Professional Documents

Culture Documents

Exta Methodology

Exta Methodology

Uploaded by

shadman zafarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exta Methodology

Exta Methodology

Uploaded by

shadman zafarCopyright:

Available Formats

Drawing motivation from Dar and Nain (2023a), Nain and Kamaiah (2014), Khanday et al.

(2023a), and Khan et al. (2023), this study makes use of nonlinear auto regressive distributive

lag mode (NARDL) due to Shin et al. (2014). The NARDL estimator is the extended version

of the ARDL estimator and has received much popularity as it has been utilized in many

economic fields, such as macroeconomics (Dar and Nain, 2023a), agricultural economics

(He, 2023), environmental economics (Cıtak et al., 2020) and financial economics (Nain and

Kamaiah, 2014). Along these lines, this study argues that the employment of the NARDL

estimator is well-suited for modelling the asymmetric impact of remittance inflows on FD.

Further, Shin et al. (2014) and Lahiani et al. (2016) contend that the NARDL estimator has

superiorities over the traditional cointegration estimators that are directly suited to this study.

First, the NARDL estimator allows the difference between the short-run and long-run

asymmetries, thus enabling us to dredge up the particular characteristics, like that of the quick

response of index prices that are unknown. Secondly, the NARDL estimator allows us to test

the responses of positive and negative changes in the dependent variable due to changes in

the independent variable. Therefore, allows us to formulate the model in the line of

asymmetry. Third, the NARDL estimator works efficiently even when the interested

variables are integrated at level (I(0)) or at the first difference (I(1)) or mixed. Moreover,

NARDL gives robust results for small sample sizes, as is the present study (Pesaran and Shin,

1999; Wani et al., 2023; Katrakilidis and Trachanas, 2012) and also works with the

endogeneity issue (Narayan, 2004). Finally, both the short and long-run estimates can be

estimated simultaneously to overcome the model instability problem (Banerjee et al., 2012).

Therefore, following Pesaran et al. (2001), the short-run dynamics can be included by

estimating the following UECM model1.

p p p

∆ FD t =α 0 +∑ bi ∆ FD t −1 + ∑ ci ∆ REM t −i+ ∑ d i ∆ Y t−i

i=1 i=0 i=0

p p p

+ ∑ ei ∆ EXR t−i + ∑ f i ∆ INFt −i+ ∑ g i ∆ FDI t−i +δ 0 FD t −1

i=0 i=0 i=0

+ δ 1 REM t−1 +δ 2 Y t −1+ δ 3 EXR t−1 +δ 4 INF t −1+ δ 5 FDI t−1 +ν t

2

Where α 0represents the constant, [b i … gi ¿ signify the coefficients at Δ (first differenced) to

estimate the short-run effects, while as the estimates [δ 0 … δ 5 ¿ of lagged level variables

explain the long-run effects of stated covariates on the FD. The specified Eq. (2) assumes the

symmetrical form; however, the main objective of this study is to find the asymmetric impact

of remittances inflow on FD. Therefore, directed by Hatemi-J (2011) and Shin et al. (2014),

we split the remittances inflow into its positive and negative parts as

−¿ ¿

+¿+ ℜ M ¿ +¿¿ −¿ ¿

ℜ M t =ℜ M 0+ ℜ M t where ℜ M t , and ℜ M t are the positive and negative partial

t

sum process generated from equations (3) to (4).

1

It is important to incorporate in the model because inclusion of short run dynamics in the long run models may

lead model stability (Zafar et al., 2023).

You might also like

- Fakulty of Computer and Mathematical Sciences Bachelor of Science (Hons.) Management MathematicsDocument13 pagesFakulty of Computer and Mathematical Sciences Bachelor of Science (Hons.) Management MathematicsFatihah SyukorNo ratings yet

- Vector Autoregression Analysis: Estimation and InterpretationDocument36 pagesVector Autoregression Analysis: Estimation and Interpretationcharles_j_gomezNo ratings yet

- Fisher Thermo Scientific Catalogue V DearDocument72 pagesFisher Thermo Scientific Catalogue V Dearmm0987654321100% (1)

- Estimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2Document37 pagesEstimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2fbn2377No ratings yet

- Estimation of SpatialDocument13 pagesEstimation of SpatialWidya RezaNo ratings yet

- On Measuring Volatility and The GARCH Forecasting PerformanceDocument18 pagesOn Measuring Volatility and The GARCH Forecasting Performance陳岱佑No ratings yet

- Journal Pre-Proof: Finance Research LettersDocument18 pagesJournal Pre-Proof: Finance Research LettersAshraf KhanNo ratings yet

