Professional Documents

Culture Documents

Incoterms 2020 - Leaflet

Incoterms 2020 - Leaflet

Uploaded by

cceleste0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesIncoterms 2020 - Leaflet

Incoterms 2020 - Leaflet

Uploaded by

ccelesteCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

eLearning module

Leading for results.

Incoterms® 2020 Learning for purpose.

Incoterms® is an acronym that stands for "International Commercial Terms". It is a series of

three-letter trade terms related to common contractual trading practices that can be used

in sales contracts. These clauses define the responsibilities and the obligations of the

buyer and the seller.

Scope Audience

This eLearning course provides a general This eLearning module is addressed to economic

overview of Incoterms® 2020 rules from both operators dealing with the trading of goods in the

the perspectives of the EU Customs & Tax customs territory of the European Union, and to

administrations and EU traders. customs and tax officials of EU national

administrations responsible for customs clearance

Incoterms® describe the party’s responsibility for formalities.

various expenses of the delivery of goods, such

Learning Outcomes

as loading the goods, arranging the transport

and insurance, processing the export and import The global objectives of the eLearning module are:

customs clearance etc. They also determine the ❖ Explain the particular delivery conditions of

transfer of risks in the event of damage to the each of the 11 Incoterms® 2020 rules;

goods during their transport. ❖ Facilitate the choice of the most appropriate

Incoterms® rule for the trading contracts

according to your needs, as the seller or the

buyer;

❖ Demonstrate how to complete the customs

declaration for the release of the goods for

free circulation in the EU for each Incoterms®

rule;

❖ Explain how Incoterms® are related to the

customs clearance and customs valuation.

❖ Highlight the benefits of the correct

application of Incoterms® in trade contracts.

To benefit fully from the course and to achieve the

learning outcomes, it is recommended to integrate

it in your own training programme and develop a

blended learning strategy.

1

Features Course duration

✓ The course is designed to be flexible and The time required to complete the course is

personalised. Users may start, pause and around 2 h and 45 minutes.

resume the course where they left off, at

their convenience.

✓ Real-life case stories help trainees apply Available languages

their theoretical knowledge and course The course is available in English. However,

assessment questions help evaluate their consult Customs and Tax EU Learning Portal for

understanding of the material. the availability of further EU language versions.

✓ In addition to the menu, a course map

allows users to quickly access the main

chapters of the course. The course map is Let’s get started!

conveniently placed in the vertical toolbar

✓ The eLearning module is publicly available via

located on the right side.

the Customs and Tax EU Learning portal for

✓ A course summary of the most relevant direct view.

information is available in a printable

✓ Troubleshoot technical issues and get help by

format. It’s also possible to print any course

clicking on “FAQ” or “Support” buttons of the

screen for future reference.

Customs and Tax EU Learning portal.

Find out more

Visit the Customs and Tax EU Learning Portal (europa.eu)

Contact DG TAXUD/E3 Management of Programmes & EU training

taxud-elearning@ec.europa.eu

You might also like

- Solution Manual For Principles of Economics 9th Edition N Gregory MankiwDocument18 pagesSolution Manual For Principles of Economics 9th Edition N Gregory MankiwVeronicaBurchcekij100% (87)

- Caf-03 Cma Sir Nasir Sp-23Document48 pagesCaf-03 Cma Sir Nasir Sp-23Riot Skin0% (1)

- Principles of Economics 8Th Edition Mankiw Solutions Manual Full Chapter PDFDocument38 pagesPrinciples of Economics 8Th Edition Mankiw Solutions Manual Full Chapter PDFJenniferWashingtonfbiqe100% (11)

- Consumer Mathematics Form 3 - Print - QuizizzDocument5 pagesConsumer Mathematics Form 3 - Print - QuizizzMATHANA SOORIA A/P ADEYAH Moe100% (3)

- ISO-TP Course PresentationDocument14 pagesISO-TP Course PresentationSarfaraz Barkat AliNo ratings yet

- A4 Cost Accounting PDFDocument249 pagesA4 Cost Accounting PDFGoodluck0% (1)

- International Economics 3rd SalvatoreDocument248 pagesInternational Economics 3rd Salvatorecrunch4444825279% (14)

