArthurOdonnellypzde100% (14)

- Edited - Professional Tax - GujaratDocument8 pagesEdited - Professional Tax - GujaratKhushboo PandeNo ratings yet

- Draft Syllabur For Financial Accounting and ReportingDocument5 pagesDraft Syllabur For Financial Accounting and ReportingBom VillatuyaNo ratings yet

- Final Fabm 1 G11week 1 4 HybridDocument34 pagesFinal Fabm 1 G11week 1 4 HybridKyla NicoleNo ratings yet

- TAX 1st Monthly-AssessmentDocument5 pagesTAX 1st Monthly-AssessmentEeuhNo ratings yet

- Pre Reading Material For Session 17 FA (Cash Flow)Document10 pagesPre Reading Material For Session 17 FA (Cash Flow)Rohit Roy100% (1)

- Tax Invoice: Shalini Swimming Pool Maintenance NO 81, Bhyatarayanadoddi Bhannerghatta Post Anekal Bangalore 560083Document1 pageTax Invoice: Shalini Swimming Pool Maintenance NO 81, Bhyatarayanadoddi Bhannerghatta Post Anekal Bangalore 560083sriharshamysuruNo ratings yet

- MA Final Exam: Topic 6: Cost-Volume-Profit AnalysisDocument2 pagesMA Final Exam: Topic 6: Cost-Volume-Profit AnalysisNurfairuz Diyanah RahzaliNo ratings yet

- HI 5020 Corporate Accounting: Session 8a Intra-Group TransactionsDocument15 pagesHI 5020 Corporate Accounting: Session 8a Intra-Group TransactionsFeku RamNo ratings yet

- Income Tax AuthoriesDocument13 pagesIncome Tax AuthoriesSrikara SimhaNo ratings yet

- Velasco PA506 Local-Fiscal-AdministrationDocument52 pagesVelasco PA506 Local-Fiscal-AdministrationCatherine AmicanNo ratings yet

- HCL Technologies Condensed Consolidated Interim Financial StatementsDocument47 pagesHCL Technologies Condensed Consolidated Interim Financial StatementsraxenNo ratings yet

- Ratio Analysis GoodDocument13 pagesRatio Analysis GoodA.Rahman SalahNo ratings yet