Professional Documents

Culture Documents

Accounting For GF Class Illustrations

Accounting For GF Class Illustrations

Uploaded by

firaolmosisabonkeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For GF Class Illustrations

Accounting For GF Class Illustrations

Uploaded by

firaolmosisabonkeCopyright:

Available Formats

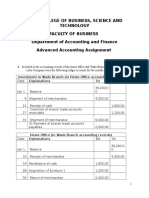

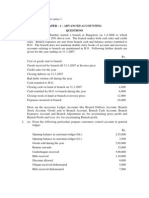

Accounting for General Funds Illustration for Class

Below is the Balance Sheet of town of X General fund on June 30, year 5 and the annual

budgets adopted for the year ended June 30, year 6.

Town of X General Fund

Balance Sheet June 30, year 5

Assets

Cash 1,600,000

Inventory of supplies 400,000

Total Assets 2,000,000

Liabilities and Fund Balance

Vouchers payable 800,000

Fund balance:

Reserved for encumbrance 400,000

Unreserved and undesignated 800,000 1,200,000

Total liabilities and fund balance 2,000,000

Required:

A. Make the necessary Journal for the following Journal entries:

1. Record the budget for the year for Town X

2. Property taxes were billed in the amount of 7,200,000 of which 140,000 was of doubtful

collectability.

3. A total of 6,500,000 amount of Property tax were collected and a total of 1,020,000

amount of cash from other revenue sources like licenses and permits, fines and forfeits,

miscellaneous sources were also collected.

4. Property taxes in the amount of 130,000 were uncollectable.

5. Purchase orders for non-recurring expenditures were issued to outside suppliers in the total

amount of 3,600,000

6. Expenditures for the year totaled 7,600,000 of which 900,000 applied to the acquisitions

of supplies and 3,500,000 applied to 3,550,000 of the purchase orders in the total

amount of 3,600,000 issued during the year.(assume consumption method).

7. Billings for services and supplies received from enterprise fund and internal service fund

totaled 300,000 and 200,000 respectively.

8. Cash payments on vouchers payable totaled 7,700,000. Cash payment to the Enterprise

fund and the internal service fund were 250,000 and 140,000 respectively.

9. The town of X general fund made an operating transfer of 110,000 to the debt service

fund for the matured principal and interests.

10. A payment of 400,000 in lieu of property taxes and a subsidy of 100,000 were received

from the Enterprise fund.

11. Supplies at a cost of 800,000 were used during the year.

12. All uncollected property taxes on June 30 year 6 were delinquent

13. The town council designated 250,000 of the unreserved and the undesignated fund

balance for the replacement of equipment during the year ending June 30, year 7.

B. Prepare Trial balance at end of fiscal year for a General fund

C. Prepare Financial statements for a GF and Prepare Closing Entries for a General Fund

1|Page Compiled by Tekalign Negash

You might also like

- Rajaneesh Company - Cash FlowsDocument3 pagesRajaneesh Company - Cash FlowsAyushi Aggarwal0% (2)

- Balance Sheet Valix C1ValixDocument14 pagesBalance Sheet Valix C1Valixmaryqueenramos79% (24)

- MC - Exercises On Donor's Tax (PRTC)Document12 pagesMC - Exercises On Donor's Tax (PRTC)Anna Charlotte50% (4)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Problems: Set C: InstructionsDocument2 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- NFP AssDocument9 pagesNFP AssAbdii Dhufeera100% (2)

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- Accounting For Special Transactions Partnership AccountingDocument15 pagesAccounting For Special Transactions Partnership AccountingJessaNo ratings yet

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- Cash Flow Exercises Set 1Document3 pagesCash Flow Exercises Set 1chiong0% (1)

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Fringe Benefits Test BankDocument12 pagesFringe Benefits Test BankAB Cloyd100% (1)

- Govt ch3Document21 pagesGovt ch3Belay MekonenNo ratings yet

- Chapter Four-Part I: Accounting For Governmental FundsDocument28 pagesChapter Four-Part I: Accounting For Governmental FundsabateNo ratings yet

- Fund FinalDocument3 pagesFund FinalAbdi Mucee TubeNo ratings yet

- General and Special Revenue FundDocument4 pagesGeneral and Special Revenue Fundfuffun6No ratings yet

- The Problems of Hospital AccountingDocument3 pagesThe Problems of Hospital AccountingPoppy VaniaNo ratings yet

- Exercises Chapter 2Document3 pagesExercises Chapter 2Phương NguyênNo ratings yet

