Professional Documents

Culture Documents

Basket File VP-DJ Shariah China A-Shares 100 ETF 27052024

Basket File VP-DJ Shariah China A-Shares 100 ETF 27052024

Uploaded by

seeme55runCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basket File VP-DJ Shariah China A-Shares 100 ETF 27052024

Basket File VP-DJ Shariah China A-Shares 100 ETF 27052024

Uploaded by

seeme55runCopyright:

Available Formats

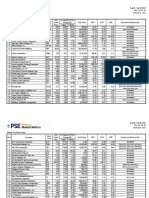

VP-DJ Shariah China A-Shares 100 ETF

Valuation Point as at close of 27/05/2024

Dealing currency: MYR Index Name: DJIM China A-Shares 100 Index

Short name: CHINA100-MYR Index Level: 114.80

Stock code: 0838EA Unit Block size: 1,000,000 units

ISIN code: MYL0838EA002 Estimated Creation Amount*: MYR 1,218,250.00 / Unit Block

Manager's fee: Up to 0.60% p.a. of the Fund's NAV. Estimated Redemption Amount*: MYR 1,107,500.00 / Unit Block

Trustee's fee: Up to 0.06% p.a. of the Fund's NAV, subject to a minimum of Net Asset Value (NAV): MYR 26,579,140.53

MYR12,000 p.a. (excluding foreign sub-custodian fees and Units in Circulation: 24,000,000 units

charges). NAV per Unit: MYR 1.1075

Index license fee: Up to 0.04% p.a. of the Fund's NAV, subject to a minimum of CNH/MYR rate: 0.6482

USD15,000 p.a. *Please refer to the prospectus for definition and further details.

Shares per Share Price Share Price Market Value

No. SEDOL Company Name

Unit Block (CNH) (MYR) (MYR)