- Delivery Service Invoice: May 15, 2021 Shipped FromDocument12 pagesDelivery Service Invoice: May 15, 2021 Shipped FromDanny Ernesto Bogado LòpezNo ratings yet

- BEAM Me Up For Better Projects - Independent Project Analysis (IPA)Document5 pagesBEAM Me Up For Better Projects - Independent Project Analysis (IPA)ccelesteNo ratings yet

- Operations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationFrom EverandOperations Management in Automotive Industries: From Industrial Strategies to Production Resources Management, Through the Industrialization Process and Supply Chain to Pursue Value CreationNo ratings yet

- 43 MW 2002 Used Wartsila 20V34SG Natural Gas GeneratorDocument3 pages43 MW 2002 Used Wartsila 20V34SG Natural Gas GeneratorccelesteNo ratings yet

- Incoterms Guide TFGDocument38 pagesIncoterms Guide TFGRamona Ion100% (1)

- Actividad de Proyecto 10Document3 pagesActividad de Proyecto 10Дажан Нйно ГутьеррезNo ratings yet

- CBAM Cement LeafletDocument2 pagesCBAM Cement LeafletBerat GündoğanNo ratings yet

- Authorised Economic Operator (Aeo) : Elearning ModuleDocument2 pagesAuthorised Economic Operator (Aeo) : Elearning ModuleMónika KunNo ratings yet

- Unreg User TemplateDocument2 pagesUnreg User TemplateCristina StanculescuNo ratings yet

- 05-Ucc Origin of GoodsDocument2 pages05-Ucc Origin of GoodsAliona JelescuNo ratings yet

- Core Syllabus Oct2011 Final AaeDocument11 pagesCore Syllabus Oct2011 Final AaeLuis MoreyraNo ratings yet

- Incoterms User GuideDocument8 pagesIncoterms User GuideBinh DoNo ratings yet

- EU Tax Competency Framework: Competencies DictionaryDocument34 pagesEU Tax Competency Framework: Competencies DictionaryDaiuk.DakNo ratings yet

- Acceptance Letter Erasmus TraineeshipDocument3 pagesAcceptance Letter Erasmus TraineeshipŞevvalNo ratings yet

- Customs Procedure PresentationDocument347 pagesCustoms Procedure PresentationbulanobariyawNo ratings yet

- CS1 - 2011 Delegates FolderDocument81 pagesCS1 - 2011 Delegates FolderLászló MéhesNo ratings yet

- Transfer Pricing and Safe Harbours: Veronika SolilováDocument12 pagesTransfer Pricing and Safe Harbours: Veronika SolilováDaniela PînteaNo ratings yet

- CFW For Private Sector Competency Dictionary enDocument21 pagesCFW For Private Sector Competency Dictionary enAyaghNo ratings yet

- Introducing A Commercial Off The Shelf Software SolutionDocument49 pagesIntroducing A Commercial Off The Shelf Software SolutionsashokreddyNo ratings yet

- Enforcing The Digital Markets Act - 1Document41 pagesEnforcing The Digital Markets Act - 1Competition Policy & LawNo ratings yet

- RTA R1 E Print PDFDocument135 pagesRTA R1 E Print PDFMohammad Tamzidul Islam100% (1)

- For A New Culture of Public Administration.: Excellence, Know-How and ValuesDocument20 pagesFor A New Culture of Public Administration.: Excellence, Know-How and ValuesMarija ErgicNo ratings yet

- Foundation Programme On Stock InvestingDocument1 pageFoundation Programme On Stock InvestingBasant RoutNo ratings yet

- BAN Curriculum NewDocument124 pagesBAN Curriculum Newgebrehiwoth12No ratings yet

- #04. Heavy-Lifterlong Range Drone Logistics MarketDocument32 pages#04. Heavy-Lifterlong Range Drone Logistics MarketRodgers OkeyaNo ratings yet

- Econs A LevelsDocument5 pagesEcons A LevelsSin GeeNo ratings yet

- Instructor'S Manual: Incoterms 2010Document2 pagesInstructor'S Manual: Incoterms 2010Norhidayah N ElyasNo ratings yet

