Professional Documents

Culture Documents

Tax

Tax

Uploaded by

Karan PrabaCopyright:

Available Formats

You might also like

- ME-Tut 4Document2 pagesME-Tut 4Shekhar SinghNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- T11 Relief&Rebates Student Oct 2021Document5 pagesT11 Relief&Rebates Student Oct 2021CHAN KER XINNo ratings yet

- Compensation Income Tax2 1Document1 pageCompensation Income Tax2 1Loudie Ann MarcosNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Computation of Total IncomeDocument13 pagesComputation of Total IncomeamitpdabkeNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- IT 2ndDocument2 pagesIT 2ndHarish NaikNo ratings yet

- Taxation Management (FIN623) : Assignment # 02Document2 pagesTaxation Management (FIN623) : Assignment # 02Rajesh KumarNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Assignment On SalaryDocument4 pagesAssignment On SalarySohel MahmudNo ratings yet

- Business Math Lesson1 Week 3Document6 pagesBusiness Math Lesson1 Week 3REBECCA BRIONES0% (1)

- Assignment TaxationDocument2 pagesAssignment TaxationDilruba HassanNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- All Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39Document14 pagesAll Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39ibsituabdelaNo ratings yet

- All Level Two Coc QuestionsDocument15 pagesAll Level Two Coc Questionsabelu habite neriNo ratings yet

- N GELSEDocument3 pagesN GELSEabim manyuuNo ratings yet

- AssignmentDocument5 pagesAssignmentMd. Alif HossainNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- May 2021 Test 1 QuestionDocument6 pagesMay 2021 Test 1 Questionxfs5k9m8stNo ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- Tax 5301 Mid 2Document1 pageTax 5301 Mid 2Sabuj BhowmikNo ratings yet

- Personal Tax PlanningDocument21 pagesPersonal Tax PlanningAjay DhawalNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Enc Encoded A0nNFhan9Jl78cAySc2AolaE2Yye0 HIgHbnr6loXue2yScW3KSbxZwM1pJvw6EDocument8 pagesEnc Encoded A0nNFhan9Jl78cAySc2AolaE2Yye0 HIgHbnr6loXue2yScW3KSbxZwM1pJvw6Eharwoko yokoNo ratings yet

- TaxationDocument8 pagesTaxationKaran PrabaNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- TAX Papers - Paper 1Document2 pagesTAX Papers - Paper 1syedshahNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Class 4 QuestionsDocument5 pagesClass 4 Questionsbaqarnaqvi6204No ratings yet

- Illustration 3Document9 pagesIllustration 3AzizNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Class Activity 2 Principles of MicroeconomicsDocument1 pageClass Activity 2 Principles of MicroeconomicsTooba NoushadNo ratings yet

- 0H9SNRYTRDocument16 pages0H9SNRYTRLoey ParkNo ratings yet

- Soal UTS 2011Document5 pagesSoal UTS 201127.Enggar ApriyaniNo ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- 5 (1) .Tax PlanningDocument19 pages5 (1) .Tax Planningabhi+shekNo ratings yet

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- Estate TutorialDocument4 pagesEstate TutorialpremsuwaatiiNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- DFI 201 Assignment 1Document1 pageDFI 201 Assignment 1raina mattNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Taxation Law Review Final ExaminationsDocument4 pagesTaxation Law Review Final ExaminationsRufino Gerard MorenoNo ratings yet

- Taxable & Nontaxable BenefitsDocument16 pagesTaxable & Nontaxable BenefitsKARENNo ratings yet

- Revision QNWDocument9 pagesRevision QNWKaran PrabaNo ratings yet

- 8 Wonders of The WorldDocument8 pages8 Wonders of The WorldKaran PrabaNo ratings yet

- Hemato MCQ 1Document5 pagesHemato MCQ 1Karan PrabaNo ratings yet

- Cambridge IGCSE: Biology 0610/13Document12 pagesCambridge IGCSE: Biology 0610/13Karan PrabaNo ratings yet

- BacterDocument6 pagesBacterKaran PrabaNo ratings yet

- Algebraic Equation Questions'Document4 pagesAlgebraic Equation Questions'Karan PrabaNo ratings yet

- Nervous Systerm QDocument15 pagesNervous Systerm QKaran PrabaNo ratings yet

- Acid 2 QDocument7 pagesAcid 2 QKaran PrabaNo ratings yet

- Cambridge IGCSE: Biology 0610/11Document16 pagesCambridge IGCSE: Biology 0610/11Karan PrabaNo ratings yet

- Ee Revision 9Document4 pagesEe Revision 9Karan PrabaNo ratings yet

- 4b. Laws of Logarithms Further Questions - AnswersDocument2 pages4b. Laws of Logarithms Further Questions - AnswersKaran PrabaNo ratings yet

- Ee Revision 6Document8 pagesEe Revision 6Karan PrabaNo ratings yet

Tax

Tax

Uploaded by

Karan PrabaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Tax

Uploaded by

Karan PrabaCopyright:

Available Formats

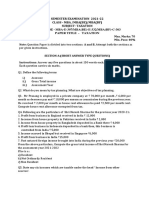

1. Encik Khairul has an annual income of RM125 300, including allowances.

It is

given that the allowances amounting to RM12 340 are tax exempted. At the same

time, he has made a donation to a library amounting to RM2 000. The total tax

relief, on the other hand, is RM22 500. Calculate Encik Khairul’s chargeable

income.

2. Mr Lim’s annual salary was RM74 000 in 2020. He claimed the following tax reliefs:

individual for RM9 000, life insurance and EPF for RM7 000, medical insurance for

RM1 325 and medical treatment expenses for his mother for RM1 250. He has also

donated RM1 000 to an approved welfare centre. His salary was deducted monthly

by RM180 for monthly tax deduction (PCB).