1 BD5CMH2 37 Interactive Entertainment Network Technology Group Co Ltd A 300 14.90 9.66 2,897.45

2 BK71F66 Advanced Micro-Fabrication Equipment Inc A 100 129.41 83.88 8,388.36

3 BP3R518 AECC Aviation Power Co Ltd A 400 35.24 22.84 9,137.03

4 BD5CLQ4 Aier Eye Hospital Group Co Ltd A 1,400 12.34 8.00 11,198.30

5 BP3R2Z1 Anhui Conch Cement Co Ltd A 600 24.61 15.95 9,571.32

6 BKDQ800 Avary Holding (Shenzhen) Co Ltd A 300 29.00 18.80 5,639.34

7 BNR4NQ2 Beijing Kingsoft Office Software Inc A 100 266.10 172.49 17,248.60

8 BD5CJ26 Beijing New Building Materials Public Co., Ltd. A 300 33.45 21.68 6,504.69

9 BP3R9J4 Beijing Tiantan Bi A 300 28.81 18.67 5,602.39

10 BP3R5C9 Beijing Tong Ren Tang Co., Ltd. A 200 45.56 29.53 5,906.40

11 BMXTWX4 Beijing Wantai Biological Pharmacy Enterprise Co Ltd A 100 67.38 43.68 4,367.57

12 BL58M76 Beijing-Shanghai High Speed Railway Co Ltd A 7,500 5.19 3.36 25,231.19

13 BD5CQ69 BYD Company Limited A 300 208.35 135.05 40,515.74

14 BNHPMD5 Cambricon Technologies Corporation Limited A 100 175.99 114.08 11,407.67

15 BD5CDB3 Changchun High & New Tech A 100 112.20 72.73 7,272.80

16 BD5CLT7 Chaozhou Three-Circle Group Co Ltd A 300 28.87 18.71 5,614.06

17 BP3R4N3 China CSSC Holdings Limited A 700 36.09 23.39 16,375.48

18 BP3RDW5 China Jushi Co Ltd A 600 12.11 7.85 4,709.82

19 BP3R370 China Northern Rare Earth Group High-Tech Co Ltd A 600 19.13 12.40 7,440.04

20 BP91NW1 China Resources Microelectronics Limited A 200 38.00 24.63 4,926.32

21 BD5CL42 China Resources Sanjiu Medical & Pharmaceutical Co Ltd A 200 62.72 40.66 8,131.02

22 BP3R262 China Shenhua Energy Co Ltd A 1,300 42.00 27.22 35,391.72

23 BD5CP62 Chongqing Changan Automobile Co Ltd A 1,300 14.17 9.18 11,940.49

24 BD5CJY8 Chongqing Zhifei Biological Products Company Limited A 400 33.14 21.48 8,592.54

25 BHQPSY7 Contemporary Amperex Technology Co Ltd A 700 200.01 129.65 90,752.54

26 BP91NL0 Eastroc Beverage (Group) Co Ltd A 100 222.98 144.54 14,453.56

27 BNHSQB0 Empyrean Technology Co Ltd A 100 78.70 51.01 5,101.33

28 BD5C7G6 Eve Energy Co Ltd A 300 36.70 23.79 7,136.68

29 BTFRHX0 Foshan Haitian Flavouring and Food Company Ltd. A 800 36.21 23.47 18,777.06

30 BG20N99 Foxconn Industrial Internet Co Ltd A 2,400 24.86 16.11 38,674.20

31 BP3R6K4 FuYao Glass Industry Group Co Ltd. A 300 47.48 30.78 9,232.96

32 BNHPPG9 GalaxyCore Inc A 400 13.11 8.50 3,399.16

33 BD5CB19 Ganfeng Lithium Co Ltd A 200 33.90 21.97 4,394.80

34 BHWLWF8 Giga Device Semiconductor (Beijing) Inc A 100 81.48 52.82 5,281.53

35 BD5CNT1 GoerTek Inc. A 500 16.55 10.73 5,363.86

36 BL58M87 Gongniu Group Co Ltd A 100 126.03 81.69 8,169.26