- Oecd Brazil Transfer Pricing Call For Input On Issues Related To The Design of Safe Harbour ProvisionsDocument18 pagesOecd Brazil Transfer Pricing Call For Input On Issues Related To The Design of Safe Harbour Provisionsvoyager8002No ratings yet

- ESP BagusDocument303 pagesESP BagusMiss EciNo ratings yet

- Proyecto 10 Evidencia 3Document9 pagesProyecto 10 Evidencia 3edna karina ortega carvajalNo ratings yet

- Evidencia 10-3Document5 pagesEvidencia 10-3johanNo ratings yet

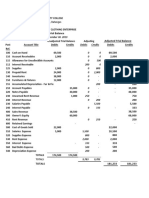

- Module 1a Cost Volume Profit AnalysisDocument8 pagesModule 1a Cost Volume Profit AnalysisStaid LynxNo ratings yet

- Transfer Pricing Documentation Model 180-498-FinalDocument19 pagesTransfer Pricing Documentation Model 180-498-FinalstormforecasterNo ratings yet

- Level I IT Support ServiceDocument53 pagesLevel I IT Support Serviceyirgalemle ayeNo ratings yet

- Smart Textiles For Sports: Report On Promising Kets-Based Products Nr. 1Document24 pagesSmart Textiles For Sports: Report On Promising Kets-Based Products Nr. 1Amna FarooquiNo ratings yet

- TX-UK J24-M25 Syllabus and Study Guide - FinalDocument24 pagesTX-UK J24-M25 Syllabus and Study Guide - FinalKhin Lapyae TunNo ratings yet

- Long Intl Commercial Awareness Training For EPC ProjectsDocument8 pagesLong Intl Commercial Awareness Training For EPC ProjectsgordonNo ratings yet

- Actividad de Aprendizaje (Incoterms) (Realizado)Document9 pagesActividad de Aprendizaje (Incoterms) (Realizado)franklin sinisterra rivasNo ratings yet

- 19nov ESIF and SoE Businesses - BruzzoneDocument10 pages19nov ESIF and SoE Businesses - BruzzoneSayuri ItoNo ratings yet

- Course Title: Cost Accounting Course Code:441 BBA Program: 05/15/2021 Mrdi/Ewubd/Act441Document25 pagesCourse Title: Cost Accounting Course Code:441 BBA Program: 05/15/2021 Mrdi/Ewubd/Act441Tanvir Ahmed ChowdhuryNo ratings yet

- Information Technology Support Service: Model CurriculumDocument53 pagesInformation Technology Support Service: Model CurriculumFiraolNo ratings yet

- Evidencia 10-3Document5 pagesEvidencia 10-3johan100% (3)

- Onboard Org Learning Module 2Document44 pagesOnboard Org Learning Module 2Miguel AlexandreNo ratings yet

- Guidelines For Developing A Mutual Recognition Arrangement/agreementDocument43 pagesGuidelines For Developing A Mutual Recognition Arrangement/agreementLia RayyaNo ratings yet

- EMSATRA202101 Spring CallDocument5 pagesEMSATRA202101 Spring CallMaria PopescuNo ratings yet

- WTO E-Learning Course CatalogueDocument22 pagesWTO E-Learning Course Cataloguellhllh 578No ratings yet

- Blueprint For Sectoral Cooperation On Skills: SpaceDocument12 pagesBlueprint For Sectoral Cooperation On Skills: Spacejovares2099No ratings yet

- Babcock University Acct 534 Lecture 5 Transfer PricingDocument28 pagesBabcock University Acct 534 Lecture 5 Transfer Pricingamehdebby1410No ratings yet

- Hari Mahardika Sembiring: Summary of QualificationDocument2 pagesHari Mahardika Sembiring: Summary of QualificationHari Mahardika BirinkNo ratings yet

- DOCOMO's Change and Challenge To Achieve New GrowthDocument6 pagesDOCOMO's Change and Challenge To Achieve New GrowthudaybadriNo ratings yet

- Cost Accounting and Control: Trainer'S ManualDocument123 pagesCost Accounting and Control: Trainer'S ManualMae Sumalo FabrigasNo ratings yet