- Soal LatihanDocument15 pagesSoal LatihanRafi FarrasNo ratings yet

- Individual Assignment Fundamentals of Acct ch-2Document5 pagesIndividual Assignment Fundamentals of Acct ch-2Gutema BekeleNo ratings yet

- Practice QuestionsDocument15 pagesPractice QuestionsKumarNo ratings yet

- Statement of Financial Position SFPDocument39 pagesStatement of Financial Position SFPAilyn del Puerto50% (2)

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Funds Flow StatementDocument5 pagesFunds Flow StatementAshfaq ZameerNo ratings yet

- Mock Midterm Exam - QuestionnaireDocument13 pagesMock Midterm Exam - QuestionnaireMaeNo ratings yet

- Govt & NFP Accounting - Ch7Document23 pagesGovt & NFP Accounting - Ch7Bikila MalasaNo ratings yet

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Corporate LiquidationDocument6 pagesCorporate LiquidationAngelieNo ratings yet

- Introduction To Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesIntroduction To Financial Accounting: The Institute of Chartered Accountants of PakistanadnanNo ratings yet

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDocument3 pagesAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNo ratings yet

- P1 1Document12 pagesP1 1Donna Mae Hernandez0% (1)

- Fundamental - I WorksheetDocument3 pagesFundamental - I WorksheetuuuNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- AAT Model Paper 2019 JulDocument6 pagesAAT Model Paper 2019 JulShihan HaniffNo ratings yet

- Cash FlowDocument6 pagesCash FlowVeron Briones0% (1)

- Individual AssignmentDocument5 pagesIndividual AssignmentMuhammad Faiyam Shafiq 1911819630No ratings yet

- Dipifr 2003 Dec QDocument10 pagesDipifr 2003 Dec QWesley JenkinsNo ratings yet

- P1 QuestionsDocument11 pagesP1 QuestionsjustjadeNo ratings yet

- Half Yearly Examination (2015 - 16) Class - XII General InstructionsDocument5 pagesHalf Yearly Examination (2015 - 16) Class - XII General Instructionsmarudev nathawatNo ratings yet

- Topic 3 Accounting For Incomplete RecordsDocument25 pagesTopic 3 Accounting For Incomplete Recordstwahirwajeanpierre50No ratings yet

- Workshop 5 QuestionsDocument3 pagesWorkshop 5 QuestionsJingwen YangNo ratings yet

- General Instruction: Auditing, Part II: Instruction To Fund AccountingDocument5 pagesGeneral Instruction: Auditing, Part II: Instruction To Fund AccountingtemedebereNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Joint Arrangement Quizzer 2 AnswerDocument12 pagesJoint Arrangement Quizzer 2 AnswerAndrea ReyesNo ratings yet

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- Far NosolnDocument11 pagesFar NosolnStela Marie CarandangNo ratings yet

- Fund Flow StatementDocument7 pagesFund Flow StatementvipulNo ratings yet

- Buttons ENGDocument2 pagesButtons ENGisabella.desa04No ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Assignment FA IIDocument5 pagesAssignment FA IIdiprajbarua1234No ratings yet

- Finaltest Advanced2023 (N)Document3 pagesFinaltest Advanced2023 (N)JeonNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- The City of Merlot Operates A Central Garage Through An: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe City of Merlot Operates A Central Garage Through An: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- Practice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountDocument3 pagesPractice Worksheet 2 For Admission: March 2018 Stood As Liabilities Amount Assets AmountAaira IbrahimNo ratings yet

- Group Assignment Accounting Cycle - ADDocument4 pagesGroup Assignment Accounting Cycle - ADShewatatek MelakuNo ratings yet

- Sale of PartnershipDocument11 pagesSale of PartnershipJoel VargheseNo ratings yet

- Acc For Public Sector CH 3Document36 pagesAcc For Public Sector CH 3Tegene TesfayeNo ratings yet

- Exercises On Errors - Suspense Account and Control AccountsDocument6 pagesExercises On Errors - Suspense Account and Control AccountsjackrobertodiraNo ratings yet

- Chapter 4 and Other Questions Chapters 1 To 5Document8 pagesChapter 4 and Other Questions Chapters 1 To 5Beatrice BallabioNo ratings yet

- Cover Letter - TemplateDocument1 pageCover Letter - TemplatefiraolmosisabonkeNo ratings yet

- CH - 4 Public Finace@2015 Part 1Document32 pagesCH - 4 Public Finace@2015 Part 1firaolmosisabonkeNo ratings yet