37 BP3R325 Great Wall Motor Company Limited A 500 26.44 17.14 8,569.20

38 BP3R3G9 Haier Smart Home Co Ltd. A 1,000 30.75 19.93 19,932.15

39 BYYFJR8 Hangzhou First PV Material Company Limited A 300 25.53 16.55 4,964.56

40 BFYQH85 Hoshine Silicon Industry Co Ltd A 100 53.99 35.00 3,499.63

41 BD5CM94 Huadong Medicine A 300 31.93 20.70 6,209.11

42 BP91MX5 Huali Industrial Group Company Limited A 100 68.27 44.25 4,425.26

43 BFY8GX9 Huizhou Desay SV Automotive Co Ltd 100 99.00 64.17 6,417.18

44 BP3R6B5 Hundsun Technologies Inc A 300 20.30 13.16 3,947.54

45 BQZDHW6 Hygon Information Technology Co Ltd A 100 70.66 45.80 4,580.18

46 BD5CNN5 Iflytek Co., Ltd. A 400 42.16 27.33 10,931.24

47 BNR4MY3 IMEIK Technology Development Co Ltd A 100 209.20 135.60 13,560.34

48 BP3R2V7 Inner Mongolia Yili Industrial Group Co.,Ltd. A 1,000 29.02 18.81 18,810.76

49 BMVB500 JA Solar Technology Co Ltd A 500 14.80 9.59 4,796.68

50 BP3RCQ2 JCET Group Co Ltd A 300 25.13 16.29 4,886.78

51 BP3RFJ6 Jiangsu Hengli Hydraulic Co Ltd A 200 51.28 33.24 6,647.94

52 BP3R369 Jiangsu Hengrui Medicine Co A 1,000 42.70 27.68 27,678.14

53 BD5CP17 Lens Technology Co Ltd A 800 15.19 9.85 7,876.93

54 BRTL411 LONGi Green Energy Technology Co Ltd A 1,100 18.53 12.01 13,212.26

55 BD5CN80 Luxshare Precision Industry Co Ltd A 1,100 31.89 20.67 22,738.21

56 BK4XS11 Maxscend Microelectronics Co Ltd A 100 86.46 56.04 5,604.34

57 BD5CPP1 Midea Group Co., Ltd. A 1,100 67.59 43.81 48,193.02

58 BK71F77 Montage Technology Co Ltd A 200 52.62 34.11 6,821.66

59 BP3R444 NARI Technology Development Co Ltd A 1,200 23.00 14.91 17,890.32

60 BD5LYF1 NAURA Technology Group Co Ltd A 100 304.00 197.05 19,705.28

VP-DJ Shariah China A-Shares 100 ETF

Valuation Point as at close of 27/05/2024

Dealing currency: MYR Index Name: DJIM China A-Shares 100 Index

Short name: CHINA100-MYR Index Level: 114.80

Stock code: 0838EA Unit Block size: 1,000,000 units

ISIN code: MYL0838EA002 Estimated Creation Amount*: MYR 1,218,250.00 / Unit Block

Manager's fee: Up to 0.60% p.a. of the Fund's NAV. Estimated Redemption Amount*: MYR 1,107,500.00 / Unit Block

Trustee's fee: Up to 0.06% p.a. of the Fund's NAV, subject to a minimum of Net Asset Value (NAV): MYR 26,579,140.53

MYR12,000 p.a. (excluding foreign sub-custodian fees and Units in Circulation: 24,000,000 units

charges). NAV per Unit: MYR 1.1075

Index license fee: Up to 0.04% p.a. of the Fund's NAV, subject to a minimum of CNH/MYR rate: 0.6482

USD15,000 p.a. *Please refer to the prospectus for definition and further details.

Shares per Share Price Share Price Market Value

No. SEDOL Company Name

Unit Block (CNH) (MYR) (MYR)