- Technical Report Writing in The Maritime & Offshore IndustryDocument4 pagesTechnical Report Writing in The Maritime & Offshore IndustryIke MaduforoNo ratings yet

- 178 00 ADIT Paper-IIIF-Transfer-Pricing-Manual Combined PDFDocument336 pages178 00 ADIT Paper-IIIF-Transfer-Pricing-Manual Combined PDFCristina IancuNo ratings yet

- Maneco Week6Document32 pagesManeco Week6johnrouge.molina0No ratings yet

- Workshop. Understanding How To Become A Smart ExplorerDocument6 pagesWorkshop. Understanding How To Become A Smart ExplorerPaola GarciaNo ratings yet

- ITC-IP-11-2024 Fibres, Textiles and Clothing Unit InternDocument3 pagesITC-IP-11-2024 Fibres, Textiles and Clothing Unit Internsanjibmukherjee080377No ratings yet

- Preventing Retail Shrinkage Measuring ValueDocument68 pagesPreventing Retail Shrinkage Measuring Valueramjee prasad jaiswalNo ratings yet

- Jul 00 Codeco 0010Document117 pagesJul 00 Codeco 0010Serge Tahou Maillot JauneNo ratings yet

- Sustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010From EverandSustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010No ratings yet

- 1EU carbon market expansion to raise diesel pricesDocument4 pages1EU carbon market expansion to raise diesel pricesccelesteNo ratings yet

- Grasping The PotentialDocument1 pageGrasping The PotentialccelesteNo ratings yet

- Best Practices Site Based ProjectsDocument2 pagesBest Practices Site Based ProjectsccelesteNo ratings yet

- An Assessment of Small Scale LNG Applications in The Mediterranean RegionDocument59 pagesAn Assessment of Small Scale LNG Applications in The Mediterranean RegionccelesteNo ratings yet

- Combined Cycle Power Plants: Tuba Turbine GMBH Resale List - Februar 2017 - Power and Industrial Plants For SaleDocument4 pagesCombined Cycle Power Plants: Tuba Turbine GMBH Resale List - Februar 2017 - Power and Industrial Plants For SaleccelesteNo ratings yet

- Used 3128kW Gas Engine Generator X 7 Units GE Jenbacher 60hz 2008Document12 pagesUsed 3128kW Gas Engine Generator X 7 Units GE Jenbacher 60hz 2008ccelesteNo ratings yet

- TBGT Catalog1 enDocument6 pagesTBGT Catalog1 enccelesteNo ratings yet

- Thormod+Moss+maritime+MALTA+LNG+Floating+Storage+Unit+ (FSU) FINAL+Document12 pagesThormod+Moss+maritime+MALTA+LNG+Floating+Storage+Unit+ (FSU) FINAL+ccelesteNo ratings yet

- Estimating Capital Cost of Small Scale LNG CarrierDocument5 pagesEstimating Capital Cost of Small Scale LNG CarrierccelesteNo ratings yet

- DHI Vessel Hull Data Sheets: Additional Vessels Data BaseDocument55 pagesDHI Vessel Hull Data Sheets: Additional Vessels Data BaseccelesteNo ratings yet

- Unveiling The Natural Gas Opportunity in The Caribbean en enDocument73 pagesUnveiling The Natural Gas Opportunity in The Caribbean en enccelesteNo ratings yet

- Study On Gas To Power Project Value Chain in The South VietnamDocument317 pagesStudy On Gas To Power Project Value Chain in The South VietnamccelesteNo ratings yet

- LNG LoadoutDocument2 pagesLNG LoadoutccelesteNo ratings yet

- LNT80 - 80,000m LNG Carrier: Main Dimensions Machinery & PropulsionDocument2 pagesLNT80 - 80,000m LNG Carrier: Main Dimensions Machinery & PropulsionccelesteNo ratings yet

- Safety in The Liquefied Natural Gas (LNG) Value Chain An Aiche Live WebinarDocument43 pagesSafety in The Liquefied Natural Gas (LNG) Value Chain An Aiche Live WebinarccelesteNo ratings yet