- 4.applied - Cointegration Approach A Solvency-Adewojo AdekunbiDocument8 pages4.applied - Cointegration Approach A Solvency-Adewojo AdekunbiImpact JournalsNo ratings yet

- SEEC DiscussionPaper No8Document24 pagesSEEC DiscussionPaper No8Shuchi GoelNo ratings yet

- Mathematics: A New Fuzzy MARCOS Method For Road Tra Risk AnalysisDocument18 pagesMathematics: A New Fuzzy MARCOS Method For Road Tra Risk AnalysisAqil QolbyNo ratings yet

- 2023 9 2 2 SahinDocument14 pages2023 9 2 2 SahinSome445GuyNo ratings yet

- Chatziantoniou Et Al, 2021 - Forecasting Oil Price Volatility Using Spillover Effects From Uncertainty IndicesDocument5 pagesChatziantoniou Et Al, 2021 - Forecasting Oil Price Volatility Using Spillover Effects From Uncertainty IndicesSlice LeNo ratings yet

- Forecasting Stock Prices On The Lq45 Index Using The Varimax MethodDocument11 pagesForecasting Stock Prices On The Lq45 Index Using The Varimax MethodMardison Carolus PurbaNo ratings yet

- For Fiza Ecoletters03 MtezarzosoyBengochea PMG CO2Document8 pagesFor Fiza Ecoletters03 MtezarzosoyBengochea PMG CO2Hafsa HinaNo ratings yet

- Bailey Kunert 2006Document13 pagesBailey Kunert 2006734500203No ratings yet

- Bayesian Analysis of DSGE ModelsDocument61 pagesBayesian Analysis of DSGE ModelsJargalmaa ErdenemandakhNo ratings yet

- Based Methods For Monitoring Gamma ProfilesDocument6 pagesBased Methods For Monitoring Gamma Profilesieom2012No ratings yet

- PP 163-175Document13 pagesPP 163-175HANBALCONTRAMUNDUMNo ratings yet

- Draft 6Document36 pagesDraft 6RobertoimeNo ratings yet

- Numerical Methods For Simulation of Stochastic Differential EquationsDocument10 pagesNumerical Methods For Simulation of Stochastic Differential EquationsJese MadridNo ratings yet

- NeurIPS 2022 Efficient Methods For Non Stationary Online Learning Paper ConferenceDocument13 pagesNeurIPS 2022 Efficient Methods For Non Stationary Online Learning Paper Conferenceancilla chimombeNo ratings yet

- Inferences On Stress-Strength Reliability From Lindley DistributionsDocument29 pagesInferences On Stress-Strength Reliability From Lindley DistributionsrpuziolNo ratings yet

- 5 Jmcms 2106007 A Novel Fuzzy Entropy Measure and Its Application in COVID 19 Razia Sharif 2Document12 pages5 Jmcms 2106007 A Novel Fuzzy Entropy Measure and Its Application in COVID 19 Razia Sharif 2sAhAr AbbAysNo ratings yet

- An Adaptive de AlgorithmDocument9 pagesAn Adaptive de AlgorithmSatyam ChiragaNo ratings yet

- Relative Responsiveness of Trade Flows To A ChangeDocument18 pagesRelative Responsiveness of Trade Flows To A ChangeDeyvi LópezNo ratings yet

- Forecasting The Sales of Console Games For The Italian MarketDocument13 pagesForecasting The Sales of Console Games For The Italian MarketKunal WadhawanNo ratings yet

- An Empirical Estimation & Model Selection of The Short-Term Interest RatesDocument24 pagesAn Empirical Estimation & Model Selection of The Short-Term Interest RatesGary BirginalNo ratings yet

- 5 Jmcms 2106007 A Novel Fuzzy Entropy Measure and Its Application in COVID 19 Razia SharifDocument12 pages5 Jmcms 2106007 A Novel Fuzzy Entropy Measure and Its Application in COVID 19 Razia SharifsAhAr AbbAysNo ratings yet

- Thesis - Summary - Muhammad Iqbal ArrafiiDocument2 pagesThesis - Summary - Muhammad Iqbal ArrafiiArrafi'i IqbalNo ratings yet

- Measuring Forecast Performance of ARMADocument10 pagesMeasuring Forecast Performance of ARMAAbhaya Kumar SahooNo ratings yet

- The Numerical Solution of Fractional Differential EquationsDocument14 pagesThe Numerical Solution of Fractional Differential Equationsdarwin.mamaniNo ratings yet