61 BYQDMF9 Ningbo Tuopu Group Co Ltd A 200 56.89 36.88 7,375.22

62 BK4XS99 Ningxia Baofeng Energy Group Co Ltd A 1,100 16.69 10.82 11,900.30

63 BFF1YZ5 Oppein Home Group Inc A 100 71.20 46.15 4,615.18

64 BD5CNB3 Qinghai Salt Lake Industry Co. Ltd. A 800 17.49 11.34 9,069.61

65 BD73M39 S.F. Holding Co Ltd A 700 38.00 24.63 17,242.12

66 BP3R3R0 Sanan Optoelectronics Co Ltd A 800 12.57 8.15 6,518.30

67 BP3R3H0 Sany Heavy Industry Co Ltd A 1,300 17.03 11.04 14,350.50

68 BYV1VC8 Seres Group Co Ltd A 200 86.60 56.13 11,226.82

69 BS7K5P8 Shaanxi Coal Industry Co Ltd A 1,500 26.04 16.88 25,318.69

70 BP3RDC5 Shandong Hualu Hengsheng Chem Co A 300 28.78 18.66 5,596.56

71 BP3RCN9 Shanghai Baosight Software Co Ltd A 300 40.02 25.94 7,782.29

72 BP3R4P5 Shanghai Intl Airport A 400 35.78 23.19 9,277.04

73 BN4P5F1 Shanghai United Imaging Healthcare Co Ltd A 100 126.24 81.83 8,182.88

74 BD5CKB2 Shanxi Coking Coal Energy Group Co Ltd A 900 11.26 7.30 6,568.86

75 BP3R682 Shanxi Lu'an Environmental Energy Development Co Ltd A 500 23.15 15.01 7,502.92

76 BD5CMN8 Shenzhen Inovance Technology Co Ltd A 400 59.71 38.70 15,481.61

77 BHQK864 Shenzhen Mindray Bio-Medical Electronics Co Ltd A 200 301.19 195.23 39,046.27

78 BMXTX20 Shenzhen New Industries Biomedical Engineering Co Ltd A 100 75.81 49.14 4,914.00

79 BNR4NP1 Shenzhen Transsion Holdings Co Ltd A 100 131.20 85.04 8,504.38

80 BD5CGB4 Sungrow Power Supply Company Limited A 200 101.17 65.58 13,115.68

81 BD5CKH8 Tianqi Lithium Corporation A 200 36.39 23.59 4,717.60

82 BP3RCK6 Tongwei Co. Ltd. A 700 22.31 14.46 10,122.94

83 BD5CL75 Unigroup Guoxin Microelectronics Co Ltd A 100 54.94 35.61 3,561.21

84 BD5CBG4 Unisplendour Co., Ltd. A 400 22.98 14.90 5,958.25

85 BK947V2 Will Semiconductor Co Ltd Shanghai A 200 94.00 60.93 12,186.16

86 BK4PZC7 Wingtech Technology Co Ltd A 200 30.00 19.45 3,889.20

87 BD5C7Z5 WUS Printed Circuit (Kunshan) Co Ltd A 300 32.15 20.84 6,251.89

88 BHWLWV4 WuXi AppTec Co Ltd A 400 42.42 27.50 10,998.66

89 BNRLFT0 Xinjiang Daqo New Energy Co Ltd A 300 25.13 16.29 4,886.78

90 BP3R6C6 Yonyou Network Technology Co Ltd A 500 11.13 7.21 3,607.23

91 BYW5QJ1 YTO Express Group Co Ltd A 500 17.14 11.11 5,555.07

92 BD5CP95 Yunnan Baiyao Group Co Ltd A 300 54.37 35.24 10,572.79

93 BFCCR30 Yunnan Energy New Material Co Ltd A 200 39.65 25.70 5,140.23

94 BP3R7Z6 Zhangzhou Pientzehuang Pharm Co A 100 231.39 149.99 14,998.70

95 BD5CNJ1 Zhejiang Dahua Technology Co.Ltd. A 500 16.72 10.84 5,418.95

96 BD5M1Y2 Zhejiang Jingsheng Mechanical & Electrical Company Limited A 200 32.40 21.00 4,200.34

97 BP3R983 Zhejiang Ju Hua Co. Ltd. A 400 24.07 15.60 6,240.87

98 BD5CH66 Zhejiang NHU Co. Ltd. A 500 19.54 12.67 6,332.91

99 BD5CDC4 Zhejiang Sanhua Intelligent Controls Co Ltd A 600 21.57 13.98 8,389.00

100 BFFJRM7 Zhongji Innolight Co Ltd A 100 168.39 109.15 10,915.04

Market value of underlying securities (MYR): 1,154,179.09

Cash component (MYR): -46,679.09

Total value per Unit Block (MYR): 1,107,500.00

This report is prepared by Value Partners Asset Management Malaysia Sdn. Bhd. Neither Value Partners nor the directors of the company accept any responsibility

whatsoever for the accuracy or completeness of the information provided by third parties. It should not be copied or distributed to third parties without the written consent of

Value Partners. The views expressed are the views of Value Partners only and are subject to change based on market and other conditions. The information provided does

not constitute investment advice and should not be relied on as such. All materials have been obtained from sources believe to be reliable but its accuracy is not

guaranteed. This material contains certain statements which may be deemed forward-looking. Please note that any such statements are not guarantee of any future

performance and actual results may differ from those projected. The information contained herein does not constitute an offer to sell or an invitation to buy any securities in

any jurisdiction in which such distribution or offer is not authorised. No part of this document or any information contained herein may be distributed, reproduced, taken or

transmitted into jurisdiction or territories in which such activities are not permitted. Any failure to comply with the restrictions may constitute a violation of the relevant laws.