- CHAPTER 4 Consolidation Subse To Date of Acquisitio 2023Document12 pagesCHAPTER 4 Consolidation Subse To Date of Acquisitio 2023firaolmosisabonkeNo ratings yet

- Chapter Two CostDocument20 pagesChapter Two CostfiraolmosisabonkeNo ratings yet

- EquityDocument17 pagesEquityfiraolmosisabonkeNo ratings yet

- Financial Management Answer and ExplanationDocument31 pagesFinancial Management Answer and ExplanationfiraolmosisabonkeNo ratings yet

- Foreign Currency TransactionsDocument9 pagesForeign Currency TransactionsfiraolmosisabonkeNo ratings yet

- Financial Management QuestionsDocument42 pagesFinancial Management QuestionsfiraolmosisabonkeNo ratings yet

- Strategic Management ModuleDocument144 pagesStrategic Management ModulefiraolmosisabonkeNo ratings yet

- Chapter 1 Capital Structure Policy and Leverage FM-II 2015Document109 pagesChapter 1 Capital Structure Policy and Leverage FM-II 2015firaolmosisabonkeNo ratings yet

- Operation Management Chapter OneDocument54 pagesOperation Management Chapter OnefiraolmosisabonkeNo ratings yet

- Briefing Paper May JeenDocument2 pagesBriefing Paper May Jeenapi-583392653No ratings yet

- Income From Property: by NJDocument8 pagesIncome From Property: by NJUmar ZahidNo ratings yet

- Ass Assessment of Companies.Document11 pagesAss Assessment of Companies.Safa100% (1)

- Pillar Two GloBE Rules Fact SheetsDocument6 pagesPillar Two GloBE Rules Fact SheetsHaryo BagaskaraNo ratings yet

- Tax Ch02Document10 pagesTax Ch02GabriellaNo ratings yet

- ITR 1 - AY 2023-24 - V1.3.xlsmDocument18 pagesITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- Business IncomeDocument15 pagesBusiness IncomeSarvar PathanNo ratings yet

- .Part - II - Sec.I - Direct TaxesDocument235 pages.Part - II - Sec.I - Direct TaxesJay Sangoi71% (7)

- Hershey Sabino (Also Known As "Contractor") Will Provide Brettonwoods Veterinary Clinic (Also Known As "Client") WithDocument1 pageHershey Sabino (Also Known As "Contractor") Will Provide Brettonwoods Veterinary Clinic (Also Known As "Client") WithHershey Ramos SabinoNo ratings yet

- New York State Film Tax CreditDocument2 pagesNew York State Film Tax CreditIvan AraqueNo ratings yet

- Application Form of .32 Pistol For DealersDocument3 pagesApplication Form of .32 Pistol For DealersAmanpreet SinghNo ratings yet

- Rental QuarterlyDocument2 pagesRental QuarterlyJhel AmbrocioNo ratings yet

- (123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFDocument4 pages(123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFTrung HậuNo ratings yet

- Computation of Total Income For ItrDocument2 pagesComputation of Total Income For Itravisinghoo7No ratings yet

- Income Tax Numericals SolutionsDocument9 pagesIncome Tax Numericals SolutionsBrown BoiNo ratings yet

- Accounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnDocument51 pagesAccounting For Governmental & Nonprofit Entities: Jacqueline L. Reck Suzanne L. LowensohnHibaaq AxmedNo ratings yet

- Combined EnfacementDocument1 pageCombined EnfacementkumarNo ratings yet

- Group 8 Assignment No. 3Document4 pagesGroup 8 Assignment No. 3Van Joshua NunezNo ratings yet

- PROBLEM 1. (Current and Non-Current Liabilities) : To Record The Purchase of Knives As PremiumsDocument2 pagesPROBLEM 1. (Current and Non-Current Liabilities) : To Record The Purchase of Knives As PremiumsDanica RamosNo ratings yet

- FA Student GuideDocument107 pagesFA Student GuideASHUTOSH UPADHYAYNo ratings yet

- Taxation of Partnerships (Autosaved)Document9 pagesTaxation of Partnerships (Autosaved)MosesNo ratings yet

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- Extrajudicial Settlement of An EstateDocument4 pagesExtrajudicial Settlement of An EstatePAMELA DOLINA100% (1)

- City FY 2020-21 Proposed BUDGETDocument601 pagesCity FY 2020-21 Proposed BUDGETWXXI NewsNo ratings yet

- ACCOUNTING Chap.4. Adjusting The AccountsDocument6 pagesACCOUNTING Chap.4. Adjusting The AccountsKyla NavaretteNo ratings yet