- Gas Natural Aprovisionamientos, SDG, S.A. v. Atlantic LNG Company of Trinidad and TobagoDocument5 pagesGas Natural Aprovisionamientos, SDG, S.A. v. Atlantic LNG Company of Trinidad and TobagoccelesteNo ratings yet

- Distribution Management CHAPTER 4Document10 pagesDistribution Management CHAPTER 4Marielle DauzNo ratings yet

- Angel Construction 15-02-24 32Document1 pageAngel Construction 15-02-24 32Amman Arul TransportNo ratings yet

- Form 05 Cusdec Ro Blank App p1 p2Document3 pagesForm 05 Cusdec Ro Blank App p1 p2chamith.transcoNo ratings yet

- Africa Leads Business Report 2017Document21 pagesAfrica Leads Business Report 2017B. GothNo ratings yet

- Draft. INV PDFDocument1 pageDraft. INV PDFPatricio ValenciaNo ratings yet

- Ae18-005-Central Banking and The Effects of Its Monetary Policies in Our EconomyDocument15 pagesAe18-005-Central Banking and The Effects of Its Monetary Policies in Our EconomyLaezelie SorianoNo ratings yet

- Jan 2022Document5 pagesJan 2022BHASKAR pNo ratings yet

- Abel Macro8c TIF Ch01-2Document14 pagesAbel Macro8c TIF Ch01-2Mr.TNo ratings yet

- Icc Incoterms 2020Document10 pagesIcc Incoterms 2020ngnvanh94No ratings yet

- Consingment Process2Document8 pagesConsingment Process2RP TechNo ratings yet

- Set Documentos MercantilesDocument44 pagesSet Documentos MercantilesDANNY WALTER REYMUNDO ARROYONo ratings yet

- AE 25 Module 1 Lesson 1Document99 pagesAE 25 Module 1 Lesson 1Queeny Mae Cantre ReutaNo ratings yet

- Financial Analysis ReportDocument26 pagesFinancial Analysis ReportMustafa MahmoodNo ratings yet

- VILLASISDocument2 pagesVILLASISJan Mikel G. GloriaNo ratings yet

- Aritra - Banerjee (128) FIIB CIP 2019 Project ReportDocument71 pagesAritra - Banerjee (128) FIIB CIP 2019 Project ReportAritra BanerjeeNo ratings yet

- FABM1 11 Quarter 4 Week 4 Las 1Document4 pagesFABM1 11 Quarter 4 Week 4 Las 1Janna PleteNo ratings yet

- Introduction To Financial Derivatives: Presented by Arjun Parthasarathy 28 June 2006Document39 pagesIntroduction To Financial Derivatives: Presented by Arjun Parthasarathy 28 June 2006Harsh ShahNo ratings yet

- Form E: (Combined Declaration and Certificate)Document1 pageForm E: (Combined Declaration and Certificate)LELANo ratings yet

- Std. X Ch. 3 Money and Credit WS (21 - 22)Document3 pagesStd. X Ch. 3 Money and Credit WS (21 - 22)YASHVI MODINo ratings yet

- Toaz - Info Blades Case CH 7 PRDocument14 pagesToaz - Info Blades Case CH 7 PRjq7gsm6zb2No ratings yet

- Chow Company Maintains A Petty Cash Fund For Small ExpendituresDocument1 pageChow Company Maintains A Petty Cash Fund For Small Expenditurestrilocksp SinghNo ratings yet

- Coal Trader International 02-06-2023Document14 pagesCoal Trader International 02-06-2023kahoutgNo ratings yet

- Original PDF Modern Corporate Finance Theory and Practice 8th Edition PDFDocument22 pagesOriginal PDF Modern Corporate Finance Theory and Practice 8th Edition PDFtiffany.gonzalez180100% (43)

- Momin 1408101063900Document12 pagesMomin 1408101063900mominalibaigNo ratings yet

- (1920) Black Man's Burden by Edmund Dene Morel (1873-1924)Document268 pages(1920) Black Man's Burden by Edmund Dene Morel (1873-1924)Herbert Hillary Booker 2nd100% (3)

- Attachments To Suhay Cash Position 2021-08-002Document42 pagesAttachments To Suhay Cash Position 2021-08-002Eloiza Lajara RamosNo ratings yet