This document does not constitute a prospectus, an offer or an invitation to subscribe to any securities, or a recommendation in relation to any securities. Investors should

note investment involves risk and past performance is not indicative of future results. Investors may not get back the full amount invested. The price of units and distribution

payable, if any, may go down as well as up. Past performance of a fund should not be taken as indicative of its future performance. Investors are advised to read and

understand the contents of the Prospectus dated 12 July 2021 and First Supplementary Prospectus dated 31 May 2023, which have been duly registered with the

Securities Commission Malaysia, before investing. Investors should consider the fees and charges involved, and risk factors of the fund in particular those associated with

investing in emerging markets. Investors can obtain a copy of the prospectuses from Value Partners Asset Management Malaysia Sdn. Bhd. or its authorised participating

dealers.

Value Partners Asset Management Malaysia Sdn. Bhd.

You might also like

- An Introduction To Scholarship Building AcademicDocument3 pagesAn Introduction To Scholarship Building AcademicNina Rosalee21% (29)

- 32642892-PL WelcomeLetterDocument4 pages32642892-PL WelcomeLetterMohan ChandraNo ratings yet

- TOP 500 Non Individual - Arranged - AlphabeticallyDocument12 pagesTOP 500 Non Individual - Arranged - AlphabeticallyjcalaqNo ratings yet

- Unit 2 Module 2 Combined-1Document14 pagesUnit 2 Module 2 Combined-1api-2930012170% (2)

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterNo ratings yet

- Yapi Kredi Portföy Yönetimi A.Ş. (Yay) Yapi Kredi Portfoy Yabanci Teknoloji Sektoru Hisse Senedi Fonu NİSAN 2024Document7 pagesYapi Kredi Portföy Yönetimi A.Ş. (Yay) Yapi Kredi Portfoy Yabanci Teknoloji Sektoru Hisse Senedi Fonu NİSAN 2024ozanooz001No ratings yet

- Urgent Communication: 25% Public Holding Made Mandatory For Listed FirmsDocument9 pagesUrgent Communication: 25% Public Holding Made Mandatory For Listed FirmsA_KinshukNo ratings yet

- The 3D Printing Etf PRNT HoldingsDocument3 pagesThe 3D Printing Etf PRNT HoldingsAlexandru SimaNo ratings yet

- Asset Listing 2021Document123 pagesAsset Listing 2021Meksen MahiedineNo ratings yet

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- LSVEXDocument4 pagesLSVEXzzoracNo ratings yet

- FactSet China Robotics AI Components 202103Document1 pageFactSet China Robotics AI Components 202103Khawla GhandaliNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianNo ratings yet

- F LCH Portfolio Holding DetailsDocument48 pagesF LCH Portfolio Holding DetailsRamdisaNo ratings yet

- Ark Israel Innovative Technology Etf (Izrl) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Israel Innovative Technology Etf (Izrl) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Romano 1No ratings yet

- Quiz 4 Reference 1Document11 pagesQuiz 4 Reference 1porrasrykuNo ratings yet

- Ark Autonomous Technology & Robotics Etf Arkq Holdings PDFDocument1 pageArk Autonomous Technology & Robotics Etf Arkq Holdings PDFandrew2020rNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- Ark Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Ionut BondrescuNo ratings yet

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)hkm_gmat4849No ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)mikiNo ratings yet

- The Nigerian Stock Exchange: 1st Tier SecuritiesDocument5 pagesThe Nigerian Stock Exchange: 1st Tier SecuritiesBawonda IsaiahNo ratings yet

- Kodex Msci Korea 20210209Document6 pagesKodex Msci Korea 20210209guimanraluca5220No ratings yet

- Stock Screener203544Document5 pagesStock Screener203544Sde BdrNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Btakeshi1No ratings yet

- InnovationDocument2 pagesInnovationmikiNo ratings yet

- Ark InnovationDocument2 pagesArk InnovationmikiNo ratings yet

- Ark Genomic Revolution Multisector Etf Arkg HoldingsDocument2 pagesArk Genomic Revolution Multisector Etf Arkg HoldingsElizabeth ParsonsNo ratings yet

- Handout Jan 24 Session-CoC and Capital StructureDocument3 pagesHandout Jan 24 Session-CoC and Capital StructureSatish KumarNo ratings yet