- An Algorithm For Solving Linear Optimization Problems Subjected To The Intersection of Two Fuzzy Relational Inequalities Defined by Frank Family of T-NormsDocument20 pagesAn Algorithm For Solving Linear Optimization Problems Subjected To The Intersection of Two Fuzzy Relational Inequalities Defined by Frank Family of T-NormsijfcstjournalNo ratings yet

- Successive Linearization Solution of ADocument9 pagesSuccessive Linearization Solution of AAnonymous lVQ83F8mCNo ratings yet

- Maximum Likelihood Estimation of Stationary Multivariate ARFIMA Processes TSayDocument17 pagesMaximum Likelihood Estimation of Stationary Multivariate ARFIMA Processes TSayAdis SalkicNo ratings yet

- 2287 Estimating Riemannian Metric WDocument24 pages2287 Estimating Riemannian Metric WhqasmiNo ratings yet

- Jurnal Pak AnilDocument38 pagesJurnal Pak AnilIrmaNo ratings yet

- SSRN Id2685523 PDFDocument7 pagesSSRN Id2685523 PDFBass1237No ratings yet

- EquationsDocument3 pagesEquationsMushtaq HussainNo ratings yet

- On Performance Indicators of Multi-Objective OptimizationDocument12 pagesOn Performance Indicators of Multi-Objective Optimizationaissadhp newtekhmamNo ratings yet

- MARS and Truncated Spline Approach On Modelling Human Development Index (HDI) in IndonesiaDocument7 pagesMARS and Truncated Spline Approach On Modelling Human Development Index (HDI) in IndonesiaochaholicNo ratings yet

- Sutherland, 2019 MMD PreprintDocument11 pagesSutherland, 2019 MMD PreprintSara MaraivaNo ratings yet

- Estimation of Nonstationary HeterogeneousDocument12 pagesEstimation of Nonstationary HeterogeneousSeydou OumarouNo ratings yet

- Mark Up SlidesDocument44 pagesMark Up SlidesWilliam MartinezNo ratings yet

- Ditzen 2018Document33 pagesDitzen 2018fbn2377No ratings yet

- Finite Difference Solution of Seepage Equation: A Mathematical Model For Fluid FlowDocument9 pagesFinite Difference Solution of Seepage Equation: A Mathematical Model For Fluid FlowthesijNo ratings yet

- Versao Final 25 07 2017 InglesDocument14 pagesVersao Final 25 07 2017 InglesFrancisco SilvaNo ratings yet

- Preprints201807 0548 v1Document12 pagesPreprints201807 0548 v1Naveen Prasad GopinathraoNo ratings yet

- Optimal Estimates For The Semidiscrete Galerkin Method Applied To Parabolic Integro-Differential Equations With Nonsmooth DataDocument22 pagesOptimal Estimates For The Semidiscrete Galerkin Method Applied To Parabolic Integro-Differential Equations With Nonsmooth DataAshokPradhanNo ratings yet

- A Simple and Fast Contour Plotting Algorithm For L PDFDocument7 pagesA Simple and Fast Contour Plotting Algorithm For L PDFwijayanataNo ratings yet

- A Comparison Between Active and Passive Vibration Control of Non-Linear Simple Pendulum PDFDocument12 pagesA Comparison Between Active and Passive Vibration Control of Non-Linear Simple Pendulum PDFmohamed mourad LafifiNo ratings yet

- A Dynamic Panel Gravity Model Application - 2 - 2 - 1Document5 pagesA Dynamic Panel Gravity Model Application - 2 - 2 - 1haileNo ratings yet

- Huang 06 Cov BasisDocument28 pagesHuang 06 Cov BasisFrank LiuNo ratings yet

- Abstract - Dr. Sunetra Ghatak - Session 2Document4 pagesAbstract - Dr. Sunetra Ghatak - Session 2সাদিক মাহবুব ইসলামNo ratings yet

- 1 s2.0 S1468121821000857 MainDocument29 pages1 s2.0 S1468121821000857 Maing5v7rm5spmNo ratings yet

- Public Expenditure and Economic Growth in NepalDocument9 pagesPublic Expenditure and Economic Growth in Nepalsaw_sea100% (1)

- Analyzing The Performance of Mutation Operators To Solve The Travelling Salesman ProblemDocument18 pagesAnalyzing The Performance of Mutation Operators To Solve The Travelling Salesman Problemcranckcracker123No ratings yet

- Sheet - Ansys, SpringbackDocument9 pagesSheet - Ansys, Springbacksupersonny007No ratings yet