(a) Calculate the income tax payable for that year.

(b) Does Mr Lee need to pay any more income tax after the monthly deductions?

Explain your answer.

You might also like

- ME-Tut 4Document2 pagesME-Tut 4Shekhar SinghNo ratings yet

- Accumt PDFDocument3 pagesAccumt PDFFatema HossainNo ratings yet

- T11 Relief&Rebates Student Oct 2021Document5 pagesT11 Relief&Rebates Student Oct 2021CHAN KER XINNo ratings yet

- Compensation Income Tax2 1Document1 pageCompensation Income Tax2 1Loudie Ann MarcosNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- Tax Assignment For FinalDocument4 pagesTax Assignment For FinalEnaiya IslamNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Computation of Total IncomeDocument13 pagesComputation of Total IncomeamitpdabkeNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- IT 2ndDocument2 pagesIT 2ndHarish NaikNo ratings yet

- Taxation Management (FIN623) : Assignment # 02Document2 pagesTaxation Management (FIN623) : Assignment # 02Rajesh KumarNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatNo ratings yet

- Assignment On SalaryDocument4 pagesAssignment On SalarySohel MahmudNo ratings yet

- Business Math Lesson1 Week 3Document6 pagesBusiness Math Lesson1 Week 3REBECCA BRIONES0% (1)

- Assignment TaxationDocument2 pagesAssignment TaxationDilruba HassanNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- All Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39Document14 pagesAll Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39ibsituabdelaNo ratings yet

- All Level Two Coc QuestionsDocument15 pagesAll Level Two Coc Questionsabelu habite neriNo ratings yet

- N GELSEDocument3 pagesN GELSEabim manyuuNo ratings yet

- AssignmentDocument5 pagesAssignmentMd. Alif HossainNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- May 2021 Test 1 QuestionDocument6 pagesMay 2021 Test 1 Questionxfs5k9m8stNo ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaNo ratings yet

- Tax 5301 Mid 2Document1 pageTax 5301 Mid 2Sabuj BhowmikNo ratings yet

- Personal Tax PlanningDocument21 pagesPersonal Tax PlanningAjay DhawalNo ratings yet

- QuickBooks For BeginnersDocument9 pagesQuickBooks For BeginnersZain U DdinNo ratings yet

- Enc Encoded A0nNFhan9Jl78cAySc2AolaE2Yye0 HIgHbnr6loXue2yScW3KSbxZwM1pJvw6EDocument8 pagesEnc Encoded A0nNFhan9Jl78cAySc2AolaE2Yye0 HIgHbnr6loXue2yScW3KSbxZwM1pJvw6Eharwoko yokoNo ratings yet

- TaxationDocument8 pagesTaxationKaran PrabaNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- TAX Papers - Paper 1Document2 pagesTAX Papers - Paper 1syedshahNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Class 4 QuestionsDocument5 pagesClass 4 Questionsbaqarnaqvi6204No ratings yet

- Illustration 3Document9 pagesIllustration 3AzizNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Class Activity 2 Principles of MicroeconomicsDocument1 pageClass Activity 2 Principles of MicroeconomicsTooba NoushadNo ratings yet

- 0H9SNRYTRDocument16 pages0H9SNRYTRLoey ParkNo ratings yet

- Soal UTS 2011Document5 pagesSoal UTS 201127.Enggar ApriyaniNo ratings yet

- Computation of Total IncomeDocument15 pagesComputation of Total Incomekhushi shahNo ratings yet

- 5 (1) .Tax PlanningDocument19 pages5 (1) .Tax Planningabhi+shekNo ratings yet

- Employt Revision Qns. 2023Document8 pagesEmployt Revision Qns. 2023Mbeiza MariamNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- Estate TutorialDocument4 pagesEstate TutorialpremsuwaatiiNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- DFI 201 Assignment 1Document1 pageDFI 201 Assignment 1raina mattNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Taxation Law Review Final ExaminationsDocument4 pagesTaxation Law Review Final ExaminationsRufino Gerard MorenoNo ratings yet

- Taxable & Nontaxable BenefitsDocument16 pagesTaxable & Nontaxable BenefitsKARENNo ratings yet

- Revision QNWDocument9 pagesRevision QNWKaran PrabaNo ratings yet

- 8 Wonders of The WorldDocument8 pages8 Wonders of The WorldKaran PrabaNo ratings yet

- Hemato MCQ 1Document5 pagesHemato MCQ 1Karan PrabaNo ratings yet

- Cambridge IGCSE: Biology 0610/13Document12 pagesCambridge IGCSE: Biology 0610/13Karan PrabaNo ratings yet

- BacterDocument6 pagesBacterKaran PrabaNo ratings yet

- Algebraic Equation Questions'Document4 pagesAlgebraic Equation Questions'Karan PrabaNo ratings yet

- Nervous Systerm QDocument15 pagesNervous Systerm QKaran PrabaNo ratings yet

- Acid 2 QDocument7 pagesAcid 2 QKaran PrabaNo ratings yet

- Cambridge IGCSE: Biology 0610/11Document16 pagesCambridge IGCSE: Biology 0610/11Karan PrabaNo ratings yet

- Ee Revision 9Document4 pagesEe Revision 9Karan PrabaNo ratings yet

- 4b. Laws of Logarithms Further Questions - AnswersDocument2 pages4b. Laws of Logarithms Further Questions - AnswersKaran PrabaNo ratings yet

- Ee Revision 6Document8 pagesEe Revision 6Karan PrabaNo ratings yet