- Settlement Report - 14feb17Document10 pagesSettlement Report - 14feb17Abdul SalamNo ratings yet

- Destruction of CertsDocument4 pagesDestruction of CertsYTOLeaderNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Dlix StrandNo ratings yet

- Thong Ke Giao Dich Tu DoanhDocument10 pagesThong Ke Giao Dich Tu DoanhĐức Anh NguyễnNo ratings yet

- Quiz 4 Reference 2Document3 pagesQuiz 4 Reference 2porrasrykuNo ratings yet

- Ark Genomic Revolution Multisector Etf Arkg HoldingsDocument2 pagesArk Genomic Revolution Multisector Etf Arkg HoldingsAxel OnsagerNo ratings yet

- ARK Genomic Revolution ETF: Holdings Data - ARKGDocument3 pagesARK Genomic Revolution ETF: Holdings Data - ARKGWille RaitolampiNo ratings yet

- Ark Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)nelsonNo ratings yet

- Ind Oil Gas EV Metrics - AllDocument1 pageInd Oil Gas EV Metrics - AllPo_PimpNo ratings yet

- Tata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorDocument13 pagesTata Investment Corporation List of Investments: Company Shares Held Value (CR) CMP SectorNIKO LAURENo ratings yet

- Next Generation InterneDocument2 pagesNext Generation InternemikiNo ratings yet

- Ark Israel Innovative Technology Etf Izrl HoldingsDocument2 pagesArk Israel Innovative Technology Etf Izrl HoldingsmikiNo ratings yet

- CFD - November 5th 2009Document3 pagesCFD - November 5th 2009Andre SetiawanNo ratings yet

- 01.03 Ark - Innovation - Etf - Arkk - HoldingsDocument2 pages01.03 Ark - Innovation - Etf - Arkk - HoldingsSalih GurdalNo ratings yet

- Thong Ke Giao Dich Tu DoanhDocument11 pagesThong Ke Giao Dich Tu DoanhĐức Anh NguyễnNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)nerdmojoNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Alan PérezNo ratings yet

- 03..03 Ark - Innovation - Etf - Arkk - HoldingsDocument2 pages03..03 Ark - Innovation - Etf - Arkk - HoldingsSalih GurdalNo ratings yet

- EQ8SID - Daily Fund Values 050424Document1 pageEQ8SID - Daily Fund Values 050424seeme55runNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)nelsonNo ratings yet

- Statement of Production Capacity: North ZoneDocument10 pagesStatement of Production Capacity: North Zoneswanky87No ratings yet

- wk35 Sep2022mktwatchDocument3 pageswk35 Sep2022mktwatchcraftersxNo ratings yet

- Ark Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Genomic Revolution Multi Sector Etf (Arkg) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Axel OnsagerNo ratings yet

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)hkm_gmat4849No ratings yet

- Dela Pena Joevanh March 2021Document1 pageDela Pena Joevanh March 2021ATRIYO ENTERPRISESNo ratings yet

- Ark Next Generation Internet Etf (Arkw) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Next Generation Internet Etf (Arkw) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document1 pageArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Databacus IncNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)amanNo ratings yet

- EPASX Q1 HoldingsDocument3 pagesEPASX Q1 Holdingszvishavane zvishNo ratings yet

- Ark Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Document2 pagesArk Innovation Etf (Arkk) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianNo ratings yet

- Gidc Customer Wise Details (16.01.2019) PDFDocument60 pagesGidc Customer Wise Details (16.01.2019) PDFAleem BawanyNo ratings yet

- Health Monitoring of Aerospace Structures: Smart Sensor Technologies and Signal ProcessingFrom EverandHealth Monitoring of Aerospace Structures: Smart Sensor Technologies and Signal ProcessingWieslaw StaszewskiNo ratings yet

- Daily Basket File - Asia Ex J REITs 05062024Document2 pagesDaily Basket File - Asia Ex J REITs 05062024seeme55runNo ratings yet