- Opt Switch CDC 04Document6 pagesOpt Switch CDC 04menilanjan89nLNo ratings yet

- Uniqueness of Entire Functions Whose Difference Polynomials Share A Polynomial With Finite WeightDocument20 pagesUniqueness of Entire Functions Whose Difference Polynomials Share A Polynomial With Finite WeightvedaNo ratings yet

- Monitoring Structural Changes in NER An Empirical Analysis of MizoramDocument10 pagesMonitoring Structural Changes in NER An Empirical Analysis of MizoramSamsur JamanNo ratings yet

- Math Kangaroo Competition: Test PaperDocument10 pagesMath Kangaroo Competition: Test PaperKhaing Phyu0% (1)

- Ag-Mechanical Monitoring Systems PDFDocument2 pagesAg-Mechanical Monitoring Systems PDFqdod_waffiNo ratings yet

- Law of ProductionDocument21 pagesLaw of ProductionvamsibuNo ratings yet

- Light: 1.1 Light Travels in Straight LinesDocument11 pagesLight: 1.1 Light Travels in Straight Linesching_jyoNo ratings yet

- SHM and Waves NotesDocument13 pagesSHM and Waves NotessauravNo ratings yet

- Textbook Inventory: Room 9 Grade Title Qty. Delivered On Hand IssuedDocument4 pagesTextbook Inventory: Room 9 Grade Title Qty. Delivered On Hand IssuedMj TizonNo ratings yet

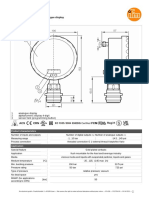

- PG2794 00 - en GBDocument4 pagesPG2794 00 - en GBphalkejituNo ratings yet

- NX Open ProgrammingDocument5 pagesNX Open ProgramminggsgsureshNo ratings yet

- Project For The Web Admin HelpDocument64 pagesProject For The Web Admin HelpAlejandro Cortes GarciaNo ratings yet

- A Simplified Bathymetric Survey System Using A Modified SounderDocument11 pagesA Simplified Bathymetric Survey System Using A Modified Sounderhardiyanto hardiyantoNo ratings yet

- Airzon: Keywords:-AQI PM Gases Air Quality Detection AirDocument5 pagesAirzon: Keywords:-AQI PM Gases Air Quality Detection AirInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Buy 13-Inch MacBook Pro - Apple (IN)Document1 pageBuy 13-Inch MacBook Pro - Apple (IN)dummy page7007No ratings yet

- Ihueze MgbemenaSDIDocument16 pagesIhueze MgbemenaSDImosanidNo ratings yet

- 2Q Budget of Work Math IVDocument2 pages2Q Budget of Work Math IVEurika LimNo ratings yet

- Taxonomy v101Document67 pagesTaxonomy v101Angela BernalNo ratings yet

- 4.negative and Zero SequenceDocument6 pages4.negative and Zero Sequencebalaer0550% (2)

- Problemas CompletosDocument16 pagesProblemas CompletosakksNo ratings yet

- Midterm Report: in Electrical EngineeringDocument11 pagesMidterm Report: in Electrical Engineeringdr.Sabita shresthaNo ratings yet

- Frequently Asked Questions: Orientation Related QuestionDocument31 pagesFrequently Asked Questions: Orientation Related QuestionMiguel Moreno EstévezNo ratings yet

- Place Value 1Document2 pagesPlace Value 1Jawaria MazharNo ratings yet

- Assignment01 PDFDocument8 pagesAssignment01 PDFHamza KhalilNo ratings yet

- Math (F4) - Straight Line 5.1Document33 pagesMath (F4) - Straight Line 5.1Roszelan MajidNo ratings yet

- Antim Prahar Business Research MethodsDocument66 pagesAntim Prahar Business Research Methodsharshit bhatnagarNo ratings yet

- Cache Coherence: From Wikipedia, The Free EncyclopediaDocument8 pagesCache Coherence: From Wikipedia, The Free EncyclopediaMohit ChhabraNo ratings yet

- Safety Concept in Codified Design of Piled Raft Foundation: NtroductionDocument10 pagesSafety Concept in Codified Design of Piled Raft Foundation: NtroductionNadim527No ratings yet

- Assignment 5 A - Quadratic EquationsDocument4 pagesAssignment 5 A - Quadratic EquationsSakiNo ratings yet

- Multimode Controller For SMPS: FeaturesDocument51 pagesMultimode Controller For SMPS: FeaturesMahdiNo ratings yet

- 1.0 Title: American International University-Bangladesh (Aiub)Document2 pages1.0 Title: American International University-Bangladesh (Aiub)Rashedul IslamNo ratings yet

- Tank Design APIDocument63 pagesTank Design APIBSK entertainmentNo ratings yet