- Money Lending Announcement (31.03.2024)Document1 pageMoney Lending Announcement (31.03.2024)seeme55runNo ratings yet

- EQ8MY25 - Daily Fund Values 050624Document1 pageEQ8MY25 - Daily Fund Values 050624seeme55runNo ratings yet

- SIB Result Q1 2024 FinalDocument24 pagesSIB Result Q1 2024 Finalseeme55runNo ratings yet

- KSSC - EGM Administrative GuideDocument3 pagesKSSC - EGM Administrative Guideseeme55runNo ratings yet

- ABF Valuation Point - in Kind Redemption As at 27 May 2024Document5 pagesABF Valuation Point - in Kind Redemption As at 27 May 2024seeme55runNo ratings yet

- 2024-04-05 Daily Basket - KLCI1XIDocument1 page2024-04-05 Daily Basket - KLCI1XIseeme55runNo ratings yet

- EQ8SID - Daily Fund Values 050424Document1 pageEQ8SID - Daily Fund Values 050424seeme55runNo ratings yet

- 2024-04-05 Daily Basket - KLCI2XIDocument1 page2024-04-05 Daily Basket - KLCI2XIseeme55runNo ratings yet

- EQ8MY25 - Daily Fund Values 050424Document1 pageEQ8MY25 - Daily Fund Values 050424seeme55runNo ratings yet

- Daily Basket File - DWA MM 05042024Document2 pagesDaily Basket File - DWA MM 05042024seeme55runNo ratings yet

- EQ8MID - Daily Fund Values 050424Document1 pageEQ8MID - Daily Fund Values 050424seeme55runNo ratings yet

- CRJ 351Document23 pagesCRJ 351seeme55runNo ratings yet

- Daily Basket File - ETFGOLD05042024Document1 pageDaily Basket File - ETFGOLD05042024seeme55runNo ratings yet

- Cimbetf Nav Basket File 50 0504Document1 pageCimbetf Nav Basket File 50 0504seeme55runNo ratings yet

- Spyh 48Document26 pagesSpyh 48seeme55runNo ratings yet

- Cimbetf Nav Basket File 40 0504Document1 pageCimbetf Nav Basket File 40 0504seeme55runNo ratings yet

- Axiata Group Berhad - Audited Financial Statements FYE2023Document262 pagesAxiata Group Berhad - Audited Financial Statements FYE2023seeme55runNo ratings yet

- MY EG AR22 - Part 4Document204 pagesMY EG AR22 - Part 4seeme55runNo ratings yet

- Daily Basket File - Asia Ex J REITs 05042024Document2 pagesDaily Basket File - Asia Ex J REITs 05042024seeme55runNo ratings yet

- Taliworks - Q4FY23Document31 pagesTaliworks - Q4FY23seeme55runNo ratings yet

- REMC-MF Eng 01 331202080Document1 pageREMC-MF Eng 01 331202080seeme55runNo ratings yet

- Att Solar System Diagram Hi Res PNGDocument1 pageAtt Solar System Diagram Hi Res PNGseeme55runNo ratings yet

- PTRANS Share Buy Back StatementDocument16 pagesPTRANS Share Buy Back Statementseeme55runNo ratings yet

- More Info Table Update 1Y Mac 2022Document1 pageMore Info Table Update 1Y Mac 2022seeme55runNo ratings yet

- X Pander PDFDocument1 pageX Pander PDFseeme55runNo ratings yet

- PBIM Runners Guide Book 2022Document20 pagesPBIM Runners Guide Book 2022seeme55runNo ratings yet

- Market Insights Report - Weekly Sector Report - 2apr2022Document17 pagesMarket Insights Report - Weekly Sector Report - 2apr2022seeme55runNo ratings yet

- AuctionConditions PDFDocument4 pagesAuctionConditions PDFseeme55runNo ratings yet

- Executive Roof Hydrant PDFDocument1 pageExecutive Roof Hydrant PDFseeme55runNo ratings yet

- Name: License No License No: 2862 License Issue Date Issue Date:11/7/2007 License Expiry Date Expiry Date:10/7/2019Document139 pagesName: License No License No: 2862 License Issue Date Issue Date:11/7/2007 License Expiry Date Expiry Date:10/7/2019ArabyAbdel Hamed SadekNo ratings yet

- The Union of Concerned ScientistsDocument13 pagesThe Union of Concerned ScientistsIlser ReineNo ratings yet

- Solution Manual For Elementary Geometry For College Students 7th Edition Daniel C Alexander Geralyn M KoeberleinDocument35 pagesSolution Manual For Elementary Geometry For College Students 7th Edition Daniel C Alexander Geralyn M Koeberleinwoolfellinde4jive1100% (29)

- Best Practice: Data Volume Management For RetailDocument67 pagesBest Practice: Data Volume Management For Retaildri0510No ratings yet

- Timeline of Indian History - Wikipedia, The Free EncyclopediaDocument24 pagesTimeline of Indian History - Wikipedia, The Free EncyclopediaPrabhu Charan TejaNo ratings yet

- Simulink Exercise: Prepared by Jayakrishna Gundavelli and Hite NAME: - DATEDocument12 pagesSimulink Exercise: Prepared by Jayakrishna Gundavelli and Hite NAME: - DATEKarthikeyan SubbiyanNo ratings yet

- Dynamic Memory Allocation-1Document38 pagesDynamic Memory Allocation-1Muskan AgarwalNo ratings yet

- Perdev PTDocument3 pagesPerdev PTCamylia CocjinNo ratings yet

- Week 2: Introduction To LiteratureDocument45 pagesWeek 2: Introduction To LiteratureEirlys NhiNo ratings yet

- Flame ArresterDocument2 pagesFlame ArresterNicholas RiveraNo ratings yet

- DIP DharDocument17 pagesDIP Dharabhi_1mehrotaNo ratings yet

- Syllabus: M. Tech. Energy Management (Regular)Document28 pagesSyllabus: M. Tech. Energy Management (Regular)Digvijay SinghNo ratings yet

- 01 Business CommunicationDocument23 pages01 Business CommunicationTanut VatNo ratings yet

- Faculty of Business ManagementDocument4 pagesFaculty of Business Managementmalik234everNo ratings yet

- Vancouver Marathon by SlidesgoDocument37 pagesVancouver Marathon by SlidesgoAriya AnamNo ratings yet

- Ekc 204aDocument24 pagesEkc 204aPreot Andreana CatalinNo ratings yet

- SOME and ANYDocument3 pagesSOME and ANYMikeNo ratings yet

- Bab 5 Unit - Gear (Nota Politeknik)Document13 pagesBab 5 Unit - Gear (Nota Politeknik)Syfull musicNo ratings yet

- Assignment 2Document2 pagesAssignment 2Nzan NkapNo ratings yet

- 1 - Mql4-BookDocument464 pages1 - Mql4-BookPradito BhimoNo ratings yet

- DivergentDocument3 pagesDivergentsasingNo ratings yet

- Test 05Document87 pagesTest 05MenaNo ratings yet

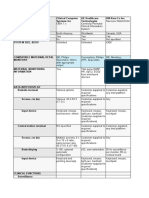

- Information Management Systems, ObstetricalDocument12 pagesInformation Management Systems, ObstetricalLee ThoongNo ratings yet

- An Empirical Investigation of Pension Fund Property RightsDocument12 pagesAn Empirical Investigation of Pension Fund Property RightsMuhammad Irka Irfa DNo ratings yet

- ECE Lab Solutions OnlineDocument4 pagesECE Lab Solutions OnlineBharath PulavarthiNo ratings yet

- Code SwitchingDocument6 pagesCode SwitchingMarion Shanne Pastor CorpuzNo ratings yet

- A Child of Books Teachers' GuideDocument12 pagesA Child of Books Teachers' GuideCandlewick Press100% (6)